Abstract

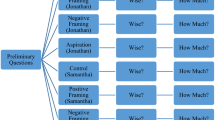

Evidence from behavioral economics suggests that the framing and labeling of choices affect financial decisions. Through a randomized control trial of over six thousand high school seniors, community college students, and adults without a college degree, we identify the existence of both framing and labeling effects in respondents’ preferences for borrowing for postsecondary education. How financially equivalent contracts are framed alters the preferences of high school and community college students. Furthermore, simply labeling a contract a “loan” reduces the likelihood of selecting that option by 8–11 percentage points among those samples. These effects are more pronounced among Black high school respondents and Hispanic high school and community college respondents who are both twice as likely as White respondents to avoid the loan option when it is labeled a “loan.” Finally, we provide suggestive evidence that this labeling effect is driven by more risk averse respondents. Our findings imply that the federal government, states, and institutions should be attentive to the language used when offering and explaining financial aid packages for higher education.

Similar content being viewed by others

Notes

The survey used two forms to reduce the time burden on completion, and the risk measure was only included on one form of the survey. Survey forms were randomly assigned to respondents.

Results are robust to the inclusion of all respondents and ignoring the covariates for which we have missing values.

The sample size is notably smaller for this analysis because only half of the respondents were asked to complete our risk aversion measure, and there are missing values due to a subset of respondents skipping this question.

However, there is already substantial variation in the terms used for labeling unsubsidized loans in institutional financial aid award letters. A recent report from New America and uAspire (2018) found 136 unique terms describing unsubsidized loans across 455 colleges' award letters, and 24 did not even use the word “loan.”

References

Abraham, K. G., Filiz-Ozbay, E., Ozbay, E. Y., & Turner, L. J. (2018). Framing effects, earnings expectations, and the design of student loan repayment schemes. NBER Working Paper No. 24484.

Addo, F., Houle, J., & Simon, D. (2016). Young, black and (still) in the red: Parental wealth, race and student loan debt. Race and Social Problems, 8, 64–76.

Avery, C., & Hoxby, C. M. (2004). Do and should financial aid packages affect students’ college choices? In C. Avery & C. M. Hoxby College choices: The economics of where to go, when to go, and how to pay for it (pp. 239–299).

Avery, C., & Turner, S. (2012). Student loans: Do college students borrow too much or not enough? Journal of Economic Perspectives, 26(1), 165–192.

Banks, S., Salovey, P., Greener, S., Rothman, A., Moyer, A., Beauvais, J., et al. (1995). The effects of message framing on mammography utilization. Healthy Psychology, 14(2), 178–184.

Boatman, A., Evans, B., Soliz, A. (2014). Applying the lessons of behavioral economics to improve the federal student loan programs: Six policy recommendations. Lumina Foundation.

Boatman, A., Evans, B., & Soliz, A. (2017). Understanding loan aversion in education: Evidence from high school seniors, community college students, and adults. AERA Open, 3(1), 1–16.

Caetano, G., Palacios, M., & Patrinos, H. A. (2011). Measuring aversion to debt: An experiment among student loan candidates. World Bank Working Paper.

Callender, C., & Jackson, J. (2005). Does the fear of debt deter students from higher education? Journal of Social Policy, 34, 509–540.

Carnevale, A. P., Rose, S. J., & Cheah, B. (2011). The college payoff: Education, occupations, lifetime earnings. Washington, DC: Georgetown University Center on Education and the Workforce.

College Board. (2015a). Trends in college pricing. New York: College Board.

College Board. (2015b). Trends in student aid. New York: College Board.

Conley, D. (1999). Being black, living in the red: Race, wealth and social policy in America. Berkeley: University of California Press.

Conley, D. (2001). Capital for college: Parental assets and postsecondary schooling. Sociology of Education, 74(1), 59–72.

Cooper, M. J., Gulen, H., & Rau, P. R. (2005). Changing names with style: Mutual fund name changes and their effects on fund flows. Journal of Finance, 60, 2825–2858.

Cunningham, A., & Santiago, D. (2008). Student aversion to borrowing: Who borrows and who doesn’t. Washington, DC: Institute for Higher Education Policy.

Delisle, J. (2017). Student and parent perspectives on higher education financing: Findings from a nationally representative survey on income-share agreements. Washington, DC: American Enterprise Institute.

Douglas-Gabriel, D. (2015). Investors buying shares in college students: Is this the wave of the future? Purdue University thinks so. Washington Post.

Eckel, C. C., & Grossman, P. J. (2008). Forecasting risk attitudes: An experimental study using actual and forecast gamble choices. Journal of Economic Behavior & Organization, 68, 1–17.

ECMC Group Foundation. (2003). Cultural barriers to incurring debt: An exploration of borrowing and impact on access to postsecondary education. Caliber Associates.

Epley, N., Mak, D., & Idson, L. (2006). Bonus or rebate? The Impact of income framing on spending and saving. Journal of Behavioral Decision Making, 19(3), 213–227.

Fellner, G., & Maciejovsky, B. (2007). Risk attitude and market behavior: Evidence from experimental asset markets. Journal of Economic Psychology, 28(1), 338–350.

Field, E. (2009). Educational debt burden and career choice: Evidence from a financial aid experiment at NYU Law school. American Economic Journal: Applied Economics, 1, 1–21.

Goldrick-Rab, S., & Kelchen, R. (2013). Making sense of loan aversion: Evidence from Wisconsin. Paper prepared for the University of Michigan Conference on Student Loans.

Grodsky, E., & Jones, M. (2007). Real and imagined barriers to college entry: Perceptions of cost. Social Science Research, 36, 745–766.

Hillman, N. W. (2015). Borrowing and repaying student loans. Journal of Student Financial Aid, 45(3), Article 5.

Johnson, E., Hershey, J., Meszaros, J., & Kunreuther, H. (1993). Framing, probability distortions, and insurance decisions. Journal of Risk and Uncertainty, 7, 35–51.

Kane, T. J., & Rouse, C. E. (1995). Labor-market returns to two- and four-year college. American Economic Review, 85, 600–614.

Keller, P., Lipkus, I., & Rimer, B. (2003). Affect, framing and persuasion. Journal of Marketing Research, 40, 54–64.

Keller, C., & Siegrist, M. (2006). Investing in stocks: The influence of financial risk attitude and values-related money and stock market attitudes. Journal of Economic Psychology, 27(1), 285–303.

Koppell, J. G., & Steen, J. A. (2004). The effects of ballot position on election outcomes. The Journal of Politics, 66, 267–281.

Krosnick, J. A., & Alwin, D. F. (1987). An evaluation of a cognitive theory of response-order effects in survey measurement. Public Opinion Quarterly, 51, 201–219.

Loewenstein, G. (1988). Frames of mind in intertemporal choice. Management Science, 34, 200–214.

Loewenstein, G., & Prelec, D. (1992). Anomalies in intertemporal choice: Evidence and an interpretation. Quarterly Journal of Economic, 107, 573–597.

Marcus, J. (2016). Student’s futures as investments: The promise and challenges of income-share agreements. Washington, DC: American Enterprise Institute.

Marx, B. M. & Turner, L. J. (2017). Borrowing trouble? Human capital investment with opt-in costs and implications for the effectiveness of grant aid. Working paper.

Monks, J. (2009). The impact of merit-based financial aid on college enrollment: A field experiment. Economics of Education Review, 28, 99–106.

Mullainathan, S., Schwartzstein, J., & Shleifer, A. (2008). Coarse thinking and persuasion. Quarterly Journal of Economics, 123, 577–619.

National Center for Education Statistics (NCES). (2015). The condition of education 2015. Washington, DC: U.S. Department of Education.

National Center for Education Statistics (NCES). (2016). The condition of education 2016. Washington, DC: U.S. Department of Education.

New American & uAspire. (2018). Decoding the cost of college: The case for transparent financial aid award letters. Washington, DC.

Palacious, M., DeSorrento, T., & Kelly, A. P. (2014). Investing in value, sharing risk: Financing higher education through income share agreements. Washington, DC: American Enterprise Institute.

Palameta, B., & Voyer, J. (2010). Willingness to pay for postsecondary education among under-represented groups. Toronto: Higher Education Quality Council of Ontario.

Pew Research Center. (2014). The rising cost of not going to college. Washington, DC: Pew Research Center.

Sabater-Grande, G., & Georgantzis, N. (2002). Accounting for risk aversion in preated prisoners’ dilemma games: An experimental test. Journal of Economic Behavior & Organization, 48(1), 37–50.

Tversky, A., & Kahneman, D. (1981). The framing of decisions and the psychology of choice. Science, 211(4481), 453–458.

Vedder, R. (2015). Income share agreements, and their role in making higher education more affordable. Forbes.

Warneryd, K. E. (1996). Risk attitudes and risky behavior. Journal of Economic Psychology, 17(1), 749–770.

Acknowledgements

We thank the Lumina Foundation for their financial support. We also thank Miguel Palacios for his prior research on this topic and his useful insights on our analysis. The views contained herein are not necessarily those of the Lumina Foundation. All errors, omissions, and conclusions are our own.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Evans, B.J., Boatman, A. & Soliz, A. Framing and Labeling Effects in Preferences for Borrowing for College: An Experimental Analysis. Res High Educ 60, 438–457 (2019). https://doi.org/10.1007/s11162-018-9518-y

Received:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11162-018-9518-y