Abstract

This paper reports the results of an empirical study investigating people’s preferences over three different types of perturbation to their survival function, each perturbation generating the same gain in life expectancy. Preferences over the three different perturbations were found to be distributed more or less evenly across the subject pool. Use of a novel experimental methodology generated economically consistent and intuitively plausible responses to (necessarily) hypothetical questions concerning improvements in life expectancy by first allowing respondents to gain experience while making similar choices in an incentivized setting involving financial risk. The results demonstrate the potential for economic experiments to contribute to the development of more robust methods for policy evaluation in domains where physical risk is an important factor.

Similar content being viewed by others

Notes

For example, Mason et al. (2009).

Had we used, for example, an annual hazard rate, this would have resulted in games of 50 bags, each containing 10,000 cards. We took the view that this would be an excessively complex distribution for respondents to deal with.

Alternatively, but equivalently, LE can be defined as, \( L{E_{40}} = 0{p_{40}} + 10(1 - {p_{40}}){p_{50}} + 20(1 - {p_{40}})(1 - {p_{50}}){p_{60}} + .. \)

Variance is calculated applying the standard formulae (Berry and Lindgren 1996), which in this case is: \( V(L{E_{40}}) = {(0 - \overline {LE} )^2}{p_{40}} + {(10 - \overline {LE} )^2}(1 - {p_{40}}){p_{50}} + {..^{-} } \)

The prize was in the range £20–50 and was adjusted on a per-session basis so that the expected payoff was equal across different sized groups. The expected payoff from participating in the experiment was £27 (£20 show-up fee and an expected payoff from the draw of £7).

The reason for offering them only three different versions of the OR strategy is that the unchanged AR programme would strictly dominate the fourth OR option.

By decreasing the risk reduction in their preferred option, a natural boundary is established (0 gain in LE) for the respondent’s choice of indifference.

Based on experiences from the piloting phases, all cards were coloured differently instead of given a number to indicate their ranking. The cards in the final survey were coloured in a randomized way; in this way the heuristic of choosing the same number (rank) in each indifference choice is avoided.

Since a very high proportion of the respondents with intransitive preferences indicated indifference in the last questions, this could indicate that the intransitivity was caused by fatigue. It appears that the intransitivity here may be caused by seeking to avoid the relatively cognitively demanding indifference question as opposed to a particular decision strategy not supported by rational choice. Thus, these individuals have not been given further attention in this paper. The intransitive respondents were on average younger (37 years compared with 41) and a smaller proportion of them have children (27% compared with 72%).

13 individuals showed intransitive preferences in the finance game. However, since the finance experiment is mainly seen as a learning exercise these individuals have been retained in the sample.

These results come with the caveat that order effects may have some influence, since practical limitations relating to non-computerised administration limited our flexibility. Results elsewhere suggest that the responses are valid and plausible, and sufficiently robust for the purposes they are used for in this paper.

This could be an artefact of the fact that individuals choosing OR only received three cards (compared with the four in the other cases). However, there is also a significant difference between AR and PR.

Also, when asked to find their indifference point, only 9 (8%) individuals chose a similarly coloured card each time. Hence deciding on a colour and then choosing this colour automatically every time a choice had to be made did not appear to be a commonly applied heuristic in this instance either.

Before the respondents were allowed to draw a card from a bag the bag was shaken and it was assured that the respondent only drew one card and that they could not see the colour of the card before it was drawn.

The prize was in the range of £20–50 depending on group size and the expected pay-off from participating in the experiment was £27 (£20 show-up fee + an expected pay-off from the draw equal to £7).

See e.g. McDowell and Newell (1996).

References

Alderfer, C. P., & Bierman, H. (1970). Choices with risk: beyond the mean and variance. The Journal of Business, 43(4), 341–353.

Aldy, J. E., & Viscusi, W. K. (2008). Adjusting the value of a statistical life for age and cohort effects. The Review of Economics and Statistics, 90(3), 573–581.

Barberis, N., & Huang, M. (2008). Stocks as lotteries: The implication of probability weighting for security prices. American Economic Review, 98(5), 2066–2100.

Berry, D. A., & Lindgren, D. A. (1996). Statistics: Theory and methods (2nd ed.). Belmont: Duxbury.

Cherry, T. L., Crocker, T. D., & Shogren, J. F. (2003). Rationality spillovers. Journal of Environmental Economics and Management, 45, 63–84.

Chilton, S., Jones-Lee, M. W., Kiraly, F., Metcalf, H., & Pang, W. (2006). Dread risks. Journal of Risk and Uncertainty, 33(3), 165–182.

Corso, P. S., Hammitt, J. K., & Graham, J. D. (2001). Valuing mortality-risk reduction: using visual aids to improve the validity of contingent valuation. Journal of Risk and Uncertainty, 23(2), 165–184.

Cropper, M. L., Aydede, S. K., & Portney, P. R. (1994). Preferences for life saving programs: how the public discounts time and age. Journal of Risk and Uncertainty, 8(3), 243–265.

Hammitt, J. K. (2007). Valuing changes in mortality risk: lives saved versus life years saved. Review of Environmental Economics and Policy, 1(2), 228–240.

Harrison, G. W., & List, J. A. (2004). Field experiments. Journal of Economic Literature, 42(4), 1013–1059.

Jenkins, S. P. (2005). Survival Analysis, www.iser.essex.ac.uk

Johannesson, M., & Johansson, P. O. (1996). To be, or not to be, that is the question: an empirical study of the WTP for an increased life expectancy at an advanced age. Journal of Risk and Uncertainty, 13, 163–174.

Jones-Lee, M. W. (1976). The value of changes in the probability of death or injury. The Journal of Political Economy, 82(4), 835–849.

Jones-Lee, M. W., Hammerton, M., & Phillips, P. R. (1985). The value of safety: results of a national sample survey. The Economic Journal, 95(377), 49–72.

Krupnick, A., Alberini, A., Cropper, M., Simon, N., O’Brien, B., Goeree, R., et al. (2002). Age, health and the willingness to pay for mortality risk reductions: a contingent valuation survey of Ontario residents. Journal of Risk and Uncertainty, 24(2), 161–186.

Mason, H., Jones-Lee, M. W., & Donaldson, C. (2009). Modelling the monetary value of a QALY: a new approach based on UK data. Health Economics, 18, 933–950.

McDowell, I., & Newell, C. (1996). Measuring health: A guide to rating scales and questionnaires (2nd ed.). New York: Oxford University Press.

Moore, M. J., & Viscusi, W. K. (1988). The quantity-adjusted value of life. Economic Inquiry, 26, 369–388.

Morris, J., & Hammitt, J. K. (2001). Using life expectancy to communicate benefits of health care programs in contingent valuation studies. Medical Decision Making, 21(6), 468–478.

Pope, C. A., Thun, M. J., Namboodiri, M. M., Dockery, D. W., Evans, J. S., Speizer, F. E., et al. (1995). Particulate air pollution as a predictor of mortality in a prospective study of U.S. adults. American Journal of Respiratory and Critical Care Medicine, 151, 669–674.

Sunstein, C. R. (2004). Lives, life-years, and willingness to pay. Columbia Law Review, 104(1), 205–252.

Viscusi, W. K. (1978). Labor market valuations of life and limb: empirical evidence and policy implications. Public Policy, 26, 359–386.

Viscusi, W. K., Magat, W. A., & Huber, J. (1991). Pricing environmental health risk: survey assessments of risk-risk and risk-dollar trade-offs for chronic bronchitis. Journal of Environmental Economics and Management, 21, 35–51.

Viscusi, W. K., & Aldy, J. E. (2003). The value of a statistical life: a critical review of market estimates throughout the world. Journal of Risk and Uncertainty, 27(6), 5–76.

Acknowledgment

This work was supported by the Health Insurance Foundation in Denmark (Helsefonden) and the Danish Centre of Excellence named AIRPOLIFE (Air Pollution in a Life Time Health Perspective). In addition, the authors are very grateful to Trine Kjær for providing econometric assistance.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A

1.1 Assumption required for the calculations of life expectancy gains

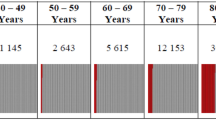

Data stems from Government Actuary’s Department (mean 2003–2005) and reflects a simple average between female and male. The simulations are carried out from the age of 40 until the age of 90.

The hazard rates are calculated the following way: \( \frac{{{l_{50}} - {l_{40}}}}{{{l_{40}}}} = {p_{40}} \)

lx is the number of survivors to exact age x of 100.000 live births who are assumed to be subject throughout their lives to the mortality rates experiences in the 3 year period to which the data relates.

Accordingly, in the money experiment, 1000p40 is the number of green counters in the first bag and the number of white counters is 1000(1-p40). In the money experiment this is the appropriate starting point for an estimation of E (tokens) since you either “survive” a whole bag or “die”. However, the life expectancy section should technically be continuous since there is both a probability of dying at the beginning of the decade, during the decade, and at the end of the decade. By assuming that the respondent needs to survive to the end of the decade, we have overestimated the probability of dying slightly and hence underestimated the current life expectancy.

Accordingly, it would have been more accurate to apply the following approximation instead of Eq. 6:

This would approximate the continuous curve more accurately. However, since the main purpose of this experiment is to show that a method works, it was decided to mirror the money game exactly in the life expectancy section. Also, since we wish to examine whether preferences shift across contexts, we must keep all other things constant.

Appendix B

2.1 Money experiment

The experiment applied was built around four different incentivised games—three option games and one indifference game—the purpose of which are described below. An additional baseline game was included which served as a practice game. Each game potentially contained five rounds and each round of a game consisted of a bag containing a total of 1,000 counters (a mix of green and white cards) where the specific mix reflected ‘game specific’ hazard rates for the next five decades. Each participant drew a counter from a bag. The counter was subsequently placed back into the bag before the next participant drew a counter.Footnote 14

In the option games of the money experiment, participants were asked to make pair-wise comparisons of three games. All games (i.e. sets of bags) reflect a changed distribution of hazard rates according to the changes described in Table 1; however, in the money game they were labelled A, B and C instead of X, Y and Z. Following a choice of which ‘game’ (i.e. set of bags) to play, the participants either ‘survived’ a bag (drew a white counter), thereby collecting a token and able to continue in the game; arrived at the end of the game; or were eliminated prematurely (drew a green counter). Furthermore, it was explained to respondents that drawing a white counter has two beneficial effects: 1) by ‘surviving’ that bag they have obtained a token to enter the draw, and 2) they are in a position to progress to the next bag(s) and hence have the chance of winning additional tokens. Changing the distribution of the counters changes both of these effects and the two effects mirror the safety and survivor effects introduced to the respondents in the subsequent LE experiment.

The tokens collected in the games were entered into a draw for a prizeFootnote 15 which was adjusted on a per-session basis to make the expected pay-off across different group sizes equal. Each token was equivalent to one entry into the draw and the winner of the prize was determined by a random draw at the end of each session. A brief outline of the format for the money experiment is presented in Table 6. Notice though the expected number of tokens in the baseline game is 3.46, which is equivalent to 3.46 decades in the life expectancy survey, the current life expectancy for a 40-year-old British individual (truncated at the age of 90).

Appendix C

3.1 Extract from the experimental protocol

-

Let us say that you were offered the opportunity to choose between three on-going programmes, X, Y and Z. All would cost more or less the same. All programmes would increase the average life expectancy by 6 months. Although in each case this would be achieved differently. By this I mean that the risks of dying in each decade would be different in each programme.

3.1.1 Handout 2

Handout 2 shows you your current risk. Programme X,Y and Z would change these in different ways.

-

X VS Z

-

i)

We will now ask you to choose between programme X and programme Z. Let us now have a look at the two programs in details.

-

OVERHEAD

-

On the top of this overhead you see the risk of dying in each decade as they are before we make any changes. Underneath is programme X indicating the change in the risk of dying in each decade offered by programme X. In programme X we have reduced the risk of dying with 14/1,000 in the first decade. This gives us a new risk of dying in the first decade of 6/1,000. The risk of dying in the second decade is still 48/1,000, 121/1,000 in the third, 347/1,000 in the fourth and 652/1,000 in the fifth.

-

Underneath is programme Z indicating the change in risk of dying in each decade offered by programme Z. In programme Z we have changed the risk of dying differently in each decade. We have reduced the risk in each decade, starting with 1/1,000 in the first decade which gives a new risk of dying equal to 19/1,000. We reduce the risk of dying with 2/1,000 in the second period to 46/1,000. In the third decade we reduce the risk of dying with 5/1,000 to 116/1,000. In the fourth decade we reduce the risk by 15/1,000 to 332/1,000 and in the fifth decade with 28/1,000 to 624/1,000.

-

-

-

ii)

The change in life expectancy is 6 months in each programme. Note that the change in life expectancy is the same in both programmes even though we don’t have the same total risk reduction i.e. 14/1,000 in X vs 51/1,000 in Z.

This is because you get a lot of survivor effect from reducing the risk in decade 1, since you have many periods ahead of you. On the other hand; reducing the risk in the fifth decade doesn’t give you any survivor effect. In order to get the same change in life expectancy from X and Z you need a bigger safety effect in later decades in Z. This mirrors the situation in the finance game where we changed different number of green cards in the different options but ended up with the same total effect as in the expected number of tokens.

-

iii)

Please take your time and think about what programme X and programme Z would mean to you. Please indicate whether you prefer X or Z in Q5 in the response sheet. If you would be equally happy with either i.e. you wouldn’t mind letting the policy makers choose which programme to implement; please tick the ‘equally happy’ box.

After you have made your choice I will ask you to answer Q6 in your response sheet.

Appendix D

4.1 Sample demographics

Description | Variable name | N | Mean |

Proportion of males | Male | 130 | 0.43 |

Age (in years) | Age | 130 | 41 |

Below 40 | Below age 40 (=1 if below the age of 40, else 0) | 130 | 0.55 |

Education (1=primary, 2= secondary, 3= higher) | Higher education (=1 if higher education, else 0) | 130 | 2.5 |

Health (5 categories. The first question in the Short Form 36 (SF- 36) health survey Footnote 16 ) | Good (=1 if health status is the respondent’s self-reported health is good or excellent) | 130 | 3.8 |

Proportion with children | children | 130 | 0.67 |

Proportion with an additional health insurance | insurance | 130 | 0.28 |

Mean individual income per month (GBP) (8 response categories) | Individual income | 129 | 1,800 |

Mean household income per month (GBP) (8 response categories) | Household income | 124 | 2,850 |

Appendix E

5.1 Results of the three different comparison questions in the experiment

LE | Money | Signed rank test ( p -value) | |

Comparison no 1 (X vs. Z) | |||

X | 43(13) | 26 | −2.6(0.01)** |

Z | 63(45) | 78 | 2.1(0.04)** |

Indifferent | 12(2) | 14 | 0.42(0.67) |

Comparison no 2 (Y vs. Z) | |||

Y | 65(29) | 47 | −2.4(0.01)** |

Z | 43(27) | 64 | 2.9(0.004)*** |

Indifferent | 10(1) | 7 | −0.78(0.44) |

Comparison no 3 (X vs. Y) | |||

X | 37(11) | 27 | −1.5(0.12) |

Y | 67(50) | 82 | 2.1(0.03)** |

Indifferent | 14(2) | 9 | −1.1(0.25) |

*,**,*** Significant at 0.1, 0.05 and 0.01 levels, respectively

Rights and permissions

About this article

Cite this article

Nielsen, J.S., Chilton, S., Jones-Lee, M. et al. How would you like your gain in life expectancy to be provided? An experimental approach. J Risk Uncertain 41, 195–218 (2010). https://doi.org/10.1007/s11166-010-9104-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11166-010-9104-y