Abstract

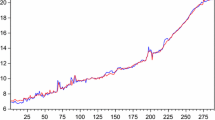

This paper tests the validity of the proposition that there is a causal relationship between government expenditure and government revenue for Greece over the period 1957–1993. The empirical analysis employs tests of cointegration as pre-tests for Granger tests of causality. The empirical evidence suggests that there is a long-run relationship between government spending and government revenue and expenditures cause revenues.

Similar content being viewed by others

References

Anderson, W., Wallace, M. S. and Warner, J. T. (1986). Government spending and taxation: What causes what? Southern Economic Journal 52: 630–639.

Baghestani, H. and McNown, R. (1994). Do revenues or expenditures respond to budgetary disequilibria. Southern Economic Journal 61: 311–322.

Blackley, P. (1986). Causality between revenues and expenditures and the size of the federal budget. Public Finance Quarterly 14: 139–156.

Boh, H. (1991). Budget balance through revenue or spending adjustments? Some historical evidence for the United States. Journal of Monetary Economics 27: 333–359.

Dickey, D. A. and Fuller, W. A. (1979). Distributions of the estimators for autoregressive time series with a unit root. Journal of the American Statistical Association 74: 427–431.

Dickey, D. A. and Fuller, W. A. (1981). The likelihood ratio statistics for autoregressive time series with a unit root. Econometrica 49: 1057–1072.

Engle, R. F. and Granger, C. W. J. (1987). Cointegration and error-correction: Representation, estimation and testing. Econometrica 55: 251–276.

Fuller, W. A. (1976). Introduction to statistical time series. New York: Wiley.

Friedman, M. (1978). The limitations of tax limitation. Policy Review (Summer): 7–14.

Granger, C. W. J. (1986). Developments in the study of cointegrated economics variables. Oxford Bulletin of Economics and Statistics 48: 213–228.

Granger, C. W. J. (1988). Developments in a concept of causality. Journal of Econometrics August: 199–211.

Johansen, S. (1988). Statistical and hypothesis testing of cointegration vectors. Journal of Economic Dynamics and Control 12: 231–254.

Johansen, S. and Juselius, K. (1990). Maximum likelihood estimation and inference on cointegration — with applications to the demand for money. Oxford Bulletin of Economics 52: 169–210.

Johansen, S. and Juselius, K. (1992). Testing structural hypotheses in a multivariate cointegration analysis at th epurchasing power parity and the uncovered interest parity for the UK. Journal of Econometrics 53: 211–244.

Jones, J. D. and Joulfaian, D. (1991). Federal government expenditures and revenues in the early years of the American Republic: Evidence from 1792 to 1860. Journal of Macroeconomics 13: 133–155.

Manage, N. and Marlow, M. L. (1986). The causal relation between federal expenditures and receipts. Southern Economic Journal 52: 617–629.

Meltzer, A. H. and Richard, S. F. (1981). A rational theory of the size of the government. Journal of Political Economy 89: 914–927.

Miller, S. and Russek, F. R. (1990). Co-integration and error-correction models: The temporal causality between government taxes and spending. Southern Economic Journal 57: 221–229.

OECD (1994). Economic outlook 56 (December): 96–98.

Peacock, A. T. and Wiseman, J. (1979). Approaches to the analysis of government expenditures growth. Public Finance Quarterly 7: 3–23.

Provopoulos, G. and Zambaras, A. (1991). Testing for causality between government spending and taxation. Public Choice 68: 277–282.

Ram, R. (1988a). Additional evidence on causality between government revenue and government expenditure. Southern Economic Journal 54: 763–769.

Ram, R. (1988b). A multicountry perspective on causality between government revenue and government expenditure. Public Finance 43: 261–269.

Von Furstenberg, G. M., Green, R. J. and Jeong, J. H. (1986). Tax and spend or spend and tax? Review of Economics and Statistics 58: 179–188.

Author information

Authors and Affiliations

Additional information

The authors gratefully acknowledge the comments of an anonymous referee on an earlier draft of this paper. The views expressed in this paper are those of the authors and not those of the Bank of Greece.

Rights and permissions

About this article

Cite this article

Hondroyiannis, G., Papapetrou, E. An examination of the causal relationship between government spending and revenue: A cointegration analysis. Public Choice 89, 363–374 (1996). https://doi.org/10.1007/BF00159364

Accepted:

Issue Date:

DOI: https://doi.org/10.1007/BF00159364