Abstract

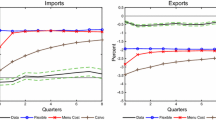

This paper examines the exchange rate policy in a tractable framework with heterogeneous firms, incomplete financial markets and nominal rigidities. External demand shocks generate exchange rate movements leading to uncertainty in the labor demand of exporter firms. When exporter firms are homogeneous in terms of productivity, a monetary policy response to external demand shocks stabilizes the export market and improves welfare, thus providing a rationale for managed exchange rate policies.

Similar content being viewed by others

Notes

Hamano and Zanetti (2020) also explore the link between selection of firms and monetary policy but in a closed economy setting.

Incomplete financial markets introduce distortions in the flexible price allocation, and provide a case for the fixed exchange rate to dominate the flexible one. While Devereux (2004) highlights the role of the elasticity of labor supply and Hamano and Picard (2017) the preference for product variety in ranking the exchange rate policy, we study how the heterogeneity in firm productivity shapes the response of the economy to demand shocks.

In line with related literature, for the sake of tractability we opt for this extreme source of market incompleteness which implies financial autarky.

As an alternative, entry cost could be paid in terms of consumption goods as in Corsetti et al. (2010) . In that case, monetary policy has an impact on the number of entrants combined with price rigidity. In our setting, we choose to express entry costs in labor units because it is closely related to our source of nominal rigidity which concerns wages. As shown in the model solution in Table 1, with wage rigidity, a positive (negative) monetary shock directly increases (decreases) the entry of firms, in the same fashion as in Corsetti et al. (2010).

The labor demand for exporting are \(l_{f_{X},t}=\left( \int _{0}^{1}l_{f_{X},t}\left( j\right) ^{1-\frac{1}{\theta }}dj\right) ^{\frac{1}{1-\frac{1}{\theta }}}\) and \(l_{f_{X},t}\left( j\right) =\left( \frac{W_{t}\left( j\right) }{W_{t}}\right) ^{-\theta }l_{f_{X},t}\).

The practice of pricing to market and dollar pricing has also been emphasized in the literature and become a motivation to limit the fluctuations in the nominal exchange rate (see Betts and Devereux (1996), Devereux and Engel (2003), Corsetti et al. (2010) and Gopinath et al. (2020) among others). Instead of price rigidity in the export market, we introduce wage rigidity and focus on financial market incompleteness as an additional distortion in the economy.

The assumption of a Pareto shape of firm productivity distribution \(\kappa >\sigma -1\) ensures a finite mean for the sales of the firms.

While there is a strand of literature that models a downward wage rigidity (see for instance, Schmitt-Grohé and Uribe (2016), our setup employs a Calvo wage stickiness hence wages are rigid both upward and downward.

The marginal cost of one additional unit of labor supply is \(\eta \theta W_{t}\left( j\right) ^{-1}\mathrm {E_{t-1}}\left[ L_{t}\left( j\right) ^{1+\varphi }\right]\), and its marginal revenue is \(\left( \theta -1\right) \left( 1+\xi \right) \mathrm {E_{t-1}}\left[ \frac{L_{t}\left( j\right) }{P_{t}C_{t}\left( j\right) }\right]\).

When combining the monetary stance with the Euler equation on bond holdings, one gets \(\frac{1}{\mu _{t}}=\text {E}_{t}\lim _{s\rightarrow \infty }\beta ^{s}\frac{1}{\mu _{t+s}}\prod _{\tau =0}^{s-1}(1+i_{t+\tau })\). The monetary stance \(\mu _{t}\) may therefore be expressed as a function of the future expected path of interest rates or as a money supply rule \(M_{t}\) as in Eq. (7).

For instance, the first argument in \({E}_{t-1}\left[ {\mathcal {U}}\right]\) can be written as \({E}_{t-1}\left[ \alpha _{t}\left( \mathrm {ln}N_{D,t}^{\frac{\sigma }{\sigma -1}}\widetilde{y}_{D,t}\right) \right] ={E}_{t-1}\left[ \alpha _{t}\right] \left\{ {E}_{t-1}\left[ \mathrm {ln}N_{D,t}\right] +{E}_{t-1}\left[ \mathrm {ln}\widetilde{y}_{D,t}\right] \right\} +\left( 1+\frac{1}{\sigma -1}\right) cov\left( \alpha _{t},\mathrm {ln}N_{D,t}\right) +cov\left( \alpha _{t},\mathrm {ln}\widetilde{y}_{D,t}\right)\). The same decomposition applies for the other terms in \({E}_{t-1}\left[ {\mathcal {U}}\right]\).

The detailed derivation of the planner problem is provided in Appendix 2.

The characteristic adjustment of the export market in our model also shows up in the terms of trade \(\hbox {TOT}_{t}=\frac{\alpha _{t}^{*}}{\alpha _{t}}\frac{W_{t}^{*}}{W_{t}}\frac{\widetilde{z}_{X,t}}{\widetilde{z}_{X,t}^{*}}\). Following a positive demand shock for Home produced goods, the terms of trade appreciate. However, the fall in terms of trade is dampened by the higher relative average productivity of Home exporters (a rise in \(\widetilde{z}_{X,t}^{FL}/\widetilde{z}_{X,t}^{*FL}\)). Because of the selection into the export market, a nominal appreciation of Home currency coexists with a higher average export price for the Home country. This result is similar to what Rodriguez-Lopez (2011) dubs a “negative expenditure switching effect”. As it can be shown easily, the terms of trade under the fixed exchange rate policy are instead constant.

A Taylor expansion of the wage evaluated at \(\alpha _{t}=1/2\) gives \(W_{i,t}=\Gamma \mu _{0}+\frac{f_{i}^{''}(1/2)}{2}Var(\alpha _{t})+\cdots\), where \(f_{i}^{''}(\alpha _{t})\) stands for the second-order derivative of the policy i.

See Appendix 5.1 for more details.

With a higher value of the elasticity of substitution \(\sigma\), the monetary intervention increases welfare by a lower extent. The numerical results are available upon request. For a broader discussion of the impact of love for variety in welfare ranking, see Hamano and Picard (2017) and Appendix 1.1.

In Appendix 5.4 we derive the optimal cooperative monetary policy.

References

Auray, Stéphane, Michael B. Devereux, and Aurélien Eyquem. 2019. Endogenous trade protection and exchange rate adjustment. NBER working papers 25517, National Bureau of Economic Research, Inc.

Barattieri, Alessandro, Matteo Cacciatore, Fabio Ghironi. 2018. Protectionism and the business cycle. NBER working papers 24353, National Bureau of Economic Research, Inc.

Bergin, Paul R., and Giancarlo Corsetti. 2020. Beyond competitive devaluations: The monetary dimensions of comparative advantage. American Economic Journal: Macroeconomics 12 (4): 246–286.

Betts, Caroline, and Michael Devereux. 1996. The exchange rate in a model of pricing-to-market. European Economic Review 40 (3–5): 1007–1021.

Cacciatore, Matteo. 2014. International trade and macroeconomic dynamics with labor market frictions. Journal of International Economics 93 (1): 17–30.

Cacciatore, Matteo, and Fabio Ghironi. 2021. Trade, unemployment, and monetary policy. Journal of International Economics, 132 (C).

Corsetti, Giancarlo, Luca Dedola, and Sylvain Leduc. 2010. Optimal Monetary Policy in Open Economies. In Handbook of Monetary Economics, eds. Benjamin M. Friedman and Michael Woodford, 1, Vol. 3, Elsevier, Chapter 16, 861–933.

Corsetti, Giancarlo, and Paolo Pesenti. 2001. Welfare and macroeconomic interdependence. The Quarterly Journal of Economics 116 (2): 421–445.

Corsetti, Giancarlo, Philippe Martin, and Paolo Pesenti (2013) Varieties and the transfer problem. Journal of International Economics, 89 (1): 1–12.

Costinot, Arnaud, Andrés Rodríguez-Clare, and Iván Werning. 2020. Micro to macro: Optimal trade policy with firm heterogeneity. Econometrica 88 (6): 2739–2776.

Devereux, Michael, and Charles Engel. 2003. Monetary policy in the open economy revisited: Price setting and exchange-rate flexibility. Review of Economic Studies 70 (4): 765–783.

Devereux, Michael B. 2004. Should the exchange rate be a shock absorber? Journal of International Economics 62 (2): 359–377.

di Mauro, Filippo, and Francesco Pappadà. 2014. Euro area external imbalances and the burden of adjustment. Journal of International Money and Finance 48 (PB): 336–356.

Erceg, Christopher J., Andrea Prestipino, Andrea Raffo. 2018. The macroeconomic effects of trade policy. International finance discussion papers 1242, Board of Governors of the Federal Reserve System (US).

Friedman, Milton. 1953. Essays in Positive Economics. University of Chicago Press.

Ghironi, Fabio, and Marc J. Melitz. 2005. International trade and macroeconomic dynamics with heterogeneous firms. The Quarterly Journal of Economics 120 (3): 865–915.

Gopinath, Gita, Emine Boz, Camila Casas, and Federico J. Díez. 2020. Dominant currency paradigm. American Economic Review 110 (3): 677–719.

Hamano, Masashige. 2014. The Harrod–Balassa–Samuelson effect and endogenous extensive margins. Journal of the Japanese and International Economies 31 (C): 98–113.

Hamano, Masashige, and Pierre M. Picard. 2017. Extensive and intensive margins and exchange rate regimes. Canadian Journal of Economics, 50 (3): 804–837.

Hamano, Masashige, and Francesco Zanetti. 2020. Monetary policy, firm heterogeneity, and product variety. Economics series working papers 917, University of Oxford, Department of Economics.

Ilzetzki, Ethan, Carmen M. Reinhart, and Kenneth S. Rogoff. 2019. Exchange arrangements entering the twenty-first century: Which anchor will hold? The Quarterly Journal of Economics 134 (2): 599–646.

Lindé, Jesper, and Andrea Pescatori. 2019. The macroeconomic effects of trade tariffs: Revisiting the Lerner symmetry result. Journal of International Money and Finance 95 (C): 52–69.

Melitz, Marc J. 2003. The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica 71 (6): 1695–1725.

Mundell, Robert A. 1961. A theory of optimum currency areas. American Economic Review 51: 657–665.

Obstfeld, Maurice. 2020. Harry Johnson’s “case for flexible exchange rates”: 50 years later. Working paper series WP20-12, Peterson Institute for International Economics.

Obstfeld, Maurice, Kenneth Rogoff. 1998. Risk and exchange rates. NBER working papers 6694, National Bureau of Economic Research, Inc.

Pappadà, Francesco. 2011. Real adjustment of current account imbalances with firm heterogeneity. IMF Economic Review 59 (3): 431–454.

Rodriguez-Lopez, Jose Antonio. 2011. Prices and exchange rates: A theory of disconnect. Review of Economic Studies 78 (3): 1135–1177.

Schmitt-Grohé, Stephanie, and Martín Uribe. 2016. Downward nominal wage rigidity, currency pegs, and involuntary unemployment. Journal of Political Economy 124 (5): 1466–1514.

Acknowledgements

We thank the editor, two anonymous referees, Javier Bianchi, Aurélien Eyquem, Fabio Ghironi, Oleg Itskhoki, Dennis Novy, Toshihiro Okubo, Facundo Piguillem, Tom Schmitz and seminar participants at Bank of England, Bank of Finland, Banque de France, CREST Ecole Polytechnique, GATE-Lyon II, HEC Lausanne, ISER Osaka, Waseda University, the AMSE-BdF Workshop, 4th BdF-BoE International Macroeconomics Workshop at Bank of England, Midwest International Trade (Spring 2019), E1Macro QMQM Queen Mary (2019), EEA-ESEM (2019), the 79th Annual Meeting of the JSIE (2020), ICMAIF (2021) and 38th EBES Conference (2022) for providing useful comments. The present project was supported by Grant-in-Aid for Scientific Research (C), JSPS 18K01521 and Murata Foundation Research Grant. Part of this work has been realized while Francesco Pappadà was visiting the Research Unit of Bank of Finland.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1: Solution of the Model

We derive here the closed form solution of the theoretical model presented in Table 1. Similar expressions hold for Foreign. First, note that using average prices and the expressions of price indices, we have \(P_{H,t}=N_{D,t}^{-\frac{1}{\sigma -1}}\widetilde{p}_{D,t}\) and \(P_{F,t}=N_{X,t}^{*-\frac{1}{\sigma -1}}\widetilde{p}_{X,t}^{*}\). Plugging these expressions in the expression of domestic profits, profits from exporting and total profits on average, we have \(\widetilde{D}_{D,t}=\frac{\alpha {t}}{\sigma }\frac{\mu _{t}}{N_{D,t}}\), \(\widetilde{D}_{X,t}=\frac{\alpha _{t}}{\sigma }\frac{\varepsilon _{t}\mu _{t}^{*}}{N_{X,t}}-f_{X,t}W_{t}\) and \(\widetilde{D}_{t}=\widetilde{D}_{D,t}+\frac{N_{X,t}}{N_{D,t}}\widetilde{D}_{X,t}\). Given the zero cutoff profits (ZCP) condition, we have \(\widetilde{D}_{X,t}=W_{t}f_{X,t}\frac{\sigma -1}{\kappa -\left( \sigma -1\right) }\). By combining these two expressions of \(\widetilde{D}_{X,t}\) we have \(\widetilde{D}_{X,t}=\frac{\sigma -1}{\kappa }\frac{\alpha _{t}}{\sigma }\frac{\varepsilon _{t}\mu _{t}^{*}}{N_{X,t}}\). Using the ZCP condition with the expression of \(\widetilde{D}_{X,t}\) and the exchange rate implied under the balanced trade \(\varepsilon _{t}=\frac{\alpha _{t}^{*}}{\alpha _{t}}\frac{\mu _{t}}{\mu _{t}^{*}}\), we have \(N_{X,t}=\frac{1}{\sigma }(1-\frac{\sigma -1}{\kappa })\frac{\alpha _{t}^{*}\mu _{t}}{W_{t}f_{X,t}}\). The assumption of a Pareto distribution of firm productivity implies that \(\widetilde{z}_{X,t}=\left[ \frac{\kappa }{\kappa -\left( \sigma -1\right) }\right] ^{\frac{1}{\sigma -1}}\left( \frac{N_{X,t}}{N_{D,t}}\right) ^{-\frac{1}{\kappa }}\).

We are now ready to derive the number of new entrants, \(N_{D,t+1}\). Free entry implies that \(\widetilde{V}_{t}=f_{E,t}W_{t}\). Combined with the expression of \(\widetilde{D}_{t+1}\), the Euler equation about the share holdings, \(\widetilde{V}_{t}=E_{t}\left[ Q_{t,t+1}\widetilde{D}_{t+1}\right]\), is expressed as

Plugging the expression of \(\widetilde{D}_{D,t+1}\), \(\widetilde{D}_{X,t+1}\) and the expression of the equilibrium exchange rate \(\varepsilon _{t}=\frac{\alpha _{t}^{*}}{\alpha _{t}}\frac{\mu _{t}}{\mu _{t}^{*}}\), the previous equation is rewritten as

which gives

Next we derive the labor demand in general equilibrium. Note that \(\widetilde{D}_{X,t}=\frac{1}{\sigma }\frac{\varepsilon _{t}\widetilde{p}_{X,t}}{\tau }\widetilde{y}_{X,t}-f_{X,t}W_{t}\) and \(\widetilde{D}_{D,t}=\frac{1}{\sigma }\widetilde{p}_{D,t}\widetilde{y}_{D,t}\). Once we plug the expression of prices into these profits, we have \(\widetilde{y}_{D,t}=\left( \sigma -1\right) \frac{\widetilde{D}_{D,t}\widetilde{z}_{D}}{W_{t}}\) and \(\widetilde{y}_{X,t}=\left( \sigma -1\right) \frac{\left( \widetilde{D}_{X,t}+f_{X,t}W_{t}\right) \widetilde{z}_{X,t}}{W_{t}}\). Replacing those expressions in the labor market clearings (8), we have

Using the expression of \(\widetilde{D}_{D,t}\), \(\widetilde{D}_{X,t}\), \(N_{D,t+1}\), \(N_{X,t}\) and the exchange rate found previously, the above expression becomes

Finally, we obtain Eq. (9) after replacing the wage setting of Eq. (6) into the above expression.

1.1 Solution of the Model Without Firm Dynamics

In our model, the monetary intervention plays a key role in mitigating the fluctuations in labor demand determined by the preference shock. In order to highlight the role of firm dynamics in labor demand fluctuations, we derive here a version of our model without selection into exporting market as described in the “lagged entry” model of Hamano and Picard (2017).

Note that by setting \(f_{X,t}=0\), all firms export despite firm heterogeneity, hence \(N_{X,t}=N_{D,t}\) and \(\widetilde{z}_{X,t}=\widetilde{z}_{D}\). In such a specific case, we have \(\widetilde{D}_{D,t}=\frac{\alpha _{t}}{\sigma }\frac{\mu _{t}}{N_{D,t}}\), \(\widetilde{D}_{X,t}=\frac{\alpha _{t}}{\sigma }\frac{\varepsilon _{t}\mu _{t}^{*}}{N_{D,t}}\). Once we replace these expressions in the Euler equation with free entry condition, we get

which gives the number of future domestic firms: \(N_{D,t+1}=\frac{\beta }{\sigma }\frac{\mu _{t}}{W_{t}f_{E,t}}E_{t}\left[ \alpha _{t+1}+\alpha _{t+1}^{*}\right] =\frac{\beta }{\sigma }\frac{\mu _{t}}{W_{t}f_{E,t}}\). The labor market clearing is

where \(\widetilde{y}_{D,t}=\left( \sigma -1\right) \frac{\widetilde{D}_{D,t}\widetilde{z}_{D}}{W_{t}}\) and \(\widetilde{y}_{X,t}=\left( \sigma -1\right) \frac{\widetilde{D}_{X,t}\widetilde{z}_{D}}{W_{t}}\). Together with \(N_{D,t+1}\), we obtain the labor demand in Hamano and Picard (2017):

The equilibrium wage is

which corresponds to the wage in our model when \(\kappa =\sigma -1\): when firm heterogeneity is the largest as possible, the adjustment at the extensive margin due to labor demand uncertainty is the smallest.

Appendix 2: Social Planner

In this section, we show the solution of a benevolent social planner. Due to the assumption of one period to build and the full depreciation of firms after one period of production, we express the expected utility only for two consecutive periods without loss of generality as

Using the good market clearing conditions \(\widetilde{c}_{D,t}=\widetilde{y}_{D,t}, \widetilde{c}_{X,t}=\widetilde{y}_{X,t}^{*}, \widetilde{c}_{D,t}^{*}=\widetilde{y}_{D,t}^{*}, \widetilde{c}_{X,t}^{*}=\widetilde{y}_{X,t}\), we get:

As argued in the text, the planner maximizes \({E}_{t-1}\left[ {\mathcal {U}}\right] +{E}_{t-1}\left[ {\mathcal {U}}^{*}\right]\) with respect to \(\widetilde{y}_{D,t},\widetilde{y}_{D,t}^{*},N_{D,t+1},N_{D,t+1}^{*},\widetilde{y}_{X,t},\widetilde{y}_{X,t}^{*},N_{X,t},N_{X,t}^{*}\) subject to two types of technological constraints, namely (5) and (8) for each country. The solution is given by Table 2. The optimal labor supply in Home is given by

where \({{\mathcal {A}}_{t}}\equiv \left( 2+\frac{1}{\sigma -1}-\frac{1}{\kappa }\right) \alpha _{t}+\beta (\frac{1}{\sigma -1}+\frac{1}{\kappa })E_{t}\left[ \alpha _{t+1}\right]\). The planner lets Home households work more when the preference attached to goods produced in the Home country is high (\(\alpha _{t}>\alpha _{t}^{*}\)). As a result, as shown in Table 2, the number of exporters in Home is higher than in Foreign (\(N_{X,t}>N_{X,t}^{*}\)) and the average domestic production in Home (\(\widetilde{y}_{D,t}>\widetilde{y}_{D,t}^{*}\)) is higher than in Foreign. The extent of this gap depends negatively upon the marginal disutility of labor supply \(\eta L_{t}^{\varphi }\) and \(\eta L_{t}^{*\varphi }\). Further, given \(N_{X,t}>N_{X,t}^{*}\) and noting that \(N_{D,t}\) and \(N_{D,t}^{*}\) are the state of the economy, the average productivity of Home exporters is lower than the average productivity of Foreign exporters (\(\widetilde{z}_{X,t}<\widetilde{z}_{X,t}^{*}\)). As a consequence, the average production of Home exporters is smaller than that of Foreign exporters (\(\widetilde{y}_{X,t}<\widetilde{y}_{X,t}^{*}\)). When the expected preference attached to goods produced in the Home country is high (\(E_{t}\left[ \alpha _{t+1}\right] >E_{t}\left[ \alpha _{t+1}^{*}\right]\)), the planner lets Home households work more. The future number of firms in the Home country is then higher than in the Foreign country (\(N_{D,t+1}>N_{D,t+1}^{*}\)).

Appendix 3: Complete Financial Markets

Let us show that the allocation of the social planner is very close to the one in our framework once we allow for complete financial markets and flexible wages. To begin with, we characterize the equilibrium exchange rate. Under complete asset markets, the marginal utility stemming from one additional unit of nominal wealth is equal across countries. Given our preferences defined in Eq. (1), this implies

Note that complete markets allow households to ensure against demand shocks, and as a consequence, the exchange rate is also independent from demand shocks. Table 3 reports the solution of the model under complete asset markets (with wage rigidity).

To what extent the allocation under complete markets differs from that implied by the social planner? Without wage rigidities, the equilibrium wage is \(W_{t}=\Gamma \mu _{0}{\mathcal {A}}_{t}^{\frac{\varphi }{1+\varphi }}\) and \(W_{t}^{*}=\Gamma \mu _{0}{\mathcal {A}}_{t}^{*\frac{\varphi }{1+\varphi }}\), where monetary stances serve just as the “nominal anchors” which determine the wage level in each country. As a result, the real variables are independent from monetary stances. In particular, the equilibrium labor supply under complete asset markets and flexible wages is

Comparing the above solution with (15), we can state that the equilibrium allocation under complete financial markets and flexible wages is identical to the one implied by the social planner once monopolistic distortions both in goods and labor markets are removed. Indeed, by setting \(\frac{\sigma -1}{\sigma }\frac{\left( \theta -1\right) \left( 1+\xi \right) }{\theta }=1\), the labor supply is equal to the one in the planner problem. In order to compare the allocation of the competitive equilibrium with the allocation of the social planner who does not have prices, we express the allocation with the above labor supply. Note that without wage rigidities, Eq. (6) implies that the equilibrium wage is \(W_{t}=\Gamma ^{1+\varphi }\mu _{t}L_{t}^{\varphi }\) and \(W_{t}^{*}=\Gamma ^{1+\varphi }\mu _{t}^{*}L_{t}^{*\varphi }\). By plugging the expressions for the model solution under complete asset markets of Table 3, we can show the Corollary of Proposition 1.

Finally, we can write the terms of trade under complete markets and flexible wages as

Following a positive demand shock for Home produced goods, the Home terms of trade appreciate because \(L_{t}/L_{t}^{*}\) increases and \(\widetilde{z}_{X,t}/\widetilde{z}_{X,t}^{*}\) decreases. The extent of the appreciation is higher for a lower elasticity of labor supply, \(1/\varphi\). This expression is considered as the desired terms of trade by the social planner. Shutting down monopolistic power and firm heterogeneity, i.e., without variation in the cutoff level of productivity, the expression of the desired terms of trade by the social planner collapses into the one in Devereux (2004).

Appendix 4: Incomplete Financial Markets and Flexible Wages

The allocation with flexible wages under incomplete financial markets is obtained by removing the expectation operator in the solution of the benchmark economy presented in Table 1: wages are flexible and are not set one period in advance. The equilibrium wage is then \(W_{t}=\Gamma A_{t}^{\frac{\varphi }{1+\varphi }}\mu _{t}\) and \(W_{t}^{*}=\Gamma A_{t}^{\frac{\varphi }{1+\varphi }}\mu _{t}\) and the monetary stance is just a nominal anchor. Accordingly, the nominal exchange rate \(\varepsilon _{t}\) has no impact on the real allocation. Plugging the equilibrium flexible wage in the solution of Table 1, we prove Proposition 3.

In the peculiar case of infinite elasticity of labor supply, that is when \(\varphi =0\), the allocation with flexible wages (and incomplete financial markets) is exactly the same as under the flexible exchange rate policy. When labor supply is infinitely elastic, the flexible exchange rate can therefore compensate for the wage rigidity. However, this does not imply that a flexible exchange rate is the dominant one. This allocation is indeed far from the first best allocation. Following a positive demand shift for Home goods, the relative number of Home exporters decreases, whereas it would increase increases in the planner solution. The adjustments at the extensive and intensive margins are inefficient even when wages are flexible in our setting with incomplete financial markets. This also implies that the fluctuations in the terms of trade under a flexible exchange rate do not reproduce the complete markets allocation. The comparison between the flexible exchange rate and the flexible wage therefore highlights the role of incomplete financial markets for the choice of the exchange rate policy.

Appendix 5: Exchange Rate Policy

1.1 Polar Exchange Rate Policies

In competitive equilibrium, \({E}_{t-1}\left[ L_{t+1}^{1+\varphi }\right]\) is constant, thus the expected utility of Home representative household for any consecutive time period is given by Eq. (11). Using the solution of Table 1 and reporting time invariant variables as a constant, we get

Recall that \(\alpha _{t}=\frac{1}{2}\upsilon _{t}\) and \(\alpha _{t}^{*}=\frac{1}{2}\upsilon _{t}^{*}\), and we assume zero serial correlation across shocks. Finally, plugging the expression of wages in equilibrium, we get

We then replace the equilibrium variables under the two polar exchange rate policies to evaluate their impact on welfare.

1.2 Welfare and Firm Heterogeneity

We provide here the proof of Proposition 5. Once we take a Taylor expansion up to the second order of \(E_{t-1}\left[ A_{t}^{1+\varphi }\right]\) and \(E_{t-1}\left[ \left( A_{t}\upsilon _{t}\right) ^{1+\varphi }\right]\), and we evaluate these functions at \(\upsilon _{t}=1\), we get

where \(A\equiv \frac{\sigma -1}{2\sigma }\left[ 1+\beta \left( \frac{1}{\sigma -1}+\frac{1}{\kappa }\right) \right]\), \(\Phi =\frac{\sigma -1}{2\sigma }\left( \frac{1}{\sigma -1}-\frac{1}{\kappa }\right)\), \(f_{FX}(\kappa )\equiv \left[ \varphi \left( A-\Phi \right) ^{2}A^{\varphi -1}-2\Phi A^{\varphi }\right]\) and \(\quad f_{FL}(\kappa )\equiv \varphi \Phi ^{2}A^{\varphi -1}\). We then obtain

since \(A-\Phi =\frac{\sigma -1}{2\sigma }\left[ \frac{\sigma }{\sigma -1}+\frac{1}{\kappa }+\beta \left( \frac{1}{\sigma -1}+\frac{1}{\kappa }\right) \right] >0\) and \(A-2\Phi =\frac{\sigma -1}{2\sigma }\left[ 1+\frac{2}{\kappa }+\beta \left( \frac{1}{\sigma -1}+\frac{1}{\kappa }\right) \right] >0\). It follows that \(\frac{\partial \Delta \ln W_{t}}{\partial \kappa }<0\).

1.3 Optimal Non-cooperative Monetary Policy

The Home monetary authority maximizes (11) with respect to \(\mu _{t}\) and takes \(\mu _{t}^{*}\) as given:

The first-order condition with respect to \(\mu _{t}\) is

A similar condition holds for the monetary authority in Foreign. Replacing \(A_{t}\), \(A_{t}^{*}\) and the optimal policies \(\mu _{t}\) and \(\mu _{t}^{*}\) in the expression of the exchange rate, we get

It is straightforward to note that

For a given demand shock, the fluctuations of the nominal exchange rate under the optimal non-cooperative policy are therefore lower than those under the flexible exchange rate policy, which are proportional to the demand shocks. Moreover, the fluctuations under the optimal policies are more limited, the higher is the Pareto shape \(\kappa\). This leads to Proposition 6.

1.4 Optimal Cooperative Monetary Policy

Under cooperation, the objective of monetary policy in the Home country is

The first-order condition with respect to \(\mu _{t}\) is

A similar condition holds for the monetary authority in Foreign. Replacing \(A_{t}\), \(A_{t}^{*}\) and the optimal policies \(\mu _{t}\) and \(\mu _{t}^{*}\) in the expression of the exchange rate, we get

The non-cooperative and cooperative monetary policies are identical when \(\kappa =\sigma -1\), that is for the largest degree of firm heterogeneity. Instead, when \(\kappa\) is larger, the gains of international monetary policy cooperation are larger, as the coordinated response to demand shocks prevent abrupt adjustments in the extensive margins of trade.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.