Abstract

This paper develops a parametric decomposition framework of labor productivity growth relaxing the assumption of labor-specific efficiency. The decomposition analysis is applied to a sample of 121 developed and developing countries during the 1970–2007 period drawn from the recently updated Penn World Tables and Barro and Lee (A new data set of educational attainment in the world 1950–2010. NBER Working Paper No. 15902, 2010) educational databases. A generalized Cobb–Douglas functional specification is used taking into account differences in technological structures across groups of countries to approximate aggregate production technology using Jorgenson and Nishimizu (Econ J 88:707–726, 1978) bilateral model of production. The measurement of labor efficiency is based on Kopp’s (Quart J Econ 96:477–503, 1981) orthogonal non-radial index of factor-specific efficiency modified in a parametric frontier framework. The empirical results indicate that the weighted average annual rate of labor productivity growth was 1.239 % over the period analyzed. Technical change was found to be the driving force of labor productivity, while improvements in human capital and factor intensities account for the 19.5 and 12.4 % of that productivity growth, respectively. Finally, labor efficiency improvements contributed by 9.8 % to measured labor productivity growth.

Similar content being viewed by others

Notes

The maintained assumption that derived demand for labor is non-increasing in ɛ, implies that human capital and labor inputs are substitutes in the production of aggregate output (Griliches 1964).

We tried to retain these countries into the estimation but having only 17 observations for each one does not permit satisfactory econometric estimates. Also the fact that these countries are into their transition period after 1990s may influenced the quality of the provided data and hence the econometric estimations.

Following referee suggestion we statistically examined the more flexible translog specification against the generalised Cobb–Douglas but it was rejected at the 5 % significance level.

See the "Data appendix" for additional details on country groupings.

The complete set of parameter estimates for the Cornwell et al. (1990) inefficiency effects model are available upon request.

These figures are the weighted averages computed using Olley and Pakes (1996) aggregation scheme using countries’ aggregate output shares as weights.

References

Abramovitz M (1986) Catching up, forging ahead, and falling behind. J Econ Hist 46:385–406

Acemoglu D (1998) Why do new technologies complement skills? Directed technical change and wage inequality. Quart J Econ 113:1055–1090

Acemoglu D, Zilibotti F (2001) Productivity differences. Quart J Econ 116:563–606

Antle JM, Capalbo SM (1988) An introduction to recent development in production theory and productivity measurement. In: Capalbo SM, Antle JM (eds) Agricultural productivity: measurement and explanation, Resources for the future, Inc., Washington, DC

Badunenko O, Hennderson DJ, Zelenyuk V (2008) Technological change and transition: relative contributions to worldwide growth during the 90s. Oxf Bull Econ Stat 70:461–492

Barro RJ, Lee JW (1993) International comparisons of educational attainment. J Monet Econ 32:363–394

Barro RJ, Lee JW (2010) A new data set of educational attainment in the world 1950–2010. NBER Working Paper No. 15902

Basu S, Weil DN (1998) Appropriate technology and growth. Quart J Econ 113:1025–54

Black SE, Lynch LM (2001) How to compete: the impact of workplace practices and information technology on productivity. Rev Econ Stat 83:434–445

Blackorby C, Lovell CAK, Thursby MC (1976) Extended hicks neutral technological change. Econ J 86:845–52

Caselli F (2005) Accounting for cross-country income differences. In: Aghion P, Durlauf S (eds) Handbook of economic growth, Elsevier, Amsterdam

Cornwell C, Schmidt P, Sickles RC (1990) Production frontiers with cross-sectional and time-series variation in efficiency levels. J Econ 46:185–200

Fan S (1991) Effects of technological change and institutional reform on production growth in chinese agriculture. Am J Agric Econ 73:266–275

Färe R, Grosskopf S, Noris M, Zhang Z (1994) Productivity growth, technical progress and efficiency change in industrialized countries. Am Econ Rev 84:66–83

Gollin D (2002) Getting income shares right. J Polit Econ 110:458–474

Griliches Z (1963) Estimates of the aggregate agricultural production function from cross-sectional data. J Farm Econ XLV:1411–27

Griliches Z (1964) Research expenditures, education, and the aggregate agricultural production function. Am Econ Rev 961(LIV):961–974

Griliches Z (1970) Notes on the role of education in production functions and growth accounting. In: Hansen WL (ed) Education, income and human capital, National Bureau of Economic Research, New York

Hall RE, Jones CI (1999) Why do some countries produce so much more output per worker than others?. Quart J Econ 114:83–116

Harberger A (1978) Perspectives on capital and technology in less developed countries. In: Artis MJ, Nobay AR (eds) Contemporary economic analysis, Croom Helm, London

Helpman E, Itskhoki O (2010) Labor market rigidities, trade and unemployment. Rev Econ Stud 77:1100–37

Henderson DJ, Russell RR (2005) Human capital and convergence: a production frontier approach. Int Econ Rev 46:1167–05

Hsieh CT (2002) What explains the industrial revolution in east asia? Evidence from the factor markets. Am Econ Rev 92:502–526

Ichniowski C, Shaw K, Prennushi G (1997) The effects of human resource management practices on productivity: a study of steel finishing lines. Am Econ Rev 87:291–313

Jorgenson DW, Nishimizu M (1978) US and Japanese economic growth, 1952–1974: an international comparison. Econ J 88:707–726

Ketteni E, Mamuneas T, Stengos T (2011) The effect of IT and human capital on economic growth. Macroecon Dyn 15:595–615

Kopp RJ (1981) The measurement of productive efficiency: a reconsideration. Quart J Econ 96:477–503

Krusell P, Rios-Rull JV (1996) Vested interests in a positive theory of stagnation and economic growth. Rev Econ Stud 63:301–329

Kumar S, Russell RR (2002) Technological change, technological catch-up, and capital deepening: relative contributions to growth and convergence. Am Econ Rev 92:527–548

Kuroda Y (1987) The production structure and demand for labor in postwar Japanese agriculture. Am J Agric Econ 69:326–337

Kuroda Y (1995) Labor productivity measurement in Japanese agriculture, 1956–1990. Agric Econ 12:55–68

Los B, Timmer MP (2005) The appropriate technology explanation of productivity growth: an empirical approach. J Dev Econ 77:517–531

Maddison A, Wu HX (2008) Measuring China’s economic performance. World Econ 9:13–44

Mamuneas T, Savvides A, Stengos T (2006) Economic development and the return to human capital: a smooth coefficient semiparametric approach. J Appl Econ 21:111–132

Nehru V, Swanson E, Dubey A (1995) A new database on human capital stock in developing and industrial countries: sources, methodology and results. J Dev Econ 46:379–401

Olley GS, Pakes A (1996) The dynamics of productivity in the telecommunications equipment industry. Econometrica 64:1263–97

Olson M (1982) The rise and decline of nations: economic growth, stagflation and social rigidities. Yale University Press, New Haven, CT

Parente SL, Prescott EC (1999) Monopoly rights: a barrier to riches. Am Econ Rev 89:1216–33

Politis D, Romano J (1994) Large sample confidence regions based on subsamples under minimal assumptions. Ann Stat 22:2031–2050

Psacharopoulos G (1994) Returns to investment in education: a global update. World Dev 22:1325–43

Schmidt P, Sickles RC (1984) Production frontiers and panel data. J Bus Econ Stat 2:367–374

Simar L (2003) Detecting outliers in frontier models: a simple approach. J Prod Anal 20:391–424

Solow RM (1957) Technical change and the aggregate production function. Rev Econ Stat 39:312–320

Welch F (1970) Education in production. J Polit Econ 80:35–59

Author information

Authors and Affiliations

Corresponding author

Data appendix

Data appendix

Below, we discuss the data series used in the econometric analysis. In particular, we provide details on variables construction and we present the prodedure used for determining country groupings.

Output Aggregate output is real gross domestic product (real GDP) measured at constant prices (2005 US$), with purchasing power parity (PPP) adjustment. It is computed using the real GDP per capita chain series (RGDPCH) and the population series (POP) from PWT6.3, i.e., RGDPCH × POP.

Labor Labor input is retrieved from real GDP chain per worker (RGDPWOK) series in PWT6.3. It is derived as the ratio of real GDP to RGDPWOK.

Physical capital The capital input is constructed from aggregate investment data in PWT6.3 via the perpetual inventory method. Specifically, the stock of capital in time t is constructed as the accumulation of the past investments, k t = k t−1(1 − δ) + I t , where I is the capital flow or investment, and δ is the depreciation rate. The initial stock of capital is computed following Harberger’s (1978) approach as k t−1 = I t /(g + δ), where g is the growth rate of output. Specifically, we used a 5 year average growth rate of output to control for short-run fluctuations in output. Concerning capital depreciation, we follow Acemoglou and Zilboti (2001) assuming a constant annual depreciation rate of physical capital at 8 %. In order to test the robustness of this result, we also used depreciation rates of 4 % (the same as Nehru et al. 1995) and 6 % but the econometric estimations did not present any significant differentiations compared with those reported here.

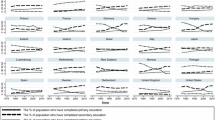

Human capital Human capital is proxied using the Barro and Lee (2010) educational data. Nevertheless, the Barro and Lee (2010) data are available in 5-year intervals while the rest of our data are on annual basis. Hence, we assume a constant annual growth rate for human capital within each interval. In order to test the validity of this assumption, we proceeded by comparing our results with those of Nehru et al. (1995) who developed estimates of education stock on annual basis. The comparative analysis verified our assumption for the strong majority of the observations. Nevertheless, it should be noted that Nehru et al. (1995) provide estimates of the stock of education for a lower number of countries and for a shorter time period than those specified here. Hence, our comparison analysis was limited to countries in common in the two studies observed for the same time period.

The Barro and Lee (2010) educational data are utilized in our analysis following Henderson and Russell (2005) approach. In particular, we adopt Hall and Jones (1999) construction where education appears as an augmentation factor for labor using an exponential specification, \(h(\varepsilon)=exp\left(\phi(\varepsilon)\right)\) with \(\phi(\varepsilon)\) being a Mincerian piecewise linear function with zero intercept and slope varying along the time span. Following Psacharopoulos (1994) survey on the evaluation of the returns to education, those parameters are defined as being 0.134 for the first 4 years, 0.101 for the next 4 years and 0.068 for education beyond the eighth year.

This specification implicitly imposes perfect substitutability between human capital and physical labor (Acemoglou and Zilboti, 2001). Alternatively, we could have followed the Welch (1970) approach treating human capital as a separate factor of production. Following Griliches (1970) we used formal statistical testing to examine both hypotheses. In doing so, the production frontier model was estimated using human capital as a separate factor of production and then utilizing a simple t test we examined the hypothesis that the coefficients of human capital and labor are equal. The result rejects the alternative hypothesis validating our choice of using Hall and Jones (1999) construction.

Capital and labor prices The calculation of capital and labor prices follows the approach suggested by Mamuneas et al. (2006) by using the share of employee compensation in national income published by the Total Economy Growth Accounting Database of the Groningen Growth and Development Centre and National Account Statistics of the United Nations. Nevertheless, the use of aggregate price data in the labor decomposition equation may introduce measurement bias in the evaluation of substitution effects. If factor prices considerably deviate from their respective social marginal products, the estimated substitution effect may be over or under-estimated depending on the direction of these deviations. To deal with this possible bias, we follow Gollin (2002) approach in empirically quantifying substitution effect, minimizing the potential biases in our decomposition results.

Country groupings Initially, the countries in our sample were classified into five groups following the Barro and Lee (2010) categorization (i.e., Advanced Economies, South and Central America and the Caribbean, Asia and the Pacific, North Africa and Middle East, and Sub-Sahara Africa). However, the results arising from the econometric estimation of our multilateral aggregate production frontier model failed to converge. Our suspicion was that our country grouping did not reflect the actual technological differences across countries in the sample. Hence, we followed Simar (2003) approach to detect the potential outliers inside the groups and more accurate define country-grouping. Using a non-parametric DEA/FDH approach which does not envelop all data points and is more robust to extreme observations, we arrived at results suggesting that North African and Middle East countries exhibit different technological structures. The same conclusion was also produced for Sub-Saharan Africa, indicating the existence of two different sub-groups with different technological features. Furthermore, the non-parametric model suggested that Malta and Cyprus (that were initially included in Advanced Economies group) were suited to North Africa and Middle East groups, respectively, and the Philippines, Thailand and Malaysia were better represented to the Asia and Pacific group.

Hence, the 121 countries in the sample are classified into seven groups as follows. Advanced Economies: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Hong Kong, Hungary, Iceland, Ireland, Israel, Italy, Japan, Korea Rep, Luxembourg, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, Taiwan, Turkey, United Kingdom, United States. South and Central America and the Caribbean: Argentina, Barbados, Belize, Bolivia, Brazil, Chile, Colombia, Costa Rica, Cuba, Dominican Republic, Ecuador, El Salvador, Guatemala, Guyana, Haiti, Honduras, Jamaica, Mexico, Nicaragua, Panama, Paraguay, Peru, Trinidad and Tobago, Uruguay, Venezuela. Asia and the Pacific: Bangladesh, Brunei, Cambodia, China, Fiji, Indonesia, Laos, Macao, Malaysia, Mongolia, Nepal, Pakistan, Papua New Guinea, Philippines, Sri Lanka, Thailand, Tonga, Vietnam. Middle East: Bahrain, Cyprus, Iran, Iraq, Jordan, Kuwait, Qatar, Saudi Arabia, Syria, United Arab Emirates. North Africa: Algeria, Egypt, Libya, Malta, Mauritania, Morocco, Tunisia. Sub-Saharan Group A: Burundi, Cameroon, Congo, Republic of, Cote d‘Ivoire, Gabon, Gambia, Kenya, Mauritius, Mozambique, Namibia, Rwanda, Senegal, South Africa, Swaziland, Uganda. Sub-Saharan Group B: Benin, Botswana, Central African Republic, Congo, Dem. Rep., Ghana, Lesotho, Liberia, Malawi, Mali, Niger, Sierra Leone, Sudan, Tanzania, Togo, Zambia, Zimbabwe.

Rights and permissions

About this article

Cite this article

Chatzimichael, K., Tzouvelekas, V. Human capital contributions to explain productivity differences. J Prod Anal 41, 399–417 (2014). https://doi.org/10.1007/s11123-013-0355-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11123-013-0355-x