Abstract

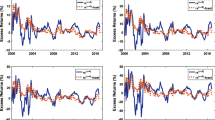

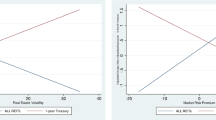

Using a rich data set for the UK for over a century, we find that the relation between the equity risk premium and the government bond maturity premium is nonlinear and subject to stochastic regime switching. We identify a regime in which both premia are jointly characterized by low volatility and another regime in which both premia are characterized by high volatility. The occurrence of the high volatility regime chronologically coincides with major changes in the pound exchange rate. The low volatility regime has a higher probability of turning up over two consecutive years than the high volatility regime, but it is not perceived by investors to be an absorbing regime. The lagged maturity premium is a strong predictor of the equity risk premium only in the regime of low volatility. In addition, the lagged equity premium is a predictor of the maturity premium also in the low volatility regime. This result on regime-dependent bidirectional predictability is robust to alternative definitions of the equity premium, and to the inclusion of real interest rate and real growth effects.

Similar content being viewed by others

Notes

Strictly speaking, long term government bonds are risk free only in the sense that they normally offer a fixed income and the likelihood of default is very small. In all other respects, they are riskier than bills.

The data source for the real interest rate and the real growth rate is the Global Financial Data provider.

A VAR with 0 lags was estimated but there was evidence of serial correlation. We have also estimated a second order VAR, but the second order lags were not statistically significant.

Using the usual LR test is problematic because the LR test does not have the standard asymptotic distribution. The problem comes from the fact that under the null hypothesis, some parameters are not identified and the scores are identically zero. To overcome this problem, we employ the non-standard LR bound test proposed by Davies (1987).

Exactly the same results hold for the alternative definition of the equity premium in terms of bonds.

For an extensive analysis of the stock-bond correlations, see Addona and Kind (2006).

These authors found that recessions lead to increases in stock market volatility.

In Tables 5 and 6, the equity risk premium is defined in terms of the Treasury bill yield. Using the alternative definition of the equity premium in terms of the long-term bond yield does not change qualitatively the results. The results are not reported to save space, but are available upon request.

References

Addona S, Kind AH (2006) International stock-bond correlations in a simple affine asset pricing model. J Bank Financ 30:2747–2765

Barberis N (2000) Investing for the long run when returns are predictable. J Finance 55:225–264

Baur D, Lucey BM (2006) Flight-to-quality or contagion? An empirical analysis of stock-bond correlations, Working Paper, Trinity College Dublin, October

Black A, Fraser P (1995) UK stock returns: predictability and business conditions. Manch Sch Suppl 63:85–102

Boudoukh J, Richardson M, Whitelaw RF (1997) Nonlinearities in the relation between the equity risk premium and the term structure. Manage Sci 43(3):371–385

Brandt M (1999) Estimating portfolio and consumption choice: a conditional Euler equations approach. J Finance 54:655–671

Campbell JY (1987) Stock returns and the term structure. J Financ Econ 18:373–389

Campbell JY, Ammer J (1993) What moves the stock and bond markets? A variance decomposition for long-term asset returns. J Finance 48:3–37

Campbell JY, Hamao Y (1989) Predictable stock returns in the United States and Japan: a study of long-term capital market integration. LSE Financial Markets Discussion Paper

Campbell JY, Viceira L (1999) Consumption and portfolio decisions when expected returns are time varying. Q J Econ 114:433–495

Chen N (1991) Financial investment opportunities and the macroeconomy. J Finance 46:529–554

Chen S-S (2007) Does monetary policy have asymmetric effects on stock returns? J Money Credit Bank 39:667–688

Clare A, Thomas S, Wickens M (1994) Is the gilt-equity yield ratio useful for predicting UK stock returns? Econ J 104:303–315

Davies RB (1987) Hypothesis testing when the nuisance parameter is present only under the alternative. Biometrika 74:33–43

Dimson E, Marsh P (2001) UK financial market returns. J Bus 74(1):1–13

Dimson E, Marsh P, Staunton M (2000) Risk and return in the 20th and 21st centuries. Bus Strateg Rev 11(2):1–18

Dimson E, Marsh P, Staunton M (2002) Triumph of the optimists: 101 years of global investment returns. Princeton University Press, Princeton

Dimson E, Marsh P, Staunton M (2003) Global investment returns yearbook, 2003. ABN-AMRO, Amsterdam

Dimson E, Marsh P, Staunton M (2007) The worldwide equity premium: a smaller puzzle. In: Mehra R (ed) Handbook of investments: equity risk premium. North Holland, Amsterdam

Estrella A, Hardouvelis G (1991) The term structure as predictor of real economic activity. J Finance 46:555–576

Fama EF, French KR (1988) Dividend yields and expected stock returns. J Financ Econ 22:3–25

Fama EF, French KR (1989) Business conditions and expected returns on bonds and stocks. J Financ Econ 25:23–49

Fama EF, French KR (1993) Common risk factors in the returns on stocks and bonds. J Financ Econ 33:3–56

Fama EF, Schwert GW (1977) Asset returns and inflation. J Financ Econ 5:115–146

Fitzgerald A (1992) The equity risk premium puzzle. Briefing paper 24, Nat West Securities

Fraser P (1995) UK stock and government bond returns: predictability and the term structure. Appl Financ Econ 5:61–67

Guidolin M, Timmermann A (2005) Economic implications of bull and bear regimes in UK stock and bond returns. Econ J 115:111–143

Hamilton JD (1989) A new approach to the economic analysis of nonstationary time series and the business cycle. Econometrica 57:357–384

Hamilton JD, Lin G (1996) Stock market volatility and the business cycle. J Appl Econ 11:573–593

Harvey C (1988) The real term structure and consumption growth. J Financ Econ 22:305–333

Kandel S, Stambaugh R (1996) On the predictability of stock returns: an asset allocation perspective. J Finance 51:385–424

Krolzig H-M (1997) Markov-switching vector autoregressions. Springer, Berlin

Lekkos I, Milas C (2004) Time-varying excess returns on UK government bonds: a non-linear approach. J Bank Financ 28:45–62

Ludvigson S, Ng S (2006) Macro factors in bond risk premia. Working Paper, Department of Economics, New York University

O’Hanlon J, Steele A (2000) Estimating the equity risk premium using accounting fundamentals. J Bus Finance Account 27(9–10):1051–1083

Pesaran M, Timmermann A (2000) A recursive modeling approach to predicting stock returns. Econ J 110:159–191

Shah M, Wadhwani S (1990) The effect of the term spread, dividend yield and real activity on stock returns: evidence from 15 countries. LSE Financial Markets Group Discussion Paper, No 98

Timmermann A (2000) Moments of Markov-switching models. J Econ 96:75–111

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Kanas, A. The relation between the equity risk premium and the bond maturity premium in the UK: 1900–2006. J Econ Finance 33, 111–127 (2009). https://doi.org/10.1007/s12197-008-9038-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12197-008-9038-2