Abstract

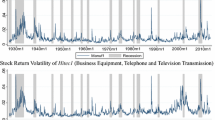

This paper examines the stock market returns and volatility relationship using US daily returns from May 26, 1952 to September 29, 2006. The empirical evidence reported here does not support the proposition that the return-volatility relationship is present and the same for each day of the week.

Similar content being viewed by others

Notes

One may visit Campbell and Cochrane (1999) and the references cited therein for the literature on habit formation.

During the period prior to May 1952, the number of trading days in a week was six: Monday through Saturday. Thus, in order to incorporate the same pattern for the day-of-the-week effect, we start our sample from May of 1952.

The final prediction error criteria (FPEC) are used to determine the optimum lag order n. FPEC determines the lag length such that it eliminates autocorrelation in the residual term. If we have autocorrelated residuals, ARCH-LM tests would suggest the presence of the residual term with heteroscedasticity even if the residuals were homoscedastic (see Cosimano and Dennis 1988).

Pagan (1984) argues that using stochastic regressors gives biased estimates. In order to avoid this, queryPagan and Ulah (1988) suggest using the Full Information Maximum Likelihood Estimation (MLE) technique to estimate the system of equations. queryBollerslev and Wooldridge (1992), however, argue that the normality of the standardized conditional errors \( {{{\varepsilon_t}} \mathord{\left/{\vphantom {{{\varepsilon_t}} {{h_t}}}} \right.} {{h_t}}} \) assumption may cause misspecification of the likelihood function and they suggest using the QMLE method to avoid the misspecification problem. Bollerslev and Wooldrige formally show that the QMLE is generally consistent and has a limited distribution.

The level of significance is 5% unless otherwise specified

References

Admati AR, Pfleiderer P (1988) A theory of intraday trading patterns: volume and price variability. Rev Financ Stud 1:3–40

Agrawal A, Tandon K (1994) Anomalies or illusions? Evidence from stock markets in eighteen countries. J Int Money Financ 13:83–106

Bali TG, Peng L (2006) Is there a risk-return tradeoff? Evidence from high- frequency data. J Appl Econ 21(8):1169–1198

Bekaert G, Wu G (2000) Asymmetric volatility and risk in equity returns. Rev Financ Stud 13:1–42

Berument H, Kiymaz H (2001) The day of the week effect on stock market volatility. J Econ Finance 25(2):181–193

Black F (1976) Studies of stock market volatility changes, Proceedings of the American Statistical Association, Business and Economics Statistics Section, 177–181

Bollerslev T, Engle RF, Wooldridge JM (1988) A capital asset pricing model with time varying covariances. J Polit Econ 96:116–131

Bollerslev T, Wooldridge JM (1992) Quasi-maximum likelihood estimation and inference in dynamic models with time-varying covariances. Econom Rev 11:143–172

Campbell JY, Cochrane JH (1999) By force of habit: a consumption- based explanation of aggregate stock market behavior. J Polit Econ 107(2):205–251

Campbell JY, Hentschel L (1992) No news is good news: an asymmetric model of changing volatility in stock returns. J Financ Econ 31:281–318

Chang E, Pinegar MJ, Ravichandran R (1993) International evidence on the robustness of the day of the-week effect. J Financ Quant Anal 28:497–513

Cheung Y, Ng LK (1992) Stock price dynamics and firm size: an empirical investigation. J Finance 47(5):1985–1997

Cosimano T, Dennis J (1988) Estimation of the variance of US inflation based upon the ARCH model. J Money, Credit Bank 20(3):409–423

Cox JC, Ross S (1976) A survey of some new results in financial option pricing theory. J Finance 31:382–402

Cross F (1973) The behaviour of stock prices on fridays and mondays. Financ Anal J 31(6):67–69

Damodaran A (1985) Economic events, information structure and the return-generating process. J Financ Quant Anal 20:423–434

Dubois M, Louvet P (1996) The day-of-the-week effect: international evidence. J Bank Financ 20:1463–1484

Dyl EA, Maberly ED (1988) The anomaly that isn’t there: a comment on friday the thirteenth. J Finance 43(5):1285–1286, American Finance Association

Ederington LH, Lee JH (1993) How markets process information: news releases and volatility. J Finance 48:1161–1191

Fishe RPH, Gosnell TF, Lasser DJ (1993) Good news, bad news, volume, and the Monday effect. J Bus Finance Account 20(6):881–892

Foster FD, Viswanathan S (1990) A theory of interday variations in volumes, variances and trading costs in security markets. Rev Financ Stud 3:593–624

Foster FD, Viswanathan S (1993) Variations in trading volume, return volatility, and trading costs: evidence on recent price formation models. J Finance 48:187–211

Franses PH, Paap R (2000) Modelling day-of-the-week seasonality in the S&P 500 index. Appl Financ Econ 10:483–488

French K (1980) Stock seturns and the weekend effect. J Financ Econ 8(1):55–69

French, Kenneth R and Roll Richard, 1986, "Stock Return Variances: The Arrival of Information and the Reaction of Traders" in Advances in Behavioral Finance, Thaler, R.H. (ed.), 1993, pp. 219–45, New York: Russell Sage Foundation.

Ghysels E, Clara PS, Valkanov R (2005) There is a risk-return tradeoff after all. J Financ Econ 76(3):509–548

Gibbons M, Hess P (1981) Day of the week effect and asset returns. J Bus 54:579–596

Harvey CR (1989) Time-varying conditional covariances in tests of asset pricing models. J Financ Econ 24:289–317

Jaffe J, Westerfield R, Ma C (1989) A twist on the monday effect in stock prices: evidence from the U.S. and foreign stock markets. J Bank Financ 13:641–650

Kim D, Kon SJ (1994) Alternative models for the conditional heteroscedasticity of stock returns. J Bus 67(4):563–598

Kiymaz H, Berument H (2003) The day of the week effect on stock market volatility and volume: international evidence. Rev Financ Econ 12:363–380

Koutmos G (1998) Asymmetries in the conditional mean and the conditional variance: evidence from nine stock markets. J Econ Bus 50:277–290

Linter J (1965) The valuation of risky assets and the selection of risky investments in stock portfolios and capital budgets. Rev Econ Stat 47:13–37

Lakonishok J, Levi M (1982) Weekend effects on stock returns: a note. J Finance 37:883–889

Lakonishok J, Maberly ED (1990) The weekend effect: trading patterns of ındividual and ınstitutional ınvestors. J Finance 45:231–243

McAndrews J, Stefanadis C (2000) The emergence of electronic communications networks in the U.S. equity markets. Federal reserve bank of New York. Current Issues in Economics and Finance 6(12):1–6

Merton RC (1973) An intertemporal capital asset pricing model. Econometrica 41:867–887

Mookerjee R, Yu Q (1999) An empirical analysis of the equity markets in China. Rev Financ Econ 8:41–60

Nelson DB (1991) Conditional heteroskedaticity in asset returns: a new approach. Econometrica 59(2):347–370

Osborne MFM (1962) Periodic structure in the Brownian motion of the stock markets. Oper Res 10:345–379

Pagan A (1984) Econometric ıssues in the analysis of regressions with generated regressors. Int Econ Rev 25:221–247

Pagan AR, Ulah A (1988) The econometric analysis models with risk terms. J Appl Econ 3:87–105

Patell JM, Wolfson MA (1982) Good news, bad news and the ıntraday timing of corporate disclosures. The Accounting Review 509–527

Ross SA (1989) Information and volatility: the no-arbitrage martingale approach to trading and resolution irrelevancy. J Finance 44:1–18

Savva CS, Osborn DR, Gill L (2006) The day of the week effect in fifteen European Stock Markets. University of Manchester

Scruggs JT (1998) Resolving the puzzling intertemporal relation between the market risk premium and conditional market variance: A two-factor approach. J Finance 53:575–603

Sharpe WF (1964) Capital asset prices: a theory of market equilibrium under conditions of market risk. J Finance 19:425–442

Smirlock M, Starks L (1986) Day of the week and intraday effects in stock returns. J Financ Econ 17:197–210

Whitelaw R (2000) Stock market risk and return: an empirical equilibrium approach. Rev Financ Stud 13:521–547

Author information

Authors and Affiliations

Corresponding author

Additional information

We would like to thank anonymous referee, Anita Akkas and Rana Nelson for their helpful comments.

Rights and permissions

About this article

Cite this article

Berument, M.H., Dogan, N. Stock market return and volatility: day-of-the-week effect. J Econ Finan 36, 282–302 (2012). https://doi.org/10.1007/s12197-009-9118-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12197-009-9118-y