Abstract

Mobile sources contribute large percentages of each pollutant, but technology is not yet available to measure and tax emissions from each vehicle. We build a behavioral model of household choices about vehicles and miles traveled. The ideal-but-unavailable emissions tax would encourage drivers to abate emissions through many behaviors, some of which involve market transactions that can be observed for feasible market incentives (such as a gas tax, subsidy to new cars, or tax by vehicle type). Our model can calculate behavioral effects of each such price and thus calculate car choices, miles, and emissions. A nested logit structure is used to model discrete choices among different vehicle bundles. We also consider continuous choices of miles driven and the age of each vehicle. We propose a consistent estimation method for both discrete and continuous demands in one step, to capture the interactive effects of simultaneous decisions. Results are compared with those of the traditional sequential estimation procedure.

Similar content being viewed by others

Notes

Heeb et al. (2003) find that cold start emissions rates (in g/km traveled) exceed stabilized emissions rates by a factor of two to five, depending on the pollutant. Sierra Research (1994) finds that a car driven aggressively has carbon monoxide emissions that are almost 20 times higher than when driven normally.

See Sierra Research (1994). Remote sensing in Texas (http://www.tnrcc.state.tx.us/air/ms/vim.html#im3) and Albuquerque NM (http://www.cabq.gov/aircare/rst.html) is used in 2005 to identify polluting vehicles.

See http://www.bts.gov/publications/transportation_statistics_annual_report/2004/. We focus on local pollutants, where emission rates depend on car characteristics. In contrast, CO\(_{2}\) is linked directly to gas use.

In the U.S., new cars face emission standards of .254 g/km of HC’s, 2.11 g/km of CO, and .248 g/km of NO\(_{x}\). Light trucks face a variety of weaker standards, but all are scheduled to become more stringent. These figures pertain to a test in the U.S. with a cold start-up phase, a transient phase at different speeds, and a hot start phase, for a total distance of 18 km at an average speed of 34 km/h.

For example, the U.S. Environmental Protection Agency (U.S. Environmental Protection Agency 1998, p.3–68) discusses the use of EPA’s MOBILE5a model or California’s EMFAC7F model.

With a higher price of gas, some households might drive fewer miles in their SUV and more in their car. We do not estimate separately the miles in each vehicle, but we do estimate a change for the (Car, SUV) bundle that can differ from the (Car, Car) bundle. Other papers have estimated substitution between vehicles within the family, but they treat the vehicles as given rather than chosen. Greene and Hu (1985) find that this kind of substitution occurs to a large extent in some households, while Sevigny (1998) finds small effects.

Our household responses represent market outcomes only if supply curves were horizontal. The simulation of a change in the price of getting a car that is one year newer can be interpreted as a new local tax or subsidy in a small open jurisdiction that can import more of those newer cars at a constant price. However, our demand system could be combined with some other estimates of supply to calculate equilibrium outcomes.

Older vehicles have higher emissions both because older vintages were produced to weaker standards and because pollution control equipment deteriorates with age. Panel data would be required to distinguish these.

Fullerton and West (2010) also simulate effects of incentives in a model of heterogeneous households’ continuous choices of car size, car age, and VMT, but they use calibrated rather than estimated parameters. That model avoids discrete choices, but it considers only one car per agent. In our model, we estimate discrete choices to consider the household’s number of vehicles.

Time variation in gasoline prices may cause time variation in used vehicle prices. Our use of cross-section data helps avoid this problem.

Our model provides estimates of \(\beta \) and \(\beta _{1}\), and these can be used to calculate (\(\delta +\rho )\), but we do not provide separate estimates of \(\delta \) and \(\rho \). Some of our steps below require an assumption about \(\delta \), and we use 20 % for this purpose. Estimates of the depreciation rate for automobiles range from 33 % (Jorgenson 1996) or 30 % (Hulten and Wykoff 1996) to 15 %, the rate implicit in the vehicle depreciation schedule currently used by the Bureau of Economic Analysis. We use 20 % because it falls between these bounds.

More general demand functions such as translog demand or the almost ideal demand system imply much more complicated indirect utility functions that could not be estimated. Also, note that no-vehicle households have zero marginal prices, so they have constant miles traveled (conditioned on observed socio-demographic variables and total income). Thus, no continuous demand equations are needed for these households.

Thus, a change in \(p_{i}\) must have the same effect on Wear that it has on miles. We tried other models, including one where indirect utility has separate terms exp(\(\alpha ^{i}_{p}p_{i}\)) and exp(\(\alpha _{q}q_{i}\)), so that \(p_{i}\) would have no effect on Wear, and \(q_{i}\) would have no effect on VMT. That model would not converge, and anyway it is restrictive by assuming no cross-price effects. We also tried models with more coefficients, to relax these restrictions, and we tried many starting points, but only the model in (4) and (5a, 5b) could be estimated simultaneously for discrete and continuous choices (especially for two-vehicle bundles considered below).

Another interesting question is about each household member’s choice of miles driven (in either car), but we have no such data. As described below, we have only data on miles driven in each vehicle.

Dubin and McFadden (1984) assume \(\eta \) has a particular form of mean and variance, in order to derive an explicit conditional expectation.

This search yields \(\xi \) equal to 0.65. Since the estimation of the logit model requires integration over the individual heterogeneity term \(\eta \), our model is a mixed logit model (McFadden and Train 2000).

The CEX data are collected by the Bureau of Labor Statistics of the U.S. Department of Labor through quarterly interviews of selected households throughout the U.S. Each household is interviewed over five consecutive quarters. Each quarter, 20 % of households complete their last interview and are replaced by new households. For CEX data, see http://elsa.berkeley.edu or http://www.icpsr.umich.edu/.

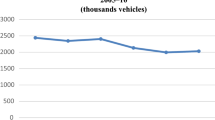

In the CEX of 1996–2000, 18.4 % of households own more than two vehicles. Some of these households may be wealthy or may include teenagers with their own vehicle, so selection bias is a potential problem. But a two-person household with a third car may not drive it very much. Also, some households may have a third vehicle for business, whereas our model of household choice assumes utility maximization.

Some estimates in Table 8 Appendix have large standard errors, implying large confidence intervals, but these are the best estimates possible, given data availability.

For MPG of new cars, http://www.fueleconomy.gov/feg/index.htm is a website of the US Environmental Protection Agency (EPA) and the Department of Energy. The EPA also provides the historical fuel economy of new vehicles at http://www.epa.gov/otaq/mpg.htm or at http://www.epa.gov/otaq/tcldata.htm.

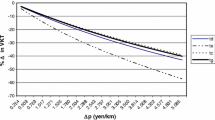

For vehicles in our sample, the calculated EPM is 1.89 g/mile for the average car and 3.56 for the average SUV. It also increases to 6.94 g/mile for a very old vehicle (with Wear \(=\)1).

If the difference in odometer readings is positive for both vehicles, then we divide it by MPG to obtain an estimate of each vehicle’s gas consumption. Each gasoline amount divided by their sum gives shares, used to allocate the observed total gas consumption. Each vehicle’s gallons divided by MPG yields VMT. If the difference in odometer readings is positive only for one vehicle, we use this figure as \(\textit{VMT}_{1}\) and calculate gasoline used in this vehicle. Then total gasoline minus gas used in this vehicle is residual gas, allocated to the other vehicle. Dividing this residual gas by MPG yields \(\textit{VMT}_{2}\). If the difference in odometer readings is positive for neither vehicle, then we do imputations based on households with similar characteristics.

If \(\lambda _{n} \quad \forall n\) are within the range of zero to one, then “the model is consistent with utility maximization for all possible values of the explanatory variables” (Train 2003, p.85). Since our \(\lambda \) are significantly less than one, the errors within each nest are correlated, evidence in favor of nesting rather than MNL.

The standard deviation for x’ \(\gamma \) is about 0.086 within a bundle, and for \(\beta \)y is about 0.78 within a bundle, so the finding that \(\eta \) has a range (\(-\)0.65,0.65) reflects a significant amount of individual heterogeneity. Therefore, introducing individual heterogeneity is expected to make a difference in parameter estimates.

This reasoning is confirmed by the choice elasticities with respect to \(p_{1}\) and \(p_{2}\) separately. For bundle 4, a 1 % higher price per mile in the car reduces the probability of choosing that bundle by 0.37 %, while a 1 % higher price per mile in the SUV (\(p_{2})\) reduces the probability of choosing that bundle by 0.81 %. Thus, the gas consumption of the SUV has twice as much impact as that of the car.

Panel data would be required to distinguish the effects of lags from contemporaneous price changes.

In Table 3, the average Wear of 0.75 corresponds to 6.2 years of age, so a 1.2 % decrease in Wear means a decrease of about one month of age. In the sequential model, the same 10 % lower \(q\) affects desired age of one-vehicle bundles by one-tenth as much, and desired ages of two-vehicle bundles by three times as much.

The specific form for utility in Eq. (4) means a specific form for demands in Eq. (5a, 5b), where ln(VMT) and ln(Wear) both depend on \(\alpha ^{i}_{p}p_{i} -- \alpha _{q}q_{i}\). In other words, the parameter that determines the important effect of gas price on miles (\(\alpha ^{i}_{p}\)) also necessarily drives the less-important effect of the gas price on choice of Wear. Similarly, the own-price effect of \(q\) on Wear also drives the cross-price effect of \(q\) on VMT. We note this fact, but we do not mean to emphasize these cross-price elasticities.

These are also short run elasticities, with no change in the number or type of vehicles. Notice that the percentage change in emissions from a change in \(p\) is more than twice the change in driving distance, because the higher \(p\) also reduces demand for Wear (which also reduces emissions). The change in \(q\) also affects both VMT and Wear in the same direction, enlarging the effect on emissions.

References

Bento, A., Goulder, L., Jacobsen, M., & Von-Haefen, R. (2009). Distributional and efficiency impacts of increased U.S. gasoline taxes. American Economic Review, 99(3), 667–699.

Bhat, C. R. (2005). A multiple discrete-continuous extreme value model: formulation and application to discretionary time-use decisions. Transportation Research: Part B: Methodological, 39(8), 679–707.

Bhat, C. R., Sudeshna, S., & Naveen, E. (January 2009). The impact of demographics, built environment attributes, vehicle characteristics, and gasoline prices on household vehicle holdings and use. Transportation Research: Part B: Methodological, 43(1), 1–18.

Brownstone, D., & Train, K. (1999). Forecasting new product penetration with flexible substitution patterns. Journal of Econometrics, 89, 109–129.

Brownstone, D., Bunch, D. S., Golob, T. F., & Ren, W. (1996). A vehicle transactions choice model for use in forecasting demand for alternative-fuel vehicles. Research in Transportation Economics, 4, 87–129.

California Air Resources Board. (1997). Test report of the light-duty vehicle surveillance program, Series 13, Project Number 2S95C1.

California Air Resources Board. (March 2000). Report of the results of the vehicle surveillance program 14, Project Number 2S97C1.

Dubin, Jeffrey, & McFadden, Daniel. (1984). An Econometric Analysis of Residential Electric Appliance Holdings and Consumption. Econometrica, 52(2), 345–62.

Eskeland, G., & Devarajan, S. (1996). Taxing bads by taxing goods: Pollution control with presumptive charges. Washington, DC: The World Bank.

Fullerton D., & West S. (2010) Tax and Subsidy Combinations for the Control of Car Pollution. The BE Journal of Economic Analysis & Policy (Advances) 10:1

Fullerton, D., & West, S. (2002). Can taxes on vehicles and on gasoline mimic an unavailable tax on emissions? Journal of Environmental Economics and Management, 43, 135–157.

Goldberg, P. (1998). The regulation of fuel economy and the demand for ‘light trucks’. Journal of Industrial Economics, 46(1), 1–33.

Greene, D. L., & Hu, P. (1985). The influence of the price of gasoline on vehicle use in multi-vehicle households. Transportation Research Record, 988, 19–24.

Hanemann, W. M. (1984). Discrete/continuous models of consumer demand. Econometrica, 52(3), 54–62.

Harrington, W., & McConnell, V. (2003). Motor vehicles and the environment. In H. Folmer & T. Tietenberg (Eds.), The international yearbook of environmental and resource economics 2003/2004. Northampton, MA: Edward Elgar.

Hausman, J. A. (1981). Exact consumer’s surplus and deadweight loss. American Economic Review, 71(4), 662–676.

Heeb, N., Forss, A.-M., Saxer, C., & Wilhelm, P. (2003). Methane, benzene and alkyl benzene cold start emission data of gasoline-driven passenger cars representing the vehicle technology of the last two decades. Atmospheric Environment, 37, 5185–5195.

Hulten, C. R., & Wykoff, F. C. (1996). Issues in the measurement of economic depreciation. Economic Inquiry, 34, 10–23.

Innes, R. (1996). Regulating automobile pollution under certainty, competition, and imperfect information. Journal of Environmental Economics and Management, 31, 219–239.

Jorgenson, D. W. (1996). Empirical studies of depreciation. Economic Inquiry, 34, 24–42.

Kohn, R. E. (1996). An additive tax and subsidy for controlling automobile pollution. Applied Economics Letters, 3, 459–462.

Mannering, F., & Clifford, W. (1985). A dynamic empirical analysis of household vehicle ownership and utilization. Rand Journal of Economics, 16(2), 215–236.

McFadden Daniel. (1979) Quantitative Methods for Analyzing Travel Behavior of Individuals Some Recent Developments. In: Hensher David., Stopher P. (ed) Behavioral Travel Modeling. Croom Heml, London, 279–318.

McFadden, D. (2001). Disaggregate behavioural travel demand’s RUM side: A 30-year retrospective. In Hensher (Ed.), Travel behavior research: The leading edge. London: Pergamon.

McFadden, D., & Train, K. (2000). Mixed MNL models for discrete response. Journal of Applied Econometrics, 15(5), 447–470.

Newell, R. G., & Stavins, R. N. (2003). Cost heterogeneity and the potential savings from market-based policies. Journal of Regulatory Economics, 23(1), 43–59.

Parry, I. W. H., Walls, M., & Harrington, W. (2007). Automobile externalities and policies. Journal of Economic Literature, 45, 374–400.

Pigou, A. C. (1920). The economics of welfare. London: MacMillan.

Plaut, P. (1998). The comparison and ranking of policies for abating mobile-source emissions. Transportation Research D, 3, 193–205.

Sevigny, M. (1998). Taxing automobile emissions for pollution control. Cheltenham, UK: Edward Elgar.

Sierra Research. (1994). “Analysis of the Effectiveness and Cost-Effectiveness of Remote Sensing Devices”. Report SR94-05-05, prepared for the U.S. Environmental Protection Agency, Sacramento, CA: Sierra Research.

Train, K. (1986). Qualitative choice analysis: Theory, econometrics, and an application to automobile demand. Cambridge, MA: MIT.

Train, K. (2003). Discrete choice methods with simulation. Cambridge, UK: Cambridge University Press.

Train, K., Davis, W. B., & Levine, M. D. (1997). Fees and rebates on new vehicles: Impacts on fuel efficiency, carbon dioxide emissions, and consumer surplus. Transportation Research E, 33, 1–13.

U.S. Environmental Protection Agency. (1998). Technical Methods for Analyzing Pricing Measures to Reduce Transportation Emissions. DC: Washington.

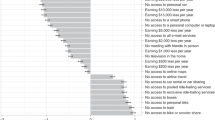

West, S. (2004). Distributional effects of alternative vehicle pollution control policies. Journal of Public Economics, 88(3–4), 735–757.

Acknowledgments

We are grateful for financial support from Japan’s Economic and Social Research Institute (ESRI), and for suggestions from Chunrong Ai, Frank Convery, Stephen Donald, Hilary Sigman, Dan Slesnick, Ken Train, Sarah West, and Cliff Winston. This paper is part of the NBER’s research programs in Public Economics (PE) and Energy and Environmental Economics (EEE). Any opinions expressed are those of the authors and not those of the ESRI or the National Bureau of Economic Research.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Feng, Y., Fullerton, D. & Gan, L. Vehicle choices, miles driven, and pollution policies. J Regul Econ 44, 4–29 (2013). https://doi.org/10.1007/s11149-013-9221-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11149-013-9221-z