Abstract

We analyze the short-run fertility and health effects resulting from the early announcement of the abolition of the Austrian baby bonus in January 1997. The abolition of the benefit was publicly announced about 10 months in advance, creating the opportunity for prospective parents to (re-)schedule conceptions accordingly. We find robust evidence that, within the month before the abolition, about 8 % more children were born as a result of (re-)scheduling conceptions. At the same time, there is no evidence that mothers deliberately manipulated the date of birth through medical intervention. We also find a substantial and significant increase in the fraction of birth complications, but no evidence for any resulting adverse effects on newborns’ health.

Similar content being viewed by others

Notes

Substantial effects on birth timing are also found by Dickert-Conlin and Chandra [10] and Chen [7] who study the effects of tax incentives on the timing of births in the US and France, respectively. Other studies have found that taxes distort other types of individual behavior such as marriages [1] or even deaths [14].

More precisely, the baby bonus replaced another policy previously in force. In the previous system, the bonus was dependent on the income of the primary caregiver in the year the child was born and was in the form of a refundable tax offset. Most, though not all, households had an incentive to move births to July 1, 2004, or later. See Gans and Leigh [12] for details.

Drago et al. [11] also analyze the introduction of the birth benefit in Australia, but use a different data source. They find that the birth benefit had both a positive effect on women’s fertility intentions and one of modest size on the effective birthrate. Positive fertility effects from the Australian policy change are also reported in Lain et al. [15].

This in turn may imply long-run effects of short-run behavioral responses, since birth weight is suspected to be causally related with later labor-market outcomes (e.g. Black et al. [3]).

As in the case of Australia, the German policy changed incentives differently for households with different characteristics. Generally, households with women working before giving birth, those planning to work shortly following birth, or those with high income received higher benefits after the reform and thus had an incentive to delay their births. See Tamm [26] for details. Neugart and Ohlsson [18] provide an alternative evaluation of the German parental benefit reform (with similar conclusions).

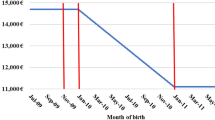

Specifically, the maximum household income in order to qualify for the “Mutter-Kind-Pass” bonus is defined as 11 \(\cdot\) HBGr, with HBGr (“Höchstbemessungsgrundlage”) denoting the upper income threshold above which the maximum pension benefit accrues. The threshold varies over time and amounted to 2,965 € in 1997. Thus, annual household income had to be lower than 32,616 € in 1997 to qualify for the “Mutter-Kind-Pass”.

Neglecting tax deductibles, [1,090 €/(4·12·94.5 € + 1.5·12·338.6 € + 1,090 €)] ≃ 0.093.

Note that it is possible that some couples already tried to conceive after February 2, 1996, even though there was confusion about the exact date of abolition until March 7, 1996. It is, therefore, still possible to find an increase in births before December 1996. See also footnote 12.

The Apgar score is used to assess the health of a newborn immediately after birth. In our data, the Apgar score one, five, and 10 min after birth is recorded. The Apgar score assesses five different categories (heart rate, breathing, muscle tone, reflex response, and skin color) with a score between zero and two each, where the scores are simply added up. Low values on the score are indicative of poor health. In the regression reported in section "Newborns’ health" below, we use the average of a child’s score 1, 5, and 10 min after birth.

It is worth mentioning that our basic sample period covers, besides the austerity package and the abolition of the baby bonus, two other major policy changes in family law that were made public in August 2001. First, parental leave duration was extended from 18 to 30 months for all mothers who were on maternity leave during August 2001, gave birth after July 2000, and earned no more than 14,600 € per year. A second reform was enacted in January 2002 and decoupled eligibility to maternity leave benefits from any prior work requirement, thus extending eligibility to self-employed women and mothers not in the labor force. We control for these policy changes by including appropriately defined indicator variables in the regressions that are based on sample periods covering these policies.

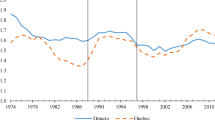

There are basically two explanations for the seasonal pattern in birth timing. First, there are seasonal fluctuations in marriages which may lead to fluctuations in births. In fact, marriage seasonality in Austria matches the seasonal pattern in births if newlywed couples immediately stop using contraceptives with the intent of conceiving. A second explanation are parental preferences regarding the month of birth [25]. See also Buckles and Hungerman [6] for a detailed discussion of both causes and consequences of seasonality in births.

November 1996 births are excluded as well because, according to the distribution of the pregnancy duration, about 5 % of responding mothers who conceived immediately after announcement delivered before November 28, 1996. This follows from the 90 % confidence interval that ranges from 266 to 287 days of pregnancy. More importantly, it turns out that the initial confusion about the exact date of the abolition was less pronounced than our reading of the newspapers suggested (see section "The abolition of the baby bonus" again) and that many prospective parents must have known the date of the abolition already before the first week of March. Indeed, we already find a substantial, and statistically significant number of additional births in November 1996 (results not shown). This implies that our main estimates based on births in December 1996 unambiguously represent a lower bound on the overall fertility effect.

Similarly, we also include additional dummies for the other major policy changes that were implemented during the sample period (see footnote 10 for details).

We also re-ran our baseline regressions using the total fertility rate as dependent variable. Results turn out to be qualitatively similar.

Specifically, we run the following regression: \(\ddot{b}_{t} = \alpha + \gamma_m + \varepsilon_{t}\), where \(\ddot{b}_{t}\) denotes the de-trended number of monthly births and γ m denotes the inclusion of a full set of monthly dummies.

It is actually quite intuitive that the estimate based on the de-trended number of births is smaller because the filter fits the time trend using all observations—including the extra births in December 1996. As a consequence, the time trend is biased upward around the date of the true policy change. This in turn results in a downward biased estimate for the fertility response in December 1996.

The first (second) sample period covers the same observations as our baseline estimates (cf. column 1(3) in panel A of Table 2), but includes 1996.11 and 1996.12 and extends the sample period until 1999.12. The third sample period uses the maximum number of observations (similar to panel B of Table 2).

A rough approximation of the total number of responding couples is obtained by multiplying the number of extra births with the probability of becoming pregnant within 3 weeks. Gnoth et al. [13] study the likelihood of spontaneous conception in subsequent cycles for a random sample of German women and find that cumulative probabilities of conception at one, three, six and twelve cycle(s) are, respectively, 38, 68, 81 and 92 %. A linear interpolation between month 0 and 1 one yields a cumulative probability of conception of 29 % at week three, which implies that approximately 2038 (=591/0.29) couples were induced to bring their baby plans forward. Relative to the December 1996 birth count that would have occurred in the absence of the policy change, the responsive sample thus amounts to as much as 29 % [=2038/(7613 − 591)].

Running the same model, but excluding either one, 2 or 3 years in between yields very similar estimates to those reported in Table 6.

For example, Rayl et al. [24] show that maternal characteristics like primiparity and older maternal age are associated with an increased risk of breech birth. The Austrian data show a very similar picture: the major determinants for both instrumental non-vaginal and instrumental vaginal delivery are primiparity and older age (results not shown).

In the medical and epidemiological literature, a mistimed pregnancy is usually defined as a pregnancy that occurred earlier than desired (e.g., Cheng et al. [8]). Under normal circumstances, antedating a child is a conscious action and should not be considered a mistimed pregnancy. In our case, however, incentives to antedate a child were increased exogenously while other relevant circumstances (e.g., financial situation, health behavior, workload, size of the apartment) remained unchanged. In such a situation, one may argue that mothers are exposed to similar risks as in the case of a truly mistimed pregnancy.

For example, Pulley et al. [23] find that the mistiming of a pregnancy positively correlates with the probability of a preterm delivery (and low birth weight). They conclude that pregnancies that are mistimed by more than a few months may have severe health consequences for both mother and child. Similar results for unintended (i.e., both mistimed and unwanted) births are reported by Orr et al. [22].

Note that it may make sense to look at the share of premature births conceived in March rather than born in December 1996. This is because babies conceived within the relevant time window of 3 weeks following the announcement, when born prematurely, would have been born at most 8.5 months later and, thus, probably already in November. However, this yields an insignificant estimate as well.

In particular, if responding mothers are of poorer health than average mothers, and poorer health (which is not observed) is positively correlated with the probability for labor complications, then the unexplained part of the differential would be upward biased and, therefore, not only capture increased behavioral/psychological risks triggered by mistimed pregnancies. A second issue is whether the included characteristics are affected by the behavioral/psychological risks themselves (which seems unlikely in our setup, however).

References

Alm, J., Whittington, L.: Does the income tax affect marital decisions? Natl. Tax. J. 48, 565–572 (1995)

Bauernberger, J., Guger, A.: Slight decline of the social expenditure/GDP ratio. Austria’s social expenditure in 1996. Austrian Econ. Q. 3(3), 147–152 (1998)

Black, S., Devereux, P., Salvanes, K.: From the cradle to the labor market? The effect of birth weight on adult outcomes. Q. J. Econ. 122(1), 409–439 (2007)

Blinder, A.: Wage discrimination: reduced form and structural estimates. J. Human Resour. 8(4), 436–455 (1973)

Blundell, R., Francesconi, M., Van der Klaauw, W.: Anatomy of policy reform evaluation: announcement and implementation effects, Mimeo (2011)

Buckles, K., Hungerman, D.: Season of birth and later outcomes: old questions, new answers. Rev. Econ. Stat. (2012) (forthcoming)

Chen, D.: Can countries reverse fertility decline? Evidence from france’s marriage and baby bonuses, 1929–1981. Int. Tax Public Financ. 18(3), 253–272 (2011)

Cheng, D., Schwarz, E., Douglas, E., Horon, I.: Unintended pregnancy and associated maternal preconception, prenatal and postpartum behaviors. Contraception 79(3), 194–198 (2009)

Cnattingius, S., Lambe, M.: Trends in smoking and overweight during pregnancy: prevalence, risks of pregnancy complications, and adverse pregnancy outcomes. Semin. Perinatol. 26(4), 286–295 (2002)

Dickert-Conlin, S., Chandra, A.: Taxes and the timing of births. J Polit. Econ. 107(1), 161–177 (1999)

Drago, R., Sawyer, K., Shreffler, K., Warren, D., Wooden, M.: Did Australia’s baby bonus increase fertility intentions and births? Popul. Res. Policy Rev. 30(3), 381–397 (2011)

Gans, J., Leigh, A.: Born on the first of July: an (un)natural experiment in birth timing. J. Public Econ. 93(1–2), 246–263 (2009)

Gnoth, C., Godehardt, D., Godehardt, E., Frank-Herrmann, P., Freundl, G. Time to pregnancy: results of the German prospective study and impact on the management of infertility. Hum. Reprod. 18(9), 1959–1966 (2003)

Kopczuk, W., Slemrod, J.: Dying to save taxes: Evidence from estate-tax returns on the death elasticity. Rev. Econ. Stat. 85(2), 256–265 (2003)

Lain, S., Ford, J., Raynes-Greenow, C., Hadfield, R., Simpson, J., Morris, J., Roberts, C.: The impact of the Baby Bonus payment in New South Wales: who is having “one for the country”? Med. J. Aust. 190(5), 238–241 (2009)

Malani A., Reif J.: Accounting for anticipation effects: an application to medical malpractice tort reform. NBER Working Paper No. 16593 (2010)

Mulder, E., Robles de Medina, P., Huizink, A., Van den Bergh, B., Buitelaar, J., Visser, G.: Prenatal maternal stress: effects on pregnancy and the (unborn) child. Early Hum. Dev. 70(1):3–14 (2002)

Neugart, M., Ohlsson, H.: Economic incentives and the timing of births: evidence from the german parental benefit reform 2007. J. Popul. Econ. 26, 87–108 (2013)

Norbeck, J., Tilden, V.: Life stress, social support, and emotional disequilibrium in complications of pregnancy: a prospective, multivariate study. J. Health Soc. Behav. 24(1), 30–46 (1983)

Oaxaca, R.: Male-female wage differentials in urban labor markets. Int. Econ. Rev. 14(3), 693–709 (1973)

Orr, S., Miller, C., et al.: Unintended pregnancy and the psychosocial well-being of pregnant women. Women’s Health Issues 7(1), 38–46 (1997)

Orr, S., Miller, C., James, S., Babones, S.: Unintended pregnancy and preterm birth. Paediatr. Perinat. Epidemiol. 14(4), 309–313 (2008)

Pulley, L., Klerman, L., Tang, H., Baker, B.: The extent of pregnancy mistiming and its association with maternal characteristics and behaviors and pregnancy outcomes. Perspect. Sex. Reprod. Health 34(4), 206–211 (2002)

Rayl, J., Gibson, P., Hickok, D.: A population-based case-control study of risk factors for breech presentation. Am. J. Obstet. Gynecol. 174(1), 28–32 (1996)

Rodgers, J., Udry, J.: The season-of-birth paradox. Biodemography Soc. Biol. 35(3), 171–185 (1988)

Tamm, M.: The impact of a large parental leave benefit reform on the timing of birth around the day of implementation. Oxf. Bull. Econ. Stat. (2012) (forthcoming)

Acknowledgments

We thank Christian Dustmann, Rafael Lalive, Josef Zweimüller, as well as seminar participants in Brixen, Engelberg and Zurich for helpful comments and suggestions. We also thank Sandro Favre and Philippe Ruh for great research assistance. This paper has previously been circulated as “Financial Incentives, the Timing of Births, Birth Complications, and Newborns’ Health: Evidence from the Abolition of Austria’s Baby Bonus”. Financial support from the Austrian Science Fund (FWF) is gratefully acknowledged (S 10304-G16: “The Austrian Center for Labor Economics and the Analysis of the Welfare State”).

Author information

Authors and Affiliations

Corresponding author

Appendix: Decomposing the increase in birth complications

Appendix: Decomposing the increase in birth complications

To explore whether the increase in birth complications is due to unobserved stress or due to selection, we perform a simple regression-based decomposition analysis based on individual-level data [4, 20]. The goal of this exercise is to determine the impact of selective fertility responses on the likelihood of some birth complication. For the decomposition analysis we simply compare mothers who gave birth in December 1996 with mothers who gave birth in December 1995. Table 8 shows the results (note that the two columns differ only in the weighting scheme used for the decomposition).

In line with the corresponding results from Table 8, the upper part of Table 8 documents a difference in the likelihood of experiencing some birth complication of about one percentage point (in Table 8, however, the difference is not statistically significant). The lower part of the table shows the decomposition results, revealing that about 12–14 % of the observed difference in the probability of some birth complication is explained by differences in observed maternal characteristics between the two groups of mothers. Consequently, 86–88 % of the difference remains unexplained.

The extent to which the unexplained part of the increase in birth complications is driven by an underlying increase in behavioral and/or psychological risks from the mistiming of births depends on whether the included variables describe maternal characteristics comprehensively. If the omitted variables are correlated with responsiveness to the incentive and, therefore, with group affiliation, then the unexplained part of the decomposition might capture not only increased behavioral/psychological risks, but also other unobserved group differences. Footnote 24

Rights and permissions

About this article

Cite this article

Brunner, B., Kuhn, A. Announcement effects of health policy reforms: evidence from the abolition of Austria’s baby bonus. Eur J Health Econ 15, 373–388 (2014). https://doi.org/10.1007/s10198-013-0481-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10198-013-0481-4

Keywords

- Baby bonus

- Scheduling of conceptions

- Timing of births

- Policy announcement

- Announcement effect

- Birth complications

- Medical intervention