Abstract

The need to balance agricultural production and environmental protection shifted the focus of Brazilian land-use policy toward sustainable agriculture. In 2010, Brazil established preferential credit lines to finance investments into low-carbon integrated agricultural systems of crop, livestock and forestry. This article presents a simulation-based empirical assessment of integrated system adoption in the state of Mato Grosso, where highly mechanized soybean–cotton and soybean–maize double-crop systems currently prevail. We employ bioeconomic modeling to explicitly capture the heterogeneity of farm-level costs and benefits of adoption. By parameterizing and validating our simulations with both empirical and experimental data, we evaluate the effectiveness of the ABC Integration credit through indicators such as land-use change, adoption rates and budgetary costs of credit provision. Alternative scenarios reveal that specific credit conditions might speed up the diffusion of low-carbon agricultural systems in Mato Grosso.

Similar content being viewed by others

Introduction

The Federal Government of Brazil is aware of its great responsibility to combat climate change. During the 15th Conference of the Parties (COP15) of the United Nations Framework Convention on Climate Change (UNFCCC), the government pledged to take domestic actions to substantially decrease its greenhouse gas (GHG) emissions. According to this pledge, national greenhouse gas emissions shall be reduced by 36.1–38.9% until 2020. As a consequence, a major mitigation effort must be made in agriculture and land use, which currently account for more than 60% of Brazil’s annual GHG emissions (MCTI 2016). Agriculture alone is expected to reduce 166 million tons of CO2eq (or 43%) of the national mitigation efforts by 2020 (World Bank 2010, 2011; Mozzer 2012). However, this should not undermine the sector’s great economic and political importance, earning around 52% of the total national exports.

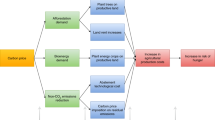

Brazil aims to simultaneously ensure climate change mitigation and economic development by offering farmers incentives to switch to low-carbon agricultural practices. A special credit program has been launched in 2010 as part of the Federal Government’s Strategy for Low-Carbon Agriculture (“ABC Plan” from Portuguese “Agricultura de Baixo Carbono”). The program supports the adoption of integrated crop–livestock–forestry systems by providing preferential loans to their adopters. Still, the impacts of this program remain largely unclear as comprehensive empirical data are lacking concerning (1) the current inventory of integrated systems and (2) the effective use of ABC Integration credit at farm level. Evaluations of the ABC credit program have been made recently but only through supply-side analyses of borrowed amounts (Observatório ABC 2015). Other studies conduct cost analyses based on data from a single farm (de Oliveira Silva et al. 2015) or investment analyses of single production alternatives (Bezerra et al. 2011; FAMATO 2013). Gil et al. (2015) present an overview of integrated land-use systems in Mato Grosso and investigate the determinants of their adoption. According to Gil et al. (2016), from the farmer perspective, there is evidently a high degree of uncertainty regarding the synergy effects of integrated systems as well as their economic performance.

Against this background, the present article is the first to assess the ABC Integration program through a “holistic” demand-side approach based on a quantitative assessment of farm systems in the state of Mato Grosso. Our study takes into account farmer economic incentives as well as the heterogeneity of local farm holdings in terms of resource endowments, investment opportunities, as well as environmental, technical and market conditions. For our policy assessment, we apply bioeconomic microsimulation, combining the software packages MPMAS and MONICA. The model setup, parameterization and validation are described in the following sections. Through computer simulations we evaluate the policy potential of current and alternative ABC credit lines in Mato Grosso and offer suggestions for their implementation. Our simulation results thereby provide detailed information on the effectiveness and efficiency of the ABC Credit Program in supporting specifically the adoption of integrated land-use systems.

Study area

Agro-ecological conditions

Mato Grosso is the third largest state of Brazil extending over 903,000 km2 (IBGE 2015), which amounts to the area of France and Germany combined. Since the 1970s, Mato Grosso experienced a rapid expansion of agricultural and pasture lands coupled with deforestation of large rainforest and savanna areas (DeFries et al. 2013). Between 1990 and 2013, the area allocated to crop production increased fivefold by 10 million hectares (IBGE 2016a) with a historical peak in 2004, when annual deforestation reached 11,800 sq. km. (INPE 2015). While overall deforestation has significantly decreased since then, recent forest clearance seems to be on the rise again (Fearnside 2015) and land clearing and subsequent soil tillage continue to cause large amounts of GHG emissions (Galford et al. 2011). Favorable climatic conditions allowing for two growing seasons per year, together with the introduction of improved seeds and techniques for dealing with soil acidity, transformed Mato Grosso into a major player in soybean, maize and cotton production (World Bank 2009). In 2013, the state accounted for 29% of the national soybean production, 25% of the national maize production and 52% of the national cotton production (IBGE 2016b). Cattle ranching is another prominent activity in the state, which concentrates 13% of the national cattle herd (IBGE 2016a).

Mato Grosso’s agricultural output is almost exclusively produced in five of the seven macroregions defined by the Mato Grosso Institute of Agricultural Economics (IMEA 2010). In each of these five macroregions, IMEA selected one representative survey site (gray-shaded areas in the right pane of Fig. 1), which taken together provide the data basis for our policy simulation analysis in this paper.

Policy setting

As mentioned above, the ABC Plan is one pillar of Brazil’s strategy for GHG mitigation. It seeks to stimulate the adoption of low-carbon agricultural practices through its dedicated credit programs (herein “ABC credit”). The program offers preferential loans to farmers for implementing one or several of the following agricultural practices: (1) integrated systems of crops, livestock and forestry, (2) restoration of degraded pastures, (3) no-tillage farming, (4) biological nitrogen fixation, (5) treatment of animal waste and (6) commercial forestry plantations (MAPA 2012).

In our present study, we focus exclusively on the credit line ABC Integration for integrated systems of crops, livestock and forestry (BNDES 2015a). There are several motivations to support these land-use systems that are up to now relatively new in Mato Grosso: (1) tree plantations as part of an integrated system increase wood and energy supply, potentially reducing pressure on natural forest areas (FAMATO 2013); (2) tree plantations contribute to carbon sequestration; (3) integration of crops and livestock may increase returns per hectare and, therefore, spare land (Strassburg et al. 2014; Cohn et al. 2014); and (4) the interaction between crops, livestock and trees may increase crop yield and livestock output (Assmann et al. 2003).

At the time of our analysis, subsidized credit of ABC Integration had an annual interest rate of 5% (BNDES 2015b), which is a very lucrative opportunity, considering that the annual interest rate of the Brazilian Central Bank is around 12% (BACEN 2015). The official documentation (BNDES 2015a), however, lacks a clear definition of what exactly is considered as a tree plantation in integrated systems. According to our discussions with local experts, the common practice is to use a lower bound of forest area of 10%. This means that a livestock–forestry system, for example, with ten hectares, should have at least 1 hectare of forestry integrated with livestock production. In integrated systems with cattle, the frequency of crop rotation differs, but the land is usually used for grazing at least once every four years in all systems (Gil et al. 2015). Like in the case of systems with forestry, for systems with cattle the criterion is also quite imprecise. The final verdict is made by local bank managers from accredited financial organizations, who decide whether the farmer application is eligible for preferential credit.

Methods and data

Methods used

For our assessment of low-carbon land-use options and the impacts of policy interventions, we apply bioeconomic microsimulation (Troost et al. 2015; Troost and Berger 2015). Bioeconomic microsimulation refers to farm-level modeling of all farm holdings in a specific study area in order to capture policy response subjected to farm heterogeneity. We simulate the decision making of each farm holding over time using whole-farm mathematical programming integrated with a regionalized crop growth simulation model. In our study, we have not yet simulated interactions between farm holdings, for example, in land markets or information communication networks. This makes our present bioeconomic micromodeling approach a disconnected multi-agent system, following the definition of Berger et al. (2006). Work is ongoing to parameterize also farm agent interactions in our bioeconomic modeling approach, which would then yield a fully connected multi-agent system.

Our bioeconomic microsimulation was implemented using MPMAS, a multi-agent software package developed for simulating farm-based economic behavior and human–environment interactions in agriculture (Schreinemachers and Berger 2011). This software has been applied in a number of empirical studies focusing on innovation diffusion in agriculture (Berger 2001; Schreinemachers et al. 2009, 2010; Marohn et al. 2013; Quang et al. 2014) as well as for integrated assessment of farm-level agricultural policies (Berger et al. 2006; Troost et al. 2015; Wossen and Berger 2015). Software architecture and model equations of MPMAS are described in greater detail in Schreinemachers and Berger (2011), following the ODD protocol.

Our MPMAS application was combined with the process-based biophysical simulator MONICA (Nendel et al. 2011). This model integration is extremely important for our study purpose since it allows us to capture local environmental conditions and constraints in our mathematical programming approach and, thus, incorporate them into farmers’ decision making. MONICA is responsible for simulating crop yields for various crop maturity groups, fertilizer application levels, soil types and climatic conditions. Further details about our MPMAS_MONICA integration can be found in Carauta et al. (2016a) and Carauta et al. (2016b). MONICA has been specifically parameterized and calibrated for the study area using 2000–2013 weather data. Simulated crop yields for all soybean, cotton and maize production alternatives implemented in MPMAS have been stored on a MySQL server. We set up a specific database application (called “mpmasql”), which accesses the database and converts the stored parameters into model input for MPMAS. For simulating agent decisions (see details below), MPMAS uses COIN’s Cbc mixed-integer programming solver, which we fine-tuned for this study. The MPMAS software, R scripts, input and output files, and model documentation can be downloaded from “http://www.uni-hohenheim.de/mas/software/BrazilSupplement.7z.”

Input data and model parameterization

As shown in Fig. 1, we parameterized MPMAS_MONICA for the five survey sites of IMEA in Mato Grosso: Canarana (Northeast), Campo Verde (Southeast), Sapezal (West), Sorriso (Mid-North) and Tangará da Serra (South Central). Crop production requirements for bioeconomic modeling were estimated using production cost surveys of IMEA (2013) and the crop-level dataset of a Brazilian agricultural consultancy company (Céleres 2013). Costs of inputs, transportation and processing, as well as conditions of credit and taxes, refer to the harvest season 2013/2014 and were also taken from IMEA (2013). Site-specific time series of prices for agricultural products were obtained from the online price database of IMEA (2015). Purchase prices for agricultural machinery were compiled from local traders, while operational costs of machinery were estimated using the methodology of the Brazilian National Supply Company (CONAB 2010). Information on soils was taken from the georeferenced soil database of Brazil (Muniz et al. 2011) and from official socio-ecological zoning maps produced by the Mato Grosso State Secretary of Planning (SEPLAN 2011).

The agent population in MPMAS_MONICA includes all crop-producing farm holdings in the five IMEA sites that operate on more than 50 hectares according to the latest agricultural census available (IBGE 2006). At the time of the census, these 844 farm holdings constituted 99% of all crop-producing farms in the IMEA sites in terms of agricultural area and 74% in terms of number. Using the empirical data from the Brazilian Agricultural Census (IBGE 2006) and from the IMEA agricultural survey (IMEA 2013), we created a statistically consistent population of 844 model agents following the Monte Carlo approach of Berger and Schreinemachers (2006).

Regarding agent decision making, we implemented a recursive whole-farm planning approach based on mathematical programming as described in Schreinemachers and Berger (2011). Each model agent seeks to maximize the expected farm income subject to its individual land, labor and cash endowments, as well as specific crop rotational and farm technical constraints. It is important to note that agents in MPMAS will only select production alternatives that are profitable to them. This microeconomic foundation makes MPMAS simulation results highly realistic as real-world farmers typically avoid unprofitable production alternatives or quickly abandon them in case they have taken them up based on too optimistic expectations (Berger and Troost 2014).

In every simulation period of MPMAS, which corresponds to one real-world agricultural year, agents actually take 3 decisions: an investment decision, a production decision and a consumption decision. During the investment decision stage, each agent decides in which durable assets (e.g., machinery, livestock, tree plantations) to invest. The agent investment decision is taken based on the values of farm resource requirements, prices and yields expected in the long run. Agents can purchase assets both on loan and with full self-financing. At this stage, agents may also decide to apply for ABC Integration credit in order to invest into low-carbon integrated systems complying with the official regulations released by the Brazilian Development Bank (BNDES 2015a).

In the subsequent production decision stage, model agents set up the farm operational plan for the current period and select the specific seeds and breeds as well as fertilizer and feed application rates for soybean, cotton, maize, eucalyptus, teak and cattle production. The agent production decision is based on individual resource requirements, prices and yields expected for that period, adding possible new assets purchased as part of the agent investment decision.

For the agent consumption decision stage, MPMAS simulates the individual economic performance (e.g., cash flow, savings, withdrawals, payback of credit taken) of each model agent based on actual prices and crop yields (simulated in MONICA) and updates the agent’s liquid and physical assets and liabilities. The resulting values for each agent are finally carried over to the next simulation period and form the initial values for the subsequent investment and production decisions. One agent optimization problem contains up to 3819 decision variables (including 150 integer variables) and 3887 constraints.

Implementation of integrated production systems

Integrated production systems in MPMAS are implemented as combinations of crops, livestock and trees on the same farm plot. Unfortunately, long-term experimental results on possible interaction effects between system components are not yet available for integrated systems containing tree crops in Mato Grosso. In the case of crop–livestock interactions, short-term experiments have already been conducted in conditions similar to those of our study area (Landers 2007; Flores et al. 2007; Silva et al. 2012; Kunrath et al. 2015) and suggest that the magnitude of short-term profitability effects is rather small. Given such limited evidence, we opted for not including any interaction effects in our present model implementation.

Four types of low-carbon systems with tree crops have been implemented in MPMAS: three with eucalyptus (Eucalyptus urograndis) and one with teak (Tectona grandis). The first eucalyptus system is for charcoal production and has a 7-year production cycle. The second eucalyptus system focuses on charcoal and wood production and has a 12-year production cycle. Model parameters for both of these systems (including investment costs, labor and machinery requirements as well as charcoal output) were estimated from FAMATO (2013). The third system is a wood-only eucalyptus seedling and coppicing double-planting system that has a 14-year production cycle based on Rode et al. (2014). Finally, for teak, we implemented a novel production system with a 20-year production cycle, as described in Bezerra et al. (2011). We estimated the model prices for forestry products from the online database of the Department of Agriculture and Supply of the Parana State (SEAB 2015). The risk premium for discounting future values of forest investments in our analysis was set to 4.9%, which is the value commonly chosen for agricultural investment analysis by local banks.

For the implementation of cattle production alternatives we used data on livestock systems from ANUALPEC (2013). In total, our model agents can select among nine cattle production systems with different intensity levels (extensive, semi-intensive or intensive) and production cycles (breeding, fattening or full cycle). Agents can practice each of the nine systems either with brachiaria grassland pasture (Brachiaria brizanta) or with unmanaged grazing land. The carrying capacities of both pasture types and the costs of brachiaria pasture formation were also taken from ANUALPEC (2013).

Model validation and simulation experiments

Model validation

Empirical validation of bioeconomic microsimulation models is commonly done by comparing the model output (endogenous variables) with the corresponding observed values (Fagiolo et al. 2007). Our model validation followed the methods described in Troost and Berger (2015), Carauta et al. (2016a) and Carauta et al. (2016b). For the validation of the MPMAS application presented here, we used two benchmarks: modal single farm land-use data of IMEA (2013) for farm-type validation and municipality land-use data of IBGE (2016b) for municipality-level validation. Conducting two separate validation tests at two levels of aggregation is necessary given that our agent-based model component simulates both the behavior of individual farms and the agricultural land-use patterns of the study area as a whole.

For the farm-type validation, we inserted the farm profiles (i.e., information on land ownership, asset endowments and location characteristics) specified by IMEA (2013) as model input and run MPMAS to simulate the land use of these farm agents. Then, we compared the simulated agent land use (by crop and season) with the land use recorded by IMEA and calculated a model efficiency based on standardized absolute errors (ESAE) of 0.47, which in our opinion is sufficient for this first policy analysis study. Troost and Berger (2015), for example, report values for ESAE at farm-type level between 0.62 and 0.71 but had detailed farm survey data available for their model parameterization. We are therefore confident being able to achieve similar model efficiency once the new IMEA dataset of 2016 becomes accessible to us. For the municipality-level validation, we compared the simulated and observed land-use shares of soybean and maize in total cropland by each municipality. At this level, ESAE model efficiency reaches 0.92.

Figure 2 depicts scatter plots of observed and simulated land uses for both validation tests to visualize the goodness of model fit at disaggregate and aggregate level. The fitted no-constant regression lines (slopes close to unity) and their calculated R-squared (0.73 for the farm types and 0.99 for the municipality level) indicate a good model fit. The slope coefficient of the regression lines for the farm-type level reaches a value of 0.4, which increases to 0.96 for the municipality level indicates that the model underestimates the land-use shares of soybean and maize by 4% on average at the municipality level, which stems from slightly overestimating the land-use share of cotton. As already mentioned above, we could not obtain empirical data concerning the adoption of low-carbon integrated systems specifically in our study areas. Therefore, simulated values of integrated systems land use were cross-checked by local experts and judged against observed values found by Gil et al. (2015).

The MONICA application was validated at the municipality level, by comparing simulated yields to observed crop yields of each municipality and crop season between 2000 and 2013 (IBGE 2016c). A validation at the farm level was not possible since crop management and yield data were not available for individual farms. Figure 3 compares the simulated crop yields of soybean, maize and cotton with the ones observed by IBGE. In the majority of years, the empirical average lies well within the range of yields simulated with MONICA.

In general, the results of our empirical validation suggest that a very good match at municipality level was achieved, whereas the farm-type-level response was less well matched. The latter is a common problem in farm-level models owing to the lack of data and the inherent unpredictability of individual human behavior which, as is the case here, might average out at more aggregate levels. Still, we believe that this does not affect the robustness of the conclusions we derive from our policy analysis.

Simulation experiments

Having validated the MPMAS and MONICA model components, three simulation experiments were considered for our policy impact assessment:

Experiment #1 (“ABC adoption”) assesses the adoption impact of the ABC program by comparing a baseline scenario [ABC] reflecting the ideal situation, in which all model agents have access to ABC Integration credit (but may not take it), with a counterfactual scenario [NO_ABC], where no subsidized credit is made available to the model agents.

Experiment #2 (“Alternative financing”) tests possible variations in financing conditions of the ABC program for integrated systems. This was done by comparing the baseline scenario [ABC] with the following alternative simulation settings:

-

“Less Subsidy” [LESS] decreases the subsidized amount by increasing the credit interest rate up to 6%

-

“Own Capital 50%” [OC50] reduces the own-capital requirement (i.e., down payment share) for integrated system adoption to 50% from currently 60% and 65%

-

“Own Capital 25%” [OC25] reduces the own-capital requirement to 25%

-

“Maximum Amount” [MAX] increases the maximum amount that model agents can borrow by one million BRL

Experiment #3 (“Teak introduction”) evaluates the ABC adoption of integrated systems under a possible introduction of teak markets [TEAK]. According to local experts, this might be a promising marketing activity for Mato Grosso that could produce high-quality wood to be sold at superior prices than current eucalyptus wood.

We would like to emphasize here that the baseline scenario in our present policy analysis does not fully reflect Mato Grosso’s current credit uptake and integrated systems adoption. Since inventory data of integrated systems are not (yet) available in Brazil, we had no direct observations to calibrate our agent decisions regarding the uptake of ABC credit for integrated systems. We, therefore, decided to create an ideal baseline for this study without any hindering bureaucratic and social factors as identified by Gil et al. (2015). As a consequence, our baseline will certainly overestimate the absolute amount of ABC credit uptake and integrated systems area of Mato Grosso’s farmers. Still, farmers’ economic incentives and their relative choice between alternative land-use activities, i.e., the policy potential of the ABC credit program in promoting the adoption of integrated systems, are well captured in our simulations.

To isolate the direct effects of policy intervention, all experiments were run for 3 agricultural years with constant average prices and crop yields. In addition, we fixed land ownership of model agents by not allowing for land sales and changes in long-term rental contracts. Still, model agents may temporarily rent in or rent out farm land for the duration of one year. Our simulation experiments thus capture the short-term to mid-term effects of policy intervention undisturbed by price and weather variability and long-term dynamics on land markets.

Simulation results

Adoption of credit for low-carbon agriculture

Figure 4 shows the simulated impacts of the ABC program for low-carbon agriculture in terms of land-use change. The left and right panels indicate the share of integrated systems in the absence and presence of ABC credit, respectively. While the share of integrated systems in the West macroregion is almost equally high in both situations, agents in other IMEA macroregions (especially in Mid-North, South Central and Northeast) increase their share of integrated systems considerably. The dotted line in both panels indicates the land-use share of integrated systems averaged over all model agents. Accordingly, our simulations suggest that with ABC credit the adoption of integrated systems more than doubled, reaching an agent land-use share of 27%.

Figure 5 shows the distribution of integrated system adoption at agent level with and without ABC credit. In our simulations, the majority of agents allocated 1000–2000 ha of their farmland to integrated systems, with some few large-scale farm agents assigning very large areas to these systems.

As Fig. 6 additionally shows, agents in West and Southeast selected predominantly iCL (crop–livestock) systems with ABC credit, while agents in Mid-North, South Central and Northeast preferred iCLF (crop–livestock–forestry). Furthermore, iLF (livestock–forest) systems were not adopted at all, and iCF (crop–forestry) systems were adopted in almost half of the area under integration in the Mid-North and in a quarter in South Central.

Alternative financing

Figure 7 compares the simulated policy costs and land areas for alternative implementations of the ABC Integration program. The left panel shows the per-hectare policy costs under various financing conditions; the right panel shows the policy costs and their impacts in terms of area, scaled-up to the state level using IBGE sampling weights. Accordingly, providing credit at an increased interest rate (i.e., with less subsidy than under current conditions) was the most cost-effective policy measure, but made agents reduce the total area with integrated systems from 27% [ABC] to 19% [LESS] of all agricultural land. Expanding the upper limit for ABC credit [MAX] led both to an increase of per-hectare policy costs and agent adoption of integrated systems. In contrast, changing the own financing requirements to 50% [OC50] and 25% [OC25] increased the per-hectare policy costs and, at the same time, made agents adopt less area of integrated systems.

After submission of the original manuscript for this article, EMBRAPA (2016) released a survey-based estimate of 1.5 million hectares of integrated systems in Mato Grosso, with crop–livestock systems (iCL) having the largest share of adoption. We note that our upscaled baseline simulation result of about 1.8 million hectares [ABC] with mainly iCL is in line with this recent estimate.

Teak introduction

The assessment of teak as a possible new production alternative is also depicted in Fig. 7. Accordingly, the introduction of teak amplified the effect of ABC credit in our simulations, since it increased the total integrated system area by about 250,000 hectares when compared to the baseline [ABC] scenario. This increase in adoption area was possible in our simulations without excessive increase of policy costs.

Discussion

Implementation of preferential credit programs

The results of our simulations suggest that ABC credit indeed contributed to the adoption of integrated systems in Mato Grosso. Without preferential credit lines, the adoption of integrated systems would be rather modest at about 11% of agricultural land use in Mato Grosso. With the introduction of the ABC program and neglecting bureaucratic and social barriers at farm level, the area of integrated systems probably more than doubled in 2013. Furthermore, in the absence of the ABC program, almost the entire area of integrated systems would be made up of crop–livestock integration (iCL). With the recent introduction of the ABC program, our simulations suggest an increase in iCLF (crop–livestock–forestry) and iCF (crop–forestry) systems.

We also found our model agents to be sensitive to changes in financing conditions of ABC credit. Agents with limited liquidity can access various financing sources that differ only slightly in terms of interest rates and upper credit limits. In addition, integrated system adoption yields only slightly higher returns than conventional systems. Small changes in financing can, therefore, trigger larger reallocation of financial resources between competing land uses and credit sources. In our simulations, increasing the maximum ABC amount that agents are allowed to borrow [MAX] sped up the adoption of integrated land-use practices. The total area of adoption upscaled to Mato Grosso state level increased to 28%, while the policy costs per hectare increased to R$47. This finding suggests that especially for large farm holdings (i.e., “thousand hectares plus”) that operate most of the agricultural lands in Mato Grosso, the current credit limits appear to too low.

The most cost-effective scenario in terms of per-hectare policy costs was the scenario [LESS], though in this scenario the overall area of adoption reduces by almost half. This result suggests that the reduction of subsidized credit may lead to subsequent discontinuity of integrated system adoption among many farm holdings in Mato Grosso. In contrast, lowering the own-capital requirements (scenarios [OC50] and [OC25]) for agents when applying for ABC credit, turned out to be a highly cost-ineffective policy measure. Policy costs increased in our simulations considerably, while the area dedicated to integrated systems decreased. This result underlines the importance of farm-level simulation that is capable of capturing the liquidity endowment of individual farm holdings and their responses to minor changes in financing conditions. Against these simulation results, the current self-financing share in ABC credit seems appropriate.

In addition, our simulation results suggest that impact and cost-effectiveness of ABC credit vary significantly across our study area. Given the heterogeneity of farming conditions observed in Mato Grosso, it appears ineffective to apply the ABC program under identical conditions in the entire state. Tailoring financing conditions to smaller geographical units could be achieved, for example, by using IBGE’s subdivision of “meso-regions” for location-specific ABC program implementations.

High-value timber as an investment opportunity

The results of our explorative simulations concerning high-value timber production suggest that enabling more farmers to participate in the teak market could further increase the state’s area of planted forests with ABC Integration credit. Once the teak market has been made accessible in our simulations, more model agents adopted forestry systems, increasing the integrated system area in Mato Grosso by about 240,000 hectares. Improving the teak market structure, therefore, appears a promising strategy for future regional development, deserving more attention and research. The improvement could be achieved, for instance, by providing technical support to teak growers through local extension networks, by creating linkages between buyers and producers or by launching advertisement campaigns of investment opportunities in the teak sector.

Conclusions

Credit from the ABC program has not been regarded as a crucial determinant of the adoption of integrated systems in Mato Grosso. In fact, only a small share of current integrated systems adopters have used the ABC credit lines so far (Gil et al. 2015; Observatório ABC 2015). Still, our simulation results suggest that ABC credit substantially increased the integrated system area in Mato Grosso and thereby highlight the importance of understanding farmer adoption decisions and responses to changes in financing conditions, especially in situations with high rates of interest and inflation which Brazil currently faces.

Transaction and learning costs associated with adopting new agricultural practices and on-farm technologies influence farmer land-use decisions. Such barriers, economic benefits of innovation and externally provided economic incentives (i.e., ABC credit) altogether constitute the factors determining the actual diffusion of agricultural innovations (Lee 2005). Our microsimulation approach accounts for innovation benefits and different forms of additional incentives but does not (yet) account for the bureaucratic and social barriers to integrated system adoption found by Gil et al. (2015). Therefore, the simulation results here should be interpreted as the upper limit of integrated system adoption, once these barriers have been removed.

It is possible to include these barriers into agent-based simulation by following the approach of Schreinemachers et al. (2010) and simulate the resultant adoption patterns—which will be done once the required empirical data from ongoing field data collection are available. Work is also ongoing to parameterize disaggregated GHG balances in our bioeconomic modeling approach, by integrating MPMAS_MONICA with a third model component CANDY (Carbon and Nitrogen Dynamics) based on field experimental data. We will then be able to extend our bioeconomic modeling approach and simulate changes in GHG emissions and carbon abatement costs in Mato Grosso.

Change history

20 March 2018

The published online version contains incorrect data in Figure 7.

References

ANUALPEC—Anuário da Pecuária Brasileira (2013) Anuário da Pecuária Brasileira. Informa Economics IEG | FNP, São Paulo. http://www.anualpec.com.br. Accessed 01 Dec 2016

Assmann TS, Ronzelli Júnior P, Moraes A, Assman AL, Koehler HS, Sandini I (2003) Rendimento de milho em área de integração lavoura-pecuária sob o sistema plantio direto, em presença e ausência de trevo branco, pastejo e nitrogênio. Rev Bras Ciência do Solo 27:675–683. doi:10.1590/S0100-06832003000400012

BACEN—Banco Central do Brasil (2015) Histórico das taxas de juros. In: Banco Cent. do Bras.—BACEN (Brazilian Cent. Bank). http://www.bcb.gov.br/Pec/Copom/Port/taxaSelic.asp. Accessed 01 Dec 2016

Berger T (2001) Agent-based spatial models applied to agriculture: a simulation tool for technology diffusion, resource use changes and policy analysis. Agric Econ 25:245–260. doi:10.1016/S0169-5150(01)00082-2

Berger T, Schreinemachers P (2006) Creating agents and landscapes for multiagent systems from random samples. Ecol Soc 11:18. http://www.ecologyandsociety.org/vol11/iss2/art19/. Accessed 01 Dec 2016

Berger T, Troost C (2014) Agent-based modelling of climate adaptation and mitigation options in agriculture. J Agric Econ 65:323–348. doi:10.1111/1477-9552.12045

Berger T, Schreinemachers P, Woelcke J (2006) Multi-agent simulation for the targeting of development policies in less-favored areas. Agric Syst 88:28–43. doi:10.1016/j.agsy.2005.06.002

Bezerra AF, Milagres FR, da Silva ML, Leite HG (2011) Análise da viabilidade econômica de povoamentos de Tectona grandis submetidos a desbastes no Mato Grosso. Cerne 17:583–592. doi:10.1590/S0104-77602011000400018

BNDES—Banco Nacional de Desenvolvimento Econômico e Social (2015a) Programa para Redução da Emissão de Gases de Efeito Estufa na Agricultura—Programa ABC (Program for reducing greenhouse gases emissions in Agriculture—The Low Carbon Agriculture Program). In: Banco Nac. Desenvolv. Econômico e Soc. http://www.bndes.gov.br/apoio/abc.html. Accessed 01 Dec 2016

BNDES—Banco Nacional de Desenvolvimento Econômico e Social (2015b) AVISO SUP/AGRIS N° 27/2015 (Report from the Brazilian Development Bank—BNDES). http://www.bndes.gov.br/SiteBNDES/export/sites/default/bndes_pt/Galerias/Arquivos/produtos/download/avisos/2015/15avAGRIS027.pdf. Accessed 01 Dec 2016

Carauta M, Libera AAD, Chen RFF, Hampf A, Dantas IRM, Silveira JMF, Berger T (2016a) On-farm trade-offs for optimal agricultural practices in Mato Grosso, Brazil. In: 54º Congresso da Sociedade Brasileira de Economia, Administração e Sociologia Rural. Maceió, Brazil. doi:10.13140/RG.2.2.22655.00169

Carauta M, Libera AAD, Latynskiy E, Hampf A, Silveira JMF, Berger T (2016b) Integrated assessment of novel two-season production systems in Mato Grosso, Brazil. In: Sauvage S, Sanchez-Perez JM, Rizzoli AE (eds) Proceedings of the 8th international congress on environmental modelling and software. Toulouse, France. doi:10.13140/RG.2.1.3824.4088

Céleres (2013) Survey of environmental and social benefits of biotechnology adoption (Private Survey—unpublished raw data). Uberlândia, Brazil. http://www.celeres.com.br/category/biotecnologia/ Accessed 01 Dec 2016

Cohn AS, Mosnier A, Havlík P, Valin H, Herrero M, Schmid E, O’Hare M, Obersteiner M (2014) Cattle ranching intensification in Brazil can reduce global greenhouse gas emissions by sparing land from deforestation. Proc Natl Acad Sci 111:7236–7241. doi:10.1073/pnas.1307163111

CONAB—Companhia Nacional de Abastecimento (2010) Custos de produção agrícola: a metodologia da Conab. Brasília, Brazil. http://www.conab.gov.br/conabweb/download/safra/custos.pdf. Accessed 01 Dec 2016

de Oliveira Silva R, Barioni LG, Moran D (2015) Greenhouse gas mitigation through sustainable intensification of livestock production in the Brazilian cerrado. EuroChoices 14:28–34. doi:10.1111/1746-692X.12079

DeFries R, Herold M, Verchot L, Macedo MN, Shimabukuro Y (2013) Export-oriented deforestation in Mato Grosso: harbinger or exception for other tropical forests? Philos Trans R Soc B Biol Sci 368:20120173. doi:10.1098/rstb.2012.0173

Fagiolo G, Moneta A, Windrum P (2007) A critical guide to empirical validation of agent-based models in economics: methodologies, procedures, and open problems. Comput Econ 30:195–226. doi:10.1007/s10614-007-9104-4

FAMATO—Federação da Agricultura e Pecuária do Estado de Mato Grosso (2013) Diagnóstico de Florestas Plantadas do Estado de Mato Grosso. Cuiabá, Brazil. http://imea.com.br/upload/Relatorio_final_floresta_plantada.pdf. Accessed 01 Dec 2016

Fearnside PM (2015) Environment: deforestation soars in the Amazon. Nature 521:423. doi:10.1038/521423b

Flores JPC, Anghinoni I, Cassol LC, de Carvalho PCF, Leite JGDB, Fraga TI (2007) Atributos físicos do solo e rendimento de soja em sistema plantio direto em integração lavoura-pecuária com diferentes pressões de pastejo. Rev Bras Ciência do Solo 31:771–780. doi:10.1590/S0100-06832007000400017

Galford GL, Melillo JM, Kicklighter DW, Mustard JF, Cronin TW, Cerri CEP, Cerri CC (2011) Historical carbon emissions and uptake from the agricultural frontier of the Brazilian Amazon. Ecol Appl 21:750–763. doi:10.1890/09-1957.1

Gil J, Siebold M, Berger T (2015) Adoption and development of integrated crop-livestock-forestry systems in Mato Grosso, Brazil. Agric Ecosyst Environ 199:394–406. doi:10.1016/j.agee.2014.10.008

Gil J, Garrett R, Berger T (2016) Determinants of crop-livestock integration in Brazil: evidence from the household and regional levels. Land Use Policy 59:557–568. doi:10.1016/j.landusepol.2016.09.022

IBGE—Instituto Brasileiro de Geografia e Estatística (2006) Statistical tables from argicultural census (Table 837). In: Censo Agrícola 2006 Tabela 837 - Número Estabel. agropecuários e Área dos Estabel. por Grup. atividade econômica, condição Prod. em relação às terras, tipo prática agrícola e Grup. área Total. http://www.sidra.ibge.gov.br/bda/tabela/listabl.asp?z=t&c=837. Accessed 01 Dec 2016

IBGE—Instituto Brasileiro de Geografia e Estatística (2015) On-line Database with States Statistics. In: Inst. Bras. Geogr. e Estatística. http://www.ibge.gov.br/estadosat/perfil.php?sigla=mt. Accessed 1 Dec 2016

IBGE—Instituto Brasileiro de Geografia e Estatística (2016a) Statistical tables from argicultural census (Table 3939). In: Produção Agrícola Munic. Tabela 3939 - Efetivo dos rebanhos, por tipo rebanho. http://www.sidra.ibge.gov.br/bda/tabela/listabl.asp?z=t&o=24&i=P&c=3939. Accessed 01 Dec 2016

IBGE—Instituto Brasileiro de Geografia e Estatística (2016b) Agricultural Production by Municipality Survey (Table 1612). In: Produção Agrícola Munic. Tabela 1612 - Área plantada, área colhida, quantidade produzida e valor da produção da lavoura temporária. http://www.sidra.ibge.gov.br/bda/tabela/listabl.asp?z=t&o=11&i=P&c=1612. Accessed 01 Dec 2016

IBGE—Instituto Brasileiro de Geografia e Estatística (2016c) Agricultural Production by Municipality Survey (Table 99). In: Produção Agrícola Munic. Tabela 99 - Rend. médio da produção da lavoura temporária. http://www.sidra.ibge.gov.br/bda/tabela/listabl.asp?z=t&o=11&i=P&c=99. Accessed 01 Dec 2016

IMEA—Instituto Mato-grossense de Economia Agropecuária (2010) Mapa de Macrorregiões do IMEA. Cuiabá, Brazil. http://www.imea.com.br/upload/downloads/REGIOES_IMEA_MUNICIPIOS.pdf. Accessed 01 Dec 2016

IMEA—Instituto Mato-grossense de Economia Agropecuária (2013) Production Cost Survey from the Mato Grosso Institute of Agricultural Economics—IMEA. (Private Survey—unpublished raw data). Cuiabá, Brazil. http://www.imea.com.br/sinc/web2/login.php. Accessed 01 Dec 2016

IMEA—Instituto Mato-grossense de Economia Agropecuária (2015) On-line agricultural database for Mato Grosso regional markets. http://www.imea.com.br/site/precos.php. Accessed 01 Dec 2016

INPE—Instituto Nacional de Pesquisas Espaciais (2015) PRODES Project: the Brazilian Institute of Space Research (INPE). In: Monit. da floresta Amaz. Bras. por satélite. http://www.obt.inpe.br/prodes/index.php. Accessed 01 Dec 2016

Kunrath TR, Carvalho PCDF, Cadenazzi M, Bredemeier C, Anghinoni I (2015) Grazing management in an integrated crop-livestock system: soybean development and grain yield. Rev Ciência Agron 46:645–653. doi:10.5935/1806-6690.20150049

Landers JN (2007) Tropical crop-livestock systems in conservation agriculture: the Brazilian experience. Food and Agriculture Organization of United Nations, Rome, Italy. http://www.fao.org/3/a-a1083e.pdf

Lee DR (2005) Agricultural sustainability and technology adoption: issues and policies for developing countries. Am J Agric Econ 87:1325–1334. doi:10.1111/j.1467-8276.2005.00826.x

MAPA—Ministério da Agricultura, Pecuária e Abastecimento (2012) Plano setorial de mitigação e de adaptação às mudanças climáticas para a consolidação de uma economia de baixa emissão de carbono na agricultura: Plano ABC (Agricultura de Baixa Emissão de Carbono). Ministério da Agricultura, Pecuária e Abastecimento, Ministério do Desenvolvimento Agrário, coordenação da Casa Civil da Presidência da República. Brasília, Brazil. http://www.agricultura.gov.br/arq_editor/download.pdf. Accessed 01 Dec 2016

Marohn C, Schreinemachers P, Quang DV, Berger T, Siripalangkanont P, Nguyen TT, Cadisch G (2013) A software coupling approach to assess low-cost soil conservation strategies for highland agriculture in Vietnam. Environ Model Softw 45:116–128. doi:10.1016/j.envsoft.2012.03.020

MCTI—Ministério da Ciência, Tecnologia e Inovação (2016) Third National Communication of Brazil to the United Nations Framework Convention on Climate Change. Ministry of Science, Technology and Innovation, Brasília, Brazil http://sirene.mcti.gov.br/documents/1686653/1706740/MCTI_volume_III_ingles.pdf/65897db2-8501-425f-824e-bc6844492e61. Accessed 01 Dec 2016

Mozzer GB (2012) Agriculture and cattle raising in the context of a low carbon economy. Brasília, Brazil. https://ideas.repec.org/p/ipc/opager/157.html. Accessed 01 Dec 2016

Muniz M, Curi N, Sparovek G, Carvalho Filho A de, Silva SHG (2011) Updated Brazilian’s georeferenced soil database—an improvement for international scientific information exchanging, principles, application and assessment in soil science. In: Burcu E, Gungor O (eds). InTech. Rijeka, Croatia. http://www.intechopen.com/books/principles-application-and-assessment-in-soil-science/updated-brazilian-s-georeferenced-soil-database-an-improvement-for-international-scientific-informat. Accessed 01 Dec 2016

Nendel C, Berg M, Kersebaum KCC, Mirschel W, Specka X, Wegehenkel M, Wenkel KOO, Wieland R (2011) The MONICA model: testing predictability for crop growth, soil moisture and nitrogen dynamics. Ecol Model 222:1614–1625. doi:10.1016/j.ecolmodel.2011.02.018

Observatório ABC (2015) Análise dos Recursos do Programa ABC: Foco na Amazônia Legal - Potencial de redução de GEE e estudo de caso sobre o Programa ABC em Paragominas. Rio de Janeiro, Brazil. http://mediadrawer.gvces.com.br/abc/original/relatorio-4_gvces-versao-final.pdf. Accessed 01 Dec 2016

Quang DV, Schreinemachers P, Berger T (2014) Ex-ante assessment of soil conservation methods in the uplands of Vietnam: an agent-based modeling approach. Agric Syst 123:108–119. doi:10.1016/j.agsy.2013.10.002

Rode R, Leite HG, da Silva ML, Ribeiro CAAS, Binoti DHB (2014) The economics and optimal management regimes of eucalyptus plantations: a case study of forestry outgrower schemes in Brazil. For Policy Econ 44:26–33. doi:10.1016/j.forpol.2014.05.001

Schreinemachers P, Berger T (2011) An agent-based simulation model of human-environment interactions in agricultural systems. Environ Model Softw 26:845–859. doi:10.1016/j.envsoft.2011.02.004

Schreinemachers P, Berger T, Sirijinda A, Praneetvatakul S (2009) The diffusion of greenhouse agriculture in northern Thailand: combining econometrics and agent-based modeling. Can J Agric Econ Can d’agroeconomie 57:513–536. doi:10.1111/j.1744-7976.2009.01168.x

Schreinemachers P, Potchanasin C, Berger T, Roygrong S (2010) Agent-based modeling for ex ante assessment of tree crop innovations: litchis in northern Thailand. Agric Econ 41:519–536. doi:10.1111/j.1574-0862.2010.00467.x

SEAB—Secretaria da Agricultura e do Abastecimento do Paraná (2015) Forest price online database from the Agriculture and Supply Secretariat of Paraná State (SEAB). In: Secr. da Agric. e do Abast. do Paraná. http://www.agricultura.pr.gov.br/modules/conteudo/conteudo.php?conteudo=129. Accessed 01 Dec 2016

SEPLAN—Secretaria de Estado de Planejamento de Mato Grosso (2011) Zoneamento Sócio-econômico ecológico: Mapa de solos do estado de Mato Grosso. Governo do Estado de Mato Grosso, Cuiabá, Brasil. http://www.dados.mt.gov.br/publicacoes/dsee/geologia/rt/DSEE-GL-RT-004-A001.pdf. Accessed 01 Dec 2016

Silva HAD, de Moraes A, Carvalho PCDF, Fonseca AFD, Dias CTS (2012) Maize and soybeans production in integrated system under no-tillage with different pasture combinations and animal categories. Rev Ciência Agron 43:757–765. doi:10.1590/S1806-66902012000400018

Strassburg BBN, Latawiec AE, Barioni LG, Nobre CA, Da Silva VP, Valentim JF, Vianna M, Assad ED (2014) When enough should be enough: improving the use of current agricultural lands could meet production demands and spare natural habitats in Brazil. Glob Environ Change 28:84–97. doi:10.1016/j.gloenvcha.2014.06.001

Troost C, Berger T (2015) Dealing with uncertainty in agent-based simulation: farm-level modeling of adaptation to climate change in southwest Germany. Am J Agric Econ 97:833–854. doi:10.1093/ajae/aau076

Troost C, Walter T, Berger T (2015) Climate, energy and environmental policies in agriculture: simulating likely farmer responses in Southwest Germany. Land Use Policy 46:50–64. doi:10.1016/j.landusepol.2015.01.028

World Bank (2009) Awakening Africa’s sleeping giant: Prospects for commercial agriculture in the Guinea Savannah Zone and beyond. Washington, DC. http://siteresources.worldbank.org/INTARD/Resources/sleeping_giant.pdf. Accessed 01 Dec 2016

World Bank (2010) Brazil Low Carbon Country Case Study. Washington, DC. https://openknowledge.worldbank.org/handle/10986/17526. Accessed 01 Dec 2016

World Bank (2011) Brazil Low Carbon Case Study: Land Use, Land-Use Change, and Forestry. Washington, DC. https://openknowledge.worldbank.org/handle/10986/12968. Accessed 01 Dec 2016

Wossen T, Berger T (2015) Climate variability, food security and poverty: agent-based assessment of policy options for farm households in Northern Ghana. Environ Sci Policy 47:95–107. doi:10.1016/j.envsci.2014.11.009

Acknowledgements

This research was financed by the CarBioCial project of the German Federal Ministry of Education and Research (BMBF). We thankfully acknowledge the scholarships awarded to the authors of this paper by the Brazilian Coordination for the Improvement of Higher Education Personnel (CAPES, BEX Number 10421/14-9), the Food Security Center (FSC) of Hohenheim University and the Protestant Academic Foundation Villigst. We would like to thank CÉLERES for the field data provided and the partnership established with the Agricultural Economics Center of UNICAMP. We are grateful to Embrapa Agrossilvipastoril and IMEA for the technical materials and knowledge provided. Special thanks to Dr. Marcio Júnior, Dr. José Siqueira, Alexandre de Oliveira and Julio Nalin for their expert opinions and facilitation of information exchange. The simulation experiments were performed using the computational resources of bwUniCluster funded by the Ministry of Science, Research and the Arts and the Universities of the State of Baden-Württemberg, Germany, within their bwHPC program.

Author information

Authors and Affiliations

Corresponding author

Additional information

A correction to this article is available online at https://doi.org/10.1007/s10113-018-1327-5.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Carauta, M., Latynskiy, E., Mössinger, J. et al. Can preferential credit programs speed up the adoption of low-carbon agricultural systems in Mato Grosso, Brazil? Results from bioeconomic microsimulation. Reg Environ Change 18, 117–128 (2018). https://doi.org/10.1007/s10113-017-1104-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10113-017-1104-x