Abstract

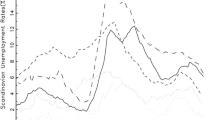

This paper investigates the effects of data transformation on nonlinearity by means of a simulation analysis based on empirical threshold models for the unemployment rate. Unemployment rate series are particularly suitable because they exhibit a number of interesting features: business cycle asymmetries, persistence, long memory and seasonality. The main finding is that evidence of nonlinearity is not independent of the form in which data are analysed and that most data transformations result in a loss of nonlinearity. This is particularly the case for seasonal adjustment transformations, which remove not only seasonality but also nonlinear features, as shown for the commonly applied Census X12 method.

Similar content being viewed by others

References

de Bruin P, Franses PHBF (1998) On data transformation and evidence of nonlinearity. Erasmus University Rotterdam, Econometric Institute, Report 9823

de Bruin P, Franses PHBF (2000) Seasonal adjustment and the business cycle in unemployment. Stud Nonlin Dynam Econom 4:73–84

Caballero RJ, Hammour ML (1994) The cleansing effect of recessions. Am Econ Rev 84:1350–1368

Canova F, Hansen B (1995) Are seasonal patterns constant over time? A test for seasonal stability. J Bus Econ Statist 13:237–252

Ericsson NR, Hendry DF, Tran HA (1994). Cointegration, seasonality, encompassing and the demand for money in the United Kingdom. In: Hargraves CP (eds). Nonstationarity time series analysis and cointegration. Oxford University Press, Oxford, pp. 179–224

Franses PHBF (1996a) Periodicity and stochastic trends in economic time series. Oxford University Press, Oxford

Franses PHBF (1996b) Recent advances in modelling seasonality. J Econ Surv 10:299–345

Franses PHBF (1998) Does seasonality in unemployment change with its (nonlinear) business cycle? Erasmus University Rotterdam, Econometric Institute, Report 9809

Geweke J, Porter-Hudack S (1983) The estimation and application of long memory time series models. J Time Ser Anal 4:221–238

Ghysels E (1990) Unit root tests and the statistical pitfalls of seasonal adjustment: the case of the US Postwar real gross national product. J Am Statist Assoc 83:168–172

Ghysels E, Perron P (1993) The effects of seasonal adjustment filters on tests for unit root. J Econom 55:57–98

Ghysels E (1994). On the economics and econometrics of seasonality. In: Sims CA (eds). Advances in econometrics, 6th world congress of the econometric society, vol 1. Cambridge University Press, Cambridge

Ghysels E, Granger CWJ, Siklos PL (1996) Is seasonal adjustment a linear or nonlinear process? J Bus Econ Statist 14:374–386

Granger CWJ, Teräsvirta T (1993) Modelling nonlinear economic relationships, advanced texts in econometrics. Oxford University Press, Oxford

Hamermesh DS, Pfann GA (1996) Adjustment costs in factor demand. J Econ Literat 34:1264–1292

Koustas Z, Veloce W (1996) Unemployment hysteresis in Canada: an approach based on long-memory time series models. Appl Econ 28:823–831

Luukkonen R, Saikkonen P, Teräsvirta T (1988) Testing linearity against smooth transition autoregressive models. Biometrika 75:491–499

Luukkonen R, Teräsvirta T (1991) Testing linearity of economic time series against cyclical asymmetry. Annales d’Economie et de Statistique 20/21:125–142

Maravall A (1995). Unobserved components in economic time series. In: Pesaran MH, Wickens MR (eds). Handbook of applied econometrics, vol 1, Macroeconomics. Handbooks in Economics. Blackwell, Oxford and Malden, pp. 12–72

Montgomery AL, Zarnowitz V, Tsay RS, Tiao GC (1998) Forecasting the US unemployment rate. J Am Statist Assoc 93:478–493

Nelson C, Plosser C (1982) Trends and random walks in macroeconomics time series: some evidence and implications. J Monet Econ 10:130–162

Ooms M, Franses PHBF (1997) On periodic correlations between estimated seasonal an nonseasonal components for US and German Unemployment. J Bus Econ Statist 15:470–481

Phillips P, Perron P (1988) Testing for a unit root in time series. Biometrika 75:335–346

Skalin J, Teräsvirta T (2002) Modelling asymmetries and moving equilibria in unemployment rates. Macroecon Dynam 6:202–241

Sowell F (1992) Maximum likelihood estimation of stationary univariate fractionally integrated time series models. J Econom 53:165–188

Teräsvirta T (1994) Specification, estimation and evaluation of smooth transition autoregressive models. J Am Statist Assoc 89:208–218

Teräsvirta T, Tjosteim D, Granger CWJ (1994) Aspects of modelling nonlinear time series. In: Engle RF, McFadden DL (eds). Handbook of econometrics, vol 4. Elsevier, North-Holland, pp. 2917–2957

Thursby JG, Schimdt P (1977) Some properties of tests for the specification error in a linear regression model. J Am Statisti Assoc 72:635–641

Tong H (1978). On a threshold model. In: Chen CH (eds). Pattern recognition and a signal processing. Sijhoff and Noordoff, Amsterdam, pp. 101–141

Tong H, Lim KS (1980) Thresholds autoregression, limit cycles and cyclical data. J R Statist Society B 42:245–292

Tong H (1983) Threshold models in nonlinear time series analysis. Springer, Berlin Heidelberg New York

Wallis KF (1987) Time series analysis of bounded economic variables. J Time Ser Anal 8:115–123

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Marrocu, E. An Investigation of the Effects of Data Transformation on Nonlinearity. Empirical Economics 31, 801–820 (2006). https://doi.org/10.1007/s00181-006-0055-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-006-0055-8