Abstract

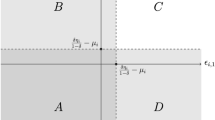

In 2010, the Obama Administration proposed new regulations designed to hold institutions of higher education (IHEs) accountable for student outcomes. I examine the effects of the regulatory uncertainty surrounding these “Gainful Employment” (GE) regulations on enrollment at for-profit IHEs. I utilize informational debt rates of GE institutions along with enrollment data from the integrated postsecondary education data system to employ a difference in difference design that compares enrollment before and after the GE regulatory proposal at for-profit IHEs to enrollment at public and nonprofit IHEs. My results suggest that for-profit IHEs experienced slower enrollment growth relative to public and nonprofit IHEs in the post-GE period. Additionally, enrollment of low-income students appeared to be disproportionately affected by the GE regulatory uncertainty.

Similar content being viewed by others

Notes

Throughout the paper, I also refer to for-profit institutions of higher education as “for-profit colleges” and “for-profit institutions”.

See Protecting Students from Worthless Degrees Act at https://www.congress.gov/bill/114th-congress/senate-bill/1165S.2098; Students Before Profits Act of 2015 at https://www.congress.gov/bill/114th-congress/senate-bill/2098/text; Defense to repayment at https://federalregister.gov/a/2016-14052.

According to the GE Manual, “Debt-to-Earnings Ratios are measures of the average share of the GE Program’s former students’ income that must be used to repay student loan debt incurred by the students for attendance in the GE Program”.

Author’s calculations using GE data merged with data from the Integrated Postsecondary Education Data System. Refer to Table 1.

Programs pass, fail, or are placed in a “zone” based on the metrics. Programs that pass the metrics have a debt to earnings ratio that is less than or equal to 8% of total earnings or less than or equal to 20% of discretionary earnings. Programs are placed in a “zone” if they have a debt to earning ratio that is greater than 8% but less than 12% of annual earnings or greater than 20% but less than 30% of discretionary earnings. Programs with a debt to earnings ratio that exceeds 12% of annual earnings or 30% of discretionary earnings fail the metrics. A program loses eligibility for financial aid if it “fails” for 2 out of 3 consecutive years or if it is placed in the zone for 4 years.

Critics of the 90/10 rule suggests that the rule incentivizes for-profit institutions to raise tuition when federal student aid funding increases. See http://www.finaid.org/loans/90-10-rule.phtml.

Institutional expenditures are explored further in forthcoming paper by author.

Institutions with traditional academic calendars report the enrollment by Oct 15 or the official fall reporting date of the institutions; institutions with 12-month academic calendars report it for students that enrolled anytime between August and October 31.

The number of nonprofit and public institutions decreased in the post GE period, so I am less concerned about my estimated calculation of GE public and nonprofit institutions.

The Department of Education first mentioned “Gainful Employment” in 2009 and anecdotal information from the securities exchange commission suggests that institutions began paying attention to the GE talks in 2010. Therefore, I expect any enrollment response to begin in the fall of 2011.

My full sample excludes institutions missing one or more years of data. Therefore, schools that closed since GE are not included in the sample.

For simplicity, my references to “two-year” include both 2 year and less than 2-year institutions.

Small schools are those schools classified as having fewer than 1000 students in the first Carnegie classification completed in 2005.

Prior to 2008, Pell grant recipients were lumped in with other federal grant aid recipients in the IPEDS. Based on the author’s calculations, grant recipients comprise between 96 to 99% of federal grant aid recipients from 2008 through 2014. Thus, in order to ensure consistency, I use the federal grant aid measure for all my years.

References

Belfield, C. R. (2013). Student loans and repayment rates: The role of for-profit colleges. Research in Higher Education, 54(1), 1–29.

Bender, L. W. (1977). Federal regulation and higher education. Washington, D.C.: American Association for Higher Education.

Bettinger, E. P., Long, B. T., Oreopoulos, P., & Sanbonmatsu, L. (2012). The role of application assistance and information in college decisions: Results from the HandR Block FAFSA experiment. Quarterly Journal of Economics, 127(3), 1205–1242.

Betts, J. (1996). What do students know about Wages? Evidence from a survey of undergraduates. Journal of Human Resources, 31(1), 27–56.

Brown, J. R., & Hoxby, C. M. (Eds.). (2014). How the financial crisis and great recession affected higher education. Chicago: University of Chicago Press.

Carleton, D. (2002). Landmark congressional laws on Education. Connecticut: Greenwood Press.

Cellini, S. R. (2012). For-profit higher education: An assessment of costs and benefits. National Tax Journal, 65(1), 153–180.

Cellini, S. R., & Chaudhary, L. (2014). The labor market returns to a for-profit college education. Economics of Education Review, 43, 125–140.

Cellini, S. R., & Darolia, R. (2017). High costs, low resources, and missing information: explaining student borrowing in the for-profit sector. Annals of the American Academy of Political and Social Science, 671(1), 92–112.

Cellini, S. R., & Goldin, C. (2014). Does federal student aid raise tuition? New evidence on for-profit colleges. American Economic Journal: Economic Policy, 6(4), 174–206.

Christman, D. E. (2000). Multiple realities: Characteristics of loan defaulters at a two-year public institution. Community College Review, 27(4), 16–32.

Cottom, T. M., & Darity, W. A., Jr. (2017). For-profit universities: The shifting landscape of marketized higher education. New York: Springer.

Deming, D. J., Goldin, C., & Katz, L. F. (2012). The for-profit postsecondary school sector: Nimble critters or agile predators? The Journal of Economic Perspectives, 26(1), 139–163.

Dinkelman, T., & Martínez, A. C. (2014). Investing in schooling in Chile: The role of information about financial aid for higher education. Review of Economics and Statistics, 96(2), 244–257.

Dynarski, M. (1994). Who defaults on student loans? Findings from the national postsecondary student aid study. Economics of Education Review, 13(1), 55–68.

Fain, P. (2011). More Selective For-Profits. Inside higher ed. https://www.insidehighered.com/news/2011/11/11/enrollments-tumble-profit-colleges

Federal Register. (2014). Program integrity: Gainful employment; Final Rule 79 Fed. Reg. 64889

Gladieux, L., & Perna, L. (2005). Borrowers who drop out: A neglected aspect of the college student loan trend. National Center report #05-2. California: National Center for Public Policy and Higher Education.

Goodwin, D. (1991). Beyond defaults: Indicators for assessing proprietary school quality. Washington, DC: Department of Education, Office of the Under Secretary.

Greene, L. L. (1989). An economic analysis of student loan default. Educational Evaluation and Policy Analysis, 11(1), 61–68.

Harrast, S. A. (2004). Undergraduate borrowing: A study of debtor students and their ability to retire undergraduate loans. Journal of Student Financial Aid, 34(1), 21–37.

Hentschke, G. C., & Parry, S. C. (2015). Innovation in times of regulatory uncertainty: Responses to the threat of “gainful employment”. Innovative Higher Education, 40(2), 97–109.

Herr, E., & Burt, L. (2005). Predicting student loan default for the University of Texas at Austin. Journal of Student Financial Aid, 35(2), 27–49.

Hossler, D., & Kwon, J. (2015). Does federal financial aid policy influence the institutional aid policies of four-year colleges and universities? An exploratory analysis. Journal of Student Financial Aid, 45(3), 49–64.

Hunter, B., & Gehring, D. D. (2005). The cost of federal legislation on higher education: The hidden tax on tuition. NASPA Journal, 42(4), 478–497.

Karp, G. (2011). For-profit college officials say federal scrutiny could make businesses stronger. Chicago Tribune. Retrieved from: http://articles.chicagotribune.com/2011-06-21/business/ct-biz-0621-bf-private-college-side-20110621_1_devry-university-chamberlain-college-career-education

Knapp, L. G., & Seaks, T. G. (1992). An analysis of the probability of default on federally guaranteed student loans. The Review of Economics and Statistics, 74(3), 404–411.

Long, M. C., Goldhaber, D., & Huntington-Klein, N. (2014). Do completed college majors respond to changes in wages? Economics of Education Review, 49, 1–14.

Looney, A., and Yannelis, C. (2015). A crisis in student loans? How changes in the characteristics of borrowers and in the institutions they attended contributed to rising loan defaults. Brookings Papers on Economic Activity, 1–89. http://www.jstor.org/stable/43752167

Lynch, M., Engle, J., & Cruz, J. L. (2010). Subprime opportunity: The unfulfilled promise of for-profit colleges and universities. Washington, D.C.: Education Trust.

Moore, R. W. (1995). The illusion of convergence: Federal student aid policy in community colleges and proprietary schools. New Directions for Community Colleges, 1995(91), 71–80.

Perlman, D. H. (1977). Self-study report by Roosevelt University on the impact of government programs and the cost of compliance with government regulations for the sloan commission on government and higher education. Illinois: Roosevelt University.

Pfeffer, J., & Salancik, G. R. (1978). The external control of organizations: A resource dependence perspective. New York: Harper and Row.

Pfeffer, J., & Salancik, G. R. (2003). The external control of organizations: A resource dependence perspective. California: Stanford University Press.

Podgursky, M., Ehlert, M., Monroe, R., & Watson, D. (2002). Student loan defaults and enrollment persistence. Journal of Student Financial Aid, 32, 27–42.

Stein, R. H. (1979). Impact of federal intervention on higher education. Research in Higher Education, 10(1), 71–82.

Steiner, M., & Teszler, N. (2003). The characteristics associated with student loan default at Texas AandM University. College Station: Texas Guaranteed in association with Texas AandM University.

U.S. Government Accountability Office (GAO). (2010). For-profit colleges: Undercover testing finds colleges encouraged fraud and engaged in deceptive and questionable marketing practices. GAO-10-948T. Retrieved from: http://www.gao.gov/products/GAO-10-948T

U.S. Senate Health, Education, Labor, and Pensions (HELP) Committee. (2012). For-profit higher education: The failure to safeguard the federal investment and ensure student success. S.PRT.112-37. Retrieved from http://www.help.senate.gov/imo/media/for_profit_report/PartI.pdf

Volkwein, J. F., & Cabrera, A. F. (1998). Who defaults on student loans? The effects of race, class, and gender on borrower behavior. In R. Fossey & M. Bateman (Eds.), Condemning students to debt: College loans and public policy (pp. 105–126). New York: Teachers College Press.

Volkwein, J. F., & Szelest, B. P. (1995). Individual and campus characteristics associated with student loan default. Research in Higher Education, 36, 41–72.

Wilms, W. W., Moore, R. W., & Bolus, R. E. (1987). Whose fault is default? A study of the impact of student characteristics and institutional practices on guaranteed student loan default rates in California. Educational Evaluation and Policy Analysis, 9(1), 41–54.

Wiswall, M., & Zafar, B. (2015). How do college students respond to public information about earnings? Journal of Human Capital, 9(2), 117–169.

Wong, A. (2015). Dollar signs in uniform: Why for-profit colleges target veterans. The Atlantic: Retrieved from https://www.theatlantic.com/education/archive/2015/06/for-profit-college-veterans-loophole/396731/

Woo, J. H. (2002a). Clearing accounts: The causes of student loan default. Rancho Cordova: EdFund.

Woo, J. H. (2002b). Factors affecting the probability of default: Student loans in California. Journal of Student Financial Aid, 32(2), 5–23.

Author information

Authors and Affiliations

Corresponding author

Additional information

The views expressed herein are those of the author and are not presented as those of the Congressional Research Service or the Library of Congress.

Rights and permissions

About this article

Cite this article

Fountain, J.H. The Effect of the Gainful Employment Regulatory Uncertainty on Student Enrollment at For-Profit Institutions of Higher Education. Res High Educ 60, 1065–1089 (2019). https://doi.org/10.1007/s11162-018-9533-z

Received:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11162-018-9533-z