Abstract

Purpose

To support the data requirements of stakeholders, the Nickel Institute (NI) conducted a global life cycle impact assessment (LCIA) to show, with indicators, the potential environmental impacts of the production of nickel and ferronickel from mine to refinery gate. A metal industry wide agreed approach on by-products and allocation was applied.

Methods

Nine companies, comprising 19 operations, contributed data, representing 52 % of global nickel metal production and 40 % of global ferronickel production. All relevant pyro- and hydrometallurgical production routes were considered, across most major nickel-producing regions. Data from Russia, the biggest nickel-producing nation, was included; the Chinese industry did not participate. 2011 was chosen as reference year for data collection. The LCIA applied allocation of impacts of by-products using both economic and mass allocations. A sensitivity analysis was conducted to further understand the relevance and impact of the different allocation approaches.

Results and discussion

The primary extraction and refining steps are the main contributors to primary energy demand (PED) and global warming potential (GWP), contributing 60 and 70 % to the PED for the production of 1 kg class I nickel and 1 kg nickel in ferronickel, respectively, and over 55 % of the GWP for both nickel products. The PED for 1 kg class 1 nickel was calculated to be 147 MJ, whilst the PED for 1 kg nickel in ferronickel was calculated to be three times higher at 485 MJ. The main factors influencing energy demand in the metallurgical processes are ore grade and ore mineralogy. Sulphidic ore is less energy intensive to process than oxidic ore. Eighty-six percent of the production volume from class 1 nickel producers, in this study, is from sulphidic ore. All ferronickel was produced from oxidic ore. The LCIA results, including a sensitivity analysis of the impact of producers with higher and lower PED, reflect the influence of the production route on energy demand and on environmental impact categories.

Conclusions

Conformant to relevant ISO standards, and backed-up with a technical and critical review, this LCIA quantifies the environmental impacts associated with the production of the main nickel products. With this study, a sound background dataset for downstream users of nickel has been provided. The Nickel Institute aims to update their data in the coming years to reflect upon changes in technology, energy efficiency, and raw material input.

Similar content being viewed by others

1 Introduction

In view of the ongoing societal debate on energy efficiency and climate change, life cycle assessment data for products and processes play an increasingly important role. Material selection for applications can as easily be influenced by sustainability indicators (e.g. ‘carbon footprint’) as by technical characteristics, such as mechanical strength or corrosion resistance. Nickel and its products can reduce energy consumption and mitigate environmental impacts through use. Due to the physical–chemical properties of nickel, Ni-containing products are known to have the potential to generate higher energy efficiency, to extend a product’s life in service, or to reduce the required maintenance of a product in use compared to other materials. These aspects can lead directly to energy and resource savings, as illustrated in a recent life cycle assessment and life cycle costing study on the world’s longest pier (Mistry et al. 2016).

Nickel can be produced from either oxidic (laterite) or sulphidic ores, the mineralogy (and ore grade) of each having an influence on energy demand both during the mining and subsequent processing stages. The mining of oxidic ore deposits is in general less energy intensive, but downstream processing of these ores requires significantly higher energy consumption. The location, depth and shape of the ore deposit can also have a major impact. Deposits in remote or relatively inaccessible areas require more infrastructure, specialised equipment and greater energy consumption. Location geography and geology also dictate energy sources.

Energy demand tends to increase with production at a given location, because the last ore grades to be mined are usually less accessible and less rich than earlier production. As an inevitable consequence of the ageing of existing sulphide ore bodies and absence of new, economically viable resources, the share of nickel production from oxidic ores in the overall mix of nickel production has been increasing as a long-term trend (Mudd and Jowitt 2014).

The metallurgical stages of the nickel production processes are energy intensive, as the chemical bonds in the nickel-containing mineral must be broken to liberate the metal. The choice of technology employed depends on factors such as raw materials input, the presence of by-products, impurities and market considerations. Primary extraction involves the conversion of prepared ore and nickel concentrate into nickel matte, nickel oxide, ferronickel, nickel cobalt intermediates and other nickel and non-nickel by-products. Around 36 % of the global nickel production originates from sulphidic ore; the remaining 64 % from lateritic/oxidic ore (INSG 2016). There are four main process routes for primary extraction for sulphidic and lateritic/oxidic ore:

-

Hydrometallurgical extraction from oxidic ore (hydro-oxidic)

-

Hydrometallurgical extraction from sulphidic ore (hydro-sulphidic)

-

Pyrometallurgical extraction from oxidic ore (pyro-oxidic)

-

Pyrometallurgical extraction from sulphidic ore (pyro-sulphidic)

No hydrometallurgical extraction from sulphidic ore is included in this nickel update study, as a result of the technology used by companies who participated. It is however known to be a less relevant production technology. All hydro-oxidic processes covered by this nickel update study produce a nickel cobalt intermediate and involve the input of significant quantities of sulphuric acid. The pyro-sulphidic route produces sulphuric acid as a by-product. The process energy required for extraction from sulphidic ores is lower per unit product than from oxidic ores, because the processing reactions for sulphides are exothermic, thus alleviating the need for energy from fossil fuels.

In 1999, the Nickel Institute undertook its first life cycle impact assessment (LCIA) of the production of nickel products (Nickel Institute and Ecobalance Inc 2003). In 2012, following changes in manufacturing technology, improved efficiencies and rationalisation and increased availability of data from nickel-producing companies, the Nickel Institute decided to generate a new life cycle inventory (LCI) and LCIA for the production of nickel products, based on 2011 data (Nickel Institute and thinkstep 2014). The nickel update study generated data with a greater geographical coverage (approximately 20 %), with all major nickel producers outside China participating. Chinese nickel producers—accounting in 2011 to more than 25 % of the primary nickel production globally—were invited to participate in the LCI update but did not contribute data.

The methods—including the use of economic allocation—employed in this update study are consistent with those harmonized for use across the metal industry (Santero and Hendry 2016). It is hoped that results will provide robust, credible and representative life cycle inventory and impact data to LCA practitioners. In addition, the results of the nickel update study are intended to be:

-

Used for communication purposes

-

Used for the nickel industry’s other environmental data reporting requirements

-

Updated regularly

An overview of data year 2011 results is presented in this article, focusing on a selection of key impact categories and indicators. The complete inventory is available within the GaBi 6 (2012) database, whilst the full LCIA report is available through the Nickel Institute’s website (www.nickelinstitute.org). A programme of inclusion of the life cycle inventory data in other commercial and public databases is underway.

2 Methodology

2.1 Goal and scope

The aim of this update study was to provide a current LCI/LCIA of two nickel products, using current, robust data on nickel production from 2011, which is representative of the global production mix outside China. This update study did not include a comparative assertion and it was not a goal within this project. Any comparisons should only be made on a product system basis and should be done in accordance with existing standards, such as the ISO 14040 series of standards, including an additional critical panel review (ISO 14040:2009-11 2009; ISO 14044:2006-10 2006).

The products studied were:

-

Class 1 nickel metal, containing >99 % nickel. Nickel metal is studied without distinction between specific products within the general category, such as nickel squares, powder, and briquettes

-

Ferronickel (29 % nickel metal content), which falls under class 2 nickel, containing <99 % nickel

For both nickel and ferronickel products, only the primary production route was considered. For both products, the secondary production route was not considered, as recovery of nickel usually only occurs during the recycling of steel, where it remains in a steel alloy form.

The functional unit, which enables the system inputs/outputs to be quantified and normalised, was 1 kg of nickel contained in the nickel product at the factory gate. Class 1 nickel is effectively 100 % nickel and, as a consequence, the associated reference flow is 1 kg nickel in 1 kg nickel product. Based on average data provided by the participants in this update study, ferronickel has an average nickel content of 29 %, and thus the associated reference flow is, on average, 1 kg nickel in 3.45 kg nickel product.

2.2 System boundary

The update study is a ‘cradle-to-gate’ LCIA, that is, it covers all of the production steps from raw materials ‘in the earth’ (i.e. the cradle) to finished products ready to be shipped from the factories (i.e. the gate). It does not include the manufacture of downstream products, their use, end of life and scrap recovery schemes. This was the appropriate choice of system boundary, because nickel products serve as intermediates that enter many different product life cycles.

The system boundary includes studying main routes of production of the nickel products, for both sulphidic and oxidic ores, including underground and surface mining; ore preparation and beneficiation; main pyro- and hydrometallurgical production routes (i.e. primary extraction to matte, ferronickel and nickel oxide); and refining to the final nickel products. By-products fall into the system boundaries and were taken into consideration. The system boundaries are shown in Fig. 1 (the outer box describes the system boundaries; the inner box the process chain).

2.3 Geographical, product and technological representation

The intended geographical scope of the update study was global. Nine Nickel Institute member companies representing 19 operations reported data. All major nickel-producing regions except China were covered, including countries in North America, South America, Australia, Europe and Asia. Chinese members were invited to participate; however, there was no interest to report data. Since this was an empirical update study, using primary industry data, theoretical inventory and impacts in relation to the Chinese industry were not modelled. The input raw materials and metallurgical processes applied in China differ greatly from the rest of the world and so conclusions are not easily drawn for China from non-Chinese data. This update study can thus be taken to be an LCI/LCIA of the nickel-producing world minus China.

For class 1 nickel, 52 % of world production by mass was covered and relevant hydro- and pyrometallurgical routes considered; for ferronickel, the update study covers 40 % of world production by mass with coverage of the pyrometallurgical route only. The primary data are actual nickel production data for the years 2010 and 2011. The upstream data are, as far as possible, for the years 2011 (electricity and fuels) and 2012 (materials).

The technology covered in the update study included underground and open-cast mining and the processing of both oxidic and sulphidic ores through pyrometallurgical and hydrometallurgical techniques. Underground mining covers 17 million t of sulphidic ore (31 %). Open-cast mining comprises 13 million t of sulphidic ore (25 %) and 24 million t of oxidic ore (44 %). In view of the resulting nickel products, 100 % of the ferronickel production results from oxidic ore being processed in pyrometallurgical processes. For nickel metal, the pyrometallurgical treatment of sulphidic ore is the predominant route within total 86 % coverage. The remaining 14 % oxidic ore is either processed through hydrometallurgical (12 %) or pyrometallurgical (2 %) processes. The technologies covered reflect the situation globally outside China. In China, the predominant nickel production technologies applied differ significantly due to the process inputs (nickel pig iron) (Reuter et al. 2015).

The primary extraction process included the following methods across the different companies:

-

Direct nickel flash (DON flash) smelting

-

Electric arc furnace (EAF)

-

High-pressure acid leach (HPAL)

-

Flash furnace

The refining process included the following methods across the different companies:

-

Ammonia phenylalanine ammonia-lyase (PAL)–H reduction

-

Chloride- and sulphide-electrowinning

-

Hydrosulphidic refining

-

Pyro-refining

-

Natural gas reforming

-

Volatisation

-

Leaching (bio/acid)

2.4 Treatment of by-products

The objective of this update study was to quantify the impacts associated specifically to the production of nickel products. However, nickel production typically yields several other products, such as platinum group metals (PGMs), cobalt, copper, iron, energy (steam and electricity) and sulphuric acid.

As per the ISO 14044 standard, the following rules for treatment of by-products are in general applicable. There are four principles of accounting for by-products which should be taken into consideration according to the following order:

-

1.

Subdivision of processes (if possible)

-

2.

System expansion (providing a credit for the by-product)

-

3.

Allocation/partitioning on physical relationships (e.g. mass)

-

4.

Allocation/partitioning on non-physical relationships (e.g. economic value)

For each of the subdivided processes, it has to be determined if system expansion or allocation is the most robust accounting methodology.

Metal products tend to have very different economic values and production volumes (e.g. platinum has a low production volume but high market value versus copper, which has high production volume but lower economic value).

System expansion is not used in this case since the primary production of valuable metals such as copper, cobalt and PGMs could also yield small amounts of nickel. If this process is credited, not only would it negate the production of copper but also small amounts of nickel. A mass allocation of impacts likewise would not reflect the differential value of the products and by-products and the aims behind producing the different metals.

In this update study, the economic value allocation is used, in accordance with the consensus approach of the metal industry (Santero and Hendry 2016). The average market value of each of the by-products over a 15-year period up to 2011 was used to reflect upon the significant price volatility of by-products. As a sensitivity analysis, the average economic value over 1.5 years for the different metal products was also studied. Figure S1, in the Electronic Supplementary Material, shows how economic allocation is applied.

During the pyrometallurgical extraction of nickel from sulphidic ore, nickel matte is produced along with sulphur containing off-gases. The off-gases are processed in an acid plant and are converted into sulphuric acid. Because of its desirable properties, sulphuric acid is the most universally used mineral acid and the most produced and consumed inorganic chemical, by volume. For the production of class 1 nickel from sulphidic ore, a credit, using system expansion, was given for the production of sulphuric acid. This approach is based on the fact that the by-product saves or avoids another product with equivalent function. The expanded system then includes the recovery processes of the by-product and the route of the product(s) that is replaced by the by-product. This procedure determines the environmental burden related with the main product by providing a credit to the analysed system by inclusion of alternative production routes applied for the identified by-products. This means for each by-product identified within the analysed product system, an alternative production route must be available and have associated life cycle inventory data. System expansion now requires that this inventory be included into the system boundaries and inverted (i.e. subtracted from the analysed system) (Fig. S2, Electronic Supplementary Material). This results in an environmental credit for the system analysed, according to the amount of by-product produced. The sulphuric acid dataset with its environmental impact categories used was from the GaBi 6 (2012) databases, representing a European regional average. At the time of modelling, this was the only available representative average dataset.

2.5 Data sources, data quality, data gaps and result calculation

2.5.1 Software and database

An LCIA model was created using the GaBi 6 Software system for life cycle engineering, developed by thinkstep AG (formerly known as PE International AG) (Universität Stuttgart and PE International AG, 2012). The GaBi database provides the LCI background data for the raw and process materials upstream of the nickel industry dataset. Regional upstream data were applied where available. GaBi datasets were developed following ISO 14040/14044 standards and are compliant with ILCD methodology (European Commission 2010).

2.5.2 Data collection and quality

Questionnaires for data collection were defined and revised together with participating member companies. Data was collected from member companies using a combination of SoFi 5 (SoFi 5 2012) web questionnaires and standard spreadsheets. The questionnaires addressed the unit process data for the respective nickel production, including any on-site utilities.

No cutoff criteria were used in collecting data as it was intended to capture the complete material input and output. All significant flows deemed to have the major influence on results, such as energy and fuels were collected. Data quality is judged by its precision (measured, calculated or estimated), completeness (e.g. are there unreported emissions?), consistency (degree of uniformity of the methodology applied on a study serving as a data source) and representativeness (geographical, time period, technology). An external review of the data by a third party expert (in nickel production and nickel production technologies) was undertaken, to eliminate data gaps and data reporting errors (Middleton 2014). The provided primary data of the technology representatives underwent an internal quality assurance and quality control process.

2.5.3 Foreground system

To the extent possible, this update study was based on primary data collected from member companies and their respective production sites (so-called foreground system). In cases, where primary data was not available, secondary data available from literature, previous LCI studies and life cycle databases was used for analysis (SoFi 5 2012).

2.5.4 Background system

Fuel and energy—upstream data

National averages for fuel inputs and electricity grid mixes were obtained from the GaBi 6 (2012) database. Where national averages were not available, a regional average was used (SoFi 5 2012). In South America, for example, the Brazilian electricity grid data is used for Columbia and Venezuela as this was the only available dataset for those regions at the time of the update study. For Columbia and Venezuela, 79 and 69 % of the national grid mix, respectively, are made up of hydropower (close to Brazil, which is 81 %) (IEA 2013). Furthermore, based on the production volumes, the impact on the average results is deemed to be small. These data are shown in Table 1.

Raw and process materials—upstream data

Data for all upstream raw materials was obtained from the GaBi 6 (2012) database. Examples of these process materials include limestone, hydrochloric acid, ammonia and sodium hydroxide. Where regional-specific data is not available, average datasets were used as best estimates (SoFi 5 2012).

Emissions to air, water and soil

Emission data associated with the production of the stated functional units was derived from the collection of primary data and by consultation with primary technical contacts familiar with the specific operations, where primary data was not available.

2.5.5 Data aggregation and averaging

The update study calculated the input and output profile for each reporting unit, and the resulting values were averaged across the units on the basis of relative production volumes—weighted vertical aggregation (see Fig. S3 in the Electronic Supplementary Material).

A vertically aggregated LCI was calculated for each process route—involving the processes of the given route only with its given yields—and these were then averaged across several routes on a production weighted basis. This horizontal averaging approach was used at process level for benchmarking during the data quality check comparing, for example, all mines, or all beneficiation processes (see Fig. S4 in the Electronic Supplementary Material). For primary extraction and refining, similar routes and technologies were compared, where applicable.

2.6 Selection of life cycle impact assessment method

3The life cycle impact assessment relates resource use and emission data from the life cycle inventory to potential impacts on the environment. Many life cycle impact assessment methodologies exist to achieve this goal, including TRACI, CML and ReCiPe. These approaches differ through their choice of characterisation models that are specific to certain regions or based on distinct methodologies. The metal industry recommends either CML or ReCiPe for European or globally based LCAs (thinkstep AG 2014). The CML (CML 2001, update April 2013) characterisation method is used here due to its mid-point approach and high level of scientific rigour.

The selected CML categories, in accordance with the harmonized metal industry approach, are:

-

Global warming potential (kg CO2-equivalents)

-

Acidification potential (kg SO2-equivalents)

-

Eutrophication potential (kg PO4-equivalents)

-

Photochemical ozone creation (smog creation) (kg C2H4-equivalents)

Selected non-CML categories:

-

Primary energy demand (MJ)

Global warming potential and non-renewable primary energy demand were chosen because of their relevance to climate change and energy efficiency, of high public and institutional interest, and deemed to be one of the most pressing environmental issues of our time. These categories are well-established and have a high level of consensus in the LCA community (thinkstep AG 2014). Eutrophication, acidification and photochemical ozone creation potentials were chosen because they are closely connected to air, soil and water quality and capture the environmental burdens associated with commonly regulated emissions such as nitrous oxides (NO x ), sulphur dioxide (SO2), volatile organic compounds (VOC) and others. Other categories, such as toxicity, biodiversity or (abiotic) resource depletion, rely on more controversial assumptions and methods and are thus less widely used and accepted in LCAs (thinkstep AG 2014). Primary energy demand (PED) and global warming potential (GWP) results are discussed in this paper; other impact category results can be found in the GaBi 6 (2012) database.

2.7 Critical review

The update study was critically reviewed to ensure that:

-

The methods used to carry out the LCA are consistent with ISO 14040

-

The methods used to carry out the LCA are scientifically and technically valid

-

The data used are appropriate and reasonable in relation to the goal of the update study

-

The interpretations reflect the limitations identified and the goal of the update study

-

The update study report is transparent and consistent

The critical review was conducted in parallel with the LCA, according to paragraph 6.2 of ISO 14044 by an independent expert.

3 Results and discussion

3.1 Life cycle inventory

The LCI results for the cradle-to-gate production of class 1 nickel and ferronickel are shown in Table 2. The results shown here are only a selection of key inventory data. The complete inventory can be found in the GaBi 6 (2012) database. From Tables 4 and 5, it can be seen that the cradle-to-gate production of 1 kg class 1 nickel requires less electricity and crude oil resources (and thus lower carbon dioxide and other energy-associated emissions) than the cradle-to-gate production of ferronickel with 1 kg Ni content. This result is due primarily to the use of laterite-based ore in the production of ferronickel, extraction of nickel from which is >6 times more energy intensive and >7 times more electricity intensive than from sulphidic ores. The associated carbon dioxide emissions for the production of ferronickel are four times higher than for nickel metal production from sulphidic ores.

3.2 Life cycle impact assessment

3.2.1 PED for the production of class 1 nickel

The total PED for the cradle-to-gate production of 1 kg of class 1 nickel is 147 MJ. This is primarily made up of energy demand from fuels and electricity in the primary extraction and refining steps. These steps account for 60 % of the total energy demand. Figures 2 and 3 show the breakdown of energy demand by unit process and by consumption source, respectively. Where data was not provided by companies in a disaggregated format (i.e. total data provided rather than per unit process), this data was totalled into non-differentiated (ND) data and provided in a separate column shown on the right side of the graphs. In all figures, the credit obtained for the production of sulphuric acid is shown.

Besides the high energy consumption associated with on-site combustion of fuels (shown in the figures as on-site emissions), the energy demand attributed to upstream materials also make up a large proportion of the PED. As seen in Fig. 3, these consumption sources make up a noticeable component of mining, beneficiation, primary extraction and refining. Sulphuric acid, sodium hydroxide and ammonia use make up the bulk of these energy resources. The credit obtained by the production of sulphuric acid in the primary extraction process is also shown. The categories liquid fuels and other energy refer to the upstream production energy demands and impacts of these materials.

3.2.2 GWP for the production of class 1 nickel

The GWP for 1 kg class 1 nickel is 7.64 kg CO2-equivalents. As the GWP is closely related to fuel consumption due to the consumption of fossil fuels, the GWP results (Fig. 4) show the same trend as the PED. On-site emissions contribute the most to the GWP in general owing to fuel combustion.

3.2.3 PED for the production of ferronickel

The total PED for the cradle-to-gate life cycle of 1 kg of ferronickel is 141 MJ. With a nickel content of 29 %, the PED for 1 kg nickel in ferronickel is 485 MJ. This is significantly higher than that of class 1 nickel, owing primarily to the use of laterite ores. Extraction of nickel from laterite ore is more energy intensive than from sulphidic ore. Primary extraction accounts for 70 % of the energy demand.

Figure 7 shows that fuel energy in mining contributes significantly more to the energy demand than that for class 1 nickel (see Fig. 5) due to processing of the laterite ore. Within the ore preparation process, on-site emissions dominate and electricity becomes significant, on average, only in the final primary extraction step (Fig. 6).

3.2.4 GWP for the production of ferronickel

The GWP of 1 kg ferronickel is 8.53 kg CO2-equivalents. For 1 kg nickel in ferronickel, the GWP is 29 kg CO2-equivalents. This is primarily due to electricity consumption during the primary extraction process step. Primary extraction contributes 65 % to the GWP, of which 64 % is attributed to electricity consumption. On-site emissions result from combustion of hard coal and other reductants (see Figs. S5 and S6, Electronic Supplementary Material).

The negative component is attributed to mitigated CO2 emissions resulting from the use of biomass, which substitutes the use of fossil fuel resources, in certain smelting processes. This result also considers the combustion of the biomass—accounted for as on-site emissions. On-site and electricity emissions dominate the GWP. For ore preparation, 75 % of the GWP emissions are a result of on-site emissions.

3.3 Sensitivity analysis

The sensitivity analysis evaluates the impact of a number of (sensitive) variables on the final results. The variables chosen, based on their value to the association and its participants as well as relevance to the context of this update study, are given in the sections below.

3.3.1 Inclusion or exclusion of nickel production routes in the update study

The nickel industry is different from many other metal producers in that nickel can be produced using a large number of different routes and technologies. The production of a given nickel product depends on factors such as the location, technology and ore type used in nickel production, influencing energy demand and thus its environmental profile. Furthermore, since the motivation of this update study was driven by greater participation by member companies, two scenarios were modelled:

-

1.

Addition of a theoretical company with the same environmental profile and production volume as a mix of companies with the lowest PED from the update study

-

2.

Addition of a theoretical company with the same environmental profile and production volume as a mix of companies with the highest PED from the update study

Due to the number of participants, benchmarking of companies—to illustrate the variation in environmental profiles—would compromise the confidentiality of data and results and therefore it was decided to not include this analysis.

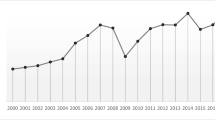

The results of this analysis can be seen in Figs. 7, 8 and 9.

As expected, the PED and GWP increased and decreased by including a theoretical company with the highest and lowest PED, respectively. However, the most significant observation from this analysis was that, although it was expected that all impacts increase with a greater energy demand, acidification potential (AP) decreased. In this case, the theoretical company with the highest PED (resulting from laterite ore production) does not generate sulphur dioxide, instead it consumes sulphuric acid. Therefore, in this case, a lower AP results compared to the baseline. Consequently, the theoretical company with the lowest PED (resulting from sulphidic ore production) generates sulphur dioxide, a gas used to produce sulphuric acid, which is credited by system expansion, reducing the AP (detailed results for AP are shown in Figs. S6 to S10, Electronic Supplementary Material).

3.3.2 Comparison of different allocation methods for class 1 nickel

For the purpose of comparison, the results for class 1 nickel were compared using different allocation methods. The sensitivity of the allocation methods on the results was tested. For the baseline results, a 1.5-year average market value (economic) allocation was used to account for the co-production of platinum group metals.

The following methods of allocation were compared against the baseline:

-

1.

Allocation by market value—15-year average market value (2006–2011)

-

2.

Allocation by mass

Figure 10 shows the results for the different methods of allocation.

Allocation by market value for both 1.5- and 15-year average prices shows a marginal difference since there is little variation in the average cost over the periods considered. Allocation by mass shows a considerably smaller result, with the impact and energy demand being approximately 15 % lower. With mass allocation, all by-products receive the same impact per kilogramme (of that specific product), whilst only considering volume. As a result, since 86 % of the class 1 nickel production volume considered in this update study is extracted from sulphidic ore, the decrease in GWP and PED reflects the lower energy demand associated with this production route. With economic allocation, products and by-products receive a relative burden per kilogramme dependent on higher or lower market value per kilogramme. Allocation by market value takes into account the value as well as the mass of a product.

3.3.3 Effect of receiving an environmental credit for the iron in ferronickel

When calculating the impact for nickel contained within ferronickel, the impact of the iron share was included in the initial result. In the stainless steel industry, ferronickel is a key component in the alloy mix. In recent LCA studies of the stainless steel industry, scrap iron, which is mainly used in (electric arc) furnaces in the stainless steel smelting process, is not provided with a burden in LCA. For this analysis, it is, therefore, assumed to treat the iron contained in the ferronickel, as a replacement for this addition of scrap iron to the furnace during smelting. Thus, the environmental credit associated with the iron in ferronickel is compared to that of iron scrap as opposed to pig iron. To test the impact on results, a credit was given with the value of scrap by using system expansion. In this update study, an average nickel content in ferronickel of 29 % was assumed, meaning that 71 % of the product mass can be attributed to iron. Other elements which can be further used are not contained in ferronickel or only occur in traces.

Table 3 compares the result of system expansion for iron contained in ferronickel with the baseline result.

A reduction of 12.6 % for the GWP is seen when considering an environmental credit for the iron contained in ferronickel. This means that, per kilogramme of nickel contained in ferronickel, the GWP could be reduced from 29 kg CO2-equivalents to 26 kg CO2-equivalents.

4 Conclusions

In conclusion, through the results of this update study, the member companies of the Nickel Institute have provided high-quality life cycle assessment data covering nickel and ferronickel production from mine to refinery gate, with good market and regional coverage, which identifies the major areas within the production of nickel and ferronickel that contribute to PED and GWP. These results are summarised in Tables 4 and 5.

Individual sites of class 1 nickel production often showed very different environmental impacts than the average, as the average consists of a range of pyrometallurgical sulphidic, pyrometallurgical oxidic and hydrometallurgical oxidic routes. All ferronickel in this update study is produced through the pyrometallurgical processing of oxidic ore. Each ferronickel-producing site therefore showed a similar trend in environmental impacts to the weighted average result. The majority (86 %) of class 1 nickel considered in this update study was produced from the less energy-intensive pyrometallurgical sulphidic route. The processing of oxidic ore has a significantly higher energy demand than sulphidic ore which is reflected in the impacts attributed to 1 kg nickel in ferronickel compared to class 1 nickel (e.g. three times higher GWP).

The primary extraction process plus the refining process contributes between 57 and 70 % of environmental impact to the categories considered here (i.e. GWP and PED). The main contributors are the on-site combustion of fuels (hard coal and light fuel oil mainly) as well as electricity consumed from power grids in the respective countries considered.

Two of the sensitivity analyses investigated in the update study also showed the significance of technology/production route on results, whilst an outcome of an analysis to credit the iron in ferronickel showed a possible benefit. The iron share in ferronickel was assumed to replace the iron scrap, used in the electric arc furnaces for stainless steel production, and therefore a credit with the value of scrap was given to determine the impact on results. A reduction of about 12.6 % in the GWP could be achieved for the primary production of ferronickel.

The LCA update study considering data for 2011 showed a higher data representativeness than that published in 1999. In addition, this was the first study to include the largest nickel-producing nation, Russia, whilst the methodology used was consistent with the latest and agreed LCA developments for the base metal industry (e.g. the application of an economic allocation). The update study covered all general nickel production routes for the two products analysed and was representative of around 52 % of the world production volume of class 1 nickel and 40 % of ferronickel production. Conformant to relevant ISO standards, and backed-up with a technical and critical review, the LCA provided a sound background dataset for downstream users of nickel to use in further studies to provide a more comprehensive understanding (e.g. use and recycling phases) of the nickel life cycle. The procedure applied to ensure the completeness of the update study, to analyse the sensitivity of key aspects as well as to check the consistency in data and results was in line with the goal and scope. The Nickel Institute’s future endeavours include plans to update their data in the coming years to reflect upon changes in technology, energy efficiency and raw material input and also to compare it with production of other nickel products (e.g. nickel pig iron).

References

EN ISO 14040:2009-11 (2009) Environmental management–life cycle assessment–principles and framework

EN ISO 14044:2006-10 (2006) Environmental management–life cycle assessment–requirements and guidelines

European Commission (2010) Joint Research Centre, Institute for Environment and Sustainability: International Reference Life Cycle Data System (ILCD) Handbook. Specific guide for life cycle inventory data sets. First edition March 2010. EUR 24709 EN. Luxembourg. Publications Office of the European Union

GaBi 6 (2012) GaBi 6 dataset documentation for the software-system and databases, LBP, University of Stuttgart and thinkstep AG, Leinfelden-Echterdingen; 2012 (http://documentation.gabi-software.com/)

International Energy Agency (IEA) (2013) World energy statistics; Paris, France; 2013

International Nickel Study Group (2016) World nickel statistics, vol. XXV, No.1 January 2016, ISSN 1022-2561

Middleton J (2014) Review of nickel life cycle data provision by participating nickel producing companies. Internal report for the Nickel Institute

Mistry M, Wong S, Koffler C (2016) LCA and LCC of the world’s longest pier: a case study on nickel containing stainless steel rebar. Int J Life Cycle Assess

Mudd GM, Jowitt SM (2014) A detailed assessment of global nickel resource trends and endowments. Econ Geol 109:1813–1841

Nickel Institute and Ecobalance Inc. (2003) Life cycle assessment of nickel products. Final report for the nickel industry LCA group. Bethesda, MD

Nickel Institute and thinkstep (2014) Life cycle assessment and life cycle costing of the progreso pier. Final report for the nickel industry LCI Task Force. Ottawa, Canada

Reuter MA, von Schaik A, Gediga J (2015) Simulation-based design for resource efficiency of metal production and recycling systems: cases—copper production and recycling, e-waste (LED lamps) and nickel pig iron. Int J Life Cycle Assess 20(5):671–693

Santero N, Hendry J (2016) Harmonization of LCA methodologies for the metal and mining industry. Int J Life Cycle Assess. doi:10.1007/s11367-015-1022-4

SoFi 5 (2012) SoFi corporate software-package, thinkstep AG, Leinfelden-Echterdingen; (http://www.thinkstep.com/software/corporate-sustainability)

Universität Stuttgart and PE International AG (2012) GaBi database & modelling principles, thinkstep AG; (http://gabi-6-lci-documentation.gabi-software.com/xml-data/external_docs/GaBiModellingPrinciples.pdf)

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Chris Bayliss

Electronic supplementary material

Below is the link to the electronic supplementary material.

ESM 1

(DOCX 601 kb)

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Mistry, M., Gediga, J. & Boonzaier, S. Life cycle assessment of nickel products. Int J Life Cycle Assess 21, 1559–1572 (2016). https://doi.org/10.1007/s11367-016-1085-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11367-016-1085-x