Abstract

The rising level of long-term care (LTC) expenditures and their financing sources are likely to impact savings and capital accumulation and henceforth the pattern of growth. This paper studies how the joint interaction of the family, the market and the State influences capital accumulation and welfare in a society in which the assistance the children give to dependent parents is triggered by a family norm. We find that with a family norm in place, the dynamics of capital accumulation differ from those of a standard Diamond (Am Econ Rev 55:1126–1150, 1965) model with dependence. For instance, if the family help is sizeably more productive than other LTC financing sources, pay-as-you-go social insurance might be a complement to private insurance and foster capital accumulation.

Similar content being viewed by others

Notes

Source: European Commission (2013a).

For more details, see European Commission (2013b).

Brown and Finkelstein (2011) provide an overview of the economic and policy issues surrounding insuring LTC expenditure risk. They also discuss the likely impact of recent LTC public policy initiatives.

Family ties have been shown to matter for evaluating the impact of PAYG systems. For instance, Lambrecht et al. (2005) find that PAYG pensions may foster growth, in a model in which altruistic parents may affect their children’s income through education and bequests.

The crucial impact of social norms (family ties) in LTC financing is emphasized, among others, by Costa-Font (2010).

According to Pauly (1990), families rationally decide to forego the purchase of LTC insurance due to intrafamily moral hazard. Instead of purchasing insurance, parents will rely on the bequest motive to induce children to provide care. Under both complete and incomplete information, Jousten et al. (2005), Pestieau and Sato (2008), and Kuhn and Nuscheler (2011) study the optimal design of a LTC policy when children are heterogeneous with respect to the degree of altruism toward parents.

For a broader overview, see also Brown and Finkelstein (2011).

As we showed in an earlier draft, considering a loading factor on the insurance premium does not qualitatively modify the analysis.

The underlying assumption is that children are credit constrained.

This reduced form is in the spirit of the ones generally used in education models which consider that the dynamics of human capital accumulation follows a known (exogenous or endogenous) process.

For an application of this method to a model of LTC financing without capital accumulation, see Canta and Pestieau (2013).

There exist several stages of dependence that can be characterized by the dependent elderly’s ability to perform in different areas of cognition and functioning: orientation, memory, judgment, home and hobbies, personal care, and community.

We thus implicitly assume that a child’s help is subject to payroll taxation exactly like precautionary savings and private LTC insurance. The alternative, implying \(c_t = (1-\tau )(1-x_t)w_t-s_t-i_t\), would not have produced very different results.

The assumption that \(H^{\text {dep}'}(\kappa )>H^{\text {not dep}'}(\kappa )=u'(\kappa )\) may be disputed (see, for instance, Finkelstein et al. 2009, 2013), since some goods may substitute or complement good health. Our assumption remains reasonable up to a certain wealth level, and we implicitly assume in this paper that this wealth threshold is not reached.

Since we always obtain bounded steady-state solutions, the resources of the economy are always finite and consumption is bounded by a threshold \(\kappa _{max}\). Since \(H^{\text {dep}}(\kappa )<H^{\text {not dep}}(\kappa )=u(\kappa )\) for any \(\kappa <{\widetilde{\kappa }}=u^{-1}[D/\xi ]\), it is sufficient to assume that D is such that \(\kappa _{max}<{\widetilde{\kappa }}\).

If \(0<\pi <\tau \), family help may vanish along the equilibrium path. We thus rule out this case (see Assumption 2).

In all figures illustrating the comparative statics with respect to the steady-state capital stock k, we always assume that k varies in a convex way. However, depending on the cases and the values of the parameters, k may also vary in a concave way.

If \(\tau >\pi \), then there exists a date after which \(x_{t}=0\), and we would be in the case studied in Sect. 3. The case \(x_0>1-\tau \) has already been excluded because children are credit constrained.

In Fig. 3, \(g(x)=\eta (x)^{\frac{1}{1-\alpha }}\) whereas \(h(x)=\mu (x)^{\frac{1}{1-\alpha }}\).

Note that this is not necessarily the case along the equilibrium path since \(\partial x_t/\partial \pi \) is negative when \(\pi >(1+x_{t-1}+\tau )/2\).

Note that \(\lambda (p_a)= \delta (1+\xi )p_a\tau \), which, together with \(\lambda '(p)>0\), implies that \(p_a>{\underline{p}}\).

References

Barcyzk, D., Kredler, M.: Evaluating long term care policy options, taking the family seriously. Working paper (2014)

Brown, J.R., Finkelstein, A.: The interaction of public and private insurance: medicaid and the long-term care insurance market. Am. Econ. Rev. 98, 1083–1102 (2008)

Brown, J.R., Finkelstein, A.: Insuring long-term care in the US. J. Econ. Perspect. 25, 119–142 (2011)

Canta, C., Pestieau, P.: Long term care insurance and family norms. BE J. Econ. Anal. Pol. 14, 401–428 (2013)

Chakrabarti, A.: Endogenous fertility and growth in a model with old age support. Econ. Theory 13, 393–416 (1999)

Chen, Y.: Endogenous health investment, saving and growth. University of Olso, Health Economics Research Programme. Working paper 8 (2007)

Costa-Font, J.: Family ties and the crowding out of long-term care insurance. Oxf. Rev. Econ. Pol. 26, 691–712 (2010)

Costa-Font, J., Courbage, C.: Crowding out of long-term care Insurance: evidence from European Expectation Data. CESifo working paper 4910 (2014)

Cox, D., Stark, O.: On the demand for grandchildren: tied transfers and the demonstration effect. J. Public Econ. 89, 1665–1697 (2005)

Cremer, H., Pestieau, P., Ponthiere, G.: The economics of long-term care: a survey. Nord Econ Policy Rev 2, 107–148 (2012)

De Nardi, M., French, E., Jones, J.B.: Why do the elderly save? The role of medical expenses. J. Polit. Econ. 118, 37–75 (2010)

Diamond, P.: National debt in a neoclassical growth model. Am. Econ. Rev. 55, 1126–1150 (1965)

Ehrlich, I., Lui, F.: Intergenerational trade, longevity, and economic growth. J. Politi. Econ. 99, 1029–1059 (1991)

European Commission: the 2012 ageing report. Economic and Budgetary Projections for the 27 EU Member States (2010–2060) (2013a)

European Commission: long term care in aging society—challenges and policy options. Commission Staff Working Document (2013b)

Fan, C.S.: A model of intergenerational transfers. Econ. Theory 17, 399–418 (2001)

Finkelstein, A., Luttmer, E., Notowidigdo, M.: Approaches to estimating the health state dependence of the utility function. Am. Econ. Rev. 99, 116–121 (2009)

Finkelstein, A., Luttmer, E., Notowidigdo, M.: What good is wealth without health? The effect of health on the marginal utility of consumption. J. Eur. Econ. Assoc. 11, 221–258 (2013)

Fuster, L.: Effects of uncertain lifetime and annuity insurance on capital accumulation and growth. Econ. Theory 13, 429–445 (1999)

Gong, L., Li, H., Wang, D.: Health investment, physical capital accumulation, and economic growth. China Econ. Rev. 23, 1104–1119 (2012)

Hemmi, N., Tabata, K., Futagami, K.: The long-term care problem, precautionary saving, and economic growth. J. Macroecon. 29, 60–74 (2007)

Jousten, A., Lipszyc, B., Marchand, M., Pestieau, P.: Long term care insurance and optimal taxation for altruistic children. FinanzArchiv 61, 1–18 (2005)

Klimaviciute, J., Perelman, S., Pestieau, P., Schoenmaeckers, J.: Caring for elderly parents: Is it altruism, exchange or family norm? CREPP, Université de Liège. Working paper (2015)

Kopecky, K., Koreshkova, T.: The impact of medical and nursing home expenses on savings. Am. Econ. J. Macroecon. 6, 29–72 (2014)

Kuhn, M., Nuscheler, R.: Optimal public provision of nursing homes and the role of information. J. Health Econ. 30, 795–810 (2011)

Lambrecht, S., Michel, P., Vidal, J.-P.: Public pensions and growth. Eur. Econ. Rev. 49, 1261–1281 (2005)

Leroux, M.-L., Pestieau, P.: Social security and family support. Can. J. Econ. 47, 115–143 (2014)

Lowenstein, A., Daatland, S.: Filial norms and family support in a comparative cross-national context: evidence from the OASIS study. Ageing Soc. 26, 203–223 (2006)

Mellor, J.: Long-term care and nursing home coverage: Are adult children substitutes for insurance policies? J. Health Econ. 20, 527–547 (2001)

Pauly, M.V.: The rational non-purchase of long-term care insurance. J. Polit. Econ. 95, 153–168 (1990)

Pestieau, P., Sato, M.: Long-term care: the state, the market and the family. Economica 75, 435–454 (2008)

Siciliani, L.: The economics of long-term care. BE J. Econ. Anal. Pol. 14, 343–375 (2013)

Silverstein, M., Gans, D., Yang, F.: Intergenerational support to aging parents: the role of norms and needs. J. Fam. Issues 27, 1068–1084 (2006)

Stark, O.: Altruism and beyond. Cambridge University Press, Cambridge, UK (1995)

Stuifbergen, M., Van Delden, J.M.: Filial obligations to elderly parents: A duty to care? Med. Health Care Philos. 14, 63–71 (2011)

Zhang, J., Zhang, J.: Social security, intergenerational transfers, and endogenous growth. Can. J. Econ. 31, 1225–1241 (1998)

Author information

Authors and Affiliations

Corresponding author

Additional information

The authors would like to thank two anonymous referees, as well as participants and discussants at UQAM, University of Strasbourg, the Norwegian–German seminar in Public Economics 2013, the La Rochelle Economic Dynamics Days 2013, the Paris-SCOR meeting 2014 on Long Term Care, the Toulouse TIGER conference 2014, and the IIPF Conference 2014 and 2015 for useful comments and suggestions. The authors acknowledge financial support from the Chair Fondation du Risque/SCOR “Risk Market and Value Creation”.

Appendices

Appendix 1: Capital accumulation and insurance behavior

An agent born in t chooses \(s_t\) and \(i_t\) to maximize \({\mathscr {W}}_t\) under the constraints \(s_{t}\ge 0\) and \(i_{t}\ge 0\). After computations, the first-order condition with respect to \(s_{t}\) is given by (4), and, when \(i_t>0\), the first-order condition with respect to \(i_t\) is equivalent to (5).

1.1 Insurance behavior depending on \(\delta \xi \) and \(\varepsilon (x_{t})\)

Merging (4) and (5) to eliminate their first term leads to the following equation: \( i_{t}/p=\xi s_{t}-\varepsilon (x_{t})w_{t+1}/R_{t+1}\). As \(\delta w_{t+1}=k_{t+1}R_{t+1}\) and \(k_{t+1}=s_t+i_t\), the equation can be rewritten as \([\delta /p+\varepsilon (x_{t})]i_{t}=[\delta \xi - \varepsilon (x_{t})]s_{t}\). Then, agents purchase LTC insurance if and only if \(\delta \xi >\varepsilon (x_{t})\) and insurance behaviors are described by (6).

1.2 Capital accumulation when \(i_t=0\)

As \(\delta w_{t+1}=k_{t+1}R_{t+1}\) and \(k_{t+1}=s_t\), (4) is equivalent to \(-1/[(1-\tau -x_t\mathbb {1})w_{t}-k_{t+1}]+\delta \beta p(1+\xi )/\{[\delta +\tau /p+\psi ^\sigma (x_t) \mathbb {1}] k_{t+1}\}+\delta \beta (1-p)/\{[\delta +\gamma \psi ^\sigma (x_t) \mathbb {1}]k_{t+1}\}=0\). As \(w_t=A(1-\alpha )k_t^\alpha \), we obtain \(\{[\delta +\tau /p+\psi ^\sigma (x_t)\mathbb {1}] [\delta +\gamma \psi ^\sigma (x_t)\mathbb {1}]+\delta \beta p(1+\xi )[\delta +\gamma \psi ^\sigma (x_t)\mathbb {1}]+\delta \beta (1-p)[\delta +\tau /p+\psi ^\sigma (x_t) \mathbb {1})]\}k_{t+1}=A(1-\alpha )(1-\tau -x_t\mathbb {1})\{\delta \beta p(1+\xi )[\delta +\gamma \psi ^\sigma (x_t) \mathbb {1}]+\delta \beta (1-p)[\delta +\tau /p+\psi ^\sigma (x_t)] \mathbb {1})]\}k_t^\alpha \). Then, according to “Insurance behavior depending on \(\delta \xi \) and \(\varepsilon (x_{t})\)” of Appendix, \(k_{t+1}=\eta _d k_t^\alpha \) when \(\pi =0\) and \( \delta \xi \le \varepsilon (x_{t})\), whereas \(k_{t+1}=\eta (x_t) k_t^\alpha \) when \(\gamma =0\), \(\pi >\tau \ge 0\) and \( \delta \xi \le \varepsilon (x_{t})\).

1.3 Capital accumulation when \(i_t>0\)

As \(i_t>0\), we obtain from (6) that \([\delta /p+\varepsilon (x_{t})]i_t=[\delta \xi -\varepsilon (x_{t})]s_t\). Using (3), we then get \(i_t=p[\delta \xi -\varepsilon (x_{t})]k_{t+1}/[\delta (1+p\xi )]\) and \(s_{t}=[\delta +p\varepsilon (x_{t})]k_{t+1}/[\delta (1+p\xi )]\). Using these equations, we obtain \(\delta (1+p\xi )\{s_{t}+ i_{t}/p+[\tau /p+\psi ^\sigma (x_{t})\mathbb {1}]w_{t+1}/R_{t+1}\}=(1+\xi )k_{t+1}\{\delta +\tau +[p+(1-p)\gamma ]\psi ^\sigma (x_{t})\mathbb {1}\}\). Using (2) and (5) we get \(\beta \delta A(1-\alpha )(1+p\xi )(1-\tau -x_{t}\mathbb {1})k_t^\alpha =\{\delta [1+\beta (1+p\xi )]+\tau +[p+(1-p)\gamma ]\psi ^\sigma (x_{t})\mathbb {1}\}k_{t+1}\). Then, according to “Insurance behavior depending on \(\delta \xi \) and \(\varepsilon (x_{t})\)” of Appendix, \(k_{t+1}=\mu _d k_t^\alpha \) when \(\pi =0\) and \(\delta \xi >\varepsilon (x_{t})\), whereas \(k_{t+1}=\mu (x_t) k_t^\alpha \) when \(\gamma =0\), \(\pi >\tau \ge 0\) and \(\delta \xi >\varepsilon (x_{t})\).

Appendix 2: Results of Sect. 3 (\(\pi =0\))

1.1 Capital accumulation when \(\pi =0\)

According to “Capital accumulation when \(i_t=0\)” and “Capital accumulation when \(i_t>0\)” of Appendix, the dynamics are described by (8). Since the sign of \(p\delta \xi -\tau \) is time independent, no switch in the insurance behavior is possible. As \(k_{t+1}\) is an increasing and concave function of \(k_t\), the capital stock \(k_{t}\) converges monotonically to the unique positive steady-state \(k^{d}\). When \(\tau =0\), since \(\eta _d=\mu _d=\zeta _p\) and \(p\delta \xi >\tau \), individuals insure and the dynamics of capital accumulation \(k_{t+1}=\zeta _pk_t^\alpha \) converge to \(k_{d|_{\tau =0}}\).

1.2 Comparative statics with respect to p when \(\pi =\tau =0\)

As \(\partial \zeta _p/\partial p=A(1-\alpha )\beta \xi /[1+(1+p\xi )\beta ]^2\) is positive, \(k_{d|_{\tau =0}}=\zeta _p^\frac{1}{1-\alpha }\) increases in p.

1.3 Comparative statics with respect to \(\tau \) when \(\pi =0\)

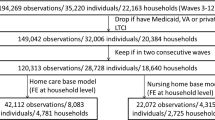

As \(\partial \eta _d/\partial \tau =-A\alpha \beta (1-\alpha )^2p^2(1+\xi )(1-\tau )/\{\alpha p[1+(1+p\xi )\beta ]+(1-\alpha )[1+(1-p)\beta ]\tau \}^2-\eta _d/(1-\tau )\) is negative, \(k_d^n=\eta _d^\frac{1}{1-\alpha }\) decreases in \(\tau \). As the nominator of \(\mu _d\) decreases in \(\tau \) while the nominator increases, \(k_d^i=\mu _d^\frac{1}{1-\alpha }\) decreases in \(\tau \). Then, the capital stocks \(k_d^i\) and \(k_d^n\) are both decreasing functions of \(\tau \). Using “Insurance behavior depending on \(\delta \xi \) and \(\varepsilon (x_{t})\)” of Appendix, it is straightforward to show that individuals insure if and only if \(\tau <\tau _{a}=\min \{p\delta \xi ,1\}\). We thus obtain Fig. 1.

Appendix 3: Results of Sect. 4 (\(\pi >\tau \ge 0\))

According to “Capital accumulation when \(i_t=0\)” and “Capital accumulation when \(i_t>0\)” of Appendix, we obtain the two-dimensional dynamical system described by (1) and (9). Then, the existence and the uniqueness of the positive steady state, denoted (\({\widetilde{k}}, {\widetilde{x}}\)), are straightforward.

1.1 Dynamics of family help

The dynamics of \(x_t\), described by (1) and represented in Fig. 2, are straightforward and independent of k. Then, the locus \(x_{t+1}=x_t\) expressed as a function of k is a vertical line with abscissa \({\widetilde{x}}\) in the plan (x, k). To the left of this line, \(x_{t+1}-x_t>0\) and, for any \(k>0\), \(x_t\) converges toward \({\widetilde{x}}\). To the right of this line, \(x_{t+1}-x_t<0\) and, for any \(k>0\), \(x_t\) converges toward \({\widetilde{x}}\).

1.2 Local dynamics with no insurance

Assume that from a date \(\kappa \ge 0\), agents do not insure. The locus \(k_{t+1}-k_t=0\) as a function of x can be written as \(g(x)=\eta (x)^{\frac{1}{1-\alpha }}\). Let us define \(a(x)=\alpha [1+(1+p\xi )\beta ]+(1-\alpha )[1+(1-p)\beta ]\varepsilon (x)\). After computations we get \(\eta '(x)=-\eta (x)/(1-\tau -x)-\alpha A p \beta (1-\alpha )^2(1+\xi )(1-\tau -x)\varepsilon '(x)/a(x)^2\). Since \(1-\tau -x>0\), \(\eta (x)>0\), \(a(x)>0\), and \(\varepsilon '(x)=\sigma \pi \psi (x)^{\sigma -1}>0\), it is straightforward to show that \(\eta '(x)<0\) and \((1-\tau -x)\eta '(x)+\eta (x)<0\). After computations, we also get \(\eta ''(x)=-[(1-\tau -x)\eta '(x)+\eta (x)]/(1-\tau -x)^2-\alpha A p \beta (1-\alpha )^2(1+\xi )\{[\varepsilon ''(x)(1-\tau -x)-\varepsilon '(x)]a(x)-2a'(x)\varepsilon '(x)(1-\tau -x)\}/a(x)^3\). Since \(1-\tau -x>0\), \(a(x)>0\), \(\varepsilon '(x)>0\), \(a'(x)>0\), \((1-\tau -x)\eta '(x)+\eta (x)<0\), and \(\varepsilon ''(x)=-\sigma (1-\sigma )\pi ^2\psi (x)^{\sigma -2}<0\) it is possible to show that \(\eta ''(x)>0\).

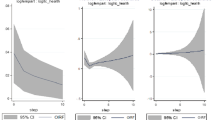

As \(\eta (x)\) is a decreasing and convex function of x, g(x) is also a decreasing and convex function of x. The equation \(k_{t+1}=g(x)^{1-\alpha }k_t^\alpha \) can be rewritten as \(k_{t+1}-k_t=[(g(x)/k_t)^{1-\alpha }-1]k_t\). Thus, below the curve \(k_{t+1}=k_t\), for any \(x\in (0,1-\tau )\), \(k_t\) converges toward g(x). Above the curve \(k_{t+1}-k_t<0\), for any \(x\in (0,1-\tau )\), \(k_t\) converges toward g(x). Then, using “Dynamics of family help” of Appendix, the dynamics in the neighborhood of (\({\widetilde{k}}^n,{\widetilde{x}}\)) are described in Fig. 3a.

1.3 Local dynamics with insurance

Assume that from a date \(\kappa \ge 0\), agents insure. The locus \(k_{t+1}-k_t=0\) as a function of x can be written as \(h(x)=\mu (x)^{\frac{1}{1-\alpha }}\). Let us define \(b(x)=\alpha [1+(1+p\xi )\beta ]+(1-\alpha )p\varepsilon (x_{t})\). After computations, we get \(\mu '(x)=-[1/(1-\tau -x)+b'(x)/b(x)]\mu (x)\). Since \(\mu (x)>0\), \(b(x)>0\), and \(b'(x)=(1-\alpha )p\sigma \pi \psi (x)^{\sigma -1}>0\), it is straightforward to show that \(\mu '(x)<0\) and \(\mu '(x)+\mu (x)/(1-\tau -x)<0\). After computations, we also get \(\mu ''(x)=-[\mu '(x)+\mu (x)/(1-\tau -x)]/(1-\tau -x)-\mu '(x)b'(x)/b(x)-[b(x)b''(x)-b'(x)^2]\mu (x)/b(x)^2\). Since \(1-\tau -x>0\), \(b(x)>0\), \(b'(x)>0\), \(b''(x)=-(1-\alpha )p\sigma (1-\sigma )\pi ^2\psi (x)^{\sigma -2}<0\), \(\mu (x)>0\), \(\mu '(x)<0\), and \(\mu '(x)+\mu (x)/(1-\tau -x)<0\), it is possible to show that \(\mu ''(x)>0\).

Since \(\mu (x)\) is a decreasing and convex function of x, h(x), which represents \(k_{t+1}-k_t=0\), is also a decreasing and convex function of x. The equation \(k_{t+1}=h(x)^{1-\alpha }k_t^\alpha \) can be rewritten as \(k_{t+1}-k_t=[(h(x)/k_t)^{1-\alpha }-1]k_t\). Below the curve \(k_{t+1}=k_t\), for any \(x\in (0,1-\tau )\), \(k_t\) converges toward h(x). Above the curve, for any \(x\in (0,1-\tau )\), \(k_t\) converges toward h(x). Then, using “Dynamics of family help” of Appendix, the dynamics in the neighborhood of (\({\widetilde{k}}^i,{\widetilde{x}}\)) are described in Fig. 3b.

1.4 Global dynamics: the different regimes

First, note that \(\mu (x_{t})=\eta (x_{t})\) if and only if \(\delta \xi =\varepsilon (x_{t})\). Then, since \(\eta (x_{t})\) is decreasing in \(\xi \) while \(\mu (x_{t})\) increases in \(\xi \), \(\mu (x_{t})\gtreqqless \eta (x_{t})\) if and only if \(\delta \xi \gtreqqless \varepsilon (x_{t})\). Since \(\varepsilon (x)\) increases in x, g(x) and h(x) cannot cross in more than one point: the point \({\widehat{x}}\) such that \(\varepsilon ({\widehat{x}})=\delta \xi \). Consequently, individuals insure for any \(x_t<{\widehat{x}}\) and do not insure for any \(x_t>{\widehat{x}}\). Since the dynamics of \(x_{t}\) are monotonic (increasing if \(x_{0}<{\widetilde{x}}\) and decreasing if \(x_{0}>{\widetilde{x}}\)) and independent of \(k_{t}\), and using the fact that \(k_{t+1}=\max \{g(x_{t})^{1-\alpha },h(x_{t})^{1-\alpha }\} k_t^\alpha \), we can distinguish four types of dynamics. Regime I occurs when \(\delta \xi \le \min \{ \varepsilon (x_0),\varepsilon ({\widetilde{x}})\}\). As \(g(x)\ge h(x)\), agents do not insure and, according to “Local dynamics with no insurance” of Appendix, we obtain the dynamics of Fig. 3a. Regime II occurs when \(\delta \xi > \max \{\varepsilon (x_0),\varepsilon ({\widetilde{x}})\}\). As \(h(x)>g(x)\), agents insure and, according to “Local dynamics with insurance” of Appendix, we obtain the dynamics of Fig. 3b. Regime III occurs when \(\varepsilon ({\widetilde{x}})<\delta \xi \le \varepsilon (x_0)\). As long as \(t\le T=E\left[ \ln \left\{ \pi -\tau -{\widehat{x}}/(\pi -\tau -x_{0})\right\} /\ln (\pi -\tau )\right] +1\), \(x_{t}>{\widehat{x}}\) decreases and agents do not insure because \(h(x)\le g(x)\). When \(t>T\), \(x_{t}<{\widehat{x}}\), \(h(x)>g(x)\) and individuals insure. Then, according to “Dynamics of family help” and “Local dynamics with no insurance” of Appendix, we obtain the dynamics of Fig. 3c. Regime IV occurs when \(\varepsilon (x_0)<\delta \xi \le \varepsilon ({\widetilde{x}})\). As long as \(t<T'=E\left[ \ln \left\{ {\widehat{x}}-\pi +\tau /(x_{0}-\pi +\tau )\right\} /\ln (\pi -\tau )\right] +1\), \(x_{t}<{\widehat{x}}\) increases and agents insure because \(h(x)>g(x)\). When \(t\ge T'\), \(x_{t}>{\widehat{x}}\), \(h(x)\le g(x)\) and agents do not insure. Then, according to “Dynamics of family help” and “Local dynamics with insurance” of Appendix, we obtain the dynamics of Fig. 3d.

Appendix 4: Comparative statics (\(\pi >\tau \ge 0\))

1.1 Insurance behavior according to \(\pi \), p and \(\tau \)

By definition, we have \(\varepsilon ({\widetilde{x}})\equiv \tau /p+[1-\gamma (1+\xi )](\pi -\tau )^\sigma \). As \(\partial \varepsilon ({\widetilde{x}})/\partial \pi =[1-\gamma (1+\xi )]\sigma (\pi -\tau )^{\sigma -1}\), \(\varepsilon ({\widetilde{x}})\) is increasing in \(\pi \). As \(\partial \varepsilon ({\widetilde{x}})/\partial p=-\tau /p^2\), \(\varepsilon ({\widetilde{x}})\) is independent of p when \(\tau =0\) and decreasing in p when \(\tau >0\). As \(\partial \varepsilon ({\widetilde{x}})/\partial \tau =1/p-[1-\gamma (1+\xi )]\sigma (\pi -\tau )^{\sigma -1}\), \(\partial \varepsilon ({\widetilde{x}})/\partial \tau \) has the sign of \({\underline{\tau }}-\tau \) with \({\underline{\tau }}=\pi -[p\sigma (1-\gamma (1+\xi ))]^{1/(1-\sigma )}\). Then, \(\varepsilon ({\widetilde{x}})\) always decreases in \(\tau \) when \(\pi <[p\sigma (1-\gamma (1+\xi ))]^{1/(1-\sigma )}\) and is always increasing up to \({\underline{\tau }}\) and decreasing afterward when \(\pi \ge [p\sigma (1-\gamma (1+\xi ))]^{1/(1-\sigma )}\). According to these variations and since private LTC insurance is positive if and only if \(\delta \xi >\varepsilon ({\widetilde{x}})\), it is straightforward to prove the existence of the thresholds \(\pi _a\), \(p_a\), \(\tau _b\), \(\tau _c\), and \(\tau _d\) and, consequently, to obtain the results of the paragraph “Insurance behavior” in Section 4.3.

1.2 Comparative statics with respect to \(\pi \) when \(\pi >\tau \ge 0\)

Since \(\partial \eta ({\widetilde{x}})/\partial \pi =-\alpha A(1-\alpha )^2(1-\pi )\beta p (1+\xi )\sigma (\pi -\tau )^{\sigma -1}/\{\alpha [1+(1+p\xi )\beta ]+(1-\alpha )[1+(1-p)\beta ]\varepsilon ({\widetilde{x}})\}^2- \eta ({\widetilde{x}})/(1-\pi )\), then \(\partial \eta ({\widetilde{x}})/\partial \pi <0\). Since the nominator of \(\mu ({\widetilde{x}})\) decreases in \(\pi \) while the nominator increases, \(\partial \mu ({\widetilde{x}})/\partial \pi <0\). As \(\eta ({\widetilde{x}})\) and \(\mu ({\widetilde{x}})\) are decreasing functions of \(\pi \), \({\widetilde{k}}^{n}=\eta ({\widetilde{x}})^{\frac{1}{1-\alpha }}\) and \({\widetilde{k}}^{i}=\mu ({\widetilde{x}})^{\frac{1}{1-\alpha }}\) are also decreasing functions of \(\pi \). According to “Insurance behavior according to \(\pi \), p and \(\tau \)” of Appendix, we thus obtain Fig. 4.

1.3 Comparative statics with respect to p when \(\pi >\tau \ge 0\)

After computations, \(\partial \eta ({\widetilde{x}})/\partial p\) has the sign of \([\delta \xi -\varepsilon ({\widetilde{x}})][\alpha +(1-\alpha )\varepsilon ({\widetilde{x}})]+\alpha (1+\xi )\tau /p\), and \(\partial \mu ({\widetilde{x}})/\partial p\) has the sign of \([\delta \xi -\varepsilon ({\widetilde{x}})]+(1+p\xi )\tau /p\).

Consider the subcase where \(\tau =0\). If \(\delta \xi \le \varepsilon ({\widetilde{x}})=\pi ^\sigma \), then individuals do not insure and \(\partial \eta ({\widetilde{x}})/\partial p<0\). Then, \({\widetilde{k}}^{n}=\eta ({\widetilde{x}})^{\frac{1}{1-\alpha }}\) is decreasing in p. If \(\delta \xi >\pi ^\sigma \), individuals insure and \(\partial \mu ({\widetilde{x}})/\partial p>0\). Then, \({\widetilde{k}}^{i}=\mu ({\widetilde{x}})^{\frac{1}{1-\alpha }}\) is increasing in p. We thus obtain Fig. 5.

Consider the subcase where \(\tau >0\). As p increases from 0 to 1, the threshold \(\varepsilon ({\widetilde{x}})\) decreases from \(+\infty \) to \(\tau +(\pi -\tau )^\sigma \). Consequently, when \(\delta \xi \le \tau +(\pi -\tau )^\sigma \) individuals decide not to insure and the steady-state capital stock is \({\widetilde{k}}^{n}\). As \(\varepsilon ({\widetilde{x}})=\tau /p+(\pi -\tau )^\sigma \), the sign of \(\partial \eta ({\widetilde{x}})/\partial p\) is, after computations, the one of \(\lambda (p)\equiv [\delta \xi -(\pi -\tau )^\sigma ][\delta +(\pi -\tau )^\sigma ]p^2+2[\delta \xi -(\pi -\tau )^\sigma ]\tau p-\tau ^2\). When \(\delta \xi \le (\pi -\tau )^\sigma \), it is straightforward that \(\partial \eta ({\widetilde{x}})/\partial p<0\). Then, \({\widetilde{k}}^{n}=\eta ({\widetilde{x}})^{\frac{1}{1-\alpha }}\) is always decreasing in p. When \((\pi -\tau )^\sigma <\delta \xi \le \tau +(\pi -\tau )^\sigma \), \(\lambda (p)\) is increasing in p and is negative in \(p=0\). Then, there exists a (unique) threshold \({\underline{p}}\) such that \(\eta ({\widetilde{x}})\) (and also \({\widetilde{k}}^{n}=\eta ({\widetilde{x}})^{\frac{1}{1-\alpha }}\)) is decreasing up to \({\underline{p}}\) and increasing afterward. We thus obtain Fig. 6a.

When \(\delta \xi >\tau +(\pi -\tau )^\sigma \), \(p_a=\tau /[\delta \xi -(\pi -\tau )^\sigma ]\in (0,1)\) and individuals decide to insure if and only if \(p>p_a\). When \(p\le p_a\), the steady-state capital stock is \({\widetilde{k}}^{n}\). According to the previous paragraph, \({\widetilde{k}}^{n}\) is decreasing up to \({\underline{p}}\) and increasing afterward.Footnote 26 When \(p>p_a\), the steady-state capital stock is \({\widetilde{k}}^{i}\). Since \(\delta \xi >\varepsilon \), we have \(\partial \mu ({\widetilde{x}})/\partial p>0\). Then, \({\widetilde{k}}^{i}=\mu ({\widetilde{x}})^{\frac{1}{1-\alpha }}\) is increasing in p. We thus obtain Fig. 6b.

1.4 Comparative statics with respect to \(\tau \) when \(\pi >\tau \ge 0\)

It is straightforward that both \(\partial \eta ({\widetilde{x}})/\partial \tau \) and \(\partial \mu ({\widetilde{x}})/\partial \tau \) have the opposite sign of \(\partial \varepsilon ({\widetilde{x}})/\partial \tau \). Consider the subcase where \(0<\pi <(p\sigma )^{1/(1-\sigma )}\). As \(\partial \varepsilon ({\widetilde{x}})/\partial \tau <0\), \({\widetilde{k}}^{n}=\eta ({\widetilde{x}})^{\frac{1}{1-\alpha }}\) and \({\widetilde{k}}^{i}=\mu ({\widetilde{x}})^{\frac{1}{1-\alpha }}\) increase in \(\tau \). According to “Insurance behavior according to \(\pi \), p and \(\tau \)” of Appendix, we thus obtain Fig. 7a. Consider now the subcase where \(\pi >(p\sigma )^{1/(1-\sigma )}\). As \(\partial \varepsilon ({\widetilde{x}})/\partial \tau \) has the sign of \({\underline{\tau }}-\tau \) with \({\underline{\tau }}=\pi -(p\sigma )^{1/(1-\sigma )}\), \({\widetilde{k}}^{n}=\eta ({\widetilde{x}})^{\frac{1}{1-\alpha }}\) and \({\widetilde{k}}^{i}=\mu ({\widetilde{x}})^{\frac{1}{1-\alpha }}\) increase (resp: decrease) in \(\tau \) if \(\tau \) is greater (resp: lower) than \({\underline{\tau }}\). According to “Insurance behavior according to \(\pi \), p and \(\tau \)” of Appendix, we thus obtain Fig. 7b.

Appendix 5: Welfare implications

1.1 First best allocation

In the first best, the social planner allocates consumption levels, the family help x, and the capital stock k. Assuming, as in Sects. 4.2 and 4.3, that \(\gamma =0\), the utility of an individual born in t can be rewritten as \({\mathscr {W}}_t=\ln [a_t-x_tw_t]+\beta (1-p)\ln d_{t+1}+\beta p(1+\xi )\ln [m_{t+1}+x_{t+1}^\sigma w_{t+1}]-\beta p D\) where \(a_t\), \(d_t\), \(m_t\) denote private non-transferred resources. Given a social discount factor \(q\in (0,1)\), the problem of the social planner is

Using the first-order conditions with respect to \(a_t\), \(d_t\), and \(m_t\), we obtain the intertemporal consumption allocation, characterized by \(\beta [a_t-x_tw_t]=qd_t=q[m_t+x_t^\sigma w_t]/(1+\xi )\). Thus, in the first best, the marginal utility from consumption should be equalized across states and between old and young living in the same period.

The optimal family help is given by the first-order condition with respect to \(x_t\), i.e., \(\beta p(1+\xi )\sigma x_t^{\sigma -1}/(m_t+x_t^\sigma w_t)=q/(a_t-x_tw_t)\). Merging with the previous first-order conditions, we obtain \(x_t=(p\sigma )^{\frac{1}{1-\sigma }}=x^{FB}\).

The first best capital accumulation satisfies the first-order condition with respect to \(k_t\), \(\ell _{t-1}-q\ell _tf'(k_t)=\big [qx_t/(a_t-x_tw_t)-\beta p(1+\xi )x_t^\sigma /(m_t+x_t^\sigma w_t)\big ](\partial w_t/\partial k_t)\) where \(\ell _t\) is the Lagrange multiplier associated with the resource constraint in time t. First, note that without family help (\(x_t=0\)) this equation reduces, at the steady state, to \(f'(k)=1/q\), which is the modified golden rule. With our Cobb–Douglas production function, this can be rewritten as \(k^M=(q\alpha A)^{\frac{1}{1-\alpha }}\). Second, using the two previous first-order conditions, the first-order condition above simplifies to \(\ell _{t-1}-q\ell _tf'(k_t)=q\ell _t(px_t^\sigma -x_t)(\partial w_t/\partial k_t)\) which yields to the steady-state capital stock \(k^{FB}=\big [q\alpha A+q\alpha A(1-\alpha )(p\sigma )^{\frac{1}{1-\sigma }}(1/\sigma -1)\big ]^{\frac{1}{1-\alpha }}\). Finally, it is easy to show that \(k^M<k^{FB}\).

1.2 First best versus laissez-faire accumulation

According to “Comparative statics with respect to \(\pi \) when \(\pi >\tau \ge 0\)” of Appendix, the steady-state capital accumulation is decreasing in \(\pi \). The steady-state capital accumulation at the laissez-faire is denoted \(k^{LF}\) and corresponds to the case with no tax rate. Thus, as \(\pi \) increases from 0 to 1, \(k^{LF}\) decreases from \(k_d|_{\tau =0}\) to 0. Note that \(k_d|_{\tau =0}-k^{FB}\) has the sign of \(\beta (1+p\xi )/[1+\beta (1+p\xi )]-[q\alpha /(1-\alpha )][1+(1-\alpha )(p\sigma )^{\frac{1}{1-\alpha }}(1/\sigma -1)]\). As \(\alpha \) increases from 0 to 1, the second term increases from 0 to \(+\infty \). Consequently, \(k^{LF}\le k_d|_{\tau =0} <k^{FB}\) whenever \(\alpha \) is high enough. For lower levels of \(\alpha \), \(k_d|_{\tau =0}>k^{FB}\), so that there always exists a threshold \({\widehat{\pi }}\) such that \(k^{LF}<k^{FB}\) for \(\pi >{\widehat{\pi }}\), and \(k^{LF}>k^{FB}\) for \(\pi <{\widehat{\pi }}\).

Rights and permissions

About this article

Cite this article

Canta, C., Pestieau, P. & Thibault, E. Long-term care and capital accumulation: the impact of the State, the market and the family. Econ Theory 61, 755–785 (2016). https://doi.org/10.1007/s00199-016-0957-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00199-016-0957-4