Abstract

Studies have shown that users experience regret in online electronic auctions. Our study adds to the research on the antecedents of regret by examining the effects of the major types of auction design on users’ experience of regret. Towards this goal, we analyzed bidders’ experience of regret in English and Dutch auctions. Given that English and Dutch auctions are known to produce different types of bidding behavior and outcomes, we expect that the two types of auction design will also have a differential impact on experiencing regret. We report results from a lab experiment that was implemented as a self-developed mobile application for hotel room reservations. We examined the effects of the two open-bid auction types on the experience of regret, and found that users are more likely to experience regret in Dutch auctions. We point out the theoretical relevance and practical implications of our findings.

Similar content being viewed by others

Introduction

A Deluxe room in the Radisson Cable Beach & Gold Resort in Nassau, Bahamas is being auctioned online. Would it make a bidder regretful if she wins the room by bidding too much or loses it by not bidding enough? Would the answer depend on the extent to which competing bids are visible to the bidder?

The benefits offered by electronic markets, defined as independently owned, IT-enabled intermediaries that connect buying and selling organizations (Soh et al. 2006), are difficult to dismiss. Compared to offline markets, electronic marketplaces have increased social welfare with lower prices and greater product selection, and have also increased market efficiency and consumer surplus (Clemons et al. 2002; Dimoka et al. 2012; Soh et al. 2006). In light of the above, related research has focused on several key aspects of electronic markets, such as designing optimal market mechanisms and auctions, understanding buyer and seller behavior, and the economic modeling of online markets (Anandalingam et al. 2005). Despite these affordances and the fact that online marketplaces are known to close the information gaps between buyers and sellers (Lusch et al. 2010), several market anomalies (e.g., overbidding) have been observed in these environments (Feng et al. 2016). Among other things, such anomalies, like general bidding behavior, have commonly been attributed to the inherent emotions that are present in conditions of decision-making under uncertainty (Engelbrecht-Wiggans and Katok 2008; Smith and Dickhaut 2005). In particular, one type of emotion to which the electronic markets and auctions literature has devoted particular attention is that of regret.

Regret is defined as “a more or less painful cognitive and emotional state of feeling sorry for misfortunes, limitations, losses, transgressions, shortcomings, or mistakes. It is an experience of felt-reason or reasoned-emotion. The regretted matters may be sins of commission as well as sins of omission; they may range from the voluntary to the uncontrollable and accidental; they may be actually executed deeds or entirely mental ones committed by oneself or by another person or group; they may be moral or legal transgressions or morally and legally neutral” (Landman 1993: 36). Regret is a negative emotion, whereby people realize or imagine that their present situation would have been better, had they acted differently (Kaur et al. 2016).

Within the context of auctions, bidders may generally experience winner regret by believing they overpaid for a product in order to win an auction (Coricelli et al. 2005; Engelbrecht-Wiggans 1989; Engelbrecht-Wiggans and Katok 2008, 2009; Gretschko and Rajko 2014; Katuscak et al. 2015), and loser regret by bidding too low in an attempt to save money, thus losing the auction (Coricelli et al. 2005; Engelbrecht-Wiggans 1989; Engelbrecht-Wiggans and Katok 2007, 2008, 2009; Gretschko and Rajko 2014; Katuscak et al. 2015). The extant literature has shown that both the post-purchase experience of regret, as well as the mere anticipation of it prior to purchasing a product, can influence users’ bidding behavior and utility function (Hung et al. 2007; Jiang et al. 2016).

Despite these advances, we still know little about the antecedents of regret in online marketplaces. To this end, our study sets out to examine how certain structural characteristics of electronic market design, i.e., different types of auction design, influence the experience of regret. We examine this relationship in the context of online auctions by examining instances of regret in two different open-bid auction types (i.e. English and Dutch auctions). In addition to having a different procedure, a key difference between these two auction types concerns the amount of information observable during the bidding process: Bidders in Dutch auctions see no bids from other bidders except the final bid that ends an auction. In contrast, bidders in English auctions can see the bids from other bidders and consequently face less uncertainty in terms of assessing the competitive dynamics in an auction (Cheema et al. 2012). Our study examines the effects of different types of auction design on the experience of regret. Effectively, our research question is the following: Characterized by different levels of bid disclosure, how do English and Dutch auction designs compare with respect to bidder’s regret?

While bids disclosed in real-time influence bidding behavior (Arora et al. 2007; Brocas et al. 2015; Cason et al. 2011; Flanagin 2007; Gretschko and Rajko 2014; Gretschko and Wambach 2014; Kannan 2012; Miettinen 2013; Soh et al. 2006), their impact on regret in open-bid auctions has yet to be analyzed. Examining such behaviors in open-bid auctions is important in order to obtain a more holistic understanding of regret in online auctions. In an open ascending-bid auction, the last submitted bid (which is the highest bid compared to the previously submitted bids) wins the product. In an open descending-bid auction, an auction starts by having an initial high price set, which is then continuously lowered until one of the bidders accepts the current standing price (Adam et al. 2017). It remains unclear if, disclosed in real-time as in the open ascending-bid auction, competing bids cause winning bidders to experience regret. On the one hand, disclosed competing bids can be seen as a benchmark against which the winning bidders experience winner regret. If no competing bids are disclosed, then there is no benchmark, and the winning bidders may not experience regret. Thus, as claimed by Dodonova and Khoroshilov (2009), winning bidders should experience more regret in an open ascending-bid auction than in an open descending-bid auction. On the other hand, given the independent private values, if the competing bids are disclosed in real-time, as is the case with open ascending-bid auctions, the winning bidders can learn from such bids how to avoid regret. Therefore, the winning bidders should experience more regret in an open descending-bid auction, where there is no disclosed competing bid from which the winning bidders can learn how to avoid regret, than they should in an open ascending-bid auction. We examine which of these two competing claims prevails. We make an even more substantive contribution to this stream of literature by analyzing the regret experienced by losing bidders, alongside with the regret that winning bidders might experience.

In sum, bid disclosures are interesting because they are a systemic feature of online auctions and auction design. Assuming independent private values, we examine how different types of auction design, as characterized by the difference in bid disclosures between open ascending-bid and open descending-bid auctions, impacts regret. As we show in a subsequent section of this paper, we draw our hypotheses by combining insights from the literature on signaling theory (Drake et al. 2015; Pavlou et al. 2007; Spence 2002) and auction fever (Adam et al. 2011), and explain how the two types of auction design that we consider in our study influence the experiencing of regret. In sum, our study contributes to the understanding of regret experienced in online auctions by enquiring into the ways in which differences in bid disclosure between open ascending-bid and open descending-bid auctions impact bidders’ regret.

The remaining parts of the study are organized as follows: In the following section, we outline related studies on regret, uncertainty, and competitive dynamics in online auctions. In the third section, we develop our hypotheses. The subsequent sections describe our method, outline our results, discuss our contributions, present implications for research and practice, and state our study’s conclusions.

Related studies

Related studies on regret

The literature on user regret has shown negative implications of experiencing regret. The presence of regret is known to negatively influence user satisfaction, repurchase intention, and the continuance of using a particular service (Kaur et al. 2016). Even the anticipation of regret can influence user behavior: Users will adjust their choices in advance in order to mitigate or minimize the experience of regret, which consequently factors into users’ final purchasing decisions (Greenleaf 2004; Jiang et al. 2016). Similarly, studies have shown that incorporating regret in the utility function can explain some well-known behavioral anomalies, such as the Allais Paradox, the coexistence of insurance and gambling, the fact that people tend to be risk averse in the domain of gains and risk-loving in the domain of losses, probabilistic insurance, and preference reversals (see Engelbrecht-Wiggans and Katok 2008).

Within the context of auctions, the possibility for regret to impact price levels in online auctions has been frequently acknowledged in the literature (Engelbrecht-Wiggans 1989; Engelbrecht-Wiggans and Katok 2007, 2008, 2009; Kleinberg and Leighton 2003). Many researchers have tested the so-called “regret aversion” hypothesis, which states that bidders avoid anticipated winner regret by underbidding, and avoid anticipated loser regret by overbidding (Dodonova and Khoroshilov 2009; Engelbrecht-Wiggans and Katok 2007, 2008, 2009). The phenomenon was initially observed in first-price sealed-bid auctions (Filiz-Ozbay and Ozbay 2007; Engelbrecht-Wiggans and Katok 2007, 2008, 2009). However, recent replications refute the aversion hypothesis (Dodonova and Khoroshilov 2009; Katuscak et al. 2015). These replications suggest that the experimental method, which the earlier studies employed, did not properly operationalize the conditions of anticipated regret (for additional information, see Katuscak et al. 2015).

Finally, in addition to examining the effects of regret on user behavior or other outcomes (e.g. price levels, electronic market profitability), research has also examined some limited antecedents of regret. For instance, regret has been shown to depend on the specific information that is provided to the winners or losers of an auction (Engelbrecht-Wiggans 1989). Recently, regret has also been shown to depend on consumers’ uncertainty about either the product’s objective attributes (e.g., a product’s quality) or the consumer’s own preferences for a product’s known attributes (Jiang et al. 2016). Taking stock of these studies, our study seeks to better understand the antecedents of regret by enquiring into the effects of auction design associated with different degrees of bid disclosure on post-purchase regret.

Related studies on auction design, bidder behavior and bid disclosure

The literature on auction design has a long-standing tradition and a comprehensive review of this literature is outside the scope of this study.Footnote 1 Nonetheless, a number of studies have examined optimal auction design under different market conditions, including the number of participants (i.e. the number of buyers or sellers in an auction), the type of items being auctioned (divisible or discrete items), the number of items being auctioned (single or multiple items), and the extent to which products differ from each other (identical or discrete items). Similarly, other studies have examined how different components of auction design generate performance outcomes (e.g. buyer or seller surplus). Examples of such components include the mechanisms of winner determination, payment determination, the design of information flows, and the bidding language, i.e., the ways through which bidders can express or submit their preferences (Anandalingam et al. 2005).

The most common types of auction design include English (open ascending-bid) and Dutch (open descending-bid) auctions. While the two types of auction design have several structural differences, a key difference involves the extent to which competing bids are visible to auction participants (Cheema et al. 2012). The extent to which competing bids are disclosed or not is important, because bid disclosures can alter bidding behaviors (Arora et al. 2007; Brocas et al. 2015; Cason et al. 2011; Hong et al. 2015; Kannan 2012). Relative to sealed bids, disclosed bids are known to generate greater value (Hong et al. 2015). The attempts of bidders to competitively exploit an informational advantage, when bids are completely disclosed, can also lead to higher prices (Cason et al. 2011; Kannan 2012).

The above findings typically depend on whether a common value or independent private values of a product are assumed across bidders (Babaioff et al. 2015a, 2015b; Brocas et al. 2015; Greenwald et al. 2010; Goeree and Offerman 2003; Hong et al. 2015). Since high value uncertainty increases the cognitive workload associated with placing an optimal bid, variation of value uncertainty about a product’s ‘true’ value across bidders determines the extent to which bidders deviate from an optimal bid (Hariharan et al. 2016). “For the common value component, information from other bidders in open-bid auctions helps reduce valuation uncertainty,” where valuation refers to the bidder’s ability to value a particular good (Hong et al. 2015: 6). In contrast, if private values of an auctioned product are mutually independent across bidders, disclosed bids in open bid auctions do not inform a bidder on how to reduce his or her valuation uncertainty (McGee 2013). In this case, bid disclosure can then only reduce a bidder’s competition uncertainty, i.e., the uncertainty in terms of identifying the intensity of competition from other auction participants (Hong et al. 2015).

As concerns our objective of better explaining the antecedents of user regret, the amount of competition uncertainty triggered by the extent of bid disclosure is particularly interesting for the following reason: On the one hand, existing research has shown that the presence of uncertainty can trigger internal emotional processes and affect individual decision-making (Hariharan et al. 2016). On the other hand, competitive dynamics is also known to trigger and induce emotional processes. Specifically, under a state of bid disclosure that comes along with a heightened sense of competition, individuals are more likely to experience the effects of competitive arousal, which is an adrenaline-laden emotional state that causes market participants to shift from a motivation to acquire a product at a sensible price to a motivation to win an auction at any cost (Hariharan et al. 2016; Ku et al. 2005).

In addition to leading to overbidding (Ariely and Simonson 2003), a heightened state of rivalry is likely to induce the experience of greater pleasure from winning, simply because a bidder is able to beat more rivals (Feng et al. 2016). Taking the above insights into consideration, we believe that the extent to which bids are disclosed or not can be particularly interesting in terms of potentially explaining other emotional processes that might be present in electronic marketplaces, most notably instances of user regret. We explain how this might be the case in the next section, where we outline our theory and our hypotheses.

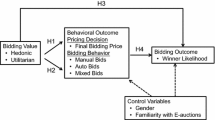

Theory and hypotheses

As mentioned in the introduction, we derive our hypotheses from signaling theory and the literature on auction fever, which draws heavily on competitive arousal theory. According to signaling theory, where information asymmetries exist, interacting parties send signals to one another to adjust their behaviors accordingly (Spence 2002). “Signals are particularly important in online auctions where information uncertainty exists in the product being sold, in the seller, and in the other bidders” (Drake et al. 2015, pg. 37). The ability of bidders to look for signals that may reduce their uncertainty of the other bidders is facilitated or constrained by different types of auction design, given that these disclose bids to different degrees. Signals may come from the rate of bidding, the current bid price, and the time left in the auction (Drake et al. 2015). Since these signals are visible in English auctions by way of the bids that are being disclosed, it is reasonable to expect that the uncertainty of assessing the number of competing bidders is lower in English auctions than it is in Dutch auctions. This holds especially because the private values of an auctioned room in our study are assumed to be independent across bidders, because the absence of a secondary market for auctioned rooms implies that no room reservation has a resale value.

At the same time, the inherent uncertainty in auctions is founded upon the premise that social interactions in these environments are more exciting than are social interactions in static marketplaces (Adam et al. 2011; Möllenberg 2004). Online auctions have a bazaar-like atmosphere that is considerably more exciting compared to purchasing products at a fixed price (Bapna et al. 2001). Under these conditions, bidders are also likely to experience the phenomenon of auction fever; where the “adrenaline starts to rush, their emotions block their ability to think clearly, and they end up bidding much more than they ever envisioned” (Murnighan 2002: 63). Moreover, the fundamental idea behind auction fever is that bidders may not be purely driven by maximizing net surplus, but might instead be motivated by other factors, such as the thrill of winning (Feng et al. 2016) and sense of competition and rivalry (Adam et al. 2011). According to competitive arousal theory, the desire to win arises from the characteristics of the competitive situation (Malhotra 2010).

Interestingly, due to their structural differences, English and Dutch auctions can invoke different types of emotions, depending on whether one wins or loses an auction (Adam et al. 2012, 2015). Specifically, bidders experience stronger immediate emotions when they lose a Dutch auction than when they win it. This is attributed to the “click-to-win” (“click-to-lose”) feature of Dutch auctions, where the bidder who wins is prepared and fully aware of winning the auction with certainty, while for the remaining bidders losing the auction comes as an unpleasant surprise. The exact opposite results can be found in English auctions, where bidders can decide to stop bidding and lose the auction with certainty (Adam et al. 2017). The experimental comparison of the bidders’ heart rates and bidding behavior has shown that an English auction, as a collection of stimuli, induces less emotional processing than the Dutch auction does (Smith and Dickhaut 2005): The ability of bidders to look for signals that inform their bidding behavior will induce less emotional bidding; they will be able to think more clearly, which should lead to less regret. Given that such signals are more prominent in English auctions as compared to Dutch auctions, we therefore hypothesize:

H1: Bidders in Dutch auctions are more likely to experience winner regret, compared to bidders in English auctions.

H2: Bidders in Dutch auctions are more likely to experience loser regret, compared to bidders in English auctions.

Research methodology

Participants and experimental design

Our inferences were tested experimentally on graduate student participants affiliated with a university in Europe. In order to achieve the statistical power of 0.8, the Wilcoxon test showed that at least 32 participants are required for each of the control and two treatment groups respectively.Footnote 2 Thus, our total sample size was 96. Our participants’ mean age was 22.4 (SD = 2.8). Thirty-seven were female (38.5%) and fifty-nine were male (61.5%). The participants took part in a one-shot auction scenario, which was scripted as a reservation for a single hotel room. The experiment was enabled through a self-developed mobile application. The interface designed for the mobile application resembled that of a leading online hotel reservation platform. Because there is no secondary market for such reservations, they do not have a resale value. Therefore, each participant’s respective value of the reservation is independent and private rather than common (Goeree and Offerman 2003; Fuchs et al. 2011). Our treatment was the type of auction design (fixed price baseline vs. English auction vs. Dutch auction). The participants were randomly assigned to one of the three treatment conditions, and their participation was incentivized accordingly. Finally, our dependent variables were winner and loser regret, established in a post-task survey of the participants.

Pretesting the scenarios

Initially, we devised three scenarios: One for the control group, and two for the two treatment groups, respectively. The average room price on booking.com was € 151/night (SD = 31). This price was chosen for our fixed price scenario. We also used a description for an actual room near that mean price for greater realism. These two considerations determined the scenario for the control group baseline.

Our rationale was for each of the two respective scenarios for the two treatment groups to consist of a specific auction design. We consulted three hotel owners to determine specific opening prices and bid increments and decrements for the two auction designs. In short, the open descending-bid auction started from the opening price of € 240 (60% higher than the control group’s price). The auction clock discretely decreased the price by € 10.3 until the first bid was submitted. This first bid settled the price, which immediately and suddenly determined the winner and losers. Furthermore, the open ascending-bid auction started from the opening price of € 60 (40% of the control group’s price). Each participant irregularly submitted his or her respective bid. Across bidders, each subsequently submitted bid was set to be € 10.3 higher than the highest previously submitted bid. The bidding continued until the auction clock ended it. The last bid settled the price, and determined the winner and losers.

Our pretest rationale was intended to assure that each scenario was easy to understand. Its purpose was also to make participants’ responses manageable. There were two auction sequences that we pretested for the two respective treatment groups. We pretested the two sequences three times. The pretests were conducted on two groups of 9 pretest participants, one for each of the two auction sequences. The first pretest showed an extensive frequency of missing data. Many of the pre-test participants did not understand the use of the auction clock. In response, we revised the instruction, by explaining the clock’s operation more simply. The second pretest showed that missing data did not disappear. Many of the pre-test participants reportedly could not provide timely responses to a sequence to which they were exposed. Thus, we shortened each sequence from five one-shot auctions to a single one-shot auction. The third pretest confirmed that the pretest participants’ responses were entered on a timely basis.

Variables

Dependent variables

Earlier studies defined regret as a function of the difference in payoff between the bidding decision taken ex-ante and the optimal decision taken ex-post after all information has been disclosed (Filiz-Ozbay and Ozbay 2007). Our regret measures were informed by these studies, as well as Engelbrecht-Wiggans (1989). However, rather than measuring regret in terms of actual bids as compared to prices (Filiz-Ozbay and Ozbay 2007; Katuscak et al. 2015), our study measured winner and loser regret by employing questionnaire items: Winner regret was measured by the extent of agreement to a claim that the participant regrets bidding too much, and could have gotten the room more cheaply. On a similar scale, loser regret was measured as a claim that the participant regrets bidding less than he or she was ready to bid, losing the room. These two five-point scales ranged from “Strongly disagree” to “Strongly agree” (please refer to theAppendix).

Treatment

Our treatment was the type of auction design. The baseline is the fixed price scenario (coded 0). The open ascending-bid auction scenario is coded 1; whereas the open descending-bid auction scenario is coded 2 (please refer to theAppendixfor the different scenarios).

Control variables

Following our earlier discussion, price can influence participants’ regret (Engelbrecht-Wiggans and Katok 2007, 2008, 2009). To control for this, we controlled the cumulative price effects of competition and valuation on our regret measures. For realism, rather than us calculating the difference between the final room reservation pricing and each participant’s estimate of private value for this reservation, we had participants themselves estimate this difference directly. By asking the participants if the winning bidder’s price for their intended room reservation was high or low, we made each participant respectively assess this difference. This control variable, referred to as the price level, was coded on a five-point scale, from “low” to “high” (please refer to theAppendix).

We provided all the rooms with an identical description (please refer to theAppendix): The rooms are perfect substitutes, and their descriptions were identical, eliminating any residual possibility for the observations of winner and loser regret to cluster across bidders.

Moreover, uncertainty aversion results in the behavior of humans, when exposed to uncertainty, to attempt to reduce that uncertainty (Kahneman and Tverksy 1984). Given the enjoyment that bidders may derive from the suspense, we adopted a measure of uncertainty aversion from Yoo et al. (2011). Participants were asked to state their agreement with: “Auctions are fun” on a five-point scale from “Strongly disagree” to “Strongly agree” (please refer to theAppendix). The measure was multiplied by −1 to obtain an indirect yet useful indicator of uncertainty aversion. By controlling for the price level and uncertainty aversion, we also indirectly controlled for the participant’s risk aversion (Hong et al. 2015).

Finally, we controlled for the participant’s age, gender, and experience with online auctions (Hong et al. 2015). We surveyed the participant’s experience in years (expyears). The participant’s experience with online auctions in years was coded on a five-point ordinal scale. The five-point scale ranged from: a) none, b) less than 1 year, c) more than 1 year but less than three years, d) more than 3 years but less than 5 years, to e) more than 5 years. In addition, we surveyed the frequency of the participant’s earlier experience with online auctions (exptimes). This experience variable was coded on a four-point ordinal scale, ranging from a) 0 times, b) from 1 to 5 times, c) from 6 to 10 times, to d) more than 10 times. These two variables were positively correlated (Spearman’s rho = 0.825), and we multiplied them to obtain the composite experience variable.

The procedure

Participants were assigned to booths in a computer laboratory. They were randomly assigned to control (the fixed price baseline; fixed price) and treatment (auction) groups, each consisting of 32 participants. The number of auctioned room reservations per group was equal to the number of participants in each group. The participants were presented with specific, on-screen instructions. Participants in the two treatment groups were exposed to either of the two auction designs, as characterized by open ascending-bid or open descending-bid auctions. Following the auctions, the participants were prompted to report their winner and loser regret. The responses were collected automatically and anonymity was guaranteed. To prevent arbitrary choices and ensure reliable data, we incentivized our participants: The participants were instructed to submit realistic bids that would reflect their behavior, as if they were bidding in reality for a room: Those who did so would receive compensation in the amount of € 30. Given that we were in a position to trace bids on a real-time basis, we informed participants that those who submitted unrealistic bids would not be compensated. This was a placebo since we controlled for the bid increment in the English auction, i.e., each subsequently submitted bid was set to be € 10.3 higher than the highest previously submitted bid, to ensure that they would not be able to submit an unrealistic bid such as ten times the amount of the highest previously submitted bid. We debriefed the participants about the placebo before giving them compensation for participating in the experiment. In the end, all 96 subjects received compensation for taking part in the study.

Results

Descriptive statistics

Table 1 illustrates the descriptive statistics of our control variables. A brief glance across the central tendencies and standard deviations suggests that for no control variable the control and two treatment groups differ significantly: In particular, the difference between the price levels across the three groups is statistically insignificant (Kruskal-Wallis test statistic = 1.7187, p value = 0.4234). Further, Table 2 displays the participants’ descriptive regret measures in the different scenarios.

Main analysis

Table 3 shows the estimated effects on the two regret measures. For comparability, the estimated parameters were standardized:

N = 96. Statistical significance at *: 95%, **: 99%, ***: 99.9%.

Top number is beta weight and bottom number in parentheses is standard error.

According to H1, taking part in Dutch auctions makes bidders more likely to experience winner regret than taking part in English auctions does. Shown in the second column of Table 3, the results support H1. Further, H2 posits that taking part in Dutch auctions makes bidders more likely to experience loser regret than taking part in English auctions does. In the Dutch auction, the estimate for loser regret strongly supported H2 (beta loser regret = 0.334, std. error = 0.488). Therefore, as shown in the third column, the results support H2.

Among the control variables: The participants’ perceived price level, estimated as their assessment of final pricing minus a respective participant’s private value, increases their winner regret experience. While experience with online auctions alleviates the participants’ experience of both regret types, age aggravates the participant’s experience of loser regret. The next section presents a detailed discussion of these findings.

Discussion

Research implications

First and foremost, our study contributes towards a better understanding of the antecedents of user regret. While numerous studies have examined the effects of regret on bidding behavior (Engelbrecht-Wiggans and Katok 2007, 2008, 2009), little remains known about the emotional state of regret. By building on studies such as those of Engelbrecht-Wiggans (1989) and Jiang et al. (2016), our study shows how different types of auction design induce the emotion of regret. To achieve this, we drew our insights from the literature on auction fever (Adam et al. 2011): We showed how, due to the disclosed competing bids, the emotions triggered by a heightened sense of rivalry can spillover towards inducing regret. We achieved this by examining instances of both winner and loser regret, and illustrated how different types of auction design are more likely to induce the actual experience of regret.

Additionally, our study makes an important contribution to the literature on auctions by showing how auction design can induce the experience of regret, by disclosing competing bids to variable degree. The prevailing logic suggests that a disclosed difference between the first and second highest bids causes winner regret (Dodonova and Khoroshilov 2009; Engelbrecht-Wiggans and Katok 2007, 2008, 2009; Filiz-Ozbay and Ozbay 2007; Katuscak et al. 2015). Following this logic, due to the missing disclosure of a second highest bid in the open descending-bid auction, there should be no winner regret in the open descending-bid auction (Dodonova and Khoroshilov 2009). Our finding contradicts this logic, and points to a contrary finding: A missing disclosure of a second highest bid in fact causes more winner regret than the open ascending-bid auction does.

A final important finding in our study includes the following: Since the open-bid auctions do not protect bidders from experiencing regret, they can individually protect themselves from experiencing regret only by underbidding or overbidding. Relative to the fixed price, the winners in the open ascending-bid auction learned from disclosed competing bids that the price they paid was higher than the second highest bid (Dodonova and Khoroshilov 2009). Hence, they experienced winner regret. However, relative to the fixed price, relying on the knowledge of disclosed competing bids, they did not experience loser regret more than they would have in the fixed price condition. Interestingly, as we hypothesized, the bidders in the open descending-bid auction experienced the highest winner and loser regret despite not knowing the second highest bid.

Implications for practitioners

Compared with traditional markets, electronic marketplaces and online auctions have several distinguishing features. These features include: 1) the removal of geographical barriers, which enables worldwide participation, 2) the enabling of asynchronous bidding, which makes online auctions more flexible and easier for people to participate, and 3) substantially lower operational costs. Therefore, online auctions can charge lower commission fees and attract more sellers and buyers (Ariely and Simonson 2003). The fact that bidders in online auctions do not physically cluster in the same geographical location also implies that these bidders have to rely on other value cues to guide their bidding behavior (Ariely and Simonson 2003). In online auctions, bidders might have a hard time in sensing the degree of competition for a particular product. Our study shows that certain types of auction design can mitigate this problem better than other types can.

Notwithstanding the unique features of online auctions mentioned earlier, participation in online markets has also been associated with several problems, including those of psychological distress (i.e., anxiety, aggression, anger and depression), habitual usage, as well as dependency and withdrawal symptoms (Park et al. 2016). Our study shows that the experience of post-purchase regret is another problem that can be added to this list. Most importantly, mitigating experiences of regret is especially important for marketplaces where user satisfaction, the repurchasing intention, and the intention to continue using a certain service is of particular importance (Kaur et al. 2016). In such cases where a key objective is the minimization of regret, sellers might want to consider adopting auction designs that minimize the possibility of experiencing regret, and as our study shows, English auctions would be a helpful choice.

Our study demonstrates that regret can be mitigated through auction or marketplace design. Benchmarked against fixed price as a baseline for certainty, our open ascending-bid auction was found to be associated with less winner regret than was our open descending-bid auction. Furthermore, against the same benchmark, our open ascending-bid auction was found to cause no loser regret at all (i.e., not significantly different from loser regret in the fixed price condition). For this reason, taking into account both regret mitigation and auction-based revenue generation parameters, designers of online marketplaces can consider employing open ascending-bid auctions rather than open descending-bid auctions. Finally, before settling exchange terms, by using open ascending-bid auctions, practitioners can deprive customers of some but not all information on competition, encouraging the most potent buyers to self-identify, thus limiting the levels of regret. As a final note, practitioners can encourage younger, but more experienced bidders to participate.

Limitations and research directions

Our study does not come without limitations. While the different types of auction design in our study disclose competing bids to a different degree, simultaneously disclosing bidding rivalry (Adam et al. 2011), the degree of bid disclosure is not the only distinguishing factor between English and Dutch auctions. Specifically, these two design types can also cause different bidding behavior and wait times (Cheema et al. 2012). Therefore, we have to remain cautious that our observed effects can be a byproduct of a number of design differences. As a final limitation, our study did not employ an auctioneer, as the allocation and payment rules were automated, given the particular auction type.

Several research extensions can be made to our study: First, researchers could test to see if bidders can avoid regret by bid rigging. One instance of bid rigging is collusive bidding, by which a coalition of bidders stifles competition. Another instance of bid rigging is chandelier bidding, by which an auctioneer’s false bids encourage competition. Moreover, future research should consider testing to see whether a seller proposing a purchase price could impact experiencing regret (on either a successful or failed purchase) (Cason and Friedman 1996). Researchers can also investigate seller regret on either a successful or failed sale. Simultaneously proposing purchase and sale prices, researchers can study even more complex exchange behaviors under competition, like speculation or market rigging. If the resulting market prices cannot clear the markets, as in bubbles or crises (Allen and Douglas 2000), this may set the stage for the study of even more complex instances of regret. Finally, our study only examined instances of post-purchase regret. A more holistic understanding of the ways in which different auction types cause regret, would also require testing its effects on anticipated regret.

In conclusion, our study relates the experience of regret to systemic auction design features. In doing so, our study contributes to the understanding of the antecedents of regret, as conditioned by the different design features of online auctions. Our study also provides specific ideas for additional research to better understand how both user and seller regret unfolds under different types of auction design.

Notes

For a detailed review, see Anandalingam et al. (2005).

We calculated the sample size and statistical power for a two-tailed sample comparison for ordinal outcomes under the proportional odds ordinal logistic model (Whitehead 1993). Our sample size and statistical power determination was calculated for cumulative odds ratio equal to 3.5, which follows from the combination of our dependent, treatment, and control variables, as well as the assumption that the control and treatment probabilities across ordinal responses follow a uniform prior.

References

Adam, M. T., Eidels, A., Lux, E., & Teubner, T. (2017). Bidding behavior in Dutch auctions: Insights from a structured literature review. International Journal of Electronic Commerce, 21(3), 363–397.

Adam, M. T., Krämer, J., Jähnig, C., Seifert, S., & Weinhardt, C. (2011). Understanding auction fever: A framework for emotional bidding. Electronic Markets, 21(3), 197–207.

Adam, M., Kramer, J., & Weinhardt, C. (2012). Excitement up! Price down! Measuring emotions in Dutch auctions. International Journal of Electronic Commerce, 17(2), 7–39.

Allen, F., & Douglas, G. D. (2000). Bubbles and crises. The Economic Journal, 110(460), 236–255.

Anandalingam, G., Day, R. W., & Raghavan, S. (2005). The landscape of electronic market design. Management Science, 51(3), 316–327.

Ariely, D., & Simonson, I. (2003). Buying, bidding, playing, or competing? Value assessment and decision dynamics in online auctions. Journal of Consumer Psychology, 13(1), 113–123.

Arora, A., Greenwald, A., Kannan, K., & Krishnan, R. (2007). Effects of information revelation policies under market structure uncertainty. Management Science, 53(8), 1234–1248.

Babaioff, M., Blumrosen, L., & Roth, A. (2015a). Auctions with online supply. Games and Economic Behavior, 90, 227–246.

Babaioff, M., Dughmi, S., Kleinberg, R., & Slivkins, A. (2015b). Dynamic pricing with limited supply. ACM Trans. Econ. Comput., 3(1), 4.

Bapna, R., Goes, P., & Gupta, A. (2001). Insights and analyses of online auctions. Communications of the ACM, 44(11), 42–50.

Brocas, I., Carrillo, J. D., & Castro, M. (2015). The nature of information and its effect on bidding behavior: Laboratory evidence in a first price common value auction. Journal of Economic Behavior and Organization, 109, 26–40.

Cason, T., Kannan, K., & Siebert, R. (2011). An experimental study of information revelation policies in sequential auctions. Management Science, 57(4), 667–688.

Cason, T. N., & Friedman, D. (1996). Price formation in double auction markets. Journal of Economic Dynamics and Control, 20(8), 1307–1337.

Cheema, A., Chakravarti, D., & Sinha, A. R. (2012). Bidding behavior in descending and ascending auctions. Marketing Science, 31(5), 779–800.

Clemons, E. K., Hann, I. H., & Hitt, L. M. (2002). Price dispersion and differentiation in online travel: An empirical investigation. Management Science, 48(4), 534–549.

Coricelli, G., Critchley, H. D., Joffily, M., O'Doherty, J. P., Sirigu, A., & Dolan, R. J. (2005). Regret and its avoidance: A neuroimaging study of choice behavior. Nature Neuroscience, 8, 1255–1262.

Dimoka, A., Hong, Y., & Pavlou, P. A. (2012). On product uncertainty in online markets: Theory and evidence. MIS Quarterly, 36(2), 395–426.

Dodonova, A., & Khoroshilov, Y. (2009). Behavioral biases in auctions: An experimental study. Economics Bulletin, 29(3), 2218–2226.

Drake, J. R., Hall, D. J., Cegielski, C., & Byrd, T. A. (2015). An exploratory look at early online auction decisions: Extending signal theory. Journal of Theoretical and Applied Electronic Commerce Research, 10(1), 35–48.

Engelbrecht-Wiggans, R. (1989). The effect of regret on optimal bidding in auctions. Management Science, 35(6), 685–692.

Engelbrecht-Wiggans, R., & Katok, E. (2007). Regret in auctions: Theory and evidence. Economic Theory: Symposium on Behavioral Game Theory, 33(1), 81–101.

Engelbrecht-Wiggans, R., & Katok, E. (2008). Regret and feedback information in first-Price sealed-bid auctions. Management Science, 54(4), 808–819.

Engelbrecht-Wiggans, R., & Katok, E. (2009). A direct test of risk aversion and regret in first Price sealed-bid auctions. Decision Analysis, 6(2), 75–86.

Feng, C., Fay, S., & Sivakumar, K. (2016). Overbidding in electronic auctions: Factors influencing the propensity to overbid and the magnitude of overbidding. Journal of the Academy of Marketing Science, 44(2), 241–260.

Filiz-Ozbay, E., & Ozbay, E. Y. (2007). Auctions with anticipated regret: Theory and experiment. The American Economic Review, 97(4), 1407–1418.

Flanagin, A. J. (2007). Commercial markets as communication markets: Uncertainty reduction through mediated information exchange in online auctions. New Media and Society, 9(3), 401–423.

Fuchs, M., Eybl, A., & Höpken, W. (2011). Successfully selling accommodation packages at online auctions - the case of eBay Austria. Tourism Management, 32, 1166–1175.

Goeree, J. K., & Offerman, T. (2003). Competitive bidding in auctions with private and common values. Economic Journal, 113(489), 598–613.

Greenleaf, E. A. (2004). Reserves, regret, and rejoicing in open English auctions. Journal of Consumer Research, 31(2), 264–273.

Greenwald, A., Kannan, K., & Krishnan, R. (2010). On evaluating information revelation policies in procurement auctions: A Markov decision process approach. Information Systems Research, 21(1), 15–36.

Gretschko, V., & Rajko, A. (2014). Excess information acquisition in auctions. Experimental Economics, 18(3), 335–355.

Gretschko, V., & Wambach, A. (2014). Information acquisition during a descending auction. Economic Theory, 55(3), 731–751.

Hariharan, A., Adam, M. T. P., Teubner, T., & Weinhardt, C. (2016). Think, feel, bid: The impact of environmental conditions on the role of bidders’ cognitive and affective processes in auction bidding. Electronic Markets, 26(4), 339–355.

Hong, Y., Wang, C., Pavlou, P. A. (2015) Comparing Open and Sealed Bid Auctions: Evidence from Online Labor Markets, Information Systems Research, Articles in Advance:1–21.

Hung, S. Y., Ku, Y. C., Liang, T. P., & Lee, C. J. (2007). Regret avoidance as a measure of DSS success: An exploratory study. Decision Support Systems, 42(4), 2093–2106.

Jiang, B., Narasimhan, C., & Turut, Ö. (2016). Anticipated regret and product innovation. Management Science, 63(12), 4308–4323.

Kahneman, D., & Tverksy, A. (1984). Choices, values, and frames. American Psychologist, 39, 341–350.

Kannan, K. N. (2012). Effects of information revelation policies under cost uncertainty. Information Systems Research, 23(1), 75–92.

Katuscak, P., Michelucci, F., & Zajicek, M. (2015). Does feedback really matter in one-shot first-price auctions? Journal of Economic Behavior and Organization, 119(3641), 139–152.

Kaur, P., Dhir, A., Chen, S., & Rajala, R. (2016). Understanding online regret experience using the theoretical lens of flow experience. Computers in Human Behavior, 57, 230–239.

Kleinberg, R., Leighton, T. (2003) The value of knowing a demand curve: Bounds on regret for online posted-price auctions, Proceedings - Annual IEEE Symposium on Foundations of Computer Science, FOCS 2003-January, 1238232:594–605.

Ku, G., Malhotra, D., & Murnighan, J. K. (2005). Towards a competitive arousal model of decision-making: A study of auction fever in live and internet auctions. Organizational Behavior and Human Decision Processes, 96(2), 89–103.

Landman, J. (1993). Regret: The persistence of the possible. Oxford University Press.

Lusch, R. F., Vargo, S. L., & Tanniru, M. (2010). Service, value networks and learning. Journal of the Academy of Marketing Science, 38(1), 19–31.

Malhotra, D. (2010). The desire to win: The effects of competitive arousal on motivation and behavior. Organizational Behavior and Human Decision Processes, 111(2), 139–146.

McGee, P. (2013). Bidding in private-value auctions with uncertain values. Games and Economic Behavior, 82, 312–326.

Miettinen, P. (2013). Information acquisition during a Dutch auction. Journal of Economic Theory, 148(3), 1213–1225.

Möllenberg, A. (2004). Internet auctions in marketing: The consumer perspective. Electronic Markets, 14(4), 360–371.

Murnighan, J. K. (2002). A very extreme case of the dollar auction. Journal of Management Education, 26(1), 56–69.

Park, S. C., Keil, M., Bock, G. W., & Kim, J. U. (2016). Winner's regret in online C2C auctions: An automatic thinking perspective. Information Systems Journal, 26(6), 613–640.

Pavlou, P. A., Liang, H., & Xue, Y. (2007). Understanding and mitigating uncertainty in online exchange relationships: A principal-agent perspective. MIS Quarterly, 31(1), 105–136.

Smith, K., & Dickhaut, J. (2005). Economics and emotion: Institutions matter. Games and Economic Behavior, 52(2), 316–335.

Soh, C., Markus, L. M., & Goh, K. G. (2006). Electronic marketplaces and Price transparency: Strategy, information technology, and success. MIS Quarterly, 30(3), 705–723.

Spence, M. (2002). Signaling in retrospect and the informational structure of markets. American Economic Review, 92(3), 434–459.

Whitehead, J. (1993). Sample size calculations for ordered categorical data. Statistics in Medicine., 12(24), 2257–2271.

Yoo, B., Donthu, N., & Lenartowicz, T. (2011). Measuring Hofstede’s five dimensions of cultural values at the individual level: Development and validation of CVSCALE. Journal of International Consumer Marketing, 23(3–4), 193–210.

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible Editor: Steven Bellman

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

The wording of the measures/instruments.

-

1. The room description:

The simple, stylish single hotel rooms at Brook Green have air conditioning and tea and coffee facilities. All rooms feature a flat-screen TV, suit press, and a private modern bathroom with a hairdryer. Guests can enjoy a full English breakfast each morning, and hearty evening meals are also available. The cozy pub also features real open fires, leather sofas, and a pretty terrace. Less than half a mile from Hammersmith Underground Station, The Brook Green hotel is 1.5 miles from Earls Court Exhibition Centre. Hammersmith Apollo is only half a mile away.

2. Dependent variables:

Winner regret:

“I regret bidding too much, and could have gotten the room cheaper.”

1. Strongly Disagree, 2. Disagree, 3. Neither Disagree nor Agree, 4. Agree 5. Strongly Agree.

Loser regret:

“I regret bidding less than what I was ready to bid, losing the room”

1.Strongly Disagree, 2. Disagree, 3. Neither Disagree nor Agree, 4. Agree 5. Strongly Agree.

3. Treatment:

Description of instruction for the fixed price scenario:

Your age in years: ____.

-

7. Gender:

Your gender:

a) male, b) female.

-

8. Experience in years: Below you see a list of hotel rooms. The booking price is fixed. If any given room has not been booked, then that room is available. If you wish to book an available room, then press “Book.” Please book only one room. Booking is done on the first come, first serve basis.

Description of the instruction for the open ascending-bid auction scenario:

Below you see a list of hotel rooms. The current bid price is updating dynamically to reflect the currently highest bid for any given room. If you wish to bid for a room, enter the currently displayed amount increased by € 10.3 in the text box and press “Submit bid.” Please submit only one bid across all of the listed rooms. When the time at the top is up, the person having bid the most for a given room wins this room.

Description of the instruction for the open descending-bid auction scenario:

Below you see a list of hotel rooms. The current bid price is updating dynamically to reflect the currently lowest bid for any given room. If you wish to bid for a given room, when the proposed price reaches a price you find acceptable, press “Accept bid.” Please submit only one bid across all of the listed rooms. The first person to have accepted the bid for a given room wins this room.

-

4. Price level:

“The price of the room for which I competed was”.

1. Low, 2. Moderately Low, 3. Neither Low nor High, 4. Moderately High, 5. High.

-

5. Participant’s uncertainty aversion:

“Auctions are fun.”

1.Strongly Disagree, 2. Disagree, 3. Neither Agree nor Disagree, 4. Agree 5. Strongly Agree.

-

6. Age:

How many years of experience do you have with online auctions?

-

a)

none,

-

b)

less than 1 year,

-

c)

more than 1 year but less than 3 years,

-

d)

more than 3 years but less than 5 years,

-

e)

more than 5 years.

-

9. Frequency of experience.

How many times have you participated in online auctions?

-

a)

not at all,

-

b)

from 1 to 5 times,

-

c)

from 6 to 10 times,

-

d)

more than 10 times.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Malekovic, N., Goutas, L., Sutanto, J. et al. Regret under different auction designs: the case of English and Dutch auctions. Electron Markets 30, 151–161 (2020). https://doi.org/10.1007/s12525-019-00355-w

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12525-019-00355-w

Keywords

- Regret

- Online auctions

- Open ascending-bid auction

- Open descending-bid auction

- English auction

- Dutch auction