Abstract

This paper explores the question of whether the market process is capable of bringing about a spontaneous monetary switch to a new currency in the presence of strong network effects of the incumbent currency as well as the absence of contingencies such as extreme inflation or political instability. It does so by examining current happenings around Bitcoin. It finds that two mechanisms stand out: the coordinating efforts of the profit-maximizing entrepreneur as well as the ability to use the old and the new currency simultaneously. Specifically, it finds that marginal decisions made by rational agents merely seeking to maximize net private benefit irrespective of the network effect, be it entrepreneurs or users of the new currency, are capable of setting in motion a switch to a new currency. Whether or not these mechanisms play out fully in the case of Bitcoin still remains to be seen.

Similar content being viewed by others

Notes

Leibowitz and Margolis (1990, 1994, 1995a & 1995b) as well as Katz & Shapiro are skeptical about the failure of markets in the face of network effects and stress the importance of sponsorship (ownership) and opportunities for privatized gain. Where goods are sponsored, the opportunities for monetary gain will create incentives to move away from the incumbent good towards the better good. Liebowitz and Margolis (1995b, p213) write “Where there is a knowable and feasible improvement from moving onto a better path, those who will benefit from the improvement, and who know it, will be willing to pay to bring the improvement about. Where simple spot market transactions are insufficient to bring these improvements about, institutional or strategic innovation seems a likely response, especially if the improvement is important enough that the innovator is likely to be well paid.”

In another place, he writes: “Solution to Knowledge problem B always calls for entrepreneurial imagination. The externality feature endemic to Knowledge Problem B outside the market context discourages us from having faith in any spontaneous discovery procedure that is patterned after the process of entrepreneurial discovery which drives the market process (p.175: 2002).”

For a review of Kirzner’s work see (Boettke 2014). Boettke argues for the applicability of spontaneous order theorizing to cases outside the market context, to the very institutions that serve as the bedrock of market exchange, contra Kirzner. We follow a similar approach in this paper by exploring the role of entrepreneurship in the spontaneous evolution of a social institution, in our case, in the presence of an incumbent institution.

Upper case “Bitcoin” is typically used to denote the distributed network while lower case “bitcoin” denotes the actual currency.

As of december 31st, 2015. Source: blockchain.info

(Antonopolous, 2014, p. 26) likens the difficulty of verifying a block to a large game of sudoku. He writes “A good way to describe mining is like a giant competitive game of sudoku that resets every time someone finds a solution and whose difficulty automatically adjusts so that it takes approximately 10 min to find a solution. Imagine a giant sudoku puzzle, several thousand rows and columns in size. If I show you a completed puzzle you can verify it quite quickly. However, if the puzzle has a few squares filled and the rest are empty, it takes a lot of work to solve! The difficulty of the sudoku can be adjusted by changing its size (more or fewer rows and columns), but it can still be verified quite easily even if it is very large. The “puzzle” used in bitcoin is based on a cryptographic hash and exhibits similar characteristics: it is asymmetrically hard to solve but easy to verify, and its difficulty can be adjusted.”

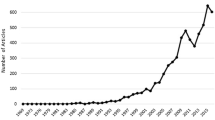

Source: State of Bitcoin Report, http://www.coindesk.com/research/state-of-bitcoin-q3-2015/

References

Antonopoulos, A. M. (2014). Mastering bitcoin. Sebastopol: O’Reilly Media.

Boettke, P. J. (2014). Entrepreneurship, and the entrepreneurial market process: Israel M. Kirzner and the two levels of analysis in spontaneous order studies. The Review of Austrian Economics. doi:10.1007/s11138-014-0252-1.

Cheah, E.-T., & Fry, J. (2015). Speculative bubbles in bitcoin markets? An empirical investigation into the fundamental value of Bitcoin. Economics Letters. doi:10.1016/j.econlet.2015.02.029.

David, P. A. (1985). Clio and the economics of QWERTY. American Economic Review, 75, 332–337.

David, P. A. (1986). Understanding the economics of QWERTY: the necessity of history. In W. N. Parker (Ed.), Economic history and the modern economist. New York: Basil Blackwell.

Dowd, K. (2014). New Private Monies: A Bit-Part Player? (Vol. Vol. 174). London: Hobart Paper.

Dowd, K., & Greenaway, D. (1993). Currency competition, network externalities and switching costs: towards an alternative view of optimum currency areas. The Economic Journal, 103(420), 1180–1189.

Dowd, K., & Hutchinson, M. (2015). Bitcoin will bite the dust. Cato Journal, 35(2), 357–382.

Dwyer, G. P. J. (2015). The economics of bitcoin and similar private digital currencies. Journal of Financial Stability, 17, 81–91. doi:10.1016/j.jfs.2014.11.006.

Hendrickson, J. R., Hogan, T. L., & Luther, W. J. (2016). The political economy of bitcoin. Economic Inquiry, 54(2), 925–939. doi:10.1111/ecin.12291.

Katz, M., & Shapiro, C. (1985). Network externalities, competition, and compatibility. American Economic Review, 75(3), 424–440.

Katz, M., & Shapiro, C. (1994). System competition and network effects. Journal of Economic Perspectives, 8(2), 93–115.

Kirzner, I. M. (1992). The meaning of market process (1996th ed.). New York: Routledge.

Klein, P., & Selgin, G. (2000). Menger’s Theory of Money: Some Experimental Evidence. In J. Smithin (Ed.),What is Money? (pp. 217–34). London: Routledge.

Lewin, Peter. (2001). The market process and the economics of QWERTY: two views. Review of Austrian Economics

Liebowitz, S. J., & Margolis, S. E. (1990). The fable of the keys. Journal of Law and Economics, 33, 1–25.

Liebowitz, S. J., & Margolis, S. E. (1994). Network externality: an uncommon tragedy. Journal of Economic Perspectives, 8, 133–150.

Liebowitz, S. J., & Margolis, S. E. (1995a). Are Network Externalities a New Source of Market Failure? Research in Law and Economics, 17, 1–22.

Liebowitz, S. J., & Margolis, S. E. (1995b). Path dependence, lock-in, and history. Journal of Law, Economics, and Organization, 11, 205–226.

Lo, S., & Wang, C. (2014). Bitcoin as Money? (Vol. No. 14–4). Boston: Current Policy Perspectives.

Luther, W. J. (2015). Cryptocurrencies, network effects, and switching costs. Contemporary Economic Policy

Luther, W. J., & Olson, J. (2015). Bitcoin is memory. Journal of Prices & Markets, 3(3), 22–33.

Menger, C. (1892). On the origins of money. The Economic Journal, 2, 239–255.

Nakamoto, S. (2010). Bitcoin: A Peer-to-Peer Electronic Cash System. www.bitcoin.org.

Selgin, G. A. (2015). Synthetic commodity money. Journal of Financial Stability, 17, 92–99. doi:10.1016/j.jfs.2014.07.002.

Stenkula, M. (2003). Carl Menger and the network theory of money. The European Journal of the History of Economic Thought. doi:10.1080/0967256032000137737.

White, L. H. (2002). Does a superior monetary standard spontaneously emerge? Journal Des Economistes et Des Etudes Humaines, 12(2), 269–281. doi:10.2202/1145-6396.1062.

White, L. H. (2015). The market for cryptocurrencies. Cato Journal, 35(2), 383–402.

Acknowledgements

The authors would like to thank Thomas Hogan, GP Manish and attendees of APEE conference 2014 for helpful comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Nair, M., Cachanosky, N. Bitcoin and entrepreneurship: breaking the network effect. Rev Austrian Econ 30, 263–275 (2017). https://doi.org/10.1007/s11138-016-0348-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11138-016-0348-x