Abstract

Mobile industry is characterized by a sharp fall in megabyte price which highly benefits to consumers. This article aims to identify the main parameters that lead to such a fall and shows that the growth of traffic is by far the main cause. It proposes a parametric model that explains the growth of traffic from investment. Using a 20-countries wireless market dataset to calibrate the model, it shows that investment actually drives the exponential growth of traffic. As the growth of revenues are much lower, the price of megabyte decreases sharply. The role of competition is ambiguous. On the one hand it reduces margin and thus prices, on the other hand, as the relationship between investment and competition turns to be inverted-U shaped, it may reduce investment and therefore slow down the fall in unit price.

Similar content being viewed by others

References

Aghion, P., Bloom, N., Blundell, R., & Griffith, R. (2005). Competition and innovation: An inverted U relationship. The Quarterly Journal of Economics, 120(2), 701–728.

Arrow, K. (1962). Economic welfare and the allocation of resources for invention. In R. Nelson (Ed.), The rate and direction of inventive activity: Economic and social factors (pp. 609–626). Princeton, NJ: NBER, Princeton University Press

Bonald, T., & Roberts, J. W. (2012). Internet and the Erlang formula. ACM SIGCOMM Computer Communication Review, 42(1), 23–30.

Chapin, J., & Lehr, W. (2011). Mobile broadband growth, spectrum scarcity, and sustainable competition. In TPRC 2011. http://ssrn.com/abstract=1992423

Christensen, C. M. (1992). Exploring the limits of the technology s-curve. Part I: Component technologies. Production and Operations Management, 1(4), 334–357.

Datta, A. (2004). Telecommunications and economic growth: A panel data approach. Applied Economics, 36(15), 1649–1654.

Doms, M. (2004). The boom and the bust in information technology investment. Economic Review-Federal Reserve Bank of San Francisco, 19–34.

Ericsson Mobility Report. June (2014).

Friederiszick, H., Grajek, M., & Röller, L. H. (2008). Analyzing the relationship between regulation and investment in the telecom sector. ESMT White Paper WP-108-01.

Gilbert, R. J., & Newbery, D. M. (1982). Preemptive patenting and the persistence of monopoly. The American Economic Review, 72(3), 514–526.

Houngbonon, G. V., & Jeanjean, F. (2014). Is there a level of competition intensity that maximizes investment in the mobile telecommunications industry? In 2014 TPRC Conference Paper. http://ssrn.com/abstract=2416780

HSBC Global research. (2014). Supercollider, European mobile consolidation is win-win for operators and citizens alike. Telecoms, Media & Technology February 2014.

Jeanjean, F. (2011). Competition through technical progress. In 10th conference of telecommunication, media and internet techno-economics (CTTE) (pp. 1–15).

Jeanjean, F. (2013). Incentives to invest in improving quality in the telecommunications industry. Chinese Business Review, 12(4), 223–241.

Kim, J., Kim, Y., Gaston, N., Lestage, R., Kim, Y., & Flacher, D. (2011). Access regulation and infrastructure investment in the mobile telecommunications industry. Telecommunication Policy, 35(11), 907–919.

Koh, H. (2006). A functional approach for studying technological progress: Application to information technology. Technological Forecasting and Social Change, 73(9), 1061–1083.

Koh, H. (2008). A functional approach for studying technological progress: Extension to energy technology. Technological Forecasting and Social Change, 75(6), 735–758.

Price, D. D. S. (1963). Big science, little science. New York: Columbia University.

Romer, P. M. (1994). The origins of endogenous growth. The Journal of Economic Perspectives, 8(1), 3–22.

Röller, L. H. & Waverman L. (2001). Telecommunications infrastructure and economic development: A simultaneous approach. The American Economic Review, 91(4), 909–923.

Röller, J. (1997). Scientometric studies on chemistry I: The exponential growth of chemical substances, 1800–1995. Scientometrics, 39(1), 107–123.

Schumpeter, J. A. (1942). Socialism, capitalism and democracy. New York: Harper and Brothers.

Tague, J., Beheshti, J., & Rees-Potter, L. (1981). The law of exponential growth: Evidence, implications and forecasts. Library Trends, 30(1), 125–149.

Wavermann, L., & Meschi, M. (2005). The impact of telecoms on economic growth in developping countries. The Vodafone Policy Paper Series, 2(3), 10–24.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Proof of Equation (2)

Let us denote \(j=i-\delta\), from Eq. (1), using the approximation of investment \(I_{t}=I_{t_{0}}(1+\lambda )^{t-t_{0}},\) the traffic writes:

We know that \(\left( 1+\theta ^{\prime }\right) =\left( 1+\theta \right) \left( 1+\lambda \right) ,\) thus \(\theta ^{\prime }=\theta +\lambda +\theta \lambda\). Notice that \(I_{0}=I_{t_{0}}(1+\lambda )^{-t_{0}},\) the expression becomes: \(T_{t}=A_{0}I_{0}\alpha \left[ \sum _{i=0}^{t}\left( 1+\theta ^{\prime }\right) ^{i}-\sum _{j=0}^{t-\delta }\left( 1+\theta ^{\prime }\right) ^{j}\right] .\) According to the sum of the terms of a geometric sequence: \(T_{t}=A_{0}I_{0}\alpha \left( 1+\theta ^{\prime }\right) ^{t}\left( \frac{\left( 1+\theta ^{\prime }\right) -\left( 1+\theta ^{\prime }\right) ^{1-\delta }}{\theta ^{\prime }}\right)\). At time \(t_{0},\) the initial traffic is \(T_{t_{0}}=A_{0}I_{0}\alpha \left( 1+\theta ^{\prime }\right) ^{t_{0}}\left( \frac{\left( 1+\theta ^{\prime }\right) -\left( 1+\theta ^{\prime }\right) ^{1-\delta }}{\theta ^{\prime }}\right) .\) As a result, traffic at time \(t\) writes: \(T_{t}=T_{t_{0}}\left( 1+\theta ^{\prime }\right) ^{t-t_{0}}.\) This is Eq. (2).

1.2 Distributions \(\frac{\mu _{t}}{I_{t}}\) and \(\varepsilon _{t}\)

Shapiro–Wilk test. Null hypothesis: the distribution is normal. Probability of null hypothesis \(>\) 0.1, it can not be rejected. Kolmogorov–Smirnov test. Probability of null hypothesis \(>\) 0.1, it can not be rejected.

1.3 Proof of Equation (6)

From Eq. (4): \(up_{t}=\frac{C_{t}\left( 1+\theta ^{\prime }\right) ^{-(t-t_{0})}}{T_{t_{0}}(1-L)_{t}}\)

For \(t_{f}=2012\) and \(t_{0}=2006\)

Same manner: \(\ln (up_{t_{0}})=\ln (C_{t_{0}})-\ln (1-L)_{t_{0}}-\ln (T_{t_{0}})\)

Thus \(\ln (up_{t_{f}})-\ln (up_{t_{0}})=\ln (C_{t_{f}})-\ln (1-L)_{t_{f}}-6\ln (1+\theta ^{\prime })-\ln (C_{t_{0}})+\ln (1-L)_{t_{0}}\).

We know that \(\left( 1+\theta ^{\prime }\right) =\left( 1+\theta \right) \left( 1+\lambda \right) ,\) therefore \(\ln \left( \frac{up_{t_{f}}}{ up_{t_{0}}}\right) =\ln \left( \frac{C_{t_{f}}}{C_{t_{0}}}\right) -\ln \left( \frac{\left( 1-L\right) _{t_{f}}}{\left( 1-L\right) t_{0}}\right) -6\ln (1+\theta )-6\ln (1+\lambda )\).

This is Eq. (6).

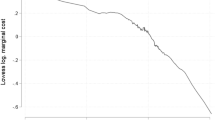

1.4 Figure 4, y-axis

Dynamic effect has two parts, on the one hand, the impact of regular investment according to the rate of technical progress, \(\theta\), in the other hand, the impact of the growth in investment, \(\lambda\). Dynamic effect is written \(\ln \left( \frac{De_{t_{f}}}{De_{t_{0}}}\right) =-\left( t_{f}-t_{0}\right) \left[ \ln \left( 1+\theta \right) +\ln (1+\lambda ) \right] .\) Denoting the impact of regular investment \(De\theta ,\) and the impact of the growth in investment \(De\lambda ,\) such that \(\ln \left( \frac{ De\theta _{t_{f}}}{De\theta _{t_{0}}}\right) =-\left( t_{f}-t_{0}\right) \ln \left( 1+\theta \right)\) and \(\ln \left( \frac{De\lambda _{t_{f}}}{ De\lambda _{t_{0}}}\right) =-\left( t_{f}-t_{0}\right) \ln \left( 1+\lambda \right) ,\) it can be written: \(\ln \left( \frac{De_{t_{f}}}{De_{t_{0}}} \right) =\ln \left( \frac{De\theta _{t_{f}}}{De\theta _{t_{0}}}\right) +\ln \left( \frac{De\lambda _{t_{f}}}{De\lambda _{t_{0}}}\right) .\) The contribution of the growth of investment to the change in unit price in CAGR is \(CAGR_{De\lambda (t_{f}-t_{0})}=e^{\frac{1}{\left( t_{f}-t_{0}\right) } \ln \left( \frac{De\lambda _{t_{f}}}{De\lambda _{t_{0}}}\right) }-1=\frac{1}{ 1+\lambda }-1=\frac{-\lambda }{1+\lambda }.\)

1.5 Erlang’s internet formula

Erlang’s internet formula: \(P_{c}(A,N)=\frac{\frac{A^{N}}{N!}\frac{N}{N-A}}{ 1+A+\cdots +\frac{A^{N-1}}{(N-1)!}+\frac{A^{N}}{N!}\frac{N}{N-A}}\) with \(A=\frac{ D}{c}\) and \(N=\frac{C}{c}\) where \(D\) is the overall traffic demand, \(C\) is the capacity and \(c\) is the peak rate allowed by the network. \(P_{c}\) is the probability of congestion.

Rights and permissions

About this article

Cite this article

Jeanjean, F. What causes the megabyte price drop in the mobile industry?. Econ Polit Ind 42, 277–296 (2015). https://doi.org/10.1007/s40812-015-0013-6

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40812-015-0013-6