Abstract

Objective

The main objective of this study was to explore the extent to which the incremental cost-effectiveness ratio (ICER), alongside other factors, predicts the final outcome of medicine price negotiation in Italy. The second objective was to depict the mean ICER of medicines obtained after negotiation.

Methods

Data were extracted from company dossiers submitted to the Italian Medicines Agency (AIFA) from October 2016 to January 2021 and AIFA’s internal database. Beta-based regression analyses were used to test the effect of ICER and other variables on the outcome of price negotiation (ΔP), defined as the percentage difference between the list price requested by manufacturers and the final price paid by the Italian National Health Service (INHS).

Results

In our dataset of 48 pricing and reimbursement procedures, the ICER before negotiation was one of the variables with a major impact on the outcome of negotiation when ≥ 40,000€/QALY. As resulting from multiple regression analyses, the effect of the ICER on ΔP seemed driven by medicines for non-onco-immunological and non-rare diseases. Overall, the negotiation process granted mean incremental costs of €64,688 and mean incremental QALYs of 1.96, yielding an average ICER of €33,004/QALY.

Conclusions

This study provides support on the influence of cost-effectiveness analysis on price negotiation in the Italian context, providing an estimate of the mean ICER of reimbursed medicines, calculated using net confidential prices charged by the INHS. The role and use of economic evaluations in medicines pricing should be further improved to get the best value for money.

Similar content being viewed by others

This study suggests that economic evaluations submitted by pharmaceutical companies to AIFA plays a role in pricing of reimbursed medicines in Italy. |

It was found that results from cost-effectiveness analyses may predict the final outcome of price negotiations, while the role of many other factors is still unclear. |

Further effort is needed to define a well-structured value framework for medicines price setting in Italy and increase the impact of cost-effectiveness analyses to ensure value-for-money of new medicines. |

1 Introduction

Price negotiation, to close the gap between what a pharmaceutical company requests for their product and the amount a payer is prepared to bear according to its value framework and budget constraints, has become common practice in many jurisdictions. Negotiation processes are complex since they need to balance multiple conflicting societal goals, such as incentivising innovation, facilitating access to medicines and ensuring affordability [1, 2]. In order to reach these goals, the parties may agree on discounts over list prices or further confidential reimbursement conditions included in the so-called managed-entry agreements (MEAs) (e.g. financial-based arrangements, including simple confidential discounts, and/or performance-based agreements [3]).

The effect of centralised negotiation on medicine prices is still controversial and in the United States its implementation for outpatient prescriptions (Medicare Part B and D) is currently a matter of complex political contention [4, 5]. Past research showed that various factors may influence the final outcome of the negotiation, depending on the different value frameworks adopted by decision makers in their own context [6, 7]. The exact list of a product’s features a payer attaches value to, as well as the weights given to them and the trade-offs a payer is prepared to make between each of those, are not generally made explicit in most countries. Previous studies used regression methods to analyse past decisions made by payers in a given jurisdiction, with a view to assess the role played by specific factors (e.g. added benefit, expected budget impact, cost-effectiveness, etc.) on the final negotiated prices. These studies found that negotiated prices were somewhat linked to clinical benefits [8,9,10] in several European countries (e.g. Germany, Italy and France), although the correlation between price and incremental therapeutic benefit was weak overall (r = 0.56 [8]; r = 0.39 [9]; r = 0.37 [10]). Other studies showed that the expected financial impact of the new treatment on pharmaceutical expenditure was among the factors that influenced the final price of medicines the most, either directly or indirectly (e.g. target population size) [11,12,13,14,15]. The cost-effectiveness of the product was found to be—among other variables—a key factor informing adoption decisions in the United Kingdom [16, 17], Sweden [18], South Korea [19], Canada [20] and Australia [21], while no empirical evidence was found regarding the role played by cost-effectiveness in medicine pricing. Perhaps unsurprisingly, given the somewhat different value frameworks used in different jurisdictions, it is impossible to infer a consistent set of predictors of final reimbursement decisions or final prices across countries based on the published literature, with each study reflecting the peculiarity of the regulatory context of interest, differences in adoption decision rules and a different case-mix of products analysed [8,9,10,11,12,13,14,15]. Moreover, given that price information is generally considered confidential and never shared between public institutions across different countries [22], the cost-effectiveness of medicines, calculated with real final prices (after the detraction of confidential discounts and the expected effect of MEAs) remains often unknown or kept confidential [23]. In this regard, Italy has a different regulatory context compared with several European countries. The assessment, appraisal and price negotiation of medicines are undertaken within a single institution (i.e. the Italian Medicines Agency—AIFA), with the potential consequent advantage of greater interconnections between processes and actors, and a better alignment with the concept of ‘value’ across reimbursement decisions and pricing of medicines. Similarly to other countries, the actual list of factors driving the final decision is often undisclosed, making the role of cost-effectiveness in subsequent price negotiation still unclear. Although health economic evaluations (HEEs) evidence has been used to inform decision making for a number of years in Italy, AIFA has only recently introduced the mandatory submission of a structured HEE study for manufacturers intending to bring their product into the Italian market [24].

The objective of this manuscript is to explore the extent to which the incremental cost-effectiveness ratio (ICER), alongside a number of other relevant factors, predicts the final outcome of the negotiation in Italy expressed as percentage discount off the list price. A secondary objective of this study is to identify the mean ICER of reimbursed medicines resulting from past negotiations; information which could be used to further investigate the existence of an implicit cost-effectiveness threshold used by the Italian decision-maker for different categories of medicines.

1.1 Italian Regulatory Context

In the Italian regulatory context, the Italian Medicines Agency (AIFA) is the competent authority for pricing and reimbursement decisions of medicines used in both out-patient and in-patient care. The price of medicines is determined through negotiation between AIFA and the pharmaceutical companies (Law No. 326 of 24 November 2003), in accordance with methods and criteria identified by the new Ministerial Decree of 2 August 2019 (OJ No. 185 of 24 July 2020) and the AIFA guideline for pricing and reimbursement (P&R) submissions published in December 2020 [24]. Among other things, the guidance contains detailed recommendations on how to conduct and report HEEs, which for the first time became mandatory in the case of new orphan drugs, new active substances and new therapeutic indications of patented products.

For its decision making, AIFA is advised by two expert committees (i.e., the Technical Scientific Committee—CTS and the Pricing and Reimbursement Committee—CPR) which work separately, but within a common iterative process, to identify those medicines deserving of reimbursement, their prices and other reimbursement conditions. Both committees are supported by the AIFA offices involved in P&R procedures. In particular, the AIFA HEE Office suggests the price targets for CPR negotiation, informed on the basis of cost-effectiveness and budget impact analysis considerations submitted by the applicants within the reimbursement dossiers and internally revised according to methods and criteria described elsewhere [25]. If the negotiations fail, medicines will not be reimbursed by the Italian NHS (INHS). Therefore, in the Italian context, the CPR resembles a ‘price-maker’ committee, since the final price set for reimbursed medicines is the result of the negotiation that takes place with the manufacturer. As such, in most cases, the final price remains confidential to the public following a non-disclosure agreement between the parties [22]. The new AIFA guideline released in 2020 details the type of information required from manufacturers to inform assessment and appraisal processes, including the specific cases where an economic evaluation is made mandatory (i.e. new orphan drugs, new active substances and new therapeutic indications of patented products). [24]. Nevertheless, a prespecified value framework for medicines price setting in Italy is still missing and no explicit cost-effectiveness threshold exists yet. The current available evidence shows that many factors may influence the outcome of the negotiation in Italy [11]; however, the role of cost-effectiveness results within price negotiations has never been investigated before. Our study is aimed at filling this gap by providing insights into the implicit cost-effectiveness threshold resulting from past reimbursement decisions.

2 Methods

2.1 Study Design

The data source of the study was represented by AIFA’s internal database of P&R procedures. All company dossiers submitted to AIFA between October 2016 (i.e., since the establishment of the HEE Office at AIFA) and January 2021, related to new medicinal products and new therapeutic indications of patented products, were extracted and included in the dataset if a cost-effectiveness analysis (CEA) from the perspective of the INHS was provided. If two or more CEAs focusing on different therapeutic indications (or different subgroup populations) were submitted in a unique P&R dossier, distinct ICERs were recorded in the database for each of them. Moreover, when the company base-case analyses considered several comparators, the ICER against the one selected by the CTS or the one most commonly used in Italian clinical practice was selected.

For those submissions where the electronic model was not provided, CEA results were included only if the total acquisition cost of each medicine was reported separately from other costs, so that the related ICER could be recalculated using final prices agreed after negotiation; on the contrary, CEAs reporting highly aggregated results were excluded. Furthermore, submissions where the main product resulted to be the dominant strategy against the selected comparator were also excluded, since the magnitude of a negative ICER could not be interpreted as a predictor of price negotiation (respectively, N = 6) [26, 27].

Finally, the following two further exclusion criteria were applied: submissions with a negative decision on reimbursement, since in these cases medicine prices are not regulated; and submissions under evaluation, for which a final decision on reimbursement has not been reached within the date set for locking the database (i.e. 15th March 2022).

2.2 Database Structure and Variable of Interest

Given the potential role of the ICER, as well as other factors, in influencing the outcome of price negotiation for medicines reimbursed by the INHS, the variable of interest (ΔP) was defined as the percentage difference between the price requested by the pharmaceutical company in the submitted dossier and the final price agreed at the end of the AIFA negotiation. Final prices, resulting from non-disclosure agreements between the parties, are not publicly available. They were calculated incorporating both confidential discounts and the expected impact of financial or outcome-based MEAs, if any. For performance-based agreements (namely payment by/at result schemes in the Italian taxonomy), the effect was estimated as an additional discount off the medicine list price based on the expected performance on the grounds of pivotal studies. To estimate the additional discount of the outcome-based MEAs, Plot Digitizer was used to calculate the area under the survival curves from the pivotal clinical trial (https://sourceforge.net/projects/plotdigitizer/), according to a procedure already described elsewhere (see [11]). For other types of financial agreements (e.g. confidential discount, cost-sharing schemes, price–volume agreements, annual rebate, etc.), the impact was also computed as an additional discount resulting from the agreed contractual arrangement.

According to the database structure used in previously published studies [11, 16, 17, 25], a number of independent variables, potentially associated with ΔP, were selected among those variables available from the P&R dossiers/procedures (Table 1), most of them are regulatory variables (e.g. orphan designation, innovativeness status), while others are related to the expected financial or economic impact on the INHS (e.g. number of eligible patients, expected pharmaceutical expenditure, ICER calculated using the price requested by the manufacturer).

2.3 Statistical Analysis

Since the variable of interest ΔP is continuous and restricted within the interval 0–1, a beta-based regression model with a logit link was used to analyse the regression structure with the aforementioned independent variables [30].

Univariate beta regression analyses were performed to test if the category of the independent variable displayed a statistically significant impact on ΔP compared with the reference category. Only those variables with a significant effect on ΔP were included in a beta-based multiple regression model. Where relevant, an interaction term between covariates was included in the model to explore any sub-group effect.

Finally, to depict the mean value of ICERs obtained using the final price agreed at the end of the negotiation (including confidential discount and the expected effect of any other MEAs), several descriptive statistics were showed, aggregating data according to different products’ features. Due to the confidential nature of the P&R procedures, data extracted from AIFA’s internal database were always presented in aggregated form. Chi-square test was used for analysing associations on categorical variables. All statistical analyses were performed using R Statistical Software (version 4.0.3; R Foundation for Statistical Computing, Vienna, Austria) and the model-fitting function used is betareg().

3 Results

Overall, in the timespan between October 2016 and January 2021, a total of 116 P&R dossiers including CEAs were submitted to AIFA (Fig. 1). Among these, 60 submissions were excluded, leaving 56 dossiers potentially eligible for inclusion as they reported a CEA conducted from the INHS perspective. These comprised 10 concerning orphan medicines (17.8%), 15 new medicinal products never marketed before (26.7%) and 31 regarded new therapeutic indications of patented products (55.3%). An additional eight P&R procedures were excluded since they were not reimbursed by the INHS or their reimbursement status was still under evaluation at the date of the database lock, on 15th March 2022. Therefore, 48 CEAs represented the final sample size of our analysis (Fig.1).

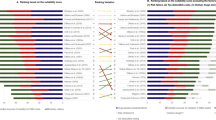

Table 2 provides mean ΔPs and beta coefficient estimates (with their 95% confidence interval [95% CI]) obtained from univariate beta regression models for each variable of interest.

The categories of the independent variables with a positive beta coefficient are associated with a higher price reduction (∆P) compared with the reference category (e.g. orphan and innovative medicines, ATMPs, medicines with higher pharmaceutical expenditure or addressing more severe diseases, etc.). Due to the low frequency recorded (n = 2/48), paediatric use was not shown in Table 2.

Three independent variables showed a positive and statistically significant coefficient: onco-immunological products, products addressing ultra-rare diseases, and products with a base-case ICER before negotiation higher than or equal to 40,000€ per QALY. These three variables were then included in a beta-based multiple regression analysis.

Given that a statistically significant greater part of onco-haematological medicines and medicines addressing ultra-rare diseases (i.e. < 1200 potentially eligible patients) have an ICER before negotiation ≥ €40,000 per QALY compared with those with an ICER < €40,000 per QALY (Chi-square 3 × 2 = 7.8; p = 0.020; Chi-square 3 × 2 = 7.9; p = 0.019, respectively), the interaction between the ‘ICER before negotiation’ and the two variables ‘onco-immunological disease’ and ‘potentially eligible patients’ was tested in two different models. Therefore, two interaction terms (ICER before negotiation × Onco-immunological products, ICER before negotiation × Potentially eligible patients) were added, respectively, in order to explore potential subgroup effects. Results from the two multiple beta regression models are shown in Table 3.

The beta coefficients returned the additional increase (or decrease if the beta is negative) in the log-odds ratio of the dependent variable per unit change in the independent variable. The first model confirmed the significant main effects on ΔP of onco-immunological medicines (p = 0.006) and ICER before AIFA negotiation (when its value is ≥ 40,000€ per QALY; p < 0.001). On the contrary, the outcome of the negotiation (ΔP) seemed poorly affected by the interaction term ICER before negotiation × Onco-immunological products, as the coefficients associated were negative.

The second model also confirmed the significant main effect on ΔP of the ICER before AIFA negotiation (p = 0.017 when the ICER is ≥ 40,000€ per QALY) and products for ultra-rare diseases (p = 0.003). Similarly to the first model, negative coefficients of the interaction term ICER before negotiation × Potentially eligible patients reflected a low impact on price variation ΔP, although they are statistically significant (Table 3).

Overall, these beta-based multiple regression models are associated with a measure for goodness of fit of 26.3% for model 1 and 19.5% for model 2 (pseudo R2). Multiple regression analyses were also conducted using incremental costs and incremental QALYs as dependent variable. Results are available in the Supplementary Table 1 and 2 (see electronic supplementary material).

Moreover, the negotiation process granted mean incremental costs of €64,688 for a mean incremental QALY of 1.96, yielding an average ICER per QALY across the sample of reimbursed medicines of €33,004 (Table 4). The variability of the mean aggregated ICER within each subset explored showed that the highest mean ICERs (i.e. ≥ 40,000€ per QALY) were identified for ATMPs, medicines reimbursed with an outcome-based MEA, and medicines for severe diseases.

4 Discussion

The present study explored the extent to which the incremental cost-effectiveness ratio, alongside other relevant factors, predicted the outcome of medicine price negotiation in Italy. In particular, the focus of the study was on the pricing of new medicinal products, or their new therapeutic indications, for which results from cost-effectiveness analyses were provided to inform price-making processes. In the literature, the role of cost-effectiveness in decision making has been studied, mainly in relation to reimbursement decisions rather than pricing, probably because of the lack of price transparency in the medicine market [22, 23]. For example, Devlin and Parkin, Dakin et al. and Cerri et al. found that cost-effectiveness was one of the key drivers of NICE decisions, together with other relevant factors [16, 17, 27]. In the Italian context, reimbursement and pricing decisions converge in one single decision by the same institution (i.e. AIFA), so that all medicines deemed worthy of reimbursement must undergo a price negotiation and, should it fail, the medicine is not reimbursed. Our study focused on factors influencing the pricing of reimbursed medicines resulting from the negotiation between AIFA and pharmaceutical companies, rather than on reimbursement decisions. The outcome of price negotiation (ΔP) was defined in terms of percentage difference between the list price requested by the company and the real final price paid by the INHS (i.e. after the reduction of any confidential discounts and the expected effect of MEAs), which is often confidential and not disclosed to the general public.

Overall, in our dataset of 48 P&R procedures, results showed the ICER before negotiation to be one of the variables with a major impact on ΔP and the only one with a statistically significant impact when its value was ≥ €40,000/QALY. In particular, as resulting from the multiple regression analysis, the effect of the ICER on ΔP was confirmed and driven mainly by an ICER ≥ €40,000/QALY, especially when it is related to non-onco-immunological medicines and medicines for non-rare diseases. Conversely, no statistically significant effect was found for the expected pharmaceutical expenditure, although a greater price reduction was negotiated for medicines with higher financial impact, consistent with the need for expenditure restraint and sustainability of the healthcare system. Furthermore, the impact of innovativeness status on ΔP was not statistically significant, although it seemed to be related to a higher price reduction compared with non-innovative medicines, as previously reported in another study conducted in the Italian context [11]. This result seemed somewhat unjustified, nor can it be explained by a higher treatment cost requested by pharmaceutical companies for innovative medicines compared with non-innovative ones (t-value = 1.4; p = 0.175).

In addition, the analyses performed in this study showed that many variables, generally informing the pricing process of medicines, were not statistically linked to the final outcome of the negotiation in Italy, one exception being the ICER. This result suggests the lack of a general framework for medicine pricing in the Italian context or, at least, the existence of an evolving price-making process, where criteria and values are still not established. This issue also emerged from a previous Italian study by Villa et al. [11], in which the regulatory variables selected for the regression analysis poorly explained the price variation obtained through negotiation. Some differences between the two studies on the role played by specific variables on ΔP (e.g. the effect of MEAs) could be explained by a diverse composition of the products’ mix included in the analyses and/or a changing approach to value judgement and pricing of medicines over time. Moreover, our results pertained specifically to medicines whose reimbursement submission included a cost-effectiveness analysis, which has only recently become mandatory in Italy for new medicines, orphan medicines and their following therapeutic indications [24]. Despite the national regulation on medicine pricing already including cost-effectiveness among criteria for price-making (CIPE Resolution No. 5 of 30 January 1997; CIPE Resolution No. 3 of 1 February 2001; Ministerial Decree 2 August 2019), it is only since March 2021, with the adoption of the new AIFA “Guidelines for the compilation of the pricing and reimbursement application” [24], that HEEs have been formally integrated in the decision-making processes. Leaving aside the issues related to the lack of an explicit threshold in Italy, it remains the fact that cost-effectiveness analyses have somewhat influenced, albeit informally and not systematically, the decisions of the AIFA Committee in charge of price negotiations. Our study showed that the aggregated ICER of medicines included in our dataset, recalculated using net confidential prices reached after negotiation, was on average just above €30,000/QALY. This value is roughly equal to the current Italian gross domestic product (GDP) per capita, suggesting a relationship between willingness to pay and ability to pay, as reported elsewhere [31]. In particular, the highest mean ICERs (i.e. ≥ 40,000€ per QALY) were observed for ATMPs and medicines for severe diseases, for which the willingness to pay is recognised to be higher in many other healthcare contexts [32]. Moreover, counterintuitively, higher ICERs were also observed for medicines reimbursed with an outcome-based MEA, for which it is actually expected that the existence of greater uncertainty around effectiveness is associated with lower willingness to pay. This result can be explained by the presence of a specific type of outcome-based MEAs in our study dataset, one that is more directed to deferring the payment of one-shot therapies over time, rather than managing uncertainty around clinical effectiveness (i.e. the first advanced therapies—Chimeric Antigen Receptor T-cell therapies—for the treatment of onco-haematological diseases).

The results of this study should be interpreted considering some potential limitations. Firstly, the relatively small sample size suggests that our results will need to be reassessed at a later stage on a larger dataset, since we could include only P&R dossiers with CEAs, whose submission by pharmaceutical companies has not been mandatory in Italy until March 2021. Second, our regression analysis included only variables considered relevant, selected from previous studies and available from the AIFA database, whereas P&R negotiation may depend on other determinants that could not be fully captured. Third, another limitation concerns a possible selection bias since the submission of the economic evaluations within P&R dossiers has been voluntary until recently and pharmaceutical companies could have omitted unfavourable CEAs, with the consequence that the mean ICER derived after negotiation could be underestimated. However, on the other hand, it is also possible that CEAs were not submitted to AIFA for medicines with an ICER obviously low compared with available alternatives. Therefore, the final effect of a possible selection bias is unpredictable. A further bias could be related to the inclusion criteria used to select the eligible CEAs (n = 48) from the total number of 116 dossiers collected. However, it can be excluded that such potential bias was influenced by any difference in the frequency of the types of P&R procedure, since no statistically significant difference between groups was found (Chi Square statistic 0.644; p-value 0.724).

5 Conclusions

This study represents the first attempt to understand whether economic evaluations, alongside other factors, influence the pricing of reimbursed medicines in Italy. Moreover, it provided an estimate of the mean incremental cost per QALY gained of medicines, calculated using net confidential prices actually reimbursed by the INHS. Despite the results of this study needing to be confirmed in a larger dataset, cost-effectiveness seems to be one of the determinants of price negotiation in the Italian context and we expect that its relevance could be even more enhanced in the next few years following the adoption of the AIFA guidelines on HEEs in 2021. Furthermore, this study is meant to encourage further effort towards a clearer definition of a value framework in pricing negotiations and increasing the impact of cost-effectiveness analyses to ensure the value for money of new medicines.

References

Panteli D, Arickx F, Cleemput I, et al. Pharmaceutical regulation in 15 European countries review. Health Syst Transit. 2016;18(5):1–122.

Paris V, Belloni A. Value in pharmaceutical pricing. In: OECD health working papers, No. 63. Paris: OECD Publishing. 2013. https://doi.org/10.1787/5k43jc9v6knx-en.

Wenzl M, Chapman S. Performance-based managed entry agreements for new medicines in OECD countries and EU member states: how they work and possible improvements going forward. In: OECD health working papers, No. 115. Paris: OECD Publishing. 2019. https://doi.org/10.1787/6e5e4c0f-en.

Richard GF, Len MN. Medicare drug-price negotiation—why now … and how. N Engl J Med. 2019;381:1404–6. https://doi.org/10.1056/NEJMp1909798.

Dusetzina SB. Your money or your life—the high cost of cancer drugs under Medicare Part D. N Engl J Med. 2022. https://doi.org/10.1056/NEJMp2202726.

Raimond VC, Feldman WB, Rome BN, Kesselheim AS. Why France spends less than the United States on drugs: a comparative study of drug pricing and pricing regulation. Milbank Q. 2021;99(1):240–72. https://doi.org/10.1111/1468-0009.12507.

Vokinger KN, Hwang TJ, Grischott T, et al. Prices and clinical benefit of cancer drugs in the USA and Europe: a cost-benefit analysis. Lancet Oncol. 2020;21(5):664–70. https://doi.org/10.1016/S1470-2045(20)30139-X.

Lauenroth VD, Kesselheim AS, Sarpatwari A, Stern AD. Lessons from the impact of price regulation on the pricing of anticancer drugs in Germany. Health Aff. 2020;39(7):1185–93.

Russo P, Marcellusi A, Zanuzzi M, et al. Drug prices and value of oncology drugs in Italy. Value Health 2021;24(9):1273–1278. https://doi.org/10.1016/j.jval.2021.04.1278.

Rodwin MA, Mancini J, Duran S, et al. The use of “added benefit” to determine the price of new anti-cancer drugs in France, 2004–2017. Eur J Cancer. 2021;145:11–8. https://doi.org/10.1016/j.ejca.2020.11.031.

Villa F, Tutone M, Altamura G, et al. Determinants of price negotiations for new drugs. The experience of the Italian Medicines Agency. Health Policy 2019;123(6):595–600.

Gandjour A, Schüßler S, Hammerschmidt T, et al. Predictors of negotiated prices for new drugs in Germany. Eur J Health Econ. 2020;21:1049–57. https://doi.org/10.1007/s10198-020-01201-z.

Korchagina D, Millier A, Vataire AL, et al. Determinants of orphan drugs prices in France: a regression analysis. Orphanet J Rare Dis. 2017;12(1):75. https://doi.org/10.1186/s13023-016-0561-5.

Jommi C, Listorti E, Villa F, et al. Variables affecting pricing of orphan drugs: the Italian case. Orphanet J Rare Dis. 2021;16(1):439. https://doi.org/10.1186/s13023-021-02022-w.

Worm F, Dintsios CM. Determinants of orphan drug prices in Germany. Pharmacoeconomics. 2020;38:397–411. https://doi.org/10.1007/s40273-019-00872-8.

Dakin HA, Devlin NJ, Odeyemi IA. “Yes”, “no” or “yes, but”? Multinomial modelling of NICE decision-making. Health Policy. 2006;77(3):352–67. https://doi.org/10.1016/j.healthpol.2005.08.008 (epub 2005 Oct 5).

Cerri KH, Knapp M, Fernández JL. Decision making by NICE: examining the influences of evidence, process and context. Health Econ Policy Law. 2014;9(2):119–41. https://doi.org/10.1017/S1744133113000030 (epub 2013 May 21).

Svensson M, Nilsson FOL, Arnberg K. Reimbursement decisions for pharmaceuticals in Sweden: the impact of disease severity and cost effectiveness. Pharmacoeconomics. 2015;33:1229–36. https://doi.org/10.1007/s40273-015-0307-6.

Bae EY, Kim HJ, Lee HJ, et al. Role of economic evidence in coverage decision-making in South Korea. PLoS ONE. 2018;13(10): e0206121.

Skedgel C, Wranik D, Hu M. The relative importance of clinical, economic, patient values and feasibility criteria in cancer drug reimbursement in Canada: a revealed preferences analysis of recommendations of the Pan-Canadian oncology drug review 2011–2017. Pharmacoeconomics. 2018;36:467–75. https://doi.org/10.1007/s40273-018-0610-0.

Harris AH, Hill SR, Chin G, et al. The role of value for money in public insurance coverage decisions for drugs in Australia: a retrospective analysis 1994–2004. Med Decis Mak. 2008;28:713–22.

Russo P, Carletto A, Németh G, Habl C. Medicine price transparency and confidential managed-entry agreements in Europe: findings from the EURIPID survey. Health Policy. 2021;125(9):1140–5.

Russo P. How reliable are ICER’s results published in current pharmacoeconomic literature? The controversial issue of price confidentiality. Glob Reg Health Technol Assess 2022;9:31–35. https://doi.org/10.33393/grhta.2022.2350.

Agenzia Italiana del Farmaco (AIFA). AIFA approves new guidelines for pricing and reimbursement of medicines (determina DG/1372/2020) https://www.aifa.gov.it/en/-/l-aifa-approva-le-nuove-linee-guida-per-la-contrattazione-dei-prezzi-e-rimborsi-dei-farmaci. Accessed 31 Oct 2021.

Carletto A, Zanuzzi M, Sammarco A, Russo P. Quality of health economic evaluations submitted to the Italian Medicines Agency: current state and future actions. Int J Technol Assess Health Care. 2020;36(6):560–8.

Paulden M. Calculating and interpreting ICERs and net benefit. Pharmacoeconomics. 2020;38:785–807. https://doi.org/10.1007/s40273-020-00914-6.

Devlin N, Parkin D. Does NICE have a cost-effectiveness threshold and what other factors influence its decisions? A binary choice analysis. Health Econ. 2004;13(5):437–52. https://doi.org/10.1002/hec.864.

World Health Organization. WHO methods and data sources for global burden of disease estimates 2000–2019. Geneva: WHO. 2020. https://cdn.who.int/media/docs/default-source/gho-documents/global-health-estimates/ghe2019_daly-methods.pdf?sfvrsn=31b25009_7.

Fattore, G. Proposta di linee guida per la valutazione economica degli interventi sanitari in Italia. Pharmacoeconomics 2009;11: 83–93. https://doi.org/10.1007/BF03320660.

Ferrari S, Cribari-Neto F. Beta regression for modelling rates and proportions. J Appl Stat. 2004;31(7):799–815. https://doi.org/10.1080/0266476042000214501.

Schwarzer R, Rochau U, Saverno K, et al. Systematic overview of cost-effectiveness thresholds in ten countries across four continents. J Comp Effect Res. 2015;4(5):485–504. https://doi.org/10.2217/cer.15.38.

Zhang K, Garau M. International cost-effectiveness thresholds and modifiers for HTA decision making. In: OHE consulting report, London: Office of Health Economics. https://www.ohe.org/publications/international-cost-effectiveness-thresholds-and-modifiers-hta-decision-making. 2020.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Financial interests

The authors declare they have no financial interests.

Potential non-financial interests

PR is head of the Health Economic Evaluation Unit at AIFA. MZ, AC, AS and FR are employees of the Health Economic Evaluation Unit at AIFA.

Disclaimer

This research did not receive any specific grant from funding agencies in the public, commercial, or not-for-profit sectors. The views expressed in this work are personal and may not be understood or quoted as being made on behalf of or reflecting the position of the Italian Medicines Agency or of one of their committees or working parties, as well as of the other institutions involved.

Data availability

The dataset generated during the current study is not publicly available since all content of the pricing and reimbursement dossiers submitted to AIFA by pharmaceutical companies is reserved, except those data publicly available from other sources; moreover, net medicine prices are also confidential as they are covered by non-disclosure agreements between AIFA and pharmaceutical companies. Further information about the data used in this study are available from the corresponding author on reasonable request.

Author contributions

All authors contributed to the study conception and design. Material preparation and data collection were performed by Matteo Zanuzzi, Annalisa Sammarco and Federica Romano. Statistical analyses were performed by Pierluigi Russo and Matteo Zanuzzi. The first draft of the manuscript was written by Pierluigi Russo and Angelica Carletto and all authors commented on previous versions of the manuscript. The supervision of the work was done by Andrea Manca. All authors read and approved the final manuscript. Confidential data considered in the analysis were managed by the co-authors employed at AIFA (PR, MZ, AC, AS, FR).

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License, which permits any non-commercial use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc/4.0/.

About this article

Cite this article

Russo, P., Zanuzzi, M., Carletto, A. et al. Role of Economic Evaluations on Pricing of Medicines Reimbursed by the Italian National Health Service. PharmacoEconomics 41, 107–117 (2023). https://doi.org/10.1007/s40273-022-01215-w

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40273-022-01215-w