Abstract

This study examines the disclosure behavior of rival firms identified by an initial public offering (IPO) candidate in its registration statement. We hypothesize that identified rivals have incentives to preempt the competitive effects of the IPO and do so by disclosing more positive information during the IPO quiet period when the IPO candidate faces communication restrictions. We find that the tone of disclosures by identified rivals becomes more positive during the quiet period, and reverses after the quiet period. We also find that identified rivals initiate highly positive press releases about their product market condition during the quiet period, with the tone reversal being mainly driven by identified rivals experiencing their competitor’s IPO withdrawal. Together, these results suggest that identified rivals’ concerns over product market competition drive their strategic disclosure behavior. Further evidence indicates that this behavior hurts the IPO candidate and benefits the identified rivals. Thus, while protecting investors and facilitating market efficiency, this quiet period regulation can become an opportunity for industry rivals to influence the IPO process and market competition.

Similar content being viewed by others

1 Introduction

Becoming a public company brings various financial and non-financial benefits to a firm, such as access to capital, increased public awareness, enhanced attractiveness for talent, and improved contracting efficiency. Fueled by these advantages, an IPO firm can grab market share from its rivals. An extensive prior literature analyzes how established industry rivals are negatively affected by a new issuance, and how IPO candidates reshape the competitive environment of the whole industry (e.g., Chemmanur and He 2011; Hsu et al. 2010). In that context, firms pursuing an initial public offering (IPO) often identify industry rivals (identified rivals) in their IPO registration statement. There is, however, little evidence on whether and how industry rivals strategically respond to the IPO filing. Hence, in this study, we examine whether identified rivals strategically release more positive information during the quiet period that follows the release of the IPO registration statement to preempt the competitive effects arising from a competitor’s IPO, thus taking advantage of the IPO firm’s inability to reply.

During the quiet period, the IPO firm and its affiliated analysts are prohibited from offering opinions or forward-looking statements about the firm’s prospects.Footnote 1 The goal of the quiet period is to prevent any communication that would hype the stock price, thus precluding the market from establishing its fair value.Footnote 2 Considered as a gag order imposed by the US Securities and Exchange Commission (SEC) on the IPO candidate’s communication activities, the quiet period rule takes effect once the firm files its registration statement, and the order remains effective up until 40 days after the IPO offering date.Footnote 3 While protecting investors from the uncertainty arising from the information asymmetry related to an IPO, the quiet period rule creates an “information seesaw,” a period during which incumbent firms that are already publicly listed can communicate to the market information that suits their interests. By contrast, an IPO firm must remain silent even when facing negative publicity.Footnote 4

We predict that identified rivals benefit from a product-market standpoint if they strategically disclose more positive information during the quiet period of a competitor that is planning an IPO. Prior research finds that investors in a firm give more weight to peer disclosure, especially in the year following an initial capital issuance. Since firm disclosure is relatively lacking and less reliable during that period (Shroff et al. 2017), peer disclosure provides a benchmark and a richer context for investors to interpret it (Baranchuk and Rebello 2018; Roychowdhury et al. 2019; Zhang 2018). By releasing good news during the quiet period, identified rivals strategically reveal to the market that the IPO firm faces fierce competition, thus injecting additional uncertainty into the IPO process. Identified rivals’ disclosure further undermines the survival profile of the issuer and dampens investors’ interests and expectations, all of which contribute to preempting the competitive effects of the IPO firm.

Our predictions notwithstanding, identified rivals may not adjust their disclosures to affect an IPO candidate. Because of proprietary costs, it is not clear ex ante whether any strategic benefits outweigh the costs of disclosing information to influence the success of an IPO. For instance, as identified rivals release more positive information concerning their product development and future investment plans, they may leak proprietary information to other industry peers. Furthermore, while identified rivals may strategically release more positive information during the IPO quiet period, at some point in the future, the tone of the information will reverse back to normal since they must disclose the less positive news that were withheld during the quiet period. In this regard, Kothari et al. (2009b) show that firms withholding bad news ultimately experience a negative stock price reaction of much greater magnitude than the positive stock price reaction initially generated from their good news disclosures. It is not obvious whether identified rivals are willing to make this trade-off.Footnote 5

Although most IPO firms strictly follow the quiet period regulation for fear of jumping the gun and getting punished, there is some evidence (Cedergren 2014) as well as anecdotal cases which suggest that some firms are willing to violate the regulation to convey information, especially forward-looking information, to a wider public.Footnote 6 Therefore, it is not guaranteed that identified rivals can successfully exploit the externalities of their strategic disclosures without any response from the IPO candidates. Hence, we consider that whether identified rivals strategically adjust their disclosure behavior during the quiet period is an empirical question.

To test our hypothesis, we examine press releases issued by identified rivals. There are several advantages to using press releases as a measure of voluntary disclosure. Compared to other forms of corporate disclosure, press releases cover a broad range of topics and provide a channel for firms to convey information in a more timely and comprehensive manner. More importantly, press releases are typically less regulated than official SEC filings. Therefore, firms have considerable latitude over the content, timing, and language to describe their business based on their own strategic preferences (Ahern and Sosyura 2014; Cedergren 2014; Dyck and Zingales 2003; Kim et al. 2018). Furthermore, the flexibility and comprehensiveness afforded by this disclosure channel allow us to capture and measure shifts in disclosure tone arising from changes in a firm’s strategic goals (Burks et al. 2018).

Focusing on a set of US IPOs taking place between 2001 and 2017, our initial tests compare the disclosure behavior of identified rivals to a control sample of non-identified industry peers matched through entropy balancing. Consistent with our hypothesis, we find that the typical press release initiated by identified rivals is more positive in tone during the IPO quiet period relative to a press release issued in the pre-quiet period, with the tone reversing back to the pre-quiet period level in the post-quiet period. Next, we explore whether identified rivals make strategic responses out of the concern for increased product market competition. Utilizing Factiva’s subject classification scheme, we specifically select press releases tagged as “product,” “contract,” or “marketing” in the news subject (NS) section, as these are most related to a firm’s product market incentive.Footnote 7 We find that identified rivals initiate highly positive press releases about their product market condition during the IPO quiet period compared to the pre-quiet period. Furthermore, the tone reverses in the post-quiet period.

This result is consistent with the hypothesis that the disclosures of identified rivals are strategic in nature, reflecting identified rivals’ incentives in preempting the IPO firm in the product market competition. Cross-sectional tests suggest that the tone reversal is mainly driven by identified rivals reacting to their competitor’s IPO withdrawal, a result consistent with identified rivals feeling less threatened and then normalizing their tone after the IPO firm announces its withdrawal from the IPO process.To further rule out the possibility that the results are driven by some economy-wide factors, we decompose each press release into content as related to industry competition or macro economy. Our results show that identified rivals use more positive language in describing their competitiveness within the industry during the IPO quiet period. However, this relation is not pronounced for news content on macro economy, which reinforces the product market incentive hypothesis.

We then examine whether the strategic changes in disclosure cause disruptions to the IPO process, i.e., have real implications. Overall, firms are more likely to withdraw from an IPO process when disclosures initiated by the identified rivals become more positive during the quiet period. Hence, identified rivals’ positive disclosures do reduce the appeal of an IPO firm.

Finally, we consider how identified rivals benefit from their strategic disclosure activities. Using pairwise product fluidity to proxy for product market threat from the IPO firm, we find that as the tone of identified rivals’ press releases gets more positive during the quiet period, the product market threat from the IPO firm becomes less intense. This effect does not exist for non-identified control firms. On the one hand, this result confirms our assumption that firms not identified as direct rivals by the IPO firm are not necessarily affected by the IPO case, and that is the reason their disclosure behavior is less likely to reduce the competitive threat from the IPO firm. On the other hand, this result is consistent with the argument that identified rivals have incentives to adjust the tone of their disclosures to preempt the product market competition in the first place.

This study contributes to several streams of literature. First, it builds on the strategic disclosure literature. Studies in this area show that firms alter their disclosure if doing so negatively affects other peer firms and helps the disclosing firms gain strategic benefits (Ahern and Sosyura 2014; Aobdia and Cheng 2018; Kim et al. 2018). This study extends this literature by introducing a strategic benefit for rival firms related to disclosing information during the IPO quiet period, namely, to preempt the IPO’s competitive effects.

Second, this paper also relates to research on information externalities. Starting from Lang and Stulz (1992), studies in this area usually revolve around disclosures arising from bankruptcy announcements and earnings releases (Cazier et al. 2020; Eshleman and Guo 2014; Pandit et al. 2011) or restatements (Durnev and Mangen 2009; Gleason et al. 2008). Deeming these disclosures to be exogenous, the research focus is on their impact on the stock market performance and operating decisions of other peer firms. More recently, some studies take an opposite approach. They do not assume that firms’ disclosure decisions are exogenous; rather, they show that some disclosure decisions are made with the intention to take advantage of the externalities of these disclosure activities to gain strategic benefits (Aobdia and Cheng 2018; Kim et al. 2018). This study adds to this stream of literature by investigating how rival firms strategically exploit the externalities of their positive disclosure during the quiet period to affect the IPO process and post-IPO competition.

Finally, this paper also contributes to the emerging debate on the merits of the IPO quiet period rule. Despite it being in force for decades, there is scant research on its effectiveness and its implications (Bradley et al. 2003, 2004; Cedergren 2014). The SEC initially imposed this rule to ensure that investors’ valuation of the IPO firm is not affected by biased information from the firm and that potential investors can equally access all material information. In the wake of a few high-profile cases, practitioners and even some regulators have begun to question its desirability, arguing it can create even greater information asymmetry between institutional and retail investors.Footnote 8 By showing that identified rivals modify their disclosures during the IPO quiet period to forestall the competitive effects from the IPO firms, our paper reveals a previously undocumented and unintended consequence of the quiet period rule.

The remainder of this paper proceeds as follows. Section 2 presents our setting and develops hypotheses. Section 3 describes the dataset and the research design. Section 4 reports empirical tests and the results. Section 5 discusses an alternative explanation and presents the additional analysis. Section 6 concludes.

2 Research setting and hypothesis development

2.1 Research setting

The goal of this study is to investigate how industry rivals strategically preempt the competitive effects of their peer’s IPO by adjusting their disclosure practices during its quiet period. We consider that an IPO firm is most vulnerable to information released by industry rivals during that period since it provides them with strong incentives and opportunities to change their disclosure behavior to gain strategic benefits. This setting does offer several desirable features for our purpose.

First, the quiet period creates an information seesaw between an IPO firm and its rivals. IPO firms are restrained in expressing positive comments during this period (Cedergren 2014), whereas rivals that are publicly traded are free to communicate whatever information that can put them in a better light. According to the SEC communication rules, IPO firms can continue to disclose “regularly released factual business and forward-looking information” during the quiet period.Footnote 9 However, for a private company that does not conduct regular public communication activities before its initial S-1 filing, any incidental information release, especially forward-looking information after its S-1 filing, is likely to be under heightened SEC scrutiny. The fact that the SEC does not precisely define what types of communications are barred or allowed implies that the quiet period rules themselves are subject to interpretation. On top of that, a few high-profile gun-jumping cases highlight the serious consequences of violating the rules.Footnote 10 In practice, firms going public tend to err on the side of caution and refrain from making too many comments, even if they’re in a predicament from negative media coverage.Footnote 11

Second, when an IPO firm files S-1 with the SEC, it must disclose information related to its competition in the Competition section. In this section, the IPO firm specifically identifies which industry rivals are currently competing with the firm. This feature allows us to extract the names of these identified rivals and substantiate their competing relations with the IPO firm. These rivals have the strongest incentives to take measures to preempt the competitive effects from the IPO.

Third, identified rivals may have been aware of the existence of an IPO firm for some time. However, the filing date of the IPO firm’s initial registration statement (or the start of the IPO quiet period) is when the investment community first knows about the direct competing relationship between the identified rivals and the IPO firm. Moreover, such a date is largely independent of identified rivals’ control. Investors’ knowledge of the IPO firm’s potential competitive threat to its identified rivals is likely to incentivize these rivals to strategically disclose information to influence investors’ perceptions and further affect the IPO’s success. Therefore, non-IPO related factors are less likely to drive any change in identified rivals’ disclosure behavior from before the S-1 filing date to after that date.

However, firms in the same industry may file a registration statement (S-1) and announce their attempt to list their stocks concurrently, which implies that the competitive effects of one IPO case are likely confounded by other concurrent industry IPOs. Hence, in line with Hsu et al. (2010), we adopt a selection approach and we identify the largest IPO (i.e., offering amount) per industry and year,Footnote 12 thus minimizing the confounding effects from other same industry IPOs. Since large IPOs usually attract significant media attention, being labeled as identified rivals does put these firms under the limelight. Hence, they are more likely to be compared with the IPO firm during the entire IPO process, thus providing them with incentives to strategically respond to the IPO effects during the quiet period.

2.2 Hypothesis development

Prior evidence suggests that firms can use strategic disclosures to derail competitors’ plans. For instance, managers can issue significantly more positive or negative news to manipulate a bidder or a target’s stock price and then the cost of the deal during merger negotiation periods (Ahern and Sosyura 2014; Kim et al. 2018). A firm can also hurt rivals’ product market competition by releasing more positive news during those rivals’ labor renegotiations (Aobdia and Cheng 2018). Sometimes, managers are even willing to issue more negative news to deter new entrants (Burks et al. 2018).

In a similar way, since a public listing in the stock market brings competitive advantages to the IPO candidates and the opposite outcomes to the industry incumbents (Hsu et al. 2010), identified rivals have a strong incentive to preempt the competitive threat from an IPO candidate. The quiet period offers identified rivals an opportunity to use strategic disclosures to undermine a firm’s IPO plans since they are not bound by the quiet period rule. As disclosing information is not without costs for industry rivals (Botosan and Stanford 2005; Verrecchia and Weber 2006), it is highly conceivable that identified rivals will adopt the most cost-effective approach to release information strategically to deal with the intensifying competition. Moreover, their competing relationship has never been so salient and informative to the whole investment community, which relies on the information from the most comparable firms to evaluate the worth of the IPO firm. Indeed, prior literature documents that investment firms tend to choose comparable firms based on peer firms identified in the IPO registration statement as the direct competitors of the IPO firm (Kim and Ritter 1999). Thus, if identified rivals intend to preempt the competitive effects of the largest IPOs (Hsu et al. 2010; Spiegel and Tookes 2020), one should expect to see a significant increase in the positivity of tone of the identified rivals’ communications, such as their press releases, during the IPO quiet period.

It is also possible that identified rivals could release significantly negative disclosures with the aim of influencing investors’ perception of industry prospects and discouraging their enthusiasm for the new issuance (Billett et al. 2020). However, we think this effect is not dominant for the following reasons. By focusing on the largest IPOs within an industry rather than pooling IPOs at the industry level (and thus including many small firms), we consider that the influence on rivals’ disclosure behavior is less likely due to the negative industry-wide trends. Furthermore, as documented by Spiegel and Tookes (2020), while some large IPOs may pose a competitive threat to other industry incumbents, most small IPO cases are driven by industry-wide trends of product commoditization that drive down profit. It could be the case that the industry-wide product commoditization drives more IPO attempts within the industry, as well as the rivals’ declining earnings performance and then strategic disclosure behavior. However, our focus on the most influential IPO cases and their competitive relationships with identified rivals helps rule out this prediction. Therefore, we make our first prediction as follows:

H1

The disclosure tone of press releases initiated by identified rivals becomes more positive during the IPO quiet period compared to control firms.

Next, we investigate identified rivals’ product market incentives behind their disclosure activities. A public offering recapitalizes the issuing firm, lowers its leverage, and provides it with more financial flexibility. Using this equity capital on product marketing or research and development, IPO firms can expand their productive capacity, enhance their product heterogeneity, and capture larger market shares in the future (Spiegel and Tookes 2020). Therefore, a major IPO could intensify the product market competition between the identified rivals and the IPO firm, as well as facilitate the product commoditization within the whole industry. These outcomes incentivize the identified rivals to differentiate their product from industry peers and to show better growth prospects through their product market related press releases. We label this as a “product market incentive.” To investigate such motivation, we analyze the content of these rival firms’ press releases as it reveals the disclosing firms’ incentives (Burks et al. 2018). We hypothesize the incentives for identified rivals as follows:

H2

The disclosure tone of product market related information becomes more positive during the IPO quiet period to enable identified rivals to differentiate themselves from others and enhance market perceptions about their product market competitiveness position.

Research on intra-industry information diffusion provides evidence that rival firms’ disclosures contain information about the economic conditions of other firms (Gleason et al. 2008; Lang and Stulz 1992; Roychowdhury et al. 2019). Not only do managers of the other firms learn from their rivals’ disclosures and adjust their own investment decisions (Durnev and Mangen 2020), but investors also keep track of these rival firms’ disclosed information and react accordingly (Baranchuk and Rebello 2018; Thomas and Zhang 2008). The issue of information asymmetry in the capital-raising process is well documented in early research (Benveniste and Spindt 1989; Myers and Majluf 1984; Rock 1986). However, the quiet period provides investors with incentives to compare the IPO firm with other publicly traded incumbents, especially those that are directly competing with the IPO firm, to get perspectives about whether the IPO candidate is going to perform well in the future and whether they should invest in the public offering.

By initiating more positive disclosures, identified rivals convey the message to the market that they are doing well in the product market sphere. Hence, identified rivals’ strategic disclosures during the IPO quiet period suggest to the market that the IPO firm may face intense competition from its direct rivals. And this message is likely to raise investors’ doubts about the IPO firm’s future profitability and success, resulting in a higher likelihood of disruptions to the IPO process. Besides, if identified rivals’ incentive to change their disclosure is to enhance their product market competition, one is likely to observe a negative relationship between the strategic changes in disclosure tone and the product market threat from the IPO firm after the IPO quiet period. Thus, we test the following hypothesis:

H3a

The positive changes in identified rivals’ disclosure tone during the quiet period increase the likelihood of disruption to the IPO process.

H3b

The positive changes in identified rivals’ disclosure tone during the quiet period reduce the competitive threat from the IPO firm in the post-quiet period.

3 Data and research design

3.1 The IPO data

We obtain an initial sample of IPOs from the SDC Platinum (now Thomson/Refinitiv). Some key data used in this study, such as the filing date, withdrawal date, or offering amount, are corrected and augmented with data from the Nasdaq website, EDGAR, and credible news agencies such as Reuters and Business Wire. The start year of our IPO sample is 2001 because press releases published before the year 2000 are incomplete on Factiva. In order to include every press release issued by the identified rivals and control firms around the initial IPO registration date, we begin the sample in 2001. We end the sample period in 2017 to ensure that data for post-IPO quiet period are available for some recent IPO cases. We first follow the IPO sample selection criteria applied in Boone et al. (2016),Footnote 13 and collect a total of 1612 IPO events. We further exclude IPOs in the financial and utility industries due to their special features in regulated industries.Footnote 14

It is worth noting that firms can make several IPO registration statements before they finally go public. Some firms may choose to abort their IPO plan before they file a registration statement again several years later, but their registration statement, especially their description of the firm’s current industry competition, remains largely unchanged in most IPO cases. This feature has several implications. It first implies that investors could already know about an IPO event and its impact on its identified rivals if this is not the IPO firm’s very first public listing attempt. Identified rivals should feel less incentivized to take strategic actions to preempt the IPO’s competitive effects if they sense that their competing relationship is already known to investors, and investors are very likely to have more information and thus rely less on peer information to assess the value of the IPO firm for later public listing attempts. It could also be the case that identified rivals make strategic disclosures way before the quiet period of the second public listing attempt if they sense that the IPO firm will not give up their public listing decision, making it difficult for us to pin down the starting point and then capture the total effect of disclosure changes. Additionally, this feature also suggests that it is possible that the pre-quiet period of the second IPO attempt could be confounded by the post-quiet period of the first IPO attempt if the two are in proximity. Therefore, to provide a clean setting and to effectively capture the changes in rivals’ disclosure behavior, we examine the identified rivals’ strategic disclosure behavior around the IPO firm’s initial public listing attempt. This restriction, coupled with the criteria of non-missing data for the initial registration and withdrawal announcement, further reduces the sample size to 1135 IPO events.

Private firms in the same industry may choose to enter the IPO process simultaneously or in proximity to take advantage of a favorable market condition. To study the changes in rival firms’ disclosure behavior around an IPO event means that we need to compare these firms’ disclosure behavior from treatment period to control period. The fact that other same-industry IPOs may occur in either treatment or control periods and can then affect the rival firms’ behavior makes it crucial to identify IPOs with the lowest likelihood of other IPOs contaminating the results. Therefore, we follow Hsu et al. (2010)’s “largest IPO volume” approachFootnote 15; there are 285 IPO events that satisfy this identification approach. Table 1 Panel A outlines the sample selection procedure for IPO events in detail. Table 1 Panel B provides the year composition of IPO sample and the yearly distribution of identified rivals’ disclosure tone. Table 1 Panel C shows the industry composition of IPO sample. Except for years immediately after the financial crisis, the IPO sample is pretty much evenly distributed across all sample years. Consistent with other IPO studies, technology, life science, and trade and services firms account for most IPOs.

To examine identified rivals’ disclosure behavior around the IPO quiet period, we first need to define the cut-off dates. Based on SEC guidelines, the quiet period begins when the initial registration statement is made effective and lasts for 40 days after the stock begins trading. However, that 40-day post-offering quiet period is hardly “quiet” anymore, because it is difficult for the SEC to punish non-compliance once the firm becomes public, but that is not the case with the pre-offering quiet period. Not only is the SEC more vigilant to an IPO firm’s information release prior to the offering date, but the agency also has the power to enforce the communication rules and punish any non-compliance through delaying or even derailing the public offering. Indeed, prior research shows that there is a significant variation in the degree of IPO candidates’ compliance with the quiet period rule after the offering date. A number of firms do release earnings announcements or even hold conference calls during this post-offering quiet period, and these firms are found to obtain more analyst coverage (Cedergren 2014). The lack of SEC enforcement on post-offering violations emboldens some IPO candidates to break the “quietness.” Therefore, to provide a clean setting in which the IPO firms are strictly regulated in their information dissemination and thus creating opportunities for identified rivals to exploit this constraint, in this study we focus on the pre-offering quiet period, which starts from the date when a company first files a registration statement (S-1) with the SEC and ends on the IPO offering or withdrawal date. In our sample, the median length of the IPO quiet period for all 1135 IPO events is around 120 days. In order to facilitate the comparison of identified rivals’ disclosure behavior from before, during, and after the quiet period, we define the following periods:

-

(1)

Pre-quiet period: the 120 days immediately preceding the day when the IPO firm files its initial security registration statement. This window spans t = − 120 to t = − 1 relative to the IPO firm’s release of its initial S-1 filing.

-

(2)

Quiet period: the period stretching from initial S-1 filing date to the IPO date or withdrawal date.

-

(3)

Post-quiet period: the 120 days following the ending date of the quiet period, so the window spans t = + 1 to t = + 120 relative to the quiet period ending date.

Financial variables for the identified rivals are measured at the quarter end immediately preceding the start of each event period, and we collect all firm-initiated press releases issued during the period starting from the beginning of the pre-quiet period to the end of the post-quiet period.

3.2 Identified rivals, control firms, and firm-initiated press releases

To collect information on these identified rivals, we read each of the 285 IPO prospectuses and collect the name of every identified rival from the Competition section. After this procedure, we identify a total of 1484 firms from these 285 prospectuses.Footnote 16 A total of 397 out of the 1484 firms can be matched with a COMPUSTAT industrial record and have no missing values for all control variables and textual variables. Table 2 Panel A describes the sample construction of the identified rivals.

To mitigate the concern that the changes in identified rivals’ disclosure behavior are due to noise in the estimation, we generate a sample of control firms and implement an entropy balancing technique to match the identified rivals and control observations. Table 2 Panel B presents the sample construction of control firms. We identify control firms as those operating in the same industry as the IPO firm but are not identified as the direct rivals by the IPO firm. Industry classification is based on the first 2-digit SIC code. Then, we restrict our control firm sample to those firms with non-missing values for control variables and textual variables for at least two consecutive event periods to analyze the changes in disclosure behavior. The final sample of matched control firms consists of 670 control firms in total. These 670 control firms correspond to 107 IPO events, and 267 identified rival instances. The identified rivals and control firms are matched in Size, ROA (return on assets), and Tobin’s Q. For each identified rival and control firm, we obtain financial data from COMPUSTAT, stock return data from CRSP, and analyst forecast data from I/B/E/S.

In the main analysis of this study, we follow Ahern and Sosyura (2014) and Kim et al. (2018) and collect press releases issued from the beginning of the pre-IPO quiet period through to the end of post-IPO quiet period from the top four press release distribution services: PR Newswire, Business Wire, Market Newswire, and GlobeNewswire. Dow Jones News Services is used as a supplemental news source. We utilize Factiva’s Intelligent Indexing code to identify and machine-read the content of firm-initiated press releases. To make sure that a firm delivers substantive information to the public through press releases, we require that the press release selected for textual analysis contains at least 50 words (WC field > 50, in which WC implies word count) and can be successfully parsed. The details of the firm-initiated press releases are reported in Table 2 Panel C.

3.3 Measures of disclosure tone and content

To investigate identified rivals’ strategic disclosure behavior, we construct two primary measures of disclosure tone. Following prior literature (e.g., Bushee et al. 2018; Jiang et al. 2019), we first use the standard dictionary method—Loughran-McDonald Master Dictionary (Loughran and McDonald, 2011)—to identify tone words. Tone_netpositive(article) is defined as the difference between the number of positive words and the number of negative words scaled by the total content word count of each press release.Footnote 17 Depending on different regression specifications, we aggregate article level tone word count at the daily level, such as the variable Tone_netpositive, or at the news subject period level, such as Market_netpositive. Further details on the construction of key disclosure tone variables are provided in “Appendix A”.

Our second measure of disclosure tone relies on an enhanced lexical resource—SentiWordNet—to gauge the numerical scores of each term’s positive and negative sentiment information.Footnote 18 Each term in the press release is associated with two numerical scores ranging from 0 to 1, indicating its positive and negative connotation. Sentiment_positivity/negativity(article) is defined as the average of positivity/negativity scores of each term across the whole article, and the Sentiment_netscore(article) is constructed by taking the sum of positivity and negativity scores.Footnote 19 In line with different regression specifications, the sentiment tone variables are defined at the daily level, such as variable Sentiment_netscore, or at the news subject period level, such as Market_netscore.

In addition to identifying the changes in disclosure tone of press releases, we also analyze the content of their disclosure to examine the product market incentives of identified rivals’ strategic disclosures. Based on Factiva’s subject classification scheme, we define the product market category as consisting of news on Marketing (C31), Products (C22), and Contract (C33).Footnote 20 Table 3 reports the description for these subject codes on Factiva.

3.4 Descriptive statistics

Table 4 Panel A presents the descriptive statistics for the disclosure variables for all sample firms. Tone_netpositive(article) and Sentiment_netscore(article) are defined at the article level, and these article level tone measures are then aggregated at the firm-day level, because firms, especially larger firms, usually release more than one press release during a day. The mean values for Tone_netpositive(article) and Sentiment_netscore(article) (0.850 and 0.015, respectively) and their firm-day level counterparts (1.060 and 0.019, respectively) are positive, suggesting that firms are more likely to release overall positive information to the public.

Table 4 Panel B reports the disclosure tone for identified rivals and matched firms along three event periods. The identified rival sample of 267 firms is matched with the group of 670 control firms through entropy balancing. The mean values of Tone_netpositive(article) and Sentiment_netscore(article) are displayed for each group during the three event periods. From the pre-quiet period to the quiet period, the identified rival group experiences an increase in Tone_netpositive(article) to 0.512; in contrast, the matched firm group’s Tone_netpositive(article) only increases very modestly by 0.008. Further, the disclosure tone in the post-quiet period seems to revert to the pre-quiet period levels for the identified rivals, with the mean value for Tone_netpositive(article) decreasing to 0.467 and the Sentiment_netscore(article) to 0.013, which is even lower than the average tone for the pre-quiet period. However, this reversal is less obvious for matched control firms. The initial increase and then reversal of the disclosure tone provide partial evidence for the first hypothesis that identified rivals have strategic incentives to initiate more positive information during the IPO quiet period compared to the matched control firms.

Table 4 Panel C shows the period average of daily level disclosure tone of news dimensions classified as Industry Competition and Macro Economy across both identified rivals and matched control firms. Overall, firms use much more positive language when they talk about their competitiveness within the industry than about the macro economy. Further, the increase in net tone for Industry Competition related content is more pronounced than for Macro Economy related information. Panel D presents the period level disclosure characteristics for identified rivals based on product market related news subjects. The product market related content category includes news subjects on marketing, product, and contract, all directly related to the product market competition faced by identified rivals. Panel E displays the mean value of subject-tone proxies for each of the three event periods. The product market related press releases become much more positive in the quiet period compared to the pre-quiet period.

Table 4 Panel F presents descriptive statistics for relevant firm variables. The average Size_IPO (natural logarithm of total assets) equals 18.880. If translated into dollar value, it is similar to the figure in Hsu et al. (2010). However, the average value for Size for identified rivals is greater than the corresponding figure for incumbent firms in Hsu et al. (2010), which, if we take the natural logarithm, equals 18.365. A likely explanation for the difference is that our sample of rival firms includes only firms identified by the IPO firm as a direct rival, whereas Hsu et al. (2010) include all firms sharing the same first 2-digit SIC code. It is highly likely that the IPO firm tends to compare itself against already established and highly valued companies in its registration statements to emphasize its own growth potential. Before entropy balancing, identified rivals and control firms are largely comparable in leverage, profitability, and growth potential, but identified rivals have higher analyst coverage and stock price than control firms, which may be due to the slightly larger size of identified rivals. Product Fluidity, the pairwise product market similarity between the IPO firm and the identified rivals, measures the product market threats from the IPO firm right after the quiet period ends. The mean value of Product Fluidity is 0.075, which is higher than the average pairwise fluidity score of 0.060 for all sample firms in the Hoberg-Phillips Data Library, consistent with the fact that the IPO firm and the identified rivals are directly competing with each other in the product market sphere.

4 Empirical results

4.1 Disclosure of identified rivals around the IPO quiet period

We test whether the identified rivals release more positive news during the IPO quiet period, a time during which their competitor—the IPO firm—faces strict regulation in its public communication (H1). The treatment sample—identified rivals is first matched with a control group consisting of the IPO firm’s other industry peers that are not identified as the direct rivals. We then estimate the following regression:

where DisclosureTone is the firm-day level tone measure (Tone_netpositive, Sentiment_netscore) defined in Sect. 3.3. The choice of control variables follows prior literature (e.g., Aobdia and Cheng 2018; Bushee et al. 2010; Shroff et al. 2013). We control for the market-to-book value of assets (Tobin’s Q), the number of analysts following the firm (AnalystFollow), the return of assets (ROA), the natural logarithm of company assets (Size), the logarithm of market capitalization (MarketCap), the total debt to assets ratio (Leverage), and the logarithm of stock price (StockPrice), as these firm characteristics are found to predict firm disclosure behavior. All these variables are measured at the prior quarter end immediately preceding the focal event period. To mitigate the effect of extreme observations, we winsorize all continuous control variables at the first and 99th percentiles.

DuringQuiet is an indicator variable that takes the value of one if the observation occurs during the IPO quiet period and zero if it occurs in the pre-quiet period. IdentifiedRival is an indicator variable that is equal to one if firm i is an identified rival in IPO firm’s initial registration statement and zero otherwise.Footnote 21 The variable of interest is DuringQuiet × IdentifiedRival, and the coefficient on this interaction term captures the incremental changes in the identified rivals’ disclosure tone from pre-quiet period to quiet period relative to that of the matched control firms.

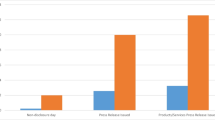

Figure 1 plots the changes in tone around the IPO quiet period.Footnote 22 In economic terms, the daily average disclosure tone of a firm’s press release becomes more positive by approximately 15% during the IPO quiet period.

Identified Rivals’ Disclosure Tone Around the IPO Quiet Period. In the figure below, the x-axis represents period (Period 0 is the IPO quiet period, Period − 1 is the pre-quiet period, and Period 1 is the post-quiet period) and the y-axis represents the period average of disclosure tone of identified rivals’ press releases. a The net disclosure tone is measured based on the Loughran-McDonald Master Dictionary (Loughran and McDonald, 2011). b The net disclosure tone is measured based on the SentiWordNet sentiment score. The sample consists of 1191 firm-period observations

Table 5 Panel A presents the results of Model [1]. The interaction term DuringQuiet × IdentifiedRival is positive for both Tone_netpositive (0.155; P < 0.1) and Sentiment_netscore (0.003; P < 0.01) specifications. The positive coefficient indicates that as a firm files its initial registration statement and enters the IPO quiet period, its identified rivals are increasingly likely to disclose positive news during the IPO quiet period relative to the pre-quiet period. The mean of Tone_netpositive is 1.060. Thus, the estimated coefficient of 0.155 in the first regression suggests that identified rivals, on average, increase the net positive tone of their press release by approximately 14.6% in the IPO quiet period (0.155/1.060 = 0.146). Similarly, in the fourth column, the coefficient on the interaction term equals 0.003. Compared with an average Sentiment_netscore of 0.019, the net sentiment score of press release increases by approximately 15.8% in the IPO quiet period (0.003/0.019 = 0.158).

To determine whether the net tone increase is influenced by the noticeability and importance of identified rivals, we partition the sample identified rivals between those that are highly noticeable and those that are less noticeable, with the level of noticeability measured by the total number of direct rivals identified by the IPO firms.Footnote 23 A direct rival firm that is identified alone or along with very few other firms easily stands out and attracts investors’ attention. Therefore, identified rivals that are highly noticeable may have stronger incentives to increase their disclosure tone than firms that are identified along with many other direct rivals. Columns (2), (3), (5), and (6) present the results of this analysis. The interaction term loads positively in both columns (2) and (5), but not in columns (3) and (6), suggesting that the identified rivals that are highly noticeable have stronger incentives to disclose positive information during the IPO quiet period. Thus, overall, results in Table 5 Panel A suggest that identified rivals initiate more optimistic press releases at times when the IPO competitor enters its quiet period, supporting the first hypothesis.Footnote 24

To provide further evidence about how the disclosure tone changes after the quiet period ends, we add to the model an indicator variable PostQuiet, which equals one if the observation occurs in the post-quiet period, and the interaction term PostQuiet × IdentifiedRival. We expect the coefficient for DuringQuiet × IdentifiedRival to be positive as what is reported in Panel A. If identified rivals intend to take advantage of the gag order and strategically release more positive news only during the IPO quiet period, then we expect that PostQuiet × IdentifiedRival does not load, as identified rivals likely revert to the normal disclosure policies once the IPO quiet period ends and the IPO firms are less constrained in their communication.

Table 5 Panel B presents the results of this analysis. Consistent with our expectation, we find a positive coefficient for DuringQuiet × IdentifiedRival in the Tone_netpositive (0.169; P < 0.1) and Sentiment_netscore (0.003; P < 0.05) specifications. Further, PostQuiet × IdentifiedRival does not load under almost all model specifications, suggesting that identified rivals disclose more positive information only during the IPO quiet period, and the disclosure tone reverts to the pre-quiet period level after the quiet period ends. These findings help address the alternative interpretation and suggest that the changes in identified rivals’ disclosure behavior are not due to the industry-wide trends but result from the identified rivals’ strategic incentives.

4.2 Analysis of the incentives for identified rivals’ disclosure

A successful public offering gives the IPO firm easier access to public financing. With extra funding, the IPO firm can enhance its product differentiation and customer loyalty and expand its business into new territories. To explore the product market incentives for the identified rivals’ disclosures, we examine how identified rivals adjust the tone of their disclosed information based on the content categories of the information. Specifically, we estimate the following regression:

Controls comprise the same variables as in Model [1]; DuringQuiet and PostQuiet are defined in the same way as in previous regressions. The dependent variable, Subject_Tone, measures the identified rivals’ period level disclosure tone for press releases of specific news subjects. We run Model [2] separately on the subsample of press releases related to each subject, and the unit of observation is firm-period.

Table 6 presents the results of the identified rivals’ product market incentives. It focuses on the news subject of marketing. Consistent with our expectation, we find a positive coefficient on DuringQuiet in column (1) (4.221; P < 0.05) and column (5) (0.057; P < 0.01), suggesting that during the IPO quiet period, identified rivals disclose more positive information when they promote existing products or services. We also find evidence that, on average, the strategic tone increase does not extend to the post-IPO quiet period. Relative to the press releases initiated during the IPO quiet period, news released in the post-quiet period is significantly less positive, evidenced by the negative coefficient on PostQuiet in column (2) (− 4.704; P < 0.05) and column (6) (− 0.071; P < 0.01), indicating that the adjustment of disclosure behavior is strategic and occurs only during the IPO quiet period.

If the changes in identified rivals’ disclosure behavior are caused by their strategic incentives to deal with the competitive effects from a successful IPO event, then whether the IPO candidate successfully lists the stock or withdraws the IPO case should influence whether identified rivals continue to paint a rosy picture of themselves in the post-quiet period. Although on average, identified rivals choose to tone down in the post-quiet period, those that still face intense competition from a large, successful IPO firm may have strong incentives to maintain their strategic tone level, while those that have the threat lifted from the IPO withdrawal may loosen up and reverse the disclosure policy back to normal.

To test this prediction, we partition the sample of identified rivals between those experiencing the IPO firm’s successful public offering and those witnessing the IPO withdrawal. Results from this cross-sectional analysis are presented in columns (3), (4), (7), and (8). As expected, the reversal in disclosure tone occurs primarily for identified rivals whose competitor withdraws its IPO. In contrast, the non-significant coefficient of PostQuiet in the Completed IPO subsample in columns (4) and (8) indicates that identified rivals are more likely to maintain their strategic tone level in the post-quiet period as their competitor successfully completes the IPO. This finding is also consistent with the evidence from Hsu et al. (2010) that shows that publicly traded rivals experience negative stock price reactions to the completed IPOs and positive stock price reactions to IPO withdrawals. Taking Hsu et al. (2010) one step further, our results on the post-quiet period tone changes suggest that identified rivals will not only passively respond to the IPO event but will also take strategic actions to deal with the competitive effects from the IPO candidate’s successful public offering.

Untabulated results on news subject of product and contract provide evidence that identified rivals respond to IPO events by initiating more positive news about products and contracts during the IPO quiet period. Moreover, the post-quiet period tone reversion is mainly driven by observations of identified rivals who witness a withdrawal of the IPO filing, consistent with identified rivals strategically changing their disclosure behavior because they have incentives to maintain their position in the product market competition.

4.3 Consequences of identified rivals’ disclosure

In this subsection, we conduct additional analyses to determine whether the IPO candidates are hurt by the identified rivals’ disclosure behavior and whether the identified rivals themselves benefit from their strategic actions.

4.3.1 Disruptions to the IPO process

To test if identified rivals’ strategic disclosure behaviors increase the likelihood of disruptions to the IPO process, we focus on the probability of IPO withdrawal, and we estimate the following model:

The dependent variable, Withdraw, is an indicator variable that equals one when the IPO is withdrawn or zero otherwise. The main variable of interest is the strategic tone change for all press releases or press releases related to specific news subjects. Tone_Chg(Total News) is defined as the average changes in the tone of press releases across the IPO firm’s identified rivals from the pre-quiet period to the quiet period. Tone_Chg(Specific Subject) is the average of changes in identified rivals’ disclosure tone of press releases about marketing, products, or contracts from the pre-quiet period to the quiet period. Controls is a vector composed of Size_IPO, the logarithm of the IPO firm’s total assets; Leverage_IPO, the ratio of the IPO firm’s total debt divided by total assets; ROA_IPO, the operating income divided by total assets; Capex, the logarithm of the firm’s capital expenditure; Cash, the IPO firm’s cash and cash equivalent divided by total assets; Reputation, an indicator variable that equals to one if the ranking of an IPO firm’s underwriter exceeds 8 according to Jay Ritter’s IPO database and zero otherwise. Detailed variable definitions are provided in “Appendix A”.

Table 7 presents the results. The proxy for tone change in the first four columns is based on word count tone measure, and in the rest of the columns the sentiment score. The coefficient for Tone_Chg, i.e., the proxy for tone or sentiment change, is positive in almost all model specifications. These results suggest that after controlling for the characteristics of the IPO firm, the strategic disclosure practices of the identified rivals during the IPO quiet period do affect how equity market evaluates the competitiveness of the IPO firm. For potential investors, the fact that the IPO candidate is surrounded by strong rivals means that the firm itself has to deliver much better performance to outcompete these public incumbents. The gap between investors’ expectations and the real value of the IPO firm may result in higher IPO withdrawal probability. Collectively, the results from Table 7 are consistent with H3a and indicate that the strategic changes in identified rivals’ disclosure practices could have negative implications on the IPO process.

4.3.2 Product market benefits

Results in previous sections show that identified rivals release more optimistic press releases during the quiet period, and such strategic disclosure behavior harms the IPO firm. However, if the final goal of identified rivals is not only to influence the IPO process but also to deal with the competitive threats from the IPO firm, it is necessary to examine if identified rivals’ strategic disclosure practices indeed help to achieve this goal. We measure product market threat from the IPO firm by using pairwise product fluidity data from the Hoberg-Phillips Data Library.Footnote 25 The measure for product market threat, Product Fluidity, is especially suited for this analysis because it measures the cosine similarity between the identified rival and the IPO firm in their 10-K product related description. Traditional measures for product competition, such as industry concentration, do not allow such a nuanced view on the pairwise competition between two industry rivals. The control variables are similarly defined as before. Next, we estimate the following regression as:

For comparison, we estimate the model on the samples of identified rivals and matched control firms. If identified rivals’ strategic disclosure behavior arises from their incentives to reduce the competitive threat from the IPO firm instead of being caused by some economy-wide trends, then we should observe a significantly negative relation between the Tone_Chg and Product Fluidity for the subsample of identified rivals and not for the matched control firms. As predicted in H3b, in Table 8 we find a significantly negative coefficient of Tone_Chg in both column (5) (− 1.351; P < 0.1) and column (2) (− 0.017; P < 0.05), which suggests that identified rivals benefit from their strategic changes in disclosure during the IPO quiet period in the form of less product market threat posed by the IPO firm. Moreover, this coefficient is not significant for the subsample of control firms, as is shown in columns (3) and (6). Control firms are not directly competing with the IPO firm, so a potentially successful IPO does not pose a serious threat to them as compared to the identified rivals. Therefore, it is not surprising to observe a muted effect of the changes in disclosure tone on the pairwise product market competition between the control firm and the IPO firm.Footnote 26

5 An alternative explanation and additional analysis

We also consider an alternative explanation for our results. For example, identified rivals could change their disclosure behavior out of concern over economic trends that also affect the IPO firm’s public listing decision. As reported by Spiegel and Tookes (2020), in most IPO events, the decline in industry rivals’ post-IPO performance results from macroeconomic factors; only in around 8% of cases is the decline due to the IPO firm being a more competitive force by going public. Therefore, economic trends may explain identified rivals’ strategic disclosure behavior during the IPO quiet period.

We note that there are four elements in our setting that help address this explanation. First, our research design focuses on the largest IPOs. Those competitive IPO cases (the 8%) that are documented in Spiegel and Tookes (2020) to have caused performance reductions of industry rivals are more likely to be the largest IPOs instead of small IPO cases. These IPOs enhance the competitive position of the IPO firm and pose a big threat to industry rivals, especially direct rivals.

Second, our study examines rivals that are specifically identified by the IPO firm in its initial registration statement. We compare the disclosure tone in identified rivals’ press releases from the pre-quiet period to quiet period, with the date of the initial registration as the cut-off date separating these two periods. These rival firms may be subject to the economy-wide trends of increased product commoditization, and therefore have strategic incentives to adjust their disclosure accordingly to distinguish themselves from others, but it is nearly impossible for them to know beforehand the exact date of the release of the IPO firm’s initial registration statement.

Third, disclosing information is not without cost, especially when the firm is facing more intense competition (Botosan and Stanford 2005; Harris 1998; Verrecchia and Weber 2006). Our findings that identified rivals provide more positive information during the IPO quiet period and then reverse their disclosure tone in the post-quiet period are only consistent with their strategic incentives to preempt the heightened product market competition. Finally, our argument for this study is that identified rivals adjust their disclosure behavior to preempt the product market competition. We consider it remains legitimate in the scenarios where economic trends such as the increased product commoditization reduce the benefits of staying private and cause firms to go public. At the same time, a firm going public leads its industry rivals to exhibit declining performance, which incentivizes these rivals to strategically release more positive news. If IPOs facilitate product commoditization, which in turn reduces customer loyalty, identified rivals should be more incentivized to take advantage of the quiet period regulation and initiate highly positive product market related news to differentiate themselves from the IPO firm and other industry peers.

Nevertheless, to provide more robust evidence that identified rivals release more optimistic information to preempt industry competition as opposed to responding to some economy-wide shift, we decompose each press release into content as related to Industry Competition or Macro Economy, and then we apply the following regression to analyze the changes of disclosure tone along these two different news dimensions. If identified rivals strategically adjust their disclosure behavior not as a response to economy-wide factors but just from an industry competition standpoint, we expect to observe the changes in disclosure tone to be more pronounced in the Industry Competition than in the Macro Economy related news dimension. The model specification is the same as Model (1), except that the disclosure tone is measured on news content that is specifically classified as Industry Competition or Macro Economy related, instead of on the entire press release.Footnote 27

Table 9 presents the results of this analysis. The increase in disclosure tone is more pronounced for news content on Industry Competition, as evidenced by the significantly positive coefficients on DuringQuiet × IdentifiedRival in four regressions, whereas identified rivals do not significantly adjust the disclosure tone when they describe news content on the macro economy. These results mitigate the concern that some economy-wide factors are driving the findings, and they also complement the evidence from previous incentive analyses that focused on the product market related press releases.

6 Conclusion

By intensifying product market competition, a large IPO is often considered as a frontal assault on established publicly traded incumbents. However, there is scant evidence as to whether and how public incumbents identify opportunities to preempt the IPO competitive effects. We fill this gap in the literature by examining the strategic disclosure of identified rivals in the quiet period, a time during which the IPO firm is restricted in their communication. Using data on firm-initiated press releases around the quiet period, we show that the disclosure tone of identified rivals’ press releases becomes more positive during the quiet period compared with a matched control group of unidentified industry peers, and the tone of their disclosures reverts to the normal level after the quiet period ends. To understand identified rivals’ product market incentives behind their disclosure choices, we examine the content of their disclosed information. We find a consistently significant positive change in the disclosure tone of product market related press releases during the quiet period. Furthermore, the cross-sectional analyses suggest that identified rivals tone down in the post-quiet period when the IPO is withdrawn. Additionally, the upward tone adjustments only exist when identified rivals talk about their industry competition instead of about some macroeconomic conditions. Overall, our evidence suggests that identified rivals strategically increase the tone of their disclosures during the quiet period to preempt the IPO competitive effects and to strengthen their position in the product market competition. Our results also suggest that the strategic changes in the disclosure behavior of identified rivals during the quiet period are likely to cause disruptions to the IPO process and weaken the product market threat from the IPO firm.

We acknowledge that our results are conditional upon our definition of industry (i.e., identification of peers), which is nonetheless consistent with much prior research. This study, the first to focus on rival firms’ disclosure during the quiet period, contributes to an extensive literature on strategic disclosures and information externality. It extends this literature by introducing a strategic benefit related to disclosing information during the quiet period—preempting the IPO’s competitive effects on rival firms. This study also contributes to the emerging literature on the IPO quiet period by identifying an unintended effect of quiet-period rules on industry rivals’ disclosure behavior. For regulators whose mission is to establish fair markets and facilitate capital formation, the unexpected findings that identified rivals can take advantage of the quiet period rules to influence the IPO process and market competition should also be relevant to them. Given the importance of public offerings in facilitating technological innovation, job creation, and financing growth (Piwowar 2017; Zweig 2010), this study is also relevant and informative to regulators and practitioners.

Notes

Section 5 of the Securities Act of 1933 regulates the public offering process. An important function of Sect. 5 is to restrain the marketing or salesmanship of registered public offerings, often referred to as “gun-jumping” provisions. Firms violating this gun-jumping provision could face delay or derail of public offering or, even worse, legal lawsuit.

For example, Scott Dietzen, the CEO of Pure Storage told a reporter from Harvard Business Review that, “When you file an S-1 with the SEC disclosing your IPO plans, you enter a ‘quiet period,’ with strict limits on what you may say publicly. If you’re in a competitive space, as we are, you run the risk that competitors will spread ‘fear, uncertainty, and doubt’ at a time when you can’t easily respond…” (Dietzen 2016) (see https://hbr.org/2016/06/pure-storages-ceo-on-choosing-the-right-time-for-an-ipo).

The SEC has a very vague definition of when an IPO quiet period officially begins. However, as described in Cedergren (2014), PR Newswire noted in its January 2005 comment letter that a majority (66 out of 125 surveyed participants) of investor relations professionals thought that the quiet period started when the firm filed its first registration statement. Also, as documented in Cedergren (2014), some firms do break the “quietness” in the 40-day post-offering quiet period due to the lack of enforcement by the SEC after the offering.

An article published in The Wall Street Journal on August 11, 2004, illustrates that point. Entitled “‘Quiet period’ makes it tough for Google to counter critics”, it describes how Google remained reticent about criticism on its auction IPO system and the skeptical comments on its business operations, citing the quiet period. As commented by a law professional in the article, “Google has been very, very conservative in this area… it’s the only appropriate thing they could have done” (Bialik 2004) (see https://www.wsj.com/articles/SB109214907584487555).

We examined identified rivals’ buy-and-hold abnormal returns (BHAR) in the post-IPO period. Untabulated results indicate that the abnormal stock returns are negative, which could be related to the normalization of identified rivals’ disclosure tone after quiet period ends.

For example, in August 2004, right before Google made its IPO, company founders Larry Page and Sergey Brin accepted to be interviewed by Playboy magazine and made several inaccurate statements about the company’s performance during the interview. Although the company’s IPO was not totally derailed, it raised the possibility of delaying the IPO process (see https://www.marketwatch.com/story/will-playboy-article-delay-google-ipo).

The detailed definition of each news subject used in Factiva is described in Sect. 3 Data and research design.

After Facebook’s botched debut, several lawmakers began to rethink the informational disadvantage that the quiet period rules could bring to average investors, e.g., being kept uninformed of relevant analysis. Mary Schapiro, the former chairman of the SEC, noted in her letter to congressman Darrell Issa that the agency would review the gag order imposed on firms ahead of IPOs (Eaglesham and Demos 2012) (see https://www.wsj.com/articles/SB10000872396390444230504577613322734045592).

SEC release No. 33–8591 addresses communication rules related to public offerings. In this document, the SEC has specified that an issuer’s release of new types of financial information or projections during the quiet period will likely constitute a violation of the rules.

For example, online grocer Webvan Group Inc. had to delay its IPO in 1998 after its CEO granted an interview to a reporter before the IPO, and the company disclosed material information through a conference call without making the same information available to the public. Salesforce.com was forced also to delay its IPO after its CEO discussed the company’s business and competitors in The New York Times.

For instance, the SEC imposed a cooling-off period on Groupon’s IPO because of concern over the firm’s performance metrics presented in its prospectus. However, when asked to comment on the SEC’s decision, the firm declined and cited a quiet period (Wasserman 2011) (see https://mashable.com/2011/07/27/groupon-sec-ip/).

As documented in prior literature, there are some data issues with the date of the IPO and its industry classification in the SDC Platinum. We follow Hsu et al. (2010) in validating this key information using COMPUSTAT, Nasdaq, and EDGAR. Industry is classified by the first two digits of the SIC code.

We apply the following criteria in selecting IPO events: the offering of common stock is made by a US-based private company; the stock is listed on a major US exchange (New York Stock Exchange, Nasdaq, American Stock Exchange); the offer price is above $5. We also exclude American depository receipts, reverse leveraged buyouts, closed-end funds, limited partnerships, unit investment trusts, tracking stocks, two-tranche offerings, simultaneous international offerings, and IPOs of non-common shares.

These two industries are highly regulated with great barriers to market entry. Many firms mention in their prospectus that they do not face direct competition in their major service area, or that their competitors are owned by the same large investors. For example, please find the discussion on industry competition in American Water Works Company’s IPO prospectus through the following link (see https://www.sec.gov/Archives/edgar/data/1410636/000119312508088989/d424b4.htm).

As argued in that study, this selection approach enables one to make the most use of the data without arbitrarily setting a cut-off value for the purpose of defining what a large IPO volume is.

Please find a few examples of identified rivals in "Appendix C".

If there are negation words (e.g., not, no, none, despite, neither) within three words before a positive word, we also count the positive word as negative.

This approach is widely used in opinion mining applications. It has a large corpus of part-of-speech (POS)-tagged English words along with their sentiment. The advantage of this approach is that it marks up the positivity or negativity of a term based on its definition and its context, for example, its relationship with adjacent words in a phrase or sentence. Therefore, this approach nicely complements the bag-of-words approach that depends on manually built dictionaries.

Sentiment_negativity is defined as the raw average sentiment score on negativity connotation multiplied by − 1.

As discussed earlier, Factiva has set a fixed structure of Intelligent Indexing Field to organize its published news articles. One of the data fields is news subject (NS), which is used to keep track of the subjects of each press release.

Considering the IPO offering process is relatively short, we can reasonably assume that the direct competing relationship between the identified rivals and the IPO firm exists from the start of the pre-quiet period to the end of the post-quiet period.

In Fig. 1, Period 0 denotes the quiet period, and Period − 1 and Period 1 represent the pre- and post-quiet period, respectively. Figure 1a plots the changes in article level word-count tone measure (based on the Loughran-McDonald Dictionary) around the IPO quiet period, and Fig. 1b plots the changes in sentiment score (another tone measure based on SentiWordNet) across the three time periods.

Firms that are identified by an IPO firm whose total number of identified rivals are below the median are classified as “highly noticeable” rivals; otherwise, they belong to the “less noticeable” group.

Moreover, we also examine whether industry concentration moderates identified rivals’ strategic disclosure during the IPO quiet period. Untabulated results are consistent with identified rivals’ disclosure tone being more positive during the quiet period no matter if the industry is highly concentrated or not. These results suggest that the competitive threat from the IPO candidate for identified rivals is real and salient and thus is not directly influenced by the overall industry concentration. We thank an anonymous reviewer for this helpful suggestion.

The data for pairwise product market fluidity are obtained from the Hoberg-Phillips Data Library. The detailed description of how to calculate these product market fluidity data can be found in the data section in Hoberg and Phillips (2014, 2016). Pairwise product fluidity is well suited for the purpose of this analysis because it measures the cosine similarity between the identified rival and the IPO firm in the product related description in their 10-K filings. Traditional measures for product competition, such as the industry concentration, do not afford such a nuanced view on the pairwise competition between two industry rivals.

Since the data on pairwise product fluidity are available for only a small number of identified rivals, the results need to be interpreted with caution.

Relying on the Business Category Dictionary developed by Kothari et al. (2009a) and the Risk Category Dictionary developed by Campbell et al. (2014), we form two key words lists, Industry Competition and Macro Economy. Sentences containing key words defined in the two words lists are grouped together and defined as either being either Industry Competition or Macro Economy related, and then each group is parsed and analyzed for its specific tone level. However, to capture a complete context for the discussion along a specific news dimension, we also extract three sentences and five sentences before and after the sentence that contains the key words. We then group these sentences together and calculate the tone level. In untabulated analyses, we find that the results still hold. "Appendix B" presents the details.

References

Ahern K, Sosyura D (2014) Who writes the news? Corporate press releases during merger negotiations. J Finance 69:241–291

Aobdia D, Cheng L (2018) Unionization, product market competition, and strategic disclosure. J Account Econ 65(2–3):331–357

Baranchuk N, Rebello MJ (2018) Spillovers from good-news and other bankruptcies: real effects and price responses. J Financ Econ 129(2):228–249

Benveniste L, Spindt PA (1989) How investment bankers determine the offer price and allocation of new issues. J Financ Econ 24(2):343–361

Bialik C (2004) ‘Quiet period’ makes it tough for Google to counter critics. The Wall Street J

Billett MT, Ma S, Yu X (2020) Torpedo your competition: Strategic reporting and peer firm IPO. Working paper, Indiana University

Boone AL, Floros IV, Johnson SA (2016) Redacting proprietary information at the initial public offering. J Financ Econ 120:102–123

Botosan C, Stanford M (2005) Managers’ motives to withhold segment disclosures and the effect of SFAS No. 131 on analysts’ information environment. Account Rev 80(3):751–771

Bradley D, Jordan B, Ritter J (2003) The quiet period goes out with a bang. J Finance 58(1):1–36

Bradley D, Jordan B, Ritter J, Wolf J (2004) The IPO quiet period revisited. J Invest Manag 2(3):1–11

Burks JJ, Cuny C, Gerakos J, Granja J (2018) Competition and voluntary disclosure: evidence from deregulation in the banking industry. Rev Account Stud 23(4):1471–1511

Bushee BJ, Core JE, Guay W, Hamm JW (2010) The role of the business press as an information intermediary. J Account Res 48(1):1–19

Bushee BJ, Gow ID, Taylor DJ (2018) Linguistic complexity in firm disclosures: Obfuscation or information? J Account Res 56(1):85–121

Campbell JL, Chen H, Dhaliwal DS, Lu H, Steele LB (2014) The information content of mandatory risk factor disclosures in corporate filings. Rev Account Stud 19(1):396–455

Cazier R, Desir R, Pfeiffer RJ, Albert L (2020) Intra-industry information transfer effects of leading firms’ earnings narratives. Rev Quant Financ Account 54:29–49

Cedergren M (2014) Joining the conversation: How quiet is the IPO quiet period? Working paper, University of Pennsylvania

Chemmanur TJ, He J (2011) IPO waves, product market competition and the going public decision: Theory and evidence. J Financ Econ 101:382–412

Dietzen S (2016) Pure Storage’s CEO on choosing the right time for an IPO. Harvard Bus Rev 2016:37–40

Durnev A, Mangen C (2009) Corporate investments: learning from restatements. J Account Res 47:679–720

Durnev A, Mangen C (2020) The spillover effects of MD&A disclosures for real investment: the role of industry competition. J Account Econ 70(1):1–19

Dyck A, Zingales L (2003) The bubble and the media. In: Cornelius PK, Kogut B (eds) Corporate governance and capital flows in a global economy. Oxford University Press, Oxford, pp 83–102

Eaglesham J, Demos T (2012) Regulators rethink pre-IPO chatter. The Wall Street J (Online), 27 August 2012.

Eshleman JD, Guo P (2014) The market’s use of supplier earnings information to value customers. Rev Quant Financ Acc 43:405–422

Gleason CA, Jenkins NT, Johnson WB (2008) The contagion effect of accounting restatements. Account Rev 83(1):83–110

Harris M (1998) The association between competition and managers’ business segment reporting decisions. J Account Res 36(1):111–128

Hoberg G, Phillips G (2016) Text-based network industries and endogenous product differentiation. J Polit Econ 124(5):1423–2465

Hoberg G, Phillips G, Prabhala N (2014) Product market threats, payouts, and financial flexibility. J Finance 69(1):293–324

Hsu HC, Reed AV, Rocholl J (2010) The new game in town: Competitive effects of IPOs. J Finance 65:495–528

Jiang F, Lee J, Martin X, Zhou G (2019) Manager sentiment and stock returns. J Financ Econ 132(1):126–149

Kim J, Verdi RS, Yost BP (2018) The feedback effect of disclosure externalities. Working paper, MIT Sloan School of Management

Kim M, Ritter JR (1999) Valuing IPOs. J Financ Econ 53:409–437

Kothari SP, Li X, Short JE (2009a) The effect of disclosures by management, analysts, and business press on cost of capital, return volatility, and analyst forecasts: a study using content analysis. Account Rev 84(5):1639–1670

Kothari SP, Shu S, Wysocki PD (2009b) Do managers withhold bad news? J Account Res 47(1):241–276

Lang HP, Stulz RM (1992) Contagion and competitive intra-industry effects of bankruptcy announcements. J Financ Econ 32:45–60

Loughran T, McDonald B (2011) When is a liability not a liability? Textual analysis, dictionaries, and 10-Ks. J Finance 66:35–65

Myers SC, Majluf NS (1984) Corporate financing and investment decisions when firms have information that investors do not have. J Financ Econ 13(2):187–221

Pandit S, Wasley CE, Zach T (2011) Information externalities along the supply chain: the economic determinants of suppliers’ stock price reaction to their customers’ earnings announcements. Contemp Account Res 28(4):1304–1343