Abstract

This paper provides a politico-economic theory that explains how an economy evolves when the longevity of its citizens is jointly determined with the process of economic development. We propose a three-period overlapping generation model where agents’ decisions embrace two dimensions: a private choice about education and a public one on innovation policy. We find that (a) poverty traps can emerge in human capital accumulation, (b) higher life expectancy increases the incentive to innovate for both young and adults, (c) different political configurations can arise depending on endogenous demographic structures and (d) the steady state can entertain both innovation and its absence.

Similar content being viewed by others

Notes

Figure 1 plots the average length of life and the distribution of time spent in educating, working and retiring for a 20-year-old person for the USA. Source: Lee (2001) and www.bls.gov.

The Economist (2010) recently brought concerns about the impact of the aging of voters on the public expenditure composition: “By 2050, more than a third of potential European Union voters will be over 65. [...] An army of retired boomers may vote for whooping sums to be spent on health care and pensions, against the wishes of younger taxpayers who might prefer spending on things like education”.

Since the seminal paper by Ben-Porath (1967), it is well documented both theoretically and empirically that a longer life makes agents more likely to invest in education, since the time span to enjoy the returns from education is longer.

Examples of technologies satisfying the requirements of our theory are the installment of large IT or energy infrastructures, such as broadband connections or nuclear plants. Furthermore, the adoption of new regulations affecting large institutional changes (financial or labour market regulation, for example) could fit our definition of systemic innovations.

It follows that we are not dealing with the risky process of producing new ideas, but with the process of implementing existing ideas in new ways that are more efficient, although not for everybody in the same way.

Poterba (1998) shows that public expenditure in primary and secondary schools is negatively correlated with the fraction of elderly residents. However, he also points out that international comparisons are difficult to perform. Both Japan and Italy share very long life expectancy values and large elderly indices, but they are at the opposite extremes of OECD countries in the ratio of spending per elderly individual to spending per child, with 2.3 and 3.8, respectively. This because demographically similar countries can behave very differently, due to institutional difference that interacts with demographic characteristics.

According to Bellettini and Ottaviano (2005), the central authority can be seen as a licensing system that has some agency to approve new technologies before they are brought to the market. Again in Mokyr (1998a)’s words: “almost everywhere some kind of non-marketing control and licensing has been introduced”. A recent example is the creation of standard-setting agencies such as the International Organization of Standardization.

See Galor (2005) for an overview on the literature.

We do not discuss the implementability and sustainability of the pension system as, among others, Bellettini and Berti Ceroni (1999) do. We assume that a commitment device between generations is in place and no one can default on it.

As Galasso and Profeta (2004) report, not all potential electors actually vote. In some countries, elderly voters have a higher turnout rate at elections than the young, thus leading to an overrepresentation of the elderly. This voting pattern is the strongest in the USA, where turnout rates among those aged 60–69 years is twice as high as among the young (18–29 years). Significant differences appear also in other countries: In France, the turnout rate of the elderly (60–69 years) is almost 50% higher than that of the young (18–29 years).

To avoid the possible emergence of Condorcet cycles, we rule out the multidimensional policy space by assuming each cohort pays the same share i of their income. This allows us to focus mainly on the role played by demographic changes in the emergence of a pro-adoption policy.

The positive effect of longevity on education is emphasized by Blackburn and Cipriani (2002), Chakraborty (2004) and Cervellati and Sunde (2005). For further evidence on the effect of health and living conditions on education attainments, see de la Croix and Licandro (1999), Lagerlof (2003) and Galor (2005).

Empirically, both private and aggregate endowment of human capital are conductive to a longer life, although we focus on the aggregate view: On the one hand, demographic and historical evidence suggests that the level of human capital profoundly affects the longevity of people. For example, the evidence presented by Mirowsky and Ross (1998) supports strongly the notions that better educated people are more able to coalesce health-producing behaviour into a coherent lifestyle, are more motivated to adopt such behaviour by a greater sense of control over the outcomes in their own lives and are more likely to inspire the same type of behaviour in their children. Schultz (1993, 1998) finds that children’s life expectancy increases with parent’s human capital and education. On the other hand, there is evidence that the human capital intensive inventions of new drugs increases life expectancy (Lichtenberg 1998, 2003) and societies endowed with a higher level of human capital are more likely to innovate, especially in medical research (Mokyr 1998b).

We assume that a commitment device is in place within the period. Given the existence of an external court able to fully enforce the contract, no one can default on the policy voted by the majority of population.

With the term progressive policy, we indicate the adoption of a new technology. Conversely, conservative policy means no adoption.

Being the two values of policy variable M = {I;N}, young born at time t face eight possible streams of policies: {I t ;I t + 1;I t + 2}; {I t ;I t + 1;N t + 2}; {I t ;N t + 1;I t + 2}; {I t ;N t + 1;N t + 2}; {N t ;I t + 1; I t + 2}; {N t ;I t + 1;N t + 2}; {N t ;N t + 1;I t + 2}; {N t ;N t + 1;N t + 2}. Adults at time t face four possible streams: {I t ;I t + 1};{I t ;N t + 1};{N t ;I t + 1};{N t ;N t + 1}. Old people just face the decision {I t } or {N t }.

More precisely, the best interpretation of old people’s p t is not in term of life expectancy, but as their mass in the political process at time t.

It is clear inspecting Eq. (11).

We refer to coalition as a situation in which the political choices of young and adults are the same, without any strategic meaning.

As an example, other kinds of dynamics include cases in which initial life expectancy is decreasing towards a lower steady state or cases in which the initial undertaken policy is I.

Without loss of generality, we assume that p 0 is the life expectancy of young born at time t = 0. Note that \(p_{0}\neq \underline{p}\): The former is the value of life expectancy that the economy shows at time t = 0, the latter is the value of life expectancy that function \(p\left( h\right) \) takes for h = 0.

The inequalities p A < 1 and p Y < 1 resolve in \(\frac{1-s}{1-s-i} <\left( \left( 1+\theta \right) \left( 1-\delta \right) ^{\gamma }\right) ^{ \frac{\beta }{\alpha }}\) and \(\frac{1}{1-i}<\left( 1+\theta \right) ^{\alpha +\beta }\) \(\left( 1-\delta \right) ^{\gamma \left( \alpha +\beta \epsilon \right) }\), respectively.

References

Aghion P, Howitt P (1998) Endogenous growth theory. MIT, Cambridge

Bauer M (1995) Resistance to new technology: nuclear power, information technology and biotechnology. Cambridge University Press, Cambridge

Becker GS, Tomes N (1986) Human capital and the rise and fall of families. J Labor Econ 4(3): 1–39

Bellettini G, Berti Ceroni C (1999) Is social security really bad for growth? Rev Econ Dynam 2(4):796–819

Bellettini G, Ottaviano GIP (2005) Special interest and technological change. Rev Econ Stud 72:43–56

Ben-Porath Y (1967) The production of human capital and the life cycle of earnings. J Polit Econ 75:352–365

Blackburn K, Cipriani GP (2002) A model of longevity, fertility and growth. J Econ Dynam Contr 26(2):187–204

Boucekkine R, De la Croix D, Licandro O (2002) Vintage human capital, demographic trends, and endogenous growth. J Econ Theor 104(2):340–375

Boucekkine R, Licandro O, Puch LA, del Rio F (2005) Vintage capital and the dynamics of the AK model. J Econ Theor 120(1):39–72

Bridgman BR, Livshits ID, MacGee JC (2007) Vested interests and technology adoption. J Monetary Econ 54(3):649–666

Canton EJF, de Groot HLF, Nahuis R (2002) Vested interests, population ageing and technology adoption. Eur J Polit Econ 18(4):631–652

Caselli F (2005) Accounting for cross-country income differences. In: Aghion P, Durlauf SN (eds) Handbook of economic growth, vol 1(1). North Holland, Amsterdam, pp 679–741

Cervellati M, Sunde U (2005) Human capital formation, life expectancy and process of economic development. Am Econ Rev 95(5):1653–1672

Chakraborty S (2004) Endogenous lifetime and economic growth. J Econ Theor 116(1):119–137

Chari VV, Hopenhayn H (1991) Vintage human capital, growth and the diffusion of new technology. J Polit Econ 99:1142–1165

de la Croix D, Licandro O (1999) Life expectancy and endogenous growth. Econ Lett 65(2):255–263

Fogel RW (1994) Economic growth, population theory and physiology: the bearing of long-term process on the making of economic policy. Am Econ Rev 84(3):369–395

Galasso V, Profeta P (2004) Lessons for an aging society: the political sustainability of social security systems. Econ Pol 19(38):63–115

Galor O (2005) From stagnation to growth: unified growth theory. In: Aghion P, Durlauf SN (eds) Handbook of economic growth, vol 1(1). North Holland, Amsterdam, pp 171–293

Jovanovic B (1997) Learning and growth. In: Kreps D, Wallis K (eds) Advances in economics and econometrics: theory and applications: seventh world congress, vol 2. Cambridge University Press, New York, pp 318–339

Krusell P, Rios-Rull JV (1996) Vested interest in a positive theory of stagnation and growth. Rev Econ Stud 63:301–329

Lagerlof N-P (2003) From Malthus to modern growth: the three regimes revisited. Int Econ Rev 44(2):755–777

Latulippe D (1996) Effective retirement age and duration of retirement in the industrial countries between 1950 and 1990. ILO Issues in Social Protection, discussion paper 2

Lee C (2001) The expected length of male retirement in the United States, 1850–1990. J Popul Econ 14(4):641–650

Lichtenberg NP (1998) Pharmaceutical innovation, mortality reduction and economic growth. NBER working paper 6569

Lichtenberg NP (2003) The impact of new drugs launches on longevity: evidence from longitudinal, disease-level data from 52 countries, 1998-2001. NBER working paper 9754

Mincer J (1974) Schooling, experience and earnings. Columbia University Press, New York

Mirowsky J, Ross CE (1998) Education, personal control, lifestyle and health—a human capital hypothesis. Res Ageing 20(4):415–449

Mokyr J (1990) The lever of riches: technological creativity and economic progress. Oxford University Press, New York

Mokyr J (1998a) The political economy of technological change: resistance and innovation in economic history. In Bergand M, Bruland K (eds) Technological revolutions in Europe. Edward Elgar, Cheltenham, pp 39–64

Mokyr J (1998b) Induced technical innovation and medical history: an evolutionary approach. J Evol Econ 8:119–137

Mokyr J (2002) The gifts of Athena: historical origins of the knowledge economy. Princeton University Press, Princeton

Olson M (1982) The rise and decline of nations—economic growth, stagflation and social rigidities. Yale University Press, New Heaven

Poterba JM (1998) Demographic structure and the political economy of public education. J Pol Anal Manag 16(1):48–66

Schultz PT (1993) Mortality decline in the low-income world: causes and consequences. Am Econ Rev 83(2):337–342

Schultz PT (1998) Health and schooling investments in Africa. J Econ Perspect 13(3):67–88

The Economist (2010) Europe’s worrying gerontocracy 395 (8677)

Acknowledgements

We are indebted to Graziella Bertocchi, Matteo Cervellati and Gianmarco Ottaviano for their constant advice and mentorship. Carlotta Berti Ceroni, Oded Galor, Alessia Russo, Gilles Saint-Paul and two anonymous referees provided valuable comments. We also thank participants at the 2nd BOMOPA Meeting in Padova, the “Institutional and Social Dynamics of Growth and Distribution” Conference in Lucca, the 2nd European Workshop on Labour Market and Demographic Change in Rostock, the 8th Workshop on Macroeconomic Dynamics in Milan, WPEG 2007 in Satiago del Chile, the “Jerusalem Conference on Economic Growth” at the Hebrew University and ASSET Meeting 2008 in Fiesole as well as the seminar participants at HWWI, IZA and at the Universities of Bologna, Modena, Siena and Toulouse for useful discussions. All errors are our own.

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Alessandro Cigno

Appendix

Appendix

Proof of Proposition 1

For simplicity, we drop the time index and substitute H with h. Let \(p\left( h\right) =\frac{p^{L}+p^{H}\left( \frac{h}{h^{F}}\right) ^{\sigma }\left(\frac{\sigma -1}{\sigma +1}\right)}{1+\left( \frac{h}{h^{F}}\right) ^{\sigma }\left( \frac{\sigma -1}{\sigma +1}\right)}\), with σ > 1 and 0 < h F < ∞. Straightforward algebra leads to \(p^{\prime }\left( h\right) \geq 0\), \(p^{\prime \prime }\left(h\right) \gtreqless 0\) for \( h\lesseqgtr h^{F}\), and \(p^{\prime }\left( h^{F}\right) =\frac{\left( p^{H}-p^{L}\right)}{4h^{F}}\left(\frac{\sigma ^{2}-1}{\sigma }\right) \). h F is therefore the value of h such that \(p\left( h\right)\) shows an inflection point. Note that \(p^{\prime }\left( h\right) |_{h=h^{F}}>0\) and \(\frac{\partial p^{\prime }\left( h\right) |_{h=h^{F}}}{\partial \sigma }>0\). From Eq. 10, we build the function \(\tilde{\Gamma} \left( p\left( h\right) ;h\right) =\Gamma \left( h_{t};i_{t}\right) h_{t}^{\epsilon }\), where we (a) separate the dependency from human capital and life expectancy and (b) drop the innovation variable i t . Varying λ we obtain that for h = h F, the limiting functions \(\tilde{\Gamma}\left(p^{L};h\right)\) and \(\tilde{\Gamma}\left(p^{H};h\right)\) take values below and above h F, respectively, i.e. \(\tilde{\Gamma}\left( p^{L};h^{F}\right) <h^{F}\) and \( \tilde{\Gamma}\left( p^{H};h^{F}\right) >h^{F}\). Since \(\lim_{\sigma \rightarrow +\infty }p^{\prime}\left( h^{F}\right) \rightarrow +\infty \), the function \(\tilde{\Gamma}\left( p\left(h\right);h\right)\) takes values \(\tilde{\Gamma}\left( p\left( h^{F}-\bigtriangleup h\right) ;\left( h^{F}-\bigtriangleup h\right) \right) <h^{F}\) and \(\tilde{\Gamma}( p( h^{F}+\bigtriangleup h) ;( h^{F}+\bigtriangleup h) ) >h^{F}\) for any ∆ h = o(h) > 0 and \(1<\sigma ^{M}\left( \bigtriangleup h\right) <\sigma <+\infty\), where \(\sigma ^{M}\left( \bigtriangleup h\right) \) is a threshold related to the \(\left(\text{arbitrary small}\right)\) magnitude of ∆ h. For continuity of \(\tilde{\Gamma}\left( p\left( h\right) ;h\right)\), there is a steady state at h F where function \(\tilde{\Gamma}\left( p\left( h\right);h\right)\) crosses the 45 degrees line from below. This steady state is therefore unstable. Calculus inspection shows that \(\frac{\partial \left( \tilde{\Gamma}\left( p\left( h\right) ;h\right) \right) }{\partial h} >0\) in [0; ∞ ), \(\lim_{h\rightarrow 0^{+}}\frac{\partial \left( \tilde{ \Gamma}\left( p\left( h\right) ;h\right) \right) }{\partial h}\rightarrow +\infty \) and \(\lim_{h\rightarrow +\infty }\frac{\partial \left( \tilde{ \Gamma}\left( p\left( h\right) ;h\right) \right) }{\partial h}\rightarrow 0^{+}\). With \(\tilde{\Gamma}\left( p\left( 0\right) ;0\right) =0\), by adopting the same logic, it is straightforward to prove that \(\tilde{\Gamma} \left( p\left( h\right) ;h\right) \) shows four steady states, alternatively unstable and stable: h U0 = 0, 0 < h S1 < h F, h U1 = h F and h F < h S2 < + ∞.□

Proof of Lemma 1

Adults get the absolute majority if and only if their share is bigger than \( \frac{1}{2}:\) imposing \(\frac{1}{\eta +1+p_{t}}>\frac{1}{2}\) we obtain p t < 1 − η. For similar considerations, it is easy to show that both \( \frac{\eta }{\eta +1+p_{t}}\) and \(\frac{p_{t}}{\eta +1+p_{t}}\) can not exceed \(\frac{1}{2}\).□

Proof of Lemma 2

The expression of p A is obtained from Eq. 16 solving \(\Delta u_{t}^{A}\left( p_{t+1}\right) =0\) for p t + 1. Given Eq. 17 and i > 0, the graph of \(\Delta u_{t}^{A}\left( p_{t+1}\right)\) has a negative intercept and crosses the \(\Delta u_{t}^{A}=0\) axis from below.□

Proof of Lemma 3

The expression of p Y is obtained from Eq. 21 solving \(\Delta u_{t}^{Y}\left( p_{t+2}\right) =0\) for p t + 2.□

Proof of Proposition 2

The strategy we follow to prove the first part of the Proposition is to break the two inequalities and to show that both cannot simultaneously hold for any parametrization of the model. Let us define

and

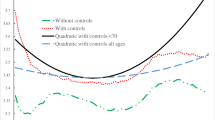

using Eqs. 19 and 23 and substituting β = α 2. We write the dependency of both Ψ1 and Ψ2 on α for brevity. It turns out that the two inequalities p A < p Y and p Y < 1 are both satisfied if both Ψ2 < 0 and Ψ1 > 0 hold, respectively. In Fig. 6, we show the shapes of these two functions in terms of α.□

Proof

The first order derivatives of Ψ1 and Ψ2 with respect to α are \(\Psi _{1}^{\prime }=\frac{\log \left( \left( 1+\theta \right) \left( 1-\delta \right) ^{\gamma }\right) }{\log \left( \left( 1+\theta \right) \left( 1-\delta \right) ^{\epsilon \gamma }\right) }+2\alpha \) and \( \Psi _{2}^{\prime }=\frac{\log \left( \left( 1+\theta \right) \left( 1-\delta \right) ^{\gamma }\right) }{\log \left( \left( 1+\theta \right) \left( 1-\delta \right) ^{\epsilon \gamma }\right) }+\frac{\log \left( \frac{ 1-s}{1-s-i}\right) }{\log \left( \left( 1+\theta \right) \left( 1-\delta \right) ^{\gamma }\right) }\). The second derivatives are \(\Psi _{1}^{\prime \prime }=2\) and \(\Psi _{2}^{\prime \prime }=0\), implying that Ψ2 is a quadratic function of α and for α > 0 it is increasing at an increasing rate. Ψ1 is a positively sloped straight line. For α = 0, both Ψ1 and Ψ2 take the same value \(\Psi \left( 0\right) _{1}=\Psi \left( 0\right) _{2}=\Psi \left( 0\right) _{n}=- \frac{\log \left( \frac{1}{1-i}\right) }{\log \left( \left( 1+\theta \right) \left( 1-\delta \right) ^{\epsilon \gamma }\right) }<0\), as shown in the graph. Moreover, Ψ2 is steeper than Ψ1, for any values of the parameters and for some small values of α \(\left( \text{from an inspection of }\Psi _{1}^{\prime }\text{ and }\Psi _{2}^{\prime }, \text{until }\frac{\log \left( \frac{1-s}{1-s-i}\right) }{\log \left( \left( 1+\theta \right) \left( 1-\delta \right) ^{\gamma }\right) }>2\alpha \right) \). Therefore, for α:0 ≤ α < α 2, Ψ2 < 0 holds, while it is not the case for Ψ1 > 0. Because of their shapes and their crossing in α = 0, Ψ1 and Ψ2 cross again for some positive value of α. If the crossing point \(\left( \Psi \left( \alpha _{c}\right) _{n}\right) \) of Ψ1 and Ψ2 lies below the α-axis and α c < 1, then there are values of α ∈ (α 1;α 2) such that both Ψ2 < 0 and Ψ1 > 0 hold at the same time. This cannot be the case because equating Ψ1 to Ψ2 gives \(\alpha _{c}=\frac{\log \left( \frac{1-s}{1-s-i}\right) }{\log \left( \left( 1+\theta \right) \left( 1-\delta \right) ^{\gamma }\right) }\), that plugged into Ψ1 or Ψ2 gives \(\Psi \left( \alpha _{c}\right) _{1}=\Psi \left( \alpha _{c}\right) _{2}=\Psi \left( \alpha _{c}\right) _{n}=\frac{\log \left( \frac{1-s}{1-s-i}\right) ^{2}}{ \left( \log \left( \left( 1+\theta \right) \left( 1-\delta \right) ^{\gamma }\right) \right) ^{2}}+\frac{\log \left( \frac{1-s-i+is}{1-s-i}\right) }{ \log \left( \left( 1+\theta \right) \left( 1-\delta \right) ^{\epsilon \gamma }\right) }>0\), for any values of θ,s,i,δ,γ and ε in their supports. The first part of the Proposition is therefore proved. The second part relies on splitting the inequality p A < p Y < 1 in two. We rewrite p A < p Y as \(\frac{m^{Y}}{m^{A}}<-\frac{\log \left( 1-i\right) +\alpha \log \left( \left( 1+\theta \right) \left( 1-\delta \right) ^{\epsilon \gamma }\right) }{\alpha \log \left( \frac{1-s}{1-s-i} \right) }\) that is satisfied for α→0 since the left-hand side is constant and independent from α while the right-hand side goes to + ∞. This result does not depend on β while it depends on i: Although for α→0 the inequality holds, for a range of α such that \(i<1-\left( \left( 1+\theta \right) \left( 1-\delta \right) ^{\gamma }\right) ^{-\alpha }\), the right-hand side numerator is negative. For some positive values of α, the investment cost cannot be too small. On the other hand, we rewrite p Y < 1 as \( \left( 1-i\right) ^{-1}<\left( 1+\theta \right) ^{\alpha +\beta }\left( 1-\delta \right) ^{\gamma \left( \alpha +\epsilon \beta \right) }\). With α and β approaching their lower and upper bounds \(\left( 0 \text{ and }1\text{, respectively}\right) \), the inequality holds for small i and it also holds for some right interval of α that is compatible with the inequality p A < p Y. This proves the second part of the Proposition.□

Proof Corollary 1

We need that p Y < 0 for some small values of i. Under assumption 17, it is enough to show that q Y > 0, by graphical considerations based on Fig. 6. This is true if and only if \( \left( 1-i\right) \left( \left( 1+\theta \right) \left( 1-\delta \right) ^{\gamma }\right) ^{\alpha }>1.\) By simple algebra, the Corollary is proved.□

Proof of Proposition 3

β = α 2 ensures that p Y < p A. For \(i<1-( \left( 1+\theta \right)\) \( \left( 1-\delta \right) ^{\gamma }) ^{-\alpha }\), young are in favour of innovation ∀ p ≥ 0. This leads to both a share of voters \(\frac{\eta }{\eta +1+p_{t}}\) in favour of innovation for \( p_{t+1}<p^{A}\) and a share of voters \(\frac{\eta +1}{\eta +1+p_{t+1}}\) in favour of innovation for \(p_{t+1}>p^{A}\). Since p O = 1 − η, it is straightforward to show that \(\frac{\eta }{\eta +1+p_{t}}<\frac{1}{2} ,\forall \eta \in (0;1]\) and \(\frac{\eta +1}{\eta +1+p_{t}}>\frac{1}{2} ,\forall \eta \in (0;1]\). In the case of \(i>1-\left( \left( 1+\theta \right) \left( 1-\delta \right) ^{\gamma }\right) ^{-\alpha }\) for the positive values of life expectancy \(0<p_{t+2}<p^{Y}\), nobody is in favour of innovation, while for \(p^{Y}<p_{t+2}\) and \(p_{t+1}<p^{A}\), only young are in favour. Being them, a minority of the political outcome is unchanged with respect to the case of nobody backing innovation. Once \(p_{t+1}>p^{A}\) is achieved, the previous analysis applies.□

Proof of Lemma 4

When \(p_{t+1}<p^{A}\) < p Y < 1, there is no way for the economy to support innovation, while with \(p_{t+1}>p^{A}\) at least adults vote for innovation. If η < 1 − p A, using the definition p O ≡ 1 − η, then p O is larger than p A. In a right interval of p A, innovation takes place because adults alone want it: Their voting share is \(\frac{1}{ \eta +1+p_{t+1}}\) > 1/2 until \(p_{t+1}<p^{O}\). In case p A < p Y < p O, innovation takes again place with \(p_{t+1}>p^{A}\), but in the interval {p Y;p O}, it would arise even if adults had not an absolute majority. Above p Y, also young contribute in backing innovation.□

Proof of Proposition 4

The Proof is divided in four points. The assumption of small δ ensures that whenever the economy switches between no innovation to innovation (or vice versa), the ordering of p O;p A;p Y and p S does not change.

-

1.

\(\left( 1.a\right) \) β = α 2 ensures, from Proposition (2), that p Y < p A. Sufficiently large s make p A to be larger than p S. In turns, small γ lower the steady state level of human capital and therefore p S. Independently from η, the orderings p Y < p S < p A and p S < p Y < p A are consistent with a conservative policy outcome for any values of p < p S. \(\left( 1.b\right) \) β/α 2 substantially larger then 1 leads to p A < p Y: In this case, the inequality p S < p A, ensured by small γ,ε and/or λ, is a sufficient condition for the case of constant no innovation to be in place. \(\left( 1.c\right) \) The strong political power of young impedes adults to decide for innovation alone, since p O < p A < p Y. The limited effectiveness of human capital production ensures p S < p Y.

-

2.

As \(\left( 1.a\right) \), in \(\left( 2.a\right) \) β = α 2 ensures that p Y < p A. At the same time, large λ ensures that p A < p S holds. For values of life expectancy above p A, output is increasing at rate θ because both adults and young vote for innovation. As in case \(\left( 1.b\right) \), β/α 2 substantially larger then 1 leads to p A < p Y also in \(\left( 2.b\right) \). Moreover, small α implies a small p A, so that for value of life expectancy larger than p A innovation is always chosen.

-

3.

This case takes place if and only if p A < p O < p S < p Y holds. This configuration requires β/α 2 larger then 1 as a necessary condition so to have p A < p Y. Moreover, young’s weight η must be small in order to have p O < p S. Small α makes the inequality p A < p O to be satisfied.

-

4.

This case takes place if and only if p A < p O < p Y < p S holds. Conditions on the parameters are the same as in point \(\left( 3\right), \) but α must be slightly larger in order to have young in favour of innovation for values of life expectancy in the interval (p Y,p S).□

Rights and permissions

About this article

Cite this article

Lancia, F., Prarolo, G. A politico-economic model of aging, technology adoption and growth. J Popul Econ 25, 989–1018 (2012). https://doi.org/10.1007/s00148-011-0364-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00148-011-0364-x