Abstract

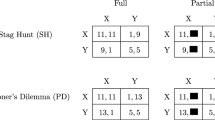

In games with strategic complementarities, public information about the state of the world has a larger impact on equilibrium actions than private information of the same precision, because public signals are more informative about the likely behavior of others. We present an experiment in which agents’ optimal actions are a weighted average of the fundamental state and their expectations of other agents’ actions. We measure the responses to public and private signals. We find that, on average, subjects put a larger weight on the public signal. In line with theoretical predictions, as the relative weight of the coordination component in a player’s utility increases, players put more weight on the public signal when making their choices. However, the weight is smaller than in equilibrium, which indicates that subjects underestimate the information contained in public signals about other players’ beliefs.

Similar content being viewed by others

Notes

Angeletos and Pavan (2004) distinguish weak and strong strategic complementarities. Under weak complementarities, the game has a unique equilibrium, while strong strategic complementarities define a coordination game with multiple equilibria.

Svensson (2006) has argued that detrimental welfare effects of public information are unlikely, because they require that public information be of lower precision than private information, which conflicts with empirical findings. For a response, see Morris et al. (2006). For discussions about the welfare effects of public information in closely related frameworks, see Cornand and Heinemann (2008), Baeriswyl and Cornand (2011), Woodford (2005), Angeletos and Pavan (2007a, 2007b), Hellwig (2005), and Myatt and Wallace (2008) among others.

Compared to the model of Morris and Shin (2002), we required the number of players to be finite and we also changed the distributions of the signals from normal to uniform in order to have a simple distribution with bounded support for the experiment. In Morris and Shin, the constant U 0 adds the average losses from miscoordination, so that the coordination part becomes a zero-sum game and aggregate welfare depends only on the distance between actions and fundamental state.

Other experiments concerning the welfare effects of public information have concentrated on games with multiple equilibria: Anctil et al. (2004) demonstrate that private signals with high precision are not sufficient to achieve coordination on an efficient equilibrium. Heinemann et al. (2004) compare perfect public and noisy private signals in a speculative attack game and find small effects towards higher efficiency with perfect information. Cornand (2006) shows that subjects put a larger weight on the public signal if they receive both a private and a public signal about the state of the economy. For other experiments dealing with public versus private information, see Forsythe et al. (1982), Plott and Sunder (1988), McKelvey and Ordeshook (1985), McKelvey and Page (1990) and Hanson (1996). They investigate how individuals use public information to augment their original private information and whether, in doing so, a rational expectations equilibrium is attained.

Having a sufficiently large support of the prior distribution enables us to reduce the informational content conveyed by the prior mean. In addition, this reduces the set of signals, for which the conditional posterior distribution is skewed.

To limit potential losses that might arise from typing mistakes, we restricted choices and stated expectations to the interval [y−20,y+20]. This restriction was not mentioned in the instructions. If a subject entered a number outside this interval, the screen displayed a message indicating that her choice is too far away from signals. Apparently, this restriction was not binding. We observed only one (out of 12,960) decision situations, where a subject actually chose an action at the border of this interval, and less than 50 decisions, where the difference between action and public signal exceeded 15. Some subjects actually reported typing mistakes.

When signals are smaller than 60 or larger than 440, the posterior distribution of θ is skewed, because of the bounded support of θ.

In the limiting case where fundamental uncertainty disappears and subjects’ payoffs depend only on the distance between their actions, equilibrium theory does not yield a unique prediction. Any coordinated strategy is an equilibrium. However, the limit of equilibria in games with a decreasing weight on fundamental uncertainty uniquely selects a strategy in which all agents follow the public signal and ignore all private information.

A formalization of focal points is provided by Alós-Ferrer and Kuzmics (2013).

Due to the bounded support of θ, the equilibrium deviates from this linear combination into the direction of the center of the support. To see this, imagine that player i receives signals x i =40 and y=50. From her private signal, she can deduce that θ=50. The posterior distribution of the other player’s signal is uniform in [40,60]. Since the other player should never choose an action below 50, the expected action by the other player is above 50. Therefore, player i should also choose an action above 50. Obviously, it is too demanding to assume that players update their beliefs correctly at the edges of the support. In the data, we find systematic effects for signals up to 60 and above 440. We checked that restricting data analysis to situations with 70<θ<430 does not alter our results.

We also conducted 6 control sessions to include treatments with only one signal in order to test the welfare reducing effect of private signals for r=1 directly by comparing payoffs. Control sessions elicited beliefs at the second stage before strategic games and with a slightly different representation of the payoff function. We only present standard sessions in the main text. The results of control sessions are reported in online Appendix B.

In all stages, it was possible to earn negative points. This actually occurred in about 3.3 % of all decision situations in standard sessions. Realized losses were of a size that could be counterbalanced by positive payoffs within a few periods. In general, losses were covered by earnings from the next three periods or balanced by earnings of previous periods.

To break ties in counting: if both signals and the action coincide, we count the choice as “Middle”. If |y−x i |=0.1, and a i =x i [a i =y], we count the choice as “equal to x i ” [“equal to y”].

Data and programs are available at http://www.macroeconomics.tu-berlin.de/menue/publications/publications_by_frank_heinemann/.

Average weights per individual are estimated by a similar procedure as average weights per session, with a separate regression for each subject.

This result seems to be corroborated by subjects’ written comments in the post-experimental questionnaire (this questionnaire is presented in online Appendix A.3). 43 % of subjects explicitly wrote (without being directly asked) that y is more informative than x i on the other participant’s decision. The percentage of subjects reporting such statements is positively correlated to the value of r in stage 3.

Shapiro et al. (2009) analyze the predictive power of level-k reasoning in a game that combines features of Morris and Shin (2002) with Nagel (1995). They try to identify whether individual strategies are consistent with level-k reasoning. They argue that the predictive power of level-k reasoning is positively related to the strength of the coordination motive and to the symmetry of information. Their experiment however treats public and private signals in an asymmetric way by normalizing public signals.

Hypotheses that arise from combining non-Bayesian higher-order beliefs with limited levels of reasoning are derived and tested in online Appendix D.

In the light of our previous impression that the level of reasoning may be correlated with r, the high parameter of r=0.8, chosen by Dale and Morgan (2012), may contribute to higher weights on public signals. They also inform subjects about the best response after each round which may enforce convergence to equilibrium.

References

Alós-Ferrer, C., & Kuzmics, C. (2013), Hidden symmetries and focal points. Journal of Economic Theory, 148, 226–258

Anctil, R., Dickhaut, J., Kanodia, C., & Shapiro, B. (2004). Information transparency and coordination failure: theory and experiment. Journal of Accounting Research, 42, 159–195.

Angeletos, G.-M., & Pavan, A. (2004). Transparency of information and coordination in economies with investment complementarities. The American Economic Review (Papers and Proceedings), 94, 91–98.

Angeletos, G.-M., & Pavan, A. (2007a), Socially optimal coordination: characterization and policy implications. Journal of the European Economic Association, 5, 585–593.

Angeletos, G.-M., & Pavan, A. (2007b). Efficient use of information and social value of information. Econometrica, 75, 1103–1142.

Baeriswyl, R., & Cornand, C. (2011). Reducing overreaction to central banks’ disclosures: theory and experiment. Working paper du GATE Lyon Saint-Etienne, No. 41.

Cornand, C. (2006). Speculative attack and informational structure: an experimental study. Review of International Economics, 14, 797–817.

Cornand, C., & Heinemann, F. (2008). Optimal degree of public information dissemination. The Economic Journal, 118, 718–742.

Cornand, C., & Heinemann, F. (2013). Limited higher order beliefs and the welfare effects of public information. Mimeo.

Dale, D. J., & Morgan, J. (2012). Experiments on the social value of public information. Mimeo.

Eil, D., & Rao, J. M. (2011). The good news-bad news effect: asymmetric processing of objective information about yourself. American Economic Journal: Microeconomics, 3, 114–138.

Forsythe, R., Palfrey, T. R., & Plott, C. R. (1982). Asset valuation in an experimental market. Econometrica, 50, 537–567.

Grossman, Z., & Owens, D. (2012). An unlucky feeling: overconfidence and noisy feedback. Journal of Economic Behavior and Organization, 84, 510–524.

Hanson, R. (1996). Correction to MacKelvey and page, “Public and private information: an experimental study of information pooling”. Econometrica, 64, 1223–1224.

Heinemann, F., Nagel, R., & Ockenfels, P. (2004). The theory of global games on test: experimental analysis of coordination games with public and private information. Econometrica, 72, 1583–1599.

Hellwig, C. (2005), Heterogeneous information and the welfare effects of public information disclosures. Mimeo, UCLA.

Kübler, D., & Weizsäcker, G. (2004). Limited depth of reasoning and failure of cascade formation in the laboratory. Review of Economic Studies, 71, 425–442.

McKelvey, R. D., & Ordeshook, P. C. (1985). Elections with limited information: a fulfilled expectations model using contemporaneous poll and endorsement data as information sources. Journal of Economic Theory, 35, 55–85.

McKelvey, R. D., & Page, T. (1990). Public and private information: an experimental study of information pooling. Econometrica, 58, 1321–1339.

Morris, S., & Shin, H. S. (2002). Social value of public information. The American Economic Review, 92, 1522–1534.

Morris, S., Shin, H. S., & Tong, H. (2006). Social value of public information: Morris and Shin (2002) is actually pro-transparency, not con: reply. The American Economic Review, 96, 453–455.

Myatt, D. P., & Wallace, C. (2008). On the sources and value of information: public announcements and macroeconomic performance. University of Oxford, Dept. of economics discussion paper no. 411.

Nagel, R. (1995). Unraveling in guessing games: an experimental study. The American Economic Review, 85, 1313–1326.

Plott, C. R., & Sunder, S. (1988). Rational expectations and the aggregation of diverse information in laboratory security markets. Econometrica, 56, 1085–1118.

Shapiro, D., Shi, X., & Zillante, A. (2009). Robustness of level-k reasoning in modified beauty contest games. Mimeo.

Slovic, P., & Lichtenstein, S. (1971). Comparison of Bayesian and regression approaches to the study of information processing in judgment. Organizational Behavior and Human Performance, 6, 649–744.

Stahl, D. O., & Wilson, P. W. (1994). Experimental evidence on players’ models of other players. Journal of Economic Behavior & Organization, 25, 309–327.

Svensson, L. E. O. (2006). Social value of public information: comment: Morris and Shin (2002) is actually pro-transparency, not con. The American Economic Review, 96, 448–452.

Woodford, M. (2005). Central bank communication and policy effectiveness. In The greenspan era: lessons for the future, Kansas city: Federal Reserve Bank of Kansas city (pp. 399–474).

Zeiliger, R. (2000). A presentation of regate, internet based software for experimental. Economics, http://www.gate.cnrs.fr/~zeiliger/regate/RegateIntro.ppt, GATE.

Acknowledgements

We are thankful to Gabriel Desgranges, John Duffy, Petra Geraats, Ed Hopkins, Paul Pezanis-Christou, and Alexander Meyer-Gohde for helpful comments, to Romain Zeiliger for programming Regate, to Kene Boun My for providing assistance, to the students for their participation in the experiment and to the Conseil Scientifique de l’Université de Strasbourg and the ANR-DFG joint grant for financial support.

Author information

Authors and Affiliations

Corresponding author

Electronic Supplementary Material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Cornand, C., Heinemann, F. Measuring agents’ reaction to private and public information in games with strategic complementarities. Exp Econ 17, 61–77 (2014). https://doi.org/10.1007/s10683-013-9357-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10683-013-9357-9