Abstract

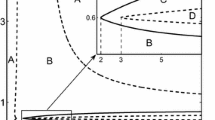

As is well known in systems theory, the parameter space of most dynamic models is stratified into subsets, each of which supports a different kind of dynamic solution. Since we do not know the parameters with certainty, knowledge of the location of the bifurcation boundaries is of fundamental importance. Without knowledge of the location of such boundaries, there is no way to know whether the confidence region about the parameters’ point estimates might be crossed by one or more such boundaries. If there are intersections between bifurcation boundaries and a confidence region, the resulting stratification of the confidence region damages inference robustness about dynamics, when such dynamical inferences are produced by the usual simulations at the point estimates only. Recently, interest in policy in some circles has moved to New Keynesian models, which have become common in monetary policy formulations. As a result, we explore bifurcations within the class of New Keynesian models. We study different specifications of monetary policy rules within the New Keynesian functional structure. In initial research in this area, Barnett and Duzhak (Physica A 387(15):3817–3825, 2008) found a New Keynesian Hopf bifurcation boundary, with the setting of the policy parameters influencing the existence and location of the bifurcation boundary. Hopf bifurcation is the most commonly encountered type of bifurcation boundary found among economic models, since the existence of a Hopf bifurcation boundary is accompanied by regular oscillations within a neighborhood of the bifurcation boundary. Now, following a more extensive and systematic search of the parameter space, we also find the existence of Period Doubling (flip) bifurcation boundaries in the class of models. Central results in this research are our theorems on the existence and location of Hopf bifurcation boundaries in each of the considered cases. We also solve numerically for the location and properties of the Period Doubling bifurcation boundaries and their dependence upon policy-rule parameter settings.

Similar content being viewed by others

References

Aiyagari S.R.: Can there be short-period deterministic cycles when people are long lived?. Q J Econ 104, 163–185 (1989). doi:10.2307/2937839

Andronov A.A.: Les cycles limits de poincaré et la théorie des oscillations autoentretenues. Comptes-rendus Acad Sci 189, 559–561 (1929)

Barnett W.A., Duzhak E.A.: Non-robust dynamic inferences from macroeconometric models: Bifurcation Stratification of Confidence Regions. Physica A 387(15), 3817–3825 (2008). doi:10.1016/j.physa.2008.01.045

Barnett W.A., He Y.: Stability analysis of continuous-time macroeconometric systems. Stud. Nonlinear Dyn Econ 3(4), 169–188 (1999). doi:10.2202/1558-3708.1047

Barnett W.A., He Y.: Nonlinearity, chaos, and bifurcation: a competition and an experiment. In: Negishi, T., Ramachandran, R., Mino, K. (eds) Economic Theory, Dynamics and Markets: Essays in Honor of Ryuzo Sato, pp. 167–187. Kluwer, Dordrecht (2001)

Barnett W.A., He Y.: Stabilization policy as bifurcation selection: would stabilization policy work if the economy really were unstable?. Macroecon Dyn 6(5), 713–747 (2002)

Barnett W.A., He Y.: Bifurcations in macroeconomic models. In: Dowrick, S., Pitchford, R., Turnovsky, S. (eds) Economic Growth and Macroeconomic Dynamics: Recent Developments in Economic Theory, pp. 95–112. Cambridge University Press, Cambridge (2004)

Barnett, W.A., He, Y.: Existence of singularity bifurcation in an open-economy Euler-equations model of the United States economy. Open Econ Rev (2008, submitted)

Benhabib J., Day R.H.: A characterization of erratic dynamics in the overlapping generations model. J Econ Dyn Control 4, 37–55 (1982). doi:10.1016/0165-1889(82)90002-1

Benhabib J., Nishimura K.: The Hopf bifurcation and the existence and stability of closed orbits in multisector models of optimal economic growth. J Econ Theory 21, 421–444 (1979). doi:10.1016/0022-0531(79)90050-4

Benhabib J., Rustichini A.: Vintage capital, investment and growth. J Econ Theory 55, 323–339 (1991). doi:10.1016/0022-0531(91)90043-4

Bergstrom A.R., Nowman K.B.: A Continuous Time Econometric Model of the United Kingdom with Stochastic Trends. Cambridge University Press, Cambridge (2007)

Bernanke B.S., Laubach T., Mishkin F.S., Posen A.S.: Inflation Targeting: Lessons from the International Experience. Princeton University Press, Princeton (1999)

Blanchard O., Kahn C.M.: The solution of linear difference models under rational expectations. Econometrica 48, 1305–1311 (1980)

Calvo G.: Staggered prices in a utility-maximizing framework. J Monet Econ 12, 383–398 (1983). doi:10.1016/0304-3932(83)90060-0

Carlstrom, C.T., Fuerst, T.S.: Forward-Looking Versus Backward-Looking Taylor Rules, Federal Reserve Bank of Cleveland Working Paper #0009 (2000)

Clarida R., Gali J., Gertler M.: Monetary policy rules in practice: some international evidence. Eur Econ Rev 42(6), 1033–1068 (1998). doi:10.1016/S0014-2921(98)00016-6

Clarida R., Galí J., Mark Gertler M.: The science of monetary policy: a new Keynesian perspective. J Econ Lit 37, 1661–1707 (1999)

Day R.H., Shafer W.: Keynesian chaos. J Macroecon 7, 277–295 (1986)

Day, R.H., Shafer, W.: Ergodic fluctuations in deterministic economic models. In: Medio, A. (ed.) Advances in Dynamic Economics: Special Issue of the Journal of Economic Behavior and Organizations, vol. 8, no. 3, pp. 339–362 (1987)

Dixit A., Stiglitz J.E.: Monopolistic competition and optimum product diversity. Am Econ Rev 67, 297–308 (1977)

Eusepi, S.: Comparing Forecast-Based And Backward-Looking Taylor Rules: a “Global” Analysis, Federal Reserve Bank of New York Staff Report #198 (2005)

Gali J., Gertler M.: Inflation dynamics: a structural econometric analysis. J Monet Econ 44, 195–222 (1999). doi:10.1016/S0304-3932(99)00023-9

Gale D.: Pure exchange equilibrium of dynamic economic models. J Econ Theory 6, 12–36 (1973). doi:10.1016/0022-0531(73)90041-0

Gandolfo G.: Economic Dynamics, 3rd edn. Springer, New York (1996)

Gavin, W.T.: Inflation targeting: why it works and how to make it work better. Federal Reserve Bank of Saint Louis Working Paper #2003-027B (2003)

Govaerts W., Kuznetsov Y.A., Sijnave B.: Bifurcation of maps in the software package CONTENT. In: Ganzha, V.G., Mayer, W.W., Vorozhtsov, E.V. (eds) Computer Algebra in Scientific Computing, pp. 191–206. Springer, New York (1999)

Hopf, E.: Abzweigung einer periodischen lösung von einer stationaren lösung eines differetial systems. Sachsische Akademie der Wissenschaften Mathematische-Physikalische, Leipzig, Working Paper #94, pp. 1–22 (1942)

Iooss G.: Bifurcation of Maps and Applications. Mathematical Studies, vol. 36. North- Holland, Amsterdam (1979)

Kuznetsov Y.A.: Elements of Applied Bifurcation Theory. Springer, New York (1998)

Leeper E., Sims C.: Toward a modern macro model usable for policy analysis. NBER Macroecon Annu 9, 81–117 (1994). doi:10.2307/3585077

McCallum B.T.: Issues in the design of monetary policy rules. In: Taylor, J.B., Woodford, M. (eds) Handbook of Macroeconomics, pp. 1483–1530. North-Holland, Amsterdam (1999)

Poincaré H.: Les Methodes Nouvelles de la Mechanique Celeste. Gauthier-Villars, Paris (1892)

Roberts J.M.: New Keynesian economics and the Phillips curve. J Money Credit Bank. 27(4), 975–984 (1995). doi:10.2307/2077783

Seydel R.: Practical Bifurcation and Stability Analysis. Springer, New York (1994)

Shapiro, A.H.: Estimating the new Keynesian Phillips curve: a vertical production chain approach. Federal Reserve Bank of Boston working paper #06-11 (2006)

Svensson L.E.O.: Inflation Targeting as a Monetary Policy Rule. J Monet Econ 43, 607–654 (1999). doi:10.1016/S0304-3932(99)00007-0

Taylor J.B.: A historical analysis of monetary policy rules. In: Taylor, J.B. (eds) Monetary Policy Rules, pp. 319–340. University of Chicago Press for NBER, Chicago (1999)

Torre V.: Existence of limit cycles and control in complete Keynesian system by theory of bifurcations. Econometrica 45(6), 1457–1466 (1977). doi:10.2307/1912311

Walsh C.E.: Monetary Theory and Policy, 2nd edn. MIT Press, Cambridge (2003)

Wen G., Daolin X., Han X.: On creation of Hopf bifurcations in discrete-time nonlinear systems. Chaos 12(2), 350–355 (2002). doi:10.1063/1.1480915

Woodford M.: Interest and Prices: Foundations of a Theory of Monetary Policy. Princeton University Press, Princeton (2003)

Author information

Authors and Affiliations

Corresponding author

Additional information

Evgeniya Duzhak’s research was partially funded by Professional Staff Congress—City University of New York grant # 60092-38-39.

Rights and permissions

About this article

Cite this article

Barnett, W.A., Duzhak, E.A. Empirical assessment of bifurcation regions within New Keynesian models. Econ Theory 45, 99–128 (2010). https://doi.org/10.1007/s00199-008-0430-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00199-008-0430-0

Keywords

- Bifurcation

- Dynamic general equilibrium

- Hopf bifurcation

- Flip bifurcation

- Period doubling bifurcation

- Robustness

- New Keynesian macroeconometrics

- Taylor rule

- Inflation targeting