Abstract

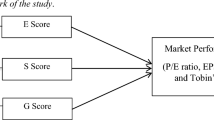

Sustainability is concerned with the impact of present actions on the ecosystems, societies, and environments of the future. Such concerns should be reflected in the strategic planning of sustainable corporations. Strategic intentions of this nature are operationalized through the adoption of a long-term focus and a more inclusive set of responsibilities focusing on ethical practices, employees, environment, and customers. A central hypothesis, that we test in this paper is that companies which attend to this set of responsibilities under the term superior sustainable practices, have higher financial performance compared to those that do not engage in such practices. The target population of this study consists of the top 100 sustainable global companies in 2008 which have been selected from a universe of 3,000 firms from the developed countries and emerging markets. We find significant higher mean sales growth, return on assets, profit before taxation, and cash flows from operations in some activity sectors of the sample companies compared to the control companies over the period of 2006–2010. Furthermore, our findings show that the higher financial performance of sustainable companies has increased and been sustained over the sample. Notwithstanding sample limitation, causal evidence reported in this paper suggests that, there is bi-directional relationship between corporate social responsibilities practices and corporate financial performance.

Similar content being viewed by others

References

Acciona. (2008). Acciona Sustainability Report.

Accor. (2008). Accor Annual Report.

Adam, C., & Zutshi, A. (2004). Corporate social responsibility: Why business should act responsibly and be accountable. Australian Accounting Review, 14(3), 31–39.

Adidas. (2008). Adidas Sustainable Performance Review.

Al-Tuwaijri, S. A., Christensen, T. E., & Hughes, K. E. (2004). The relations among environmental disclosure, environmental performance, and economic performance: A simultaneous equations approach. Accounting, Organizations and Society, 29, 447–471.

Aras, G., & Crowther, D. (2008). Evaluating sustainability: Need for standards. Issues in Social and Environmental Accounting, 2(1), 19–35.

Bansal, P. (2005). Evolving sustainability: A longitudinal study of corporate sustainable development. Strategic Management Journal, 26(3), 197–218.

Barnett, M. L. (2007). Stakeholder influence capacity and the variability of financial returns to corporate social responsibility. Academy of Management Review, 32, 794–816.

Brown, M. T. (1990). Working ethics: Strategies for decision making and organizational responsibility. San Francisco, CA: Jossey Bass.

Buchanan, D., Fitzgerald, L., Ketley, D., Gollop, R., Jones, J. L., Lamont, S. S., et al. (2005). No going back: A review of the literature on sustaining organizational change. International Journal of Management Reviews, 7(3), 189–205.

Cacioppe, R., Forster, N., & Fox, M. (2007). A survey of managers’ perceptions of corporate ethics and social responsibility and action that may affect companies’ success. Journal of Business Ethics, 82, 681–700.

Carroll, A. B. (1979). A three-dimensional conceptual model of corporate performance. Academy of Management Review, 4(4), 497–505.

De Vaus, D. A. (1986). Surveys in social research. London: Allen & Unwin.

Diageo Plc. (2008). Diageo Corporate Citizenship Report.

Dowling, G. R. (2001). Creating corporate reputations. Oxford: Oxford University Press.

Epstein, M. J. (1996). Improving environmental accounting with full environmental cost accounting. Environmental Quality Management, Autumn, 11–22.

Epstein, M. J., & Roy, M. J. (2001). Sustainability in action: Identifying and measuring key performance drivers. Long Range Planning, 34, 585–604.

Fadul, J., Halliburton, R., & Maurer, R. A. (2004). Business ethics, corporate social responsibility, and firm value in the oil and gas industry, SPE Annual Technical Conference and Exhibition, 26–29 September, Houston, Texas

Fredrick, W. C. (2006). Corporations, be good! The story of corporate social responsibility. Indianapolis, IN: Dogear Publishing.

Friedman, M. (1970). The social responsibility of business is to increase its profits. New York Times Magazine 13, September 32–33.

Gelb, D. S., & Strawser, J. A. (2001). Corporate social responsibility and financial disclosure: An alternative explanation for increased disclosure. Journal of Business Ethics, 33(1), 874–907.

Godfrey, P. C. (2005). The relationship between corporate philanthropy and shareholder wealth: A risk management perspective. Academy of Management Review, 30, 777–798.

Gray, R. (2010). Is accounting for sustainability actually accounting for sustainability and how would we know? An exploration of narratives of organizations and the planet. Accounting, Organizations and Society, 35, 47–62.

Henri, J.-F., & Journeault, M. (2010). Eco-control: The influence of management control systems on environmental and economic performance. Accounting Organization and Society, 35(1), 63–80.

Intel. (2008). Intel Social Responsibility Report.

Jensen, M. C. (2001). Value maximization, stakeholder theory, and the corporate objective function. Journal of Applied Corporate Finance, 14(3), 8–21.

Kurucz, E., Colbert, B., & Wheeler, D. (2008). The business case for corporate social responsibility. In A. Crane, A. McWilliams, D. Matten, J. Moon, & D. Siegel (Eds.), The Oxford handbook of corporate social responsibility (pp. 83–112). Oxford: Oxford University Press.

Lee, D. D., Faff, R. W., & Smith, K. L. (2009). Reviving the vexing question: Does superior corporate social performance lead to improved financial performance? Australian Journal of Management, 34, 21–49.

Lopez, V. M., Garcia, A., & Rodriguez, L. (2007). Sustainable development and corporate performance: A study based on the Dow Jones sustainability index. Journal of Business Ethics, 75, 285–300.

McElhaney, K. A., Toffel, M. W., & Hass, N. (2005). Designing a sustainability management system at BMW group: The Designworks/USA case study. Greener Management International, 46, 103–116.

McGuire, J. B., Sundgren, A., & Schneeweis, T. (1988). Corporate social responsibility and firm financial performance. Academy of Management Journal, 31(4), 854–872.

Morhardt, J. E., Baird, S., & Freeman, K. (2002). Scoring corporate environmental and sustainability reports using GRI 2000, ISO 14301 and other criteria. Corporate Social and Environmental Management Journal, 9, 215–233.

Nunnally, J. C. (1978). Psychometric theory. McGraw-Hill: New York.

Patten, M. (2002). The relation between environmental performance and environmental disclosure. Accounting, Organizations and Society, 27(8), 763–773.

Patten, M. (2008). Does the market value corporate philanthropy? Evidence from the response to the 2004 tsunami relief effort. Journal of Business Ethics, 81(3), 599–607.

Pettigrew, A. M. (1985). The awakening Giant: Continuity and change in ICI. Oxford: Blackwell.

Pivato, S., Misani, N., & Tencati, A. (2008). The impact of corporate social responsibility on consumer trust: The case of organic food. Business Ethics: A European Review, 17, 3–12.

Preston, L. E., & O’Bannon, D. P. (1997). ‘The corporate social-financial performance relationship: A typology and analysis. Business and Society, 36, 419–429.

Rimmer, M., Macneil, J., Chenhall, R., Smith, K., & Watts, L. (1996). Reinventing competitiveness: Achieving best practices in Australia. South Melbourne: Pitman.

Roberts, W. P., & Dowling, R. G. (2002). Corporate reputation and sustained superior financial performance. Strategic Management Journal, 23, 1077–1093.

Robinson, J. (2004). Squaring the circle? Some thoughts on the idea of sustainable development. Ecological Economics, 48(4), 369–384.

Rondinelli, D. A., & Berry, M. A. (2000). Environmental citizenship in multinational corporations. Social responsibility and sustainable development. European Management Journal, 18(1), 70–84.

Schaltegger, S., & Synnestvedt, T. (2002). The link between ‘green’ and economic success: environmental management as the crucial trigger between environmental and economic performance. Journal of Environmental Management, 65, 339–346.

Schaltegger, S., & Wagner, M. (2006). Integrative management of sustainable performance, measurement and reporting. International Journal of Accounting. Auditing and Performance Evaluation, 3, 1–19.

Scholtens, B. (2008). A note on the interaction between corporate social responsibility and financial performance. Ecological Economics, 68, 46–55.

Singh, K. R., Murty, H. R., Dikshit, A. K., & Gupta, S. K. (2009). An overview of sustainability assessment methodologies. Ecological Indicators, 9(2), 189–212.

Stone, B. A. (2001). Special-purpose taxonomy of corporate social performance concepts. Accounting and the Public Interest, 1, 42–73.

Sustainability–UNEP. (1997). The 1997 Benchmark Survey: The Third International Progress Report on Company Environmental Reporting. Oxford: Oxford University Press.

Székely, F., & Knirsch, M. (2009). Responsible leadership and corporate social responsibility: Metrics for sustainable performance. European Management Journal, 23, 628–647.

Tenuta, P. (2010). The measurement of sustainability. Review of Business Research, 10(2), 163–171.

Waddock, S. A., & Graves, S. B. (1997). The corporate social performance—financial performance link. Strategic Management Journal, 18, 303–319.

Wagner, M. (2007). Integration of environmental management with other managerial functions of the firm: Empirical effects on drivers of economic performance. Long Range Planning, 40, 611–628.

Wagner, M. (2011). Corporate performance implications of extended stakeholder management: New insights on mediation and moderation effects. Ecological Economics, 70(5), 942–950.

Wagner, M., & Schaltegger, S. (2003). How does sustainability performance relate to and business competitiveness? Greener Management International, 44, 5–16.

Wagner, M., & Schaltegger, S. (2004). The effect of corporate environmental strategy choice and environmental performance on competitiveness and economic performance. An empirical analysis in EU manufacturing. European Management Journal, 22(5), 557–572.

Warhurst, A. (2002). Sustainability indicators and sustainability performance management. Report to the Project: Mining, Minerals and Sustainable Development (MMSD), International Institute for Environment and Development (IIED). Warwick, England. http://www.iied.org/mmsd/mmsd_pdfs/sustainability_indicators.pdf.

Wood, D. J. (1991). Corporate social performance revisited. Academy of Management Review, 16(4), 691–718.

World Commission on Environment, Development. (1987). Our common future. Oxford: Oxford University Press.

Acknowledgments

We are thankful to Research Management Institute, University Teknologi Mara for the research grant for this paper.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Items in the Checklist

Community Index (CI)

-

1

Does the company have a charitable foundation and if so, how much was given during the most recent fiscal year?

-

2

Does the company have exceptional or particularly innovative charitable-giving programs?

-

3

Is the company an industry leader with respect to its performance in Community activism?

-

4

Does the company have exceptional volunteer programs?

-

5

Is there evidence of new initiatives implemented by or awards given to the company with respect to its performance in this category?

-

6

What community programs does the company have in place?

-

7

Does the company have employee volunteer programs?

-

8

Do the company’s volunteer programs involve a large portion of the company’s current and former workforce?

-

9

Does the company participate in public/private partnerships related to education, job training, or urban revitalization and if so, what is the nature of the company’s commitment to them?

-

10

Does the company have partnerships with local schools or community-based groups?

-

11

Does the company have a corporate giving program and if so, how much was given during the most recent fiscal year?

-

12

Is the company committed to donating a given percentage of its pretax profits to charitable organizations and if so, what percentage is the target goal?

Diversity Index (DI)

-

1

Has the company demonstrated a commitment to workforce diversity?

-

2

Does the company actively hire and promote minority and women?

-

3

Has the company demonstrated its commitment to diversity through strong representation of women, minorities, and the disabled on boards of directors, in top management, and/or among the company’s highest paid employees?

-

4

Has the company demonstrated its commitment to diversity through its training and advancement programs (e.g., support networks, management reviews, mentoring)?

-

5

Has the company demonstrated its commitment to diversity through participation in women and minority vendor and banking programs?

-

6

Has the company demonstrated its commitment to diversity through implementation of innovative work/life programs (e.g., flextime, job sharing, child care, elder care)?

-

7

Does the company have programs to train woman for advancement?

-

8

Does the company conduct diversity training for its employees?

-

9

Does the company have a history of violations in the area of abusive labor conditions?

-

10

Does the company have a poor Equal Employment Opportunity Commission (EEOC) record?

-

11

Does the company’s record in this area show a systematic or repeated disregard for the need to foster an open and diverse work environment?

-

12

Does the company have affirmative action programs pertaining to recruitment and promotion?

-

13

Does the company, at a minimum, have in place specifically stated policies against discrimination in hiring and promotion based upon sexual orientation?

-

14

Does the company have a set of standards for its overseas operations and non-U.S. contractors and suppliers?

-

15

Does the company have a board or staff task force or committee set up to address diversity-related issues?

-

16

Does the company clearly exclude women from positions in operating top management?

-

17

Does the company have women and minorities serving in positions with substantial profit and loss responsibilities?

-

18

Does the company have gender equity in wages?

-

19

How does the company portray woman in advertising and marketing materials?

-

20

What is the nature and extent of any civil discrimination lawsuits brought against the company?

-

21

Does the company have an understanding of the need for minority constituencies to have more of a voice in business?

Environment Index (EI)

-

1

Is the company in compliance with environmental laws and regulations?

-

2

What civil lawsuits, particularly those covering overseas issues, has the company been subject to, with respect to its environmental performance in the past 3 years?

-

3

What assets have the company accrues for pollution remediation?

-

4

Does the company have environmental remediation liabilities?

-

5

Does the company have current substantial liabilities for the remediation of asbestos?

-

6

Is the company dedicated to the conservation of energy and natural resources, with emphasis on the impact of operations on the local community?

-

7

Is the company proactive in its environmental efforts?

-

8

Has the company demonstrated a commitment to change, with respect to its environmental performance?

-

9

Has the company developed new products and/or processes that will reduce or minimize environmental impact?

-

10

Has the company adopted new technologies and/or redesigned products to conserve the use of energy, water, materials, and/or land?

-

11

Is the company involved with the new development or use of clean energy, sustainable renewable energy, or natural foods?

-

12

Is the company perceived as an industry leader, with respect to its performance in this category?

-

13

What is the effectiveness of the company’s environmental policies; specifically, are the company’s established programs and/or goals actually improving its environmental performance?

-

14

Has the company taken positive steps toward preserving our environment?

-

15

Does the company have environmental policies in effect with measurable goals, companywide responsibility, and quantitative accountability?

-

16

Does the company have voluntary programs in place, including recycling?

-

17

Does the company have specific environmental policies and if so, what are they?

-

18

What are the company’s major policies to prevent air and water pollution?

-

19

Does the company have an environmental report, including quantitative data on emissions/pollution? What are the company’s levels of emission? What are the company’s levels of environment data, e.g., TRI, spills, etc.?

-

20

What are the company’s recycling efforts?

-

21

Are all company operations (including those abroad) in compliance with environmental statutes?

-

22

What is the nature and amount of EPA violations and fines paid?

Ethical Index (ETI)

-

1

Does the co. have a written Code of Business Conduct used as a guide to help employees live up to the company’s ethical standards?

-

2

Does the code go beyond the legal minimums?

-

3

Does the code include corporate policies dealing with business conduct specifically related to Equal Employment Opportunity?

-

4

Does the code include corporate policies dealing with business conduct specifically related to conflicts of interest?

-

5

Does the code include corporate policies dealing with business conduct specifically related to commercial bribery?

-

6

Does the code include corporate policies dealing with business conduct specifically related to international business relationships?

-

7

Does the code include corporate policies dealing with business conduct specifically related to use and public disclosure of inside info, and the use of confidential and proprietary information?

-

8

Does the code include corporate policies dealing with business conduct specifically related to export compliance and international economic sanctions?

-

9

Does the code include corporate policies dealing with business conduct specifically related to political contributions?

-

10

Does the code include corporate policies dealing with business conduct specifically related to antitrust and competition laws?

-

11

Does the code include corporate policies dealing with business conduct specifically related to health, safety, and environment?

-

12

Does the code include corporate policies dealing with business conduct specifically related to harassment?

-

13

Has the company, its executives, managers, and employees consistently operated within the framework provided by the Code of Business Conduct in the past 3 years?

Appendix 2: CSR Rating Agencies/Organization

S. no. | Agency/Organization name | Country |

|---|---|---|

1 | Accountability Rating | UK |

2 | Allianz Global Investors | Germany/UK/France |

3 | Analistas Internacionales en Sostenibildad SA | Spain |

4 | Arese | France |

5 | ASSET4 | Switzerland |

6 | Avanzi SRI Research | Italy |

7 | Bank Sarasin Co Ltd | Switzerland |

8 | BHF-Bank AG | Germany |

9 | Business Ethics | USA |

10 | Business in the Community (BITC) | UK |

11 | Calvert Group Ltd | USA |

12 | Centre for Australian Ethical Research (CAER) | Australia |

13 | Centre Info SA | Switzerland |

14 | Citizens Advisers Inc | USA |

15 | Co-op America | USA |

16 | CoreRatings Ltd | UK |

17 | Corporate Knights | Canada |

18 | Corporate Monitor | Australia |

19 | Covalence SA | Switzerland |

20 | Danish Governments Pricewaterhouse Coopers | Denmark |

21 | Dutch Sustainability Research BV (DSR) | The Netherlands |

22 | E.Capital Partners SPA | Italy |

23 | Ecos | Switzerland |

24 | Ethibel | Belgium |

25 | Ethical & Environmental Screening Service (ESS) | UK |

26 | Ethical Consumer Research Association (ECRA) | UK |

27 | EthicFinance | France |

28 | Ethiscan Canada Ltd | Canada |

29 | Foundation Ecologisy Desarollo (EcoDes) | Spain |

30 | FTSE Group | UK |

31 | Global Ethical Standard Investment Services AB (GES) | Sweden |

32 | Global Risk Management Services (GRM) | UK |

33 | Goldman Sachs Corporation | USA |

34 | Imug | Germany |

35 | Imug/SECURVITA | Germany |

36 | Innovest Group | USA |

37 | Inrate | Switzerland |

38 | Institutional Shareholder Services (ISS) | USA |

39 | Jantzi Research Inc | Canada |

40 | Johannesburg Securities Exchange | South Africa |

41 | KAYMEA Investment Research & Analysis | Israel |

42 | Kempen Capital Management/SNS Bank | UK/The Netherlands |

43 | Kynder Lydenberg & Domini (KLD) Research & Analytics | UK |

44 | Lombard Odier Darier Hentsch & Chie | Switzerland |

45 | MAALA | Israel |

46 | Name of the agency/organization | Country |

47 | Network for Social Responsibility Economy | Switzerland |

48 | O.D.E. | France |

49 | Oekom Research AG | Germany |

50 | Pictet & Cie | Switzerland |

51 | PIRIC | UK |

52 | Repu Tax | Australia |

53 | Safety & Environmental Risk Management (SERM) | UK |

54 | Scoris GmBH | Germany |

55 | SiRi Company | Switzerland |

56 | STOCK at STAKE | Belgium |

57 | Sustainable Asset Management (SAM) Group Holding AG | Switzerland |

58 | Sustainable Investment Research Institute (SIRIS) Pty | Australia |

59 | Triodos | The Netherlands |

60 | UBS (Union Bank of Switzerland) | Switzerland |

61 | Verite | USA |

62 | Vigeo | France |

63 | Vonix | Austria |

64 | Westpac Investment Management Corporation | Australia |

65 | Zurcher Kantonalbank | Switzerland |

Appendix 3: Item-by-Item Analysis

Community Index (CI)

Items | Mean | Std. deviation | N |

|---|---|---|---|

11. Corporate giving program and amount given | 3.10 | 1.51 | 98 |

10. Partnership with local Schools or community-based groups | 3.05 | 1.56 | 98 |

9. Public/private partnership | 2.99 | 1.62 | 98 |

6. Community programs | 2.85 | 1.58 | 98 |

7. Employee volunteer program | 2.56 | 1.72 | 98 |

2. Exceptional and innovative charitable-giving programs | 2.39 | 1.58 | 98 |

8. Current and former workforce volunteering (in percent) | 2.14 | 1.72 | 98 |

4. Exceptional volunteer program | 1.92 | 1.61 | 98 |

1. Contribution to charitable foundations | 1.52 | 1.82 | 98 |

3. Performance in community activism | 1.42 | 1.72 | 98 |

5. New initiative and awards received | 1.31 | 1.82 | 98 |

12. Commitment to donating | 0.51 | 1.32 | 98 |

Diversity Index (DI)

Items | Mean | Std. deviation | N |

|---|---|---|---|

1. Commitment to workforce diversity | 2.74 | 1.68 | 98 |

12. Recruitment and promotion | 2.50 | 1.77 | 98 |

2. Hiring and promoting minority and women | 2.41 | 1.75 | 98 |

14. Standards for overseas operations | 2.13 | 1.88 | 98 |

6. Implementation of innovative work/life programs | 1.91 | 1.88 | 98 |

3. Representation of women and minorities | 1.83 | 1.86 | 98 |

13. Discrimination in hiring and promotion | 1.48 | 1.85 | 98 |

21. Minorities constituents to have more of a voice | 1.39 | 1.34 | 98 |

7. Women’s training for advancement | 0.99 | 1.62 | 98 |

4. Training and advancement programs on diversity | 0.97 | 1.6 | 98 |

15. Diversity-related issues | 0.91 | 1.64 | 98 |

19. Women in advertising and marketing materials | 0.74 | 0.88 | 98 |

5. Participation in women and minority programs | 0.72 | 1.38 | 98 |

17. Women and minorities at position with substantial profit (loss) | 0.7 | 1.46 | 98 |

8. Diversity training for employees | 0.69 | 1.43 | 98 |

18. Gender equality in wages | 0.14 | 0.7 | 98 |

9. History of violations—abusive labor conditions | 0.05 | 0.41 | 98 |

16. Exclusion of women from top management position | 0.04 | 0.24 | 98 |

20. Civil discrimination lawsuit against the company | 0.04 | 0.24 | 98 |

10. Equal employment opportunity | 0.01 | 0.1 | 98 |

11. Open work environment | 0.01 | 0.1 | 98 |

Environmental Index (EI)

Items | Mean | Std. deviation | N |

|---|---|---|---|

1. Written code of business conduct | 2.78 | 1.63 | 98 |

2. Beyond the legal minimums | 2.54 | 1.85 | 98 |

3. Equal employment opportunity codes | 2.16 | 1.74 | 98 |

4. Conflict of interest | 1.64 | 1.78 | 98 |

5. Commercial bribery | 1.64 | 1.76 | 98 |

6. International business relationships | 1.36 | 1.64 | 98 |

7. Use of confidential and proprietary information | 1.31 | 1.58 | 98 |

8. Export compliance and international economic sanctions | 1.28 | 1.66 | 98 |

9. Political contributions | 1.15 | 1.49 | 98 |

10. Antitrust and competition laws | 1.07 | 1.44 | 98 |

11. Health, safety and environment | 1.01 | 1.48 | 98 |

12. Harassment | 0.77 | 1.09 | 98 |

13. Operated within framework of code of business conduct | 0.6 | 0.88 | 98 |

Rights and permissions

About this article

Cite this article

Ameer, R., Othman, R. Sustainability Practices and Corporate Financial Performance: A Study Based on the Top Global Corporations. J Bus Ethics 108, 61–79 (2012). https://doi.org/10.1007/s10551-011-1063-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10551-011-1063-y