Abstract

Income inequality in developing countries remains a major concern. It has been established that higher inequality makes a greater proportion of the population vulnerable to poverty. This paper aimed to analyse the effect of the interaction between ICTs and human capital on income inequality in developing countries. Covering 89 developing countries for the period 2000 to 2015 and based on panel fixed effects instrumental variables technique, this study finds that the interaction between ICTs and human capital reduces overall income inequality on the one hand, and on the other, leads to an increase in the income shares of the poorest, and in particular relative to the richest in developing countries. Furthermore, the interaction between ICTs and human capital reinforces the impact of ICTs on income inequality in developing countries. These results suggest that prioritizing the acquisition of human capital by the poorest, as well as promoting access to and use of ICTs for the benefit of the poorest would significantly contribute to reduce overall income inequality and increase income shares of the poorest in developing countries.

Similar content being viewed by others

Introduction

The World Inequality Report 2022 concludes that the richest 10% of the global population currently takes 52% of the global income, whereas the poorest half of the population earns 8.5% of it (Chancel et al. 2021). This trend has been exacerbated during the COVID-19 pandemic. Indeed, this health crisis has resulted in restrictions on activities involving physical contact, such as working, which is the main means of obtaining income. However, despite these restrictions, the economic activity of countries has, willy-nilly, been maintained, mainly through the intensive use of Information and Communication Technologies (ICTs). In fact, according to ITU (2021), ICT has been vital in helping maintain continuity in business activity, employment, education and provision of basics citizens’ services. ICTs therefore make it possible to maintain economic activity. However, economic development is very often accompanied by an increase in inequality, particularly in developing countries. Several empirical studies have, however, shown that ICTs can reduce income differences between groups in a society, notably through, open up new opportunities for income growth and improving access to knowledge (Kudasheva 2015; Das and Drine 2020). Thus, if ICTs allow access to new knowledge, access and diffusion of ICTs require a certain level of knowledge, and therefore of human capital. Moreover, the complexity of understanding the various sources and manifestations of income inequality in developing countries leads us to consider more than just the direct impact of ICTs. Indeed, increased ICTs penetration may not have an impact on income inequality if it is not associated with a significant level of human capital in society. Since developing countries are characterized by high levels of income inequality and low levels of human capital, this study is therefore interesting because of the combined importance of ICTs and human capital in the functioning of these countries’ economies. Also, there is the need to analyse the effect of the interaction between ICTs and human capital on income inequality, to better understand the nexus of ICTs and income inequality in developing countries.

Although the link between ICTs and income inequality has been extensively studied, there is an important questioning related to the adoption of ICTs as a prerequisite to their use and thus to their potential effects on the distribution of income in a society. Since ICTs are endowed with real complexity, it seems appropriate to assume that their adoption is conditioned by the possession of a substantial level of human capital. The major question here, therefore, is whether the relationship between ICTs and income inequality is indifferent to whether or not human capital is combined with ICTs. This question is all the more relevant in the current context of health crisis. Indeed, the COVID-19 pandemic has highlighted the fragilities to which most of the World’s countries, and particularly, developing countries are subject. According to Bundervoet et al. (2021), in developing countries, women, young and less-educated workers—groups disadvantaged in the labor market before the COVID-19 shock—were significantly more likely to lose their jobs and experience decreased incomes in the immediate aftermath of the pandemic. At the same time, Internet penetration increased more than 20 per cent on average in Africa, in Asia and the Pacific, and in Least Developed Countries (ITU 2021). However, according to Richmond and Triplett (2017), ICTs growth may exacerbate inequality due to differential access and skill premium. Especially since access to education has important distributional consequences. Indeed, according to Dervis and Qureshi (2016) inequality in wellbeing is likely to be much lower in countries that provide most of the education almost free for everyone than in countries where most education must be paid for, even though their Gini coefficients of disposable income may be similar. Thus, given the closeness of the link between ICTs and human capital, there is the need to account for human capital interaction effect with ICTs in the relationship of the latter with income inequality, particularly, with income quintile in developing countries.

A survey of the existing literature shows that human capital interaction effect with ICTs has not been sufficiently explored in the study of ICTs-income inequality nexus. There is the need to fill this gap in the literature. The results of this study will contribute to better understand the relationship between ICTs and income inequality, particularly, relative to the income quintiles in developing countries. Therefore, the aim of this study is to examine the effect of interaction between ICTs and human capital on income inequality in developing countries. We hypothesized that the combined effect of ICTs and human capital on income inequality would be negative. Furthermore, we assumed that this effect would be positive on income shares of the poorest quintiles as well as ratios with respect to the highest quintile. Finally, we hypothesized that the interaction between ICTs and human capital would reinforce the impact of ICTs and human capital individually.

The rest of the article is organized as follows: “ICT, Human Capital and Income Inequality: lessons from the Literature” provides background on the literature on the relationship between ICTs, human capital and income inequality. Section 3 presents the data and empirical strategy. Section 4 presents and discusses the results. Section 5 concludes.

ICT, Human Capital and Income Inequality: lessons from the Literature

The scientific literature on the economic role of Information and Communication Technologies (ICTs) is mainly focused on the analysis of their effect on economic growth. Thus, the development of endogenous growth models in the late 1980s, initiated by the work of Romer (1986, 1990) and Lucas (1988), has prompted a number of empirical studies to investigate the endogenous sources that determine economic growth (Vu 2011). Similarly, Romer (1990), Grossman and Helpman (1991), and Aghion and Howitt (1998) Cited by Vu (2011). provide models that treat research and development activities as the engine of long-term economic growth. However, Aghion (2002) suggests that growth-enhancing policies (in education or training) can be designed to increase labour mobility. To this end, they can lead to inequality within groups of workers between jobs and sectors during transition. However, such policies nevertheless lead to a more equal distribution of permanent income.

In most countries, economic growth and income inequality are the top economic policy priorities. The first priority stems from the fact that it is expected to raise average living standards and the second is related to the fact that, in addition to pure concerns about the welfare of the poor, it fosters dissension and inadequate provision of essential public goods (Zhou and Tyers 2018). However, although growth changes income distribution, there does not appear to be a stable relationship between growth, inequality and relative poverty (Englert 2007). As a result, ICTs are generally regarded as a factor that can increase the outcomes of economic growth and reduce income inequality between different groups in society, provided, of course, that they are able to adopt them efficiently. In this regard, Nevado-Peña et al. (2019) suggest that Sen’s (2001) opportunity and capability approach can be applied to ICTs access and use. This application of ICTs will be achieved by examining individual differences in people's capabilities and freedom. Indeed, people's freedom is a factor in their ability to use ICTs. Thus, according to the same authors, the use of ICTs will depend either on their availability, accessibility or the ability of individuals to use them, or on the freedom of individuals to include them or not in their lives.

However, there are general, opposing theories and perspectives on the assumption that ICTs are related to quality of life. Indeed, while some authors support important contributions of ICTs, others show a moderate or even insignificant effect of ICTs in developing countries (Li and Wu 2019).

However, according to Nevado-Peña et al. (2019), at the individual level, ICTs affect daily life; while at the macro level, they influence sustainable development and, in turn, quality of life. More specifically, Das and Drine (2020) show that access to new technologies and the capacity to absorb them are essential for successful development. Similarly, according to the OECD (2011), access to information and computer technologies could lead to higher income levels, poverty reduction and improved living standards in countries. Thus, access to education and information and communication technologies has a specific effect on inequality in the distribution of employment income. Indeed, according to the same source, people with a general working knowledge of new ICTs, and specific skills for a job, have benefited from a substantial increase in wages and personal income. On the other hand, workers with lower or no skills at all see no change in their wages. As a result, income inequality between high and low-skilled workers is increasing. Thus, according to Franzini and Raitano (2019), the trend towards wage inequality is explained by the increase in skill bonuses (inequality between people with different levels of education).

In the same vein, Aghion et al. (2013) suggest that an increase in the skills bonus occurs when a more skilled workforce is needed to spread a new innovation across all sectors of the economy. Moreover, according to the same authors, the diffusion of a new innovation increases wage inequality within the group. This increase is mainly due to the fact that the increased speed of embodied technical progress associated with the diffusion of the new innovation increases the market premium for workers. In general, this combination of built-in technical progress and the diffusion of new innovation is rapidly adapting to leading-edge technology. To this end, it is able to survive the process of creative destruction that occurs when innovation spreads to different sectors of the economy. Similarly, according to Vu (2011), any improvement in working conditions that enables people to have better access to information and facilitates their learning productivity and communication skills effectively expands the existing stock of human capital. To this end, it improves its utilisation. Along the same lines, Ducombe (2001) Cited by Nevado-Peña et al. (2019) analyses ICTs as facilitators of social welfare, in that they contribute to poverty reduction and improved health and education. However, regardless of the specific impact on growth, the expansion of digital technology use has been accompanied by marked inequality (Unwin 2020). With this in mind, Grazzi and Vergara (2012) show that the process of ICTs diffusion is very heterogeneous, reflecting pre-existing inequalities in other socio-economic dimensions. Therefore, according to Unwin (2020), ICTs are accelerators to the extent that where there is pre-existing high inequality, ICTs are almost certainly more of a catalyst for its increase.

Data Description, Empirical Specification and Estimation Technique

Data Description

In order to determine the effect of the interaction between ICTs and human capital on income inequality in developing countries, we chose a combination of five data sources: (i) The UNU-WIDER World Income Inequality Database (WIID) for variables relating to income inequality (Gini coefficient, Palma ratio and quintile income shares), (ii) the World Development Indicators (WDI) for ICTs variable (individuals using the Internet (% of population) and for control variables, (iii) the Barro and Lee (2015) for the secondary school completed and average years of secondary schooling, (iv) the World Governance Indicators (WGI) for the control of corruption variable, and (v) the Freedom House database for the Political Rights index.

Thus, following Chauvet et al. (2015), and following the recommendations of Atkinson and Brandolini (2001, 2009), we have chosen to use the WIID database insofar as it includes additional information allowing the selection of consistent estimators of inequality. The “World Income Inequality Database (WIID)”, is produced by the United Nations University—WIDER, following the former work of Deninger and Squire (1996). This database provides information on income inequality for 189 countries. We use version 4 (WIID4) of this database. Furthermore, depending on the level of development of countries, this data source takes into account estimated inequality values based either on income or consumption.

Thus, according to Deaton and Zaidi (2002), in most developing countries and in Latin American countries, inequality is assessed with reference to income and not consumption. Conversely, in most Asian and African countries, inequality surveys preferably collect data on consumption (UNU-WIDER 2019).Therefore, since most developing countries have very little data on income, we have focused on consumption-based indicators of inequality at the expense of income-based ones. Income data were used when consumption data were not available. This is the case for some countries in Eastern and Central Europe and Latin America. In such cases, we introduced a dummy variable, \(INCOME_{i,t}\), in the model to control the discrepancy in the measure of inequality. Following Chauvet et al. (2015), we also excluded all data that did not take into account the population as a whole. The WIID4 database includes both data on Gini indices, the Palma ratio, and income quintiles. We will use all this information in the regressions.

Based on the availability of data, we have identified 89 developing countries that we observed over the period from 2000 to 2015. Indeed, the starting date was chosen because we found that very few developing countries had ICTs data prior to 2000.The date of arrival represents the most recent date on which data on most variables are available, particularly data on human capital. Among these countries, we have mainly countries in Africa, Central and Eastern Europe and Latin America. See the list of countries in Table 6 in Annex.

Following Chauvet et al. (2015), we used six dependent variables. However, Chauvet et al. (2015) did not use the Palma ratio as a dependent variable., namely: the Gini coefficient, the Palma ratio, the first quintile (Q1), the second quintile (Q2), the ratio of the first and fifth quintile (Q1/Q5), and the ratio of the sum of the first and second quintiles to the fifth quintile (Q1 + Q2)/Q5. The Gini coefficient is equal to zero (0) when the distribution of income within the population is equal. On the other hand, when in a society the total income goes to only one person/household unit, leaving the rest of the population without any income, then the Gini coefficient tends towards 1 or 100%.Similarly, the palma ratio which represents the share of the top ten percent divided by the share of the bottom forty percent is interpreted in the same way as the Gini index and is increasingly used as a measure of inequality. However, the Palma ratio has some advantages over the Gini coefficient. Indeed, it captures the tails of the distribution, while the Gini coefficient mainly focuses on the entire distribution (Cobham et al., 2015) Cited by Tchamyou et al. (2019). On the other hand, the quintile group shares express the share of the total income going to each fifth of the population, ordered according to the size of their income. These shares are expressed as percentages of total income. Thus, the first quintile group includes the poorest 20% of the population, while the fifth quintile includes the richest 20%.

Inequality is generally captured by the Gini coefficient or index. This measure makes it possible to analyze the phenomenon of inequality as a whole within a well-defined spatio-temporal framework. However, when one wishes to analyze this phenomenon for sub-groups of a population, this coefficient does not seem adequate. Therefore, in order to analyze the impact of the interaction of ICTs and human capital on income inequality for the poorest components of the population, we have opted to use the quintile income shares.

In this study, we consider a significant impact of the interaction term between ICTs and human capital on income inequality in developing countries. However, if we consider that this impact reflects a reduction in income inequality as a whole, there could be an increase in the income shares for the quintiles of the poorest people. Indeed, the ownership of ICTs and human capital is preceded by costs. In addition, we assume that ICTs penetration in a country is concomitant with the acquisition of human capital by the population of that country. Thus, following Asongu and Le Roux (2017), and Tchamyou et al. (2019), we use the individuals using the Internet (% of population) as an ICTs proxy variable. In addition, we use the secondary school completed for the working-age population. The working-age population refers to individuals aged 15–64., as measure of human capital. Furthermore, for robustness checks, we use a different definition of human capital, namely the average years of secondary schooling for the working-age population.

Furthermore, in accordance with the inequality literature, we control for GDP per capita, credit market imperfections, democracy (political rights), rural population, government consumption expenditure, and control of corruption. GDP per capita is used to understand the effect of the country’s level of wealth on the inequalities that exist between the different components of the population. It can be assumed that GDP per capita will have a positive impact on income inequality as a whole, but a negative impact on income inequality for the quintiles of the poorest. Concerning the imperfections of the credit market, we can hypothesize that credit markets can be a channel through which ICTs may impact inequality. One can, moreover, suppose that the recognition of political rights to citizens can increase redistributive activities, and consequently, reduce income inequality. Population growth is used to capture the impact of changes in the number of individuals in the population on the distribution of the country’s wealth. Indeed, the higher the rate of population growth, the greater the inequality is assumed to be. With regard to the secondary school completed and the average years of secondary schooling, which represent human capital, it is generally noted that the accumulation of human capital tends to reduce inequalities. Conversely, since rural populations in developing countries are expected to be poorer than urban populations, it is generally assumed that the more rural–urban migration there is, the less income inequality there is. Similarly, government expenditures are generally seen as a factor in reducing inequality, especially when it is allocated efficiently for the benefit of the population. Such efficiency requires the existence of good quality institutions. Therefore, it can be assumed that controlling corruption could have a negative impact on income inequality, as well as contribute to the widespread adoption and diffusion of ICTs among the population.

The definitions of variables are presented in Table 1 while Table 2 displays summary statistics.

On the basis of Table 2 below, it can be seen that our sample of countries displays a rather unequal distribution of income, with an average Gini index of 41.81 and an income share of the lowest quintiles (Q1 + Q2) that only represents 35% of the highest quintile income share.

With regard to Table 7 in Annex, it is known that the aim of the correlation matrix is to control for issues of multicollinearity among variables. This concern is apparent in inequality variables. To avoid conflicting results, inequality indicators are used distinctly as dependent variables. The correlation coefficient between two variables is between − 1 and 1. The correlation coefficient between the Gini index and the Palma ratio is 0.935 indicating a very strong linear dependence between the two variables. These two variables are positively correlated, indicating a simultaneous change (increase, decrease or constancy) in the values of the two variables. Similarly, we note that the correlation coefficient between the Gini index and the quintile group shares is generally close to − 1, indicating that the Gini index and the quintile group shares are negatively correlated. It can be assumed that these two categories of variables move in opposite directions. Thus, when the Gini index values increase, those of the quintile group shares decrease, and vice versa. This could provide a better understanding of the effects of ICT, human capital and the interaction variable between ICT and human capital on income inequality in developing countries.

Empirical Specification

This paper analyses the effect of the interaction between ICTs and human capital on income inequality in developing countries. To do this, we use the following basic econometric specification:

where i denotes the different countries \(\left( {i = 1, \ldots N} \right)\) and t indicates the time period \(\left( {t = 1, \ldots T} \right)\). The dependent variable \(INEQ_{it}\) represents income inequality in country i over the period t. In this study, income inequality refers to six different indicators, namely: Gini coefficient, Palma ratio, first quintile (Q1), second quintile (Q2), ratio of the first and fifth quintile (Q1/Q5), and ratio of the sum of the first and second quintile to the fifth quintile (Q1 + Q2)/Q5.\(ICT_{it}\) represents Information and Communication Technologies in country i during the period t, \(HC_{it}\) indicates human capital, which is approximated to the secondary school completed, \(ICT_{it} \times HC_{it}\) is the interaction variable of ICTs with human capital, \(GDPperCap\) is the gross domestic product per capita, \(X_{it}\) is a vector of the other control variables namely credit market imperfections, democracy (political rights), control of corruption, population growth, rural population, government expenditures, income dummy variable (equal to 1 if the inequality indicator is determined from income and 0 if the inequality indicator is determined from consumption) assumed to affect income inequality, \(\beta_{0}\), \(\beta_{1}\),\(\beta_{2}\), \(\beta_{3}\), \(\beta_{4}\), \(\beta_{5}\) are the parameters and vectors of the parameters to be estimated. The \(\nu_{i}\) and \(\mu_{t}\) are vectors of dummy variables representing country-specific and period-specific effects, respectively; and \(\varepsilon_{it}\) is the error term. Robust standard errors are estimated to allow correction for heteroskedasticity. In addition, \(ICT_{it}\); \(HC_{it}\) and \(ICT_{it} \times HC_{it}\) are the main variables of interest in the Eq. (1), we are interested in the sign of the coefficients \(\beta_{1}\); \(\beta_{2}\) and \(\beta_{3}\). A positive (or negative) sign of \(\beta_{1}\); \(\beta_{2}\) and \(\beta_{3}\) indicates that an increase (decrease) in income inequality widens as ICT, human capital and interaction term of ICTs and human capital strengthen respectively. Concerning quintiles income shares, positive (or negative) sign of \(\beta_{1}\); \(\beta_{2}\) and \(\beta_{3}\) indicates that an increase (decrease) in quintile income shares as ICT, human capital and interaction term of ICTs and human capital strengthen respectively. Key control variables include GDP per capita, credit market imperfections, democracy (political rights), control of corruption, population growth, rural population, government expenditures.

Estimation Technique

This paper aimed to analyse the effect of the interaction between ICTs and human capital on income inequality in developing countries. To achieve this objective, the use of panel data, rather than cross-sectional data, makes it possible to control for country-specific effects that are crucial when considering a considerable number of heterogeneous countries (Ali et al. 2018). For this type of data, the most commonly used estimation methods are Fixed Effect Models, Random Effect Models, and Generalized Moment Method (GMM).

The GMM method has many advantages over the others two: unbiased dynamic modeling, correction for endogeneity, and more efficiency in presence of high persistence in the data (Soto 2009; Chauvet et al. 2015; Ali et al. 2018). However, when there is no persistence in the data, the fixed effects method could be preferred. In the presence of persistence in the data (which implies the existence of a unit root in the series (Dua and Mishra 1999)), the use of the GMM estimation technique is preferred. On the other hand, in the absence of persistence in the data (which implies the non-existence of a unit root in the series), the use of the fixed effects estimation technique is recommended. Thus, to check for persistence in the data, we used the Fisher test for panel unit root using an augmented Dickey-Fuller test. The results of this test revealed no evidence of persistence over time. The results of the Fisher test are available from the authors. We preferred this test to others, Levin-Lin-Chu, Harris-Tsavalis, Breiting and Hadri Lagrange Multiplier Tests require strongly balanced data. Im-Pesaran-Shin test allow for unbalanced panels, but is not adequate when there are gaps in data. because it allows us to consider panels that are unbalanced and have gaps in the data. Thus, since the data used in this study have these two characteristics (unbalanced panels and have gaps), we felt it was appropriate to use the Fisher test as indicated above. Consequently, the results of this test lead us to use a fixed effects panel model. Furthermore, according to Lee and Lee (2018), the fixed effects estimation controls for possible bias when unobserved and persistent country characteristics that influenced the income inequality variable correlated with the explanatory variables.

In addition, to control for potential reverse causality bias, which may arise from the presence of endogenous independent variables in the model, we chose to adopt fixed effects instrumental variables (FEIV) technique. The latter estimation technique uses lagged values of potential endogeneous independent variables (ICTs, human capital, interaction variable of ICTs with human capital, GDP per capita) as instruments (Ali et al. 2018; Lee and Lee 2018). Specifically, following Lee and Lee (2018), it is practically difficult to adopt instrumental variable estimation techniques by constructing a set of fully convincing exogenous instruments in this panel structure.

Results, Robustness Checks and Discussion

Baseline Results

Tables 3 and 4 below present the results of the estimation of Eq. (1) using the fixed effects (FE) and fixed effects instrumental variables (FEIV) estimation techniques respectively. This latter method was used to take into account the potential endogeneity bias (reverse causality bias) that would result from the presence of endogenous independent variables in the specified model. In addition, using each of the above estimation techniques, we first estimate the model without introducing the interaction term of ICTs with human capital, in order to verify that the respective impacts of ICTs and human capital are in accordance with the literature (Kudasheva 2015; Franzini and Raitano 2019; Das and Drine 2020). Each of these tables is thus made up of 12 columns, the first 6 of which present the results of the estimations without the introduction of the interaction term.

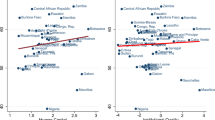

More specifically, the results of the estimation of Eq. (1) using simple FE estimators are presented in Table 3. The columns (1) and (2) using the Gini index and the Palma ratio as dependant variables show that ICTs and human capital individually have an overall significant and negative impact on income inequality. However, when the interaction variable is introduced into the model (see columns (7) and (8)), it seems to have no significant impact on inequality. In contrast, the columns (3) to (6) using quintile income shares as well as ratios with respect to the highest quintile as dependant variables show that ICTs have a positive impact on the income shares of the poorest quintiles as well as ratios with respect to the highest quintile. However, human capital taken individually seems to have, in general, no impact on these quintile income shares. Moreover, when we introduce the interaction variable of human capital with ICTs (see columns (9) to (12)), we note that its impact appears to be greater than that of ICTs taken individually, although the impact of human capital taken individually remains insignificant.

Sources Authors’ calculations based on UNU-WIDER (WIID), World Bank (WDI & WGI), Barro and Lee (2015), Freedom House database data.

However, given the potentially endogenous nature of several independent variables in Eq. (1), namely ICTs, human capital, the interaction variable of human capital with ICTs, and GDP per capita, the simple FE estimators do not appear to be an appropriate technique for estimating Eq. (1). Also, following Lee and Lee (2018), we used the FEIV estimation technique which uses lagged values of the potential endogeneous independent variables as instruments. The results of the estimation of Eq. (1) using this latter estimation technique are presented in Table 4 below. Thus, we note in the first two columns ((1) and (2)), which use the Gini index and the Palma ratio respectively, it can be seen that both ICTs and human capital have a significant and negative impact on income inequality. This implies that both ICTs and human capital would reduce overall income inequality in developing countries.

From column (3) to column (4) using the income quintiles, it can be seen that both ICTs and human capital have a significant and positive impact on the income shares of the two lowest quintiles, would mean that ICTs and human capital benefit the poorest by increasing their shares of income. From column (5) to column (6) using the ratios of income quintiles with respect to the highest quintile, we found that ICTs has a positive and significant impact on the income shares of the poorest quintiles relative to the income share of the highest quintile. This would reflect the fact that ICTs seems to significantly increase the share of income of the poorest relative to the richest. Human capital considered individually would have no significant impact on these ratios. Human capital does not, therefore, individually seem to have any influence on the distribution of income of the poorest compared to the richest.

Furthermore, the introduction of the interaction variable of human capital with ICTs (from column (7) to column (12)) shows that this variable tends to reinforce the relationship between ICTs and income inequality in developing countries. Indeed, we note that in columns (7) and (8), ICTs have a negative impact on inequality. Human capital has a negative impact on Gini index, but does not have a significant impact on Palma ratio. However, the interaction term significantly strengthens the impact of ICTs on income inequality. Thus, human capital would have a catalytic effect on the impact of ICTs on inequality, as the impact of the interaction variable is also significant and negative, but larger than the impacts of ICTs and human capital individually. With respect to columns (9) and (10), ICTs have positive and significant impacts on the two lowest quintiles. Human capital does not have a significant impact on one of these lowest quintiles. In this case as well, the introduction of the interaction term allows us to note that the latter reinforces the impact of ICTs on the income shares of the two poorest quintiles. ICTs associated with human capital would thus allow the poorest to increase their shares of income.

Finally, when we consider columns (11) and (12), we see that the individual ICTs have a significant and positive impact, albeit small, on the income shares of the poorest quintiles with respect to the highest quintile. Human capital, taken individually, does not have a significant impact on these quintile income shares. On the other hand, the introduction of the interaction variable of human capital with ICTs seems to reinforce the positive impact of ICTs on the income shares of the poorest quintiles with respect to the highest quintile. In this case, we can also conclude that the accumulation of human capital associated with access to and use of ICTs reduces the gap, in absolute value, between the income shares of the two lowest quintiles and the income share of the highest quintile. Thus, the enhanced effect of human capital with ICTs on inequality would be more concentrated in the poorest quintiles, leading to an improvement in the level income shares of the latter relative to the richest quintile.

Robustness Checks

In Table 5 below, we assess the robustness of our core results by using a different definition of human capital. Thus, we provide estimation results using the average years of secondary schooling. This variable is taken from the database constructed by Barro and Lee (2015). We present only the results from the estimation of Eq. (1) by the fixed effects instrumental variables (FEIV). The new results are in line with our previous finding regarding the interaction variable of human capital with ICTs. Indeed, this variable seems to reinforce the impact of ICTs on income inequality both at the aggregate level, and in relation to income shares of the poorest quintiles as well as ratios with respect to the highest quintile. However, taken individually, the impact of human capital appears to be opposite to that of ICTs in every case. The latter result could be justified by the fact that the longer it takes to complete secondary education, the more likely it is that overall income inequality will increase and quintile income shares will decrease.

Discussion

Can income inequality be affected by the interaction between ICTs and human capital in developing countries? Our analysis underlines that, in order to answer this question, contextual and socio demographic factors must be taken into account. The results indicate that ICTs and human capital have a significant impact on income inequality. When inequality is considered at the aggregate level (Gini index and Palma ratio), this impact turns out to be negative. Moreover, the interaction variable of human capital with ICTs, when introduced, tends to reinforce the relationship between ICTs and income inequality in developing countries. Furthermore, when considering the income shares of the poorest quintiles (Q1 and Q2) as well as ratios with respect to the highest quintile (Q1/Q5 and (Q1 + Q2)/Q5), it can be seen that both ICTs and human capital have a significant and positive impact on the income shares of the two lowest quintiles, but that only the ICTs have a significant and positive impact on the income shares of the two poorest quintiles with respect to the richest quintile. Moreover, the introduction of the interaction variable of human capital with ICTs seems to reinforce the impact of ICTs on these quintile income shares.

In line with the hypothesis, we conclude that the interaction between ICTs and human capital significantly affects income inequality in developing countries. Thus, while this impact is negative when considering inequality as a whole, it becomes positive when using the income shares of the poorest quintiles as well as ratios with respect to the highest quintile. Thus, the enhanced effect of human capital with ICTs in addition to reducing income inequality at the global level, would be more concentrated in the poorest quintiles, leading to an improvement in the level income shares of the latter relative to the richest quintile.

Thus, access to and use of ICTs by poor individuals could enable them to increase their income shares. Moreover, if these individuals have an average level of human capital, the effect of their use of ICTs will be enhanced. ICTs penetration should therefore go hand in hand with a significant acquisition of human capital by populations, so that the combined effect of ICTs and human capital can lead to the reduction of income inequalities in favour of the poorest populations. Technology and human capital are generally considered to be the results of investments made by individuals, firms or countries for the purpose of obtaining gains. These gains can be translated into increased income, productivity or economic growth. When the products resulting from such investments are sufficiently adopted and widely disseminated, one can expect effects in terms of improving the living conditions of populations.

However, possession of an ICTs tool does not necessarily lead to optimal use of that tool. Indeed, without a sufficient level and quality of human capital, it is possible that even with ICTs, one may not be able to exploit all its functionalities and therefore all its benefits. From this perspective, ICTs associated with human capital are likely to reinforce socio-economic inequalities in general and income inequalities in particular between different groups in society and especially for the poorest of them.

However, while previous studies on income inequality have generally analyzed the impact of either ICTs or human capital on income inequality, this study has analyzed the impact of the interaction between these two variables on income inequality. Moreover, income inequality is usually only approached at an aggregate level, notably through the use of the Gini index. The present study used not only the Gini index, but also the Palma ratio and a set of quintile income shares in order to determine the impact of the interaction of human capital with ICTs on the overall income distribution, but also on the variation of income shares of the poorest, especially relative to the richest in developing countries.

Conclusion

This paper examines the effect of the interaction between ICTs and human capital on income inequality in developing countries. Covering 89 developing countries for the period 2000 to 2015 and based on panel fixed effects instrumental variables technique, this study concluded that the interaction between ICTs and human capital systematically reinforces the impact of ICTs on income inequality in developing countries. Indeed, the reduction of income inequality is accelerated if access to and use of ICTs are associated with a significant level of human capital. More specifically, the combination of ICTs and human capital reduces overall income inequalities in developing countries on the one hand, and on the other, leads to an increase in the income shares of the poorest, and in particular relative to the richest.

These results indicate that prioritizing the acquisition of human capital by the poorest, as well as promoting access to and use of ICTs for the benefit of the poorest, should enable them to seize most of the income-generating opportunities available to them. In addition, in a global context marked by the occurrence of repeated crises and in particular the health crisis due to the COVID-19 pandemic, which has imposed social distancing measures on the different countries of the world, it seems essential for the poorest to have adequate technological and educational capacities to be able to better adapt and therefore survive whenever the political, economic and health situation does not allow them to participate directly in the economic activity of their respective countries.

Indeed, the main implication of our findings is that investment in human capital should be systematically taken into account in the definition and implementation of public policies in developing countries. In fact, successful adoption and diffusion of any innovation, whether social, economic or technological, requires that individuals in society have a substantial level of human capital. If it has been demonstrated that ICTs have an impact on income inequalities, tending to reduce them, we can, at the end of this study, suggest that human capital can reinforce this impact. However, in most developing countries, the acquisition of human capital is not within the reach of everyone, compared to developed countries. The poor are very often confronted with the problem of the high costs inherent in accessing human capital. It would therefore be relevant for public decision-makers in these countries to allow free or almost free access to human capital, particularly for the poorest. But, there are pending questions concerning the nature of human capital required to developing countries in view of optimising the impact of ICTs on income inequality. This topic remains an interesting fertile ground to explore in future research.

References

Aghion, P. 2002. Schumpeterian growth theory and the dynamics of income inequality. Econometrica 70 (3): 855–882.

Aghion P, Akcigit U, Howitt P. What do we Learn from Schumpeterian Growth Theory? Working Paper. 18824:NBER Working Paper Series. 2013

Aghion, P., and P. Howitt. 1998. Endogenous growth theory. Cambridge: MIT Press.

Ali, M., Egbetokun, A., & Memon, M. H. 2018. Human capital, social capabilities and economic growth. Economies, 6 (1): 2.

Asongu, S.A., and S. Le Roux. 2017. Enhancing ICT for inclusive human development in sub-saharan Africa. Technological Forecasting and Social Change. https://doi.org/10.1016/j.techfore.2017.01.026.

Atkinson, A.B., and A. Brandolini. 2001. Promise and pitfalls in the use of “secondary” data-sets: Income inequality in OECD countries as a case study. Journal of Economic Literature 34 (3): 771–799.

Atkinson, A.B., and A. Brandolini. 2009. On data: a case study of the evolution of income inequality across time and across countries. Cambridge Journal of Economics 33 (3): 381–404.

Barro RJ, Lee J-W, 2015. Barro-Lee Data (1950–2015). http://www.barrolee.com.

Bundervoet T, Davalos ME, Garcia N. The Short-term Impacts of COVID-19 on Households in Developing Countries: An Overview Based on a Harmonized Data Set of High-Frequency Surveys? Policy Research Working Paper, no. WPS 9582. COVID-19 (Coronavirus). World Bank Group (2021). Washington, DC.

Chancel L, Piketty T, Saez E, Zucman G et al. World Inequality Report 2022. World Inequality Lab, 2021

Chauvet L, Ferry M, Guillaumont P, Guillaumont-Jeanneney, Tapsoba SJ-A, Wagner L Economic Volatility and Inequality: Does Aid Matter? Working Paper, 2015.

Das, G.G., and I. Drine. 2020. Distance from the technology frontier: how could Africa Catch-up via socio-institutional factors and human capital ? Technological Forecasting & Social Change 150 (2020): 119755. https://doi.org/10.15185/izawol.462.

Deaton, A., & Zaidi, S. 2002. Guidelines for constructing consumption aggregates for welfare analysis (Vol. 135). World Bank Publications.

Deninger, K., & Squire, L. 1996. A new data set measuring income inequality. World Bank Economic Review.

Dervis K, Qureshi Z. Income Distribution within Countries: Rising Inequality, Global Economy and Development at Brookings Brief. 2016

Dua, P., and T. Mishra. 1999. Presence of persistence in industrial production: the case of India. Indian Economic Review 34: 23–38.

Englert, M. 2007. L’impact de la croissance économique sur la pauvreté et l’inégalité : l’importance des choix politiques. Mémoire de Recherche: Université Libre de Bruxelles.

Franzini, M., and M. Raitano. 2019. Earnings inequality and workers’ skills in Italy. Structural Change and Economic Dynamics 51: 215–224.

Freedom House 2021 Freedom in the World. https://freedomhouse.org.

Grazzi, M., and S. Vergara. 2012. ICT in developing countries: are language barriers relevant ? Evidence from paraguay. Information Economics and Policy 24: 161–171.

Grossman, G., & Helpman, E. 1991. Innovation and growth in the global economy. The MIT Press, Cambridge, Massachusetts.

ITU 2021 Measuring Digital Development. Facts and Figures. International Telecommunication Union.

Kudasheva, T., S. Kunitsa, and B. Mukhamediyev. 2015. Effects of access to education and information-communication technology on income inequality in kazakhstan. Procedia Social and Behavioral Sciences. 191: 940–947.

Lee, J.-W., and H. Lee. 2018. Human capital and income inequality. Journal of the Asia Pacific Economy. https://doi.org/10.1080/13547860.2018.1515002.

Li, Q., and Y. Wu. 2019. Intangible capital, ICT and sector growth in China. Telecommunications Policy. 44: 101854.

Lucas, R.E., Jr. 1988. On the mechanics of economic development. Journal of Monetary Economics 22 (1): 3–42.

Nevado-Peña, D., V.-R. López-Ruiz, and J.-L. Alfaro-Navarro. 2019. Improving quality of life perception with ICT Use and technological capacity in Europe. Technological Forecasting & Social Change 148: 119734.

OECD. 2011. Divided We Stand: Why Inequality Keeps Rising. Paris: OECD Publishing. https://doi.org/10.1787/9789264119536-en.

Richmond, K., and R.E. Triplett. 2017. ICT and income inequality: a cross-national perspective. International Review of Applied Economics. https://doi.org/10.1080/02692171.2017.1338677.

Romer, P.M. 1986. Increasing returns and long-run growth. Journal of Political Economy 94 (5): 1002–1037.

Romer, P.M. 1990. Endogenous technological change. Journal of Political Economy 98 (5): 71–102.

Soto M. System GMM Estimation with a Small Sample. Barcelona Economics Working Paper Series (Working Paper no 395). 2009

Tchamyou, V.S., G. Erreygers, and D. Cassimon. 2019. Inequality, ICT and financial access in Africa. Technological Forecasting and Social Change 139: 169–184.

UNU-WIDER. 2019. World Income Inequality Database (WIID). User Guide and Data Sources. UNU-WIDER.

Unwin, T. 2020. Digital Inequalities, 347–355. Netherlands: International Encyclopedia of Human Geography. Elsevier.

Vu, K.M. 2011. ICT as a source of economic growth in the information age: empirical evidence from the 1996–2005 period. Telecommunications Policy 35: 357–372.

World Bank. 2018a. World development indicators database. Washington, DC: World Bank Group.

World Bank. 2018b. World Governance Indicators Database, www.govindicators.org. Washington, DC: World Bank Group.

Zhou, Y., and R. Tyers. 2018. Automation and Inequality in China. China Economic Review. https://doi.org/10.1016/j.chieco.2018.07.008.

Acknowledgements

The authors are grateful to the anonymous referees, the associate editor, and the editor for their valuable suggestions.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Nga Ndjobo, P.M., Ngah Otabela, N. Can Income Inequality be Affected by the Interaction Between ICTs and Human Capital?: The Evidence from Developing Countries. J. Quant. Econ. 21, 235–264 (2023). https://doi.org/10.1007/s40953-022-00336-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40953-022-00336-5

Keywords

- ICTs

- Human capital

- Income inequality

- Quintile income shares

- Developing countries

- Fixed effects instrumental variables

- I24

- O15

- O33