Abstract

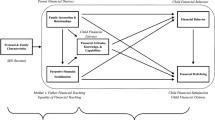

The financial behaviors of adolescents, especially those from economically disadvantaged families, is critical and has long-term effects. This study tested and compared two conceptual models that connect a family’s material hardship to adolescents’ financial behaviors by using a convenience sample of adolescents in Hong Kong. The main purpose of this study was to offer effective entry points for parents and family practitioners to implement interventions for improving the financial behaviors of adolescents, particularly those from economically disadvantaged families. The model of financial socialization demonstrates that material hardship was associated with financial behaviors through financial self-beliefs, direct parental instruction, and the adoption of parental financial role models. The model of general poverty links material hardship to financial behaviors through parental investment, parental stress, financial literacy, and financial self-beliefs. Of the two models, the model of parental financial socialization offers more effective entry points for family practitioners to implement interventions.

Similar content being viewed by others

References

Amin, S., Rahman, L., Ainul, S., Rob, U., Zaman, B., & Akter, R. (2010). Enhancing adolescent financial capabilities through financial education in Bangladesh. New York City: Population Council.

Asaad, C. T. (2015). Financial literacy and financial behaviors: assessing knowledge and confidence. Financial Services Review, 24(2), 101–117.

Ashby, J. S., Schoon, I., & Webley, P. (2011). Save now, save later? European Psychologist, 16(3), 227–237.

Bandura, A. (1982). Self-efficacy mechanism in human agency. American Psychologist, 37(2), 122–147.

Bruhn, M., de Souza Leao, L., Legovini, A., Marchetti, R., & Zia, B. (2013). The impact of high school financial education: Experimental evidence from brazil. (Working paper No. 6723). Washington, D.C.: World Bank Policy Research.

Cassells, R. C., & Evans, G. W. (2017). Ethnic variation in poverty and parenting stress. In K. Deater-Deckard & R. Panneton (Eds.), Parental stress and early child development (pp. 15–45). New York City: Springer International Publishing.

Census and Statistics Department. (2016). Hong Kong annual digest of statistics. Hong Kong: Hong Kong Government Printer.

Chao, R., & Sue, S. (1996). Chinese parental influence and their children’s school success: A paradox in the literature on parenting styles. In S. Lau (Ed.), Growing up the Chinese way: Chinese child and adolescent development (pp. 93–120). Hong Kong: The Chinese University of Hong Kong Press.

Chavda, H., Haley, M., & Dunn, C. (2005). Adolescents’ influence on family decision-making. Young Consumers, 6(3), 68–78.

Chen-Yu, J. H., Hong, K., & Seock, Y. (2010). Adolescents' clothing motives and store selection criteria: a comparison between South Korea and the United States. Journal of Fashion Marketing and Management: An International Journal, 14(1), 127–144.

Clarke, M. C., Heaton, M. B., Israelsen, C. L., & Eggett, D. L. (2005). The acquisition of family financial roles and responsibilities. Family and Consumer Sciences Research Journal, 33(4), 321–340.

Coddington, C. H., Mistry, R. S., & Bailey, A. L. (2014). Socioeconomic status and receptive vocabulary development: replication of the parental investment model with Chilean preschoolers and their families. Early Childhood Research Quarterly, 29(4), 538–549.

Collins, C. (2006). Status of US brands slips globally among teens. Retrieved from www.csmonitor.com/2006/0216/p13s01-usec.html

de Bassa Scheresberg, C. (2013). Financial literacy and financial behaviors among young adults: evidence and implications. Numeracy, 6(2), 5.

Drever, A. I., Odders-White, E., Kalish, C. W., Else-Quest, N. M., Hoagland, E. M., & Nelms, E. N. (2015). Foundations of financial well-being: Insights into the role of executive function, financial socialization, and experience-based learning in childhood and youth. Journal of Consumer Affairs, 49(1), 13–38.

Earls, F. J., Brooks-Gunn, J., Raudenbush, S. W., & Sampson, R. J. (2005). Project on human development in Chicago neighborhoods (PHDCN): Home observation for measurement of the environment, wave 1, 1994–1997. Ann Arbor: Inter-university Consortium for Political and Social Research.

Forrest, R., La Grange, A., & Yip, N. (2004). Hong Kong as a global city? Social distance and spatial differentiation. Urban Studies, 41(1), 207–227.

Friedline, T. L., Elliott, W., & Nam, I. (2011). Predicting savings from adolescence to young adulthood: a propensity score approach. Journal of the Society for Social Work and Research, 2(1), 1–21.

Furnham, A., & Thomas, P. (1984). Pocket money: a study of economic education. British Journal of Developmental Psychology, 2(3), 205–212.

Gershoff, E. T., Aber, J. L., Raver, C. C., & Lennon, M. C. (2007). Income is not enough: Incorporating material hardship into models of income associations with parenting and child development. Child Development, 78(1), 70–95.

Haskett, M. E., Ahern, L. S., Ward, C. S., & Allaire, J. C. (2006). Factor structure and validity of the parenting stress index-short form. Journal of Clinical Child and Adolescent Psychology, 35(2), 302–312.

HKICPA. (2005). Hong Kong teens predict prosperous future for Hong Kong. Retrieved from http://app1.hkicpa.org.hk/corporate_relations/media/pressrelease/2005/050622e.pdf

Hu, L., & Bentler, P. M. (1998). Fit indices in covariance structure modeling: sensitivity to underparameterized model misspecification. Psychological Methods, 3(4), 424–453.

Huang, C. Y., Costeines, J., Kaufman, J. S., & Ayala, C. (2014). Parenting stress, social support, and depression for ethnic minority adolescent mothers: impact on child development. Journal of Child and Family Studies, 23(2), 255–262.

Investor Education Center. (2015). A review of financial education initiatives in Hong Kong. Hong Kong: Investment Education Center.

Jorgensen, B. L., & Savla, J. (2010). Financial literacy of young adults: the importance of parental socialization. Family Relations, 59(4), 465–478.

Karlan, D., Ratan, A. L., & Zinman, J. (2014). Savings by and for the poor: a research review and agenda. Review of Income and Wealth, 60(1), 36–78.

Kaur, A., & Medury, Y. (2011). Impact of the internet on teenagers' influence on family purchases. Young Consumers, 12(1), 27–38.

Kempson, E., Finney, A., & Poppe, C. (2017). Financial well-being: A conceptual model and preliminary analysis (Final edition). Oslo: Consumption Research Norway - SIFO.

Kim, J., & Chatterjee, S. (2013). Childhood financial socialization and young adults' financial management. Journal of Financial Counseling and Planning, 24(1), 61–79.

Kim, J., LaTaillade, J., & Kim, H. (2011). Family processes and adolescents’ financial behaviorss. Journal of Family and Economic Issues, 32(4), 668–679.

Mandell, L. (2008). Financial literacy of high school students. In J. J. Xiao (Ed.), Handbook of consumer finance research (pp. 163–183). New York: Springer.

McCoy, D. C., Zuilkowski, S. S., & Fink, G. (2015). Poverty, physical stature, and cognitive skills: Mechanisms underlying children’s school enrollment in Zambia. Developmental Psychology, 51(5), 600–614.

McLoyd, V., Mistry, R. S., & Hardaway, C. R. (2014). Poverty and children's development. In E. T. Gershoff, R. S. Mistry, & D. A. Grosby (Eds.), Societal contexts of child development: Pathways of influence and implications for practice and policy (pp. 109–124). New York: Oxford University Press.

Moschis, G. P. (1987). Consumer socialization: A life-cycle perspective. MA: Lexington Books.

Neckerman, K. M., Garfinkel, I., Teitler, J. O., Waldfogel, J., & Wimer, C. (2016). Beyond income poverty: measuring disadvantage in terms of material hardship and health. Academic Pediatrics, 16(3), S52–S59.

OECD. (2005). Improving financial literacy: Analysis of issues and policies. Paris: OECD.

Otto, A. (2013). Saving in childhood and adolescence: Insights from developmental psychology. Economics of Education Review, 33, 8–18.

Perry, V. G., & Morris, M. D. (2005). Who is in control? The role of self-perception, knowledge, and income in explaining consumer financial behaviors. Journal of Consumer Affairs, 39(2), 299–313.

Serido, J., Shim, S., Mishra, A., & Tang, C. (2010). Financial parenting, financial coping behaviors, and well-being of emerging adults. Family Relations, 59(4), 453–464.

Serido, J., Shim, S., & Tang, C. (2013). A developmental model of financial capability A framework for promoting a successful transition to adulthood. International Journal of Behavioral Development, 37(4), 287–297.

Shih, T., & Ke, S. (2014). Determinates of financial behaviors: insights into consumer money attitudes and financial literacy. Service Business, 8(2), 217–238.

Shim, S., Xiao, J. J., Barber, B. L., & Lyons, A. C. (2009). Pathways to life success: a conceptual model of financial well-being for young adults. Journal of Applied Developmental Psychology, 30(6), 708–723.

Shim, S., Barber, B. L., Card, N. A., Xiao, J. J., & Serido, J. (2010). Financial socialization of first-year college students: the roles of parents, work, and education. Journal of Youth and Adolescence, 39(12), 1457–1470.

Shim, S., Serido, J., & Barber, B. L. (2011). A consumer way of thinking: linking consumer socialization and consumption motivation perspectives to adolescent development. Journal of Research on Adolescence, 21(1), 290–299.

Shim, S., Serido, J., Tang, C., & Card, N. (2015). Socialization processes and pathways to healthy financial development for emerging young adults. Journal of Applied Developmental Psychology, 38, 29–38.

Simons, L. G., Wickrama, K., Lee, T., Landers-Potts, M., Cutrona, C., & Conger, R. D. (2016). Testing family stress and family investment explanations for conduct problems among African American adolescents. Journal of Marriage and Family, 78(2), 498–515.

Sonuga-Barke, E. J., & Webley, P. (1993). Children's saving: A study in the development of economic behavior. Hove: Psychology Press.

Surachman, A. (2015). Parental investment and poverty dynamics in west java, Indonesia. Journal of Family and Economic Issues, 36(3), 340–352.

Vasilyeva, M., Dearing, E., Ivanova, A., Shen, C., & Kardanova, E. (2018). Testing the family investment model in Russia: estimating indirect effects of SES and parental beliefs on the literacy skills of first-graders. Early Childhood Research Quarterly, 42, 11–20.

Walstad, W. B., & Rebeck, K. (2005). Financial fitness for life–high school test examiner's manual. New York: National Council on Economic Education.

Wong, H., Saunders, P., Wong, W. P., Chan, W. Y., & Chua, H. W. (2012). Research study on the deprivation and social exclusion in Hong Kong. (Final report). Hong Kong: Hong Kong Council of Social Service.

Xiao, J. J., Tang, C., & Shim, S. (2009). Acting for happiness: financial behaviors and life satisfaction of college students. Social Indicators Research, 92(1), 53–68.

Xiao, J. J., Tang, C., Serido, J., & Shim, S. (2011). Antecedents and consequences of risky credit behavior among college students: application and extension of the theory of planned behavior. Journal of Public Policy & Marketing, 30(2), 239–245.

Yau, C., & Zhou, V. (2017). What hope for the poorest? Hong Kong wealth gap hits record high. . Retrieved from http://www.scmp.com/news/hong-kong/economy/article/2097715/what-hope-poorest-hong-kong-wealth-gap-hits-record-high

Yeung, W. J., Linver, M. R., & Brooks-Gunn, J. (2002). How money matters for young children's development: Parental investment and family processes. Child Development, 73(6), 1861–1879.

Yoh, T., Mohr, M. & Gordon, B. (2006). The effect of gender on Korean teens’ athletic footwear purchasing. Retrieved from http://thesportjournal.org/article/the-effect-of-gender-on-korean-teens-athletic-footwear-purchasing-2/. Accessed 20 Dec 2017.

Yu, C. (2002). Evaluating cutoff criteria of model fit indices for latent variable models with binary and continuous outcomes. (Doctoral dissertation). Los Angeles: University of California.

Acknowledgements

I would like to thank all adolescent participants and their affiliated schools, for their cooperation and contribution.

Funding

This study was funded by grants from the Research Grant Council Strategic Public Policy Research (HKIEd 7001-SPPR-11).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of Interest

The authors declare no potential conflicts of interest with respect to the research, authorship, and/or publication of this article.

Informed Consent

Informed consent was obtained from all individual participants included in the study.

Rights and permissions

About this article

Cite this article

Zhu, A.Y.F. Links Between Family Poverty and the Financial Behaviors of Adolescents: Parental Roles. Child Ind Res 12, 1259–1273 (2019). https://doi.org/10.1007/s12187-018-9588-6

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12187-018-9588-6