Abstract

Showrooming is a phenomenon when a customer views a product at a physical store, but buys it online from the same store’s website or from a competitor’s website. In this paper, we develop economic models of price competition between a traditional retailer and an online retailer under customer showrooming behaviour. Our results indicate that showrooming hurts the traditional retailer and benefits the online retailer in terms of sales volumes and profits. The combined offline and online market expands under showrooming. We consider two strategies—effort/investment made and online entry by the traditional retailer—to counter showrooming. Either strategy makes the traditional retailer better off, and the online retailer worse off, in terms of sales volumes and profits; also, the overall market, including offline and online sales, contracts. Moreover, when the traditional retailer makes an online entry, although its offline sales decrease, its total offline and online sales increase; also, although the overall market contracts, total online sales and the online price increase. We consider two scenarios of simultaneous and sequential moves made by the retailers to set their prices. We observe that both the retailers benefit under sequential moves than in the simultaneous move; however, the overall market demand is lower in sequential moves than in the simultaneous move. We have also conducted sensitivity analyses to check for robustness of the results. We conclude the paper by highlighting the managerial implications of this research and providing possible directions for future research.

Similar content being viewed by others

Introduction

Showrooming is the phenomenon when a customer visits a traditional or brick-and-mortar retail store to view and experience a product, but instead of buying the product from the store, she buys it online from the same store’s website or from a competitor’s website. When customers search offline at a retail store, but buy online from a competitor’s website (competitive showrooming), this adversely impacts the store’s profitability. On the other hand, when customers search offline at a retail store, and buy online from the same store’s website (loyal showrooming), this has a positive impact on the store’s profitability (Frasquet and Miquel-Romero 2021; Rajkumar et al. 2021). Zhang et al. (2021) define competitive showrooming as intra-showrooming and loyal showrooming as inter-showrooming. It is as if the physical store acts as a showroom for the online sales channel. The term ‘showrooming’ became popular when there were talks in the US media that the electronics chain Best Buy had become a ‘showroom for Amazon’ (Goodfellow 2012; Quint et al. 2013). Traditional retailersFootnote 1 consider showrooming a serious threat to their sales potential. The growing availability of smartphones and easy accessibility of the internet have further fuelled customer showrooming behaviour and added to the concern of traditional retailers. Surveys have shown that showrooming can vary from about 40% to 60% and can be as high as 70% if only shoppers using smartphones in-store are taken into consideration (Zimmerman 2012; Quint et al. 2013; Balakrishnan et al. 2014; Rapp et al. 2015; Gensler et al. 2017; Rejon-Guardia and Luna-Nevarez 2017; Kuksov and Liao 2018; Fassnacht et al. 2019; Flavian et al. 2020; Chai et al. 2021; Frasquet and Miquel-Romero 2021; Johnson and Ramirez 2021; Zhang et al. 2020; Zhang et al. 2021). A PwC report revealed that 68% of consumers gathered product information at offline stores before purchasing online (Rajkumar et al. 2021). Research shows that for certain product categories, such as electronics and appliances, 83% of shoppers practice showrooming (Teixeira and Gupta 2015). Shoppers, who use smartphones, look for price comparison, product information and customer review on the websites and apps of traditional and online retailers before making a purchasing decision. Products such as electronics, appliances, sporting goods, clothing/apparel, shoes, books and furniture, which are ‘non-digital’ in nature (Balakrishnan et al. 2014; Bell et al. 2014; Mehra et al. 2018; Li et al. 2021; Rajkumar et al. 2021) and for which shoppers value in-store view-touch-feel-and-fit experience, are more prone to showrooming than other types of products that are generic in nature such as groceries (Quint et al. 2013; Rejon-Guardia and Luna-Nevarez 2017; Jing 2018).

The primary reasons for showrooming cited by shoppers, who engage in showrooming, are lower online prices [Amazon’s prices for consumer electronics were 11% and 8% lower than Walmart’s and Best Buy’s in-store prices, respectively; also, Amazon’s prices were 14% below Target’s prices (Zimmerman 2012)], a desire to experience the product at a physical store before purchasing it online, shopping and delivery convenience of online purchase, and product unavailability at physical stores (Quint et al. 2013; Teixeira and Watkins 2015; Rajkumar et al. 2021). Showrooming has pretty badly affected large traditional US retailers. Some of the scaring news items published in the literature are as follows. Walmart lost $20 billion in market cap in one day (Mohammed 2015). Target’s sales were flat. Sales at Best Buy stores opened in the previous year had fallen by more than 4%. At Penney, same-store sales dropped by 26% compared to the same period the year before (Teixeira and Watkins 2015). Benjy’s quarterly loss mounted to $700 million (Teixeira and Gupta 2015). According to Retail Next, although traditional retailers still account for 94% of retail sales, footfall is declining at an annual rate of 15% and half of the customers are showrooming.Footnote 2 Yet another report states that in the USA, 6000 traditional stores had to shut shop, resulting in a loss of 100,000 jobs, and one-third of shopping malls will either fail or have to reinvent themselves in the next 10 years (Darlington 2019). While the traditional retailers were experiencing a sharp decline in sales, the online retail market was growing at 17% per year (Teixeira and Watkins 2015). According to another estimate, online retail sales grew 23% in 2015 while Amazon became the largest online retailer accounting for 26% of total online retail sales (Sopadjieva et al. 2017). Although the decline in sales at physical stores and growth of online retail cannot be entirely attributed to the phenomenon of showrooming, it is now evident that showrooming does play a significant role in weaning away shoppers from physical stores to the online marketplace.

This paper develops economic models of price competition between a traditional retailer and an online retailer under customer showrooming behaviour. Two scenarios have been considered for setting prices, namely when the retailers simultaneously set their prices, and when one of the retailers acts as the Stackelberg leader, and the other follower, to sequentially set their prices. Also, when the retailers simultaneously set their prices, the competitive dynamics in the presence of the traditional retailer’s strategies, namely the effort/investment made by the traditional retailer and the traditional retailer’s online entry, to counter showrooming are analysed. The extant literature shows contradictory results as to the benefits/losses accrued to the traditional and online retailers in the presence of showrooming. The objective of this paper is to investigate the movement of prices, sales and profits of the two retailers under showrooming and also when the traditional retailer adopts the above-mentioned strategies to counter showrooming under some practical assumptions made in the paper. It is intended to compare the assumptions and findings of the current paper with those in the extant literature and observe under what conditions the results corroborate or conflict with each other. In particular, the following questions have been addressed in this paper:

-

(a)

Does showrooming benefit, or hurt, the traditional and online retailers?

-

(b)

Does showrooming increase, or decrease, the overall market demand?

-

(c)

How do the strategies adopted by the traditional retailer to counter showrooming alter the competitive dynamics and affect the overall market demand?

-

(d)

How do the simultaneous and sequential moves by the retailers to set prices compare in terms of prices, sales volumes and profits of the retailers and the overall market demand?

The significant findings of this paper are as follows:

When the retailers simultaneously set their prices,

-

(a)

Prices, sales and profits decrease for the traditional retailer and increase for the online retailer under showrooming.

-

(b)

The combined offline and online demand increases with showrooming, indicating customer benefits due to showrooming.

-

(c)

When the traditional retailer puts in effort/makes an investment to counter showrooming, the price, sales and profit of the traditional retailer increase while the same decrease for the online retailer. Also, the combined offline and online demand decreases, hurting customers in the process.

-

(d)

When the traditional retailer makes an online entry to counter showrooming, its price and profit increase. As far as the sales volume is concerned, the traditional retailer’s offline sales volume decreases; however, its total sales volume, including offline and online sales, increases. On the other hand, for the online retailer, while the price increases, its sales volume and profit decrease. From the customers’ point of view, while online sales, including the sales of the online arm of the traditional retailer and the online retailer, increase, total offline and online sales decrease. This result points to the fact that upon online entry by the traditional retailer, although the online market expands, the overall market, including offline and online, contracts.

When the retailers sequentially set their prices, in comparison with when the retailers simultaneously set their prices,

-

(a)

Irrespective of which retailer acts as the leader, prices and profits of both the retailers increase. However, the price charged by a retailer is the highest when it acts as the leader while the profit made by a retailer is the highest when it acts as a follower.

-

(b)

When the traditional retailer acts as the leader, offline sales decrease and online sales increase.

-

(c)

When the online retailer acts as the leader, offline sales increase and online sales decrease.

-

(d)

Irrespective of which retailer acts as the leader, total offline and online sales decrease, and the combined sales volume is the lowest when the traditional retailer acts as the leader.

Almost all the proofs (except one) in this paper are parameter-independent, i.e. they hold for the entire ranges of parameter values and not for specific ranges, thereby making the findings of this paper robust.

The rest of the paper is organized as follows. “Literature review” Section presents the literature review. ”Problem description and modelling assumptions” Section describes the problem and modelling assumptions. “Model development” Section presents the economic models. In “Demand and profit functions for the retailers” Section, the demand and profit functions for the retailers are explained. “Simultaneous move by the retailers to set prices” Section presents the economic model of price competition between the traditional and online retailers under customer showrooming behaviour when the retailers simultaneously set their prices. Economic models for the effort/investment made and online entry by the traditional retailer to counter showrooming are derived in “Effort/investment made by the traditional retailer to counter showrooming and Online entry by the traditional retailer to counter showrooming” Sections, respectively. “Sequential move by the retailers to set prices” Section presents the economic models when the retailers sequentially set their prices. Models when the traditional retailer acts as the leader and when the online retailer acts as the leader are derived in “Traditional retailer as the leader and online retailer as the follower and Online retailer as the leader and traditional retailer as the follower” Sections, respectively. “Summary of results and managerial implications” Sections presents a summary of results and highlights the managerial implications of this research. Finally, “Conclusions, limitations of the study and directions for future research” Section presents concluding remarks and directions for future research.

Literature review

The extant literature is rich in multichannel competition in retail. In multichannel retail, the literature is replete with the competitive dynamics between a manufacturer and a traditional retailer when the manufacturer decides to sell directly through an online sales channel besides selling through the brick-and-mortar retail store (see, for example, Tsay and Agrawal 2004; Cattani et al. 2006; Wang et al. 2018; Feng et al. 2019). There is also a vast amount of literature on click-and-mortar, i.e. when a traditional retailer creates an online channel and sells both offline and online (see, for example, Ofek et al. 2011; Zhang et al. 2017; Radhi and Zhang 2019). Brynjolfsson and Smith (2000) and Li et al. (2015) study the dynamics among traditional retailers that sell through physical stores only, online retailers that sell online only and ‘hybrid’ retailers that sell both offline and online. Brynjolfsson et al. (2009) and Abhishek et al. (2016) analyse the competitive dynamics between traditional and online retailers. Agatz et al. (2008) present a literature review on the integration of e-fulfilment with multiple alternative distribution channels or bricks-and-clicks.

None of the above papers considers showrooming in multichannel retail. There is, of course, literature on free riding where customers free-ride information on one channel and buy on another channel. Wu et al. (2004) study the free-riding phenomenon among two groups of online retailers where one group of retailers provides informational services while the other group does not. Customers may free-ride information provided by the former group of retailers and buy at a lower price from the latter group of retailers. The authors find that an online retailer has to provide informational services to make positive profits even if there is free riding and retailers cannot make positive profits by free riding all the time. Shin (2007) in the context of two traditional retailers—one service-providing and the other free riding—shows that free-riding benefits not only the free-riding retailer, but also the retailer that provides service. Free riding not only reduces the intensity of price competition, but also enables the service-providing retailer to charge a higher price and make positive profits.

Xing and Liu (2012) consider a manufacturer selling through a traditional and an online retailer. The online retailer free-rides the sales effort put up by the traditional retailer which reduces the effort of the traditional retailer, thereby affecting the manufacturer’s profit and overall supply chain performance. The authors discuss the role of various contracts in coordinating the sales effort of the traditional retailer and improving the supply chain efficiency. Zhou et al. (2018) consider a manufacturer selling through a direct online sales channel and a traditional retailer. The manufacturer’s online sales channel free-rides the pre-sales informational services provided by the traditional retailer by sharing its cost of service. The authors investigate how free riding affects the pricing/service strategies and profits of the dual channels.

Showrooming, as defined earlier, is a special kind of service free riding in retail (Gensler et al. 2017; Jing 2018; Viejo-Fernandez et al. 2020; Chai et al. 2021; Li et al. 2021). Rajkumar et al. (2021) define showrooming as a cross-channel free-riding behaviour that involves offline search followed by online purchase. According to Balakrishnan et al. (2014), showrooming intensifies competition between a traditional and an online retailer, reducing profits for both the firms. Basak et al. (2017) also observe that profits for both the retailers decrease as showrooming increases. Therefore, reduced showrooming is not only beneficial for the traditional retailer, but also desirable from the point of view of the online retailer. However, a high level of showrooming benefits customers by reducing retail prices.

Mehra et al. (2018) consider competition between a traditional retailer and an online retailer under showrooming. They show that showrooming is detrimental to the profit of the traditional retailer. They analyse two strategies for the traditional retailer to counter showrooming, namely price matching and exclusivity of product assortment through arrangements with known brands and creation of store brands. While price matching is proposed to be a short-term strategy, exclusivity of product assortment is considered to be a long-term strategy. The authors show that price matching is more effective under showrooming than when there is no showrooming, and implementing product exclusivity through the store-brand strategy is better than exclusivity through the known-brand strategy under showrooming while the opposite is true when there is no showrooming. Kuksov and Liao (2018) consider the role of contracts between a manufacturer and a traditional retailer and show that the traditional retailer’s profit may actually increase under showrooming. The authors state that the overall demand increases under showrooming and hence the manufacturer may incentivize the traditional retailer for providing informational services either through a lower wholesale price or through direct compensation. Manufacturer incentives may, therefore, increase the traditional retailer’s profit even if it invests in improving the store service level. The authors have developed their model under some strong assumptions such as a single manufacturer has been considered who is selling both offline and online and hence inter-brand competition has been ignored; all shoppers, irrespective of whether they would ultimately buy from a physical store or online, visit the physical store which may not be true in practice, and some shoppers would never visit the physical store and always buy online; and shoppers’ valuation of products online is lower than that in a physical store which, again, may not be always true, especially for ‘non-digital’ products. The authors do, of course, admit that their model also shows the possibility that showrooming could be detrimental to the traditional retailer’s profit.

Jing (2018) considers competition between a traditional and an online retailer in the presence of showrooming. The author shows that under low product match uncertainty, showrooming intensifies competition and decreases the profits of both the retailers, thus supporting the retailers’ recent strategy to stock more exclusive products. However, the author concludes that under high product match uncertainty, showrooming may have different effects on competition and may very likely increase the online retailer’s profit. Zhang and Zhang (2020) consider offline entry by a supplier that sells through an online channel. Their study focuses on the online retailer’s demand information sharing strategy with the supplier under the agency selling and reselling agreements. The authors observe that the online retailer may be better off with supplier offline entry when there is showrooming and is always worse off when there is no showrooming. When the supplier makes an offline entry, showrooming enables customers to get information offline and buy online which may bring additional online revenues and benefit the online retailer. For a low level of showrooming, the loss from channel competition due to supplier offline entry dominates the benefits of showrooming and hence it hurts the online retailer while for a high level of showrooming, the benefits of showrooming outweigh the loss from channel competition and the online retailer benefits by supplier offline entry.

Li et al. (2019) consider a dual-channel supply chain where a manufacturer sells directly through an online sales channel and indirectly through a traditional retailer. The authors study the effect of showrooming on the wholesale and retail prices and channel profitability under three service strategies of the traditional retailer—no service, ex ante and ex post. In the no-service strategy, the traditional retailer does not exert any service effort and hence the showrooming effect is non-existent. This situation serves the purpose of the benchmark model. In the ex ante service strategy, the traditional retailer sets the level of its service effort before the manufacturer decides its wholesale and online retail prices. On the other hand, in the ex post service strategy, the traditional retailer sets the level of its service effort and retail price after the manufacturer has decided its wholesale and online retail prices. The authors show that the firms are benefited the most by showrooming when the traditional retailer adopts the ex post service strategy. The showrooming effect results in the manufacturer charging a high wholesale price for the traditional retailer’s ex ante service strategy and a low wholesale price for the latter’s ex post service strategy. Moreover, the study shows that as the showrooming effect increases, the firms reap higher profits when the traditional retailer adopts the ex post service strategy. The authors demonstrate the applicability of their models through three case studies on companies in the business of smart projectors, film industry and electrical appliances.

Basak et al. (2020) extend their earlier model (Basak et al. 2017) to analyse the effect of the wholesale price set by the manufacturer on the offline and online retail prices in the presence of showrooming. The authors investigate the feasibility of a coordination mechanism between the manufacturer and the traditional retailer so that the traditional retailer expends more sales effort to boost demand and create a dedicated customer base. The authors derive a three-parameter contract that can result in a win–win situation for the manufacturer and the traditional retailer, with more benefits for the traditional retailer with a relatively lower market potential. Moreover, the authors find that the contract brings down the retail price benefitting the customer.

Liu et al. (2020) study the impact of showrooming on an integrated dual channel, i.e. a retailer having both offline and online sales channels with joint pricing decisions for the channels and an associated return policy, and show that an appropriately designed dual channel can indeed increase the profitability of the retailer. The authors show that the retailer can intentionally create a channel price gap to encourage showrooming, which will result in considerable fulfilment and return cost savings. Moreover, the authors find that the return policy decisions are closely related to pricing decisions, and show that it may be beneficial for the retailer to engage with customers indirectly, rather than directly, via customer showrooming behaviour.

Raj et al. (2020) examine the effect of the unilateral pricing policy (UPP), in which the manufacturer sets a minimum retail price for both the traditional and online retailers to help the traditional retailer set a high level of pre-sales services for customers, on customer showrooming behaviour. The authors find that the UPP price depends on the extent of showrooming, customer price sensitivity and customer valuation of pre-sales services. The authors compare the outcomes of a UPP with those of a conventional pricing policy (CPP) where retailers set their prices independently.

Zhang et al. (2020) consider competition between two manufacturers that sell their products through an omnichannel retailer. The retailer showcases the product of one of the manufacturers at its physical store and sells the products of both the manufacturers through an online store. Customers can either buy products directly from the online store or inspect products at the physical store and then buy from the online store (showrooming). Two types of showrooming behaviour have been analysed—intra-showrooming and inter-showrooming. In intra-showrooming, customers inspect products displayed at the physical store and buy the same manufacturer’s products from the online store. On the other hand, in inter-showrooming, customers inspect products of one manufacturer at the physical store, but buy products of the other manufacturer from the online store. The authors investigate the roles of customer inter-showrooming behaviour and information services provided by the physical store in an omnichannel environment. The authors find that customer inter-showrooming behaviour benefits the manufacturer whose products are not displayed at the physical store and sold online only and hurts the dual-channel manufacturer whose products are displayed at the physical store. Also, inter-showrooming is beneficial to the omnichannel retailer when the inter-showrooming intensity is not too high. The authors study a coordination mechanism between the dual-channel manufacturer and the retailer to enhance information services provided at the physical store and find that the online-only manufacturer may be either better off or worse off depending on two counteracting effects of enhanced information services. Further, customers located away from the physical store are adversely affected by inter-showrooming and service compensation while local customers benefit from them. Finally, the authors note that in-store fulfilment, besides serving as a showroom, at the physical store will have a positive impact on the omnichannel retailer’s information service provision.

Li et al. (2020) study the effect of opening a showroom by an online retailer on its profitability. The authors find that the feasibility of opening a showroom in terms of cost and availability of local customers increases the retailer’s profit. The authors also find that the effect of different in-store assortment strategies on the retailer’s profitability depends on the intensity of customer intra- and inter-showrooming behaviour, as defined above. Moreover, the expected return cost for pure online shopping is a critical determinant of the retailer’s omnichannel pricing strategies and information service decisions.

Chai et al. (2021) use the Hotelling model to analyse the store brand strategy of a traditional retailer as a tool to mitigate the adverse impact of showrooming. The authors find that introducing premium store brands is an effective means to combat showrooming. As the breadth and depth of national brand product mismatch increase, the store brand strategy increases the profit of the traditional retailer and decreases the profit of the online retailer. However, an increase in store brand awareness would not necessarily increase the traditional retailer’s profit; rather it would depend on the hassle cost and a brand promotion strategy would decrease the loss of the traditional retailer’s profit.

Li et al. (2021) study the effect of showrooming in a dual-channel supply chain comprising a manufacturer, which operates a direct sales channel, and an online channel. The product in question has both digital and non-digital attributes. While customers can check both the digital and non-digital attributes at the physical store, they can check only the digital attributes at the online store. The authors investigate the impact of in-store product demonstration on online and offline retail pricing decisions under customer showrooming behaviour. They observe that the showrooming behaviour may be beneficial to the manufacturer operating a physical store and harmful to the online retailer. Specifically, the authors find that when the level of in-store demonstration is medium, the manufacturer and the online retailer would be better off if they choose the non-demonstration and non-showrooming strategies, respectively. The authors also show that when the manufacturer sets the wholesale prices endogenously, both the manufacturer and the online retailer choose the same strategy, leading to Pareto improvement in the supply chain.

Zhang et al. (2021) explore the effect of intra- and inter-showrooming on a supplier and a traditional retailer when the supplier opens a direct online sales channel besides traditional retailing and the traditional retailer opens an online sales channel for omnichannel retailing. The authors show that showrooming can benefit both the supplier and the traditional retailer when customers’ hassle costs for visiting the physical store and the traditional retailer’s additional revenue for each customer visit are medium. Further, the authors show that the traditional retailer’s omnichannel strategy may shrink this ‘win–win’ range because of the aggravating competition effect of showrooming.

For a systematic literature review on webrooming, showrooming and omnichannel retailing, readers may refer to Sahu et al. (2021).

The literature review reveals that the effect of showrooming on traditional and online retailing has been studied from various perspectives. For example, the problem set-ups and assumptions have been different for different papers. While some of the papers have focused on the effect of showrooming on the competition between traditional and online retailers (e.g. Balakrishnan et al. 2014; Basak et al. 2017; Jing 2018; Mehra et al. 2018; Chai et al. 2021) or on a traditional retailer opening an online sales channel and vice versa (e.g. Li et al. 2020; Liu et al. 2020; Zhang and Zhang 2020; Zhang et al. 2021), others have studied the effect of showrooming on a dual-channel supply chain, i.e. a manufacturer supplying to two competing traditional and online retailers (e.g. Basak et al. 2020; Raj et al. 2020), a manufacturer selling directly through an online sales channel and indirectly through a traditional retailer (e.g. Kuksov and Liao 2018; Li et al. 2019), a manufacturer selling directly through a physical store and indirectly through an online retailer (e.g. Li et al. 2021) or two competing manufacturers with one selling only through an online sales channel and the other selling through both a traditional retailer and an online sales channel (e.g. Zhang et al. 2020). While some papers have explicitly considered travelling/hassle/(in)convenience costs in connection with purchasing on a particular channel (e.g. Balakrishnan et al. 2014; Mehra et al. 2018; Li et al. 2020, 2021; Liu et al. 2020; Chai et al. 2021; Zhang et al. 2021), others have ignored such costs (e.g. Basak et al. 2017, 2020; Li et al. 2019; Raj et al. 2020). Also, the economic models used to analyse the effect of showrooming have been different in different papers. While one set of papers have used linear demand functions with sales/service/advertising efforts of the traditional retailer, the other set of papers have derived demand functions based on the utility theory to model customer showrooming behaviour. Most of the papers have developed game theoretic models either with simultaneous moves or with one of the players as the Stackelberg leader and others as followers to set their respective prices and sales/service effort levels. Therefore, the results derived by these papers have also been different. While some of the papers conclude that showrooming benefits the online retailer and adversely affects the traditional retailer (e.g. Mehra et al. 2018), others reveal that showrooming has a negative impact on both the traditional and online retailers (e.g. Balakrishnan et al. 2014; Basak et al. 2017; Jing 2018). Also, that showrooming may increase the traditional retailer’s profit has been observed by some authors (e.g. Kuksov and Liao 2018; Zhang et al. 2021). Similarly, for a dual-channel supply chain, the effect of showrooming on the profitability of the manufacturer(s) and the retailers, and also of the supply chain as a whole, has been studied for various scenarios. Strategies that the manufacturer and the traditional retailer may adopt, such as price matching, exclusivity of product assortment at the physical store (e.g. Jing 2018; Mehra et al. 2018; Li et al. 2020; Chai et al. 2021), opening an online sales channel and/or increasing sales/service efforts (e.g. Basak et al. 2017, 2020; Li et al. 2019, 2021; Raj et al. 2020; Zhang and Zhang 2020), to combat showrooming have also been studied in detail in the literature. Although the results might have been different for different problem set-ups and modelling assumptions, the literature is unanimous about the importance of studying the impact of customer showrooming behaviour on retailing and the strategies that manufacturers and traditional retailers may adopt to mitigate the ill effects of showrooming and how the same can be exploited to their advantage, making this evolving area contemporary and worthwhile for research.

Problem description and modelling assumptions

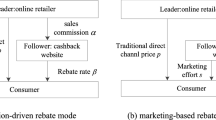

We consider price competition between a traditional and an online retailer, who sell an identical product, under customer showrooming behaviour. First, we develop economic models when the retailers simultaneously decide on their prices, in line with Balakrishnan et al. (2014) and Mehra et al. (2018). We assume that the selling period is short and the retailers simultaneously announce their prices based on the best response function of the other retailer. Next we consider two strategies—effort/investment made and online entry by the traditional retailer—to counter showrooming and extend the economic models. Finally, we develop economic models for the scenario when one of the retailers acts as the Stackelberg leader, and the other follower, to sequentially set their prices, in line with Basak et al. (2017). The sequential decision-making process is relevant when the selling period is sufficiently long and one of the retailers is dominant and more powerful than the other retailer. In this scenario, the leader first sets its price based on the best response function of the follower and then the follower sets its price by observing the price set by the leader. The following are the practical assumptions made in the models and their justifications:

-

(a)

The market potential of the traditional retailer is greater than that of the online retailer. Although online retail sales are growing faster than offline retail sales, according to the latest US Census Bureau report, online retail sales are still about 11.8% of total retail sales in the first quarter of 2020 in the US Census Bureau News (2020). Even when we consider different categories of products, some of them are experiencing faster growth rates in online sales than other categories; however, their online sales are still far below their offline sales. According to a report (Statista 2020), books, movies, music, games, apparel, shoes, consumer electronics, cosmetics and body care, and bags and accessories show high potential for online sales, but less than 40% of the respondents in the USA, who participated in the survey, would buy or order these items online while the rest would still prefer to buy them offline. Another report (Wilson 2017) mentions that even though online grocery purchases show an increasing trend, 93% of shoppers still prefer to inspect the produce in-store; also, for apparel and fast fashion and sporting goods, although their online sales are increasing in volume, more than 75% and 50% of consumers, respectively, still prefer to buy them in-store. Yet another report (Kesteloo and Hoogenberg 2013) predicts that the share of online sales in four categories—health and beauty, consumer electronics and appliances, toys and games, and apparel—will increase from 9 to 27% by 2020 in the Netherlands. From the data presented, it is clear that offline sales will dominate online sales for almost all, if not all, product categories in the foreseeable future. Therefore, models developed in this paper ensure that the traditional retailer’s offline sales volume always exceeds the online retailer’s sales volume. This is in contrast to the assumptions made by Basak et al. (2017; 2020) and Zhou et al. (2018), who either have allowed the market potential of the online retailer to exceed that of the traditional retailer or have considered equal market potential for offline and online sales.

-

(b)

Shoppers, who buy from traditional stores, and shoppers, who showroom, are not homogenous although they buy identical products in-store and online, respectively. Shi et al. (2019) also note customer heterogeneity in online vs. offline retail competition. As mentioned earlier, one of the primary reasons for shopping online is that online retail prices are generally lower than offline retail prices for most of the products, and the showrooming phenomenon bears testimony to this fact wherein price-sensitive shoppers check products in traditional stores, but prefer to buy online because of lower prices. A survey conducted by Quint et al. (2013) shows that the top three reasons for showrooming are ‘lower price from the online retailer’, ‘free shipping from the online retailer’ and ‘always planning to purchase the product online’ with 69, 47 and 27% of the respondents citing the reasons, respectively. Gensler et al. (2017) also observe that expected average price savings from showrooming are positively associated with showrooming. Balakrishnan et al. (2014) and Mehra et al. (2018) note that showroomers visit a traditional store to experience a product and then switch to an online retailer to buy it at a cheaper price. All these evidences point to the fact that shoppers, who showroom, are more price-sensitive than shoppers, who buy from traditional stores. Showroomers are fundamentally online shoppers, who visit traditional stores for experience and information, but instead of buying in-store, they buy online at a price lower than that in traditional stores. In general, pricing has been found to be one of the major drivers of online purchase decisions for most of the product categories (KPMG 2017). Therefore, we assume that the own- and cross-price sensitivities of online demand are greater than the respective own- and cross-price sensitivities of offline demand, which leads to the offline retail price being greater than the online retail price in the models developed in this paper. This is, again, in contrast to the assumptions made by Basak et al. (2017, 2020), Zhou et al. (2018), Li et al. (2019) and Raj et al. (2020), who consider the same own- and cross-price sensitivities of the offline and online demand.

-

(c)

We consider a downward-sloping linear demand function where the constant (or intercept) represents factors, other than price, that contribute to demand. Therefore, the constant term in the demand function, ceteris paribus, represents the market potential of a product given that its price approaches zero. We assume that the non-price factors associated with customer showrooming behaviour, such as convenience, flexibility, free shipping and home delivery, contribute to the market potential of demand. Therefore, showrooming will induce a reduction in the market potential of offline demand and an increase in the market potential of online demand of equal magnitude. This is contrary to the assumption made by Basak et al. (2017, 2020), Li et al. (2019) and Zhang and Zhang (2020), who define the shift in demand as a function of sales/service effort put in by the traditional retailer. However, their assumption does not take into consideration the fact that showrooming is a behavioural phenomenon that is influenced by internal and external factors such as demographics, previous showrooming experience, social pressure and accepted social norm, availability of smartphones and other mobile devices, accessibility to high-speed internet and a continued upsurge of internet retailers, besides price consciousness (Rejon-Guardia and Luna-Nevarez 2017; Dahana et al. 2018; Sit et al. 2018). There is no empirical evidence that increasing sales effort by the traditional retailer will increase the demand faced by the online retailer due to showrooming. On the contrary, the extant literature highlights increasing sales effort by the traditional retailer as a strategy to counter showrooming. Therefore, in this paper, we have modelled customer showrooming behaviour as an exogenous parameter that affects the market potential of either retailer.

Model development

In this section, first the notations used in model development are listed. Then, the demand and profit functions for the traditional and online retailers are explained. Next, a game-theoretic model of the system when the retailers simultaneously decide on their respective prices under showrooming is derived, followed by model development for the effort/investment made by the traditional retailer to counter showrooming.

Notations:

Index

- i:

-

{1: Traditional retailer; 2: Online retailer}

Parameters

- α:

-

Market potential of online sales as a fraction of the market potential of offline sales

- β, γ, θ:

-

Parameters representing sensitivity of demand functions to prices

- s:

-

Parameter representing the showrooming behaviour of customers as a fraction of the market potential of offline sales

Variables

- p1(p2):

-

Price charged by the traditional (online) retailer

- q1(q2):

-

Demand/sales volume for the traditional (online) retailer

- Π1(Π2):

-

Profit of the traditional (online) retailer

Demand and profit functions for the retailers

The normalized demand functions for the traditional and online retailers can be written as follows:

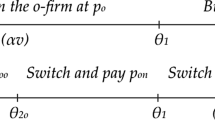

We consider linear demand functions in line with Basak et al. (2017, 2020), Zhou et al. (2018), Li et al. (2019), Raj et al. (2020) and Zhang and Zhang (2020). We assume that the showrooming behaviour of customers affects the market potential of offline and online sales. Accordingly, the expressions for market potential in the demand functions reflect the showrooming effect. Here, α, β and γ are parameters such that \(0 < \alpha ,\beta ,\gamma < 1\). Since it is assumed that online customers are more price-sensitive than offline customers, it follows \(\theta > 1\). Since it is also assumed that online customers are more likely to switch to offline purchase in case of an increase in online price than offline customers, who prefer to shop at traditional stores and may not be as tech-savvy as online customers to make a move to online stores when the offline price increases, it follows \(\beta > \gamma\). According to the assumption that the market potential of online sales is lower than the market potential of offline sales, it follows \(\alpha + s < 1 - s\) or \(s < \frac{1 - \alpha }{2}\).

Therefore, assuming that the variable cost is the same for online and offline sales and normalizing it to zero, the profit functions for the traditional and online retailers can be written as follows:

Simultaneous move by the retailers to set prices

This is considered as the base case. Here, the traditional and online retailers move simultaneously to decide on their respective prices not knowing what the pricing strategy of the other retailer would be. Assuming that both the retailers are rational, they settle for Nash equilibrium prices, as commonly found in the literature.

Therefore, to obtain Nash equilibrium prices, we partially differentiate the profit functions, Eqs. (1) and (2), with respect to their corresponding prices and equate them to zero. Subsequently, by solving the two equations, we obtain the following Nash equilibrium prices:

The expressions for Nash equilibrium q1, q2, Π1 and Π2 are obtained as follows:

Table 1 shows the optimal prices, sales and profits of the traditional and online retailers for the base case.

Proposition 1

The following will hold under showrooming:

-

(a)

\(p_{1} > p_{2}\)

-

(b)

\(q_{1} > q_{2}\)

-

(c)

\(\Pi_{1} > \Pi_{2}\)

Proofs of all propositions are given in Appendix 1.

Proposition (1) shows that the price, sales volume and profit of the traditional retailer are higher than those for the online retailer under showrooming. It can be shown that the same would have held even if there was no showrooming. This is especially true under the assumption that the market potential of offline sales is higher than that of online sales and online customers are more price-sensitive than offline customers. Results may vary under a different setting in Basak et al. (2017) and Zhou et al. (2018), who consider that the market potential of online sales can exceed that of offline sales or they may be equal, and offline and online customers are equally price-sensitive.

Further, it can be easily shown from Eqs. (3–8) that the Nash equilibrium prices, sales volumes and profits of both the retailers assume fractional values under normalized demand functions.

We have performed a sensitivity analysis of the traditional and online retailers’ profits against the parameters α, θ and s. The results of the sensitivity analysis are presented in Appendix 2. Figure 1 shows that both retailers’ profits increase with α; however, the online retailer’s profit increases at a faster rate than that of the traditional retailer, thereby making the difference in the traditional and online retailers’ profits a decreasing function of α. It is observed that this difference is positive as long as the market potential of the online retailer is lower than that of the traditional retailer; however, when the market potential of the online retailer crosses the same for the traditional retailer, the online retailer realizes a higher profit than the traditional retailer. Figure 2 plots the traditional and online retailers’ profits against θ. When θ increases, the traditional retailer’s profit remains unchanged since it is not dependent on θ, but the online retailer’s profit decreases. Therefore, the difference in the traditional and online retailers’ profits increases with θ. The result is intuitive since θ represents the price-sensitivity of online customers and we have assumed that the same is at least equal to the price-sensitivity of offline customers. Figure 3 shows that the traditional retailer’s profit decreases and the online retailer’s profit increases with the showrooming parameter, s. Therefore, the difference in the retailers’ profits decreases as s increases with the difference being positive for small values of s and negative for large values of s. It may be noted that as s increases, the market potential of the online retailer increases and the same for the traditional retailer decreases. As observed in Fig. 1, when the market potential of the traditional retailer is higher than that of the online retailer, the traditional retailer realizes a higher profit than the online retailer; however, when the market potential of the online retailer crosses the same for the traditional retailer, the profit of the online retailer also exceeds the same for the traditional retailer. Therefore, the results of this paper are dependent on the assumptions made for model development.

Proposition 2

p1, q1 and Π1 decrease with s for the traditional retailer, while p2, q2 and Π2 increase with s for the online retailer.

Proposition (2) shows that under increasing customer showrooming, the online retailer benefits at the expense of the traditional retailer, although the price, sales volume and profit of the traditional retailer are always higher than those for the online retailer. This is in line with the finding of Xing and Liu (2012), who observe that the profit of the traditional retailer is affected when the online retailer free-rides information on the traditional sales channel. Proposition (2) also supports the findings of Kuksov and Liao (2018) and Mehra et al. (2018), who show that showrooming could be detrimental to the profit of the traditional retailer. However, this is in contrast to the observation made by Shin (2007), i.e. both the service-providing and the free-riding retailers benefit as a result of customer free-riding information on one channel and buying on another channel. On the other hand, Balakrishnan et al. (2014), Basak et al. (2017) and Jing (2018) show that showrooming intensifies competition between the traditional and online retailers, reducing profits for both the firms. Therefore, reduced showrooming is beneficial from the point of view of both the traditional and online retailers. On the contrary, Proposition (2) indicates that while the online retailer benefits as a result of customer free-riding information on the traditional channel (showrooming) and buying on the online channel, the traditional retailer, which provides informational services, is adversely impacted in terms of its price, sales volume and profit. As mentioned, this result will hold as long as the market potential of offline sales is higher than that of online sales and online customers are more price-sensitive than offline customers. Figure 3 in Appendix 2 presents a sensitivity analysis of the retailers’ profits against the showrooming parameter, s.

Proposition 3

The combined offline and online demand, \(q_{1} + q_{2}\) increases with s.

Proposition (3) shows that although the traditional retailer loses market share, the gain in the market share of the online retailer results in an overall increase in demand under customer showrooming behaviour. This result indicates market expansion and customer benefits under showrooming and is in line with the observation made by Bell et al. (2018) and Kuksov and Liao (2018). The traditional retailer may lose market share to the online retailer under showrooming in the short run; however, an overall expansion of the market provides an opportunity to the traditional retailer to grab a pie of the expanded market in the long run. Also, the traditional retailer may expect lower wholesale prices and/or incentives from the manufacturer, who benefits from market expansion (Kuksov and Liao, 2018). It may be observed from the proof of Proposition (3) in Appendix 1 that the combined market demand also increases with parameters, α, β and γ, and it is independent of θ.

Proposition 4

While prices, sales volumes and profits of both the retailers increase with the parameters, α, β and γ, the online retailer’s price and profit decrease with the parameter, θ.

Proposition (4) indicates that increasing market potential of the online channel and cross-price sensitivity parameters benefit both the retailers. In other words, if the market potential of the online channel increases at the same level of showrooming, it not only benefits the online retailer, but also increases the price, sales volume and profit of the traditional retailer. On the other hand, increasing own-price sensitivity parameter for the online retailer expectedly decreases its price and profit, while the traditional retailer remains unaffected. Figure 2 in Appendix 2 shows the sensitivity of the traditional and online retailers’ profits against θ.

Sensitivity analyses of the retailers’ profits against the parameters β and γ are shown in Figs. 4 and 5 in Appendix 2, respectively. Figure 4 shows that while the traditional retailer’s profit increases sharply with β, the online retailer’s profit increases marginally with β, thereby making the difference in the retailers’ profits sharply increase with β. On the other hand, Fig. 5 shows that both the retailers’ profits increase sharply with γ; however, the difference in their profits decreases as γ increases. The sensitivity analyses reveal that both the retailers benefit by increasing cross-price sensitivities; however, their effects are different for the traditional and online retailers. It has been reasonably assumed that the cross-price sensitivity parameter, β for the online retailer is at least equal to the cross-price sensitivity parameter, γ for the traditional retailer.

Effort/investment made by the traditional retailer to counter showrooming

Suppose the traditional retailer puts in effort by way of rearranging the layout and display at the showroom to make it more attractive to customers, providing better in-store experiences, introducing loyalty/rewards programmes for customer retention, investing in technology such as mobile apps and in-store Wi-fi, investing in inventory so that items never go out of stock, and so on to mitigate customer showrooming behaviour. Let the normalized level of effort put in by the traditional retailer be represented by \(\varepsilon\) such that \(0 < \varepsilon < 1\). Also, let the associated normalized investment made by the traditional retailer be \(\varepsilon^{2}\) such that the investment required increases quadratically with the level of effort. Although Basak et al. (2017, 2020) consider a linear cost function, we consider an increasing and convex cost function in line with Tsay and Agrawal (2004), Xing and Liu (2012), Kuksov and Liao (2018), Zhou et al. (2018), Li et al. (2019), Raj et al. (2020), and Zhang and Zhang (2020). It is assumed that with a level of effort of \(\varepsilon\), the showrooming parameter, s, reduces to \(s\left( {1 - \varepsilon } \right)\), i.e. drops by \(100 \times \varepsilon \%\) or, in other words, it may be said that \(100 \times \varepsilon \%\) of sales that were lost to showrooming, may now be reclaimed, thus increasing the market potential of the traditional retailer by the same amount. Then, the normalized demand and profit functions for the retailers can be written as follows:

It may be noted that for the traditional retailer, \(\varepsilon\) is an additional variable in this model. Therefore, partially differentiating Eq. (10) with respect to p1 and \(\varepsilon\), partially differentiating Eq. (11) with respect to p2, and equating them to zero, we get three equations. Solving these three equations, we get the following Nash equilibrium solutions:

The expressions for q1, q2, Π1 and Π2 are obtained as follows:

Table 2 shows the optimal prices, sales and profits of the traditional and online retailers and the optimal effort put in by the traditional retailer to counter showrooming.

It can be proved that the price, sales volume and profit of the traditional retailer are still higher than those for the online retailer post-investment made by the traditional retailer to counter showrooming.

Further, it can be shown from Eqs. (12–(18) that the Nash equilibrium prices, sales volumes and profits of both the retailers assume fractional values under normalized demand functions; also, \(0 < \varepsilon < 1\), as defined.

Proposition (5) checks if the price, demand/sales volume and profit of the traditional retailer increase upon investment made to counter showrooming.

Proposition 5

The following hold for the traditional retailer:

-

(a)

Price charged increases.

-

(b)

Demand/sales volume increases.

-

(c)

Profit increases given \(\gamma > 0.064\).

Part (c) of Proposition (5) highlights the fact that the profit of the traditional retailer may not always increase upon investment made to counter showrooming. This is clear from Eq. (17) that although the price and demand/sales volume of the traditional retailer, and hence the revenue, increase post-investment, as shown in parts (a) and (b) of Proposition (5), the investment made may actually bring down the profit below the pre-investment level depending on the choice of parameter values. Therefore, the traditional retailer has to weigh options before making any investment to counter showrooming and would wish to invest only when the benefits outweigh the cost. Part (c) of Proposition (5) shows that when \(\gamma > 0.064\), for any combination of other parameter values, the profit of the traditional retailer always increases post-investment.

Proposition 6

The following hold for the online retailer post-investment by the traditional retailer:

-

(a)

Price charged decreases.

-

(b)

Demand/sales volume decreases.

-

(c)

Profit decreases.

Proposition (6) shows that the online retailer loses upon the traditional retailer’s investment to counter showrooming.

A sensitivity analysis of the traditional and online retailers’ profits with respect to the parameters, α, β, γ, θ and s shows similar trends as observed for the base case. The sensitivity of the traditional retailer’s effort, \(\varepsilon\) against various parameters is shown in Appendix 2. Figure 6 shows that as α increases, the market potential of the online retailer increases, resulting in an increased effort put in by the traditional retailer. Figure 7 shows that the traditional retailer’s effort increases with the showrooming parameter, s, but with a decreasing return to scale. This may be attributed to the cost of effort, which is quadratic in nature, and therefore increases with effort with an increasing return to scale. While the traditional retailer’s effort is independent of θ, Figs. 8 and 9 show that the same increases with the cross-price sensitivity parameters, β and γ, respectively.

Proposition 7

The combined offline and online demand, \(q_{1} + q_{2}\), decreases post-investment by the traditional retailer.

Proposition (7) shows that although the traditional retailer benefits at the cost of the online retailer by making an investment to counter showrooming, the combined offline and online customer demand/sales volume falls below the pre-investment level. This result indicates a contraction of the overall market demand/sales volume post the traditional retailer’s investment to counter showrooming. It may be noted from the proof of Proposition (7) shown in Appendix 1 that the result is contingent upon the assumption, β > γ. When β = γ, the pre-investment combined offline and online demand remains the same post-investment.

A sensitivity analysis of the pre- and post-investment combined offline and online demand with respect to the parameters, α, β, γ and s is shown in Appendix 2. It may be observed from Figs. 10, 11, 12 and 13 that the combined demands pre- and post-investment are almost the same with the pre-investment combined demand marginally exceeding the post-investment combined demand. Figure 10 shows that the combined demand increases with α as the market potential of the online retailer increases with the difference between pre- and post-investment combined demands marginally increasing with α. Figure 11 shows that the combined offline and online demand pre- and post-investment marginally increases with the showrooming parameter, s with the difference between pre- and post-investment combined demands marginally increasing with s. Figures 12 and 13 show that the combined offline and online demand pre- and post-investment increases with the parameters, β and γ, respectively. While the difference between pre- and post-investment combined demands marginally increases with β, the same marginally decreases with γ and becomes zero when γ equals β.

Online entry by the traditional retailer to counter showrooming

The traditional retailer can make a foray into the online market to counter the effect of showrooming. Therefore, the traditional retailer sells both offline and online. While it sets the offline price, the online price is set by its online arm along with the online retailer, and the prices charged by the online arm of the traditional retailer and the online retailer are the same, thereby creating an undifferentiated online marketplace for the online customer. This is in line with the assumption made by Balakrishnan et al. (2014). Hence, we have the following offline and online demand functions, respectively:

While the offline demand can be attributed solely to the traditional retailer, the online demand has to be apportioned to the traditional and online retailers. Let \(\lambda q_{2} \;\left( {0 < \lambda < 1} \right)\) of the online demand be attributed to the online arm of the traditional retailer and \(\left( {1 - \lambda } \right)q_{2}\) of the online demand be attributed to the online retailer. This is also in line with the assumption made by Balakrishnan et al. (2014).

Therefore, offline and online sales of the traditional retailer = \(q_{1} + \lambda q_{2}\) and online sales of the online retailer = \(\left( {1 - \lambda } \right)q_{2}\).

The profit functions for the traditional and online retailers can be written as follows, respectively:

The fixed cost/investment for setting up an online arm by the traditional retailer has not been included in its profit function. It is assumed that the traditional retailer will consider setting up an online arm only if the benefits outweigh the fixed cost/investment.

Now, partially differentiating the profit functions with respect to their prices, equating them to zero and solving the equations, we get the following Nash equilibrium prices:

The following are the expressions for q1 and q2:

Table 3 shows the optimal prices, sales and profits of the traditional and online retailers upon online entry by the traditional retailer to counter showrooming.

Proposition (8) shows that the price, sales volume (offline + online) and profit of the traditional retailer are higher than those of the online retailer, respectively.

Proposition 8

The following will hold:

-

(a)

\(p_{1} > p_{2}\)

-

(b)

\(q_{1} + \lambda q_{2} > \left( {1 - \lambda } \right)q_{2}\)

-

(c)

\(\Pi_{1} > \Pi_{2}\)

Proposition 9

The following will hold for the traditional retailer post its entry into the online market:

-

(a)

Price charged increases.

-

(b)

Offline sales volume decreases. However, total sales (offline and online) increase.

-

(c)

Profit increases.

Proposition (9) shows that upon online entry by the traditional retailer, even if its profit from offline sales may decrease, its total profit from offline and online sales will increase. This observation is similar to that made by Bernstein et al. (2008). Also, Gao and Su (2017) note that if showrooming customers are persuaded to purchase from the traditional retailer’s online channel, it may benefit the traditional retailer.

Proposition 10

The following will hold for the online retailer post the traditional retailer’s entry into the online market:

-

(a)

Price charged increases.

-

(b)

Sales volume decreases.

-

(c)

Profit decreases.

The results of Propositions (9) and (10) are in line with the observations made by Balakrishnan et al. (2014).

Sensitivity analyses of the traditional and online retailers’ profits against different parameter values have been performed and are shown in Appendix 2. Figure 14 shows that for higher values of λ (≥ 0.4), profits of both the traditional and online retailers, as well as their difference, increase with α, as the potential of the online market increases. This is in contrast to the base case where the difference decreases with α. The reason may be attributed to the fact that now the traditional retailer, besides selling in the offline market, has forayed into the online market, and therefore, whenever the online market expands, given that the traditional retailer has a significant share of the online market (λ ≥ 0.4), its profit increases faster than the online retailer’s profit with α, making the difference in their profits an increasing function of α. Hence, it may be concluded that when the traditional retailer enters into the online market and gains a significant market share, the results derived in this paper still hold, independent of the assumptions made for model development. A similar conclusion may be drawn for the sensitivity of the retailers’ profits against the showrooming parameter, s. As shown in Fig. 15, the nature of the graph is the same as that for the base case; however, for a significant online market share of the traditional retailer (λ ≥ 0.4), the difference in the retailers’ profits, although decreasing with s, is still positive within the reasonable range of the parameter, s, indicating independence of modelling assumptions and robustness of the results derived in the paper. While the trend with respect to β remains the same as for the base case, it is observed that the nature of the difference in the retailers’ profits with respect to θ and γ reverses in comparison with the same for the base case for higher values of λ. Figure 16 shows the sensitivity of the retailers’ profits against λ. It may be intuitively explained that as the traditional retailer’s share of the online market increases, its profit increases, the online retailer’s profit decreases, and as a result, the difference in their profits increases.

Proposition 11

The following will hold post the traditional retailer’s entry into the online market:

-

(a)

Total online sales of the online arm of the traditional retailer and online retailer increase.

-

(b)

Total offline and online sales decrease.

Proposition (11) shows that upon the traditional retailer’s entry into the online market, although the online market expands, the total market size, including offline and online sales, contracts.

A sensitivity analysis of the combined offline and online demand, pre- and post-online entry by the traditional retailer, has been performed and is shown in Appendix 2. It has been found that the trend with respect to the parameters, α, β, γ and s is more or less similar to that for the case when the traditional retailer puts in effort to counter showrooming. Figure 17 shows that while the combined demand, pre-online entry by the traditional retailer, is independent of θ, the same, post-online entry by the traditional retailer, marginally increases with θ, reducing the difference between the two. On the other hand, Fig. 18 shows that while the combined demand, pre-online entry by the traditional retailer, is independent of λ, the same, post-online entry by the traditional retailer, marginally decreases with λ, increasing the difference between the two.

Sequential move by the retailers to set prices

In this game, one of the retailers acts as the Stackelberg leader and the other acts as the follower. The leader moves first and sets its price. The follower then makes its move and sets its price based on the price set by the leader. To reach equilibrium, the leader derives the follower’s best response function and incorporates it into its profit function to determine its price. Subsequently, the follower determines its price by observing the price set by the leader.

Traditional retailer as the leader and online retailer as the follower

Given a price, p1 set by the traditional retailer, we get the best price for the online retailer as \(p_{2} = \frac{{\alpha + s + \gamma p_{1} }}{2\theta }\). Incorporating the expression for p2 in the profit function for the traditional retailer as given in Eq. (1), we get

Now, differentiating the above profit function and equating it to zero, we obtain the following:

It can be easily shown that Π1 is concave in p1. Therefore, p1, as obtained in Eq. (25), maximizes Π1.

Also, the following expressions may be obtained:

Table 4 shows the optimal prices, sales and profits of the traditional and online retailers when the traditional retailer acts as the Stackelberg leader.

Proposition 12

The following will hold when the traditional retailer acts as the leader and the online retailer acts as the follower, in comparison with when both the retailers move simultaneously to set their respective prices:

-

(a)

Prices of both the retailers increase.

-

(b)

While offline sales decrease, online sales increase.

-

(c)

Profits of both the retailers increase.

-

(d)

Total offline and online sales decrease.

Online retailer as the leader and traditional retailer as the follower

Given a price, p2 set by the online retailer, we get the best price for the traditional retailer as \(p_{1} = \frac{{1 - s + \beta \theta p_{2} }}{2}\). Incorporating the expression for p1 in the profit function for the online retailer as given in Eq. (2), we get

Now, differentiating the above profit function and equating it to zero, we obtain the following:

It can be easily shown that Π2 is concave in p2. Therefore, p2, as obtained in Eq. (31), maximizes Π2.

Also, the following expressions may be obtained:

Table 5 shows the optimal prices, sales and profits of the traditional and online retailers when the online retailer acts as the Stackelberg leader.

Proposition 13

The following will hold when the online retailer acts as the leader and the traditional retailer acts as the follower, in comparison with when both the retailers move simultaneously to set their respective prices:

-

(a)

Prices of both the retailers increase.

-

(b)

While offline sales increase, online sales decrease.

-

(c)

Profits of both the retailers increase.

-

(d)

Total offline and online sales decrease.

Proposition (14) shows the relationships between prices, sales volumes and profits of each of the retailers under simultaneous and sequential moves.

Proposition 14

Let the superscript ‘Sim’ denote the game when the retailers make simultaneous moves. Also, let the superscripts ‘Seq (TR = L)’ and ‘Seq (OR = L)’ denote the games when the traditional retailer (TR) is the leader (L) and when the online retailer (OR) is the leader (L) under sequential moves, respectively. Then, the following will hold:

-

(a)

\(p_{1}^{{Seq{\kern 1pt} \left( {TR = L} \right)}} > p_{1}^{{Seq{\kern 1pt} \left( {OR = L} \right)}} > p_{1}^{Sim}\)

-

(b)

\(q_{1}^{{Seq{\kern 1pt} \left( {OR = L} \right)}} > q_{1}^{Sim} > q_{1}^{{Seq{\kern 1pt} \left( {TR = L} \right)}}\)

-

(c)

\(\Pi_{1}^{{Seq{\kern 1pt} \left( {OR = L} \right)}} > \Pi_{1}^{{Seq{\kern 1pt} \left( {TR = L} \right)}} > \Pi_{1}^{Sim}\)

-

(d)

\(p_{2}^{{Seq{\kern 1pt} \left( {OR = L} \right)}} > p_{2}^{{Seq{\kern 1pt} \left( {TR = L} \right)}} > p_{2}^{Sim}\)

-

(e)

\(q_{2}^{{Seq{\kern 1pt} \left( {TR = L} \right)}} > q_{2}^{Sim} > q_{2}^{{Seq{\kern 1pt} \left( {OR = L} \right)}}\)

-

(f)

\(\Pi_{2}^{{Seq{\kern 1pt} \left( {TR = L} \right)}} > \Pi_{2}^{{Seq{\kern 1pt} \left( {OR = L} \right)}} > \Pi_{2}^{Sim}\)

-

(g)

\(\left( {q_{1} + q_{2} } \right)^{Sim} > \left( {q_{1} + q_{2} } \right)^{{Seq{\kern 1pt} \left( {OR = L} \right)}} > \left( {q_{1} + q_{2} } \right)^{{Seq{\kern 1pt} \left( {TR = L} \right)}}\)

The above are standard results for upward sloping reaction curves (see, for example, Gal-Or 1985).

Summary of results and managerial implications

The important results of this research that provide significant managerial insights are the following:

When the traditional retailer adopts no strategy to counter showrooming:

-

(a)

Showrooming hurts the traditional retailer and benefits the online retailer by decreasing the sales volume and profit for the former and increasing the same for the latter.

-

(b)

The overall market demand, including offline and online sales, increases under showrooming, thereby benefitting the market. Although sales and profits of the traditional retailer may decline in the short run, the overall expansion of the market provides it with an opportunity to benefit in the long run.

-

(c)

When the market potential of online sales increases at the same level of showrooming, sales volumes and profits of both retailers increase.

When the traditional retailer adopts a strategy to counter showrooming:

-

(a)

The traditional retailer is better off, and the online retailer is worse off, when the traditional retailer adopts a counter-strategy to mitigate the ill effects of showrooming.

-

(b)

The combined offline and online sales decrease post-adoption of a strategy by the traditional retailer to counter showrooming, thereby contracting the market.

-

(c)

When the traditional retailer makes an online entry, its offline sales decrease, but its total offline and online sales increase.

-

(d)

When the traditional retailer makes an online entry, total online sales and the online retail price increase.

-

(e)

Sensitivity analyses reveal that the results of this study even hold for wide ranges of parameter values when the traditional retailer enters into the online market, making them robust and independent of modelling assumptions.

When one of the retailers acts as the Stackelberg leader:

-

(a)

Both the traditional and online retailers achieve higher sales volumes in sequential moves when the other retailer acts as the leader than in the simultaneous move.

-

(b)

Both the traditional and online retailers make higher profits in sequential moves than in the simultaneous move and the higher profit made by a retailer in sequential moves is when the other retailer acts as the leader.

-

(c)

The combined offline and online sales decrease in sequential moves than in the simultaneous move and the overall market demand is the lowest when the traditional retailer acts as the leader.

Results show that as long as the market potential of offline sales exceeds that of online sales, which is the present situation given that in the USA, online retail sales account for only 10% of total retail sales, as mentioned before, and online customers are more price-sensitive than offline customers, traditional retailers need not worry about competitiveness against online retailers as the sales volumes and profits of traditional retailers are always higher than those for online retailers at all levels of showrooming. It is only when the market potential of online sales increases as a result of showrooming that traditional retailers need to devise a counter-strategy to arrest the decline in their sales volumes and profits. Traditional retailers need not bother about price-sensitive showroomers because they are anyway online shoppers and would not buy from a traditional store, and hence there is not much that traditional retailers can do to make them shop in a traditional store. However, shoppers that showroom based on non-price factors, such as flexibility and delivery convenience, can be converted to in-store buyers, and traditional retailers must focus on them so that they are compelled to buy in-store rather than switching to an online retailer. In fact, it is shown in this paper that if traditional retailers invest to counter showrooming, their sales volumes and profits might actually improve at the expense of online retailers. Therefore, instead of taking defensive strategies to counter showrooming, as mentioned in the extant literature (See, for example, Moran 2013; Teixeira and Gupta 2015), such as price matching, charging a fee for showrooming, not allowing mobile devices or disabling Wi-fi and internet in store, which are short-term and would drive shoppers away from stores, managers of traditional stores should accept showrooming as an unavoidable phenomenon and leverage the opportunity to reap benefits for their stores (Wohlsen 2012). Even if the sales volumes and profits of traditional retailers decline under showrooming, they can leverage the overall expansion of the market in the long run. Moreover, traditional retailers need not worry about showrooming because if the market potential of online sales increases at the same level of showrooming, it not only benefits online retailers, but also increases the sales volumes and profits of traditional retailers.