Abstract

Existing research has uncovered little evidence against the hypothesis of US crime rates being unit root processes, despite the uncomfortable implications of this assumption. In light of this, the present paper draws upon noted changes in the temporal patterns of US crime rates since 1960 to undertake an informed approach to testing of the unit root hypothesis which incorporates two potential points of structural change. The results obtained show the unit root hypothesis to be rejected for all classifications of criminal activity examined over the period 1960 to 2007. In addition, the dates of the detected breakpoints are supported by a variety of arguments available in the existing criminology literature concerning alternative determinants of crime and their movements. Interestingly, a difference is observed in the nature of the breaks detected for violent and property crimes. However, potential explanations for this are again found in theoretical arguments available in the criminology literature. Finally, the implications of the current findings for the properties of crime, its subsequent statistical analysis and past and future research are discussed.

Similar content being viewed by others

Notes

The issues of trends in the mean and variance of a unit root process are discussed further in the following section.

Throughout this study repeated reference will be made to breaks or structural change. In all instances, this refers to breaks in the level and/or trends underlying series under investigation, rather than breaks or changes in other factors such as variance.

The initial version of our current two-break paper was completed independently prior to the publication of, and without knowledge of, the related research of Narayan et al. (2010). The work of Narayan et al. (2010) came to our attention while undertaking revisions to the originally submitted version of our current paper to address a variety of issues suggested to us by the editors and two anonymous referees. However, as the thrust of the current paper concerns consideration of two potential breaks in US crime rates and subsequently the issues of both whether these lead to a reversal in the unit root inference currently present in the literature and how the detected breakpoints relate to existing knowledge of crime, there is a clear difference between our studies.

Simply put, it can be seen that Eq. (3) states that the variance of x is equal to the variance of the constant initial value (which has variance of zero) and the collective variance of the t error terms (each of which has a variance of σ2).

Interested readers can derive the expected value and variance of x t from (8) by considering the sum of a geometric progression and allowing the time period (t) to tend to infinity.

More precisely, the series should be referred to as asymptotically stationarity.

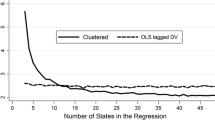

These critical values can be derived via Monte Carlo simulation involving the numerical simulation of artificially derived unit root processes and application of the specified test over a sufficiently large number of replications.

The test is referred to as the KPSS test due to the initials of the authors.

Interested readers will find an excellent and detailed coverage of these and further unit root tests is provided by Maddala and Kim (1998).

The empirical results drawn upon code which is which has generously been provided by Professor Junsoo Lee and is available from http://www.cba.ua.edu/~jlee/.

All series are expressed in per capita terms, measured per 100,000 inhabitants. See http://bjs.ojp.isdoj.govfor further information.

To check the GAUSS code employed to undertake the empirical analysis required for the LM τ test, the results presented in the seminal study of Lee and Strazicich (2003) for US real wages and the Standard and Poor 500 index were replicated. The results for these series were chosen as they employ the particular two-break in intercept and trend model applied in the present analysis.

The method employed here follows that outlined in the seminal study of Lee and Strazicich (2003) and the approach adopted by Strazicich et al. (2004) in an analysis of income convergence in OECD economies. Interestingly, the sample employed is nearly identical in size to the post-World War II sample examined by Strazicich et al. (2004), differing by one observation only.

In the interests of brevity, the significance of individual breakpoints is not reported. However, all breakpoints identified under two-break analysis for crime rate series other than the three series (property crime burglary, larceny) to be discussed are very highly significant with the exception of the second break for rape. The second break for this series just satisfies the rule of significance at the 10% level with the test statistic for this break having a p value of 0.1 to 2 decimal places. In all other cases breakpoints are exceptionally significant with very small p values recorded for their tests of significance.

Levitt (2004) also notes the apparent contradiction of reduced economic stress accompanying the crime boom of the 1960s.

For example, see Saridakis (2004).

References

Arvanites T, Defina R (2006) Business cycles and street crime. Criminology 44:139–164

Baltagi B (2006) Estimating an economic model of crime using panel data from North Carolina. J Appl Econom 21:543–547

Banerjee A, Lumsdaine R, Stock J (1992) Recursive and sequential tests of the unit root and trend break hypotheses: theory and international evidence. J Bus Econ Stat 10:271–287

Becker G (1968) Crime and punishment: an economic approach. J Polit Econ 76:169–217

Benson B, Rasmussen D (1991) The impact of drug enforcement upon crime: an investigation of opportunity cost of police resources. Contemp Econ Policy 9:106–115

Benson B, Kim I, Rasmussen D, Zuehlke T (1992) Is property crime caused by drug use or drug enforcement policy? Appl Econ 24:679–692

Cantor D, Land K (1985) Unemployment and crime rates in the post World War II United States: a theoretical and empirical analysis. Am Sociol Rev 50:317–332

Cohen L, Felson M (1979) Social change and crime rate trends: a routine activities approach. Am Sociol Rev 44:588–607

Cook S, Manning N (2004) The disappointing properties of GLS-based unit root tests in the presence of structural breaks. Commun Stat B: Comput Simul 33:585–596

Cook P, Zarkin G (1985) Crime and the business cycle. J Leg Stud 14:115–128

Cork D (1999) Examining space-time interaction in city-level homicide data: crack markets and the diffusion of guns among youth. J Quant Criminol 15:379–406

Cornwell C, Trumbull W (1994) Estimating the economic model of crime with panel data. Rev Econ Stat 76:360–366

Dickey D, Fuller W (1979) Distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc 74:427–431

Elliott G, Rothenberg T, Stock J (1996) Efficient tests for an autoregressive unit root. Econometrica 64:813–836

Greenberg D (1985) Age, crime and social explanation. Am J Sociol 91:1–21

Greenberg D (2001) Time series analysis of crime rates. J Quant Criminol 17:291–327

Grogger J, Willis M (2000) The emergence of crack cocaine and the rise of urban crime rates. Rev Econ Stat 82:519–529

Hale C (1998) Crime and the business cycle in post-War Britain revisited. Br J Criminol 38:681–698

Hendry D, Massmann M (2007) Co-breaking: recent advances and a synopsis of the literature. J Bus Econ Stat 25:33–51

Kapuscinski C, Braithwaite J, Chapman B (1998) Unemployment and crime: toward resolving the paradox. J Quant Criminol 14:215–243

Kim T, Leybourne S, Newbold P (2000) Spurious rejections by Perron tests in the presence of a break. Oxford Bull Econ Stat 62:433–444

Kovandzic T, Sloan J (2002) Police levels and crime rates revisited: a county-level analysis from Florida (1980–1998). J Crim Justice 30:65–76

Kwiatkowski D, Phillips P, Schmidt P, Shin Y (1992) Testing the null of stationarity against the alternative of a unit root. J Econom 54:159–178

LaFree G (1999) Declining violent crime rates in the 1990s: predicting crime booms and busts. Annu Rev Sociol 25:145–168

Lee J, Strazicich M (2003) Minimum LM unit root test with two structural breaks. Rev Econ Stat 85:1082–1089

Lee J, Strazicich M (2004) Minimum LM unit root test with one structural break. mimeo, Department of Economics, Appalachian State University

Lee J, Huang C, Shin Y (1997) On stationary tests in the presence of structural breaks. Econ Lett 55:165–172

Levitt S (2004) Understanding why crime fell in the 1990s: four factors that explain the decline and six that do not. J Econ Perspect 18:163–190

Leybourne S, Mills T, Newbold P (1998) Spurious rejections by Dickey-Fuller tests in the presence of a break under the null. J Econom 87:191–203

Lumsdaine R, Papell D (1997) Multiple trend breaks and the unit root hypothesis. Rev Econ Stat 79:212–218

Maddala G, Kim I-M (1998) Unit roots, cointegration and structural change. Cambridge University Press, Cambridge

Marvell T, Moody C (1996) Specification problems, police levels and crime rates. Criminology 34:609–646

McDowall D, Loftin C (2005) Are US crime rates trends historically contingent? J Res Crime Delinq 42:359–383

Mendes S (2000) Property crime and drug enforcement in Portugal. Crim Justice Policy Rev 11:195–216

Merton R (1938) Social structure and anomie. Am Sociol Rev 3:672–682

Narayan P, Nielsen I, Smyth R (2010) Is there a natural rate of crime? Am J Econ Sociol 69:759–782

Ng S, Perron P (1995) Unit root tests in ARMA models with data-dependent methods for the selection of the truncation lag. J Am Stat Assoc 90:268–281

Ng S, Perron P (2001) Lag length selection and the construction of unit root tests with good size and power. Econometrica 69:1519–1554

Nunes L, Newbold P, Kuan C-M (1997) Testing for unit roots with breaks: evidence on the great crash and the unit root hypothesis reconsidered. Oxford Bull Econ Stat 59:435–448

Perron P (1989) The great crash, the oil price shock, and the unit root hypothesis. Econometrica 57:1361–1401

Perron P (1990) Testing for a unit root in a time series with a changing mean. J Bus Econ Stat 8:153–162

Perron P, Vogelsang T (1992) Nonstationarity and level shifts with an application to purchasing power parity. J Bus Econ Stat 10:301–320

Pyle D, Deadman D (1994) Crime and the business cycle in post-War Britain. Br J Criminol 34:339–357

Rosenfeld R, Fornago R (2007) The impact of economic conditions on robbery and property crime: the role of consumer sentiment. Criminology 45:735–769

Saridakis G (2004) Violent crime in the United States of America: a time-series analysis between 1960–2000. Eur J Law Econ 18:203–221

Schmidt P, Phillips P (1992) LM tests for a unit root in the presence of deterministic trends. Oxford Bull Econ Stat 54:257–287

Shepard E, Blackley P (2005) Drug enforcement and crime: recent evidence from New York State. Soc Sci Q 86:322–342

Shoesmith G (2010) Four factors that explain both the rise and fall of US crime, 1970–2003. Appl Econ 42:2957–2973

Strazicich M, Lee J, Day E (2004) Are incomes converging among OECD countries? Time series evidence with two structural break. J Macroecon 26:131–145

Witt R, Witte A (2000) Crime, prison and female labour supply. J Quant Criminol 16:69–85

Wolpin K (1978) An economic analysis of crime and punishment in England and Wales, 1894–1967. J Polit Econ 86:815–840

Zimring F (2007) The great American crime decline. New York, Oxford University Press

Zivot E, Andrews D (1992) Further evidence on the great crash, the oil price shock and the unit root hypothesis. J Bus Econ Stat 10:251–270

Acknowledgments

The authors are very grateful to the editors and two anonymous referees for numerous comments which have improved both the content and presentation of this paper.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Cook, J., Cook, S. Are US Crime Rates Really Unit Root Processes?. J Quant Criminol 27, 299–314 (2011). https://doi.org/10.1007/s10940-010-9124-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10940-010-9124-4