Abstract

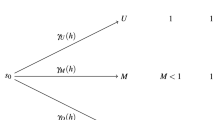

A competitive general equilibrium model with complete collateralized contracts under limited commitment is proposed and analyzed. With limited aggregate collateral, risk sharing is imperfect. There exists a minimal spanning set of finite collateralized contracts that generates the feasible space and that contains more than the complete set of collateralized Arrow securities. Examples show that exogenously restricting feasible contracts has a significant impact on agents’ welfare. I prove that constrained optimal allocations can be decentralized as a general equilibrium with collateral constraints, and vice versa. Because a capital good serves as collateral, it has an additional value, called collateral premium. The collateral premium is zero if and only if risk sharing is perfect. This is a testable implication of the model.

Similar content being viewed by others

References

Aiyagari S.: Uninsured idiosyncratic risk and aggregate saving. Q J Econ 109(3), 659–684 (1994)

Alvarez F., Jermann U.: Efficiency, equilibrium, and asset pricing with risk of default. Econometrica 68(4), 775–797 (2000)

Araujo A., Fajardo J., Páscoa M.: Endogenous collateral. J Math Econ 41(4–5), 439–462 (2005)

Araujo A., Monteiro P., Páscoa M.: Incomplete markets, continuum of states and default. Econ Theory 11(1), 205–213 (1998)

Araujo A., Páscoa M.: Bankruptcy in a model of unsecured claims. Econ Theory 20(3), 455–481 (2002)

Arrow K.: The role of securities in the optimal allocation of risk bearing. Rev Econ Stud 31(2), 91–96 (1964)

Binswanger H., Deininger K., Feder G.: Power, distortions, revolt and reform in agricultural land relations. Handbook Dev Econ 3(Part 2), 2659–2772 (1995)

Caballero R., Krishnamurthy A.: International and domestic collateral constraints in a model of emerging market crises. J Monet Econ 48(3), 513–548 (2001)

Dubey P., Geanakoplos J., Shubik M.: Default and punishment in general equilibrium. Econometrica 73(1), 1–37 (2005)

Fostel A., Geanakoplos J.: Collateral restrictions and liquidity under-supply: a simple model. Econ Theory 35(3), 441–467 (2008)

Geanakoplos, J.: Promises promises. In: Santa Fe Institute Studies in the Sciences of Complexity, vol. 27, pp. 285–320. Addison-Wesley, Reading (1997)

Geanakoplos, J.: Liquidity, default, and crashes. In: Advances in Economics and Econometrics: Theory and Applications. Eighth World Congress (2003)

Geanakoplos, J., Zame, W.: Collateralized asset markets. Technical report, UCLA Working Paper (2007)

Heaton J., Lucas D.: Evaluating the effects of incomplete markets on risk sharing and asset pricing. J Political Econ 104(3), 443 (1996)

Holmstrom B., Tirole J.: LAPM: a liquidity-based asset pricing model. J Finan 56(5), 1837–1867 (2001)

Kehoe T., Levine D.: Debt-constrained asset markets. Rev Econ Stud 60(4), 865–888 (1993)

Kilenthong, W.T.: Essays on general equilibrium with limited commitment. PhD Dissertation, University of Chicago (2006, June)

Kilenthong, W.T., Townsend, R.M.: Market based, segregated exchanges in securities with default risk. UCSB Working Paper (2009)

Kiyotaki N., Moore J.: Credit cycles. J Political Econ 105(2), 211–248 (1997)

Kocherlakota N.R.: Implications of efficient risk sharing without commitment. Rev Econ Stud 63(4), 595–609 (1996)

Krasa S., Sharma T., Villamil A.: Bankruptcy and firm finance. Econ Theory 36(2), 239–266 (2008)

Krishnamurthy A.: Collateral constraints and the amplification mechanism. J Econ Theory 111(2), 277–292 (2003)

Kubler F., Schmedders K.: Stationary equilibria in asset-pricing models with incomplete markets and collateral. Econometrica 71(6), 1767–1793 (2003)

Ligon E., Thomas J., Worrall T.: Informal insurance arrangements with limited commitment: theory and evidence from village economies. Rev Econ Stud 69(1), 209–244 (2002)

Lustig, H.: The market price of aggregate risk and the wealth distribution. UCLA Working Paper (2007)

Magill M., Quinzii M.: Theory of Incomplete Markets. MIT Press, USA (1996)

Milgrom P., Segal I.: Envelope theorems for arbitrary choice sets. Econometrica 70(2), 583–601 (2002)

Negishi T.: Welfare Economics and Existence of an Equilibrium for a Competitive Economy. Metroeconomica 12(2–3), 92–97 (1960)

Prescott E.S., Townsend R.M.: Firms as clubs in walrasian markets with private information. J Political Econ 114(4), 644–671 (2006)

Radner R.: Competitive equilibrium under uncertainty. Econometrica 36(1), 31–58 (1968)

Ray D.: Development Economics. Princeton University Press, Princeton (1998)

Sundaram R.: A First Course in Optimization Theory. Cambridge University Press, Cambridge (1996)

Townsend R.: Optimal contracts and competitive markets with costly state verification. J Econ Theory 21(2), 265–293 (1979)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Kilenthong, W.T. Collateral premia and risk sharing under limited commitment. Econ Theory 46, 475–501 (2011). https://doi.org/10.1007/s00199-010-0535-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00199-010-0535-0

Keywords

- Collateral premium

- Complete collateralized contracts

- General equilibrium

- Limited commitment

- Endogenous incomplete markets