Abstract

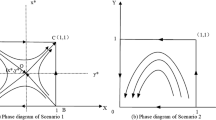

This paper addresses the question of how an established firm can successfully defend its market against current and future competitors. Previous studies on this issue are surprisingly scarce and typically concentrate on only a single generic defense strategy. Thus, little is known about the degree and the manner in which different generic defense strategies, such as a deterrence strategy (pursued before competitor market entry) and a shakeout strategy (pursued after competitor market entry), differ in effectiveness and efficiency and about the corresponding role of product and market conditions. As these strategies tend to be costly, an established firm must decide which of these strategies to focus its scarce resources on. Drawing on evolutionary game theory and an empirical calibration and validation study, this paper seeks to fill these research gaps. While both strategies turn out to be viable options for market defense, the authors find that in general, a shakeout strategy tends to be superior to a deterrence strategy. However, the authors also identify product and market conditions under which an established firm is better off focusing on a deterrence strategy. In methodological respects, the paper contributes to the marketing discipline by introducing evolutionary game theory, which has not been used previously for analyzing marketing issues, as well as an evolutionary approach to research on market defense.

Similar content being viewed by others

Notes

The need to focus on one of these strategies mainly arises due to established firms’ resource constraints. However, theoretically, these strategies could also be used consecutively and thus are not entirely mutually exclusive.

This assumption is a reasonable premise, because in this case, the incumbent lacks sufficient strength to withstand competitive forces and thus to ensure its survival in the long run (Gatignon et al. 1997; Porter 1985). For such a situation, research in economics and industrial organization (Agrarwal and Gort 1996), in organization theory (Madsen and Walker 2007), as well as in marketing and strategic management (Aaker 1988; Karakaya 2000) predicts or recommends an established firm’s market exit in the long run.

In the long run (i.e., when considering multiple periods), the probability that the product still exists after n periods is described by the probability distribution of the number n of Bernoulli trials (with (1 – P) as “success” probability). The convolution of n independent Bernoulli trials is given by the geometric distribution, which reflects the probability distribution of the number b of Bernoulli trials required to get one “success” (in our study: the end of the PLC). Overall, the expected value of a geometrically distributed variable b (in our study: the expected length of the PLC) is 1 divided by the corresponding ‘success’ probability (1 – P) (for mathematical details, see Freedman et al. 1998).

It is worth mentioning that unlike “monopoly markets” (markets without competitors), our study’s notion of “oligopoly markets” refers to markets with competitors. As this distinction does not account for the specific number of competitors, our use of “oligopoly markets” somewhat differs from the common understanding of this term as markets with only few competitors.

These probabilities also account for differences in firm-level capabilities between the incumbent and (current and future) competitors (Ramaswami et al. 2009). Specifically, higher levels of incumbent capabilities are associated with a lower probability of failed competitor deterrence η and a higher probability of successful competitor shakeout ρ and of successful competitor influencing σ (Jayachandran and Varadarajan 2006) Analogous, higher levels of competitor capabilities go along with a higher probability of failed competitor deterrence η and a lower probability of successful competitor shakeout ρ and of successful competitor influencing σ.

This approach is similar to approaches of a significant number of studies in the fields of population ecology and population genetics (e.g., Caswell 2001; Cushing et al. 1996; Ginzburg 1986; Henson 1998; Parayre and Hurry 2001; van Boven and Weissing 2004), analyzing the conditions under which organisms emerge, grow, and die. In the context of incumbents’ defense strategies, the long-term growth rate of a firm’s total number of markets λ is a suitable parameter for identifying the optimal amount of investment (which maximizes the probability of long-term survival), as it is a good indicator for the firm’s ability to defend its markets against current and future competitors (i.e., for the firm’s environmental fitness). Also, this rate is closely and inherently associated with a firm’s long-term survival (i.e., the higher the long-term growth rate, the more likely is a firm to survive in the long run). In this context, it needs to be mentioned that in our model, by means of the normalization factor ζ, the long-term growth rate λ equals 1 (in case of the optimal amount of investment) and is otherwise less than 1 (in case of a suboptimal amount of investment) (for details, see Appendix A). Hence, the optimal amount of investment enables the firm to defend its markets against current and future competitors, thus preventing the firm’s number of markets from decreasing in the long run and thus securing long-term survival. By contrast, in case of a suboptimal amount of investment, the firm is not able to defend its markets against current and future competitors, which results in a reduction of the firm’s number of markets in the long run and thus in a serious threat to long-term survival.

Although we believed that collecting data from one carefully selected key informant per firm would be sufficient, we performed a test for possible informant bias. For this purpose, we asked each respondent to name another executive within their firm who is also strongly involved in market defense activities. 213 managers agreed to provide the requested information. Subsequently, we contacted the potential secondary informants by telephone and asked them to participate in an interview (to complete a shortened version of the questionnaire). This resulted in a total of 115 responses of secondary informants. After discarding 11 questionnaires of inappropriate respondents (Kumar et al. 1993), we compared the responses of the primary and secondary informant of each firm on a subset of 11 items of our original questionnaire. Inter-informant correlations range between 0.62 and 0.74 and are all highly significant (p < 0.01). This result provides further confidence in using the primary responses and that respondents had a similar interpretation of the key terms in mind when answering the questionnaire.

To validate our model’s appropriateness for providing managerial recommendations, we asked managers in our survey to rate their firm’s actual amount of investment in different generic defense strategies and their firm’s respective market defense success. As responses on both amount of investment and success were obtained from the same source (the same manager), these responses may be subject to common-method variance. Although this issue affects only our empirical validation of model appropriateness, not our empirical calibration of model parameters and resulting findings with respect to our research questions, we nevertheless performed a corresponding test. For this purpose, we again performed the empirical validation procedure, this time also drawing on the responses of the secondary informant. Specifically, in a first step, we carried out the procedure using the responses on amount of investment of the secondary informant and the responses on success of the primary informant. In a second step, we carried out the procedure using the responses on amount of investment of the primary informant and the responses on success of the second informant. In both cases, the findings closely parallel the findings reported in Table 2, indicating that common-method bias is not a notable problem in our study.

This is based on the fact that a value of 3 (proportional) corresponds to q = 1 and of 5 (strongly decreasing) to q ≈ 0 (in a positive range). Hence, 4.09 corresponds to q ≈ 0.50 (rounded to ensure the solvability of the model).

To further check the robustness of our findings, we examined the interrelation between the probability of deterrence and shakeout. Results show that with an increasing probability of successful shakeout, the optimal amount of deterrence investment declines. Analogously, an increasing probability of successful deterrence reduces the optimal amount of shakeout investment. These results are entirely consistent with those presented before.

To illustrate the use of these two strategies, two examples from business practice are provided on the basis of information retrieved from qualitative interviews with executives from these companies. The first example relates to a large manufacturer of electronic devices (characterized by a short PLC at the category level) that repeatedly faces market entry of smaller competitors. Although these competitors typically do not endanger the firm’s long-term survival in the market, they nevertheless depress its future profits (which are also limited due to the short PLC). For market defense purposes, the firm relies heavily on competitor shakeout. Specifically, it invests heavily in retaliatory activities targeted at new entrants, such as carrying out comparative advertising, initiating price wars, and otherwise enticing customers away from these new competitors. So far, these activities considerably weakened most entrants, so that the firm frequently managed to squeeze out these competitors, contributing to its image as a fierce competitor. The second example refers to a small mechanical engineering company that produces printing machines (characterized by a long PLC at the category level) which constantly fears market entry of competitors that tend to be significantly larger in terms of number of employees and annual revenues. To secure long-term future profits and to prevent these powerful entrants from endangering this company’s long-term survival in the market, the firm concentrates on competitor deterrence. Specifically, it invests heavily in building and maintaining competitor barriers to entry, for example, through creating a strong, favorable brand image, entertaining close business relationships with the biggest customers in the market, and blocking access to suppliers of key components by means of exclusivity contracts. As a result, the firm so far successfully discouraged potential competitors from market entry.

References

Aaker, D. A. (1988). Developing business strategies (2nd ed.). New York: Wiley.

Agrarwal, R., & Gort, M. (1996). The evolution of markets and entry, exit and survival of firms. The Review of Economics and Statistics, 78(5), 489–498.

Ailawadi, K. L., Kopalle, P. K., & Neslin, S. A. (2005). Predicting competitive response to a major policy change: Combining game-theoretic and empirical analyses. Marketing Science, 24(1), 12–24.

Bain, J. (1956). Barriers to new competition. Cambridge: Harvard University Press.

Basdeo, D. K., Smith, K. G., Grimm, C. M., Rindova, V. P., & Derfus, P. J. (2006). The impact of market actions on firm reputation. Strategic Management Journal, 27(12), 1205–1219.

Blattberg, R. C., & Deighton, J. (1996). Manage marketing by the customer equity test. Harvard Business Review, 74(13), 6–44.

Blattberg, R. C., & Hoch, S. J. (1990). Database models and managerial intuition: 50% model and 50% manager. Management Science, 36(8), 887–899.

Blattberg, R. C., Deighton, J., Hoch, S. J., Kim, Byung-Do, & Neslin, S. A. (2008). Database marketing. New York: Springer.

Bohlmann, J. D., Golder, P. N., & Mitra, D. (2002). Deconstructing the pioneer’s advantage. Management Science, 48(September), 1175–1195.

Bordley, R. (2003). Determining the appropriate depth and breadth of a firm’s product portfolio. Journal of Marketing Research, 40(February), 39–53.

Bowman, D., & Gatignon, H. (1995). Determinants of competitor response time to a new product introduction. Journal of Marketing Research, 32(February), 42–53.

Burnham, T. A., Frels, J. K., & Mahajan, V. (2003). Consumer switching costs: A typology, antecedents, and consequences. Journal of the Academy of Marketing Science, 31(2), 109–126.

Calantone, R. J., & di Benedetto, C. A. (1990). Defensive industrial marketing strategies. Industrial Marketing Management, 19(3), 267–278.

Caswell, H. (2001). Matrix populations models. Sunderland: Sinauer.

Chandy, R. K., & Tellis, G. J. (2000). The incumbent’s curse? Incumbency, size, and radical product innovation. Journal of Marketing, 64(July), 1–17.

Clark, B. H., & Montgomery, D. B. (1998). Competitive reputations, multimarket competition and entry deterrence. Journal of Strategic Marketing, 6(June), 81–96.

Cubbin, J., & Domberger, S. (1988). Advertising and post-entry oligopoly behaviour. The Journal of Industrial Economics, 37(December), 123–140.

Cushing, J. M., Dennis, B., Desharnais, R. A., & Costantino, R. F. (1996). An interdisciplinary approach to understanding nonlinear ecological dynamics. Ecological Modelling, 92, 111–119.

Day, G. S., & Montgomery, D. B. (1999). Charting new directions for marketing. Journal of Marketing, 63(October), 3–13.

Dong, W., Swain, S. D., & Berger, P. D. (2007). The role of channel quality in customer equity management. Journal of Business Research, 60(12), 1243–1252.

Dutta, S., Bergen, M., & John, G. (1994). The governance of exclusive territories when dealers can bootleg. Marketing Science, 13(1), 83–99.

Eliashberg, J., & Jeuland, A. P. (1986). The impact of competitive entry in a developing market upon dynamic pricing strategies. Marketing Science, 5(Winter), 20–36.

Eshel, I. (1983). Evolutionary and continuous stability. Journal of Theoretical Biology, 103, 99–111.

Freedman, D., Pisani, R., & Purves, R. (1998). Statistics (3rd ed.). Norton: New York.

Friedman, D. (1991). Evolutionary games in economics. Econometrica, 59(3), 637–666.

Gatignon, H., Anderson, E., & Helsen, K. (1989). Competitive reactions to market entry: Explaining interfirm differences. Journal of Marketing Research, 26(February), 44–55.

Gatignon, H., Anderson, E., Helsen, K., Robertson, T. S., & Fein, A. J. (1997). Incumbent defense strategies against new product entry. International Journal of Research in Marketing, 14(May), 163–176.

Ginzburg, L. (1986). The theory of population dynamics. Journal of Theoretical Biology, 122, 385–399.

Gruca, T. S., & Sudharshan, D. (1995). A framework for entry deterrence strategy. Journal of Marketing, 59(July), 44–55.

Guiltinan, J. P., & Gundlach, G. T. (1996). Agressive and predatory pricing: A framework for analysis. Journal of Marketing, 60(3), 87–103.

Gupta, S. (1994). Managerial judgment and forecast combination. Marketing Letters, 5(1), 5–17.

Han, J. K., Kim, N., & Kim, H.-B. (2001). Entry barriers: A dull-, one-, or two-edged sword for incumbents? Journal of Marketing, 65(January), 1–14.

Hannan, M., & Freeman, J. (1977). The population ecology of organizations. The American Journal of Sociology, 82, 929–964.

Hauser, J. R., & Shugan, S. M. (1983). Defensive marketing strategies. Marketing Science, 2(4), 319–360.

Hauser, J. R., & Shugan, S. M. (2008). Commentary: Defensive marketing strategies. Marketing Science, 27(1), 85–87.

Hauser, J. R., & Wernerfelt, B. (1989). The competitive implications of relevant-set/response analysis. Journal of Marketing Research, 26(November), 391–405.

Henrich, J., & Henrich, N. (2006). Culture, evolution and the puzzle of human cooperation. Cognitive Systems Research, 7(March), 220–245.

Henson, S. M. (1998). A continuous, age-structured insect population model. Journal of Mathematical Biology, 39, 217–243.

Holak, S. L., & Tang, Y. E. (1990). Advertising’s effect on the product evolutionary cycle. Journal of Marketing, 54(3), 16–29.

Homburg, C., & Fürst, A. (2005). How organizational complaint handling drives customer loyalty: An analysis of the mechanistic and the organic approach. Journal of Marketing, 69(3), 95–114.

Horn, R. A., & Johnson, C. R. (1990). Matrix analysis. Cambridge: Cambridge University Press.

Jayachandran, S., & Varadarajan, R. (2006). “Does success diminish competitive responsiveness? Reconciling conflicting perspectives“. Journal of the Academy of Marketing Science, 34(3), 284–294.

Karakaya, F. (2000). Market exit and barriers to exit. Psychology and Marketing, 17(August), 651–668.

Karakaya, F., & Stahl, M. J. (1989). Barriers to entry and market entry decisions in consumer and industrial goods markets. Journal of Marketing, 53(2), 80–91.

Karakaya, F., & Stahl, M. J. (1992). Underlying dimensions of barriers to market entry in consumer goods markets. Journal of the Academy of Marketing Science, 20(3), 275–278.

Kreps, D. M., & Wilson, R. (1982). Reputation and imperfect information. Journal of Economic Theory, 27(2), 253–279.

Krider, R. E., & Weinberg, C. B. (1998). Competitive dynamics and the introduction of new products. Journal of Marketing Research, 35(February), 1–15.

Kuester, S., Homburg, C., & Robertson, T. S. (1999). Retaliatory behavior to new product entry. Journal of Marketing, 63(October), 90–106.

Kumar, N., Stern, L. W., & Anderson, J. C. (1993). Conducting interorganizational research using key informants. Academy of Management Journal, 36(December), 1633–1651.

Lam, S. Y., Venkatesh Shankar, M., Erramilli, K., & Murthy, B. (2004). Customer value, satisfaction, loyalty, and switching costs. Journal of the Academy of Marketing Science, 32(3), 293–311.

Leeflang, P. S. H., & Wittink, D. R. (2000). Building models for marketing decisions: Past, present and future. International Journal of Research in Marketing, 17, 105–126.

Little, J. D. C. (1970). Models and managers: The concept of a decision calculus. Management Science, 16(8), 466–485.

Little, J. D. C. (2004). Comments on ‘Models and managers: The concept of a decision calculus’. Management Science, 50(12), 1854–1860.

Little, J. D. C., & Lodish, L. M. (1981). Commentary on ‘Judgment-based marketing decision models’. Journal of Marketing, 45(Fall), 24–29.

Madsen, T. L., & Walker, G. (2007). Incumbent and entrant rivalry in a deregulated industry. Organization Science, 18(4), 667–687.

McGrath, R. G., Chen, M.-J., & MacMillan, I. (1998). Multimarket maneuvering in uncertain spheres of influence: Resource diversion strategies. Academy of Management Review, 23(4), 724–740.

McIntyre, S. H. (1982). An experimental study of the impact of judgment-based marketing models. Management Science, 28(1), 17–33.

Milgrom, P., & Roberts, J. (1982). Predation, reputation and entry deterrence. Journal of Economic Theory, 27(August), 280–312.

Montgomery, D. B., Moore, M. C., & Urbany, J. E. (2005). Reasoning about competitive reactions: Evidence from executives. Marketing Science, 24(1), 138–149.

Olazábal, A. M., Cava, A., & Sacasas, R. (2006). Marketing and the law. Journal of the Academy of Marketing Science, 34(1), 84–88.

O'Shaughnessy, J. (1992). Explaining buyer behavior. New York: Oxford University Press.

Palmer, A. (2000). Co-operation and competition: A Darwinian synthesis of relationship marketing. European Journal of Marketing, 34(5/6), 687–704.

Parayre, R., & Hurry, D. (2001). Corporate investment and strategic stability in hypercompetition. Managerial and Decision Economics, 22(August), 281–298.

Pfeffer, J., & Salancik, G. R. (1978). The external control of organizations. A resource dependence perspective. New York: Harper and Row.

Porter, M. E. (1985). Competitive advantage: Creating and sustaining superior performance. New York: Free Press.

Prabhu, J., & Stewart, D. W. (2001). Signaling strategies in competitive interaction: Building reputations and hiding the truth. Journal of Marketing, 38(February), 62–72.

Ramaswami, S., Srivastava, R., & Bhargava, M. (2009). Market-based capabilities and financial performance of firms. Journal of the Academy of Marketing Science, 37(2), 97–116.

Roberts, J. (2005). Defensive marketing. Harvard Business Review, 83(November), 150–157.

Robertson, T. S., Eliashberg, J., & Rymon, T. (1995). New product announcement signals and incumbent reactions. Journal of Marketing, 59(July), 1–15.

Robinson, W. T. (1988). Marketing mix reactions to entry. Marketing Science, 7(Fall), 368–385.

Robinson, W. T., & Fornell, C. (1985). Sources of market pioneering advantages in consumer goods industries. Journal of Marketing Research, 22(August), 305–317.

Samuelson, L. (2002). Evolution and game theory. Journal of Economic Perspectives, 16(2), 47–66.

Scherer, F. M., & Ross, D. (1992). Industrial market structure and economic performance. Boston, MA: Houghton Mifflin Company.

Shang, J., Yildirim, T. P., Tadikamalla, P., Mittal, V., & Brown, L. H. (2009). Distribution network redesign for marketing competitiveness. Journal of Marketing, 73(2), 146–163.

Shankar, V. (1999). New product introduction and incumbent response strategies. Journal of Marketing Research, 36(August), 327–344.

Steenkamp, Jan-Benedict, E. M., Nijs, V. R., Hanssens, D. M., & Dekimpe, M. G. (2005). Competitive reactions to advertising and promotion attacks. Marketing Science, 24(January), 35–54.

Stump, R. L., & Heide, J. B. (1996). Controlling supplier opportunism in industrial relationships. Journal of Marketing Research, 33(4), 431–441.

Sugden, R. (2001). The evolutionary turn in game theory. Journal of Economic Methodology, 8(1), 113–130.

Taylor, P. D. (1996). Inclusive fitness arguments in genetic models of behaviour. Journal of Mathematical Biology, 34(May), 654–674.

Tirole, J. (1988). The theory of industrial organization. Cambridge, MA: MIT Press.

Triola, M. F. (2007). Elementary statistics (10th ed.). Reading, MA: Addison-Wesley.

van Boven, M., & Weissing, F. J. (2004). The evolutionary economics of immunity. The American Naturalist, 163(February), 277–294.

Varadarajan, R. P., & Jayachandran, S. (1999). Marketing strategy: An assessment of the state of the field and outlook. Journal of the Academy of Marketing Science, 27(2), 120–143.

Wang, F., Zhang, X.-P. S., & Ouyang, M. (2009). Does advertising create sustained firm value? Journal of the Academy of Marketing Science, 37(2), 130–143.

Weibull, J. W. (1998). Evolution, rationality and equilibrium in games. European Economic Review, 42(May), 641–649.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A

Long-term basic structure of the model

As stated in the main text, the dynamics of the model is given by the linear recurrence equation

with a non-negative matrix A. According to the Perron-Frobenius theorem for non-negative matrices (Horn and Johnson 1990), which ensures the existence of eigenvalues and eigenvectors of a real positive matrix, Eq. A.1 always converges towards the equation

where u is a right eigenvector with respect to eigenvalue λ and describes the firm’s long-term market structure u = (u M , u O , u RM ). The condition A.2 corresponds to the system of equations

The last two equations determine the long-term market structure u up to a constant factor:

The dominant eigenvalue λ reflects that once a firm’s long-term market structure u is reached, the firm’s total number of markets will grow with a factor λ per period. This factor is introduced to resolve the trade-off between positive and negative consequences of defense investments and thus to identify the optimal amount of defense investment x*.

Because the firm’s total number of markets cannot infinitely increase (e.g., owing to merely a finite number of potential markets as well as prohibitively high transaction and coordination costs in reality), it is reasonable to assume that λ does not exceed 1. In contrast, λ can be less than 1, as the firm’s total number of markets may well shrink to zero in the long run. However, there are two different types of possible causes of this decrease—defense-related causes (i.e., whether and how the firm defends its markets against competitors) and non-defense-related causes (e.g., declining product lifecycles). Unfortunately, the mixture of the effects of these two different types of causes does not allow separate analysis of the effect of defense-related causes (i.e., of the firm’s amount of defense investment x) on the firm’s number of markets in the long run and thus on the firm’s long-term survival (which is, however, the goal of the model).

Hence, to be able to identify a firm’s optimal amount of investment x*, it is necessary to assume that (only) in case of the optimal amount of investment x* (which enables the firm to successfully defend its markets against current and future competitors and thereby maximizes the probability of long-term survival), the firm’s number of markets does not shrink to zero in the long run (for a similar logic, see van Boven and Weissing 2004; Caswell 2001). Thus, in this case only, we need to normalize λ to 1 by means of the parameter ζ. In all other cases (i.e., a suboptimal amount of investment), λ is less than 1. This is also in line with our focus on the firm’s long-term survival. Specifically, if the firm defends its markets in a suboptimal way, it will not be able to withstand competitive forces in the long run. Thus, its market position will sooner or later erode, which in turn forces the firm’s market exit (Karakaya 2000; Madsen and Walker 2007). The requirement on ζ corresponding to the condition λ = 1 results from inserting Eq. A.4 into the first equation of A.3:

In the following, we normalize the right eigenvector u so that:

Such a standardization is useful because then u O directly corresponds to the proportion of the firm’s oligopoly markets. Using the last two equations of A.3, Eq. A.6, and the assumption λ = 1, a straightforward calculation yields the explicit expressions for u M , u O , and u RM :

Appendix B

Calculation of the optimal defense investment

To derive the optimal defense investment, i.e., the evolutionary stable strategy (ESS), we compare two alternative investments x and y competing with each other. It is important to recognize that the success of the investment y also depends on the investment x due to reputational effects. Thus, according to Eq. 4 in the main text, the probability η of a market entry attempt is represented by η(y, x) = g(y) u O (x). Overall, we obtain the following matrix A(y, x) that describes the dynamics of incumbent’s market structure, when the incumbent pursues the investment strategy y (van Boven and Weissing 2004):

The parameter ζ depends on x for technical reasons. λ is normalized to 1 in the case of an optimal incumbent’s investment x*. To ensure the comparability to an alternative investment y, both long-term growth rates have to be normalized by the factor ζ (x*).

As stated in the main text, the optimal investment x* is characterized by the fact that no alternative investment y leads to a higher λ when competing with x*, i.e., the investment x* “is a strict best response to itself” (Samuelson 2002, p. 49). In other words, the defense investment x* is optimal (i.e., evolutionary stable), if the following condition holds:

It is worth mentioning that λ(x*, x*) = 1 owing to the normalization by the parameter ζ (see Eq. A.5). Thus, x* is evolutionary stable, if the function λ(y, x*) attains a maximum in y at y = x*, i.e.,

By means of the second-order condition

it can be examined whether x* does indeed correspond to a maximum. The second-order condition

is also relevant, because it allows examining whether x* is convergence stable. Convergence stability ensures that the evolutionary stable strategy can be attained by a series of strategy substitution events and thereby provides a dynamic perspective of the ESS concept (Eshel 1983; Taylor 1996). To apply Eq. B.3, we need the dominant eigenvalue λ(y, x) of the Matrix A(y, x), which is, in practice, difficult to calculate. However, we simplify Eq. B.3 using left eigenvectors (Caswell 2001). The left eigenvector v with respect to eigenvalue λ = 1 is given by the equation v = vA, and can be calculated up to a constant factor:

The eigenvalue λ = λ (y, x*) of Matrix A = A(y, x *) as well as its derivative with respect to y can be calculated by means of right and left eigenvectors u = u(y, x *) and v = v(y, x *):

Consequently, because of the conditions B.1 and B.7, x * can be calculated based on the equation

where \( v_i^{*} = {v_i}({x^{*}}) \) and \( u_i^{*} = {u_i}({x^{*}}) \) denote the elements of the left and right eigenvector of the Matrix A(x *, x *), respectively. Inserting the elements of Matrix B.1 in Eq. B.8, we derive the ESS condition (see Eq. 5 in the main text).

The second-order conditions B.4 and B.5 can be controlled by means of left and right eigenvectors (for further details, see Caswell 2001, chap. 9.4). By normalizing the left and right eigenvectors so that vu = 1, we obtain:

Appendix C

Rights and permissions

About this article

Cite this article

Homburg, C., Fürst, A., Ehrmann, T. et al. Incumbents’ defense strategies: a comparison of deterrence and shakeout strategy based on evolutionary game theory. J. of the Acad. Mark. Sci. 41, 185–205 (2013). https://doi.org/10.1007/s11747-011-0299-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11747-011-0299-5