Abstract

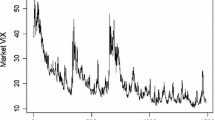

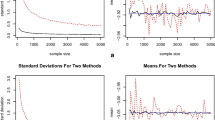

In this paper, we compare the forecast ability of GARCH(1,1) and stochastic volatility models for interest rates. The stochastic volatility is estimated using Markov chain Monte Carlo methods. The comparison is based on daily data from 1994 to 1996 for the ten year swap rates for Deutsch Mark, Japanese Yen, and Pound Sterling. Various forecast horizons are considered. It turns out that forecasts based on stochastic volatility models are in most cases superiour to those obtained by GARCH(1,1) models.

Similar content being viewed by others

References

Besag, J.E., Green, P.J., Higdon, P., Mengersen, K. (1995). Bayesian computation and stochastic systems (with discussion). Statistical Science10, 3–66.

Ballerslev, T. (1986). Generalized autoregression conditional heteroscedasticity, Journal of Econometrics31, 307–327.

Boscher, H., Fronk, E.-M., Pigeot, I. (1998). Estimation of the stochastic volatility by Markov chain Monte Carlo. In: R. Galata, H. Küchenhoff (eds.): Festschrift zum 65. Geburtstag von Prof. Dr. Hans Schneeweiß: Econometrics in theory and practice. Heidelberg, Physica-Verlag: 189–203.

Engle, R.F. (1982). Autoregressive conditional heteroscedasticity with estimates of the variance of the United Kingdom inflation. Econometrica50, 987–1007.

Engle, R.F., Ng, V.K., Rothschild, M. (1995). Asset pricing with a FACTOR-ARCH covariance structure: empirical estimates for treasury bills. In: Engle, R.F. (ed.): ARCH Selected Readings. Oxford: Oxford University Press, 277–299.

Gilks, W.R., Richardson, S., Spiegelhalter, D.J. (1996). Introducing Markov chain Monte Carlo. In: Gilks, W.R., Richardson, S., Spiegelhalter, D.J. (eds.): Markov Chain Monte Carlo in Practice. London: Chapman and Hall, 1–19.

Hastings, W.K. (1970). Monte-Carlo sampling methods using Markov chains and their applications. Biometrika57, 97–109.

Heynen, R.C., Kat, H.M. (1994). Volatility prediction: a comparison of the stochastic volatility, GARCH(1,1), and EGARCH(1,1) models. Journal of Derivatives Winter1994, 50–65.

Kim, S., Shephard, N., Chib, S. (1998). Stochastic volatility: Likelihood inference and comparison with ARCH models. Review of Economic Studies65, 361–393.

Metropolis, N., Rosenbluth, A.W., Rosenbluth, M.N., Teller, A.H., Teller, E. (1953). Equations of state calculations by fast computing machines. Journal of Chemical Physics21, 1087–1092.

Simphard, N. (1996). Statistical aspects of ARCH and stochastic volatility. In: Cox, D.R., Barndorff-Nielson, O.E., Hinkley, D.V. (eds.): Time Series Models in Econometrics, Finance and Other Fields. London: Chapman and Hall, 1–67.

Taylor, S.J. (1986). Modelling Financial Time Series. Chichester: John Wiley.

Tierney, L. (1994). Markov Chain for exploring posterior distributions (with discussion). Annals of Statistics21, 1701–1762.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Boscher, H., Fronk, EM. & Pigeot, I. Forecasting interest rates volatilities by GARCH (1,1) and stochastic volatility models. Statistical Papers 41, 409–422 (2000). https://doi.org/10.1007/BF02925760

Received:

Revised:

Issue Date:

DOI: https://doi.org/10.1007/BF02925760