Abstract

This paper is built upon previous work concerning how three factors—an upper echelon’s compensation, the total compensation level of a chief executive officer (CEO), and compensation gaps between a CEO and a top management team (TMT)—affect a firm’s international expansion level. Using longitudinal data (2000–2005) from 528 publicly listed firms in Taiwan as our sample, we found that CEO total compensation level and TMT total compensation were positively related to firms’ international expansion level, and that the larger the compensation gap between CEO and TMT, the higher the given firm’s international expansion level. The implications that these findings have for future research are discussed.

Similar content being viewed by others

Notes

The structural attribute consists of the following two items: foreign assets as a percentage of total assets (FATA) and overseas subsidiaries as a percentage of total subsidiaries (OSTS).

These variables were loaded as a factor using the “principal component extraction” method and “varimax rotation.”

This study excluded long-term incentive compensation such as the value of stock options because, in Taiwan, a firm’s annual report does not disclose these data.

This study includes all industries in Taiwan and classifies them into five categories: construction, heavy manufacturing, light manufacturing, the high-tech industry, and other.

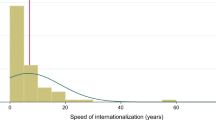

The maximum value of our sample’s international-expansion level is 2.729 and the minimum is 0. The average FSTS value is .043, the average FATA value is .487, and the average value of geographical dispersion is 1.312.

References

Adams, J. S. 1965. Inequity in social exchange. In L. Berkowitz (Ed.). Advances in experimental social psychology. New York: Academic.

Adithipyangkul, P., Alon, I., & Zhang, T. (2011) Executive perks: Compensation and corporate performance in China. Asia Pacific Journal of Management, 28(2): 401–425.

Araujo, L., & Rezende, S. 2003. Path dependence, MNCs and the internationalization process: A relational approach. International Business Review, 12: 719–737.

Arendt, L. A., Priem, R. L., & Ndofor, H. A. 2005. A CEO-adviser model of strategic decision-making. Journal of Management, 31: 680–699.

Autio, E., Sapienza, H., & Almeida, J. 2000. Effects of age at entry, knowledge intensity, and imitability on international growth. Academy of Management Journal, 43: 909–924.

Barkema, H. G., & Shvyrkov, O. 2007. Does top management team diversity promote or hamper foreign expansion?. Strategic Management Journal, 28: 663–680.

Berry, C. H. 1975. Corporate growth and diversification. Princeton, NJ: Princeton University Press.

Brady, G., & Helmich, D. 1982. The hospital administrator and organizational change: Do we recruit from the outside?. Hospital and Health Services Administration, 27: 53–62.

Buck, T., Liu, X., & Skovoroda, R. 2008. Top executive pay and firm performance in China. Journal of International Business Studies, 39: 833–850.

Carpenter, M. A., & Sanders, W. M. G. 2002. Top management team compensation: The missing link between CEO pay and firm performance?. Strategic Management Journal, 23: 367–375.

Carpenter, M. A., & Sanders, W. M. G. 2004. The effects of top management team pay and firm internationalization on MNC performance. Journal of Management, 30: 509–528.

Coombs, J. E., & Gilley, M. K. 2005. Stakeholder management as a predictor of CEO compensation: Main effects and interactions with financial performance. Strategic Management Journal, 26: 827–840.

Daniels, J., & Bracker, J. 1989. Profit performance: Do foreign operations make a difference?. Management International Review, 29: 46–56.

Devers, C. E., Cannella, Jr., A. A., Reilly, G. P., & Yoder, M. E. 2007. Executive compensation: A multidisciplinary review of recent developments. Journal of Management, 33: 1016–1072.

Dow, J., & Raposo, C. C. 2005. CEO compensation, change, and corporate strategy. Journal of Finance, 60: 2701–2727.

Ezzamel, M., & Watson, R. 1998. Market comparison earnings and the bidding-up of executive cash compensation: Evidence from the United Kingdom. Academy of Management Journal, 41: 221–231.

Fernández, Z., & Nieto, N. J. 2006. Impact of ownership on the international involvement of SMEs. Journal of International Business Studies, 37: 340–351.

Fong, B. A., Misangyi, V. F., & Tosi, Jr., H. L., 2010. The effect of CEO pay deviations on CEO withdrawal, firm size, and firm profits. Strategic Management Journal, 31(6): 629–651.

George, G., Wiklund, J., & Zahra, S. A. 2005. Ownership and the internationalization of small firms. Journal of Management, 31: 210–233.

Gerhart, B., Minkoff, H. B., & Olsen, R. N. 1995. Employee compensation: Theory, practice, and evidence. In S. D. Rosen & P. T. Barnum (Eds.). GR Ferris. Oxford: Blackwell Publishers.

Geringer, J., Beamish, P., & da Costa, R. 1989. Diversification strategy and internationalization: Implications for MNE performance. Strategic Management Journal, 10: 109–119.

Greene, W. H. 2000. Econometric analysis, 4th ed. Englewood Cliffs, NJ: Prentice Hall.

Greve, H. R. 2003. Organizational learning from performance feedback: A behavioral perspective on innovation and change. Cambridge: Cambridge University Press.

Hambrick, D. C., Cho, T. S., & Chen, M. J. 1996. The influence of top management team dissimilarity on firms’ competitive moves. Administrative Science Quarterly, 41: 659–684.

Hambrick, D. C., & Finkelstein, S. 1995. The effects of ownership structure on conditions at the top: The case of CEO pay raises. Strategic Management Journal, 16: 175–194.

Hanlon, M., Rajgopal, S., & Shevlin, T. 2003. Are executive stock options associated with future earnings?. Journal of Accounting & Economics, 36: 3–43.

Henderson, A., & Fredrickson, J. 2001. Top management team coordination needs and the CEO pay gap: A competitive test of economic and behavioral views. Academy of Management Journal, 44: 96–117.

Henderson, A. D., & Fredrickson, J. W. 1996. Information-processing demands as a determinant of CEO compensation. Academy of Management Journal, 39: 575–606.

Herrmann, P., & Datta, D. K. 2005. Relationships between top management team characteristics and international diversification: An empirical investigation. British Journal of Management, 16: 69–78.

Hitt, M. A., Bierman, L., Uhlenbruck, K., & Shimizu, K. 2006a. The importance of resources in the internationalization of professional service firms: The good, the bad, and the ugly. Academy of Management Journal, 49: 1137–1157.

Hitt, M. A., Hoskisson, R. E., & Kim, H. 1997. International diversification: Effects on innovation and firm performance in product-diversified firms. Academy of Management Journal, 40: 767–798.

Hitt, M. A., Tihanyi, L., Miller, T., & Connelly, B. 2006b. International diversification: Antecedents, outcomes, and moderators. Journal of Management, 32: 831–867.

Jaw, Y.-L., & Lin, W.-T. 2009. Corporate elite characteristics and firm’s internationalization: CEO-level and TMT-level roles. International Journal of Human Resource Management, 20: 220–233.

Johanson, J., & Vahlne, J. E. 1977. The internationalization process of the firm—a model of knowledge development and increasing foreign market commitments. Journal of International Business Studies, 8: 23–32.

Katz, L. F. 2004. Efficiency wage theories: A partial evaluation. NBER Working paper no. 1906, National Bureau for Economic Research, Cambridge, MA.

Kuivalainen, O., Sundqvist, S., & Servais, P. 2007. Firm’s degree of born-globalness, international entrepreneurship orientation and export performance. Journal of World Business, 42: 253–267.

Lambert, R., Larcker, D., & Weigelt, K. 1993. The structure of organizational incentives. Administrative Science Quarterly, 38: 438–461.

Larraza-Kintana, M., Wiseman, R. M., Gomez-Mejia, L. R., & Welbourne, T. 2007. Distinguishing between employment and compensation risk influences on perceived risk taking. Strategic Management Journal, 28: 1001–1020.

Leone, A. J., Wu, J. S., & Zimmerman, J. L. 2006. Asymmetric sensitivity of CEO cash compensation to stock returns. Journal of Accounting & Economics, 42: 167–192.

Li, H., & Li, J. 2009. Top management team conflict and entrepreneurial strategy making in China. Asia Pacific Journal of Management, 26(2): 263–283.

Lien, Y.-C., Piesse, J., Strange, R., & Filatotchev, I. 2005. The role of corporate governance in FDI decisions: Evidence from Taiwan. International Business Review, 14: 739–773.

Lin, W.-T., Cheng, K.-Y., & Liu, Y. 2009. Organizational slack and firm internationalization: A longitudinal study of high-technology firms. Journal of World Business, 44: 397–406.

Lin, Y.-F. 2005. Corporate governance, leadership structure and CEO compensation: Evidence from Taiwan. Corporate Governance: An International Review, 13: 824–835.

Main, B., O’Reilly, C. A., & Wade, J. 1993. Top executive pay: Tournament or teamwork?. Journal of Labor Economics, 11: 607–628.

McDougall, P. P., & Oviatt, B. M. 2000. International entrepreneurship: The intersection of two research path. Academy of Management Journal, 43: 902–906.

Miller, D. J. 1995. CEO salary increases may be rational after all: Referents and contracts in CEO pay. Academy of Management Journal, 38: 1361–1385.

Minichilli, A., Corbetta, G., & MacMillan, I. C. 2010. Top management teams in family-controlled companies: ‘Familiness’, ‘faultlines’, and their impact on financial performance. Journal of Management Studies, 47: 205–222.

Mitchell, J., & Hambrick, D. 1992. Diversification posture and top management team characteristics. Academy of Management Journal, 35: 9–37.

Palmer, T. B., & Wiseman, R. M. 1999. Decoupling risk taking from income stream uncertainty: A holistic model of risk. Strategic Management Journal, 20: 1037–1062.

Peng, M. W. 2006. Global strategy. Cincinatti, OH: Thomson-South-Western.

Peterson, R. S., Smith, D. B., Martirana, P. V., & Owens, P. D. 2003. The impact of chief executive officer personality on top management team dynamic: One mechanism by which leadership affects organizational performance. Journal of Applied Psychology, 88: 795–808.

Prahalad, C. 1990. Globalization—the intellectual and managerial challenges. Human Resource Management, 29: 27–38.

Sanders, W. M. G., & Carpenter, M. A. 1998. Internationalization and firm governance: The role of CEO compensation, top team composition, and board structure. Academy of Management Journal, 41: 158–178.

Sullivan, D. 1994. Measuring the degree of internationalization of a firm. Journal of Business Studies, 25: 325–342.

Sullivan, D., & Bauerschmidt, A. 1989. Common factors underlying barriers to export: A comparative study in the European and US paper industry. Management International Review, 29: 46–63.

Sun, S. L., Zhao, X., & Yang, H. 2010. Executive compensation in Asia: A critical review and outlook. Asia Pacific Journal of Management, 26(3): 361–380.

Tihanyi, L., Ellstrand, A. E., Daily, C. M., & Dalton, D. R. 2000. Composition of the top management team and firm international diversification. Journal of Management, 26: 1157–1177.

Tihanyi, L., Johnson, R. A., Hoskisson, R. E., & Hitt, M. A. 2003. Institutional ownership differences and international diversification: The effects of boards of directors and technological opportunity. Academy of Management Journal, 46: 195–211.

United Nations. 2005. World investment report. New York: United Nations.

Vancil, R. 1987. Passing the baton. Boston: Harvard University Press.

Wang, H., Feng, J., Liu, X., & Zhang, R. 2011. What is the benefit of TMT’s governmental experience to private-owned enterprises? Evidence from China. Asia Pacific Journal of Management, 28(3): 555–572.

Watson, R., Storey, D., Wynarczyk, P., Keasey, K., & Short, H. 1996. The relationship between job satisfaction and managerial remuneration in small and medium-sized enterprises: An empirical test of ‘comparison income’ and ‘equity theory’ hypotheses. Applied Economics, 28: 567–576.

Werner, S., & Ward, S. 2004. Recent compensation research: An eclectic review. Human Resource Management Review, 14: 201–227.

Westphal, J., & Bednar, M. 2008. The pacification of institutional investors. Administrative Science Quarterly, 53: 29–72.

Yip, G. S., Biscarri, J. G., & Monti, J. A. 2000. The role of the internationalization process in the performance of newly internationalizing firms. Journal of International Marketing, 8: 10–35.

Yokota, R., & Mitsuhashi, H. 2008. Attributive change in top management teams as a driver of strategic change. Asia Pacific Journal of Management, 25(2): 297–315.

Zahra, S. A. 2005. Entrepreneurial risk taking in family firms. Family Business Review, 18: 23–40.

Zajac, E. J., & Westphal, J. D. 1995. Accounting for the explanations of CEO compensation: Substance and symbolism. Administrative Science Quarterly, 40: 283–308.

Author information

Authors and Affiliations

Corresponding author

Additional information

Wen-Ting Lin acknowledges financial support from the National Science Council (NSC 98-2410-H-194-114-MY3). We are grateful to the Senior Editor, Professor Lu, and two anonymous reviewers for their insightful comments.

Rights and permissions

About this article

Cite this article

Lin, WT., Cheng, KY. The effect of upper echelons’ compensation on firm internationalization. Asia Pac J Manag 30, 73–90 (2013). https://doi.org/10.1007/s10490-011-9261-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10490-011-9261-9