Abstract

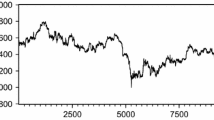

To better characterize the dependence structure of the joint returns distribution, we propose to blend copula functions with Asymmetric GARCH (AGARCH) models, which are allowed for generalized error distribution. We model the copula’s marginals by the AGARCH processes that can differentiate between the impacts of positive and negative shocks on the returns volatility while taking the large kurtosis of the returns into account. An application of the procedure is elaborated on the All Ordinaries Index and its corresponding Share Price Index on future contracts in Australia. The findings reveal that the two spot and future markets show a strong right tail dependence but no left tail dependence. This provides a very useful knowledge for the risk management and hedging in futures markets.

Similar content being viewed by others

References

Bhar, R.: Return and volatility dynamics in the spot and futures markets in Australia: An intervention analysis in a bivariate EGARCH-X framework. J. Futur. Mark. 21(9), 833–850 (2001)

Bhatti, M.I., Nguyen, C.C.: Diversification evidence from international equity markets using extreme values and stochastic copulas. J. Int. Financial Mark. Inst. Money 22, 622–646 (2012)

Brailsford, T.J., Frino, A., Hodgson, A., West, A.: Stock market automation and the transmission of information between spot and futures markets. J. Multinational Financial Manag. 9(3–4), 247–264 (1999)

Chen, X., Fan, Y.: Pseudo-likelihood ratio tests for semiparametric multivariate copula model selection. Can. J. Stat. /La Revue Canadienne de Statistique 33(3), 389–414 (2005)

Dark, J.: Bivariate error correction FIGARCH and FIAPARCH models on the Australian All Ordinaries Index and its SPI futures, Monash Econometrics and Business Statistics Working Papers 4/04. Monash University, Department of Econometrics and Business Statistics (2004)

Ding, Z., Granger, C.W.J., Engle, R.F.: A long memory property of stock market returns and a new model. J. Emp. Finance 1(1), 83–106 (1993)

Fermanian, J.-D.: Goodness-of-fit tests for copulas. J. Multivar. Anal. 95, 119–152 (2005)

Figlewski, S.: Hedging performance and basis risk in stock index futures. J. Finance 39(3), 657–669 (1984)

Figlewski, S.: Hedging with stock index futures: theory and application in a new market. J. Futur. Mark. 5(2), 183–199 (1985)

Frino, A., Walter, T., West, A.: The lead-lag relationship between equities and stock index futures markets around information releases. J. Futur. Mark. 20(5), 467–487 (2000)

Genest, C., Quessy, J.-f., Rémillard, B.: Goodness-of-fit procedures for copula models based on the probability integral transformation. Scand. J. Stat. 33(2), 337–366 (2006)

Glosten, L.R., Jagannathan, R., Runkle, D.E.: On the relation between the expected value and the volatility of the nominal excess return on stocks. J. Finance 48(5), 1779–1801 (1993)

Gulen, H., Mayhew, S.: Stock index futures trading and volatility in international equity markets. J. Futur. Mark. 20(7), 661–685 (2000)

Hodgson, A., Nicholls, D.: The impact of index futures markets on Australian sharemarket volatility. J. Bus. Finance Acc. 18(2), 267–280 (1991)

Joe, H.: Multivariate Models and Dependence Concepts. Chapman and Hall, London (1997)

Joe, H., Xu, J.J.: The Estimation Method of Inference Functions for Margins for Multivariate Models. Department of Statistics, University of British Columbia Technical report (1996)

Ling, S., McAleer, M.: Stationarity and the existence of moments of a family of GARCH processes. J. Econ. 106(1), 109–117 (2002)

Manner, H.: Estimation and model selection of copulas with an application to exchange rates. METEOR, Maastricht Research School of Economics of Technology and Organization, Research memoranda, Maastricht (2007)

Nelson, D.B.: Conditional heteroskedasticity in asset returns: a new approach. Econometrica 59(2), 347–370 (1991)

Nguyen, C., Bhatti, M.I.: Copula model dependency between oil prices and stock markets: evidence from China and Vietnam. J. Int. Financial Mark. Inst. Money 22(4), 758–773 (2012)

Patton, A.J.: Modelling asymmetric exchange rate dependence. Int. Econ. Rev. 47(2), 527–556 (2006)

Seelajaroen, R.: Hedge ratios and hedging effectiveness of the SPI futures contract. Australian National University, Working paper (2000)

Yang, W., Allen, D.E.: Multivariate GARCH hedge ratios and hedging effectiveness in Australian futures markets. Acc. Finance 45(2), 301–321 (2005)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Nguyen, C., Bhatti, M.I. & Hayat, A. Volatility linkages in the spot and futures market in Australia: a copula approach. Qual Quant 48, 2589–2603 (2014). https://doi.org/10.1007/s11135-013-9909-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11135-013-9909-2