Abstract

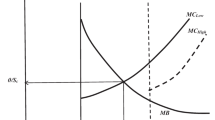

When analyzing what to do with a currently defaulted loan, the lender must consider the impact of his foreclosure versus workout decision on the expected payoff of subsequent loans as well as on the payoff of the current loan. This is because borrowers with future loan payoff dates can observe the lender's actions and update prior information regarding the lender's toughness or wimpiness when dealing with defaulted loans. In this paper we consider the strategic interaction between a lender and multiple borrowers, where borrowers have distinct, sequentially maturing mortgage loans and where the lender has private information regarding the magnitude of his foreclosure costs. We find that a variety of strategic outcomes can occur that explain the co-existence of workout and foreclosure in the mortgage marketplace. In general, the lender's workout/foreclosure response depends on the cost of bluffing (e.g., foreclosing when workout is cheaper) versus the value of reducing expected defaults and workout concession losses on future loans (e.g., imperfect foreclosure cost information leads future borrowers to payoff the mortgage when default would have been optimal under perfect information). Given recently revised expectations regarding the depth of the real estate recession, our results may explain the move by many lenders away from granting workout concessions and toward taking a harder line when dealing with defaulting borrowers.

Similar content being viewed by others

References

Bulow, Jeremy, and Kenneth Rogoff. “A Constant Recontracting Model of Sovereign Debt,”Journal of Political Economy 97 (1989), 155–178.

Childs, Paul D., Steven H. Ott, and Timothy J. Riddiough. “The Value of Recourse and Cross-Default Clauses in Commercial Mortgage Contracting, Unpublished Manuscript, MIT (1994).

Ciochetti, Brian.Credit Risk Diversification in Commercial Mortgage Portfolios. Unpublished Dissertation, University of Wisconsin-Madison (1994).

Curry, Timothy, Joseph Blalock, and Rebel Cole. “Recoveries of Distressed Real Estate and the Relative Efficiency of Public vs. Private Management,AREUEA Journal 19 (1991), 495–515.

Dunn, Kenneth B., and Chester S. Spatt. “An Analysis of Mortgage Contracting: Prepayment Penalties and Due-on-Sale Clauses,”Journal of Finance 40 (1985), 293–308.

Eaton, Jonathon. “Lending with Costly Enforcement of Repayment and Potential Fraud,”Journal of Banking and Finance 10 (1986), 281–293.

Eaton, Jonathon, and Mark Gersovitz. “Debt with Potential Repudiation: Theoretical and Empirical Analysis,”Review of Economic Studies 48, (1981), 289–309.

Giammarino, Ronald M. “The Resolution of Financial Distress,”Review of Financial Studies 2, (1989), 25–47.

Grossman, Herschel I., and John B. Van Huyck. “Sovereign Debt as a Contingent Claim: Excusable Debt, Repudiation, and Reputation,”American Economic Review 78, (1988), 1088–1097.

Huberman, Gur, and Charles Kahn. “Limited Contract Enforcement and Strategic Renegotiation,”American Economic Review 78 (1988), 471–485.

Kau, James B., Donald C. Keenan, Walter S. Muller, and James F. Epperson. “Pricing Commercial Mortgages and Their Mortgage-Backed Securities,”Journal of Real Estate Finance and Economics 3, (1990), 333–356.

Kreps, David M. “A Course in Microeconomic Theory,” Princeton University Press, Princeton, New Jersey (1990).

Kreps, David M., and Robert Wilson. Sequential Equilibria,Econometrica 50 (1982), 863–894.

Nash, John C. “The Bargaining Problem,Econometrica 18 (1950), 151–162.

Riddiough, Timothy J., and Howard E. Thompson. “Commercial Mortgage Pricing with Unobservable Borrower Default Costs,AREUEA Journal 21, (1993), 265–291.

Riddiough, Timothy J. and Steve B. Wyatt. “Strategic Default, Workout and Commercial Mortgage Valuation,”Journal of Real Estate Finance and Economics 9, (1993a), 5–23.

Riddiough, Timothy J., and Steve B. Wyatt. “Wimp or Tough Guy: Sequential Default Risk and Signaling with Mortgages,” unpublished manuscript, MIT (1993b).

Rubinstein, Ariel. “Perfect Equilibrium in a Bargaining Model,”Econometrica 50 (1982), 97–109.

Selten, R. “Reexamination of the Perfectness Concept for Equilibrium Points in Extensive Games,”International Journal of Game Theory 4 (1975), 25–55.

Schwartz, Eduardo, and Salvador Zurita. “Sovereign Debt: Optimal Contract, Underinvestment, and Forgiveness,”Journal of Finance 47 (1992), 981–1004.

Titman, Sheridan, and Walter Torous. “Valuing Commercial Mortgages: An Empirical Investigation of the Contingent-Claims Approach to Pricing Risky Debt,”Journal of Finance 44 (1989), 345–373.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Riddiough, T.J., Wyatt, S.B. Wimp or tough guy: Sequential default risk and signaling with mortgages. J Real Estate Finan Econ 9, 299–321 (1994). https://doi.org/10.1007/BF01099281

Issue Date:

DOI: https://doi.org/10.1007/BF01099281