Abstract

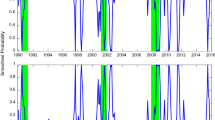

A bivariate Markov-switching model identifies two regimes in the futures-price and risk-premium models. The persistent underlying states have very different implications for spot and risk-premium forecasts. In the “low” state, a positive bias predicts spot price appreciation. The “high” state is associated with lower spot appreciation and higher risk premiums. The regime-switching framework provides a new perspective on the intertemporal role of gold as a hedge or safe-haven asset. The gold spot-price appreciation regime is shown to be correlated with higher inflation rates and the complement regime is associated with high market returns and stock market risk premia. Since the state-space methodology procedure can be employed using only past data, forecasts of the persistent unobserved underlying state of the gold price appreciation regime will be augmented as more data becomes available.

Similar content being viewed by others

Notes

Five obviously invalid prices in the late 1980s of $9, $9.1, $4.9, $4.1, and $53.9 are treated as missing. Only one of these missing dates is relevant for the monthly data employed for the empirical models. The previous day’s price substitutes for missing observations.

This procedure is applied everywhere except for the third-nearest contract on the first trading day in January 1982. On that date, the approximately three-month contract is not priced until after the New Year’s Day holiday. The following business day’s price substitutes. Additionally, an implausible closing price is reported for the third-nearest contract on December 5, 1980. The average of the day’s high and low price substitutes. Alternative date selection algorithms, such as days where the nearest contract expires in four weeks or the three-month contract in 12 weeks, yield similar results but require more corrections for irregularities in the maturity structure of available futures prices.

References

Barone-Adesi G, Geman H, Theal J (2010) On the lease rate, convenience yield and speculative effects in the gold futures market. Swiss Finance Institute Research Paper

Baur DG, Lucey BM (2010) Is gold a hedge or a safe haven? An analysis of stocks, bonds and gold. Financ Rev 45(2):217–229

Baur DG, McDermott TK (2010) Is gold a safe haven? International evidence. J Bank Financ 34(8):1886–1898

Blose LE (2010) Gold price, cost of carry, and expected inflation. J Econ Bus 62(1):35–47

Brooks C, Prokopczuk M, Wu Y (2013) Commodity futures prices: More evidence on forecast power, risk premia and the theory of storage. The Quarterly Review of Economics and Finance 53(1):73–85

Büyüksahin B, Harris JH (2011) Do speculators drive crude oil futures prices. Energy J 32(2):167–202

Carter A, Steigerwald D (2013) Markov regime-switching tests: Asymptotic critical values. J Econ Methods 2(1):25–34

Cho J, White H (2007) Testing for regime switching. Econometrica 75(6):1671–1720

Chow Y (1998) Regime switching and cointegration tests of the efficiency of futures markets. J Futur Mark 18(8):871–901

Christie-David R, Chaudhry M, Koch TW (2000) Do macroeconomics news releases affect gold and silver prices J Econ Bus 52(5):405–421

CME (2013) Why gold futures? CME group. Online; accessed October, 2013. URL http://www.cmegroup.com/trading/metals/goldfutures/gold-futures.html

Coakley J, Dollery J, Kellard N (2011) Long memory and structural breaks in commodity futures markets. J Futur Mark 31(11):1076–1113

Cootner P (1960) Returns to speculators: Telser versus Keynes. J Polit Econ 68 (4):396–404

Deaves R, Krinsky I (1995) Do futures prices for commodities embody risk premiums J Futur Mark 15(6):637–648

Doornik JA (2007) Object–Oriented Matrix Programming Using Ox, 3rd edn. Timberlake Consultants Press and Oxford

Einloth J (2009) Speculation and Recent Volatility in the Price of Oil. Working Paper, Division of Insurance and Research, Federal Deposit Insurance Corporation, Washington, D.C.

Erb CB, Harvey CR (2013) The golden dilemma. Tech. rep. National Bureau of Economic Research

Fama E, French K (1987) Commodity futures prices: Some evidence on forecast power, premiums, and the theory of storage. J Bus:55–73

Fama E, French K (1988) Business cycles and the behavior of metals prices. J Financ 43 (5):1075–1093

Gilbert CL (2010) Speculative influences on commodity futures prices 2006-2008. United Nations Conference on Trade and Development

Gorton G, Hayashi F, Rouwenhorst K (2013) The fundamentals of commodity futures returns. Eur Finan Rev 17 (1):35–105

Hamilton J (1989) A new approach to the economic analysis of nonstationary time series and the business cycle. Econometrica: Journal of the Econometric Society:357–384

Hamilton JD (1994) Time series analysis, vol 2. Cambridge University Press

Hood M, Malik F (2013) Is gold the best hedge and a safe haven under changing stock market volatility? Review of Financial Economics

Irwin SH, Sanders DR (2011) Index funds, financialization, and commodity futures markets. Applied Economic Perspectives and Policy 33(1):1–31

Irwin SH, Sanders DR, Merrin RP, et al. (2009) Devil or angel? The role of speculation in the recent commodity price boom (and bust). J Agric Appl Econ 41(2):377–391

Ivanov SI (2013) The influence of ETFs on the price discovery of gold, silver and oil. J Econ Financ 34:453–462

Keynes J (1930) A Treatise on money. Macmillan, London

Kim C (1994) Dynamic linear models with Markov–switching. J Econ 60 (1–2):1–22

Kim C (1999) State–space Models with Regime Switching: Classical and Gibbs–sampling Approaches with Applications. The MIT press

Lee H, Yoder J (2007) A bivariate Markov regime switching GARCH approach to estimate time varying minimum variance hedge ratios. Appl Econ 39(10):1253–1265

MacKinnon J., White H (1985) Some heteroskedasticity–consistent covariance matrix estimators with improved finite sample properties. J Econ 29(3):305–325

Muth J (1961) Rational expectations and the theory of price movements

Reboredo JC (2013) Is gold a safe haven or a hedge for the US dollar? Implications for risk management. J Bank Financ 37:2665–2676

Sanders DR, Irwin SH (2013) Measuring index investment in commodity futures markets. Energy J 34(3)

Stoll HR, Whaley RE (2010) Commodity index investing and commodity futures prices. J Appl Finance 20(1):7–46

Tang K, Xiong W (2012) Index investment and the financialization of commodities. Financial Analysts Journal 68(6)

Worthington AC, Pahlavani M (2007) Gold investment as an inflationary hedge: cointegration evidence with allowance for endogenous structural breaks. Appl Financ Econ Lett 3(4):259–262

Author information

Authors and Affiliations

Corresponding author

Appendix A: Markov-switching Kalman filter

Appendix A: Markov-switching Kalman filter

The parameter estimates from the state-space model are estimated using GAUSS 10 and the optmum package implemented using code derived in part on code which accompanies Kim (1999). Figures and other empirical results are produced using OxConsole 6.1, Doornik (2007). The procedure requires the filter of Kim (1994); the Kalman filter and the modification for collapsing the probability of each state by Hamilton (1989). Adopting notation where \(\boldsymbol {\delta }_{t|t-1}^{[i,j]}=\boldsymbol {E}_{t-1}^{[j]}\boldsymbol {\delta }_{t}^{[i]}\), the expectation of δ t given that the current state is i and the previous state was j, for all i,j, the Kalman filter and updating equations are given in Eq. 20 through Eq. 25:

Given the information set at time t is represented by 𝜃 t , Hamilton’s filter for collapsing probabilities is given by Eq. 26 through Eq. 30:

where p is the estimated transition probability and Pr(⋅) represents the probability operator. The model is estimated by maximizing the vector of parameters δ over the log likelihood:

Rights and permissions

About this article

Cite this article

Kopchak, S.J. The regime-switching risk premium in the gold futures market. J Econ Finan 40, 472–491 (2016). https://doi.org/10.1007/s12197-014-9308-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12197-014-9308-0