Abstract

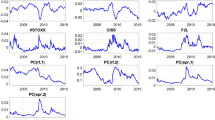

Applying a t-DCC-GARCH model to daily spread data, four phases of interaction in euro area sovereign bond markets are identifi ed between January 2008 and June 2013. The initial period (January-October 2008) is followed by a general rise in pairwise correlation values between November 2008 and late 2009/early 2010. Interaction then declines on a piecemeal basis up to early 2012. In autumn 2012, coinciding with the announcement of the Outright Monetary Transactions programme by the European Central Bank, there is evidence of some reengagement of bond markets with one another. Policy then seems to have had an infl uence on euro area sovereign bond market behaviour. While it can act to calm markets, policy may also be unduly infl uencing market dynamics and raising moral hazard issues.

Similar content being viewed by others

Author information

Authors and Affiliations

Corresponding author

Additional information

The author would like to thank Frank Browne and Kieran McQuinn for comments and suggestions. The views expressed in this article are, nevertheless, those of the author and not necessarily those of the Central Bank of Ireland or the ESCB.

Rights and permissions

About this article

Cite this article

Cronin, D. Interaction in euro area sovereign bond markets during the financial crisis. Intereconomics 49, 212–220 (2014). https://doi.org/10.1007/s10272-014-0502-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10272-014-0502-2