Summary

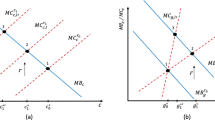

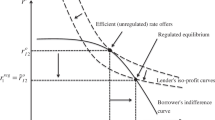

This paper investigates credit card rate stickiness using a screening model of consumer credit markets. In recent years, while the cost of funds has fallen, credit card rates have remained stubbornly high, spurring legislators to consider imposing interest rate ceilings on credit card rates. The model incorporates asymmetric information between consumers and banks, regarding consumers' future incomes. The unique equilibrium is one of two types: separating (in which low-risk consumers select a collateralized loan and high-risk consumers select a credit card loan), or pooling (in which both types of consumers choose credit card loans). I show that a change in the banks' cost of funds can have an ambiguous effect on the credit card rate, so that the credit card rate need not fall when the cost of funds does. Usury ceilings on credit card rates are detrimental to consumer welfare, so would be counter to their legislative intent.

Similar content being viewed by others

References

Ausubel, L.M.: The failure of competition in the credit card market. Amer. Econ. Rev.81, 50–81 (1991)

Berlin, M., Mester, L.J.: Credit card rates and consumer search. Federal Reserve Bank of Philadelphia Working Paper No. 88-1/R, July 1992

Besanko, D., Thakor, A.V.: Competitive equilibrium in the credit market under asymmetric information. J. Econ. Theory42, 167–182 (1987)

Besanko, D., Thakor, A.V.: Collateral and rationing: sorting equilibria in monopolistic and competitive credit markets. Int. Econ. Rev.28, 671–689 (1987)

Calem, P.S.: The strange behavior of the credit card market. Business Review, Federal Reserve Bank of Philadelphia 3–14, Jan/Feb 1992

Card issuers face threat of legislation over interest rates. Banking Policy Report10, 2–3 (1992)

Chan, Y.S., Thakor, A.V.: Collateral and competitive equilibria with moral hazard and private information. J. Finance42, 345–364 (1987)

Choi, S.W.: Collateral and credit rationing under adverse selection, in Three papers on credit rationing under adverse selection. Ph.D. dissertation, University of Pennsylvania, 1991

Gale, W.G.: Collateral, rationing, and government intervention in credit markets. In: Hubbard, R.G. (ed.) Asymmetric information, corporate finance, and investment. Chicago: University of Chicago Press, 1990

Klemperer, P.: Markets with consumer switching costs. Quart. J. Econ.102, 375–394 (1987)

Milde, H., Riley, J.G.: Signaling in credit markets. Quart. J. Econ.103, 101–129 (1988)

Morgan, B.W.: Credit card interest rates: perceptions, politics and realities. Banking Policy Report11, 1 and 8–12 (1992)

Peers, A.: Secured credit cards draw a better class of borrower. Wall Street J., p. 29 (1988)

Riley, J.G.: Informational equilibrium. Econometrica47, 331–360 (1979)

Rothschild, M., Stiglitz, J.E.: Equilibrium in competitive insurance markets: an essay on the economics of imperfect information. Quart. J. Econ.90, 629–649 (1976)

Stiglitz, J.E., Weiss, A.: Credit rationing and collateral. In: Edwards, J. et al. (eds.) Recent developments in corporate finance. Cambridge: Cambridge University Press, 1986

Stiglitz, J.E., Weiss, A.: Macro-economic equilibrium and credit rationing. Bell Communications Research, mimeo, 1987

Wilson, C.A.: A model of insurance markets with incomplete information. J. Econ. Theory16, 167–207 (1977)

Author information

Authors and Affiliations

Additional information

I thank George Mailath, Paul Calem, Gerhard Clemenz, Sally Davies, George Kanatas, Leonard Nakamura, Tony Santomero, Tony Saunders, participants in the 1990 Financial Management Association Meetings, and co-editor Michael Woodford for helpful comments.

The views expressed here are those of the author and do not necessarily represent the views of the Federal Reserve Bank of Philadelphia or the Federal Reserve System.

Rights and permissions

About this article

Cite this article

Mester, L.J. Why are credit card rates sticky?. Econ Theory 4, 505–530 (1994). https://doi.org/10.1007/BF01213621

Received:

Revised:

Issue Date:

DOI: https://doi.org/10.1007/BF01213621