Abstract

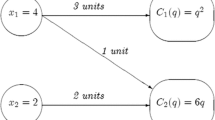

In this paper, we consider a model of production allocation in the context of the theory of the firm under uncertainty. This is the case of a firm that has just produced a known amount of an output and can allocate it to two possible ends: one with a certain price, the other with an uncertain price. We first establish conditions to determine whether the firm will make use of both ends or of only one of them. In particular, we find a limit value for the certain price (which we call the frontier price) below which the firm decides to allocate the total amount of production to the uncertain end. We then study comparative-static effects on the optimal output allocated to each end, and also on the frontier price. Finally, we analyze an application concerning the middleman who buys the firm’s output in the certain end. This is a pricing problem: namely obtaining the price in the certain end that the middleman must offer to the producer in order to attain a desired amount of output. In two specific cases, we also provide closed-form expressions for the optimal allocation to both ends and for the frontier price.

Similar content being viewed by others

Notes

Dalal and Raju (2003) do consider corner solutions, but only in a very particular case.

The firm is competitive at least in the output market. In addition, we consider that this output is perfectly divisible.

For the consideration of a shift parameter, see for instance, Dalal and Raju (2003).

The notation \(F^{'}_q\) stands for the partial derivative \(\partial F/\partial q\). An analog notation will be used for any partial derivative.

In Sect. 4, we emphasize this interpretation of the function \(F\), at least when the firm exhibits CARA.

Proposition 4 below establishes that this intuition is indeed correct.

We have to mention a previous technical point: a variation in those parameters makes the price \(\alpha \) change, and it is possible that \(p\) is no longer greater than \(\alpha \). Since the Implicit Function Theorem is a local result, and \(\alpha \) is continuous as a function of the parameters, this difficulty can easily be solved.

Note that if \(u''\) is decreasing, then the firm exhibits IARA; the converse, however, is not true.

That is, both of these prices lie in an interval \(\left[ 0,M\right] \). It is reasonable to assume that prices are bounded above, and calculations are more straightforward.

Another sufficient condition for the strict concavity of \(g\) is that the firm exhibits IRRA. This can be seen as a consequence of Lemma 2 in Dalal and Alghalith (2009).

Indeed: \(0 = \mathop {\mathsf{{E} }}\nolimits [X] - \mathop {\mathsf{{E} }}\nolimits [Y] = \int _0^M t\, dH(t) = \bigl . t\, H(t) \bigr |_0^M - \int _0^M H(t)\, dt = \tilde{H}(M)\).

References

Alghalith, M. (2006a). Hedging decisions with price and output uncertainty. Annals of Finance, 2(2), 225–227.

Alghalith, M. (2006b). Price and output risk: Empirical analysis. Applied Economics Letters, 13(6), 391–393.

Alghalith, M. (2010). Preferences estimation without approximation. European Journal of Operational Research, 207(2), 1144–1146.

Blome, C., & Schoenherr, T. (2011). Supply chain risk management in financial crises—A multiple case-study approach. International Journal of Production Economics, 134, 43–57.

Buccola, S. T. (1982). Portfolio selection under exponential and quadratic utility. Western Journal of Agricultural Economics, 7(1), 43–51.

Chung, K. H. (1990). Output decision under demand uncertainty with stochastic production. Management Science, 36(11), 1311–1328.

Dalal, A. J., & Alghalith, M. (2009). Production decisions under joint price and production uncertainty. European Journal of Operational Research, 197(1), 84–92.

Dalal, A. J., & Katz, E. (2003). The multi-market firm, transportation costs, and the separation of the output and allocation decisions. Oxford Economic Papers, 55(4), 644–656.

Dalal, A. J., & Raju, S. S. (2003). Domestic and foreign sales when prices in both markets are uncertain. Bulletin of Economic Research, 55(2), 125–148.

Gaffney, C., & Ben-Israel, A. (2013). A simple insurance model: Optimal coverage and deductible. Annals of Operations Research, 1–17. doi:10.1007/s10479-013-1469-2.

Gollier, C. (2001). The economics of risk and time. Cambridge: The MIT Press.

Hey, J. D. (1981). Hedging and the competitive labor-managed firm under price uncertainty. The American Economic Review, 71(4), 753–757.

Holthausen, D. M. (1979). Hedging and the competitive firm under price uncertainty. The American Economic Review, 69(5), 989–995.

Katz, E., Paroush, J., & Kahana, N. (1982). Price uncertainty and the price discriminating firm in international trade. International Economic Review, 23(2), 389–400.

Kumbhakar, S. C. (2001). Risk preferences under price uncertainties and production risk. Communications in Statistics-Theory and Methods, 30(8–9), 1715–1735.

Kumbhakar, S. C. (2002). Specification and estimation of production risk, risk preferences and technical efficiency. American Journal of Agricultural Economics, 84(1), 8–22.

Kumbhakar, S. C., & Tsionas, E. G. (2002). Estimation of production risk and risk preference function: A nonparametric approach. Annals of Operations Research, 176(1), 369–378.

Kumbhakar, S. C., & Tveterås, R. (2003). Risk preferences, production risk and firm heterogeneity. The Scandinavian Journal of Economics, 105(2), 275–293.

Lippman, S. A., & McCall, J. J. (1981). Competitive production and increases in risk. The American Economic Review, 71(1), 207–211.

Lippman, S. A., & McCall, J. J. (1982). The economics of uncertainty: Selected topics and probabilistic methods. In K. J. Arrow, & M. J. Intriligator (Eds.), Handbook of mathematical economics (Vol. 1, pp. 211–284). North-Holland, Amsterdam, chap 6.

Picazo-Tadeo, A. J., & Wall, A. (2011). Production risk, risk aversion and the determination of risk attitudes among Spanish rice producers. Agricultural Economics, 42(4), 451–464.

Saha, A., Shumway, C., & Talpaz, H. (1994). Joint estimation of risk preference structure and technology using expo-power utility. American Journal of Agricultural Economics, 76(2), 173–184.

Sandmo, A. (1971). On the theory of the competitive firm under price uncertainty. The American Economic Review, 61(1), 65–73.

Sun, Y., Wissel, J., & Jackson, P. L. (2013). Separation results for multi-product inventory hedging problems. Annals of Operations Research, 1–17. doi:10.1007/s10479-013-1473-6.

Wiens, T. B. (1976). Peasant risk aversion and allocative behavior: A quadratic programming experiment. American Journal of Agricultural Economics, 58(4), 629–635.

Wu, D., & Olson, D. L. (2009). Enterprise risk management: Small business scorecard analysis. Production Planning & Control, 20(4), 362–369.

Wu, D., & Olson, D. L. (2010a). Enterprise risk management: A DEA VaR approach in vendor selection. International Journal of Production Research, 48(16), 4919–4932.

Wu, D., & Olson, D. L. (2010b). Enterprise risk management: Coping with model risk in a large bank. Journal of the Operational Research Society, 61(2), 179–190.

Wu, D., Olson, D. L., & Birge, J. R. (2011). Introduction to special issue on “Enterprise risk management in operations”. International Journal of Production Economics, 134(1), 1–2.

Acknowledgments

We are grateful to the associate editor and an anonymous referee for their very helpful comments. Rodríguez-Puerta was partially supported by the University of Pablo de Olavide, under the Project with reference number APP2D10121; and Álvarez-López was partially supported by the Spanish Comisión Interministerial de Ciencia y Tecnología: CICYT (Interministerial Commission of Science and Technology), under the Projects with reference numbers ECO2008-06395-C05-03 and ECO2012-39553-C04-01.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1

We collect some auxiliary lemmas in this appendix. The first is taken from Lippman and McCall (1982) (a partial result in their Theorem \(2\) on p. 252). As the proof is simple, it is given here. Lemma 4 is a well-known result, at least in its non-strict version. We write here a simple proof for the strict case, which is the one needed.

Lemma 1

Let \(\psi \) and \(\phi \) be two real functions defined on \(\mathbb {R}\) such that \(\psi >0\) and \(\phi \) is increasing. If \(\xi =\psi \cdot \phi \), and \(X\) is a non-degenerate real random variable such that the expectation \(E\!\left[ X\, \psi (X) \right] \) is finite, then:

and the reverse inequality holds when \(\phi \) is decreasing. In addition, if \(\phi \) is strictly increasing or strictly decreasing, the corresponding inequalities also hold strictly.

Proof

When \(t<0\), we can write: \(\phi (t) \leqslant \phi (0)\) (since \(\phi \) is increasing), and hence:

(recalling that \(\psi >0\)). However, this inequality also holds when \(t>0\). The result follows after a straightforward calculation. \(\square \)

Lemma 2

Define: \(T(q,s)\equiv \mathop {\mathsf{{E} }}\nolimits \bigl [ u''\bigl ( sq + P(q_T-q) + B \bigr )\,(P-s) \bigr ]\). Depending on whether the firm exhibits DARA, CARA or IARA, the number \(T(q,s)\) is greater than or equal to \(0\), null, or smaller than or equal to \(0\), respectively, in any of the following cases: \((q,s)=(q^*,p)\) and \((q,s)=(0,\alpha )\).

Proof

We have: \(T(q^*,p) = \mathop {\mathsf{{E} }}\nolimits \bigl [ u''\bigl ( W(q^*) \bigr )\,(P-p) \bigr ] = \mathop {\mathsf{{E} }}\nolimits \bigl [ r_u\bigl ( W(q^*) \bigr ) \, u'\bigl ( W(q^*) \bigr )\,(p-P) \bigr ]\). Assume that the firm exhibits DARA. Set \(\psi (t) = u'\bigl ( t(q^*-q_T) + p q_T + B \bigr )\) and \(\phi (t) = r_u \bigl ( t(q^*-q_T) + p q_T + B \bigr )\); thus \(\psi >0\), and \(\phi \) is increasing. Taking \(X=p-P\), with Lemma 1 we obtain:

according to the first-order condition. The proof for CARA or IARA is, mutatis mutandis, the same. And for the case \((q,s)=(0,\alpha )\), proceeding with the same functions \(\psi \) and \(\phi \), and the same random variable \(X\), but writing \(0\) and \(\alpha \) instead of \(q^*\) and \(p\), respectively, we obtain:

where the last factor is null according to the definition of \(\alpha \). \(\square \)

Lemma 3

If \(R_u<1\), then:

and

for all \(q\).

Proof

As \(R_u<1\), we have: \( u'(W) + W \, u''(W) > 0\). If we write \(W=W(q) = (q_T-q)(P-p)+W(q_T)\) and consider that the wealth \(W\) is non-negative for every level of output, we obtain:

and by taking expectations we conclude the result. In order to prove the second inequality, we simply write \(W(q) = W(0) - q(P-p)\) and proceed in the same way.\(\square \)

Lemma 4

Let X and Y be two random variables, defined on an interval \(\left[ 0,M\right] \), with the same finite expectation. Assume that \(\int _0^t \bigl ( G(s) - F(s) \bigr ) \,ds \geqslant 0 \) for all \(t\in \left[ 0,M\right] \), with strict inequality for some \(t_0\), where \(F\) and \(G\) are the distribution functions of \(X\) and \(Y\), respectively. If \(v\) is a real function of class \(\fancyscript{C}^2\) that is strictly concave on the interval \(\left[ 0,M\right] \), then \(\mathop {\mathsf{{E} }}\nolimits [v(X)] > \mathop {\mathsf{{E} }}\nolimits [v(Y)]\), and the reverse inequality holds if \(v\) is strictly convex.

Proof

Set \(H = F-G\), and \(\tilde{H}(t) = \int _0^t H(s)\,ds\) for \(0\leqslant t\leqslant M\). Thus \(H(0)=\tilde{H}(0) =H(M)=0\), and also \(\tilde{H}(M)=0\) since \(\mathop {\mathsf{{E} }}\nolimits [X]=\mathop {\mathsf{{E} }}\nolimits [Y]\).Footnote 12 Therefore we can write:

For each \(t,\,v''(t)\leqslant 0\) (due to the concavity of \(v\)) and \(\tilde{H}(t)\leqslant 0\) (by hypothesis), and thus this last integral is positive or null. However, \(\tilde{H}(t_0)<0\) and the function \(\tilde{H}\) is continuous, and hence this function is strictly negative on some open interval \(J\) around \(t_0\). In addition, since the function \(v\) is strictly concave, in any open subinterval of \(\left[ 0,M\right] \) there exists a point where \(v''\) is negative. The continuity of \(v''\) lets us assert that \(v''<0\) on some open interval included in \(J\). With this observation, we can conclude that the integral is in fact strictly positive.\(\square \)

Appendix 2

In this appendix, for the two special cases analyzed in Sect. 3.5, we list the derivatives of \(q^*\) and \(\alpha \) with respect to the various parameters in order to verify the results in Propositions 3–8.

CARA utility and normal distribution of the random variable \(P\) We have:

This confirms the assertions in Propositions 3–8.

Quadratic utility In this paragraph, we write \(D\equiv (\mu -p)^2+ \sigma ^2\). For the derivative \(dq^*/dp\), we obtain:

and considering that \(u'\bigl ( W(q_T) \bigr ) = 2b\, D(q_T-q^*)/(\mu -p)\):

which confirms the result in Proposition 3. In order to verify Proposition 4, we highlight that an increase in the absolute risk aversion \(r_u\), the utility remaining of the quadratic type, is equivalent to a decrease in the quotient \(\gamma \equiv a/b\), as a result of the equality \(r_u(t)=2/(\gamma -2t)\). Therefore:

which is in accordance with the cited proposition. Finally, by taking into account that \(r'_u=r^2_u\), we also have:

This enables us to verify the results in Propositions 5–8.

Rights and permissions

About this article

Cite this article

Rodríguez-Puerta, I., Álvarez-López, A.A. Optimal allocation of a fixed production under price uncertainty. Ann Oper Res 237, 121–142 (2016). https://doi.org/10.1007/s10479-014-1702-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-014-1702-7