Abstract

Individuals tend to self-report higher well-being levels on certain days of the week than they do on the remaining days, controlling for observables. Using the 2008 release of the British Household Panel Survey, we test whether this empirical observation suffers from selection bias. In other words, we examine if subjective well-being is correlated with unobserved characteristics that lead the individuals to take the interview on specific days of the week. We focus on two distinct well-being measures: job satisfaction and happiness. We provide convincing evidence for both of these measures that the interviews are not randomly distributed across the days of the week. In other words, individuals with certain unobserved characteristics tend to take the interviews selectively. We conclude that a considerable part of the day-of-the-week patterns can be explained by a standard “non-random sorting on unobservables” argument rather than “mood fluctuations”. This means that the day-of-the-week estimates reported in the literature are likely to be biased and should be treated cautiously.

Similar content being viewed by others

Notes

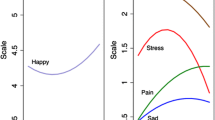

Specifically, Taylor (2006) uses the BHPS data and documents that those who are interviewed on Fridays report higher levels of job satisfaction and lower levels of mental stress than those interviewed in the middle of the week. Akay and Martinsson (2009) test the same hypothesis using the German Socio-Economic Panel (GSOEP) data and the result yields a “blue” Sunday. Helliwell and Wang (2011) utilize the Gallup/Healthways U.S. daily poll to examine the differences in the dynamics of two key measures of subjective well-being: emotions and life evaluation. They find no day-of-the-week effect for life evaluations, but significantly more happiness, enjoyment, and laughter; while significantly less worry, sadness, and anger on weekend than on weekdays. Earlier studies on this topic include Rossi and Rossi (1977), Stone et al. (1985), Kennedy-Moore et al. (1992), and Egloff et al. (1995). See Csikszentmihalyi and Hunter (2003) and Pettengill (2003) for literature surveys.

That individual-level well-being significantly varies across the days of the week is an extreme version of short-term state dependency.

See Pollak (2003).

See Heckman (1979) for the original paper.

Table 1 presents the basic summary statistics for these variables as well as the outcome variables.

Conscientiousness is one of the big-five personality traits that constitute an individual’s non-cognitive skills. See Borghans et al. (2008) for an extensive description of these concepts.

See, for example, Blanchflower and Oswald (2008) for similar findings for happiness.

See also Heckman and Honore (1990).

Remember that in our case D = 1 refers to taking the interview on a Friday or Saturday versus the remaining days for the job satisfaction analysis and on a Sunday or Monday versus the remaining days for the happiness analysis.

References

Akay, A., & Martinsson, P. (2009). Sundays are blue: Aren’t they? The day-of-the-week effect on subjective well-being and socio-economic status. IZA Discussion Paper No. 4563.

Argyle, M. (2001). The psychology of happiness. London: Routledge.

Becker, G. S. (1976). The economic approach to human behavior. Chicago, IL: University of Chicago Press.

Blanchflower, D., & Oswald, A. J. (2008). Is well-being U-shaped over the life cycle? Social Science and Medicine, 66, 1733–1749.

Borghans, L., Duckworth, L. A., Heckman, J. J., & ter Weel, B. (2008). The economics and psychology of personality traits. Journal of Human Resources, 43, 972–1059.

Clark, A. E., Frijters, P., & Shields, M. (2008). Relative income, happiness, and utility: An explanation for the Easterlin paradox and other puzzles. Journal of Economic Literature, 46, 95–144.

Clark, A. E., & Oswald, A. J. (1996). Satisfaction and comparison income. Journal of Public Economics, 61, 359–381.

Clark, A. E., Oswald, A. J., & Warr, P. (1996). Is job satisfaction U-shaped in age? Journal of Occupational and Organizational Psychology, 69, 57–81.

Croft, G. P., & Walker, A. E. (2001). Are the Monday blues Ail in the mind? The role of expectancy in the subjective experience of mood. Journal of Applied Social Psychology, 31, 1133–1145.

Csikszentmihalyi, M., & Hunter, J. (2003). Happiness in everyday life: The uses of experience sampling. Journal of Happiness Studies, 4, 185–199.

Easterlin, R. A. (1974). Does economic growth improve the human lot? In: P. A. David, M. W. Reder (Eds.), Nations and households in economic growth: Essays in honor of Moses Abramovitz. New York, NY: Academic Press.

Easterlin, R. A. (1995). Will raising the incomes of all increase the happiness of all? Journal of Economic Behavior and Organization, 27, 35–48.

Easterlin, R. A. (2001). Income and happiness: Towards a unified theory. Economic Journal, 111, 465–484.

Egloff, B., Tausch, A., Kohlmann, C., & Krohne, H. (1995). Relationships between time of day, day of the week, and positive mood: Exploring the role of the mood measure. Motivation and Emotion, 19, 99–110.

Frey, B. S., & Stutzer A. (2002). What can economists learn from happiness research? Journal of Economic Literature, 40, 402–435.

Goldberg, D. P. (1972). The detection of psychiatric illness by questionnaire. Oxford: Oxford University Press.

Goldberg, D. P. (1978). Manual of the General Health Questionnaire. Windsor: NFER.

Goldberg, D. P., & Williams, P. (1988). A user’s guide to the General Health Questionnaire. Windsor: NFER.

Heckman, J. J. (1979). Sample selection bias as a specification error. Econometrica, 47, 153–161.

Heckman, J. J., Honore B. E. (1990). The empirical content of the Roy model. Econometrica, 58, 1121–1149.

Heckman, J. J., & Robb R. (1985). Alternative methods for evaluating the impact of interventions: An overview. Journal of Econometrics, 30, 239–267.

Heckman, J. J., & Vytlacil E. J. (2007). Econometric evaluation of social programs, part I: Causal models, structural models, and econometric policy evaluation. In: J. J. Heckman & E. E. Leamer (Eds.), Handbook of econometrics, vol. 6, chap. 70 (pp. 4779–4874). New York, NY: Elsevier.

Heckman, J. J., & Vytlacil E. J. (2007). Econometric evaluation of social programs, part II: Using the marginal treatment effect to organize alternative econometric estimators to evaluate social programs, and to forecast their effects in new environments. In: J. J. Heckman & E. E. Leamer (Eds.), Handbook of econometrics, vol. 6, chap. 71 (pp. 4875–5143). New York, NY: Elsevier.

Helliwell, J. F., & Wang, S. (2011). Weekends and subjective well-being. NBER Working Paper No. 17180.

Hu, Y. J., Stewart-Brown, S., Twigg, L., & Weich, S. (2007). Can the 12-item General Health Questionnaire be used to measure positive mental health? Psychological Medicine, 37, 1005–1013.

Kahneman, D., Diener, E., & Schwarz, N. (1999). Well-being: The foundation of hedonic psychology. New York, NY: Russell Sage Foundation.

Kennedy-Moore, E., Greenberg, M. A., Newman, M. G., & Stone, A. A. (1992). The relationship between daily events and mood: The mood measure may matter. Motivation and Emotion, 162, 143–155.

Larsen, R. J., & Kasimatis M. (1990). Individual differences in entrainment of mood to the weekly calendar. Journal of Personality and Social Psychology, 58, 164–171.

Larsen, R. J., & Kasimatis M. (1991). Day-to-day physical symptoms: Individual differences in the occurrence, duration, and emotional concomitants of minor daily illnesses. Journal of Personality, 59, 387–423.

Leung, S. F., & Yu, S. (1996). On the choice between sample selection and two-part models. Journal of Econometrics, 72, 197–229.

Little, R. J. A., & Rubin, D. B. (1987). Statistical analysis with missing data. New York, NY: Wiley.

Manning, G. M., Duan, N., & Rogers, W. H. (1987). Monte Carlo evidence on the choice between sample selection and two-part models. Journal of Econometrics, 35, 59–82.

McCabe, C. J., Thomas, K. J., Brazier, J. E., & Coleman, P. (1996). Measuring the mental health status of a population: A comparison of the GHQ-12 and the SF-36. British Journal of Psychiatry, 169, 516–521.

Pettengill, G. N. (2003). A survey of the monday effect literature. Quarterly Journal of Business and Economics, 42, 3–27.

Pollak, R. A. (2003). Gary Becker’s contributions to family and household economics. Review of Economics of the Household, 1, 111–141.

Rose, M. (1999). Explaining and forecasting job satisfaction: The contribution of occupational profiling. University of Bath (Unpublished manuscript).

Rossi, A. S., & Rossi, P. E. (1977). Body time and social time: Mood patterns by menstrual cycle phase and day of week. Social Science Research, 6, 273–308.

Roy, A. D. (1951). Some thoughts on the distribution of earnings. Oxford Economic Papers, 3, 135–146.

Stone, A. A., Hedges, S. M., Neale, J. M., & Satin, S. (1985). Prospective and cross-sectional mood reports offer no evidence of a “Blue Monday” phenomenon. Journal of Personality and Social Psychology, 1, 129–134.

Taylor, M. P. (2006). Tell me why I don’t like Mondays: Investigating day of the week effects on job satisfaction and psychological well-being. Journal of the Royal Statistical Society (Series A), 169, 127–142.

Tumen, S., & Zeydanli, T. (2012). Is happiness contagious? Separating spillover externalities from the group-level social context. Paris School of Economics (Unpublished manuscript).

Tumen, S., & Zeydanli, T. (2012). Social interactions in job satisfaction. Paris School of Economics (Unpublished manuscript).

Acknowledgments

We thank Andrew Clark, Laszlo Goerke, Alex Michalos (the editor), Claudia Senik, four anonymous referees, and the participants of the EDEEM Jamboree 2013 Meeting (CORE) in Louvain-la-Neuve for very helpful comments and insightful suggestions. Tugba Zeydanli gratefully acknowledges financial support from the European Doctorate in Economics—Erasmus Mundus. The views expressed here are of our own and do not necessarily reflect those of the Central Bank of the Republic of Turkey.

Author information

Authors and Affiliations

Corresponding author

Technical Appendix

Technical Appendix

1.1 The Random Utility Model

The econometric framework we use is a standard random-utility specification in combination with a version of the two-sector Roy model (Roy 1951).Footnote 9 Suppose that the survey respondents can choose whether to take the survey on certain days of the week (D = 1) versus the remaining days (D = 0). For our job satisfaction analysis, D = 1 refers to taking the survey on a Friday or Saturday and D = 0 refers to taking it on the remaining days of the week. Similarly, for happiness, D = 1 refers to taking the survey on a Sunday or Monday and D = 0 refers to taking it on the remaining days of the week. For simplicity, we mention throughout this section only D = 1 or D = 0 without a further reference to the days associated with these choices.

The equations motivating the individuals’ choice of D = 1 versus D = 0 can be written as follows:

where Z is a row-vector of observed covariates. This is the standard additive random-utility specification, where \({\varvec{\alpha}}_0^{\prime}\) and \({\varvec{\alpha}}_1^{\prime}\) are the deterministic components, and ν 0 and ν 1 are the random components.

To rationalize the choice of D, we assume an index function

which can be rewritten, after plugging in the random utility equations, as

where \({\varvec{\gamma}} = \varvec{\alpha}_1 - \varvec{\alpha}_0\) and η = ν 1 − ν 0. The key consideration is that the econometrician observes the subjective (or self-reported) well-being response Y 1 if I ≥ 0 and he observes Y 0 if I < 0. The intuition is as follows. For a moment, let’s consider the job satisfaction example. The interviewee takes the interview on a Friday or Saturday (D = 1) rather than the other days if she receives higher utility from doing so. This higher utility (i.e., U 1 > U 0) is translated into the expression I ≥ 0 and, accordingly, Y 1 is observed. The utilities are not observed; but, what the econometrician observes are a choice and an associated well-being outcome. The observed subjective well-being outcome, in this setup, is

which means that Y = Y 0 if D = 0 and Y = Y 1 if D = 1. Y 1 is observed when U 1 ≥ U 0 and Y 0 is observed otherwise. The main lesson that this formulation communicates is the following. The day of the week on which the interviewee takes the interview is a matter of choice. There are both observed and unobserved factors that may be affecting this choice. Accounting for unobservables may change the results reported in the literature. This formulation aims at explicitly controlling for unobserved determinants of the day of the week.

To map this formulation to data, we formulate two outcome equations:

where X is a row-vector of observed covariates. We assume that \((\varvec{X},\varvec{Z}) \perp\!\!\!\perp (\eta,\epsilon_{1},\epsilon_{0})\), where \(\perp\!\!\!\perp\) denotes statistical independence. We also assume that the error terms are jointly normally distributed as \((\eta,\epsilon_{1},\epsilon_{0}) \sim \mathcal{N}(\varvec{0},\varvec{\Upsigma})\), where \(\varvec{\Upsigma}\) is the covariance matrix and can be written as

Note that from \(\eta = \epsilon_1 - \epsilon_0\), it is easy to show that σ η η = σ 11 + σ 00 − 2σ 10, σ η1 = σ 11 − σ 10, and σ η0 = σ 10 − σ 00.

As we explain above, \(D = {\bf 1}\!\hbox{l}(I \geq 0)\), where \({\bf 1}\!\hbox{l}\) stands for an indicator function. From data on Y, D, and (X, Z), the following quantities can be obtained:

One key issue is the distinction between Z and X. For identification purposes, we assume that these two data vectors overlap except one extra variable in Z; that is, dim(Z) = dim(X) + 1, where the notation “dim” describes the dimension of a data vector. In other words, we need an extra variable that affects the choice of the agent, but does not affect the outcome of interest. This is known in the literature as an “exclusion restriction” (or an instrument) that secures identification in selection-correction models.

1.2 Selection Correction

We start with the following Probit regression, which is the typical first step in a selection-correction procedure:

This probit equation identifies \({\varvec{\gamma}}/\sigma_{\eta}\), where \(\sigma_{\eta} = \sqrt{\sigma_{\eta \eta}}.\) Now we consider the regression equations related to the two outcome equations. The first outcome equation gives

and the second outcome equation gives

where \(\lambda(\cdot)\) is the inverse Mills ratio and, as a general rule, \(\lambda(c)=\phi(c)/\Upphi(-c)\).

From the probit regression in (9), we already know the parameter \({\varvec{\gamma}}/\sigma_{\eta}\). Therefore, we can form \(\lambda\left(-\frac{\varvec{z} {\varvec{\gamma}}^{\prime}}{\sigma_{\eta}}\right)\) and \(\lambda\left(\frac{\varvec{z} {\varvec{\gamma}}^{\prime}}{\sigma_{\eta}}\right)\). Equations (10) and (11) suggest that we can run regressions of Y 1 on X and \(\lambda\left(-\frac{\varvec{z} {\varvec{\gamma}}^{\prime}}{\sigma_{\eta}}\right)\), and of Y 0 on X and \(\lambda\left(\frac{\varvec{z} {\varvec{\gamma}}^{\prime}}{\sigma_{\eta}}\right)\) to identify \({\varvec{\beta}}_0, {\varvec{\beta}}_1, \sigma_{\eta 0}/\sigma_{\eta}\), and σ η1/σ η . Footnote 10

1.3 Treatment Effects

In our context, “treatment” refers to taking the interview on a Friday or Saturday for job satisfaction analysis and Sunday or Monday for happiness analysis (i.e., D = 1). Obtaining the treatment effect estimates would be useful for our analysis, since it will enhance our understanding of the existence, extent, and the sources of the selection structure. Calculation of the treatment effects is simple and straightforward after obtaining the bias corrected estimates. The most commonly sought treatment effect parameter is the ATE. It can simply be formulated as

This can be interpreted as the effect of randomly assigning D = 1 to everyone with X = x. The main problem with this parameter is analogous to the central question that we address in this paper; that is, it may not reflect a true causal effect of D = 1 versus D = 0 on the subjects, because the ones who choose D = 1 maybe systematically different from the ones who choose D = 0. Footnote 11 This difference leads the evaluation of the outcome at the counterfactual states to be biased.

The other two treatment effect parameters that we calculate in this study are the TT and the TUT. These parameters can nicely be formulated as a function of the control functions estimated during the implementation of the selection-correction procedure (see Heckman and Vytlacil 2007a, b for details). The parameter TT can be formulated as

while TUT can be formulated as

where \(p_{\varvec{z}}\) refers to the propensity score estimated in the first stage probit regression. The average TT is the average gain for those who sort into treatment compared to what the average person would gain. It oversamples the unobserved characteristics that lead to selectivity for those individuals who are more likely to choose D = 1. In other words, it calculates the net effect between those who actually participate and those who do not, as if they had given the chance to revert their choice of D = 0 into D = 1. A symmetric definition can be provided for TUT: it oversamples the unobserved characteristics that lead to selectivity for those individuals who are less likely to choose D = 1.

For the purposes of this paper, we are interested in the “averages” of these three treatment effect parameters. In other words, the estimates reported in this paper are the parameter estimates integrated over the entire horizon of x and z in our sample. It is also possible to report the distribution of these treatment effects over the sample space. But, we report only the means to keep the paper as compact as possible.

Notice that when the coefficient of the inverse Mills ratio calculated at the second stage is zero, then the TT and TUT collapses into ATE. This is the case with no selectivity. When there is positive sorting into the treatment state (as in our case), on the other hand, the econometrician would find TT > ATE > TUT. Moreover, it is easy to verify that ATE is a weighted average of the TT and TUT. In Sect. 3, we use these formulas and calculate the treatment effect parameters for both the job satisfaction and happiness scores.

Rights and permissions

About this article

Cite this article

Tumen, S., Zeydanli, T. Day-of-the-Week Effects in Subjective Well-Being: Does Selectivity Matter?. Soc Indic Res 119, 139–162 (2014). https://doi.org/10.1007/s11205-013-0477-6

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11205-013-0477-6