Abstract

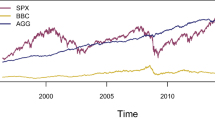

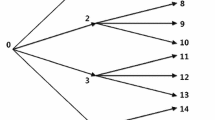

We describe a study of application of novel risk modeling and optimization techniques to daily portfolio management. In the first part of the study, we develop and compare specialized methods for scenario generation and scenario tree construction. In the second part, we construct a two-stage stochastic programming problem with conditional measures of risk, which is used to re-balance the portfolio on a rolling horizon basis, with transaction costs included in the model. In the third part, we present an extensive simulation study on real-world data of several versions of the methodology. We show that two-stage models outperform single-stage models in terms of long-term performance. We also show that using high-order risk measures is superior to first-order measures.

Similar content being viewed by others

References

Arthur, D., & Vassilvitskii, S. (2007). k-means++: The advantages of careful seeding. Proceedings of the eighteenth annual ACM-SIAM symposium on Discrete algorithms. SIAM, pp. 1027–1035.

Artzner, P., Delbaen, F., Eber, J. M., & Heath, D. (1999). Coherent measures of risk. Mathematical Finance, 9, 203–228.

Artzner, P., Delbaen, F., Eber, J. M., Heath, D., & Ku, H. (2007). Coherent multiperiod risk adjusted values and Bellmans principle. Annals of Operations Research, 152, 5–22.

Cheridito, P., Delbaen, F., & Kupper, M. (2006). Dynamic monetary risk measures for bounded discrete-time processes. Electronic Journal of Probability, 11, 57–106.

Föllmer, H., & Penner, I. (2006). Convex risk measures and the dynamics of their penalty functions. Statistics Decisions, 24(1), 61–96.

Fritelli, M. M., & Scandolo, G. (2006). Risk measures and capital requirements for processes. Mathematical Finance, 16, 589–612.

Heitsch, H., & Romisch, W. (2009). Scenario tree modeling for multistage stochastic programs. Mathematical Programming, 118(2), 371–406.

Heitsch, H., Romisch, W., & Strugarek, C. (2006). Stability of multistage stochastic programs. SIAM Journal on Optimization, 17, 511–525.

Hochreiter, R., & Pflug, G. Ch. (2007). Financial scenario generation for stochastic multi-stage decision processes as facility location problems. Annals of Operations Research, 152, 257–272.

Kijima, M., & Ohnishi, M. (1993). Mean-risk analysis of risk aversion and wealth effects on optimal portfolios with multiple investment opportunities. Annals of Operations Research, 45, 147–163.

Mansini, R., Ogryczak, W., & Speranza, M. G. (2003). LP solvable models for portfolio optimization: A classification and computational comparison. IMA Journal of Management Mathematics, 14(3), 187–220.

Markowitz, H. M. (1952). Portfolio selection. Journal of Finance, 7, 77–91.

Matmoura, Y., & Penev, S. (2013). Multistage optimization of option portfolio using higher order coherent risk measures. European Journal of Operational Research, 227(1), 190–198.

Miller, N. L. (2008). Mean-risk portfolio optimization problems with risk-adjusted measures. PhD thesis, Rutgers University.

Miller, N., & Ruszczyński, A. (2011). Risk-averse two-stage stochastic linear programming: Modeling and decomposition. Operations Research, 59, 125–132.

Ogryczak, W., & Ruszczyński, A. (1999). From stochastic dominance to mean-risk models: Semideviations as risk measures. European Journal of Operational Research, 116(1), 33–50.

Ogryczak, W., & Ruszczyński, A. (2001). On consistency of stochastic dominance and mean-semideviation models. Mathematical Programming, 89, 217–232.

Ogryczak, W., & Ruszczyński, A. (2002). Dual stochastic dominance and related mean-risk models. SIAM Journal on Optimization, 13, 60–78.

Pflug, G. Ch. (2001). Scenario tree generation for multiperiod financial optimization by optimal discretization. Mathematical Programming, 89, 251–271.

Pflug, G. Ch., & Römisch, W. (2007). Modeling, measuring and managing risk. Singapore: World Scientific.

Riedel, F. (2004). Dynamic coherent risk measures. Stochastic Processes and Their Applications, 112, 185–200.

Rockafellar, R. T., & Uryasev, S. (2000). Optimization of conditional value at risk. The Journal of Risk, 2, 21–41.

Rockafellar, R. T., & Uryasev, S. (2002). Conditional value at risk for general loss distributions. Journal of Banking and Finance, 26, 1443–1471.

Ruszczyński, A. (2003). Decomposition methods. In A. Ruszczyński & A. Shapiro (Eds.), Stochastic Programming (pp. 141–211). Amsterdam: Elsevier.

Ruszczyński, A. (2006). Nonlinear Optimization. Princeton: Princeton University Press.

Ruszczyński, A. (2010). Risk-averse dynamic programming for Markov decision processes. Mathematical Programming, 125(2), 235–261.

Ruszczyński, A., & Vanderbei, R. (2003). Frontiers of stochastically nondominated portfolios. Econometrica, 71, 1287–1297.

Ruszczyński, A., & Shapiro, A. (2006a). Conditional risk mappings. Mathematical Operations Research, 31, 544–561.

Ruszczyński, A., & Shapiro, A. (2006b). Optimization of convex risk functions. Mathematical Operations Research, 31, 433–452.

Shapiro, A., Dentcheva, D., & Ruszczyński, A. (2009). Lectures on stochastic programming: Modeling and theory. SIAM.

SPSS Inc. (2004).TwoStep Cluster Analysis. Technical Report.

Van Der Weide, R. (2002). GO-GARCH: A multivariate generalized orthogonal GARCH model. Journal of Applied Econometrics, 17(5), 549–564.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Gülten, S., Ruszczyński, A. Two-stage portfolio optimization with higher-order conditional measures of risk. Ann Oper Res 229, 409–427 (2015). https://doi.org/10.1007/s10479-014-1768-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-014-1768-2