Abstract

We develop a new governance perspective on port–hinterland linkages and related port impacts. Many stakeholders in a port’s hinterland now demand tangible economic benefits from port activities, as a precondition for supporting port expansion and infrastructural investments. We use a governance lens to assess this farsighted contracting challenge. We find that most contemporary economic impact assessments of port investment projects pay scant attention to the contractual relationship challenges in port-hinterland relationships. In contrast, we focus explicitly on the spatial distribution of such impacts and the related contractual relationship issues facing port authorities or port users and their stakeholders in the port hinterland. We introduce a new concept, the Port Hinterland Impact (PHI) matrix, which focuses explicitly on the spatial distribution of port impacts and related contractual relationship challenges. The PHI matrix offers insight into port impacts using two dimensions: logistics dedicatedness, as an expression of Williamsonian asset specificity in the sphere of logistics contractual relationships, and geographic reach, with a longer reach typically reflecting the need for more complex contacting to overcome ‘distance’ challenges with external stakeholders. We use the PHI matrix in our empirical, governance-based analysis of contractual relationships between the port authorities in Antwerp and Zeebrugge, and their respective stakeholders.

Similar content being viewed by others

Introduction

Notteboom and Rodrigue (2005) have convincingly argued that many ports have become more functionally integrated with their hinterlands, with ports acting as ‘impact hubs’ for a broad region. The new economic geography of port impacts, which have become more spatially dispersed than in the past, is imposing new contractual relationship challenges on ports and on the various economic actors in their hinterland with whom contractual relationships need to be crafted and fine-tuned. A contractual relationship refers to any economic exchange between two or more parties, whereby these parties face the challenge of jointly selecting the most efficient ‘governance structure’ for this exchange, given the characteristics of the transaction at hand. The presence of relationship-specific investments associated with an exchange, that is, dedicated investments that cannot be easily redeployed elsewhere without loss of economic value, calls for more complex contractual relations, the extreme case being that of internalization (for example, the vertical integration of activities in a supply chain), see Williamson (1979). Examples of new contractual relationships and challenges for ports can be found in van der Lugt et al (2013) on the importance of inter-firm alliances in the port of Rotterdam, and in Verhoeven (2010) on the role of port authorities as entrepreneurs and community managers.

Most large seaports in the Hamburg-Le Havre range have been able to manage the contracting pressures arising from stakeholders interested in a variety of ‘societal’ economic impacts (as opposed to firm-level impacts) in the port area itself. Such societal impacts include, inter alia, effects related to employment (for example, in the realm of worker compensation, contracting status, health and safety issues and so on) as well as environmental externalities. Achieving stakeholder consensus has occurred through extensive, dedicated managerial attention and investments from port authorities and port users, devoted to solving the above challenges. In return, port authorities and large port users have often been able to safeguard or even recapture their ‘social licence to operate’. This licence had become challenged for two reasons: first, many port activities being less visible to large parts of the communities located close to the port and experiencing negative port activity impacts; second, activist community and environmental groups focusing on (alleged) negative social and environmental externalities of port activities. For example, many port authorities now use ‘green portfolio’ approaches to guide modal shifts in hinterland transportation, thereby gaining renewed support from local stakeholders interested in mitigating environmental and health impacts (Haezendonck et al, 2009).

As a result of many port authorities’ successful strategies in addressing intra-port stakeholder concerns, much of the debate on seaport expansion has shifted towards the wider, spatially distributed, effects of port development, whereby ‘contracts’ must be struck with a variety of stakeholders located in this broader geographic space. Here, economic impact assessments are often used as a methodology to support resource allocation and funding of new infrastructure projects for port development. Unfortunately, in most economic impact assessment reports, the spatial configuration and significance of economic impacts, and especially their distribution across stakeholders located outside of the port area, has only been given scant attention.

Economic impact assessments typically focus on aggregate effects, for example, in terms of employment and value added, based on aggregations of local port firms’ impacts, and less focused on economic relations with actors located outside the port area, in particular for cargo ports (Dooms et al, 2014). However, stakeholders such as inland ports and terminals, logistics services providers, commercial and residential real estate developers, community groups and various government agencies outside of the port area are often mainly interested in how port cargo ultimately affects activities unfolding in the particular geographic area where they operate or that falls under their jurisdiction, for example, in terms of value added created. Access to accurate information on spatially distributed economic impacts is a precondition for these economic actors to engage in farsighted contracting (in the spirit of Williamson, 1996) with port authorities, for example, in terms of support for transport infrastructure expansion.

From a governance perspective, ‘new-generation’ regional economic impact studies can therefore contribute to mitigating two main contracting challenges, namely bounded rationality (BRat) and bounded reliability (BRel) problems faced by the stakeholders involved (Verbeke and Greidanus, 2009; Verbeke, 2013). BRat problems reflect the scarcity of mind of the various stakeholders in terms of their ability to access, understand and act upon accurate information on spatially distributed, port economic impacts. Regional economic impact studies, especially if consistent with the port authority’s broader strategic planning efforts, can also reduce BRel challenges, or problems of scarcity of effort to make good on open-ended promises, experienced by the stakeholders involved. For example, open-ended promises made by the port authority, such as a long-term commitment to engage in dedicated investments towards ameliorating a particular logistics connection, become more credible when accurate information on the size and scope of cargo flows, as well as their economic value and the distribution thereof across time, space and economic actors involved, is shared with the hinterland stakeholders.

In this article, we therefore introduce a new concept, the port hinterland impact (PHI) matrix, which provides detailed insights into the hinterland impact of a port using two dimensions: logistics dedicatedness and geographic reach. We suggest that this matrix should be integrated into all future, port regional economic impact studies, because the information embedded in the matrix will support decision making and especially farsighted contracting between port authorities and economic actors in the hinterland, for example with respect to the joint planning, funding and usage of new, dedicated infrastructure.

The article is structured as follows: the second section discusses the importance of the extended hinterland when designing port economic impact assessments. The third section introduces the new concept of the PHI matrix. The fourth section includes a critical discussion of a number of PHI matrix applications, and proposes a new research agenda. The fifth section concludes.

From Local to Regional Impacts: The Need for a Governance-Based Model

Since the rise of the container in the late 1960s, and especially during periods of economic recession, port stakeholders have become increasingly concerned about the decreasing employment and value added generated locally by ports in urban areas. Hall and Jacobs (2012, p. 189) even argued that the new logistics requirements of global trade routes and supply chain systems have made the joint, harmonious development of ports and the cities where they are located a vestige of the past. Here, port authorities, port users and other stakeholders may need to establish new governance mechanisms:Footnote 1 (i) to guide the development and utilization of new transport infrastructure capacity; (ii) to encourage innovation; (iii) to address externalities and; (iv) to create, capture and distribute economic value. The challenges at hand have been well described in the ‘dry port’ and extended gateway literature (VIL, 2006; Charlier, 2011), whereby economic activities conventionally located inside the port are increasingly being ‘transferred’ from the seaport to a ‘dry port’, see, for example, McCalla (1999) and Roso et al (2009).

Veenstra et al (2012), but also Haralambides and Gujar (2011) and Iannone (2012), have argued that a better performance of the overall supply chain can often be achieved by extending the sea-terminal connection into the hinterland, thereby potentially generating increased overall benefits in terms of the logistics chain’s performance, modal shift opportunities and regional development effects. Here, the focus can be on developing environment-friendly logistics linkages between the port and its hinterland. In addition, appropriate infrastructure expansion and related services development strategies in the hinterland may allow the broader port region to create value added and employment, based upon maritime cargo, especially containers, through distribution centres performing value added logistics (VAL) with a regional, national and even continental reach. In Europe, this last category of centres is referred to as ‘European distribution centres’ (EDCs), whereby typically substantial attention is devoted to mitigating environmental impacts.

Despite the fact that developments in port networks and extended gates are mainly driven by port authority and port user expansion strategies, as described by Roso and Lumsden (2010) and Roso et al (2009), this ‘delegation’ of activities towards the hinterland is likely also to involve the transfer of value added towards this same hinterland. Here, the concept of ‘delegation’ may be somewhat inappropriate as various economic actors are involved in complex contracting, associated with the broader spatial distribution of economic activities.

For example, van der Horst and van der Lugt (2011) and Cullinane et al (2012) interpreted the shift of VAL away from seaports into the hinterland as an expression of emergent, strategic freight networks, including a better spread of flows and terminals linked to or (partly) owned by the port, which guarantees critical volume and more fluid flows. Here, port networks entail much more, from a contracting perspective, than a single connection between a dry port and a seaport. However, Veenstra et al (2012) have suggested that many network challenges have remained unexplored, such as potential trade-offs between port interests, terminal owner interests and other network actors’ interests.

A number of recent scholarly papers, such as van der Horst and van der Lugt (2011), Cullinane et al (2012) and Veenstra et al (2012), have focused on the benefits of dry ports for regional economic development. However, the potential trade-offs in terms of the creation of value added within the network, which give rise to complex contracting challenges, have been largely ignored. In this context, Hall and Jacobs (2012) have expressed their concern that the conventional port–city relationship will become increasingly complex, reflecting only a fraction of the contracting needed with multiple parties to establish viable logistics chains encompassing the hinterland. Here, it is critical to investigate the benefits, but also the costs and risks related to the dry port concept for the various stakeholders involved. The migration of port activities to the hinterland typically triggers specific governance and related contracting demands from these stakeholders.

Verbeke and Dooms (2008) and Wang and Ducruet (2012) have suggested that it may be difficult to quantify economic impacts from the perspective of all relevant stakeholders or for a well-defined geographic area affected by a port development project. In a 2008 paper, Verbeke and Dooms developed an integrative framework, covering relevant stakeholders and the wider geographical area, and an operational calculation model for long-term strategic port planning, based on origin–destination statistics of containers to VAL clusters in the hinterland. This model allows evaluating long-term port expansion trajectories, including impacts of new investment projects on the four main elements in the seaport system: the maritime transport component, the port activity component, the hinterland transport component and the broader port network component. As one example of the relevance of this approach when applied to the port of Antwerp, Verbeke and Dooms (2008) found that the predicted, additional direct economic impacts of container projects in the Belgian port network component in terms of value creation and direct employment, confirmed a shift from direct added value and direct employment creation within the port area to the wider region outside the port area.

However, large impacts on the broader port network were viewed as conditional upon the relevant public agencies making available appropriate transport infrastructure and land for locating VAL activities in this network. Table 1 shows the results of the predicted impacts, associated with developing the port of Antwerp’s extended gateway. Verbeke and Dooms’ (2008) results were consistent with Notteboom and Rodrigue’s (2005) earlier work, which documented the growth of the port of Antwerp’s ‘extended gateway’, thereby confirming the rise of port regionalization.

Robinson (2002) has argued that ports are mere elements in complex, logistics-driven value chains, and are thereby involved in the processes of value creation, capture and distribution. Therefore, from a governance perspective, the main challenge for the stakeholders involved is to generate and utilize effectively information on spatially distributed economic impacts. In concrete terms, this comes down to economizing on BRat and BRel, two concepts defined above and reflecting, respectively, ‘scarcity of mind’ and ‘scarcity of effort to make good on open-ended promises’. For example, economizing on BRat and BRel can be achieved by showing unambiguously to all stakeholders, which part of overall economic value is (or will be) generated by whom, in which part of the chain and in which locations. Unfortunately, as already noted above, most prior studies including Bryan et al (2006), consider only local port impacts, including assessments of the impacts on suppliers to the maritime and industrial cluster (by estimating multipliers), as well as spending impacts in the local economy by the port workers.

In addition to analysing expected economic impacts from the perspective of different stakeholders, the analysis should be done for different types of cargo as well and not only focus on containerized goods, which has mostly been the case in recent studies on dry ports. In addition, any analytical model adopted should be generally applicable to port networks and not be dependent on the availability of aggregated data, devoid of a spatial component.

Here, we must point out that completing Table 1 (in the realm of container traffic) requires the availability of transparent and reliable data on the origin/destination of containers, the spatial productivity of inland containers terminals, the spatial productivity of logistics activities in the port network, employment per hectare, added value per hectare and capacity utilization of the actual intermodal terminals and logistics activities (for example, warehouses). In the Belgian case, and for container traffic, these data were readily available from several prior studies.

Unfortunately, for other traffic categories (such as new cars, conventional cargo), a large number of these parameters were not available. Therefore, the use of this methodology (we refer to Dooms and Verbeke (2006) for a detailed insight into the method used) is presently limited to large container ports, whereby data on these ports’ hinterland and logistics network are readily available. From a governance perspective, however, we should emphasize that this type of information is critical to successful, complex contracting with economic actors in the port’s hinterland and broader network.

We also observed two further complexities, based on various consulting studies (mainly port economic impact assessments) and academic papers (Gripaios and Gripaios, 1995; De Brucker et al, 1998, Bryan et al, 2006; Haezendonck, 2007). First, stakeholder opposition against port development projects has strongly increased in the last few decades, driven, inter alia, by a stakeholder focus on ecological and mobility impacts. But even beyond these impacts, some entrenched stakeholders also tend to resist increased competition and efficiency, as well as modern labor regulations in line with technological and organizational advances (for example, the opposition to widely suggested changes of the ‘Major’ law regulating port labour in Belgium) and so on. Stakeholders opposing further port expansion have sometimes credibly argued that the data included in port economic impact assessments had been artificially inflated, thus providing further ammunition against the case for new port development. Port authorities and port users engaged in promoting exaggerated economic impact estimations have thereby lost substantial credibility with many stakeholders, whose initial commitment to port development, or at least the acceptance thereof, has declined as a result. These actors increasingly view port authorities and port users as intrinsically unreliable contracting partners, who will not hesitate to embellish data when its suits their public relations goals vis-à-vis their network partners. The relevant port authorities’ and port users’ unreliability appears to have backfired and has negatively affected contracting relationships with network partners.

Second, a number of port impact benchmarking studies have been conducted, but these typically do not conform to minimum standards of transparency in terms of concepts used, methodologies adopted and comparative analyses performed. Imperfect data and imperfect comparisons among such studies amount to a serious BRat problem. Ill-conceived benchmarking triggers further disagreements among economic actors with a stake in port development on the actual impacts of port-related activities and the geographic distribution thereof. Such benchmarking studies, instead of providing useful information to guide managerial improvements towards best practices, trigger conflict among stakeholders as to the veracity of particular sets of information, thereby potentially resulting in delayed or contested resources. BRat problems are exacerbated rather than mitigated, and accusations of unreliability abound.

Whence, the development of an accurate, generally applicable model to measure PHIs in economic terms, including a standardized methodology, is advisable in order to alleviate BRat and BRel problems. An appropriate model should take into account where economic value is actually generated in the hinterland, and be sufficiently accurate for all stakeholders at different geographical levels to rely on the results for (future) investment decisions and related contracting with other stakeholders. A model conducive to economizing by reducing BRat and BRel challenges is likely to contribute to wider stakeholder support and acceptance of port activity and expansion projects.

Spatially Distributed Impacts of Port Activity: Introduction of the Port Hinterland Matrix Concept

A port’s spatially distributed impacts refer to the direct and indirect effects beyond those arising inside the port area. Here, two parameters must be included in any analysis focused on governance and contracting challenges in the port economic system.

The first parameter represents a quantitative element, namely the port’s geographic reach, starting from the left of Figure 1: how much of the port traffic coming into – or moving out of – the port – travels, for example, 100 or more kilometres from and into the hinterland? Of the remaining traffic, how much travels 50 km or more? Or between 25 and 50 km? This parameter is important as it defines the economic actors with a stake in port development beyond the port area itself. A longer reach typically reflects transactions with higher logistics and regulatory complexity. More distance may also involve an increasing port market contestability, which could then lead to changing or wider port ranges of competing ports. An analysis should be conducted of the port’s reach for each traffic category since the actors involved in each ‘strategic traffic unit’ (for example, containers, general cargo, liquid bulk, dry bulk and so on) are likely very different.

The second parameter in Figure 1 is a qualitative element, reflecting asset specificity: how difficult is port substitution or how dedicated is the logistics chain involved? The answer ranges from having minimal, low-cost substitution difficulties to the case of quasi-destruction of the value chain, if the port infrastructure were removed or became inaccessible. Importantly, a dedicated logistics chain, where economic actors are closely tied to one port with no – or very expensive – alternatives available, creates a situation of bilateral dependency. Such bilateral dependency is not restricted to relationships occurring inside the port area, but may involve, inter alia, the port authority or local port users and stakeholders outside of the port area. Here, both sets of actors can benefit from dedicated investments to solidify the logistics chain vis-à-vis rival chains passing through other ports, and a situation of complex contracting ensues.

In such cases, the first critical governance challenge is to bring as much relevant and accurate information as possible to the surface, describing the present and expected future relationship between the actors in quantitative terms. This means information on expected value creation, capture and distribution, including spillover effects, thereby reducing BRat. The second critical governance challenge for every actor involved in a bilateral dependency relationship, in the form of complex, long-term contracting is to make sure that each party involved in the transactions is reliable, in terms of keeping promises made to the other parties. One example is that of a port authority giving priority to a particular seaport investment (for example, a new container dock benefiting EDCs in the hinterland) in return for credible commitments from network partners in the hinterland that they will uphold promises towards port capacity utilization benchmarks.

Building upon the above analysis, a port’s position in Figure 1 can be linked to the value of the cargo, transported efficiently thanks to the logistics chain going through the port. In the case of high logistics dedicatedness, there would be a loss inflicted on all economic actors involved in case the port did not exist or were not accessible. This reflects an opportunity cost: ‘What in case the port did not exist?’ However, this opportunity cost cannot be simply measured through calculating transport cost differentials with alternative logistics chains. Whereas transport cost differentials are real and should be taken into account, the more important point, from a governance perspective, is that the economic actors involved have engaged in irreversible investments that cannot be redeployed elsewhere without a severe economic loss.

If both the port’s geographic reach extends further and logistics chain dedicatedness is higher (meaning a higher opportunity cost if the port were not accessible), the spatial distribution effect is stronger, and the contracting challenges more severe. A strong regional effect can then be expressed in monetary terms by assessing the value of the goods going through the port. This is a regional flow that would be disrupted if the port could not be accessed. In other words, the economic contributions of ports are not limited to local value added and employment, but can also be proxied by the value of the goods that pass through these ports in the context of international trade relationships. These value figures should be properly assessed: geographically dispersed economic systems often thrive to a large extent thanks to efficient logistics chains, with seaports at their heart, that connect localized port clusters with the broader economy.

In addition, this regional effect in terms of the estimated value of goods flowing through regionally distributed logistics chains is only the tangible expression of multiple, underlying contracting relationships involving a multitude of economic actors, and with the logistics dedicatedness being a proxy for this underlying complexity.

In the next section, we will briefly discuss two applications of the above framework. The first application was completed in the context of the IMPACTE (Intermodal Port Access & Commodities Transport in Europe) project, whereby a PHI matrix was developed for 11 Channel Ports located in the United Kingdom, Belgium and France. The second application is an application to the port of Antwerp (Belgium).

Applications of the PHI Matrix

All data for the IMPACTE study were collected during an 18-month period, with the European Commission co-funding the project (through the European Reconstruction and Development Fund), and with 27 ports and regional authorities from Belgium, France and the United Kingdom (UK) being involved. The second study was a 6-month research study commissioned by the Antwerp Port Authority to determine the economic significance of logistics activities in the port hinterland. We created large data sets with quantitative data on trade flows (origin–destination statistics and value data) and conducted in-depth interviews with several port authorities, port operators, shipping lines as well as industrial companies (see below for a detailed description of our approach to compose PHI matrices in each case).

We used as the basis for our analysis for each port the traffic volumes passing through this port (2006 data were available for each port). The data sources included official maritime statistics (particularly for the UK ports), data published by port authorities on their websites (for example, Ostend, Zeebrugge and Calais), information obtained directly from the port authorities and the researchers’ in-depth market knowledge from prior studies.

Wherever possible, ingoing and outgoing traffic flow data were compiled per mode of appearance (for example, dry bulk, containers and so on). Each of these traffic flows has idiosyncratic characteristics in terms of likely distance of transport towards the hinterland, market share distribution among inland transport modes and value of the freight. For example, dry bulk cargoes usually have a relatively low value and are likely to be distributed only within a short distance inland, whereas ‘accompanied’ roll-on/roll-off (RoRo) traffic typically has a very high value and is likely to be transported over long distances. In contrast, LoLo (lift-on/lift-off) container traffic, though also distributed over long distances, is much more suitable for inland distribution by rail and inland navigation.

The analysis of each port’s reach into the hinterland was based on a variety of sources. For example, in ports such as Dover and Calais for RoRo traffic, recent surveys had been carried out that provided the necessary inputs for our analysis. In other ports, data from the MDS Transmodal GB (Great Britain) Freight Model were used, supplemented by market knowledge from in-depth interviews with port users and port authorities.

The cargo flows were then allocated to the various ‘distance’ categories in the PHI matrix (<25 km, 25–50 km, 50–100 km and >100 km), in order to understand the port’s hinterland reach for each specific cargo category. An average value per tonne of freight by broad commodity type was calculated based on UK trade statistics for 2006 at a 2-digit level Standard International Trade Classification. Our analysis allowed an estimate of the value in Euro of the cargo passing through each port per mode of appearance. The generalized cost of inland distribution per ton of cargo for each mode of appearance was calculated using some simple cost models for each mode.

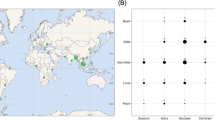

The logistics dedicatedness dimension was analysed through in-depth interviews with port users, such as terminal operators’ shipping companies and forwarders. For each port, and each traffic category, we surveyed a number of port users representing a significant market share in the port traffic portfolio. For each cargo component (as represented in the matrix shown in Figure 2, namely liquid bulk, dry bulk, containers, conventional cargo and RoRo) in terms of geographic reach, we asked experts to assess the degree of logistics dedicatedness. The experts consulted included the port users mentioned above, as well as members of regional and national port organisations and committees. Based on this qualitative information, we assigned each traffic flow segment to a particular cell in the PHI matrix. Here, we used origin-destination data for each cargo type, and gathered information on the volume as well as the (total) value of these goods. We also identified the degree to which these flows are footloose, i.e., whether these flows could easily be moved to another port. After an initial matrix was produced, we validated the results at the port authority level.

PHI matrix for the port of Zeebrugge (based on 2006 data).

Notes: RoRo (93.3 per cent) means that 93.3 per cent of the RoRo traffic is situated in that section of the matrix.; €47 651 million: this represents 93.3 per cent of the total RoRo value (€51 095 million).; ‘very strong’ dependence implies that port substitution is not feasible, and would trigger the unravelling of the dedicated logistics chain.; ‘strong’ dependence implies highly difficult, very costly, but technically feasible port substitution.

The application of the PHI matrix to 11 Belgian, UK and French ports in the Channel Straits suggests that many traffic categories in most ports in each of the three countries are rather footloose, that is, can relatively easily move from one port to another as a function of transportation cost optimization. At the micro level, this conclusion may be somewhat disturbing, since each port authority and port company operator would prefer to have international logistics chains heavily dependent and committed to the port over long periods of time. In reality, simple market contracting rules. Here, footloose cargo flows are an expression of a well-functioning, competitive port system, whereby efficiency considerations or lower transport costs drive the structuring of logistics chains and port choice. In this context, we should emphasize, however, that the footloose nature of many traffic categories only holds for relatively small traffic shifts in the short run, as capacity constraints in other ports would prevent large scale moves of cargo from one port to another.

For purposes of illustration, we show the PHI matrix for the port of Zeebrugge. On the basis of Figure 2, the regional impact of Zeebrugge is a mixed story. The logistics chains for container and RoRo cargo are rather footloose (as is the case with many ports for these cargo types), suggesting the dominance of short-term market contracting. However, this observation does not hold for other cargo flows such as Liquid Natural Gas, with some flows locally embedded in the port through large scale, non-redeployable investments by a gas distribution company, and other flows more widely distributed across geographic space. On the basis of the interviews with port users and logistics operators in the hinterland, there are some indications that the Zeebrugge port authority is attempting to develop stronger linkages with inland hubs and is seeking strategic partnerships with reciprocal investments from cargo recipients engaged in VAL in the hinterland (for example Zeebrugge’s cooperation and rail connection with Dourges in the North of France and Zeebrugge’s Portconnect estuary shipping products on Antwerp and Rotterdam).

We also created a PHI matrix for the port of Antwerp, a very large and diversified port with annual cargo flows exceeding 190 million tonnes (data from 2008). We gathered and analysed quantitative data on origin–destination relationships for various cargo flows, starting with 12 in-depth interviews with port users. Here, we focused on gaining insights into both the geographic reach and logistical dedicatedness of each cargo flow. Special attention was devoted to the container sector, which has been growing in relative importance over the past two decades.

Initially, we defined 12 cargo flows for positioning in the PHI matrix: fruit, forest products, steel and other metal products, other conventional cargo, iron ore, cars, other RoRo traffic, containers (with a split among containers transported by road, rail and inland navigation), fertilizers, grain and cereals, crude oil and other liquid bulk. After the interviews, we concluded that a number of proposed cargo flows needed to be decomposed further into subcategories, and a number of additional categories needed to be included in the analysis to obtain more meaningful results. We decomposed the container flows into merchant haulage (MH) and carrier haulage (CH) (see below), forest products into paper, wood, pulp and kaolin and dry bulk into grains, fertilizers, blue stone, zinc and lead concentrates, ores and coal.

Importantly, based on the interviews conducted, we concluded that the unbundling of the port’s geographic reach in segments covering 25, 50, 100 and 100+ kms (as used in the IMPACTE research) was not an appropriate decomposition for the port of Antwerp in order to obtain meaningful results. The interviewees suggested geographic segments of 0–50 kms, 50–100 kms, 100–200 kms and 200 kms and beyond. The interviewees also suggested to take into account a few additional cargo flows such as other dry bulk (malt, plastic grains), project cargo and second hand cars. They also proposed to decompose further forest products, containers and dry bulk (see below).

As regards logistical dedicatedness, some interviewees thought that the port of Antwerp has historically neglected to implement a strategy to attract regional, European headquarters of shipping lines (in particular in the container sector), thereby missing an opportunity to achieve higher logistics dedicatedness to the port. They viewed the port of Rotterdam as a best practice. The respondents thought that future investments to attract regional headquarters would be instrumental in increasing the logistical dedicatedness of the traffic category involved.

In the realm of container traffic, a distinction should be made between MH and CH. CH containers typically have a longer geographic reach but are less dedicated or committed to a port. Large carriers can typically restructure their transport corridors and do not need to include a particular port for specific transport and logistics operations. With CH, a critical mass of cargo allows to switch in a cost-effective fashion to alternative modes and/or ports. However, CH-induced port shifts can involve substantial port capacity availability requirements, which may not always be present in competing ports in the short run.

MH cargo flows tend to be smaller and have a more restricted geographic reach. However, these flows are typically also more ‘dedicated’ to a specific port or port operator, agent or forwarder, with whom privileged, long-term contracting relationships are maintained. The reason is that the firms driving MH (for example, large manufacturing firms) are typically embedded in specific locations themselves, sometimes close to a port, and want to invest in stable logistics chains with high quality services, which guarantee the absence of supply interruptions.

Consistent with the situation of the Channel Ports, the interviewees identified the growing importance of extended gateways for containers, whereby port authorities should engage in longer-term relational contracting with other key economic actors in the networks that drive the main container flows, an insight consistent with the work of Notteboom and Rodrigue (2005) and Verbeke and Dooms (2008). Such relational contracting implies a reduced focus on immediate, short-term transport cost minimization and greater emphasis on longer-term elements such as reliability in service quality and security of supply. In this context, the content of the containers can also play an important role in determining the desirability of establishing long-term relationships with specific economic actors. For example, some stuffed and stripped containers are dedicated to a port because of the required logistics expertise and productivity, which may not be available in other ports (for example, the port of Antwerp’s superiority in handling containers filled with unprocessed tobacco).

The interviewees observed a general decrease of cargo flows’ dependency on the port of Antwerp, that is, a loss of logistics dedicatedness, which is the opposite of what most port authorities would like to see. The interviewees argued that many cargo flows can now easily shift, that is, would incur low redeployment costs when shifting from one port to another because most competitors have access to the same level of knowhow and technology, for example for grain, new vehicles, coal and ores. However, in the short run, large-scale shifts usually remain rare because of capacity constraints in competing ports.

Figure 3 shows the PHI matrix for the port of Antwerp. For a correct interpretation of the PHI matrix, the following elements need to be taken into account. First, when no specific percentages are mentioned for a particular cargo flow, this implies that the entire cargo volume is positioned in a single cell of the matrix. Second, where percentages are mentioned, the sum of all percentages in the matrix for a particular cargo flow (for example, forest products or containers) should equal 100 per cent. Third, where relevant, the specific port user and/or the hinterland mode used and/or the country of origin/destination is mentioned for specific cargo flows.

The port of Antwerp has become weaker as far as logistical dedicatedness for project cargo with high value added is concerned. This is at least partially the result of the lack of specialized investments in the port to attract this cargo type, but also because of the higher costs in Antwerp where ‘self-handling’ possibilities are lacking, in contrast to the prevailing logistics practices in competing ports.

For a series of cargo flows, the port has been able to maintain strong logistics dedicatedness, namely for fruit and other conventional cargo, liquid bulk, forest products, blue stone and kaolin, used cars, fertilizers and the crude oil for Antwerp’s industrial cluster. In each case, port users have engaged in substantial ‘cargo-flow-specific’ investments that have boosted the port’s attractiveness.

Limitations

In the two cases above, the PHI matrix provides insight into the regional impact of ports in terms of logistical dedicatedness and geographic reach of cargo flows. However, our analysis has a number of important limitations. First, the analyses included in this article were based on time-sensitive data. A more dynamic approach, showing cargo flow shifts in the PHI matrix would undoubtedly enrich the analysis.

Second, for strongly diversified ports, more disaggregated data collection would be advisable for a correct interpretation of the results. However, it may become very costly to collect disaggregated origin–destination data and information on the value of goods on a regular basis and for the multiple cargo flows to be considered. If the PHI matrix is used to benchmark ports in a competitive setting, a port-range based collection of data would be appropriate, which of course requires more resources, and raises data availability and comparability problems.

Third, the port of Antwerp case suggests a linkage between the two axes of the PHI matrix. A strong logistics dedicatedness typically appears to be linked with a short geographic reach, whereas footloose traffic is usually associated with a longer geographic reach. From a hinterland/network perspective, this result is hardly unexpected since longer distances imply more overlap among port hinterlands and hence may result in fiercer port competition.

Fourth, the research team strongly depended on expert information to determine the level of logistics dedicatedness. Efforts should be made to measure directly port dependence or logistics dedicatedness through asset-specificity-related variables, in order to obtain more robust results.

Fifth, the scale, function, competitive situation and governance of a particular port may require a customized approach when attempting to operationalize the PHI matrix’ dimensions, for example, in terms of relevant ‘distance segments’ for the geographic reach variable and the specific proxies used to assess logistical dedicatedness, that is, the presence or absence of particular assets and investments with low redeployability potential in other logistics chains.

Sixth, within the framework of the IMPACTE study discussed above, the PHI matrix was considered primarily a communications and public relations tool by some partner ports and regional authorities involved in the project. In contrast, in the port of Antwerp case, the operationalization of the PHI matrix morphed into an in-depth reflection on the proper governance of contractual relations with hinterland stakeholders. The question therefore arises how the PHI matrix is presently used as a strategic governance tool to support farsighted contracting with a variety of external stakeholders, whereby important, dedicated logistics chains deserve substantial managerial attention to the micro-level detail of establishing efficient contractual relationships with external stakeholders. It would certainly be worthwhile to compare applications and to analyse whether achieving strategic governance goals, in terms of reducing BRat and BRel challenges and creating an organizational context for managing complex transactions in their entirety has been facilitated by using this matrix.

Conclusion

We have developed a new governance perspective on the challenges facing port authorities and port users when contracting with the various economic actors in the port’s hinterland. We have introduced the PHI matrix as a new analytical tool to support ‘optimal’ contracting, whether explicit or implicit, with such hinterland actors. The PHI matrix, if used as a governance tool, allows reducing in a substantive fashion BRat and BRel problems in contracting. BRat problems are reduced by identifying and highlighting three types of data critical to contracting and broader strategic decision making by port authorities and hinterland actors, namely: (i) quantitative (volume-related) hinterland origin–destination statistics; (ii) information on the value of the traded cargo, and (iii) qualitative information on the logistics dedicatedness of traffic segments. The first two information sets provide an initial indication as to where senior managerial attention should be devoted to, in order to improve further logistics efficiency. If in addition to representing a large cargo volume and value, a particular traffic segment is also associated with substantial logistics dedicatedness, this should trigger more complex contracting schemes because of various types of specific assets involved (for example, dedicated and interconnected infrastructure components in the logistics network).

BRel problems are mitigated because the PHI matrix eliminates information asymmetries between contracting parties: both the absolute and relative importance of a particular hinterland actor for the port authority and port users are highlighted, and this sets the stage for ‘contractual negotiations’ in terms of the joint development of new projects, the determination of the importance for the various actors of taking equity stakes in specific ventures and so on. Obviously, each economic actor in the hinterland should be able to develop its own hinterland port impact (HPI) matrix as the mirror image of the PHI matrix at the port level. An HPI matrix is required to assess the port’s importance to the stakeholder in quantitative and qualitative terms, both now and in the future. Such HPI matrix is critical especially in cases whereby dedicated joint investment projects with high asset specificity are contemplated.

Our new matrix represents a critical complement of traditional value added and employment-related impact analyses, which are typically restricted to a narrow geographic zone and are devoid of insight into the nature of contractual relationships with actors located outside of the port and immediately adjacent geographic areas. Such analyses offer little insight into how relationships with spatially dispersed stakeholders in the port’s broader geographic environment should be governed. It could be argued, mistakenly, that the PHI matrix also carries with it increased risks. For example, if it appears that a particular port traffic segment generates little value added locally (but high value added within the larger region) and has a rather footloose character, local stakeholders in the port area or adjacent to it might well withdraw their support from dedicated investments supporting these traffic segments. But the occurrence of such situation should be considered consistent with efficient governance: from a farsighted contracting perspective, highly asset-specific investments should be made by the actors who will benefit most from these investments and are willing to engage in complex contracting (with vertical integration being the most far reaching contracting form in cases of very high asset specificity). Such investments should not be made by actors such as the port authority, or local port users, who are spatially embedded in the port, but would not be the primary beneficiaries of a particular traffic segment’s growth and related logistics chain improvements.

The obvious caveat associated with low local stakeholder involvement in logistics chains, where these stakeholders experience little direct economic impacts of a particular traffic segment, is that spillovers must be taken into account. Individual traffic segments typically do not exist in a vacuum, but can contribute to both virtuous cycles of port expansion and vicious cycles of port contraction. For example, if local stakeholders withhold their support from investment projects with little immediate economic benefit accruing to them, but this affects negatively the port’s overall competitive position, for example, vis-à-vis shipping companies operating in the port’s foreland, such spillover should be factored into strategic decision making. Individual traffic segments in a port cannot necessarily be isolated from other segments in sophisticated logistics chains, and certainly do not materialize in an institutional vacuum.

We welcome further intellectual dialogue on our new, governance-based approach to port-hinterland relationships. More debate among scholars and managers involved in strategic decision making on large scale port investments will undoubtedly shed more light on both the potential, generalized relevance and the limits of our PHI matrix. We are hopeful that the PHI matrix, as an analytical tool supporting economizing behaviour by both port authorities and hinterland actors, will ultimately lead to improved, farsighted governance of port-hinterland relationships.

Notes

A governance-based model, as referred to in the title of this section, has been succesfully introduced in some major seaports in the Low Countries, such as Antwerp and Rotterdam, based on these ports’ experience in consensus management, and shows that this type of model is in fact feasible in practice.

References

Bryan, J., Munday, M., Pickernell, D. and Roberts, A. (2006) Assessing the economic significance of port activity: Evidence from ABP operations in industrial South Wales. Maritime Policy and Management 33 (4): 371–386.

Charlier, J. (2011) Hinterlands, port regionalisation and extended gateways: The case of Belgium and Northern France. In: P. Hall, R. McCalla, C. Comtois and B. Slack (eds.) Integrating Seaports and Trade Corridors. Burlington-Farnham, Surrey, UK: Ashgate.

Cullinane, K., Bergqvist, R. and Wilmsmeier, G. (2012) The dry port concept – Theory and practice. Maritime Economics & Logistics 14 (1): 1–13.

De Brucker, K., Verbeke, A. and Winkelmans, W. (1998) Sociaal-economische evaluatie van overheidsinvesteringen in transportinfrastructuur, Garant: Leuven.

Dooms, M., Haezendonck, E. and Verbeke, A. (2014) Towards a meta-analysis and toolkit for port related socio-economic impact studies conducted for seaports. Maritime Policy and Management. Forthcoming.

Dooms, M. and Verbeke, A. (2006) An integrative framework for long-term strategic seaport planning: An application to the port of Antwerp. In: T. Notteboom (ed.) Ports are more than piers. Liber Amicorum presented to Prof. Dr. Willy Winkelmans, pp. 173–192.

Gripaios, P. and Gripaios, R. (1995) The impact of a port on its local economy: The case of Plymouth. Maritime Policy & Management 22 (1): 13–24.

Haezendonck, E. (2007) Transport Project Evaluation: Extending the Cost-Benefit Approach. Chaltenham, UK: Edward Elgar Publishing.

Haezendonck, E., Dooms, M. and Verbeke, A. (2009) Green benchmarking: Green portfolio analysis as a strategic tool for competitive positioning. Paper submitted for the 2009 Academy of Management Conference.

Hall, P.V. and Jacobs, W. (2012) Why are maritime ports (still) urban, and why should policy-makers care? Maritime Policy & Management 39 (2): 189–206.

Haralambides, H. and Gujar, G. (2011) The Indian dry ports sector, pricing policies and opportunities for public-private partnerships. Research in Transportation Economics 33 (1): 51–58.

Iannone, F. (2012) The private and social cost efficiency of port hinterland container distribution through a regional logistics system. Transportation Research Part A: Policy and Practice 46 (9): 1424–1448.

McCalla, R.J. (1999) Global change, local pain: Intermodal seaport terminals and their service areas. Journal of Transport Geography 7 (4): 247–254.

Notteboom, T. and Rodrigue, J.P. (2005) Port regionalization: Towards a new phase in port development. Maritime Policy & Management 32 (3): 297–313.

Robinson, R. (2002) Ports as elements in value-driven chain systems: The new paradigm. Maritime Policy & Management 29 (3): 241–255.

Roso, V. and Lumsden, K. (2010) A review of dry ports. Maritime Economics & Logistics 12 (2): 196–213.

Roso, V., Woxenius, J. and Lumsden, K. (2009) The dry port concept: Connecting container seaports with the hinterland. Journal of Transport Geography 17 (5): 338–345.

van der Horst, M.R. and van der Lugt, L.M. (2011) Coordination mechanisms in improving hinterland accessibility: Empirical analysis in the port of Rotterdam. Maritime Policy & Management 38 (4): 415–435.

van der Lugt, L., Dooms, M. and Parola, F. (2013) Strategy making by hybrid organisations: The case of the port authority. Research in Transportation Business & Management 8: 103–113.

Veenstra, A., Zuidwijk, R. and van Asperen, E. (2012) The extended gate concept for container terminals: Expanding the notion of dry ports. Maritime Economics & Logistics 14 (1): 14–32.

Verbeke, A. (2013) International Business Strategy: Rethinking the Foundations of Global Corporate Success. Cambridge, UK: Cambridge University Press.

Verbeke, A. and Dooms, M. (2008) Integrating the Extended Gateway Concept in Long-Term Strategic Seaport Planning: A European Case Study. Conference Proceedings of the Van Horne Institute’s 2007 Pacific Gateway Round Table. Canada: University of Calgary.

Verbeke, A. and Greidanus, N. (2009) The end of the opportunism versus trust debate: Bounded reliability as a new envelope concept in research on MNE governance. Journal of International Business Studies 40 (9): 1471–1495.

Verhoeven, P. (2010) A review of port authority functions: Towards a renaissance? Maritime Policy & Management 37 (4): 247–270.

VIL (Flanders Institute for Logistics). (2006) Annual Report 2005. Antwerp, Belgium: VIL.

Wang, C. and Ducruet, C. (2012) New port development and global city making: Emergence of the Shanghai – Yangshan multilayered gateway hub. Journal of Transport Geography 25: 58–69.

Williamson, O.E. (1979) Transaction-cost economics: The governance of contractual relations. Journal of Law and Economics 22 (2): 233–261.

Williamson, O.E. (1996) The Mechanisms of Governance. Oxford: Oxford University Press.

Acknowledgements

Data for the Zeebrugge empirical case in this article were collected by the authors through the EU-supported IMPACTE study (Intermodal Ports Access and Commodities Transport in Europe – The Economic Role of Ports, 2008).

Author information

Authors and Affiliations

Additional information

The online version of this article is available Open Access

Rights and permissions

This work is licensed under a Creative Commons Attribution 3.0 Unported License The images or other third party material in this article are included in the article’s Creative Commons license, unless indicated otherwise in the credit line; if the material is not included under the Creative Commons license, users will need to obtain permission from the license holder to reproduce the material. To view a copy of this license, visit http://creativecommons.org/licenses/by/3.0/

About this article

Cite this article

Haezendonck, E., Dooms, M. & Verbeke, A. A new governance perspective on port–hinterland relationships: The Port Hinterland Impact (PHI) matrix. Marit Econ Logist 16, 229–249 (2014). https://doi.org/10.1057/mel.2014.10

Published:

Issue Date:

DOI: https://doi.org/10.1057/mel.2014.10