Abstract

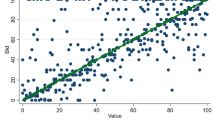

We give an exposition and numerical studies of upper hedging prices in multinomial models from the viewpoint of linear programming and the game-theoretic probability of Shafer and Vovk. We also show that, as the number of rounds goes to infinity, the upper hedging price of a European option converges to the solution of the Black–Scholes–Barenblatt equation.

Similar content being viewed by others

References

Avellaneda M., Buff R.: Combinatorial implications of nonlinear uncertain volatility models: The case of barrier options. Appl. Math. Finance 6, 1–18 (1998)

Bachelier L., Davis M.H.A., Etheridge A.: Louis Bachelier’s Theory of Speculation: The Origins of Modern Finance. Princeton University Press, Princeton (2006)

Bertsimas D., Kogan L., Lo A.W.: Hedging derivative securities and incomplete markets: an ε-arbitrage approach. Oper. Res. 49, 372–397 (2001)

Bick A., Willinger W.: Dynamic spanning without probabilities. Stoch. Process. Appl. 50, 349–374 (1994)

Courtois C., Denuit M.: Convex bounds on multiplicative processes, with applications to pricing in incomplete markets. Insur. Math. Econ. 42, 95–100 (2008)

Cox J.C., Ross S.A., Rubinstein M.: Option pricing: a simplified approach. J. Financial Econ. 3, 229–263 (1979)

Crandall M.G., Ishii H., Lions P.-L.: User’s guide to viscosity solutions of second order partial differential equations. Bull. Am. Math. Soc. 27, 1–67 (1992)

Fleming W.H., Soner M.H.: Controlled Markov Processes and Viscosity Solutions, 2nd edn. Springer, New York (2006)

Gozzi F., Vargiolu T.: Superreplication of European multiasset derivatives with bounded stochastic volatility. Math. Methods Oper. Res. 55, 69–91 (2002)

Karatzas I., Shreve S.E.: Methods of Mathematical Finance. Springer, New York (1998)

Kumon M., Takemura A.: On a simple strategy weakly forcing the strong law of large numbers in the bounded forecasting game. Ann. Inst. Stat. Math. 60, 801–812 (2008)

Meyer G.H.: The Black Scholes Barenblatt equation for options with uncertain volatility and its application to static hedging. Int. J. Theor. Appl. Finance 9, 673–703 (2006)

Musiela M., Rutkowski M.: Martingale Methods in Financial Modelling, 1st edn. Springer, Berlin (1997)

Peng, S.: G-expectation, G-Brownian motion and related stochastic calculus of Itô type. In: Stochastic Analysis and Applications, pp. 541–567. Abel Symposium, vol. 2. Springer, Berlin (2007)

Pham H.: Continuous-time Stochastic Control and Optimization with Financial Applications. Springer, Berlin (2009)

Royden H.L.: Real Analysis, 3rd edn. Prentice Hall, New Jersey (1988)

Rüschendorf L.: On upper and lower prices in discrete time models. Proc. Steklov Inst. Math. 237, 134–139 (2002)

Schachermayer, W.: Portfolio optimization in incomplete financial markets. Notes of the Scuola Normale Superiore Cattedra Galileiana, Pisa (2004)

Shafer G., Vovk V.: Probability and Finance: It’s Only a Game!. Wiley, New York (2001)

Shafer, G., Vovk, V., Takemura, A.: Levy’s zero-one law in game-theoretic probability. arXiv:0905.0254v1 [math.PR] (submitted for publication)

Shreve S.E.: Stochastic Calculus for Finance I—The Binomial Asset Pricing Model. Springer, New York (2003)

Shreve S.E.: Stochastic Calculus for Finance II—Continuous-Time Models. Springer, New York (2005)

Smith G.D.: Numerical Solutions of Partial Differential Equations, 3rd edn. Clarendon Press, Oxford (1985)

Takemura A., Vovk V., Shafer G.: The generality of the zero-one laws. Ann. Inst. Stat. Math. 63, 873–885 (2011). doi:10.1007/s10463-009-0262-0

Takeuchi K., Kumon M., Takemura A.: A new formulation of asset trading games in continuous time with essential forcing of variation exponent. Bernoulli 15, 1243–1258 (2009)

Vargiolu, T.: Existence, uniqueness and smoothness for the Black–Scholes–Barenblatt equation. Department of Pure and Applied Mathematics, University of Padova, Rapporto Interno no. 5 (2001). http://www.math.unipd.it/~vargiolu/BSB.pdf

Vovk V.: Rough paths in idealized financial markets. Lith. Math. J. 51, 274–285 (2011)

Vovk, V.: Continuous-time trading and the emergence of probability. Finance Stoch. (2011) (to appear)

Wilmott P., Howison S., Dewynne J.: The Mathematics of Financial Derivatives. Cambridge University Press, Cambridge (1995)

Author information

Authors and Affiliations

Corresponding author

About this article

Cite this article

Nakajima, R., Kumon, M., Takemura, A. et al. Approximations and asymptotics of upper hedging prices in multinomial models. Japan J. Indust. Appl. Math. 29, 1–21 (2012). https://doi.org/10.1007/s13160-011-0047-8

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13160-011-0047-8

Keywords

- Black–Scholes–Barenblatt equation

- Contingent claim

- Cox–Ross–Rubinstein formula

- Incomplete market

- Stochastic control

- Trinomial model