Abstract

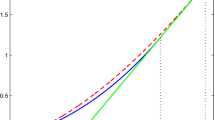

This paper considers the impact of entrepreneurial risk aversion and incompleteness on investment timing and the value of the option to invest. A risk averse entrepreneur faces the irreversible decision of when to pay a cost in order to receive a one-off investment payoff. The uncertainty associated with the investment payoff can be partly offset by hedging, but the remaining unhedgeable risk is idiosyncratic. Nested within our incomplete set-up is the complete model of McDonald and Siegel (Q J Econ 101:707–727, 1986) which assumes investment payoffs are perfectly spanned by traded assets. We find risk aversion and idiosyncratic risk erode option value and lower the investment threshold. Our main finding is that there is a parameter region within which the complete and incomplete models give differing investment signals. In this region, the option is never exercised (and investment never occurs) in the complete model, whereas the entrepreneur exercises the option in the incomplete setting. Strikingly, this parameter region corresponds to a negative implicit dividend yield on the payoff, and so this exercise behavior contrasts with conventional wisdom of Merton (Bell J Econ Manage 4:141–183, 1973) for complete markets. Finally, in this parameter region, increased volatility speeds-up investment and option values are not strictly convex in project value, in sharp contrast to the conclusion of standard real options models.

Similar content being viewed by others

References

Bergman Y.Z., Grundy B.D. and Wiener Z. (1996). General properties of option prices. J. Financ. 51(5): 1573–1610

Berk J.B., Green R.C. and Naik V. (1999). Optimal investment, growth options and security returns. J. Financ. 54: 1553–1607

Brennan M.J. and Schwartz E.S. (1985). Evaluating natural resource investments. J. Bus. 58(2): 135–157

Brock W., Rothschild M. and Stiglitz J. (1989). Stochastic capital theory. In: Feiwel, G. (eds) John Robinson and Modern Economic Theory, pp 591–622. Macmilan, New York

Detemple J. and Sundaresan S. (1999). Nontraded asset valuation with portfolio constraints: a binomial approach. Rev. Financ. Stud. 12: 835–872

Dixit A. and Pindyck R. (1994). Investment Under Uncertainty. Princeton University Press, Princeton

Grenadier S.R. (1999). Information revelation through option exercise. Rev. Financ. Stud. 12(1): 95–129

Henderson, V., Hobson, D.: Horizon unbiased utility functions. Stochas. Process. Appl. doi: 10:1016/j.spa.2007.03.013 (2007)

Hugonnier J. and Morellec E. (2007). Corporate control and real investment in incomplete markets. J. Econ. Dyn. Control 31(5): 1781–1800

Ingersoll J.E. (2006). The subjective and objective evaluation of incentive stock options. J. Bus. 79(2): 453–487

McDonald R. and Siegel D.R. (1986). The value of waiting to invest. Q. J. Econ. 101: 707–727

McKean, H.P.: A free boundary problem for the heat equation arising from a problem in mathematical economics. Industrial Management Review 6, Spring, pp. 32–39. (Appendix to Samuelson (1965)) (1965)

Merton R.C. (1971). Optimum consumption and portfolio rules in a continuous time model. J. Econ. Theory 3: 373–413

Merton R.C. (1973). Theory of rational option pricing. Bell J. Econ. Manage. 4: 141–183

Miao, J., Wang, N.: Investment, consumption and hedging under incomplete markets. J. Financ. Econ. (2006) (to appear)

Myers S.C. (1977). Determinants of corporate borrowing. J. Financ. Econ. 5(2): 147–176

Nicholson S., Danzon P.M. and McCullough J. (2005). Biotech-pharmaceutical alliances as a signal of asset and firm quality. J. Bus. 78(4): 1433–1464

Quigg L. (1993). Empirical testing of real option pricing models. J. Financ. 48(2): 621–640

Samuelson P.A. (1965). Rational theory of warrant pricing. Ind. Manage. Rev. Spring 6: 13–31

Titman S. (1985). Urban land prices under uncertainty. Am. Econ. Rev. 75: 505–514

Author information

Authors and Affiliations

Corresponding author

Additional information

The author thanks George Constantinides, Graham Davis, Jerome Detemple, Avinash Dixit, David Hobson, Stewart Hodges, Bart Lambrecht, Andrew Lyasoff, Robert McDonald, Pierre Mella-Barral, Jianjun Miao, Bob Nau (ES discussant), Gordon Sick, James Smith, Stathis Tompaidis, Elizabeth Whalley and Zvi Wiener for their comments. The author also thanks seminar participants at the University of Texas at Austin (2004), Kings College London, the Cornell Finance Workshop, the Oxford-Princeton Finance Workshop, the BIRS Finance Workshop (2004), the Eighth Annual Real Options conference, the Bachelier Finance Society Third World Congress (2004), Princeton University, Boston University, the Fields Institute Toronto, QMF 2004, Warwick Business School, and the Econometric Society Winter Meetings (2006). First version: July, 2004.

Rights and permissions

About this article

Cite this article

Henderson, V. Valuing the option to invest in an incomplete market. Math Finan Econ 1, 103–128 (2007). https://doi.org/10.1007/s11579-007-0005-z

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11579-007-0005-z