Abstract

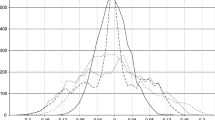

An efficient treatment of practical issues on detecting multiple structural changes is presented. The efficacy of this method is examined by comparing the conventional hypothesis-testing method via comprehensive simulations and empirical applications. The method recommended is a model-selection using the Bayesian information criterion and allowing for heteroscedasticity. Empirical results show that the first structural change of Japanese economic growth occurred in 1974Q2, which was detected in 1979Q4, and that the second structural change occurred in 1992Q2, which was detected in 1998Q1. Two advantages of the model-selection method compared to the hypothesis-testing method are also discussed.

Similar content being viewed by others

References

Andrews DWK (1993) Test for parameter instability and structural change with unknown change point. Econometrica 61, 821–856

Andrews DWK, Ploberger W (1994) Optimal tests when a nuisance parameter is present only under the alternative. Econometrica 62, 1383–1414

Bai J, Perron P (1998) Estimating and testing linear models with multiple structural changes. Econometrica 66, 47–78

Bai J, Perron P (2001) Multiple structural change models: A simulation analysis. Working Paper in Boston University (http://econ.bu.edu/perron)

Bai J, Perron P (2003) Computation and analysis of multiple structural change models. Journal of Applied Econometrics 18, 1–22

Chu CSJ, Stinchcombe M, White H (1996) Monitoring structural change. Econometrica 64, 1045–1065

Hansen B (2001) The new econometrics of structural change: dating breaks in U.S. labor productivity. Journal of Economic Perspective 15, 117–128

Kitagawa G, Akaike H (1978) A procedure for the modeling of non-stationary time series. Annals of the Institute of Statistical Mathematics 30(B), 351–363

Liu J, Wu S, Zidek JV (1997) On segmented multivariate regressions. Statistica Sinica 7, 497–525

Lumsdaine R, Papell D (1997) Multiple trend breaks and the unit root hypothesis. Review of Economics and Statistics 79, 212–218

McConnell MM, Perez-Quiros G (2000) Output fluctuations in the United States: what has changed since the early 1980’s? American Economic Review 90, 1464–1476

Mehl A (2000) Unit root tests with double trend breaks and the 1990s recession in Japan. Japan and the World Economy 12, 363–379

Ng S, Perron P (1995) Unit root tests in ARIMA models with data-dependent methods for the selection of the truncation lag. Journal of the American Statistical Association 90, 268–281

Ohara H (1999) A unit root test with multiple trend breaks: a theory and an application to US and Japanese macroeconomic time series. Japanese Economic Review 50, 266–290

Yao YC (1988) Estimating the number of change-points via Schwarz’ criterion.” Statistics and Probability Letters 6, 181–189

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Fukuda, K. Simulated real-time detection of multiple structural changes: Evidence from Japanese economic growth. Statistical Papers 48, 559–580 (2007). https://doi.org/10.1007/s00362-007-0357-0

Received:

Revised:

Issue Date:

DOI: https://doi.org/10.1007/s00362-007-0357-0