Abstract

This paper investigates the determinants of total factor productivity and income growth by taking into account both the position of the industry in the global value chain and the complexity of participation for the period of 1996–2009 for 40 developed and developing countries. Our estimation results clearly show that while all measures of forward GVC participations raise the total factor productivity growth of manufacturing industries, there is no effect of participation into GVCs on the productivity of services sectors. Almost all measures of backward and forward GVC substantially promote the output growth of manufacturing and services industries. These significant results provide strong evidence for the learning by trading hypothesis and indicate the importance of deeper involvement into GVCs for higher sectoral productivity. Substantial evidence for the positive impact of importing and exporting intermediates, participating in GVCs, on sectoral performance imply that the successes of industries highly depend on their efficient integration in the global production process.

Résumé

Cet article étudie les déterminants de la productivité totale des facteurs et de la croissance des revenus en prenant en compte à la fois le positionnement de l'industrie dans la chaîne de valeur mondiale (CVM) et la complexité de la participation pour la période 1996-2009, dans 40 pays développés et en développement. Selon nos résultats, nous voyons clairement que toutes les mesures de participation en aval aux CVM augmentent la croissance de la productivité totale des facteurs des industries manufacturières, mais qu’il n'y a aucun effet lié à la participation aux CVM sur la productivité du secteur des services. Presque toutes les mesures de la participation aux CVM, que ce soit en amont ou en aval, favorisent considérablement l’augmentation de la production pour les industries manufacturières et des services. Ces résultats significatifs fournissent des preuves solides en faveur de l'hypothèse selon laquelle c’est en faisant du commerce que l’on s’améliore dans ce domaine et montrent l'importance d'une implication plus conséquente dans les CVM pour une productivité sectorielle plus élevée. Au vu des preuves importantes qui existent concernant l'impact positif sur la performance sectorielle de l'importation et de l'exportation de produits intermédiaires, et de la participation aux CVM, cela suggère que le succès des industries dépend fortement de leur intégration efficace dans le processus de production à l’échelle mondiale.

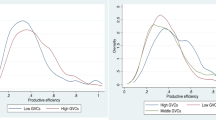

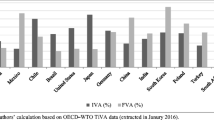

Notes: The bottom columns represent the GVC participation index, the middle columns represent simple GVC participation, and the top columns stand for complex GVC participation

Notes: See Notes to Fig. 1

Notes: See Notes to Fig. 1

Notes: See Notes to Fig. 1

Similar content being viewed by others

Notes

We also utilize the EU KLEMS (Jäger, 2016) and the 2016 release of TiVA (OECD, 2016) databases. Because of the smaller number of cross sectional units (14 and 17 sectors of 14 European countries and the USA for the 1996–2011 and 2005–2015, respectively) and lack of human capital variables, we prefer to use the WIOD sample. The OLS, FE, and SGMM estimations are quite parallel with those from the WIOD. The results are available on request.

See R Core Team (2019).

These two databases are merged directly via their sector codes because all sector codes in two databases are reported according to International Standard Industrial Classification of All Economic Activities (ISIC) Revision 3.

Australia, Austria, Belgium, Bulgaria, Brazil, Canada, China, Cyprus, Czech Republic, Germany, Denmark, Spain, Estonia, Finland, France, United Kingdom, Grece, Hungary, Indonesia, India, Ireland, Italy, Japan, Korea, Republic of Lithuania, Luxemburg, Latvia, Mexico, Malta, Netherlands, Poland, Portugal, Romania, Russia, Slovak Republic, Slovenia, Sweden, Turkey, Taiwan, and USA.

Even if the year coverage of the dataset includes the period of 1995–2011, we have period 1996–2009 as an operational sample because price indices and skill variables are not available for the years 2010 and 2011. In fact, the year coverage is quite optimal since the 2008 Global Financial Crisis makes the relationship between trade and output variables less clear. In the WIOD 2016 release, education variables are missing and the year coverage of this dataset, the period 2005–2014 includes 2008 Global Financial Crisis and global downturn after that. Even though the OLS and fixed effects results are roughly the same with the first period, our sample on 43 countries and 19 manufacturing/31 services sectors renders SGMM estimations impossible.

These sectors are hotels and restaurants and financial intermediation.

Countries having no data for R&D expenditures are Bulgaria, Brazil, Cyprus, Denmark, Indonesia, India, Lithuania, Luxemburg, Latvia, Malta, Sweden, and Taiwan.

Since R&D data are only available for 28 countries in our sample, we also repeat the output growth analysis for this restricted group. Our conclusions do not change meaningfully in this restricted group at all.

Note that our value added measures (following the OECD) also include taxes of sectors as opposed to the Wang’s calculations.

The details of calculations and explanations about backward and forward linkages can also be found in the Appendix.

In Table 1, “Y” stands for the share of backward related volumes in output and “V” stands for the share of forward related volumes in output.

The detailed derivation of the theory can be found in Grossman and Helpman (1991).

In fact, this approach only takes into account the direct linkages of trade. However, in the input–output framework, there are some indirect linkages across countries and industries (Krammer, 2010). For instance, if country A imports from another country B, which has already imported from another country C, the realized R&D spillover should be larger than Keller’s calculation because technology spillover from country C to country B is not counted in it. Nishioka and Ripoll (2012) enhance the Coe and Helpman framework by utilizing input–output matrix and propose both direct and indirect R&D channels for productivity accounting. In our model, since we are not mainly interested in R&D spillovers, we ignore this part and mainly focus on the intermediate inputs.

In the empirical literature, studies generally employ the OLS estimation methodology. We also exercise our analysis with the OLS. In this analysis, we add not only time dummies but also country and sectoral dummies into our models. In this context, Roodman (2009) asserts that employing fixed effects dummies into SGMM is mistake because it might cause bias especially if time dimension is very small. Comparing the OLS and SGMM estimations, we find very similar results and get the similar conclusions though. Because of the space limitations, the OLS results are not presented in here, but they are available upon request.

When we employ both backward and forward participation ratios together in our model, the significances of these variables continue to exist in almost all specifications. Due to the space consideration, we do not report the results here, but they are available upon request.

Indeed, we also measure only foreign part of backward complex participation index by omitting domestic value added returning home from intermediate inputs. Similarly, we consider only foreign part of forward complex participation index by dropping domestic value added embodied in intermediate goods exports used for production of re-exports that finally returns to source country. The results are parallel with the GVC part because domestic part of complex GVC index is very fractional (nearly 0.001 percentage in total output).

We also utilize OECD’s Analytical database for Multinational Enterprises database to get information regarding multinationals in each sector. Among several variables such as number of enterprises, employees, R&D expenditure, output; we prefer to use value added of multinationals. We calculate the share of value added of multinationals in each sector. The significance of all GVC measures continue to exist in the manufacturing sample without any significant positive effect of the share of multinational companies in sectors. Therefore, we argue that our results are quite robust. However, we cannot repeat the SGMM analysis for the service sectors because the number of observations in TFP analysis is extremely low (just 81 observations), the number of instrument outweighs the number of cross units, and the estimation has invalid Hansen test statistics. To be more specific, out of 40 countries in our sample, only 22 countries have information regarding multinationals. The year 2009 is also missing in OECD database. In output growth analysis, we find similar results for manufacturing sample. For the services sample, while forward simple GVC participation positively affects the output growth, the share of multinationals also appears to be significantly positive in some specifications. Actually, the number observations of services sample sharply decreases when we include the variable regarding multinationals. Therefore, we cannot make proper discussion because of this data limitations. Furthermore, we also try other variables such as the number of enterprises, but we reach the similar conclusion. Because of these data limitations (especially for the services industries and TFP growth analysis) and overall significant results, we prefer to continue with our benchmark results.

Our calculation of backward and forward lengths also depends on Wang’s calculation methodology.

References

Antràs, P., and D. Chor. 2013. Organizing the global value chain. Econometrica 81 (6): 2127–2204.

Antrás, P., D. Chor, T. Fally, and R. Hillberry. 2012. Measuring the upstreamness of production and trade flows. American Economic Review 102 (3): 412–416.

Antrás, P., A. De Gortari, and O. Itskhoki. 2017a. Globalization, inequality and welfare. Journal of International Economics 108: 387–412.

Antrás, P., T.C. Fort, and F. Tintelnot. 2017b. The margins of global sourcing: Theory and evidence from us firms. American Economic Review 107 (9): 2514–2564.

Arellano, M., and O. Bond. 1991. Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Review of Economic Studies 58: 277–297.

Baldwin, J., and W. Gu. 2003. Export market participation and productivity performance in Canadian manufacturing. Canadian Journal of Economics 36: 634–657.

Baldwin, J.R., and B. Yan. 2016. Global value chain participation and the productivity of Canadian manufacturing firms. Montreal: Institute for Research on Public Policy.

Bernard, K. 2007. Private damages actions: A US perspective on importing US damages actions to the EU. Antitrust Chronicle 11.

Bastos, P., J. Silva, and R. Proença. 2016. Exports and job training. The World Bank. Policy Research Working Paper No. 7676. World Bank, Washington, DC. © World Bank. https://openknowledge.worldbank.org/handle/10986/24513 License: CC BY 3.0 IGO.

Bournakis, I. 2012. Sources of TFP growth in a framework of convergence-evidence from Greece. International Review of Applied Economics 26 (1): 47–72.

Bournakis, I., D. Christopoulos, and S. Mallick. 2018. Knowledge spillovers and output per worker: An industry-level analysis for OECD countries. Economic Inquiry 56 (2): 1028–1046.

Cameron, G. 2005. The sun also rises: Productivity convergence between Japan and the USA. Journal of Economic Growth 10 (4): 387–408.

Cameron, G., J. Proudman, and S. Redding. 2005. Technological convergence, R&D, trade and productivity growth. European Economic Review 49 (3): 775–807.

Chor, D., K. Manova, and Z. Yu. (2014). The global production line position of Chinese firms. In: Paper presented at the Industrial Upgrading and Urbanization Conference, Stockholm.

Coe, D.T., and E. Helpman. 1995. International R&D spillovers. European Economic Review 39 (5): 859–887.

Criscuolo, C., and J. Timmis. 2017. The relationship between global value chains and productivity. International Productivity Monitor 32: 61–83.

Constantinescu, C., A. Mattoo, and M. Ruta. 2017. Trade developments in 2016: Policy uncertainty weighs on world trade. Washington: World Bank.

De Loecker, J. 2013. Detecting learning by exporting. American Economic Journal: Microeconomics 5 (3): 1–21.

De Marchi, V., E. Giuliani, and R. Rabellotti. 2018. Do global value chains offer developing countries learning and innovation opportunities? The European Journal of Development Research 30 (3): 389–407.

Dietzenbacher, E., and I. Romero. 2007. Production chains in an interregional framework: Identification by means of average propagation lengths. International Regional Science Review 30 (4): 362–383.

Ethier, W.J. 1982. National and international returns to scale in the modern theory of international trade. The American Economic Review 72 (3): 389–405.

Fally, T. 2012. On the Fragmentation of Production in the US. Boulder: University of Colorado-Boulder.

Feder, G. 1982. On exports and economic growth. Journal of Development Economics 12: 59–73.

Formai, S. and F. Vergara Caffarelli. 2016. Quantifying the productivity effects of global sourcing. Bank of Italy Temi di Discussione (Working Paper) No: 1075.

Gereffi, G. 1994. The organization of buyer-driven commodity chains: How US retailers shape overseas production networks. In Commodity chains and global capitalism, ed. M. Korzeniewicz and G. Gereffi, 95–122. New York: Praeger.

Grossman, G.M., and E. Helpman. 1991. Trade, knowledge spillovers, and growth. European Economic Review 35 (2–3): 517–526.

Grossman, G.M., and E. Rossi-Hansberg. 2008. Trading tasks: A simple theory of offshoring. American Economic Review 98 (5): 1978–1997.

Hagemejer, J. 2018. Trade and growth in the new member states: The role of global value chains. Emerging Markets Finance and Trade 54 (11): 2630–2649.

Hagemejer, J., and M. Ghodsi. 2017. Up or down the value chain? A comparative analysis of the GVC position of the economies of the new EU Member States. Central European Economic Journal 1 (48): 19–36.

Humphrey, J., and H. Schmitz. 2002. How does insertion in global value chains affect upgrading in industrial clusters? Regional Studies 36 (9): 1017–1027.

Ignatenko, A., F. Raei, and B. Mircheva, 2019. Global value chains: What are the benefits and why do countries participate? IMF Working Papers, WP/19/18.

Jäger, K. 2016. EU KLEMS Growth and productivity accounts 2017 release, statistical module 1. Description of methodology and country notes for Spain.

Johnson, R.C. 2018. Measuring global value chains. Annual Review of Economics 10: 207–236.

Johnson, R.C., and G. Noguera. 2012a. Accounting for intermediates: Production sharing and trade in value added. Journal of International Economics 86 (2): 224–236.

Johnson, R.C., and G. Noguera. 2012b. Fragmentation and trade in value added over four decades. National Bureau of Economic Research, No. w18186.

Jona-Lasinio, C., and V. Meliciani. 2019. Global value chains and productivity growth in advanced economies: Does intangible capital matter? International Productivity Monitor 36: 53–78.

Jones, L., Demirkaya, M., and E. Bethmann. 2019. Global value chain analysis: Concepts and approaches. Journal of International Commerce and Economics 1.

Keller, W. 1997. Technology flows between industries: Identification and productivity effects. Economic Systems Research 9 (2): 213–219.

Keller, W., and S.R. Yeaple, 2003. Multinational enterprises, international trade, and productivity growth: firm-level evidence from the United States. NBER Working Paper No. 9504, Cambridge, MA: NBER.

Khan, T.S. 2006. Productivity growth, technological convergence, R&D, trade, and labor markets: Evidence from the French manufacturing sector. IMF Working Papers: 1–38.

Kılıçaslan, Y., U. Aytun, O. Meçik, and Y. Kılıçaslan. 2019. Global value chain integration and productivity: The case of Turkish manufacturing firms. In: 25th Annual Conference of Economic Research Forum.

Koopman, R., W. Powers, Z. Wang, and S.-J. Wei. 2010. Give credit where credit is due: Tracing value added in global production chains. (No. w16426). National Bureau of Economic Research.

Koopman, R., Z. Wang, and S.-J. Wei. 2014. Tracing value-added and double counting in gross exports. American Economic Review 104 (2): 459–494.

Krammer, S.M. 2010. International R&D spillovers in emerging markets: The impact of trade and foreign direct investment. The Journal of International Trade & Economic Development 19 (4): 591–623.

Kummritz, V. 2016. Do global value chains cause industrial development? The Graduate Institute of International and Development Studies, Centre for Trade and Economic Integration.

Li, B. and Y. Liu. 2014. Moving up the value chain. mimeo Boston University.

Melitz, M.J. 2003. The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica 71 (6): 1695–1725.

Miller, S.M., and M.P. Upadhyay. 2000. The effects of openness, trade orientation, and human capital on total factor productivity. Journal of Development Economics 63 (2): 399–423.

Nishioka, S., and M. Ripoll. 2012. Productivity, trade and the R&D content of intermediate inputs. European Economic Review 56 (8): 1573–1592.

OECD. 2012. The OECD analytical BERD (ANBERD) Database. Retrieved from: https://www.oecd.org/sti/ind/ANBERD_full_documentation.pdf

OECD. 2016. Global value chains and trade in value-added: An initial assessment of the impact on jobs and productivity. OECD Trade Policy Papers, No. 190, OECD Publishing, Paris.

Pahl, S. and M. Timmer. 2018. Vertical Specialization in Trade over the Course of Development. Paper presented at the Draft prepared for the workshop ‘New Perspectives on Structural Change: Causes and Consequences of Structural Change in the Global Economy’, UNU-Merit, Maastricht.

Peng, J., and Y. Zhang. 2020. Impact of global value chains on export technology content of China’s manufacturing industry. Sustainability 12 (1): 432.

Porter, M. 1985. Value chain. The Value Chain and Competitive advantage: creating and sustaining superior performance.

R Core Team. 2019. R: A language and environment for statistical computing. Vienna: R Foundation for Statistical Computing. Available at https://www.R-project.org/.

Romer, P.M. 1990. Endogenous technological change. Journal of Political Economy 98 (52): 71–102.

Roodman, D. 2009. How to do xtabond2: An introduction to difference and system GMM in Stata. The Stata Journal 9 (1): 86–136.

Suganuma, K. 2016. Upstreamness in the global value chain: Manufacturing and services. In: Paper presented at the Meeting of the Japanese Economic Association at Nagoya University on June.

Szymczak, S., and J. Wolszczak-Derlacz. 2019. Global Value Chains and Labour Markets-Wages, Employment or Both: Input-Output Approach (No. 59). Faculty of Management and Economics, Gdansk University of Technology.

Tajoli, L., and G. Felice. 2018. Global value chains participation and knowledge spillovers in developed and developing countries: An empirical investigation. The European Journal of Development Research 30 (3): 505–532.

Taglioni, D., and D. Winkler. 2016. Making global value chains work for development. Washington: The World Bank.

Timmer, M.P., E. Dietzenbacher, B. Los, R. Stehrer, and G.J. de Vries. 2015. An illustrated user guide to the world input–-output database: The case of global automotive production. Review of International Economics 23: 575–605.

Timmer, Marcel P., Mary O. Mahony, and Bart Van Ark. 2007. EU KLEMS growth and productivity accounts: An overview. International Productivity Monitor 14: 71.

Trefler, D., and S.C. Zhu. 2010. The structure of factor content predictions. Journal of International Economics 82 (2): 195–207.

UIBE. 2017a. Data files structure of the UIBE GVC index system. Retrieved from https://v2.fangcloud.com/share/a26979974d538c7e5aeb24b55a?folder_id=63000172546&lang=en

UIBE. 2017b. UIBE Global value chain indexes system—Concept note. Retrieved from: https://v2.fangcloud.com/share/a26979974d538c7e5aeb24b55a?folder_id=63000172546&lang=en

UIBE GVC Index Team. 2017. Data files structure of the UIBE GVC index system. Retrieved from: http://139.129.209.66:8000/d/daedafb854/

Wang, Z., S.-J. Wei, X. Yu, and K. Zhu. 2016. Characterizing global value chains. Retrieved from: https://www.gtap.agecon.purdue.edu/resources/download/8178.pdf

Wang, Z., S.-J. Wei, X. Yu, and K. Zhu. 2017. Characterizing global value chains: Production length and upstreamness. (No. w23261). National Bureau of Economic Research.

Windmeijer, F. 2005. A finite sample correction for the variance of linear efficient two-step GMM estimators. Journal of Econometrics 126 (1): 25–51.

World Development Report. 2020. Trading for Development: In the Age of Global Value Chains. Washington: International Bank for Reconstruction and Development/The World Bank.

Yanikkaya, H. 2003. Trade openness and economic growth: A cross-country empirical investigation. Journal of Development Economics 72 (1): 57–89.

Yanikkaya, H., and A. Altun. 2019. Impacts of participation in export value chains on TFP growth. Ege Academic Review 19 (1).

Yanikkaya, H., and A. Altun. 2020. The impact of global value chain participation on sectoral growth and productivity. Sustainability 12: 1–18.

Ye, M., and S. Voigt. 2014. The global value chains in BRICS countries. Fudan Journal of the Humanities and Social Sciences 7 (3): 411–420.

Acknowledgements

The first author acknowledges support from the Turkish Academy of Sciences.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

The Length of GVC Based on Forward Linkages

Distance to final use, that is so called upstreamness index, is proposed by Fally (2012). The index is defined as the row sum of the Ghosh inverse matrix (Antrás et al., 2012; Johnson, 2018). It means forward linkages and measures the number of stages before the goods or services are attained by the final consumers. Wang et al. (2016) propose decomposition of forward linkages utilized by the seller perspective. The important point is the fact that the total index based on forward industrial linkages is mathematically identical to the upstreamness index represented by Fally (2012) and Antrás et al. (2012). To reiterate, the novel part of this index is decomposition of production activities into a variety of segments.

The Calculation of Length of GVC Based on Forward Linkages

The distance to final demand is computed in the following way:

where \(PLv\) represents the number of forward production stages, \(\widehat{{V_{c} }}\) is diagonal matrix of value added over output ratio of sectors. \(L\) is Leontief inverse matrix, \(\hat{Y}\) is diagonal matrix of final products. \(PLv\) is the ratio of domestic sales, traditional trade, and GVC related domestic value added to output of sectors. Further calculations and derivations of these formulations can be found in Wang et al. (2016).

The Length of GVC Based on Backward Linkages

Length of GVC are introduced and calculated as an index for the number of production stages by Antrás and Chor (2013). The index takes the value of 1 if there is single production stage, otherwise takes the value higher than 1 depending on how many stages are passed or how many inputs are used regardless of domestic or foreign. It is defined as the column sum of Leontief inverse matrix (Johnson, 2018). Wang et al. (2016) propose an advanced accounting framework, which decomposes the backward linkages utilized by the user perspective.

The Calculation of Length of GVC Based on Backward Linkages

where \(X\) is gross output, \(Y\) is final products and \(A\) is the input coefficient matrix calculated dividing each entries of intermediate input matrix by output of sectors.

where \(\left( {I - A} \right)^{ - 1}\) is defined as Leontief Inverse Matrix.

In input–output matrix form, the length of GVC, that is number of production stages, is computed according to this formula:

where \(PLy\) represents the number of backward production stages, \(\widehat{{V_{c} }}\) is diagonal matrix of value added over output ratio of sectors. \(L\) is Leontief inverse matrix, \(\hat{Y}\) is diagonal matrix of final products. \(PLy\) is the ratio of foreign buying, traditional trade, and GVC related foreign value added to output of sectors (Tables 4 and 5).

Rights and permissions

About this article

Cite this article

Yanikkaya, H., Altun, A. & Tat, P. Does the Complexity of GVC Participation Matter for Productivity and Output Growth?. Eur J Dev Res 34, 2038–2068 (2022). https://doi.org/10.1057/s41287-021-00452-7

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41287-021-00452-7