Abstract

Grain was the most important food source in early modern Europe (c. 1500–1800), and its price influenced the entire economy. The extent to which climate variability determined grain price variations remains contested, and claims of solar cycle influences on prices are disputed. We thoroughly reassess these questions, within a framework of comprehensive statistical analysis, by employing an unprecedentedly large grain price data set together with state-of-the-art palaeoclimate reconstructions and long meteorological series. A highly significant negative grain price–temperature relationship (i.e. colder = high prices and vice versa) is found across Europe. This association increases at larger spatial and temporal scales and reaches a correlation of \(-\,0.41\) considering the European grain price average and previous year June–August temperatures at annual resolution, and of \(-\,0.63\) at decadal timescales. This strong relationship is of episodic rather than periodic (cyclic) nature. Only weak and spatially inconsistent signals of hydroclimate (precipitation and drought), and no meaningful association with solar variations, are detected in the grain prices. The significant and persistent temperature effects on grain prices imply that this now rapidly changing climate element has been a more important factor in European economic history, even in southern Europe, than commonly acknowledged.

Similar content being viewed by others

1 Introduction

The importance of grain in early modern (c. 1500–1800) Europe can hardly be overstated as grain-based food, in most regions, represented 70–80% of the caloric intake for a majority of the population. Such a large proportion of workers’ income was spent on grain-based food that grain prices, to a large extent, determined the real wage levels and affected general consumer patterns (e.g. Hoskins 1964, 1968; Appleby 1979; Van Zanden 1999; Allen 2000; Campbell 2010). The entire economy was highly grain dependent, with taxes and land rents largely obtained from the surplus of grain agriculture (Le Roy Ladurie and Goy 1982; Leijonhufvud 2001; Edvinsson 2009). This predominant role of cereals in the economy made grain trade one of the most important and well-monitored fields of commerce (Rahlf 1996; Persson 1999; Federico 2011; Bateman 2011; Chilosi et al. 2013). An inadequate supply of grain, triggering high prices, frequently caused economic destitution, civil unrest, malnutrition, and even famines (e.g. Abel 1974; Pfister 1988; Mauelshagen 2010; Alfani and Ó Gráda 2017).

The causes of variations in grain yields and prices in early modern (c. 1500–1800) Europe are a research topic first initiated over two centuries ago (e.g. Herschel 1801). Determining the extent to which grain prices were affected by climate variabilityFootnote 1, or mediated through climate-influencing factors such as solar variability, and whether such relationships were episodic or periodic (cyclic)Footnote 2, are long-standing research problems approached from both (economic) history and the environmental sciences. This research has employed data of various quantities and qualities and has been conducted at different levels of statistical rigour. Here, we revisit the question of direct influences of climate variability, and indirect influences of solar variability, on grain prices in early modern Europe within a framework of comprehensive and internally consistent statistical analysis.Footnote 3 To achieve these goals, we employ the so far largest collection of grain price series of multi-centennial length from across Europe, early instrumental climate series, state-of-the-art palaeoclimate reconstructions, and the latest generation of solar variability estimates. We first provide an overview of previous work on the influence of climate (Sect. 2.1) and solar variability (Sect. 2.2) on grain prices in early modern Europe, then identify research gaps (Sect. 2.3), present the data and methods (Sect. 3), and results of our analyses (Sect. 4), and finally discuss various implications and associated uncertainties (Sect. 5).

2 State of the art

2.1 Climate variability and grain prices in early modern Europe

The influence of long-term climate variability on early modern grain yields and prices, and more generally on the economy, has for a long time been a matter of contrasting views. Positions in historical scholarship have ranged from climate determinism to, more commonly, an outright rejection of detectable climate influences (for a review, see Ljungqvist et al. 2021). A pioneering study by Brückner (1895), covering the eighteenth and nineteenth centuries, concluded that higher rainfall decreased grain yields and increased grain prices in western and central Europe, whereas the opposite was observed in eastern Europe, promoting climate-influenced grain trade patterns and policies. Beveridge (1921, 1922) studied the co-variance in periodicity between wheat prices and precipitation in western and central Europe within a more advanced statistical framework. He reported, like Brückner (1895), higher wheat prices during periods with more rainfall.

These early works stand in contrast to later prevailing views. Many historians have, until recently, not considered climate variability as an explanatory factor for variations in harvests or grain prices over longer timescales (see, e.g. Mauelshagen 2010). In his influential work on early modern food crises, Abel (1974) understood adverse climate impacts as randomly occurring shocks. De Vries (1980) acknowledged significant climate influences on grain harvests and prices, but still argued that climatic crises had little to no long-term importance in economic history. Persson (1999), in his monumental work on the early modern grain market, appears not to have envisioned climate change as a factor behind long-term grain price trends, and Fogel (1992) even went as far as to attempt to disprove the connection between adverse climate conditions for agriculture and the occurrence of famines in early modern Europe. These presumptions are, as discussed in Chakrabarty (2009) and Campbell (2010), rooted in theoretical foundations of historical scholarship to search exclusively for endogenous explanations, internal to human society, and a reluctance to give exogenous (environmental) factors a role of agency in history.

Despite the scepticism expressed by many historians, modern research has detected a robust influence of climate-induced harvest variations on both grain prices and real wage levels across early modern Europe.Footnote 4 Dry summers were advantageous, and cold springs and wet summers detrimental, for wheat in England (Scott et al. 1998; Brunt 2015), most of France (Le Roy Ladurie 1967), and across central Europe (Pfister 2005), although drought also posed a significant risk in the latter region (Brázdil et al. 2019). Short and cold growing seasons threatened grain yields in northern Europe (Huhtamaa 2018). Spring droughts and cold winters were important hazards in Mediterranean Europe (White et al. 2018).

The existence of distinctive climate variability on harvest yields does not necessarily translate into the same effects on grain prices (e.g. Mauelshagen 2010). Hoskins (1964, 1968), and many scholars of this generation, envisioned a weak and inconsistent climate signal in grain price data. De Vries (1980) anticipated a weaker link between climate and grain prices than one would expect from climate impacts on harvests. Pfister (1988) was of the opinion that while short-term grain price variations largely were climate driven, in the long-run grain prices were more closely linked to the economic development and trade patterns than to agricultural productivity. The most prevailing view today appears to be that climate variations influenced year-to-year and perhaps also decade-to-decade grain price variability, but played little role over longer timescales (see e.g. Kelly and Ó Gráda 2014a, b).

It is notable that most studies suggesting limited climate influences on the long-term grain price development have used detrended grain prices, to remove inflation, in such a way that any low-frequency price variability was removed too. This procedure has precluded the detection of relationships between climate variability and grain price volatility at longer timescales. Esper et al. (2017) detrended grain price data in a way that preserved low-frequency information. They retained multi-decadal trends in grain prices across early modern Europe and showed that much of these lower frequency variations could be explained by temperature variability.

2.2 Solar variability and grain prices in early modern Europe

The notion that the quasi-cyclic variations in solar radiation (Sect. 3.3; “Appendix 1”) affect agricultural productivity, reflected in grain prices, has a long history. An anti-correlation between sunspot numbers and wheat prices was originally proposed by Herschel (1801): for the period 1646–1755, he identified five periods with low sunspot numbers and higher wheat prices and five periods with high sunspot numbers and lower wheat prices. This led Herschel (1801) to conclude that fewer sunspots resulted in poorer climate conditions for wheat and therefore triggered higher prices. Subsequent work by Carrington (1863) and Poynting (1884), however, failed to confirm the sunspot–grain price relationship proposed by Herschel (1801). Nevertheless, other studies reported such associations in India through solar forcing of the monsoon precipitation (e.g. Jevons 1878, 1879; Chambers 1886). Many researchers have subsequently analysed the links between sunspot variability and grain yields and prices, with various results, though mostly referring to short time-spans [see, for instance, King et al. (1974), Harrison (1976), Garnett et al. (2006)].

Several relatively recent studies have apparently supported the original findings by Herschel (1801). Pustil’nik and Din (2004) compared periodicities in English wheat prices from 1249–1702 with the length of measured solar cycles over the period 1700–2000. They relate an observed \({\sim }\,10\)-year wheat price cycle to the prevailing \({\sim }\,11\)-year sunspot cycle. Using 22 European wheat price series covering 1590–1702, Pustil’nik and Din (2009) reported a north–south dipole pattern in solar cycle effect on wheat prices: prices in northern Europe being higher during solar minima, whereas prices in southern Europe being higher during solar maxima, and no sensitivity for large parts of central Europe.

However, claims of sunspot–grain price relationships have been contested for an apparent lack of statistical stringency. Love (2013) critically tested the proposed associations by employing three separate statistical methods considering wheat prices from London and the USA. He showed the relationships to be statistically insignificant when using methods that fully take auto-correlation into account. Furthermore, Love (2013) highlighted that studies reporting significant effects of the \({\sim }\,11\)-year sunspot cycle on grain price series have pre-filtered the data in a way that an over-fit is obtained (see further discussion in Sect. 5.3).

2.3 Objectives

The need for additional research on the relationship between climate variability and grain prices was recently highlighted by Camenisch and Rohr (2018). In particular, we have identified the following limitations of most previous climate–grain price studies: (1) The use of relatively small price data sets, typically representing only limited regions of Europe. (2) A focus on wheat prices and omission of other grain types. (3) The use of high-pass filtered grain price data, precluding detection of possible low-frequency signals. (4) Employing either instrumental data, covering a short time-span, or proxy-based climate reconstructions covering a longer time-span. (5) Assessing the climate influence on grain prices for a single season only.

The objective of this article is to fill some of these research gaps by: (a) studying, with identical methods, the direct effects of climate variability as well as the indirect effects of solar variability on the same unprecedentedly large price data set containing all four grain types (barley, oats, rye, and wheat). (b) Employing instrumental data and proxy-based reconstructions of temperature and precipitation/drought for both the annual mean and summer season. (c) Exploring the climate–grain price relationships at different frequencies with and without lags. (d) Analysing possible common periodicities in grain prices and climate and/or solar variability. By doing so, we revisit the grain price–climate relationships in a holistic and methodically more rigorous way than hitherto attempted. Our focus is entirely on the long-term relationship between grain prices and climate (and solar) variability as modern research has proven the high-frequency (inter-annual) climate–grain price relationship beyond doubt, whereas the long-term relationship is contested though reported to be actually even stronger by Esper et al. (2017).

We restrict our analysis to the 1500–1800 period. The decreasing number of available grain price series prior to c. 1500, and increasing data gaps, preclude robust statistical analysis further back in time. Furthermore, a large proportion of grain price series end c. 1800 at approximately the same time as agricultural modernisation, increasing long-distance trade, improved transport infrastructure, and rapid urbanisation occurred. Already Beveridge (1921) found that the Thirty Years’ War (1618–1648) period and, to a lesser extent, the period following the French Revolution (1789) resulted in a decoupling of grain prices from climate variability. This was empirically confirmed by Esper et al. (2017). We will therefore in this study investigate the effects of excluding these two periods from the analysis.

3 Materials and method

3.1 Grain price data

Generations of scholars have through meticulous archival work collected and published long grain price series. Notable early achievements include Rogers (1887) for England, Elsas (1936–1949) for Germany, Hauser (1936) for France, Posthumus (1946–1964) for the Netherlands, Pelc (1937) for Poland, and Hamilton (1934, 1947) for Spain. The majority of the published price series are now digitised and made publicly available in the Allen-Unger Global Commodity Prices Database (Allen and Unger 2019). We collected all barley, oats, rye, and wheat price series from this database, supplemented by additional series digitised by Esper et al. (2017), having less than 20% years with gaps over the 1546–1650 period in common for all grain price series. Reflecting the relative importance of different grain types for the early modern grain market, our data set consists of 10 price series for barley, 7 for oats, 14 for rye, and 25 for wheat across western and central Europe (Table 1; Fig. 1).

For series with more than one value per year, the mean was calculated to obtain an annual average.Footnote 5 Missing values in a grain price series were infilled using the (standardised) average price from other locations within the same grain price cluster (see Sect. 3.4).Footnote 6 To allow for an assessment of climatic forcing of the grain prices, it is necessary to first remove the presence of long-term inflation and volatility trends in such a way that low-frequency variability, potentially related to climate variations, is preserved. A data adaptive power transformation (Cook and Peters 1997) was applied to minimise volatility changes related to price level, and a cubic smoothing spline (Cook and Peters 1981) with a 50% frequency-response cut-off equal to 300-years was used to remove long-term inflation trends from the price series. The suitability of these methods for analysing environmental forcing in grain prices has been demonstrated by Esper et al. (2017) and confirmed by Ljungqvist et al. (2018). The price series of barley, oats, rye, and wheat were finally divided into regional groups by employing a hierarchical cluster analysis (see Sect. 3.4). The time-series of the grain price clusters, for each grain type, are shown together with the mean for each grain type over the 1500–1800 period in Fig. 2.

3.2 Temperature and hydroclimate data

Continuous series of meteorological climate data are available from numerous locations in Europe since the mid-eighteenth century (Jones 2001), although a few temperature and precipitation records, though with gaps, extend back to the late seventeenth century (Briffa et al. 2009). We have included five temperature and five precipitation series starting prior to 1750 (Table 2). Annually resolved palaeoclimate reconstructions are employed to assess the influence of climate variability on grain prices over the entire 1500–1800 period. For summer (June–August) temperature, we use the reconstruction by Luterbacher et al. (2016) as updated by Ljungqvist et al. (2019). This reconstruction is derived from tree-ring data and historical documentary evidence, resolved at a 5\(^\circ\) \(\times\) 5\(^\circ\) grid, of which we extracted the spatial average representing 55\(^\circ\)N–35\(^\circ\)N and 10\(^\circ\)W–20\(^\circ\)E. We are only using this European average, rather than the individual 5\(^\circ\) \(\times\) 5\(^\circ\) grid cells, considering the very high correlation grid-cell inter-correlation (mean r = 0.71; median r = 0.77). For annual mean temperature, we use the documentary-based reconstructions for Central Europe by Glaser and Riemann (2009) (henceforth GR09) and Dobrovolný et al. (2010) (henceforth D10).Footnote 7

For variations in growing season drought conditions, we employ the Old World Drought Atlas (Cook et al. 2015). This tree-ring-based reconstruction reflects June–August soil moisture conditions in the form of self-calibrated Palmer Drought Severity Index (scPDSI) values presented on a 0.5\(^\circ \times 0.5^\circ\) grid across Europe. Since we cannot exactly mimic the coverage corresponding to our grain price clusters, we calculate the spatial average of the drought index for three regions, broadly corresponding to different hydroclimate regimes, namely west-central Europe (\(55^\circ\)–\(45^\circ\)N, \(10^\circ\)W–\(10^\circ\)E), east-central Europe (\(55^\circ\)–\(45^\circ\)N, \(10^\circ\)E–\(20^\circ\)E), and Mediterranean Europe (\(45^\circ\)–\(35^\circ\)N, \(10^\circ\)W–\(20^\circ\)E).

Selection of analysed time-series: a–d Regional clusters of detrended and standardised grain price data, here 10-year smoothed for illustrative purposes only, displayed by grain type and showing the mean of all series of the same grain type. e Mean of the area 55\(^\circ\)N–35\(^\circ\)N/10\(^\circ\)W–20\(^\circ\)E of the June–August temperature reconstruction by Luterbacher et al. (2016), as updated by Ljungqvist et al. (2019) (green), and the Central Europe annual mean temperature reconstructions by Glaser and Riemann (2009) (GR09, blue) and Dobrovolný et al. (2010) (D10, red). f Mean of the tree-ring reconstructed June–August self-calibrated Palmer Drought Severity Index (scPDSI) by Cook et al. (2015) for west-central Europe (55\(^\circ\)–45\(^\circ\)N, 10\(^\circ\)W–10\(^\circ\)E), east-central Europe (55\(^\circ\)–45\(^\circ\)N, 10\(^\circ\)E–20\(^\circ\)E), and Mediterranean Europe (45\(^\circ\)–35\(^\circ\)N, 10\(^\circ\)W–20\(^\circ\)E). g Observed sunspot group numbers since 1610 (Svalgaard and Schatten 2016) and \(^{14}\)C and \(^{10}\)Be reconstructed total solar irradiance (Jungclaus et al. 2017). The periods corresponding to the Thirty Years’ War (1618–1648) and following the French Revolution (1789) are grey-shaded

3.3 Solar variability data

The intensity of sunlight emitted by the Sun varies over time, influencing Earth’s climate, but solar irradiance has only been measured with satellite observations since 1978. However, it is possible to estimate solar variability prior to that considering the changing sunspot numbers as indicator of solar activity. Sunspots are areas of lower temperature in the photosphere, or ‘surface’, of the Sun appearing in differing numbers with a \(\sim\) 11-year cycle. Superimposed on this \(\sim\) 11-year cycle are longer cycles of solar activity (see “Appendix 1” for further details).

Sunspot abundances are typically counted in two ways: the number of individual spots or the number of groups (i.e. sunspot clusters) containing spots. The former can be ambiguous, as some observers counted more spots than others due to different types of equipment or personal preferences in separating closely spaced spots. However, the number of individual sunspots and the sunspot group number have a proportional relationship (correlating at r = 0.94 over the period 1700–2015). Observation-based estimates of the annual sunspot group number extend back to 1610 (Svalgaard and Schatten 2016) and are employed in this study.

Prior to the invention of the telescope in 1608, estimates of solar activity rely on reconstructions based on cosmogenic radiocarbon (\(^{14}\)C) and beryllium isotopes (\(^{10}\)Be). They are produced by cosmic rays modulated by solar activity as well as by the geomagnetic field. The \(^{14}\)C or \(^{10}\)Be solar irradiance reconstructions show temporal discrepancies at inter-annual to decadal timescales, compared to observed sunspot group numbers, but consistent long-term variability (Fig. 2). We employ state-of-the-art total solar irradiance reconstructions at annual resolution published by Jungclaus et al. (2017).

3.4 Cluster analysis and intra-cluster correlations

Since many of our 56 grain price series show a strong co-variance, we employ a method to cluster similar series on the basis of quantitative algorithms. We applied a hierarchical cluster analysis to the grain price series over their common period 1546–1650, for each grain type separately, to group and subsequently average similar series (Fig. 3). Thereby, we reduce the number of series, increase the signal-to-noise ratio, and limit the spatial degrees of freedom problem (for the latter, see Sect. 3.5). We considered the Euclidean (straight line) distance norm and the method for cluster agglomeration based on Ward (1963).Footnote 8 After the dendrogram is calculated, a cut is made of the ‘tree’ and this defines the clusters. We chose a cut corresponding to a large jump in the inter-cluster distances. The detected clusters correspond closely with major geographic regions in Europe (see Fig. 1). In all 16 cluster mean time-series were formed: four each for barley and rye, three for oats, and five for wheat (Fig. 3).

Cluster analysis is a data-driven approach to define regions of co-variance and grouping data independently of a priori assumptions of geographical co-variability patterns. Thus, the grouping of the grain price series is entirely determined by the co-variance among the different series. Such an approach is relatively uncommon in economic history, though it has many advantages as discussed in Sect. 5.1, but has predecessors in Chilosi et al. (2013) and Studer (2015) employing principal component analysis to detect regions of high grain price co-variability.

The different grain price cluster series are highly correlated, as are the individual grain price series, except the Barley Central cluster (consisting only of data from Speyer and Strasbourg). Furthermore, the Peripheral and West-central barley clusters, Central oats cluster, Central rye cluster, and West-central wheat price cluster exhibit inhomogeneities (i.e. unrealistically low prices) following the period after the French Revolution (1789).

Hierarchical cluster analysis of the price series for barley, oats, rye and wheat using the Ward’s method for agglomeration and the Euclidean distance. ‘Height’ refers to the inter-cluster distance. The mean correlation between grain price series within each cluster over the common period 1546–1650 is shown. Cluster abbreviations: C central; EC east-central; Per peripheral; WC west-central

3.5 Correlation analysis and significance estimation

In this study, we make extensive use of correlation analysis along with various spectral analysis methods. The conclusions from such analyses depend not on the magnitude of the result but, rather, its magnitude relative to the significance level. We therefore put effort into using the most appropriate methods for establishing significance levels of all results we present. Correlation analysis in this article refers to calculations of the Pearson correlation coefficients. However, we also tested the use of Spearman’s rank correlation, potentially more suitable for correlations between time-series with nonlinear relationships, but found only minor differences between the two methods.

We require that results are significant at the \(p_{crit}=0.05\) level or better. The significance of the correlations was determined in different ways: using a t test or using synthetic data based on a phase-scrambling technique (Schreiber and Schmitz 2000). The standard t test does not take serial correlations of the data into account as it assumes that the number of degrees of freedom is almost the same as the number of data points (n–2). For auto-correlated data, this assumption is broken and the t test can be too optimistic—i.e. the probability of getting a false positive is higher than expected.

The effect of serial correlations is systematically included in the phase-scrambling technique, where the significance is estimated by directly counting the rate of false positives using synthetic data. The synthetic data are generated by random scrambling of the Fourier phases, and the resulting time-series has no causal relationship with the original series, but its auto-correlative structure is the same (Prichard and Theiler (1994); see also Christiansen et al. (2009) for an example of the implementation of this). The synthetic data are used to build distributions of the sampled correlations under the null-hypothesis of no correlation. If the detected correlation is an outlier from this synthetic distribution, the result is considered significant.

While the phase-scrambling technique is used in general throughout the article, we also use the parametric t test. When considering correlations between 10-year filtered data, which are strongly auto-correlated by nature, we used a modification of the t test introduced by Bartlett (1935) (see “Appendix 2”), based on estimating the effective degrees of freedom used in the t test on the basis of the auto-correlation of the two series at lag 1 (see “Appendix 3”). More precisely, the reduced number of degrees of freedom is \(n (1-\alpha _1 \alpha _2)/(1+\alpha _1 \alpha _2)\), where \(\alpha _1\) and \(\alpha _2\) are the auto-correlations at lag 1 of series 1 and 2, respectively. Note that this procedure is strictly only valid if the series in question behave like AR1-processes.

For proper statistical correlation analysis, it is not only necessary to take the auto-correlation of single series (i.e. across time) into account, but also acknowledge effects from spatial correlations (see Christiansen and Ljungqvist (2017) and references therein). It can be tempting, but incorrect, to interpret multiple significant correlations as extra verification just because there are several of them in those cases where the series are inter-correlated. Significance testing methods that are able to deal with this include surrogate data testing (e.g. Thejll 2001; Christiansen 2013) as well as reducing the amount of data by aggregating similar time-series. To mitigate the spatial degrees of freedom problem, we have used the latter method by applying cluster analysis (Sect. 3.4) to the grain price series.

3.6 Spectral analysis methods

We employ spectral analysis methods to understand which periodicities are present in our data, if any, and whether similar periodicities exist in pairs of time-series. Thus, we calculate power density spectra as well as the coherency (sometimes labelled ‘coherency-squared’) of single series and pairs of series. A power density spectrum is essentially the amplitude of the Fourier transform of the auto-correlation function for a single series. Coherency is the amplitude of the Fourier transform of the cross-correlation between two series. We performed extensive testing on constructed pairs of time-series (see “Appendix 4”) of the ability of such analyses to detect known links; we have come to the conclusion that the above-mentioned analysis tools provide causality insights provided one only considers frequency-intervals (actually, periods = 1/f) where the power density is significant in both series in the presence of simultaneous significant coherence. Extensive testing (not shown) revealed that the imposition of data gaps, e.g. due to the omission of the Thirty Years’ War (1618–1648), did not generate spectral artefacts, allowing us to use spectral methods assuming continuous dataFootnote 9. Significance levels of spectral analyses are established by repeatedly applying the same approaches to surrogate data that have similar spectral properties as the original data. The surrogate data are of the same length have the same mean, variance, and auto-correlative structure as the original series. We performed 10,000 such surrogate data trials and estimated \(p=0.05\) significance levels for different period.

4 Results

Cross-correlation matrix between grain price clusters and instrumental annual mean temperature and precipitation data from the start of each instrumental series until 1800. The correlations between the different grain price clusters run from 1659, start year of the longest instrumental series, until 1800. Correlations significant at \(p=0.05\) with a t test are marked with a dot (\(\cdot\)). Values also significant using the phase-scrambling test are marked with a plus sign (+). Blue colours correspond to negative correlations (i.e. ‘anti-correlations’) and red colours to positive correlations

4.1 The relationship between climate variability and grain prices

In this section, we analyse the relationship between instrumental and reconstructed temperature and hydroclimate variability on the grain price variations. Figures 4, 5, and 6 show the individual pair-wise correlations for all combinations while the histograms in Fig. 8 summarise the distribution of the correlations between grain price data and different climate data sets. Furthermore, Tables 4, 5, and 6 in Appendix contain the correlation values and their significance.

4.1.1 Correlations between instrumental climate data and grain prices

The correlations between the grain price clusters and the instrumental series of annual mean temperature are in general negative (individual start date to 1800), which is best seen for Central England, De Bilt, and Uppsala, indicating that high grain prices correspond to low temperatures and vice versa (blue squares in Fig. 4). We found a modest average correlation of r = − 0.13, with 29% of the correlations significantly negative using the phase-scrambling-based significance test (42% using the t test), demonstrating a real connection, especially for the two longest instrumental temperature series (Central England and De Bilt). Only the barley and oat clusters correlate negatively with the Berlin temperature data, whereas all rye (except Rye central) and all wheat clusters correlate positively (i.e. high price = high temperature) with the Bologna temperature data. Using June–August temperature data instead of the annual mean, the correlation coefficients are overall lower and less significant, except for De Bilt (Table 4 in Appendix). Similar results were obtained when extending the period of correlations between instrumental data and the barley and wheat price data to 1820.

The correlations between the grain price clusters and annual precipitation are mainly weakly positive (i.e. high price = high precipitation) though only 7% are significant considering the phase-scrambling-based significance test (9% using the t test) (Fig. 4; Table 4 in Appendix). Thus, only weak evidence is found for a real connection. Significant correlations are mainly obtained with the Kew, England, record, which is the longest precipitation series. Using June–August precipitation results in, on average, a more negative grain price–precipitation association, though less than 3% of the correlations are significant using the phase-scrambling-based significance test (5% using the t test) (see Table 4 in Appendix). Significant grain price–temperature and grain price–precipitation correlations are not only restricted to grain price clusters close to the location of the particular meteorological stations.

4.1.2 Correlations between reconstructed climate data and grain prices

Cross-correlation matrix for grain price clusters, reconstructed temperature and drought series, and solar activity series over the period 1500–1788 (and excluding the Thirty Years’ War, 1618–1648) with grain prices lagging climate and solar forcing data 1 year. Correlations significant at \(p=0.05\) with a t test are marked with a dot (\(\cdot\)). Values also significant using the phase-scrambling test are marked with a plus sign (+). Blue colours correspond to negative correlations (i.e. ‘anti-correlations’) and red colours to positive correlations

We found negative correlations between all grain price clusters and all three temperature reconstructions over the 1500–1788 period (excluding the Thirty Years’ War, 1618–1648). The average correlation is r = − 0.22, and more than half (54%) of these are significant at \(p=0.05\) using the phase-scrambling method (86% with the t test). The strongest correlations are obtained when using the June–August temperature reconstruction (Table 5 in Appendix). While a few correlations could be significant by chance, we emphasise that this general picture provides strong evidence for a real negative association between temperature and grain price. The stronger and more significant correlations using reconstructed data, compared to instrumental data, may result from the periods of analysis being much larger though the reconstructions potentially contain more noise.

The highest correlations between reconstructed temperature and grain prices are found either for grain type means or the grain price average including all 56 series (r = –0.39 between the latter and reconstructed June–August temperature). We note a changing temperature sensitivity of the grain price series over time. For example, the correlations between temperature and grain price are generally stronger in the period prior to the Thirty Years’ War (1500–1617) than in the period following the war (1649–1788). Beyond this temporal pattern, no clear geographical difference in the sensitivity of grain prices to temperature is apparent (see further discussion in Sect. 5.2).

The correlations between grain prices and reconstructed drought are weak and include only few significant correlations (less than 5% using the phase-scrambling method) that could easily occur by chance. These drought–grain price correlations, albeit mainly insignificant, are in general positive (i.e. wetter climate conditions = high prices) and are in agreement with the positive (though also mainly insignificant) relationship between instrumental precipitation and grain prices (Sect. 4.1.1).

Grain price variations can be expected to lag climate variability as the price level responds to harvest size (see “Appendix 5”). Analysing the lag effect of climate on grain prices in the subsequent year, slightly higher correlations with temperatures are found (Fig. 5). The correlation reaches r = − 0.41 between the average of all 56 grain price series and reconstructed June–August temperature. We find a bigger change, with stronger and more significant correlations, between grain prices and drought when considering a 1 year lag. Wetter years tend to result in higher grain prices the following year and vice versa.

In all the analyses above, we excluded the Thirty Years’ War (1618–1648) and the period following the French Revolution (1789).Footnote 10 Including these two periods slightly decrease the correlations between temperature and grain price—in line with earlier findings by Esper et al. (2017). Finally, the ‘Wheat Peripheral’ cluster extending back to 1348 allows us to test the effects of having a \({\sim }\) 150-year longer period of overlap with reconstructed June–August temperature and drought data. However, using this longer period results in decreasing, rather than increasing, correlations.

Cross-correlation matrix for 10-year box-car filtered grain price clusters, and reconstructed temperature and drought series, and solar activity series over the 1500–1788 period (and excluding the Thirty Years’ War period) in once-per-decade steps. Correlations significant at \(p=0.05\) with a t test are marked with a dot (\(\cdot\)). Values also significant using the phase-scrambling test are marked with a plus sign (+). Blue colours correspond to negative correlations (i.e. ‘anti-correlations’) and red colours to positive correlations

4.1.3 Decadal-scale correlations between climate and grain prices

Using 10-year smoothed data, by applying 10-year box-car and spline filters, stronger climate–grain price correlations are obtained (Fig. 6; Table 6 in the Appendix). Here we focus on the 10-year box-car filtered data, considering that the auto-correlation structure is easier to account for and thus less complex to perform statistical testing for significance on (Appendix 2), though similar results are obtained using 10-year spline filtered data (Table 6 in Appendix). The larger correlations using smoothed data should only be interpreted with a simultaneous close look at how the significance levels change with the smoothing. Reducing the number of degrees of freedom increases the range of observed correlations even under the null-hypotheses of uncorrelated series. Indeed, the range of the correlations has increased but the number of significant correlations has in general remained constant. For the temperature–grain price correlations, the average correlation increases to r = –0.42 (compared to r = –0.22 for unsmoothed data), with 51% being significant (compared to 54% for unsmoothed data). However, the number of significant drought–grain price correlations increases slightly (from 5% for unsmoothed data to 13% for smoothed data).

The presence of stronger, but still equally significant, correlations after 10-year low-pass filtering the data demonstrates that the climate–grain price relationship may not only be a result of high-frequency co-variability. This implies the presence of an important multi-decadal relationship. As with the annually resolved data, the highest correlations are obtained using the grain type mean or the grain price average of all 56 series. The latter correlates at r = –0.63 with reconstructed June–August temperature, r = –0.55 with the GR09 reconstructed annual mean temperature, and r = –0.49 with the D10 reconstructed annual mean temperature. The highest correlation obtained (r = –0.66) is found between the barley price mean and reconstructed June–August temperature.

Spectral power density and coherency analyses between climate data and average grain prices over the 1500–1788 period with the Thirty Years’ War (1618–1648) period excluded. Stippled lines indicate the significant at \(p=0.05\) significance levels determined by surrogate-data methods based on generating unrelated series with the same autocorrelation at lag 1 as the original series. 10,000 surrogate data trials were performed, and the \(p=0.05\) significance determined at each period along the x-axis for both spectral power and coherency

4.1.4 Spectral and coherency analysis between climate and grain prices

The spectral analysis reveals highly significant periodicities of \({\sim }\) 5 years and weakly significant periodicities of \({\sim }\) 16 years in the grain price data over the 1500–1788 period (Fig. 7). Another, though barely significant, grain price oscillation of \({\sim }\) 50 years is recorded. The instrumental climate data reveal no periodicities on shorter timescales and are too short to robustly detect periodicities at longer timescales. However, the Central England temperature series shows spectral power on multi-decadal timescales, which is difficult to interpret given the limited length of the series, and the De Bilt temperature series shows a \({\sim }\) 20-year periodicity bordering significance. The three temperature reconstructions reveal spectral power on multi-decadal timescales. Otherwise, only weak periodicities of \({\sim }\) 3 years are found in the June–August temperature reconstruction, of \({\sim }\) 7 years in the GR09 annual mean temperature reconstruction, and of \({\sim }\) 4 years in the D10 annual mean temperature reconstruction.

Coherency analysis reveals a wide range of common periodicities between the grain price data and the climate series. The most prevailing ones are seen at \({\sim }\) 4 years, \({\sim }\) 20 years, and \({\sim }\) 50 years (Fig. 7). In addition, a common periodicity with the grain prices of \({\sim }\) 8–9 years as well as \({\sim }\) 12-years is recorded in the D10 annual mean temperature reconstruction. We only consider as significant coherence those periodicities that are significant in both series in the power density spectrum (see Sect. 3.6). Thus, the absence of simultaneous significant power in the power density spectra of climate and grain price series, and their coherence, implies that results regarding coherency shown in Fig. 7 must be interpreted with caution. It also means that the climate–grain price relationship is of an episodic rather than periodic nature.

4.1.5 Summary of climate–grain price relationships

To conclude, overall similar correlations are obtained between grain prices and the (relatively short) instrumental series as well as between grain prices and proxy-based climate reconstructions (for the distribution of the different correlations; see the histograms in Fig. 8). Negative correlations (i.e. colder = high prices and vice versa), which to a large extent are significant, are found between grain prices and temperature regardless of whether instrumental or reconstructed data are used. Mainly insignificant and mostly positive correlations are found between grain prices and hydroclimate—again regardless of whether instrumental precipitation or reconstructed data are employed. We emphasise the results using the conservative phase-scrambling method to calculate significance as the common parametric t test may spuriously overestimate the connection between grain price and climate, and could erroneously lead to a conclusion that a strong connection between grain price and temperature and hydroclimate exists (see Sect. 3.5).

We found the climate–grain price relationships not to be regionally restricted, but rather to be large-scale features extending across most of Europe. The strongest temperature signals are obtained for the grain type means and the average of all 56 grain price series. This negative relationship also increases in strength moving from annual to decadal timescales while maintaining its significance. An absence of simultaneous significant periodicities in the grain price and climate data demonstrates that the climate–grain price relationships are of an episodic and not a periodic nature.

4.2 Correlation between solar variability and grain prices

The sunspot group numbers and the two solar irradiance reconstructions show very different correlation patterns to grain price data (Tables 5 and 6). This is, at least partly, caused by the \({\sim }\) 11-year cycles in the \(^{14}\)C and \(^{10}\)Be solar irradiance reconstructions being incorrect in their timing compared to the actual observed solar cycle as reflected in the sunspot group number record (see Sect. 3.3). We therefore mainly focus here on the correlations between grain prices and the temporally correct sunspot group number observations (although they only extend back to 1610). Significant positive correlations (i.e. higher solar activity = higher prices) are found for the East-central clusters of barley, rye, and wheat prices (Fig. 5). Significant negative correlations (i.e. lower solar activity = higher prices) are observed for the Peripheral clusters for both rye and wheat prices. In addition, significant positive correlations are found with the West-central and Central barley price clusters. These correlations are not affected by lagging the grain prices 1 year relative to the sunspot group number data (Fig. 5).

Considering instrumental data, the strongest correlation between solar variability (sunspot group numbers) and temperature is r = 0.29 from 1659–1800 for Central England annual mean temperature (and r = 0.21 for the full period of overlap 1659–2015). The sunspot group numbers are also significantly positively correlated with reconstructed June–August temperature and annual mean temperatures by GR09 and by D10 (the latter only with the t test). Periods with a high sunspot number thus tend to (weakly) correspond to higher temperatures and vice versa.

4.2.1 Coherency between grain prices and solar variability

All three solar variability series contain the well-known \({\sim }\) 11-year sunspot cycle as a highly significant periodicity. They do not contain any other significant periodicities. No corresponding, or even remotely similar, cyclicity is evident in the grain price data (Fig. 9). Nor is the coherency analysis showing any coherency at \({\sim }\) 11-year frequency bands (although the \(^{14}\)C solar irradiance reconstruction contains a significant periodicity of just less than \({\sim }\) 10 years). Coherency is seen at \({\sim }\) 5-year periodicity. This is, as noted in Sect. 4.1.4 above, highly significant in the grain price data. However, even though a weak and insignificant tendency to such periodicity is also found in the spectral analysis of the solar variability series, the \({\sim }\) 5-year coherency cannot be considered robust.

We subdivided both the solar activity estimates and the grain price data into periods of high and low solar activity to assess whether there is significant \({\sim }\) 11-year power in the grain price data during one of these periods, and less so during the others, as this would be an indication of a causal link between solar variability and grain prices.Footnote 11 The periodograms of both the solar activity reconstructions for these intervals, and corresponding intervals of the grain price average, are shown in Fig. 9. We observe that there is significant \({\sim }\) 11-year periodicity in solar activity in both time-intervals, with a characteristic shifting of the main, quasi-decadal, intervals with low solar activity which have longer cycles than intervals with high activity—which is a well-known result (e.g. Eddy 1976). Furthermore, we note that there is a significant \({\sim }\) 12-year periodicity in the grain prices, presumably related to similar solar variability, during intervals of low solar activity, but not during intervals of high activity.

Spectral power density and coherency analyses between average grain prices and solar variability series. The Thirty Years’ War (1618–1648) period is removed. From the middle of the middle row, we show a separate analysis, namely the power spectra for the average grain price series and three solar activity series during periods of high and low solar activity. The grain price average series is divided into intervals corresponding to the solar activity series in the power spectra. Significance calculated as for Fig. 7

5 Discussion

5.1 The grouping of grain price data through cluster analysis

Grouping the grain price series through hierarchical cluster analysis is a data-driven approach unaffected by a priori presumptions about geographical co-variability patterns among the grain price series. It is entirely the degree of co-variance among the different series that determines the clusters. This data-driven approach used to identify geographic patterns appears more reliable than grouping the data by either historical or present-day political boundaries as regions of high price co-variability are hardly consistent with such boundaries (Chilosi et al. 2013). Hierarchical cluster analysis is similar to principal component analysis, also a data-driven approach, which has successfully been used in economic history by Chilosi et al. (2013) and Studer (2015) to determine regions of wheat price co-variability and, thus, market integration, in early modern Europe.

Hierarchical cluster analysis, like any other method, has its limitations (Christiansen 2007) and may produce spurious patterns if co-variability is generally low. Even if this is not the case, there can still be borderline cases, where the grouping of particular grain price series remains ambiguous. One such case is arguably that the geographically nearby data from Cologne and Frankfurt fall into different clusters (groups) for rye prices. Alternative approaches considering geographically or politically predefined regions would fail to detect such patterns. Furthermore, they would be disadvantageous because changes in grain prices in a region were not necessarily a result of changes in productivity within the same region. Cluster analysis and similar data-driven approaches, on the other hand, group the grain price data with regard to their actual co-variability regardless of whether it is a result of changes in regional productivity or because of changes in trade patterns or trade costs.

The grouping through hierarchical cluster analysis is based on the co-variability of price series for each of the four grain types separately. Some of this co-variability may be partly related to common climatic conditions. Nevertheless, trade patterns appear to affect the cluster grouping much stronger. For example, it is not surprising that the rye prices in Pisa belong to the same ‘Peripheral’ cluster as Gdansk, or that barley and oats prices in Pisa fall in the same ‘Peripheral’ clusters as Southern England. These patterns are a result of the import of grain from the Baltic Sea region, particularly since the late sixteenth century (Van Tielhof 2002), as opposed to wheat that was a locally grown crop in Italy, and thus falls into the Italy cluster. Some of these potentially surprising group assignments, particularly in the ‘Peripheral’ cluster, are clearly related to maritime grain trade (Unger 2011). Grouping these data by predefined categories, e.g. by nation or region, would therefore hide these important relationships. This also means that climatic signals in a particular grain price series are not controlled by local, or regional climate conditions, but may instead contain the climate fingerprints from other regions in Europe. Considering that many price series are controlled by climate variations in other parts of Europe, it is not surprising that the highest climate–grain price relationships are found when averaging the price data at larger spatial scales. Thus, the large-scale common variability will be presented in averaged series. In the case of Pisa, regional comparisons with only Italian climate data would therefore remain incomplete.

Different grain price clusters are influenced by varying long-distance trade partly shaped by geography. The East-central cluster, essentially Central Europe, is located in a landlocked area, albeit with important rivers facilitating water transport, whereas the West-central cluster is closer to the coast. The Central cluster is entirely located in the Upper Rhine Valley. The ‘Peripheral’ cluster is entirely coastal, and arguably a result of maritime trade with overall lower transport costs (Jacks 2004). Not only the price level, but also the price variations, tended to differ between regions dominated by overland trade and regions dominated by water-way trade (Chilosi et al. 2013).

5.2 Climate forcing on grain price variations

We have found stronger, and more significant, negative correlations between temperature and grain prices than hitherto reported. Higher temperatures correspond with lower grain prices, and vice versa, and this relationship becomes stronger with increasing spatial scale—confirming earlier findings by Esper et al. (2017) indicating that correlations increase with spatial domain. Our study is the first to demonstrate this negative temperature–grain price relationship across the diverse environmental settings of entire Europe as well as for the prices of barley, oats, rye, and wheat. Wheat was the price-driving grain in early modern Europe (Chilosi et al. 2013). Thus, an increase or decrease in the price for the other grain types is potentially co-influenced by climate-induced yield variations of wheat.

Even if summer temperature alone explains \({\sim }\) 40% of the decadal-scale average European grain price variations, and about \({\sim }\) 16% of the inter-annual variations, a major portion of the grain price variability remains unexplained by climate conditions. However, multiple regression against several different climate variables in addition to summer temperature (e.g. annual mean temperature and precipitation) would likely increase the portion of grain price variability explained by climate (see e.g. Edvinsson et al. 2009; Brunt 2015). Multiple regression analyses, however, come with technical problems in demonstrating statistical significance due to regression inter-correlation and dependence (e.g. interrelationship between annual mean and summer temperatures), and were beyond the scope of the present article.

The grain prices were nonetheless controlled only partly by harvest variations which, in turn, were affected by numerous non-climatic factors such as seed quality, pests, diseases and other factors including armed conflicts, labour force availability, demography, epidemics, and market conditions (see Sect. 5.4). We also show that climate had a temporally varying effect on grain prices. The relationship disappeared entirely during the Thirty Years’ War (1618–1648) and, to a lesser extent, following the French Revolution (1789). These changes were likely due to the disintegration of established market forces and regional decoupling of trade (Beveridge 1921; Chilosi et al. 2013; Esper et al. 2017). We presume that periods characterised by other, mostly spatially more restricted, armed conflicts also weakened the climate signal in the grain prices. This is, however, not within the scope of this study as armed conflicts were a recurrent situation in early modern Europe. Finally, we note a tendency towards weaker temperature–grain price relationships throughout the eighteenth century, likely related to a lesser grain price sensitivity to harvest variations and an increased market integration manifested in a decreasing grain price volatility (e.g. Chilosi et al. 2013). Unfortunately, it is difficult to determine the effects of various institutional changes, as opposed to climatic influences, using grain price data alone as the prices might be influenced by production across various regions.

It is entirely plausible that the temperature–grain price relationship was stronger during the coldest phases of the Little Ice Age than during its warmer phases. This could explain a particular strong temperature signal in the grain prices during the period from the late sixteenth to the early seventeenth century, compared to during the eighteenth century, as previously suggested by Pfister and Brázdil (1999). When the growing seasons were shorter, the temperature sensitivity of grain yields might increase in a nonlinear manner. The fact that all of the 10% coldest summers between 1500–1800 occurred between 1574–1704 directly disproves earlier notions by scholars such as Abel (1974) and Persson (1999) that climate “shocks” on early modern agriculture, and thus on grain prices, can be considered random occurrences. Instead such “shocks”, as evident from palaeoclimate reconstructions not available to this earlier generation of scholars, followed clear temporal trends of low-frequency climate variability.

The lack of clear regional differences in the relationship between grain price and temperature and hydroclimate is worth attention. A negative relationship between grain prices and hydroclimate (i.e. drier climate condition = higher prices) could have been expected for several of the regional grain price clusters. However, hydroclimate–grain price relationships showing significant correlations are instead mostly positive (i.e. wetter climate condition = higher prices)—as already indicated by Brückner (1895) for western and central Europe. This positive relationship may appear surprising given the drought sensitivity of agriculture in much of Europe, as far north as central Sweden (Edvinsson et al. 2009), and earlier findings showing significantly higher grain prices following exceptionally dry summers (Esper et al. 2017). The weak hydroclimate signal we found in the grain prices is likely related to spatial scale. Compared to temperature, hydroclimate shows a very large spatial heterogeneity in general (Ljungqvist et al. 2016) and during summer in Europe in particular (Büntgen et al. 2010). Drought, or excessive precipitation, will for most years have a more local to sub-regional spatial signature than temperature (Ljungqvist et al. 2019). Hydroclimate effects on crops are usually nonlinear, and may even include tipping points beyond which more precipitation (i.e. severe single events) could lead to reduced harvest. Single extreme precipitation events are not captured in the data we use. Finally, we note the possibility that grain agriculture in the past was less drought sensitive than today. It is not straightforward to transfer modern climate–harvest relations into the past considering the differences in farming practices and seed types (e.g. Michaelowa 2001). Historical grain seed varieties could have different properties, and climatic sensitivity, than those of today but comparatively little is known about this (for an example from Sweden; see Leino 2017).

At longer temporal scales, and larger spatial scales, temperature appears to be the dominating climate factor influencing early modern grain harvests and prices. Brázdil et al. (2019) reported an inconsistent, and statistically insignificant, relationship between drought and seventeenth and eighteenth century grain prices in the Czech Lands, with only a clear signal during certain extreme drought years. In England, dry conditions—except when very severe and prolonged—were normally advantageous for wheat yields (Brunt 2015) and rarely detrimental for barley, rye, and oats yields (Scott et al. 1998; Michaelowa 2001; Pribyl 2017). Considering that wheat was the grain price driver, drought had presumably more modest effects on barley, rye, and oats prices than on their yields.

5.3 The effect of solar variability on grain prices

The solar variability signal on the grain prices is weak, and temporally inconsistent, as opposed to the significant and consistent climate signals. This is not surprising considering that solar variability only indirectly affected grain prices through its effects on climate. The rather weak, though significant, solar forcing on climate would further be masked in the grain prices, which only partly depend on climate, and might be distinct during certain periods only. A solar forcing signal in the climate, transferred to the grain prices, would additionally be complicated by, for example, much stronger albeit more short-lived volcanic forcings (Breitenmoser et al. 2012; Esper et al. 2013a, b), and a larger unforced natural variability in the climate system across timescales (Luterbacher et al. 2016; Wang et al. 2017)—although we found no highly significant associations between large volcanic eruptions and grain prices (not shown).Footnote 12

We conclude that there exist too many overlaying signals in the grain prices to detect distinct solar cycle influences, even if there would be such an underlying control on harvest yields. The influence of solar forcing also appears to show spatial heterogeneity, much like that of precipitation and drought, presumably resulting in an averaging out of any solar signals in grain prices at larger spatial scales. We hypothesise that the weak, and temporally variable, solar-modulated climate influence on grain prices is the reason for previous contradictory findings (Sect. 2.2). This conclusion is in line with the results of Love (2013) who demonstrated that sunspot number–grain price correlations claimed to be significant became insignificant when the independent degrees of freedom were considered. Our finding of a marginally significant power density at \(\sim\) 12 years in grain price averages for periods of low solar activity, while there is no such sign at periods of high solar activity, might be an example of a temporal unstable (weak) solar–grain price relationship or, alternatively, just a spurious correlation.

5.4 Grain price and harvest yield relationships

The strong temperature–grain price relationship reported here for early modern Europe is noteworthy because grain price variability only partly, and indirectly, reflects harvest yield variations that, in turn, also depend on non-climatic factors. The relationship between climate variability, harvests, and grain prices is additionally controlled by demographic pressure, economic conditions and the political and institutional setting (Bauernfeind et al. 2001; Mauelshagen 2010; Krämer 2015). Grain prices are also affected by the organisation of markets, efficiency and cost of transportation, and levels of demand (Bateman 2011, 2015; Chilosi et al. 2013). Domestic prices could, to a considerable extent, be affected by inflationary policies at the same time as international grain prices played a greater role than regional harvest yields (Persson 1999). To further complicate matters, it could take several years for prices in more peripheral regions to adjust to international changes (Edvinsson 2012).

The scarceness of accurate harvest data makes it challenging to quantify the strength of the nonlinear relationships between grain price and harvest variations in early modern Europe over larger spatial scales. Studies of this are also hampered by the fact that only local- to regional-scale harvest estimates are available, whereas grain prices typically reflect larger spatial scales. The correlation between tithe revenues (reflecting yields) and rye prices for the Nuremberg region in southern Germany between 1339 and 1670 has been found to be as low as r = –0.4 (i.e. only 16% of the tithe variance is predictable by price) (Bauernfeind and Woitek 1996). However, during medieval times, with less developed markets, studies for England suggest stronger yield–price relationships (Campbell 2010, 2016; Camenisch 2015; Bekar 2019).

A reasonable presumption is that harvest variations show a stronger climate influence compared to grain price variations, because the former were much less affected by human agency than the latter. However, Camenisch and Rohr (2018) have instead tentatively suggested the relationship between climate variability and grain prices to be stronger than the relationship between climate and harvest yields. The rationale for this reasoning is that grain prices represent production over a larger geographical region and are thus less biased by local-scale growth conditions. Partly along the same lines, Edvinsson (2012) suggested that the aggregated grain price level variability can serve as a good indicator of harvest variations in early modern Europe as a whole, whereas grain prices are not good indicators of regional-scale harvest variations in parts of Europe that had a developed market. This could explain why we find the highest temperature–grain price correlations when using the grain price average of all 56 series.

There is an obvious need for further research on harvest–grain price relationships in early modern Europe as well as on the climate signal fingerprint in harvest yields. Some research has been conducted about harvest–grain price relationships for medieval England (Schneider 2014; Campbell 2016; Bekar 2019). Other studies have been conducted for the early modern period and not exclusively for England (Bauernfeind and Woitek 1996; Nielsen 1997; Wrigley 1989). These studies show, at most, moderately strong harvest–price relationships. We envision that future harvest–grain price relationship studies to a large extent employ tithes [a typically 10% tax levied of the harvest; Kain (1979)] as estimates of harvest size. The challenges are considerable, however, as the extent to which the long-term tithe trends actually represent productivity changes is uncertain and because tithe series are available for some regions only (e.g. Le Roy Ladurie and Goy 1982; Leijonhufvud 2001; Santiago-Caballero 2014). Another source of actual harvest data is manorial harvest yield records (Slicher van Bath 1963). However, relatively few long such records exist, and they reflect local (estate) scale yields, which are not necessarily representative even at a regional scale (Campbell 2016).

5.5 Climate adaptation of agriculture and the effects of market integration

The impact of climate variability on grain prices is likely mitigated by different adaptation strategies making grain agriculture more resilient to climate fluctuations (Ljungqvist 2017). A growing body of literature has shown how farming, and society at large, in early modern Europe adopted and adjusted to climatic change and variability [for a review, see Ljungqvist et al. (2021)]. Cultivation at various elevations and sites with different soil properties and climate sensitivities along with a growing diversification of grain crops altered climate resilience. The cultivation of different crops, with different climate response, as well as the entire change of crops to cope with long-term climatic changes were potentially successful adaptation strategies practised at different spatio-temporal scales (Ljungqvist et al. 2021). Both wheat and rye were grown in most regions of Central Europe (Landsteiner 2005), with barley taking the role of rye on the British Isles (Campbell 2016), to reduce the risks of harvest failure of one grain crop. Barley and oats were also cultivated, primarily for beer production and animal feed in Central Europe, that in times of scarcity could be an important human food source (Landsteiner 2005). Even in comparably warm regions, such as Ottoman Bosnia, farmers altered practices and changed to barley, oats and spelt, instead of wheat, during the climax of the Little Ice Age (Mrgić 2011). Such adaptation was even applied at the northern edge of grain agriculture, where in present-day Finland autumn-sown rye, which ripens earlier, replaced barley as the main crop during the cold seventeenth century (Huhtamaa and Helama 2017b). Finnish farmers also responded to cold climatic periods by increasing slash-and-burn cultivation in substitution of permanent fields (Huhtamaa and Helama 2017a). Similarly transitions from cold-sensitive wine grapes to cold-tolerating barley for beer production are found in parts of Central Europe during the climax of the Little Ice Age (Landsteiner 1999).

The storage and trade of seed corn were important to reduce the impacts of adverse climate conditions on grain production and prices (Krämer 2015). The lack of grain seeds after years of unfavourable climatic conditions constrained harvest yields for one to two more years in regions with low market integration (Hoskins 1964, 1968; Appleby 1979; Bekar 2019). This problem lessened in many European regions throughout the early modern period, although it persisted in marginal fringe areas with a low market integration. However, storage facilities such as public grain magazines could provide a safer access to seed corn, as well as dampen the price shocks of grain, after poor harvests (Alfani and Ó Gráda 2017). Grain magazines became increasingly common during the eighteenth century (Collet 2010) even in marginal regions such as Norway (Hansen 2015). The access to, and price of, grain and other commodities were negatively affected during cold periods, when yields decreased in larger regions and over longer periods, also by frozen water bodies that hampered shipping and land transport (Krämer 2015). This was such a major problem for communication and commerce that labour-intensive ice removal was undertaken already in the fourteenth century on waterways in the Low Countries (De Kraker 2017).

Besides climate variability, the development of agricultural technology and labour force was of substantial importance to early modern grain harvest and prices. At a continental scale, this is expressed by the similar grain yield ratios (Slicher van Bath 1963) between western and eastern Europe prior to c. 1570, a similar decrease during the climax of the Little Ice Age (c. 1570–1710) in both regions of Europe, but very different recovery patterns. During the eighteenth century, socio-political and technological differences caused grain yield ratios in western Europe to increase much above their pre-1570 level, whereas this did not occur in eastern Europe (Pei et al. 2016). Similar differences attributable to a range of institutional and technological factors supported a higher productivity, and lower climate sensitivity, of English compared to French grain agriculture during the eighteenth century (Michaelowa 2001; Brunt 2015). Mixed farming methods, improvement of the soil quality, along with stronger market incentives also increased English yields earlier than at most other places in Europe (Tello et al. 2017). To assess the decreasing climate sensitivity of grain agriculture, due to institutional and technological advances, actual harvest yield data rather than price data need to be considered in future studies. Moreover, it would be practically impossible to statistically assess influences of agricultural adaptation to climatic change in our grain price data as the time periods considered then would be too short to reach statistical significance given the relatively low climate–price correlations (see, however, Esper et al. 2017).

Socio-political and technological factors explain most of the decreasing grain price volatility, and increasing price convergence, through an improved market integration towards the end of the early modern period. However, it is possible that climatic change could have played a small part as well. Periods with extremely cold years, causing more frequent adverse growth conditions in large portions of Europe, would supposedly have contributed to a higher grain price volatility. Furthermore, locations towards the north, and at higher elevations, would be the regions most affected by periods with more frequent exceptionally cold years (or growing seasons). Consequently, the grain harvests would be affected to various extents in different parts of Europe, which theoretically could contribute to a decreased price convergence over the continent. Several scholars, most notably Bateman (2011, 2015), have found about as high a degree of European grain market integration in the first half of the sixteenth century as in the second half of the eighteenth century, but a much reduced grain market integration during much of the intervening period. This period of market decoupling—the late sixteenth century and the seventeenth century—coincides with the climax of the Little Ice Age. However, correlation does not equate causation, and we support the consensus view that socio-political factors, mainly frequent and large-scale warfare, explain most of the market contraction. We believe the question of a possible climatic contribution to this grain market decoupling can be tested empirically in future research by analysing both grain yield data and grain price data together with palaeoclimate data and early meteorological measurements.

5.6 Comparison with previous findings

The existence of a climate influence on grain prices in early modern Europe is well established for inter-annual timescales, but has been a matter of debate for longer timescales (see Sect. 2.1). However, Esper et al. (2017) demonstrated the presence of a significant temperature effect on grain prices also at multi-decadal to centennial timescales. We have found an even stronger, and more significant, temperature–grain price relationship than Esper et al. (2017) by analysing 56 instead of 19 grain price series and employing an updated June–August temperature reconstruction and, in addition, two annual mean temperature reconstructions. Importantly, we find 10-year low-pass filtered data to show stronger correlations and still, despite the reduced degrees of freedom, to be statistically significant, whereas Esper et al. (2017) reported similar correlations to be statistically insignificant. These differences could partly be related to different smoothing techniques, as Esper et al. (2017) use spline smoothing instead of box-car smoothing (Appendix B), though the much increased European grain price network employed here was likely needed to reach significance.

Although temperature has been found to be the most important climate variable for early modern grain prices, numerous studies have also pointed to the significance of drought or excessive precipitation (Sect. 2.1). We only found week, inconsistent, and regionally varying effects of hydroclimate on the grain prices. This is partly at odds with Esper et al. (2017) who detected a negative high-frequency summer drought–grain price relationship. These conflicting findings are presumably related to the fact that we did not study, in particular, high-frequency climate–grain price relationships. The importance of temperature, relative to drought and precipitation, for grain yields and prices clearly increases towards lower frequencies as well as with increasing spatial scale.

We have noted a highly significant \({\sim }\) 5-year and a weakly significant \({\sim }\) 16-year periodicity in the grain price data (Fig. 7). The \({\sim }\) 16-year periodicity corresponds to the original findings by Beveridge (1921) of a 15.3-year cyclicity of early modern grain prices in western and central Europe. More recently, Scott et al. (1998) reported for England a \({\sim }\) 5–6-year and a broader \({\sim }\) 13–16-year oscillation in barley, oats, and wheat prices. Beveridge (1922) linked his 15.3-year cyclicity to periodicities in precipitation, while Scott et al. (1998) emphasised the importance of temperature as well as precipitation for their \({\sim }\) 13–16-year oscillation but found their \({\sim }\) 5–6-year oscillation unrelated to climate. Conversely, we have been unable to detect any significant coherency between grain prices and climate for either the \({\sim }\) 5-year or the \({\sim }\) 16-year periodicities. This absence of coherent periodicities between grain prices and climate (or solar) variability disproves earlier presumptions of a cyclicity. It demonstrates the presence of an episodic instead of a periodic (cyclic) relationship.

6 Conclusions

The importance of direct climate effects, as well as indirect influences of solar variability, for grain price variability in early modern Europe (c. 1500–1800) has been contested issues, with previous scholarship showing partly conflicting results. We have systematically revisited these questions, within a framework of rigid statistical testing, by employing an unprecedentedly large network of 56 grain price series of multi-centennial length, and benefiting from recent advances in palaeoclimatology and solar physics. A highly significant negative grain price–temperature relationship (i.e. colder = high prices and vice versa) is apparent across most of Europe, valid for barley, oats, rye, and wheat. Over the 1500–1788 period, excluding the Thirty Years’ War (1618–1648), the correlation is as strong as r = –0.41 between previous year June–August temperature and the average of all grain price series. This negative correlation increases to r = –0.63 at decadal timescales. Conversely, we found only weak and spatially inconsistent relationships between grain prices and hydroclimate (precipitation and drought). No robust evidence could be detected for the existence of an effect of solar forcing on early modern grain prices.

Considering that summer temperature variability alone, at decadal timescales, explained as much as 40% of the variance in average European grain prices, climate must be considered an important historical agent given that grain prices played such a decisive role in the early modern European economy. Grain price variability was a major driver behind changes in real wage levels and the average standard of living, and periods of high grain prices were frequently triggering malnutrition, crisis, and civil unrest. Our findings therefore demonstrate that temperature variability was an important factor influencing grain price variability, on inter-annual to multi-decadal timescales, across Europe supporting the argument that climate variability played a significant role in human history.

Notes

Throughout this article, climate denotes the average weather conditions over a longer time period and includes both the mean and the variability of this long-term average; climatic change refers to changes in the mean of the climate as well as changes in frequency and magnitude of certain extreme conditions like very cold summers.

Periodic and episodic mean occurring at regular and irregular, respectively, intervals. There is some overlap in the definitions, but in general a periodic time-series will have a well-defined peak in its power spectrum while episodic series will not.

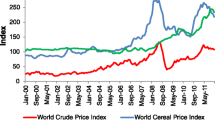

As discussed in Sect. 3.3 and “Appendix 1”, we include the Sun in our analysis, in terms of a potential solar influence on climate, and subsequently via climate on growth conditions for grain prices, but not as a representative of a direct influence on plant growth. Although the solar cycle is linked to variations in the intensity of sunlight the variation is so small (about 0.1–0.2% in visible light) that it most likely has a relatively small effect on growth conditions. The possibility that solar activity influences the climate—e.g. the hydrological cycle via clouds—is among the more likely possibilities that makes the analysis of solar activity, as a potential climate-modulating factor, interesting.