ABSTRACT

BACKGROUND

Millions of adults will gain Medicaid or private insurance in 2014 under the Affordable Care Act, and prior research shows that underinsurance is common among middle-income adults. Less is known about underinsurance among low-income adults, particularly those with public insurance.

OBJECTIVE

To compare rates of underinsurance among low-income adults with private versus public insurance, and to identify predictors of being underinsured.

DESIGN

Descriptive and multivariate analysis of data from the 2005–2008 Medical Expenditure Panel Survey.

PARTICIPANTS

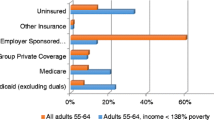

Adults 19–64 years of age with family income less than 125 % of the Federal Poverty Level (FPL) and full-year continuous coverage in one of four mutually exclusive insurance categories (N = 5,739): private insurance, Medicaid, Medicare, and combined Medicaid/Medicare coverage.

MAIN MEASURES

Prevalence of underinsurance among low-income adults, defined as out-of-pocket expenditures greater than 5 % of household income, delays/failure to obtain necessary medical care due to cost, or delays/failure to obtain necessary prescription medications due to cost.

KEY RESULTS

Criteria for underinsurance were met by 34.5 % of low-income adults. Unadjusted rates of underinsurance were 37.7 % in private coverage, 26.0 % in Medicaid, 65.1 % in Medicare, and 45.1 % among Medicaid/Medicare dual enrollees. Among underinsured adults, household income averaged $6,181 and out-of-pocket spending averaged $1,115. Due to cost, 8.1 % and 12.8 % deferred or delayed obtaining medical care or prescription medications, respectively. Predictors of underinsurance included being White, unemployed, and in poor health. After multivariate adjustment, Medicaid recipients were significantly less likely to be underinsured than privately insured adults (OR 0.22, 95 % CI 0.17–0.28).

CONCLUSIONS

Greater than one-third of low-income adults nationally were underinsured. Medicaid recipients were less likely to be underinsured than privately insured adults, indicating potential benefits of expanded Medicaid under health care reform. Nonetheless, more than one-quarter of Medicaid recipients were underinsured, highlighting the importance of addressing cost-related barriers to care even among those with public coverage.

Similar content being viewed by others

REFERENCES

Sommers BD, Epstein AM. Medicaid expansion–the soft underbelly of health care reform? N Engl J Med. 2010;363(22):2085–2087.

Schoen C, Doty MM, Robertson RH, Collins SR. Affordable care act reforms could reduce the number of underinsured US adults by 70 percent. Heal Aff. 2011;30(9):1762–1771.

Short PF, Banthin JS. New estimates of the underinsured younger than 65 years. JAMA. 1995;274(16):1302–1306.

Blewett LA, Rodin H, Davidson G, Davern M. Measuring adequacy of coverage for the privately insured: new state estimates to monitor trends in health insurance coverage. Med Care Res Rev. 2009;66(2):167–180.

Schoen C, Doty MM, Collins SR, Holmgren AL. Insured but not protected: how many adults are underinsured? Health affairs. 2005;Suppl Web Exclusives:W5-289-W5-302.

Ziller EC, Coburn AF, Yousefian AE. Out-of-pocket health spending and the rural underinsured. Heal Aff. 2006;25(6):1688–1699.

Donelan K, DesRoches CM, Schoen C. Inadequate health insurance: costs and consequences. Med Gen Med. 2000;2(3):E37.

Kogan MD, Newacheck PW, Blumberg SJ, Ghandour RM, Singh GK, Strickland BB, et al. Underinsurance among children in the United States. N Engl J Med. 2010;363(9):841–851.

Where are states today? Medicaid and state-funded coverage eligibility levels for low-income adults. Washington, D.C.: Kaiser Family Foundation; 2009.

Long SK, Coughlin T, King J. How well does Medicaid work in improving access to care? Health Serv Res. 2005;40(1):39–58.

Finkelstein A, Taubman S, Wright BJ, Bernstein M, Gruber J, Newhouse JP, et al. The Oregon health insurance experiment: evidence from the first year. Cambridge: National Bureau of Economic Research; 2011.

Heberlein M, Brooks T, Guyer J, Artiga S, Stephen J. Holding steady, looking ahead: annual findings of a 50-state survey of eligibility rules, enrollment and renewal procedures, and cost sharing practices in medicaid and CHIP, 2010–2011. Washington: Kaiser Family Foundation; 2011.

Focus on health reform: summary of new health reform law. Menlo Park, CA: Kaiser Family Foundation; 2011.

Methodology Report #22: Sample design of the Medical Expenditure Panel Survey Household Component, 1998–2007. Rockville, MD: Agency for Healthcare Research and Quality; 2008.

Sommers BD. Loss of health insurance among non-elderly adults in Medicaid. J Gen Intern Med. 2009;24(1):1–7.

Paez KA, Zhao L, Hwang W. Rising out-of-pocket spending for chronic conditions: a ten-year trend. Heal Aff. 2009;28(1):15–25.

Lavarreda SA, Brown ER, Bolduc CD. Underinsurance in the United States: an interaction of costs to consumers, benefit design, and access to care. Annu Rev Public Health. 2011;32:471–482.

Bashshur R, Smith DG, Stiles RA. Defining underinsurance: a conceptual framework for policy and empirical analysis. Med Care Rev. 1993;50(2):199–218.

Ku L, Coughlin TA. Sliding-scale premium health insurance programs: four states’ experiences. Inquiry. 1999;36(4):471–480.

Andersen RM. Revisiting the behavioral model and access to medical care: does it matter? J Health Soc Behav. 1995;36(1):1–10.

Schoen C, Collins SR, Kriss JL, Doty MM. How many are underinsured? Trends among U.S. adults, 2003 and 2007. Heal Aff. 2008;27(4):w298–w309.

Long SK. Hardship among the uninsured: choosing among food, housing, and health insurance. Policy brief. Washington: The Urban Institute; 2003.

Bustamante AV, Chen J. Health expenditure dynamics and years of U.S. residence: analyzing spending disparities among Latinos by citizenship/nativity status. Heal Serv Res. 2012;47(2):794–818.

Arellano ABR, Wolfe SM. Unsettling scores: a ranking of state Medicaid programs. Washington: Public Citizen; 2007.

Sommers BD, Baicker K, Epstein AM. Mortality and access to care among adults after state Medicaid expansions. N Engl J Med. 2012;367(11):1025–1034.

Medicare premiums and coinsurance rates for 2012. Baltimore, MD: Centers for Medicare and Medicaid Services; 2012.

Acknowledgements

Dr. Magge was supported by the National Research Service Award grant 6 T32 HP10263 from the National Institutes of Health. Dr. Magge had full access to all of the data in the study and takes responsibility for the integrity of the data and the accuracy of the data analysis. All authors have no conflicts of interest to disclose. Dr. Sommers is currently serving as a Senior Advisor in the U.S. Department of Health & Human Services, but this work was conducted while he was a faculty member at the Harvard School of Public Health, and in no way represents the views of the Department. We thank Tracey Wilkinson, M.D., Caroline Kistin, M.D., Webb Long, M.D., and Neil Gupta, M.D for their thoughtful manuscript review.

Conflict of Interest

All authors have no conflicts of interest to declare.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Magge, H., Cabral, H.J., Kazis, L.E. et al. Prevalence and Predictors of Underinsurance Among Low-Income Adults. J GEN INTERN MED 28, 1136–1142 (2013). https://doi.org/10.1007/s11606-013-2354-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11606-013-2354-z