Abstract

Against the dual backdrop of China vigorously promoting high-speed railways (HSR) construction and establishing an ecological civilization system, HSR as urban transportation infrastructure, is currently gaining growing attention from the academic community due to its environmental benefits as well as its effects in energy conservation and emission reduction. In this context, this research treats the initiation of HSR as a quasi-natural experiment, meanwhile empirically examining the effect of HSR on energy structure restructuring and exploring the micro-level channels through which it operates. The empirical results validate the reduction effect of HSR opening on fuel energy consumption of industrial enterprises, especially the usage of fuel coal. This highlight remains valid across a series of robustness tests. Moreover, it is evident that the “driving effect” of enterprise technological innovation capability and the “industrial upgrading effect” of enterprise relocation are effective transmission pathways in the process of HSR opening influencing the adjustment of energy consumption structure. Moreover, the unique characteristics of enterprise, industry, and region introduce a certain degree of heterogeneity. The low-energy-consumption effect of HSR is more pronounced in high-carbon industry enterprises, technology-intensive enterprises, firms engaged in innovation pilot cities, small to the medium-sized city and resource-based city. This paper provides a new perspective on energy structure adjustment, contributing to offering solid experiences and references for environmental governance in China and other emerging economies.

Similar content being viewed by others

Introduction

The utilization of fossil fuels exerts a pivotal influence in the industrial production of human society, and the global geopolitical landscape exerts a substantial influence on the dynamics of the global energy market (Antonakakis et al. 2017; Ben Cheikh and Ben Zaied 2023). The Russia-Ukraine conflict is a turning point in world history that has had a profound effect on the international system, the global order, and the natural world (Xin and Zhang 2023; Solokha et al. 2023; Pata et al. 2023; Chishti et al. 2023). To diminish their reliance on Russian energy, major energy-consuming nations across the globe have initiated changes in the composition of their energy consumption, progressively elevating the radio of green energy while concurrently reducing reliance on fossil fuels (Abay et al. 2022; Ha 2023; Colgan et al. 2023). On the other hand, traditional fossil fuels, which are the primary source of energy consumption, cause a variety of environmental pollution issues, and energy conservation and emission reduction have become a universal strategy (Adebayo et al. 2020; Depren et al. 2022). Typically in China, a rapidly developing country, the swift economic expansion has led to a heightened consumption of fossil fuels. In 2020 General Secretary Xi Jinping pledged to stop China’s carbon dioxide emissions from growing by 2030. Therefore, improving energy efficiency, reducing pollution emissions, and realizing a green economy are of great practical significance to China and the world.

Transportation infrastructures have important positive significance for the development of technology and industrial structure (Gong et al. 2023; Liu et al. 2022; Lumeng et al. 2023), and enhancing efficiency and service flexibility can contribute to a decrease in energy consumption and overall costs within the transportation system (Guo et al. 2016). As of 2023, the operational mileage of high-speed railways in China is projected to reach 42,000 km, this milestone positions China as the country with the most extensive high-speed railways operational mileage globally (Huang and Zong 2020). Certainly, the effect of HSR on the progress of industries and technologies with the aim of reducing energy consumption is a question that warrants investigation and clarification.

In the realm of infrastructure research, existing literature predominantly concentrate on investigating the effects of HSR on economic efficiency and eco-efficiency (Li and Cheng 2022; Guo et al. 2020; Li et al. 2023). In contrast, empirical knowledge to study how HSR affects energy consumption is still limited. In consideration of this, we consider the implementation of HSR in China as a quasi-natural experiment and analyze its influence on the environment. In detail, we adopt the difference-in-differences model (DID) and difference-in-difference-difference model (DDD) to evaluate the effect of HSR on energy consumption, and then we utilize PSM-DID, placebo test, and other robustness tests to verify the highlights. To our best knowledge, this paper may provide three folds marginal contributions to existing literature: firstly, our primary academic contribution lies in elucidating the mechanisms through which the initiation of high-speed rail influences energy restructuring. Furthermore, we aim to investigate whether, and if so, how HSR affects the energy mix, providing insights to inform sustainable growth policies and strategies. Secondly, existing research mostly pays close attention to exploring macro level impact of HSR operation on human capital flows and regional economic expansion. This paper takes the study to the firm level, using industrial firm data and industrial firm pollution data, and dissects the intrinsic mechanism of HSR’s impact on energy restructuring based on the micro level. From the aspect of the effect of HSR opening on enterprises, it is verified that HSR achieves a change in energy consumption structure through the technological upgrading effect and industrial restructuring effect. Thirdly, this paper extends research on the energy rebound impact at the firm level within China’s industrial sector, utilizing data spanning from 2003 to 2012. The objective is to offer an objective foundation for policy-making departments to formulate sensible and effective energy policies. In summary, this study holds significant value for the research on the sustainable growth impacts of HSR in China, which offers policy recommendations and strategic implementation for the government.

The subsequent sections are organized as follows. Section 2 provides the literature review and the methodology and empirical data are shown in Section 3. The detailed analysis and mechanism analysis are represented in Section 4 and Section 5. Finally, the crucial conclusions and policy implications are draw in Section 6.

Theoretical hypothesis

High-speed railways exert a direct influence on carbon emissions through substitution effects. The transportation sector stands as one of the largest consumers of energy (Li et al. 2019; Solaymani 2019). HSR represents a novel, low-energy transportation mode that facilitates the achievement of emission reduction targets by supplanting other high-energy modes of transportation (Rus 2009; Akerman 2011). If the electrical energy support for HSR operations undergoes further decarbonization, it logically follows that a more substantial reduction in emissions would be researched. Furthermore, by linking metropolises, economic development centers, and other neighboring cities, HSR enhances regional cooperation among cities and enhances the spatial allocation of production factors (Tian et al. 2022). In turn, this has a consequential effect on the progress of industries and technologies, subsequently influencing the energy consumption. Existing studies suggest that technological innovation, changes in industrial structure, and government intervention all play a role in shaping the energy consumption structure of enterprises (Chen et al. 2020; Fu 2018; Liu et al. 2021; Lu and Zhang 2022; Zhou et al. 2022). This section analyzes how HSR affect enterprise energy consumption through structural transformation and technological innovation.

Technological innovation effect. The initiation of HSR greatly compress spatiotemporal distance (Fan and Xu 2023), effectively eliminates the barriers to factor flow that result from the limited connectivity of traditional modes of transportation (Gao and Zheng 2020; Komikado et al. 2021; Miwa et al. 2022), reducing unnecessary losses in the spread of knowledge and technology. The knowledge overflow effects will be established through the stream of innovation elements between areas (Huang and Wang 2020), which in turn may produce learning, imitation, and incentive behaviors among innovation subjects (Wang et al. 2022; Zhang et al. 2020). Zhang et al. (2020) argue that HSR can influence business innovation by improving geographic proximity. Innovation may pave the way for the adoption of more energy-efficient technologies, phasing out outdated production equipment with high-energy consumption, or fostering the development of green products, consequently enhancing overall energy efficiency (Yang et al. 2021). Secondly, the introduction of HSR broadens the market scope for products, efficiently lowers transaction costs for enterprises, leading to increased profits. Consequently, enterprises with higher profits exhibit stronger motivation for independent research and development, fostering innovation and enhancing their technological capabilities (Zhang and Zhou 2022; Zhou and Zhang 2022; Chien et al. 2021). Technological progress has compelled enterprises to shift from a trajectory of pollution growth to green growth. This transition inevitably involves the phasing out of outdated, polluting energy sources in favor of clean production energy, thereby achieving energy conservation and emission alleviation at the source of pollution. (Mol and Spaargaren 2000).

Industrial structure effect. Industry has long been an important factor in causing environmental pollution problems (Chen et al. 2021). The upgrading and translation of industrial structure takes a crucial role in enhancing ecological quality (Su et al. 2022). The increased demand for regional labor brought about by HSR has raised corporate labor costs (Feng et al. 2023; Lan et al. 2023), finally, when labor costs are too high, highly polluting enterprises move to non-central cities. When pollution-intensive enterprises in cities are forced to move to other areas due to cost pressures, high-tech enterprises and service enterprises gain more room for development (Wang et al. 2019a, 2019b). In comparison to primary and secondary industries, the service industry and high-tech industries exhibit low pollution intensity characteristics. HSR enhances the agglomeration of urban service industries and facilitates the progress of emerging industries (Wang et al. 2019a, 2019b; Chen and Wang 2022), which can directly and effectively reduce energy consumption intensity (Wang et al. 2019a, 2019b). Besides, some scholars pointed out that HSR may induce new travel and consumption demand through the creation effect, causing increased energy consumption and negative influences on the environment (Du et al. 2020). Figure 1. describes the theoretical mechanism of this paper.

Based on the above analysis, the following research hypotheses are proposed:

Hypothesis 1: The initiation of HSR is conducive to the optimization of energy consumption structure.

Hypothesis 2: The optimization effect of HSR on energy structure mainly depends on technical innovation and industrial structure.

Research design

Empirical model

To comprehend the influence of HSR expansion on energy structure, we employed the DID and DDD model to investigate the underlying nexus between HSR and the adjustment of coal consumption and fuel oil consumption. The benchmark regression model is shown as follows.

where i and t describes the enterprise and the year. Y is the energy consumption of the enterprise. HSR is a dummy variable of whether the there is a high-speed railway in the place where the enterprise is located. Xit represents control variables. α indicates the city fixed effects, γ is year fixed effects, θ represents firm fixed effects, and εit represents random disturbance terms.

Additionally, to explore the heterogeneity of the HSR operation effect, we introduced the DDD model by incorporating the eci and its interaction with HSR into the baseline model. This approach is contributed to a more comprehensive identification of the “net impact” of the energy consumption restructuring associated with the HSR opening policy, thereby enhancing the reliability of the evaluation conclusion from the DID model.

where group is a grouping dummy variable that describes whether the firm is a high-energy-consuming enterprise (eci), a technology-intensive enterprise (tech), a labor-intensive enterprise (labor), a capital-intensive enterprise (cap), whether the firm is located in a small or medium-sized city (city), and whether the firm has produced a new product (np). All the above variables are dummy variables. Where eci takes 1 if the enterprise is a high-energy consumption enterprise, and 0 otherwise; tech takes 1 if the enterprise is technology-intensive, and 0 otherwise; labor takes 1 if the enterprise is labor intensive, and 0 otherwise; cap takes 1 if the enterprise is capital intensive, and 0 otherwise; np takes 1 if the enterprise has produced new products, and 0 otherwise; if the firm is located in a small or medium-sized city, then city takes 1, otherwise it takes 0. time takes 1 in the year when the city implement the HSR and the year after, otherwise it takes 0; treat takes 1 when the city opened the HSR between 2003 and 2012, otherwise it takes 0. Meanings of other variables refer to the Eq. (1).

Data and variables

Data source

Our data were mainly collected from dual sources, including macro dataset and micro dataset. Firstly, the data related to HSR is based on macro level, which is derived from the China Railway Yearbook and the 12306 official websites. Secondly, the data related to the firm-level characteristics are sourced from the China Industrial Enterprise Database and the Corporate Green Development Database. This includes a range of control variables and mechanism variables. Besides, we use the business code, business name, postal code and location information to match those two databases. The sample time span is from 2003 to 2012, and the number of matching samples is 477,568 observations.

Explained variable

Generally, energy consumption is commonly regarded as a direct source of environmental pollution. Zhang et al. (2013) highlighted that the dominance of coal in the energy consumption structure has created a steadfast demand for energy in support of China’s economic growth, consequently amplifying CO2 emissions. Therefore, we introduced the consumption of fuel oil and fuel coal as the explained variables in this paper and the data are logarithmically processed.

Core explanatory variable

The status of whether HSR is open is defined as 1 for cities in the year of HSR opening and subsequent years. According to China’s official 2010 National Economic and Social Development Statistics Report, there is six highly energy-consuming trade. Set eci as a dummy variable that is 1 for highly energy-consuming trade and 0 otherwise. Interact this variable with whether the HSR is open or not (HSR_highcar).

Control variables

On the basis of the literature of Zhou et al. (2020) and Chai et al. (2022), this paper introduces nine control variables into baseline regression: enterprise age (X1); enterprise scale (X2) is calculated by the natural logarithm of total assets; practitioner scale (X3) is described by the company’s staff number in logarithmic form; liquid liability (X4) is the share of total non-liquidity liabilities to total assets; liquidity index (X5) is described by the share of current debts to current assets; solvency index (X6) is calculated by the ratio of debt to asset; financial costs (X7) is calculated by the proportion of interest expense to debt; general and administrative expenses (X8) equals the proportion of administrative expenses to total profit; enterprise profitability (X9) is calculated by the share of the sales profit to sales revenue. The statistical description of variables can be found in Table A in Appendix A.

Empirical results and analysis

Baseline regression analysis

This paper utilizes the DID model to explore the influence of HSR opening on energy restructuring. The estimation highlights are described in Table 1. Based on columns (1) and (2), it is clear that the inhibitory effect of HSR operation on the consumption of fuel coal and the inhibitory tendency of HSR operation on fuel oil. Evidently, the positive effect of HSR operation on energy structure adjustment is partially established, namely hypothesis 1 is partially verified. Moreover, in terms of the industrial feature of enterprises, we adopt a DDD to examine the potential inhibitory effect of HSR on industries with high-carbon characteristics, the results are represented in columns (3) and (4). There is a clear and sizable negative nexus between HSR opening and energy consumption in highly energy-consuming trade.

Robustness test

Parallel trend test

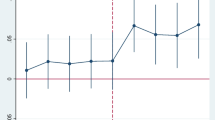

In this section, we adhered to the methodology proposed by Yang et al. (2019) and assess the parallel trends assumption of the DID estimation:

where t represents the time lag to the year of HSR operation which equals zero. The parameter k takes values from −4 to 4, where the positive value corresponds to a year after the operation of HSR, while a negative value represents a year before the opening. If the estimation in years before the opening are distinctly significant, it suggests a potential violation of the parallel trend’s assumption. The results parallel trends are demonstrated in Fig. 2 in the Appendix A.

According to Fig. 2A, the total coal consumption in the year of opening of HSR shows an upward trend, decreasing in the initial year, increasing in the next year, and finally showing a downward trend, and this phenomenon may be corresponding to the energy rebound effect. Existing experience shows that improving energy efficiency does not always achieve the desired purpose of reducing energy consumption, and may even increase energy consumption, which Berkhout et al. (2000) refers to as the energy Rebound Effect. Increased energy output lowers the production costs and prices of energy and related products, resulting in increased product demand and economic growth, while economic expansion pulls energy demand, creating a rebound effect. However, two years after the operation of HSR, the energy rebound effect gradually diminished, and the introduction of HSR eventually led to an obvious reduction in fossil fuel consumption. As can be seen from Fig. 2B, the regression coefficients for HSR are not obvious in the four years prior to and in the first year after the implementation of HSR. The estimation parameter of HSR is distinctly positive in the second year after the operation of HSR and significantly negative after the second year. This may also be related to the energy rebound effect.

Placebo test

To conduct a more comprehensive examination of potential interference from unobservable factors in the results, we adopt the method outlined by Li et al. (2016). We perform a placebo test by randomly choosing cities where HSR is implemented. An insignificant regression coefficient for the dummy variable (HSR) implies that the decrease in fossil fuel consumption is attributed to the introduction of HSR rather than other unobservable factors. Simultaneously, to prevent the influence of rare events on regression outcomes, we performed 500 random samples for both coal consumption and fuel consumption data. Subsequently, we repeated the regression using the benchmark model (1). Figure 3 displays the probability density distribution of regression parameters and their p-values following 500 random samples. The distribution appears almost symmetrical, with an average value close to 0. Moreover, most p-values exceed 0.1, indicating that statistically, most coefficients do not significantly deviate from zero. Furthermore, the observed estimated coefficient for the HSR opening falls within the realm of small probability events in the kernel density plot from the aforementioned placebo test. This demonstrate that the decrease in fossil fuel consumption can be attributed to the introduction of HSR. Consequently, it is reasonable to affirm that the estimated results and central conclusions exhibit high robustness.

PSM-DID

The commencement of High-Speed Rail (HSR) might exhibit some selective bias, making it challenging to effectively fulfill the random sampling assumption of the DID method. To mitigate the impact of selective bias and bolster the credibility of the main conclusion, we adopt the address proposed by Miwa et al. (2022). Additionally, employing the PSM-DID method for supplementary validation is crucial. Utilizing the PSM method to select the treat and control groups helps address sample selection issues more effectively, thereby eliminating estimation bias in the DID analysis. The key steps are as follows: First, enterprise age, enterprise scale, practitioner scale, liquid liability, liquidity index, solvency index, financial costs, general and administrative expenses, and enterprise profitability as covariates. Moreover, a logit model is carried out to estimate the propensity score. Then, using intra-caliper nearest-neighbor matching (the caliper range is set to 0.01), matching samples are selected on a 1:2 basis for cities without HSR. Lastly, the usual support assumption to verify the balance of the matched samples and delete the samples that do not satisfy the conditions. After the above propensity score matching is completed, the multi-period DID model is then constructed for estimation, The results of the balance test are reported with the kernel density estimation in Appendix B. Columns (2) in Table 2 report the estimation of the multi-temporal PSM-DID. It is evidence that the parameter of HSR are still obviously negative and not substantially differ from the benchmark results, meaning that the adjustment effect of HSR operation on energy restructuring is robust.

Replace variables

In above the baseline conclusion, this work excludes the samples that have never opened HSR, the sample of provincial capitals and cities above sub-provincial level, and the sample of HSR cities three years before opening, respectively.

The estimation highlights are presented in Tables 3 and 4. After replacing the environmental pollution variables, there are no changes in the regression results and significance of HSR, proving that the alleviating effect of HSR on fossil fuel consuming is robust.

Heterogeneity analysis

Considering that the different developmental entities may exhibit significant characteristics in terms of energy structure demands, we hope to analysis the heterogeneity of the construction of HSR on the energy restructuring in this section. To further investigate whether the opening of HSR exhibits distinct heterogeneity effects on specific subgroups, we subdivide sample groups based on characteristics of enterprise, industry, and region levels to assess the potential variations. The results are presented in Table 3.

As for enterprise characteristics, our emphasis lies on two aspects: the nature of corporate ownership and the innovation capability of the enterprise. That is, we constructs two dummy variables indicating whether an enterprise produces new products and whether the enterprise is state-owned correspondingly, and introduce their interaction terms with the HSR in the regression. It is evident that the influence of the opening of HSR on energy restructuring exhibits certain heterogeneity due to variations in enterprise characteristics. First of all, compared to others, companies producing new products consume relatively less fossil fuel under the backdrop of HSR opening, especially in terms of coal consumption. This underscores the significance of technological advancement as a key factor in reducing fossil fuel consumption. Enterprises engaged in the production of new products typically employ advanced manufacturing processes and equipment, which may result in a relatively higher energy efficiency, reducing their dependence on traditional energy sources (Shen et al. 2023). Meanwhile, enterprises with larger technological proficiency are more likely to comply with and adapt to environmental regulations. The opening of HSR may bring about an increased environmental responsibility for companies, and technological leaders are more likely to embrace green technologies to reduce reliance on traditional energy sources, potentially avoiding fines or other regulatory sanctions (Li et al. 2022). By contrast, the heterogeneity of the effect of HSR on energy restructuring are not evident across different ownership characteristics of enterprises, according to the coefficients from the regression analysis. It is undoubted that although stated-owned enterprises generally play a crucial role in the Chinese economy and often possess unique resources and policy advantages, objectively, these advantages are not directly correlated with the impact of HSR on the energy structure of enterprises. In comparison, unstated-owned enterprises are typically more flexible, allowing them to adapt more quickly to changes in transportation costs and market opportunities (Huang et al. 2023). This point may make them easier to undergo energy restructuring.

As the features of industries are generally various, the opening of HSR probably has various influences on them (Dong et al. 2022; Faggio et al. 2017). To investigate the heterogeneous influence of HSR opening on reducing the fossil fuel consumption of enterprises, we divided samples according to two industry characteristics: the high-carbon industry and the industry factor intensity. The corresponding dummy variables are introduced into the DDD model to conduct the heterogeneity regression. According to the regression results, it can be inferred that it exhibits certain heterogeneity due to variations in industry characteristics. Column (1) in panel B shows that the introduction of HSR distinctly reduces the fuel coal consumption of technology-intensive firms, and although there exists a negative association with fuel oil, it does not significant. The results in column (3) indicate that the HSR operation significantly reduces the fuel oil consumption of capital-intensive enterprises, but has no significant effect on fuel coal consumption, and similar highlight can be obtained from the results in column (5) for the labor-intensive enterprise. Fossil fuels represented by coal and oil directly produce pollutants such as CO2 and SO2 in the production and utilization process, and such energy consumption is a crucial cause of pollution discharge (Duranton et al. 2014). Whether it is technology-intensive, capital-intensive, or labor-intensive, the impact brought by HSR has significantly reduced the fossil energy consumption of these enterprises and facilitate the transformation of the energy structure.

Considering that cities along the HSR route exhibit diverse characteristics in social, economic, and environmental aspects, these features may influence the extent to which high-speed railways affects traditional energy consumption. In this regard, we analyze the potential heterogeneity from three folds, including city size, urban innovation capability, and city type. Following the aforementioned approach, we attempt to construct three representative variables and introduced them into the estimation. For small and medium-sized urban areas which have resident population lower than 1 million, we assigned a value of 1, and for other cities, it was set to 0. According to the China’s innovative city pilot policy, we assigned a value of 1 to innovation pilot cities and 0 to others. Regarding the natural resource endowment of cities, we assigned a value of 1 to resource-based cities and 0 to others. It can be visually observed that the heterogeneity effects between HSR and traditional energy consumption are more pronounced under different features of cities. As expected, the construction of HSR effectually reduce the fossil fuel consuming of enterprises in the small-medium cities and innovation pilot cities, especially this inhibitory effect is more significant in the coal consumption. In detail, innovative cities typically exhibit a higher degree of industrial structure optimization and possess robust digital infrastructure levels, which are more inclined to leverage the convenience and low-carbon nature of high-speed railways, making better use of its advantages in clean energy and energy interconnectivity. Consequently, innovative cities can reduce their reliance on coal and fuel oil consumption (Zhou et al. 2023). In terms of the larger cities with higher technological innovation capabilities and environmental awareness, their energy structure may already be more diversified and low-carbon (Xu et al. 2021). Therefore, the introduction of HSR may not bring about significant changes or stimuli to industrial production and energy consumption. On the contrary, the operation of HSR in small-medium cities can enhance regional connectivity and market openness, fostering product innovation, and the adoption of renewable energy, consequently reducing dependence on high-carbon sources like coal (Li et al. 2022; Zhang et al. 2023). Moreover, the suppressive effect of HSR on traditional energy consumption is more distinct in resource-oriented cities. Specifically, it is notably effective in curbing the use of petroleum by enterprises in resource-based cities. The reasons for this phenomenon may be attributed to the reality that the opening of HSR stimulates economic development in resource-oriented cities, increasing the demand and scale of industrial production, thereby elevating the consumption of coal by industrial enterprises (Wu et al. 2023). However, as a low-carbon, efficient, and safe transportation mode, high-speed rail effectively improves transportation conditions in resource-based cities. It can partially substitute for less efficient and more energy-consuming road transport, reducing dependence on and consumption of fuel (Zhang and Hanaoka 2021).

Micro mechanism

The previous discussion exhibits the robust conclusion that HSR can greatly decrease corporate reliance on fossil fuels. Thus, we further analysis the specific mechanisms of HSR influences corporate fossil fuel consumption to gain effectively policy implications.

Impact of HSR on technological progress

To examine whether the operation of HSR facilitates the enhancement of production productivity and the technological progress, this subsection introduces two proxies, including labor productivity and enterprise new products. The former is calculated by the industrial sales output per capita (lnsales) and the total industrial output per capita (lnoutput). According to the regression estimations, it is clear that the construction of HSR is contributed to the labor productivity of enterprises and the production of new products. This key point is verified by some existing literature (Zhou and Zhang 2022). As mentioned above, the implementation of HSR significantly compresses temporal and spatial distances (Miwa et al. 2022), meanwhile enhancing corporate competitiveness. This is attributed to its effective promotion of technological innovation and product development in enterprises. From one perspective, the introduction of HSR dramatically shortens the distances between cities, breaking barriers to the flow of high-tech human resources, innovative capital, and information exchange among cities along the rail line. The efficient transportation mode provides more opportunities for the sharing of technological resources and innovation collaboration among enterprises (Wang et al. 2022). From another perspective, the availability of HSR enables enterprises to respond more rapidly to market demands, identify new opportunities for product research and development by understanding market demands and trends, thereby strengthening their competitiveness (Yang et al. 2019).

Subsequently, this section proceeds to an in-depth discussion on the potential impact of enterprise heterogeneity via the DDD method. From one aspect, we consider the dummy variable indicating the production of new products (HSR_np) and whether the enterprise belongs to high-carbon industries (HSR_highcar), and the relevant results are shown in columns 5 to 8. It is evident the enterprises with higher initial innovation levels after the opening of HSR have less labor productivity improvement, thus, the construction of HSR plays a convergence effect and reduce the productivity gap between innovative and non-innovative enterprises. To further examine the industry differences in enterprises upgrading driven by HSR, the highlights in column (7) and (8) demonstrate that the opening of HSR significantly increases productivity in high-carbon industries compared to non-high-carbon industries. This also offers empirical proof for the ability of the aforementioned high-carbon industries to reduce energy consumption under the implementation of high-speed railways.

Impact of HSR on the industrial structure upgrading

Referring to the current literature, the high-speed railways exhibit a certain “diversion” effect, whereby enterprises are motivated to relocate from central cities to small and mid-sized urban areas along the route, resulting in a notable industrial spreading effect (Chen and Whalley 2012). Indeed, the changes in industrial structure and production scale can be regarded as the most direct ways to impact industrial energy use and carbon emissions (Adom et al. 2012). In this regard, it is necessary to explore the potential nexus between HSR and enterprises’ entry and exit, as well as industrial structure adjustments.

As stated above, this subsection applied the proxies of the entry rate (fentry) and the exit rate (fout) of urban industrial firms to represent the situation of enterprises’ entry and exit, especially the enterprises in the high-carbon industries, including its entry rate (indentry) and the exit rate (indout) of urban industrial firms. Based on the estimations in Table 5, it is clear that the construction of HSR does greatly promote industrial relocation. The primary reason for this phenomenon is that the introduction of HSR tightens the connections between various cities and regions. Enterprises can strategically reallocate based on their needs and market advantages, achieving optimized resource allocation. Meanwhile, due to the convenience of high-speed railway connections, some high value-added industries are more likely to attract investments and talents, which helps guide resources towards high-tech, high value-added industries, thereby enhancing the overall industrial structure of the region. Therefore, from this perspective, HSR can alleviate the consumption of fossil fuels through the path of industrial structure adjustment and optimization (Shen et al. 2023). Therefore, hypothesis 2 is evidently established.

Conclusions and policy suggestions

Conclusions

Under the background of China’s comprehensive step into the era of HSR, the increasing effect of HSR not only on the economic level and technology level, but also on the energy-consuming structure is beginning to emerge. In this paper, we map the data of Chinese industrial enterprises with the of industrial pollution and use a quasi-natural experiment with the data from 2003 to 2012 to systematically explore the impact of the opening of HSR on energy consumption and its intrinsic mechanism of action using a multi-period DID approach. Our empirical analysis has several highlights: (1) High-speed railways opening significantly reduces firms’ fossil energy consumption, and the core conclusion still hold after robustness tests; (2) The differences in characteristics among enterprises, industries, and regions are the sources of heterogeneity in the low-energy-consumption effects of high-speed railways. Specifically, the introduction of HSR significantly reduces the traditional energy consumption of technology-intensive enterprises, capital-intensive enterprises, and high-carbon industry enterprises. Meanwhile, this inhibitory influence is more pronounced in small to medium-sized cities, innovation pilot cities, and resource-oriented cities. (3) The mechanism verification shows that HSR reduces the total fossil energy consumption of enterprises by promoting industrial structure upgrading, enhancing innovation level and promoting enterprise upgrading.

Policy suggestions

According to the above research conclusions, the following policy recommendations can be put forwarded. Firstly, the government should facilitate the construction of HSR and expand the coverage of the railway network, which is beneficial for further exerting non-economic benefits such as energy restructuring and low-carbon transformation brought about by HSR. The construction of HSR is a high-input, high-tech project, and there is a certain time lag in its completion return. Secondly, cities with different sizes should effectively realize the effect of energy saving and emission alleviation brought about by the introduction of HSR from various paths according to local conditions. For cities with small population sizes, HSR brings the inflow of production factors such as technology, so it should steadily promote the coverage of HSR in small and medium-sized cities. Third, the government should also focus on the progress of ecological protection and stimulates industrial transformation and upgrading. It is essential to optimize the industrial structure and encourage enterprises to transform and upgrade. Considering the heterogeneity of HSR on the energy consumption of different classes of enterprises, that HSR opening can reduce energy consumption for technology-intensive firms and capital-intensive firms while raising the consumption of fuel oil for labor-intensive firms, it is feasible to adjust the proportion of different types of enterprises in the industry to reduce overall energy consumption. Local governments ought to facilitate the radio of technology-intensive industries and capital-intensive industries based on vigorously developing green technologies, giving priority to promoting the progress of low-carbon, ecological-friendly industries and encouraging the transformation of traditional industries.

Data availability

The data that support the findings of this study are available from the corresponding author upon reasonable request.

References

Abay AKA, Breisinger C, Glauber JW, Kurdi S, Laborde Debucquet D, Siddig K (2022) The Russia-Ukraine crisis: implications for global and regional food security and potential policy responses, Vol. 39. International Food Policy Research Institute. https://doi.org/10.2499/p15738coll2.135913

Adebayo TS, Awosusi AA, Adeshola I (2020) Determinants of CO2 emissions in emerging markets: an empirical evidence from MINT economies. Int J Renew Energy Dev 9:411–422. https://doi.org/10.1016/j.apenergy.2010.07.022

Adom PK, Bekoe W, Amuakwa-Mensah F, Mensah JT, Botchway E (2012) Carbon dioxide emissions, economic growth, industrial structure, and technical efficiency: empirical evidence from Ghana, Senegal, and Morocco on the causal dynamics. Energy 47:314–325. https://doi.org/10.1016/j.energy.2012.09.025

Akerman J (2011) The role of high-speed rail in mitigating climate change - The Swedish case Europabanan from a life cycle perspective. Transp Res Part D Transp Environ 16:208–217. https://doi.org/10.1016/j.trd.2010.12.004

Antonakakis N, Gupta R, Kollias C, Papadamou S (2017) Geopolitical risks and the oil-stock nexus over 1899–2016. Financ Res Lett 23:165–173. https://doi.org/10.1016/j.jenvman.2023.118561

Ben Cheikh N, Ben Zaied Y (2023) Renewable energy deployment and geopolitical conflicts. J Environ Manag 344:118561. https://doi.org/10.1016/j.jenvman.2023.118561

Berkhout PH, Muskens JC, Velthuijsen JW (2000) Defining the rebound effect. Energy Policy 28:425–432. https://doi.org/10.1016/S0301-4215(00)00022-7

Chai S, Zhang K, Wei W, Ma W, Abedin MZ (2022) The impact of green credit policy on enterprises’ financing behavior: evidence from Chinese heavily-polluting listed companies. J Clean Prod 363:132458. https://doi.org/10.1016/j.jclepro

Chen DK, Chen SY, Jin H, Lu YL (2020) The impact of energy regulation on energy intensity and energy structure: Firm-level evidence from China. China Econ Rev 59:101351. https://doi.org/10.1016/j.chieco.101351

Chen L, Li K, Chen S, Wang X, Tang L (2021) Industrial activity, energy structure, and environmental pollution in China. Energy Econ 104:105633. https://doi.org/10.1016/j.eneco.2021.105633

Chen Q, Wang M (2022) Opening of high-speed rail and the consumer service industry: evidence from China. Econ Anal Policy 76:31–45. https://doi.org/10.1016/j.eap.2022.07.010

Chen Y, Whalley A (2012) Green infrastructure: the effects of urban rail transit on air quality. Am Econ J Econ Policy 4(1):58–97. https://doi.org/10.1257/pol.4.1.58

Chien F, Sadiq M, Nawaz MA, Hussain MS, Tran TD, Le Thanh T (2021) A step toward reducing air pollution in top Asian economies: The role of green energy, eco-innovation, and environmental taxes. J Environ Manag 297:113420. https://doi.org/10.1016/j.jenvman.2021.113420

Chishti MZ, Khalid AA, Sana M (2023) Conflict vs sustainability of global energy, agricultural and metal markets: a lesson from Ukraine-Russia war. Resour Policy 84:103775. https://doi.org/10.1016/j.resourpol.2023.103775

Colgan JD, Gard-Murray AS, Hinthorn M (2023) Quantifying the value of energy security: how Russia’s invasion of Ukraine exploded Europe’s fossil fuel costs. Energy Res Soc Sci 103:103201. https://doi.org/10.1016/j.erss.2023.103201

Depren SK, Kartal MT, Çelikdemir NÇ, Depren Ö (2022) Energy consumption and environmental degradation nexus: a systematic review and meta-analysis of fossil fuel and renewable energy consumption. Ecol Inform 70:101747. https://doi.org/10.1016/j.ecoinf.2022.101747

Dong Z, Wang S, Zhang W, Shen H (2022) The dynamic effect of environmental regulation on firms’ energy consumption behavior-Evidence from China’s industrial firms. Renew Sustain Energy Rev 156:1119666. https://doi.org/10.1016/j.rser.2021.111966

Du H, Chen Z, Zhang Z, Southworth F (2020) The rebound effect on energy efficiency improvements in China’s transportation sector: a CGE analysis. J Manag Sci Eng 5(4):249–263. https://doi.org/10.1016/j.jmse.2020.10.005

Duranton G, Morrow PM, Turner MA (2014) Roads and trade: evidence from the US. Rev Econ Stud 81(2):681–724. https://doi.org/10.1093/restud/rdt0399

Faggio G, Silva O, Strange WC (2017) Heterogeneous agglomeration. Rev Econ Stat 99(1):80–94. https://doi.org/10.1162/REST_a_00604

Feng QY, Chen ZH, Cheng CC, Chang HQ (2023) Impact of high-speed rail on high-skilled labor mobility in China. Transp Policy 133:64–74. https://doi.org/10.1016/j.tranpol.2023.01.006

Fu T (2018) How does government intervention determine a Firm’s fuel intensity: evidence from China. J Clean Prod 196:1522–1531. https://doi.org/10.1016/j.jclepro.2018.06.124

Fan X, Xu Y (2023) Does high-speed railway ****promote urban innovation? Evidence from China. Socio-Econ Plan Sci 86:101464. https://doi.org/10.1016/j.seps.2022.101464

Gao YY, Zheng JH (2020) The impact of high-speed rail on innovation: an empirical test of the companion innovation hypothesis of transportation improvement with China’s manufacturing firms. World Dev 127:104838. https://doi.org/10.1016/j.worlddev.2019.104838

Gong M, Zeng Y, Zhang F (2023) New infrastructure, optimization of resource allocation and upgrading of industrial structure. Financ Res Lett 54:103754. https://doi.org/10.1016/j.frl.2023.103754

Guo Y, Yu W, Chen Z, Zou R (2020) Impact of high-speed rail on urban economic development: an observation from the Beijing-Guangzhou line based on night-time light images. Socio-Econ Plan Sci 72:100905. https://doi.org/10.1016/j.seps.2020.100905

Guo Y, Peeta S, Mannering F (2016) Rail-truck ****multimodal freight collaboration: a statistical analysis of freight-shipper perspectives. Transp Plan Technol 39(5):484–506. https://doi.org/10.1080/03081060.2016.1174365

Ha L (2023) An application of QVAR dynamic connectedness between geopolitical risk and renewable energy volatility during the COVID-19 pandemic and Russia-Ukraine conflicts. J Environ Manag 342:118290. https://doi.org/10.1016/j.jenvman.2023.118290

Huang Y, Zong H (2020) The spatial distribution and determinants of China’s high-speed train services. Transp Res Part A Policy Pract 142:56–70. https://doi.org/10.1016/j.tra.2020.10.009

Huang J, Lian S, Qu R et al. (2023) Investigating the role of enterprises’ property rights in China’s provincial industrial energy intensity. Energy 282:128940. https://doi.org/10.1016/j.energy.2023.128940

Huang Y, Wang Y (2020) How does high-speed ****railway affect green innovation efficiency? A perspective of innovation factor mobility. J Clean Prod 265:121623. https://doi.org/10.1016/j.jclepro.2020.121623

Komikado H, Morikawa S, Bhatt A, Kato H (2021) High-speed rail, inter-regional accessibility, and regional innovation: evidence from Japan. Technol Forecast Soc Change 167:120697. https://doi.org/10.1016/j.techfore.2021.120697

Lan XJ, Hu ZE, Wen CH (2023) Does the opening of high-speed rail enhance urban entrepreneurial activity? Evidence from China. Socio-Econ Plan Sci 88:101604. https://doi.org/10.1016/j.seps.2023.101604

Li P, Lu Y, Wang J (2016) Does flattening government improve economic performance? Evidence from China. J Dev Econ 123:18–37. https://doi.org/10.1016/j.jdeveco.2016.07.002

Li R, Xu M, Zhou H (2023) Impact of high-speed rail operation on urban economic resilience: evidence from local and spillover perspectives in China. Cities 141:104498. https://doi.org/10.1016/j.cities.2023.104498

Li X, Cheng Z (2022) Does high-speed rail improve urban carbon emission efficiency in China? Socio-Econ Plan Sci 84:101308. https://doi.org/10.1016/j.seps.2022.101308

Li Y, Du Q, Lu X, Wu J, Han X (2019) Relationship between the development and CO2 emissions of transport sector in China. Transp Res Part D Transp Environ 74:1–14. https://doi.org/10.1016/j.trd.2019.07.011

Li Y, Yang J, Zhang W et al. (2022) Does high-speed railway promote high-quality development of enterprises? evidence from China’s listed companies. Sustainability 14(18):11330. https://doi.org/10.3390/su141811330

Liu XG, Ji Q, Yu J (2021) Sustainable development goals and firm carbon emissions: evidence from a quasi-natural experiment in China. Energy Econ 103:105627. https://doi.org/10.1016/j.eneco.2021.105627

Liu Z, Zeng S, Jin Z, Shi JJ (2022) Transport infrastructure and industrial agglomeration: evidence from manufacturing industries in China. Transp Policy 121:100–112. https://doi.org/10.1016/j.tranpol.2022.04.001

Lu YG, Zhang L (2022) National mitigation policy and the competitiveness of Chinese firms. Energy Econ 109:105971. https://doi.org/10.1016/j.eneco.2022.105971

Lumeng W, Hailin C, Shilai C (2023) Information infrastructure, technic link and corporate innovation. Financ Res Lett 104086. https://doi.org/10.1016/j.frl.2023.104086

Miwa N, Bhatt A, Morikawa S, Kato H (2022) High-Speed rail and the knowledge economy: evidence from Japan. Transp Res Part A Policy Pract 159:398–416. https://doi.org/10.1016/j.tra.2022.01.019

Mol AP, Spaargaren G (2000) Ecological modernisation theory in debate: a review. Environ Polit 9:17–49. https://doi.org/10.1080/09644010008414511

Pata UK, Kartal MT, Liu H, Zafar MW (2023) Environmental reverberations of geopolitical risk and economic policy uncertainty resulting from the Russia-Ukraine conflict: a wavelet based approach for sectoral CO2 emissions. Environ Res 231:116034. https://doi.org/10.1016/j.envres.2023.116034

Rus GD (2009) Economic analysis of high speed rail in Europe. Fundacion BBVA. https://www.researchgate.net/publication/326159879_Economic_Analysis_of_High_Speed_Rail_in_Europe

Solaymani S (2019) CO2 emissions patterns in 7 top carbon emitter economies: the case of transport sector. Energy 168:989–1001. https://doi.org/10.1016/j.energy.2018.11.145

Solokha M, Pereira P, Symochko L, Vynokurova N, Demyanyuk O, Sementsova K, Inácio M, Barceló D (2023) Russian-Ukrainian war impacts on the environment. Evidence from the field on soil properties and remote sensing. Sci Total Environ 902:166122. https://doi.org/10.1016/j.scitotenv.2023.166122

Su F, Chang J, Li X, Fahad S, Ozturk I (2022) Assessment of diverse energy consumption structure and social capital: a case of southern Shaanxi province China. Energy 125506. https://doi.org/10.1016/j.energy.2022.125506

Shen Q, Pan Y, Feng Y (2023) The impacts of high-speed ****railway on environmental sustainability: quasi-experimental evidence from China. Humanit Soc Sci Commun 10(1):1–19. https://doi.org/10.1057/s41599-023-02135-6

Tian M, Wang Y, & Wang Y (2022) High-speed rail network and urban agglomeration economies: research from the perspective of urban network externalities. Socio-Econ Plan Sci 101442. https://doi.org/10.1016/j.seps.2022.101442

Wang F, Wei X, Liu J, He L, Gao M (2019a) Impact of high-speed rail on population mobility and urbanisation: a case study on Yangtze River Delta urban agglomeration, China. Transp Res Part A Policy Pract 127:99–114. https://doi.org/10.1016/j.tra.2019.06.018

Wang S, Li C, Zhou H (2019b) Impact of China’s economic growth and energy consumption structure on atmospheric pollutants: based on a panel threshold model. J Clean Prod 236:117694. https://doi.org/10.1016/j.jclepro.2019.117694

Wang YM, Cao GH, Yan YL, Wang JJ (2022) Does high-speed rail stimulate cross-city technological innovation collaboration? Evidence from China. Transp Policy 116:119–131. https://doi.org/10.1016/j.tranpol.2021.11.024

Wu T, Lin S, Wang J et al. (2023) High-speed rail and city’s ****carbon productivity in China: a spatial difference-in-differences approach. Environ Sci Pollut Res 30(19):56284–56302. https://doi.org/10.1007/s11356-023-26297-7

Xin B, Zhang M (2023) Evolutionary game on international energy trade under the Russia-Ukraine conflict. Energy Econ 125:106827. https://doi.org/10.1016/j.eneco.2023.106827

Xu H, Qiu L, Liu B et al. (2021) Does regional planning policy of Yangtze River Delta improve green technology innovation? Evidence from a quasi-natural experiment in China. Environ Sci Pollut Res 28:62321–62337. https://doi.org/10.1007/s11356-021-14946-8

Yang X, Lin S, Li Y, He M (2019) Can high-speed rail reduce environmental pollution? Evidence from China. J Clean Prod 239:118135. https://doi.org/10.1016/j.jclepro.2019.118135

Yang X, Zhang H, Lin S et al. (2021) Does high-speed ****railway promote regional innovation growth or innovation convergence? Technol Soc 64:101472. https://doi.org/10.1016/j.techsoc.2020.101472

Zhang XZ, Wu WX, Zhou ZX, Yuan L (2020) Geographic proximity, information flows and corporate innovation: evidence from the high-speed rail construction in China. Pac-Basin Financ J 61:101342. https://doi.org/10.1016/j.pacfin.2020.101342

Zhang X, Zhou H (2022) The effect of market competition on corporate cash holdings: an analysis of corporate innovation and financial constraint. Int Rev Financ Anal 82:102163. https://doi.org/10.1016/j.irfa.2022.102163

Zhang X, Wu L, Zhang R, Deng S, Zhang Y, Wu J, Li Y, Lin L, Li L, Wang Y, Wang L (2013) Evaluating the relationships among economic growth, energy consumption, air emissions and air environmental protection investment in China. Renew Sustain Energy Rev 18:259–270. https://doi.org/10.1016/j.rser.2012.10.029

Zhou M, Li K, Chen Z (2020) Corporate governance quality and financial leverage: evidence from China. Int Rev Financ Anal 73:101652. https://doi.org/10.1016/j.irfa.2020.101652

Zhou QL, Li T, Gong LT (2022) The effect of tax incentives on energy intensity: Evidence from China’s VAT reform. Energy Econ 108:105887. https://doi.org/10.1016/j.eneco.2022.105887

Zhou T, Zhang N (2022) Does high-speed rail make firms cleaner in China? J Environ Manag 311:114901. https://doi.org/10.1016/j.jenvman.2022.114901

Zhang W, Zeng M, Zhang Y et al. (2023) Reducing carbon emissions: can high-speed railway contribute? J Clean Prod 413:137524. https://doi.org/10.1016/j.jclepro.2023.137524

Zhou T, Huang X, Zhang N (2023) Does the high-speed railway make cities more carbon efficient? Evidence from the perspective of the spatial spillover effect. Environ Impact Assess Rev 101:107137. https://doi.org/10.1016/j.eiar.2023.107137

Zhang R, Hanaoka T (2021) Deployment of electric vehicles in China to meet the carbon neutral target by 2060: provincial disparities in energy systems, CO2 emissions, and cost effectiveness. Resour Conserv Recycl 170:105622. https://doi.org/10.1016/j.resconrec.2021.105622

Acknowledgements

This work was supported by Postdoctoral Science Foundation of China (2022M720131).

Author information

Authors and Affiliations

Contributions

Conceptualization, YF; methodology, JZ; software, YF; validation, RL; formal analysis, JZ; data curation, YP; writing—original draft preparation, JZ and YF; writing—review and editing, YP; visualization, SN; supervision, JZ; funding acquisition, SN.

Corresponding authors

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This article does not contain any studies with human participants performed by any of the authors.

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this license, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Feng, Y., Zhang, J., Luo, R. et al. How does the opening of high-speed rail drive energy restructuring? New micro evidence from China. Humanit Soc Sci Commun 11, 173 (2024). https://doi.org/10.1057/s41599-024-02622-4

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-024-02622-4

- Springer Nature Limited