Abstract

-

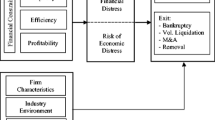

This study examines the dual implications of dual-option subsidiaries on exit decisions during times of economic crisis. Retaining dual-option subsidiaries in crisis-stricken countries means leaving a shadow option open for future growth once a crisis ends. However, MNCs may encounter problems pursuing either option due to challenges in managing dual-option subsidiaries with clashing strategic mandates.

-

The equivocal nature of dual-option subsidiaries points to the possibility of another factor playing an important moderating role in exit decisions—subsidiary performance—which has been rarely considered in the MNC real options literature. Our primary argument is that lower subsidiary performance increases the influence of shadow option value embedded in dual-option subsidiaries.

-

Analyzing a sample of 703 Korean overseas manufacturing subsidiaries in Asian countries, we find that when profitability falls, subsidiaries with dual options are less likely to be exited than those with single options.

Similar content being viewed by others

References

Adner, R., & Levinthal, D. (2004). What is not a real option: Considering boundaries for the application of real options to business strategy. Academy of Management Review, 29(1), 74–85.

Allen, L., & Pantzalis, C. (1996). Valuation of the operating flexibility of multinational corporations. Journal of International Business Studies, 27(4), 633–653.

Allison, P. D. (1984). Event history analysis. Newbury Park: Sage.

Barkema, H., Bell, J., & Pennings, J. (1996). Foreign entry, cultural barriers, and learning. Strategic Management Journal, 17(2), 151–166.

Bartelsman, E., Scarpetta, S., & Schivardi, F. (2005). Comparative analysis of firm demographics and survival: Evidence from micro-level sources in OECD countries. Industrial and Corporate Change, 14(3), 365–391.

Barnett, M. (2008). An attention-based view of real options reasoning. Academy of Management Review, 33(3), 606–628.

Belderbos, R., & Sleuwaegen, L. (2005). Competitive drivers and international plant configuration strategies: A product-level test. Strategic Management Journal, 26(6), 577–593.

Belderbos, R., & Zou, J. (2007). On the growth of foreign affiliates: Multinational plant networks, joint ventures, and flexibility. Journal of International Business Studies, 38(7), 1095–1112.

Belderbos, R., & Zou, J. (2009). Real options and foreign affiliates divestments: A portfolio perspective. Journal of International Business Studies, 40(4), 600–620.

Benito, G. (1997). Divestment of foreign production operations. Applied Economics, 29(10), 1365–1377.

Benito, G. (2005). Divestment and international business strategy. Journal of Economic Geography, 5(2), 235–251.

Benito, G., & Welch, L. (1997). De-internationalization. Management International Review, 37(2), 7–25.

Birkinshaw, J., Holm, U., Thilenius, N., & Arvidsson, N. (2000). Consequences of perception gaps in the headquarters–subsidiary relationship. International Business Review, 9(3), 321–344.

Boddewyn, J. J. (1979). Foreign divestment: Magnitude and factors. Journal of International Business Studies, 10(1), 21–26.

Borde, S., Madura, J., & Akhigbe, A. (1998). Valuation effects of foreign divestitures. Managerial and Decision Economics, 19(2), 71–79.

Bowman, E., & Hurry, D. (1993). Strategy through the option lens: An integrated view of resource investments and the incremental-choice process. Academy of Management Review, 18(4), 760–782.

Bowman, E., & Moskowitz, G. (2001). Real options analysis and strategic decision making. Organization Science, 12(6), 772–777.

Brouthers, K., & Dikova, D. (2010). Acquisitions and real options: The greenfield alternative. Journal of Management Studies, 47(6), 1048–1071.

Busby, J., & Pitts, C. (1997). Real options in practice: An exploratory survey of how finance officers deal with flexibility in capital appraisal. Management Accounting Research, 8(2), 169–186.

Cox, D. (1972). Regression models and life-tables. Journal of the Royal Statistical Society, Series B (Methodological), 34(2), 187–220.

Cox, D., & Oakes, D. (1984). Analysis of survival data. London: Chapman and Hall.

Chung, C. C., & Beamish, P. (2005a). Investment mode strategy and expatriate strategy during times of economic crisis. Journal of International Management, 11(3), 331–355.

Chung, C. C., & Beamish, P. (2005b). The impact of institutional reforms on characteristics and survival of foreign subsidiaries in emerging economies. Journal of Management Studies, 42(1), 35–62.

Chung, C. C., Lu, J., & Beamish, P. (2008). Multinational networks during times of economic crisis versus stability. Management International Review, 48(3), 279–295.

Chung, C. C., Lee, S. H., Beamish, P., & Isobe, T. (2010). Subsidiary expansion/contraction during times of economic crisis. Journal of International Business Studies, 41(3), 500–525.

Chung, C. C., Lee, S. H., Beamish, P., Southam, C., & Nam, D. (2013). Pitting real options theory against risk diversification theory: International diversification and joint ownership control in economic crisis. Journal of World Business, 48(1), 112–136.

Collis, D. J. (1991). A resource-based analysis of global competition: The case of the bearings industry. Strategic Management Journal, 12(Summer), 49–68.

Cuypers, I., & Martin, X. (2010). What makes and what does not make a real option? A study of equity shares in international joint ventures. Journal of International Business Studies, 41(1), 47–69.

Dess, G., & Davis, P. (1984). Porter’s (1980) generic strategies as determinants of strategic group membership and organizational performance. Academy of Management Journal, 27(3), 467–488.

Dixit, A. K. (1989). Entry and exit decisions under uncertainty. Journal of Political Economy, 97(3), 620–638.

Dixit, A. K. (1992). Investment and hysteresis. Journal of Economic Perspectives, 6(1), 107–132.

Dixit, A. K, & Pindyck, R. S. (1994). Investment under uncertainty, Princeton: Princeton University Press.

Driouchi, T., & Bennett, D. (2011). Real options in multinational decision-making: Managerial awareness and risk implications. Journal of World Business, 46(2), 205–219.

Efron, B. (1974). The efficiency of Cox’s likelihood function for censored data. Journal of the American Statistical Association, 72(359), 557–565

Erikson, T. (2002). Entrepreneurial capital: The emerging venture’s most important asset and competitive advantage. Journal of Business Venturing, 17(3), 275–290.

Fisch, J. H. (2011). Real call options to enlarge foreign subsidiaries: The moderating effect of irreversibility on the influence of economic volatility and political instability on subsequent FDI. Journal of World Business,46(4), 517–526.

Fisch, J. H., & Zschoche, M. (2012). The role of operational flexibility in the expansion of international production networks. Strategic Management Journal, 33(13), 1540–1556.

Hurry, D., Miller, A., & Bowman, E. (1992). Calls on high-technology: Japanese exploration of venture capital investments in the United States. Strategic Management Journal, 13(2), 85–101.

Jacque, L., & Vaaler, P. (2001). The international control conundrum with exchange risk: An EVA framework. Journal of International Business Studies, 32(4), 813–832.

Kogut, B. (1989). A note on global strategies. Strategic Management Journal, 10(4), 383–389.

Kogut, B. (1991). Joint ventures and the option to expand and acquire. Management Science, 37(1), 19–33.

Kogut, B., & Singh, H. (1988). The effect of national culture on the choice of entry mode. Journal of International Business Studies, 19(3), 411–432.

Kogut, B., & Kulatilaka, N. (1994a). Operating flexibility, global manufacturing, and the option value of a multinational network. Management Science, 40(1), 123–139.

Kogut, B., & Kulatilaka, N. (1994b). Options thinking and platform investments: Investing in opportunity. California Management Review, 36(2), 52–71.

Kulatilaka, N., & Perotti, E. C. (1998). Strategic growth options. Management Science, 44(8), 1021–1031.

Lee, S. H., Peng, M., & Barney, J. (2007). Bankruptcy law and entrepreneurship development: A real options perspective. Academy of Management Review, 32(1), 257–272.

Lee, S. H., & Makhija, M. (2009a). Flexibility in internationalization: Is it valuable during an economic crisis? Strategic Management Journal, 30(5), 537–555.

Lee, S. H., & Makhija, M. (2009b). The effect of domestic uncertainty on the real options value of international investments. Journal of International Business Studies, 40(3), 405–420.

Lee, S. H., & Song, S. (2012). Host country uncertainty, inter-MMC subsidiary shift of production, and foreign subsidiary performance: The case of Korean multinational corporations. Strategic Management Journal, 33(11), 1331–1340.

Li, J. T. (1995). Foreign entry and survival: Effects of strategic choices on performance in international markets. Strategic Management Journal, 16(5), 333–351.

Li, J., & Li, Y. (2010). Flexibility versus commitment: MNEs’ ownership strategy in China. Journal of International Business Studies, 41(9), 1550–1571.

Li, Y., James, B., Madhavan, R., & Mahoney, J. (2007). Real options: Taking stock and looking ahead. Advances in Strategic Management, 24, 33–66.

McGrath, R. (1999). Falling forward: Real options reasoning and entrepreneurial failure. Academy of Management Review, 24(1), 13–30.

Monteiro, L., Avidsson, N., & Birkinshaw, J. (2008). Knowledge flows within multinational corporations: Explaining subsidiary isolation and its performance implications. Organization Science, 19(1), 90–107.

Myers, S. (1984). Finance theory and financial strategy. Interfaces, 14(1), 126–137.

Ozsomer, A., & Gencturk, E. (2003). A resource-based mode of market learning in the subsidiary: The capabilities of exploration and exploitation. Journal of International Marketing, 11(3), 1–29.

O’Brien, J. P., & Folta, T. B. (2009). Sunk costs, uncertainty and market exit: A real options perspective. Industrial and Corporate Change, 18(5), 807–833

Padmanabhan, P. (1993). The impact of European divestment announcements on shareholder wealth: Evidence from the UK. Journal of Multinational Financial Management, 2(3/4), 185–208.

Pindyck, R. S. (1991). Irreversibility, uncertainty, and investment. Journal of Economic Literature, 29(3), 1110–1152.

Rangan, S. (1998). Do multinationals operate flexibly? Theory and evidence. Journal of International Business Studies, 29(2), 217–237.

Reuer, J., & Leiblein, M. J. (2000). Downside risk implications of multinationality and international joint ventures. Academy of Management Journal, 43(2), 203–214.

Roth, K., & Morrison, A. (1990). An empirical analysis of the integration-responsiveness framework in global industries. Journal of International Business Studies, 21(4), 541–564.

Rugman, A. (1979). International diversification and the multinational enterprise. Lexington: Lexington Books.

Tang, C., & Tikoo, S. (1999). Operational flexibility and market valuation of earnings. Strategic Management Journal, 20(8), 749–761.

Therneau, T. M., & Grambsch, P. M. (2000). Modeling survival data: Extending the Cox model. New York: Springer.

Tiwana, A., Wang, J., Keil, M., & Ahluwalia, P. (2007). The bounded rationality bias in managerial valuation of real options: Theory and evidence from IT projects. Decision Sciences, 38(1), 157–181.

Tong, T. W., Reuer, J., & Peng, M. W. (2008). International joint ventures and the value of growth options. Academy of Management Journal, 51(5), 1014–1029.

Tong, T. W., & Li, Y. (2011). Real options and investment mode: Evidence from corporate venture capital and acquisition. Organization Science, 22(3), 659–674.

Torneden, R. (1975). Foreign divestment by U.S. multinational corporations: With eight case studies. New York: Praeger.

UNCTAD. (2000). World investment report 2000: Transnational corporations, market structure and competition policy. New York: United Nations.

Xu, D., Zhou, C., & Phan, P. H. (2010). A real options perspective on sequential acquisitions in China. Journal of International Business Studies, 41(1), 166–174.

Vassolo, R. S., Anand, J., & Folta, T. B. (2004). Non-additivity in portfolios of exploration activities: A real options-based analysis of equity alliances in biotechnology. Strategic Management Journal, 25(11), 1045–1061.

Vivarelli, M., & Santarelli, E. (2007). Entrepreneurship and the process of firms’ entry, survival and growth. Industrial and Corporate Change, 16(3), 455–488.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Chung, C., Lee, SH. & Lee, JY. Dual-Option Subsidiaries and Exit Decisions During Times of Economic Crisis. Manag Int Rev 53, 555–577 (2013). https://doi.org/10.1007/s11575-012-0157-9

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11575-012-0157-9