Abstract

Young adulthood (18–30 years old) is a crucial period due to its developmental tasks such as career establishment and financial independence. However, young adults’ relative lack of resources makes them vulnerable to employment disruptions (job loss and income loss), which may have both immediate and long-term effects on their financial wellbeing and mental health. The economic impact of COVID-19 restrictions resulted in an increase in unemployment and a decrease in income worldwide, especially for young adults. This study examined to what extent and how job loss and income loss due to the pandemic influenced young adults’ perception of their present financial wellbeing, future financial wellbeing, and psychological wellbeing by using cross-sectional survey data collected from six countries (China, Italy, Lithuania, Portugal, Slovenia, and the United States). Results showed that the impact of income loss and job loss on all three types of wellbeing were mediated by young adults’ negative perception of the COVID-19 lockdown restriction (i.e., perceived as a misfortune). Cross-country differences existed in the key variables. The association between employment disruptions, young adults’ perception of the COVID-19 lockdown restriction, and wellbeing were equivalent across countries except China. Implications for policy and practice are discussed.

Similar content being viewed by others

1 Introduction

The transition from school to full-time work is an important “coming of age” milestone in developed economies (Garrett & Eccles, 2009; Savickas, 1999). As a primary source of income, employment provides the financial resources to achieve financial stability, a hallmark of adult autonomy (Arnett, 2014). Yet, global economic uncertainty exacerbated by the COVID-19 pandemic has threatened the employment outlook for many young adults. In the early stages of the pandemic, Eurostat data reported a 4.7-point increase in unemployment during the second quarter of 2020 among younger workers (15–24), but no change among older workers (Grzegorczyk & Wolff, 2020). In the United States, monthly Current Population Survey data between January 2020 and April 2020 showed that young adults (20–29) experienced the largest increase in unemployment among workers of all ages: a 10.3-point increase for women and an 8.5-point increase for men; the increases were highest for young workers without a college degree (Moen et al., 2020). Despite a projected decrease in unemployment rates in the US (Cox, 2021), there remains widespread uncertainty about the speed and the strength of an economic recovery in developed economies (Jackson et al., 2021). Young adults are particularly vulnerable to employment uncertainty, given their “relative lack of work-relevant skills and experience, smaller social network connections, fewer economic resources to support them as they search for work, and less information about how to find jobs” (Kalleberg, 2020, p. 259). While recent studies have shown that daily life disruptions due to COVID-19 resulted in greater psychological distress and mental health problems for young adults compared to other age groups (e.g., Gambin et al., 2021; Glowacz & Schmits, 2020; Qiu et al., 2020), few studies have examined the economic impact of COVID-19 lockdown restriction on young adults’ wellbeing. The primary goal of the present study is to examine the impact of employment disruptions due to COVID-19 (job loss, income loss) on multiple aspects of young adults’ wellbeing (i.e., present financial, future financial, and psychological).

Although full-time work is associated with adult status across most developed economies, expectations about employment and financial stability among young adults may differ due to social norms and government policies. For instance, continued financial dependence on family may be less of a stigma in countries where intergenerational family support is expected to continue well into young adulthood (e.g., Italy and Portugal; Kujawa et al., 2020). In addition, job loss or reduced income may have less financial impact on young adults in countries with more comprehensive social welfare systems (e.g., China; Ringen & Ngok, 2017). However, in the United States, limited government social support and negative perceptions about family financial support to grown children may exacerbate the impact of employment disruptions on young adults’ wellbeing (Kujawa et al., 2020; Mortimer et al., 2016). To further understand the associations between employment disruptions (loss of job, loss of income) and wellbeing (i.e., present financial, future financial, psychological), we consider if the associations differ by country of residence using online survey data collected from young adults living in six different countries during the pandemic (China, Italy, Lithuania, Portugal, Slovenia, USA).

Because individual perceptions of the future influence the transition to adulthood (Bellare et al., 2019), in the present study, we also investigate the potential role of young adults’ perception of the COVID-19 lockdown restriction in these associations using a stress appraisal framework (Lazarus & Folkman, 1984). From this perspective, an individual may interpret an event that has occurred (in our case, COVID-19 and its ensuing lockdown restriction) in relation to their personal situation (employment disruptions) to determine the level of stress (or impact) on their wellbeing. As such, we expect to find an indirect effect of employment disruptions on wellbeing, in addition to its direct effects via young adults’ perception of the COVID-19 lockdown restriction.

1.1 Employment Disruption During Young Adulthood and the Pandemic

The extant literature on employment disruptions during young adulthood has provided evidence of both immediate and longer-term outcomes. For instance, a systematic review of 17 studies revealed a positive association between unemployment and mental health problems, although this association was weakened or diminished when controlling for baseline mental health status (Bartelink et al., 2020). In a longitudinal study, Krahn et al. (2015) examined employment trajectories of young adults and found that frequent employment fluctuations (month-to-month change in employment status) in early young adulthood (ages 19 to 25) were predictive of lower income at age 32 for both men and women. However, the researchers also found that an early career change had a positive impact on income and career satisfaction at age 32 among men. A four-year longitudinal study examining the associations between employment and mental health among young adults revealed that young adults who were employed full-time reported lower initial levels of depressive symptoms compared to young adults who were not employed full-time (Domene et al., 2017). One study also found that reduced life satisfaction due to unemployment persisted even after reemployment (Knabe & Rätzel, 2011).

The pandemic presented widespread employment challenges. According to a report by the World Health Organization (WHO, 2020), the pandemic placed half of the 3.3 billion global workforce at risk of losing their livelihoods. In the US, nearly half of all households experienced employment income loss during the pandemic, and the impact was greater among households with no children and those with lower levels of income (Falk, 2020). This category included young adults, implying that they encountered greater obstacles in their attempts to stabilize their career and income. Ganson et al. (2021) found that young adults who experienced a recent employment disruption (loss of job or loss of income) reported higher symptoms of depression and anxiety; surprisingly, young adults who did not experience an actual loss but who thought they might experience a loss in the coming weeks also reported higher symptoms of depression and anxiety.

1.2 Separate Effects by Type of Economic Disruption

Economic disruptions are a major source of financial stress that negatively influence the psychological and financial wellbeing of individuals and families (for a recent review, see Friedline et al., 2021), not just those living in extreme poverty (Adler et al., 1994; Despard et al., 2020). In the present study we focus on the two most common economic disruptions due to COVID-19: job loss (being unemployed) and reduction in hourly payment or annual salary (International Labour Organization (ILO), 2021). Income loss makes it more difficult for individuals to meet their financial obligations, resulting in financial stress (Jahoda, 1981). A study by Sirgy et al. (2001) identified several major needs that can be fulfilled only through employment: social needs, esteem needs, actualization needs, knowledge needs, family needs, health and safety needs, and aesthetic needs. Other studies have shown that unemployment and job loss undermine these needs and may lead to loss of identity and self-worth (Amundson & Borgen, 1982; McKee-Ryan, 2016). In a household panel study of low-income households in Germany, Pohlan (2019) found evidence of both economic and social consequences of job loss, including fewer economic resources, lower levels of life satisfaction, mental health, and social integration. In a nationally representative U.S. sample from the 2020 COVID-19 Household Pulse Survey (HPS), Yao and Wu (2021) found that, compared to working respondents, those who were involuntarily not working had higher levels of anxiety and depressive disorders, in addition to more economic difficulties (e.g., difficulty affording food, paying bills). Although studies typically focus on either income loss or job loss, there is some empirical support that income loss and job loss are distinct types of employment disruptions. For instance, Shen and Kogan (2020) found that both income loss and job loss were independently associated with lower levels of life satisfaction. Ruengorn et al. (2021) provided evidence on differential impact of job loss and income loss. Specifically, the researchers found that job loss due to the pandemic was positively related to perceived stress, while income loss due to the pandemic was positively related to anxiety symptoms. In the present study, we account for the independent effects of both job loss and income loss during the pandemic on young adults’ wellbeing (i.e., present financial, future financial, psychological).

1.3 The Theoretical Framing for the Study

Despite the magnitude of employment disruptions in the wake of the COVID-19 pandemic, it is important to examine individual factors in understanding its impact. The Transactional Model of Stress (TMS; Lazarus, 1966, 1999; Lazarus & Folkman, 1984) defines stress in terms of the relation between the individual and the environment. A key tenet of this theory is that personal meaning and values are essential to human life and represent the essence of stress, emotion, and adaptation (Lazarus, 1999, p. 6). According to TMS, individuals evaluate an event or situation in terms of its personal impact (e.g., relevance, potential benefits, and potential dangers), a process referred to as primary appraisal. Once potential sources of stress are appraised as threatening or beneficial, individuals then evaluate what can be done in their current circumstances to prevent harm or improve the chances for benefit, a process referred to as secondary appraisal. Broadly conceived, appraisal is a cognitive process of making meaning of external events in the context of one’s own situation, and thus personal appraisal mediates the association between the situation and personal wellbeing (Folkman et al., 1986). A robust literature using TMS provides support for the mediating role of appraisal on the association between stress and wellbeing (Gomes et al., 2016; Lazarus & Folkman, 1984; Scherer & Moors, 2019; Zacher & Rudolph, 2021). In accordance with TMS, we conceptualize employment disruptions (loss of job, loss of income) as a potential source of stress (i.e., stressor) that will contribute to one’s appraisal of the COVID-19 lockdown restriction. We speculate that employment disruptions in the context of COVID-19 will be associated with lower levels of young adults’ wellbeing both directly and indirectly as a result of a general negative stress appraisal process.

1.4 The Present Study

Although the relationship between economic disruptions and mental health of young adults during COVID-19 is established, a gap in knowledge exists about the impact of economic disruptions on young adults’ financial and psychological wellbeing. To address this gap, we examine these associations using data gathered from young adults (ages 18–30) across six countries. Specially, we test the following main hypotheses: (1) Direct Effects: Income loss and job loss are separately and negatively related to young adults’ perception of the COVID-19 lockdown restriction and wellbeing (i.e., present financial, future financial, and psychological); (2) Indirect Effects: Both income loss and job loss will have an additional indirect effect on young adults’ wellbeing (i.e., present financial, future financial, and psychological) via the perception of the COVID-19 lockdown restriction. Prior to testing our hypotheses, we will conduct preliminary descriptive and comparative analyses to test for mean level differences across countries.

2 Methods

2.1 Study Design and Sample

This study used data from a broader research project, COVIN (COVid INternational), carried out by Lanz et al., 2021 . We collected cross-sectional survey data from 2282 young adults aged 18 to 30 years (M = 23.3, SD = 3.52) across six different countries (i.e., China, Italy, Lithuania, Portugal, Slovenia, and the US). We used a snowball sampling approach to recruit a convenience sample, initially contacting colleagues, students, and friends via email and social media and providing a link to the Qualtrics survey. We asked our contacts to forward the link to other young adults they knew. A small number of the participants were recruited via Amazon Mturk (0.9%). After indicating consent, participants completed a 15-min online survey. In addition to sociodemographic factors, participants were asked to reflect on several aspects of their life both prior to and after COVID-19 restrictions that were put in place in their locations. The data were collected between July and September, 2020. The whole sample included 1596 females (69.9%), 478 males (20.9%), and 21 gender queer (0.9%). Refer to Lanz et al., 2021 for more detailed information on the study design.

For the present study, we excluded participants (n = 601) who completed the demographic questions but did not respond to any of the measurements assessing key variables. The participants in the two groups differed significantly by country, gender, age, and educational status. Young adults who completed only the demographic questions were more likely to live in Lithuania and China [χ2(5) = 98.20: p < 0.001; Cramer’s V = 0.207] and less likely to be married [χ2(4) = 12.64; p = 0.014]. In addition, those who completed only the demographic questions were more likely to be male [χ2(2) = 19.81; p < 0.001; Cramer’s V = 0.097], younger [t (2056) = −3.65; p < 0.001], and those still enrolled in education [χ2(1) = 6.50; p = 0.011]. There were no differences in the two groups regarding pre-COVID living arrangement [χ2(1) = 0.029; p = 0.87], current living arrangement [χ2(1) = 0.013; p = 0.91], or family socioeconomic status (SES) [t (1682) = 1.92; p = 0.055]. The final sample consisted of 349 males (20.8%), 1313 females (78.2%), and 17 gender queer (1%); the mean age was 23.48 (SD = 3.49); 1081 participants reported being enrolled in education (64.3%), and 600 participants did not (35.7%); 191 participants (11.5%) reported a job loss after the COVID-19 restrictions were implemented; the mean family SES level for the current sample, measured as a rung on a ladder from 1 to 10 was 6 (SD = 1.80). Detailed demographic information for each country is shown in Table 1.

2.2 Measures

2.2.1 Income Loss

Participants responded to a single question “I have lost job-related income due to the coronavirus” to indicate the level of income loss. Responses ranged from “1—completely not true” to “5—completely true”.

2.2.2 Job Loss

Participants indicated their job status both prior to and after the COVID-19 lockdown restriction was put in place in their location by selecting from a list of six options (i.e., full-time, part-time, occasionally, unemployed, unpaid employment, retired). We dropped “retired” as no participants selected this option. We further coded job loss (= 1) for participants who were in paid employment prior to the COVID-19 lockdown restriction (i.e., full-time, part-time, or occasionally) but were not in paid employment after the lockdown restriction was put in place (i.e., unemployed, unpaid employment). For participants who experienced a change in employment status but not job loss (e.g., full-time employed prior to the lockdown restriction and part-time employed after the restriction), we coded job loss (= 0).

2.2.3 Perception of the COVID-19 Lockdown Restriction

To indicate their perception of COVID-19 once the lockdown restriction was put in place, participants responded to a single question “How do you feel when you reflect on your time spent in lockdown?”. Responses ranged from 1 (“I feel that this period was a great opportunity for me (e.g., personal growth, time to do things I need/like, …”) to 5 (“I feel that this period was a great misfortune for me (e.g., I could not do anything good for me in that period, …”). For the current analyses we recoded the variable (− 2 to 2), so that the higher score indicated a more positive perception.

2.2.4 Financial Wellbeing

We used two subscales of the Multidimensional Subjective Financial Wellbeing Scale for Emerging Adults (MSFWBS; Sorgente & Lanz, 2019) to measure participants’ perception of their present financial wellbeing and future financial wellbeing. There are ten items in the Present Financial Wellbeing subscale (e.g., I have enough money to pursue my passions) and five items in the Future Financial Wellbeing subscale (e.g., In the near future, I will have enough money to carry out my plans). The participants rated each of the items on a five-point scale (1—strongly false, 5—strongly true). This scale has been validated in Italy and Portugal (Iannello et al., 2020; Lanz et al., 2020; Vosylis & Klimstra, 2022). In other countries, our colleagues who are native speakers translated the scale and had a second bilingual expert check the accuracy of the translation. Cronbach’s α was 0.934 for the Present Financial Wellbeing subscale for the whole sample, ranging from 0.907 to 0.952 across the six countries. Cronbach’s α was 0.824 for the Future Financial Wellbeing subscale for the whole sample, ranging from 0.768 to 0.863 across countries.

2.2.5 Psychological Wellbeing

We used the Brief Inventory of Thriving (BIT) to measure participants’ general psychological wellbeing, a shortened version of the Comprehensive Inventory of Thriving (CIT) (Su et al., 2014). The ten items in the BIT serve as a brief mental health screening tool (e.g., I feel good most of the time). Participants rated each of the items on a five-point scale (1—strongly disagree, 5—strongly agree). This scale has been validated in the United States (Su et al., 2014), Italy, Portugal, and China (Sorgente et al., 2019, 2021). In other countries, our colleagues who are native speakers translated the scale and had a second bilingual expert check the accuracy of the translation. Cronbach’s α for the overall measure was 0.907 for the whole sample, ranging from 0.886 to 0.925 across countries.

2.2.6 Control Variables

We included two control variables in the model: participants’ family socioeconomic status (SES), given that high family SES may buffer the negative impact of COVID-19 job loss and income loss, and education status, given that the COVID-19 impact on employment may differ between those who have started full-time careers versus those who are still enrolled in education. For SES, we presented a ladder with ten levels (from one to ten), asking participants to imagine that the ladder represents where families stand in their country and then indicate where they would place their own family of origin on the ladder. Higher values indicate higher SES for the family of origin. For education status, participants indicated if they were enrolled in any level of education at the time of data collection. We then created a dummy-coded variable to represent if participants were enrolled in education (= 1) or not (= 0).

2.3 Analysis

To address our research questions, we performed descriptive analysis, measurement invariance analysis, path analysis, and multi-group path analysis. Results of simulation studies (e.g., Kim et al., 2017), as well as other studies with similar analyses (e.g., Byrne & van de Vijver, 2017; Klassen et al., 2010; Stupar-Rutenfrans et al., 2021), suggest that our sample size for each country was adequate for the planned analyses. Descriptive analyses were conducted in SPSS 26 to provide an overview of the key variables, and the other analyses were performed in Mplus 8.4.

2.3.1 Measurement Invariance Analysis

Before proceeding to the main analyses, we sought to verify that our key measures had comparable scores across different countries. To do so, for each scale, we conducted confirmatory factor analysis (CFA) in each country and on the entire sample to verify the scales’ factorial structure. Once a fitting factorial model was found, we verified that the measurement model parameters (i.e., factor loading, intercept, and residuals) were invariant across different countries, which provides a basis for meaningful comparison. As Byrne and van de Vijver (2017) suggested, the exact measurement invariance, normally tested when comparing a few groups could be problematic when a larger number of groups are involved. Instead, the approximate measurement invariance using the maximum likelihood alignment method is recommended (Muthén & Asparouhov, 2014). In the current study, we conducted the approximate measurement invariance analysis and followed the criteria that the measure performs similarly across countries and mean comparison can be meaningfully tested if the percentage of non-invariant parameters was within the 25% cut-off point (Muthén & Asparouhov, 2014).

2.3.2 Path Analysis and Multiple Group Path Analysis

To test our hypothesized model, we performed single-group and multi-group path analyses. Specifically, using the entire sample, we first tested a model according to which: (a) job and income loss were correlated; (b) job and income predicted a mediator (perception of the COVID-19 lockdown restriction) and three outcomes (present financial wellbeing, future financial wellbeing, and psychological wellbeing); (c) the mediator predicted three outcomes; (d) residual variances of the three outcomes were correlated All endogenous variables (perception of the COVID-19 lockdown restriction and three types of wellbeing) were also regressed on the two covariates to control for the effects of education and SES. Using this model, we also estimated direct, indirect (through perception of the COVID-19 lockdown restriction), and total effects of job loss and income loss on wellbeing.

After testing our model on the overall sample, we investigated cross-country differences. As a preliminary step, we compared the means of all study variables across the six countries to understand if young adults from different countries were experiencing different levels of employment disruptions and wellbeing. We then examined if the association between employment disruptions due to COVID-19 and young adults wellbeing varied across countries. To do so, we tested if the parameters of the conceptual mediation model linking study variables were equivalent across the six countries.

In our model, the three types of wellbeing were represented by continuous factor scores (obtained from measurement invariance analysis) that were slightly skewed although had similar to normal distributions (maxskewness = −0.438), while our mediator was a single variable with five possible values that had a symmetrical yet slightly platykurtic score distribution (skewness = −0.111, kurtosis = −0.904). Considering the former and the fact that we had some missing data present in our dataset (see Table 2) that was likely missing at random (Little’s MCAR test χ2 = 38.164; df = 41; p = 0.597; Little, 1988), we opted for the robust maximum likelihood (MLR) estimation (Rhemtulla et al., 2012) for our path analytic model parameters. In doing so, we also invoked full information maximum likelihood (FIML) estimation to handle missing data.

3 Results

3.1 Descriptive Results

Means, standard deviations for each key variable, and the correlations between key variables are presented in Table 2. The intercorrelations among the six key variables were statistically significant.

3.2 Measurement Invariance (MI)

We used fixed alignment optimization (with the US as the reference group) as the model with free alignment optimization was poorly identified (Muthén & Asparouhov, 2014). The results of MI analyses indicated that at least some items within each scale of the study had non-invariant factor loadings or intercepts; however, the percentage of non-invariant parameters was within the 25% cut-off point (Muthén & Asparouhov, 2014), suggesting that the construct scores were sufficiently comparable across countries. Detailed procedures are provided in the supplementary materials.

3.3 Path Analysis: Direct and Indirect Effects Linking Job and Income Loss with Wellbeing

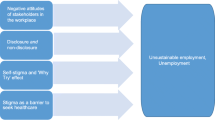

Model fit indexes suggested that our model, tested on the full sample, had a good fit with the data: χ2 = 13.66, df = 4; p = 0.008; CFI = 0.995; TLI = 0.973; RMSEA = 0.038, 90% CI = [0.017 0.061]; SRMR = 0.018. Model results (see Fig. 1) indicated that job loss and income loss were negatively related to the COVID-19 lockdown restriction perceptions, suggesting that participants who experienced job loss and/or income loss during the pandemic were less likely to perceive the pandemic lockdown as a positive opportunity. In addition, perception of the COVID-19 lockdown restriction was positively linked to all three types of wellbeing, suggesting that the more participants perceived the COVID-19 lockdown restriction as an opportunity, the higher their wellbeing; and vice versa, the more the lockdown restriction was perceived by participants as a misfortune, the lower was their wellbeing.

Results from the path analytical model also partially supported the first hypothesis, which posited that employment disruptions (both income loss and job loss) due to the COVID-19 pandemic have a direct and indirect (via perceptions of the COVID-19 lockdown restriction) negative association with young adults’ present and future financial wellbeing and general psychological wellbeing (Table 3 presents indirect effects). Both job loss and income loss directly and indirectly (via perceptions of the COVID-19 lockdown restriction) were negatively associated with young adults’ present financial wellbeing. Income loss both directly and indirectly (via perceptions of the COVID-19 lockdown restriction) related to young adults’ future financial wellbeing, while job loss was only indirectly linked to future financial wellbeing. Lastly, both income and job loss were associated with psychological wellbeing, but only indirectly via perceptions of the COVID-19 lockdown restriction.

3.4 Cross-Country Differences

3.4.1 Mean Differences

To examine the mean differences in the three types of wellbeing, we first saved factor scores from the MI analysis, centered these factor scores, and then conducted several tests using the MODEL TEST command in Mplus. Results indicated significant mean differences across the six countries in all three types of wellbeing (see Table 4), supporting our third hypothesis. Highest levels of present financial wellbeing were found in the Slovenian sample, while lowest were in the Chinese and the U.S. samples. Highest levels of future financial wellbeing were found in the Slovenian sample, while lowest were in the Chinese and Italian samples. Lastly, highest levels of psychological wellbeing were found in the Slovenian sample, while lowest were in the Italian sample. Significant differences in job-related income loss, job loss, and perceptions of the COVID-19 lockdown restriction were also found across the six countries. The U.S. sample reported the highest income loss due to COVID-19; young adults in Italy had higher income loss than those in Slovenia and China; Chinese young adults reported lower income loss than Portuguese and Lithuanian young adults. Statistical results also indicated a significant difference between the US and all other countries in perception of the COVID-19 lockdown restriction. On average, U.S. young adults perceived the COVID-19 lockdown restriction as a misfortune; however, those who lived in the other five countries on average perceived the COVID-19 lockdown restriction as an opportunity. In terms of job loss, 19.6% of U.S. young adults reported being unemployed during the pandemic, which was significantly higher than the percentage in other countries; the lowest percentage of young adults reporting job loss was in China, which is 3.8%.

3.4.2 Model Comparison

We conducted a multi-group analysis to test our third hypothesis, which predicted that the effects of employment disruptions due to COVID-19 on wellbeing may be different across countries. We first fitted a configural model with path coefficients being freely estimated in each country, and then fitted a constrained model with the path coefficients being invariant across countries. The model fit indices for the unconstrained model were: χ2 = 57.04, df = 24; p < 0.001; CFI = 0.984; TLI = 0.911; RMSEA = 0.070, 90%CI = [0.047 0.094]; SRMR = 0.035; the model fit indices for the constrained model were: χ2 = 139.841, df = 79, p < 0.001; CFI = 0.970; TLI = 0.950; RMSEA = 0.052, 90%CI = [0.038 0.066]; SRMR = 0.050. The constrained model was significantly worse than the configural mode (ΔCFI = −0.014 > −0.01; p = 0.011 for Satorra and Bentler (2001) scaled chi-square difference test), which indicated that some paths in the mediation model were different across countries.

Modification indices clearly suggested releasing a single constraint in the Chinese sample. Specifically, we released the constraint from job loss to perception of COVID-19 for China, and the model fit indices for this constrained model were: χ2 = 127.465, df = 78, p < 0.001; CFI = 0.976, TLI = 0.959, RMSEA = 0.048, 90%CI = [0.032 0.062], SRMR = 0.047. This model was not significantly worse than the configural model (ΔCFI = −0.008 < −0.01, p = 0.067 for Satorra and Bentler (2001) scaled chi-square differences). This result suggested that the path leading from job loss to perception of the COVID-19 lockdown restriction was different for the Chinese sample. In particular, the unstandardized paths for the remaining countries were equal and negative (effect = −0.264; p = 0.004), while for the Chinese sample this effect was positive (effect = 1.186; p = 0.002). This result indicated that job loss in the Chinese sample was associated with a positive perception of the COVID lockdown restriction once accounting for the loss of income. Consequently, the indirect effects linking job loss to wellbeing via perception of the lockdown restriction were also different for the Chinese sample. Specifically, in the Chinese sample the indirect effect linking job loss to wellbeing (once accounting for the loss of income) was positive, while in the remaining countries, this indirect effect was negative. For the remaining countries, the direct and indirect effects closely matched the results of the overall sample.

4 Discussion

Using data collected from six countries (i.e., China, Italy, Lithuania, Portugal, Slovenia, US) in a cross culturally designed research project, the current study investigated the effect of two types of employment disruptions due to COVID-19 (i.e., income loss and job loss) on levels of young adults’ perception of their current and future financial wellbeing and psychological wellbeing, and found a negative impact for both income loss and job loss. We further investigated if young adults’ perception of the COVID-19 lockdown restriction mediated the associations. We found that all indirect effects from job loss and income loss on all three types of wellbeing (present and future financial wellbeing, psychological wellbeing) through perception of the COVID-19 lockdown restriction were significant.

Considering the timing of data collection and variations in the severity of the pandemic across countries, as well as differences in social and governmental policies and cultural expectations, as expected, we identified cross-country differences in mean levels of the key study constructs among six countries. However, despite mean level differences, the associations between employment disruptions and wellbeing were the same in all countries except China.

4.1 Employment Disruption and Perceived Wellbeing

Consistent with our hypothesis, we found a negative association between both types of employment disruption and young adults’ wellbeing, while accounting for the other type of disruption. The impact pattern in the two types of disruption seems different; job-related income loss was directly and negatively associated with both present and future financial wellbeing after accounting for the influence of job loss, while job loss was directly and negatively associated with only present financial wellbeing after accounting for the influence of income loss. The different patterns may reflect that many of the participants in our sample were college students, and while job loss per se at this stage may negatively influence their present financial situation, it may not harm their career identity. It is also possible that participants had multiple sources of income (e.g., multiple part-time jobs, scholarships, student loans), and thus the loss of income, but not the loss of job, was more salient. While plausible, our data do not allow us to directly test these explanations. However, we do find some evidence that access to a broader set of resources may influence the perception of COVID-19; specifically, higher parental social-economic status was associated with more positive perception of the COVID-19 lockdown restriction. Also, each of the countries represented in the study provided some form of unemployment benefits or insurance, which may have offset the adverse effects of job loss in the short term. Finally, young adults may perceive unemployment during the pandemic as a temporary layoff and expect a rapid recovery once the pandemic subsides (Parkinson, 2021). Holding this belief may help young adults cope with the negative effects of job loss by attributing it to COVID-19. In contrast, young adults may have to adjust their spending and saving behaviors to meet their current expenses when faced with an income loss. This could mean incurring debt which could cause both immediate and long-term financial distress. Finally, only a small number of participants reported a job loss, which may weaken the power to detect the separate impact of job loss and income loss.

4.2 Perception of the COVID-19 Lockdown Restriction as a Mediator

Because one’s appraisal of a stressful event may influence how one interprets it (Lazarus & Folkman, 1984), we also examined and found support for the mediating role of participants’ perception of the COVID-19 lockdown restriction on the association between employment disruptions and current and future wellbeing of young adults. We found that the indirect effects of job loss and income loss were significant on all three types of wellbeing (present financial, future financial, and psychological) through perception of the COVID-19 lockdown restriction. While both job loss and income loss were associated with lower levels of positive perception towards COVID-19 lockdown restriction (i.e., perceived as an opportunity for self-development), on average, a unit increase in positive perception towards the COVID-19 lockdown restriction was correlated with higher levels of all three types of wellbeing. Financial wellbeing encompasses both objective financial resources and subjective perception of financial status (Gudmunson & Danes, 2011), and employment uncertainty and disruption may undermine both objective financial resources and subjective feelings of financial stability (Kalleberg, 2020). Based on data collected from multiple countries during the pandemic, the current study provides support for this view. That is, lockdowns and stringent restrictions during the pandemic resulted in widespread employment disruption (i.e., job loss and/or income loss) at least in the short term (Falk, 2020) and lowered young adults’ financial wellbeing and psychological wellbeing, and this negative impact can also be explained by the reduced positive perception of these disruptions. However, as previously noted, perception of the COVID-19 impact is further influenced by access to a broader set of resources. In our model, this is evidenced by the positive association between higher parental socioeconomic status and positive perception of the COVID-19 lockdown restriction.

4.3 COVID-19 Impact Across Countries

While the coronavirus outbreak led to economic turmoil around the world, the response to the pandemic and the impact on young adults varied widely. In the current study, the U.S. sample has the highest rate of job loss with 19.6% (n = 270) of the young adults reporting a job loss after the pandemic lockdown restriction, while the lowest rate was observed in the Chinese sample with 3.8% of the young adults having a job loss. Similarly, the U.S. young adults reported the highest level of job-related income loss, with the lowest level of income loss observed in the Chinese sample. The information obtained from the survey sample is consistent with the economic data at the national and/or regional level. In the United States, the spread of the coronavirus contributed to the highest job loss rate since the Great Depression (Romm, 2020). The Gross Domestic Product (GDP) economy of the 19-member Eurozone shrank by 12.1% in the second quarter of 2020—the sharpest decline since 1995 (Eurostat, 2020). In China, the first country to experience the outbreak of the COVID-19 pandemic, the government quickly implemented a series of strict lockdown and quarantine orders to limit the spread of the virus (The State Council of PRC, 2020). At the time of data collection, there were few newly reported cases, and the economy was functioning as normal. Meanwhile, the European and American countries were experiencing the worst effects of the first wave of COVID-19 (WHO Statistics https://covid19.who.int/). It is possible that the uncertainty in the economy and job market reported in our results reflect differences in the pandemic restrictions in China compared to other countries.

In terms of present financial wellbeing, future financial wellbeing, and psychological wellbeing, Slovenian young adults reported higher than average levels. Similar to other European countries, Slovenia was heavily impacted by the pandemic, with the average level of registered unemployment in 2020 increased by 14.6% compared to the previous year (EC, 2021). Nevertheless, young adults reported greater resilience and higher wellbeing. This may be because a large portion of the Slovenian sample are still enrolled in education. Young people in Slovenia rely heavily on parents to support them financially, which may offset the negative impact of employment disruptions due to COVID-19 on wellbeing (Zupančič & Sirsch, 2018). For those who are not enrolled in education, higher wellbeing might be a result of the pandemic-related social welfare policies. By the end of data collection, five rounds of economic stimulus packages were issued, more than any other country engaged in this study (IMF, 2021). In March 2020, the Slovenian government approved the first economic stimulus package that included measures for the population that experienced employment disruption. For example, people could have tax deferrals for up to 24 months or tax payments in installments over 24 months; about €50 million were used for wage subsidies for suspended and quarantined employees; a monthly basic income was guaranteed for households and the self-employed. The third economic stimulus package approved in May 2020 allocated about €1 billion subsidies for employees whose work time was shortened. The fifth economic stimulus package issued in September 2020 expanded monthly income compensation to support the self-employed and employees in micro-companies, and quarantined employees would have a full salary replacement. If Slovenian young adults, or their parents lost a job, they were beneficiaries of these measures. Comparatively, other participating countries either had little direct financial support for individual employees (i.e., China) or fewer rounds of social welfare policies (i.e., Italy, Portugal, Lithuania, the United States) during the study period. For example, the United States government had issued only the first round of coronavirus aid and relief to support low-income households and small businesses to alleviate the losses; the Italian government initiated the “Cura Italia” emergency package that contained measures to preserve jobs and reduce income loss for laid-off employees; the Lithuanian government approved wage subsidies and job search allowances in May 2020.

Interestingly, we found that the Chinese young adults reported the lowest job loss rate and income loss level, but they also reported lower levels of present and future financial wellbeing as well as psychological wellbeing. Macro-economic shocks usually have a long-lasting impact on financial wellbeing (Kahn, 2010; Schwandt & von Wachter, 2019), even for individuals who do not experience a direct financial loss (Leininger & Kalil, 2014). We speculate that because China is an economically developing country, and young adults experience higher levels of work-related stress in general (Kortum et al., 2010), it may be that lower levels of financial and psychological wellbeing may have existed both before the pandemic and after the lockdown. This interpretation, however, falls beyond the scope of the present study.

Despite the significant mean level differences in employment disruptions (job loss and income loss) due to COVID-19, as well as differences in perceived present financial, future financial, and psychological wellbeing across countries, the direct and indirect effects of employment disruptions on the three types of wellbeing were equivalent across all countries except for China. That is, even though young adults were experiencing different levels of employment disruptions due to COVID-19 and reporting different levels in the three types of wellbeing, the processes and mechanism were the same for young adults in five of the countries examined. This finding is consistent with previous evidence (Lanz et al., 2021; Tang et al., 2021) in that the perceived impact of COVID-19 had the same effect on individual flourishing and future perception across different countries.

In China, job loss was positively related to young adults’ perception of the COVID-19 lockdown restriction, different from the other countries. At the time of data collection, there were few cases of COVID-19 diagnosis and the lockdown restriction had ended in China. Thus, Chinese participants were asked to estimate the impact of COVID-19 more than six-months earlier, which might be inaccurate. This inaccuracy might further be intensified if the young adults who lost their job during the pandemic were re-employed at the time of data collection. In addition, the Chinese sample reported the lowest job loss rate (n = 7). The significant positive impact of job loss on Chinese young adults’ perception of COVID-19 might be a Type I error rate given the small sample size.

5 Limitations

Although the current study focuses on the impact of employment disruption on young adults’ perceived financial and psychological wellbeing, it does not address the long-term impact of employment disruption on this population. For China, the full-scale COVID-19 lockdown restriction only lasted for two months even in the most severely affected cities; for the United States, stringent quarantine orders lasted for almost three months and containment measures continued for over a year; some European countries (i.e., Italy, Lithuania, Portugal, Slovenia) experienced extended and repeated lockdowns. The number of cases reported, the number of waves, and the length of the lockdown restriction could have impacted the resilience and general wellbeing of young adults across different countries. In the current study, we utilized cross-sectional data, which limits our ability to make causal inferences or to fully consider the on-going impact of COVID-19 within each country. Future studies using longitudinal data are needed to examine the longer-term impact of COVID-19 employment disruptions.

In addition, the study sample contains a limited number of participants who experienced job loss, compared to the number of young adults who experienced income loss and we cannot differentiate between voluntary and involuntary employment disruption. Future studies examining the effects of employment disruption among young adults may want to take this into account as a consideration for policy and practice. Voluntary turnover in order to invest in vocational education and training during macro-economic uncertainty may reduce the sense of loss, while involuntary job loss during a crisis may have more severe negative psychological effects on young adults (Akkermans et al., 2020).

Finally, our study relies on a convenience sampling approach, which makes it less representative. Females and college students are overrepresented in the current sample. In addition, most of the Chinese young adults were living in northwestern and northeastern cities, and thus we do not have representation from cities that may have been more severely impacted by the pandemic. Although the overall economy in China rebounded quickly, however, the recovery was uneven across regions and in different sectors (Cheng & Zhang, 2020). This may also be the case for the United States sample. While this is a common issue in the field of developmental psychology (Nielsen et al., 2017) and social sciences in general (Peterson & Merunka, 2014), caution is warranted in interpreting or applying the study findings beyond the current sample.

6 Implications and Conclusions

Despite its limitations, the findings from our study provide unique insights into the financial lives of young adults transitioning to full-time adult roles and responsibilities during an historic global event. The findings address the importance for policymakers to provide corresponding financial support for groups experiencing different forms of employment disruptions. Measures may include but are not limited to direct financial aid for individuals to deal with a sudden loss of job and income; financial subsidies for employers to help maintain the income level for a longer period to reduce worries for the future; encouraging employment and self-employment opportunities emerging in the pandemic and continuing post-pandemic for young adults, such as economic activities carried out by innovative technologies through Internet platforms and networks (e.g., E-commerce, Internet Finance, instant messaging, mobile office, online games).

In addition to financial and social support in an emergency, it is also critical for educators to guide and prepare young adults to prepare for and cope with a sudden financial shock, either caused by internal or external factors. Increasing awareness and knowledge in financial management strategies and cultivating preventative financial practices (e.g., emergency savings) will mitigate the impact of financial shocks and contribute to long-term financial stability. Also, our study found that the family SES was related to young adults’ perception of the COVID-19 lockdown restriction and all three types of wellbeing. More financial and social support should be dedicated to young adults who cannot count on the family SES which places them in a more vulnerable position. Finally, different interventions should be designed and implemented considering the different working and living conditions across the different countries in which young adults live.

Data Availability

The raw data and the materials (the survey, questions, and questionnaire items) used in the study may be obtained from the corresponding author upon request.

Code Availability

Mplus coding and data analysis output for the study are available upon request.

References

Adler, N. E., Boyce, T., Chesney, M. A., Cohen, S., Folkman, S., Kahn, R. L., & Leonard, S. L. (1994). Socioeconomic status and health: The challenge of the gradient. American Psychologist, 49(1), 15–24. https://doi.org/10.1037/0003-066X.49.1.15

Akkermans, J., Richardson, J., & Kraimer, M. L. (2020). The Covid-19 crisis as a career shock: Implications for careers and vocational behavior. Journal of Vocational Behavior, 119, 103434. https://doi.org/10.1016/j.jvb.2020.103434

Amundson, N. E., & Borgen, W. A. (1982). The dynamics of unemployment: Job loss and job search. The Personnel and Guidance Journal, 60(9), 562–564. https://doi.org/10.1002/j.2164-4918.1982.tb00723.x

Arnett, J. J. (2014). Presidential address: The emergence of emerging adulthood: A personal history. Emerging Adulthood, 2(3), 155–162. https://doi.org/10.1177/2167696814541096

Bartelink, V. H. M., Zay Ya, K., Guldbrandsson, K., & Bremberg, S. (2020). Unemployment among young people and mental health: A systematic review. Scandinavian Journal of Public Health, 48(5), 544–558. https://doi.org/10.1177/1403494819852847

Bellare, Y., Michael, R., Gerstein, L. H., Cinamon, R. G., Hutchison, A., Kim, T., & Choi, Y. (2019). Future perceptions of US and Israeli young male adults. Journal of Career Development, 46(4), 351–365. https://doi.org/10.1177/0894845318763956

Byrne, B. M., & van de Vijve, F. J. (2017). The maximum likelihood alignment approach to testing for approximate measurement invariance: A paradigmatic cross-cultural application. Psicothema, 29(4), 539–551. https://doi.org/10.7334/psicothema2017.178

Cheng, L., & Zhang, J. (2020). Is tourism development a catalyst of economic recovery following natural disaster? An analysis of economic resilience and spatial variability. Current Issues in Tourism, 23(20), 2602–2623. https://doi.org/10.1080/13683500.2019.1711029

Cox, J. (2021). Jobs report disappoints—Only 235,000 positions added vs. expectations of 720,000. CNBC. https://www.cnbc.com/2021/09/03/jobs-report-august-2021.html

Despard, M. R., Friedline, T., & Martin-West, S. (2020). Why do households lack emergency savings? The role of financial capability. Journal of Family and Economic Issues, 41(3), 542–557. https://doi.org/10.1007/s10834-020-09679-8

Domene, J. F., Arim, R. G., & Law, D. M. (2017). Change in depression symptoms through emerging adulthood: Disentangling the roles of different employment characteristics. Emerging Adulthood, 5(6), 406–416. https://doi.org/10.1177/2167696817700262

European Commission. (2021). GDP and employment flash estimates for the second quarter of 2020. Retrieved from https://ec.europa.eu/eurostat/documents/2995521/10545332/2-14082020-AP-EN.pdf/7f30c3cf-b2c9-98ad-3451-17fed0230b57

Eurostat. (2020). GDP down by 12.1% and employment down by 2.8% in the euro area. Retrieved from https://ec.europa.eu/eurostat/documents/2995521/10545332/2-14082020-AP-EN.pdf/7f30c3cf-b2c9-98ad-3451-17fed0230b57

Falk, G. (2020). COVID-19 Pandemic’s Impact on Household Employment and Income. Congressional Research Service (IN11457). Retrieved from https://crsreports.congress.gov/product/pdf/IN/IN11457/6

Folkman, S., Lazarus, R. S., Gruen, R. J., & DeLongis, A. (1986). Appraisal, coping, health status, and psychological symptoms. Journal of Personality and Social Psychology, 50(3), 571–579. https://doi.org/10.1037/0022-3514.50.3.571

Friedline, T., Chen, Z., & Morrow, S. (2021). Families’ financial stress & wellbeing: The importance of the economy and economic environments. Journal of Family and Economic Issues, 42(1), 34–51. https://doi.org/10.1007/s10834-020-09694-9

Gambin, M., Sękowski, M., Woźniak-Prus, M., Wnuk, A., Oleksy, T., Cudo, A., Hansen, K., Huflejt-Łukasik, M., Kubicka, K., Łyś, A. E., & Gorgol, J. (2021). Generalized anxiety and depressive symptoms in various age groups during the COVID-19 lockdown in Poland. Specific predictors and differences in symptoms severity. Comprehensive Psychiatry, 105, 152222. https://doi.org/10.1016/j.comppsych.2020.152222

Ganson, K. T., Tsai, A. C., Weiser, S. D., Benabou, S. E., & Nagata, J. M. (2021). Job insecurity and symptoms of anxiety and depression among US young adults during COVID-19. Journal of Adolescent Health, 68(1), 53–56. https://doi.org/10.1016/j.jadohealth.2020.10.008

Garrett, J. L., & Eccles, I. S. (2009). Transition to adulthood: Linking late-adolescent lifestyles to family and work status in the mid-twenties. Transitions from School to Work: Globalization, Individualization, and Patterns of Diversity. https://doi.org/10.1017/CBO9780511605369.011

Glowacz, F., & Schmits, E. (2020). Psychological distress during the COVID-19 lockdown: The young adults most at risk. Psychiatry Research, 293, 113486. https://doi.org/10.1016/j.psychres.2020.113486

Gomes, A. R., Faria, S., & Lopes, H. (2016). Stress and psychological health: Testing the mediating role of cognitive appraisal. Western Journal of Nursing Research, 38(11), 1448–1468. https://doi.org/10.1177/0193945916654666

Grzegorczyk, M., & Wolff, G. (2020). The scarring effect of COVID-19: youth unemployment in Europe. Bruegel Blog. Retrieved from: https://www.bruegel.org/2020/11/the-scarring-effect-of-covid-19-youth-unemployment-in-europe/

Gudmunson, C. G., & Danes, S. M. (2011). Family financial socialization: Theory and critical review. Journal of Family and Economic Issues, 32, 644–667. https://doi.org/10.1007/s10834-011-9275-y

Iannello, P., Sorgente, A., Lanz, M., & Antonietti, A. (2020). Financial wellbeing as predictor of subjective and psychological wellbeing among emerging adults: Testing the moderator effect of individual differences. Journal of Happiness Studies, 22, 1385–1411. https://doi.org/10.1007/s10902-020-0027

International Labour Organization. (2021). ILO Monitor: COVID-19 and the world of work (8th edn). Retrieved from https://www.ilo.org/global/topics/coronavirus/impacts-and-responses/WCMS_824092/lang--en/index.htm

International Monetary Fund. (2021). Policy Responses to COVID-19. Retrieved from https://www.imf.org/en/Topics/imf-and-covid19/Policy-Responses-to-COVID-19

Jackson, J. K., Nelson, R. M., Weiss, M. A., Sutter, K. M., Schwarzenberg, A. B., & Sutherland, M. D. (2021). Global economic effects of COVID-19. Congressional Research Service. Retrieved from https://fas.org/sgp/crs/row/R46270.pdf

Jahoda, M. (1981). Work, employment, and unemployment: Values, theories, and approaches in social research. American Psychologist, 36(2), 184–191. https://doi.org/10.1037/0003-066X.36.2.184

Kahn, L. (2010). The long-term labor market consequences of graduating from college in a bad economy. Journal of Labor Economics, 17(2), 303–316. https://doi.org/10.1016/j.labeco.2009.09.002

Kalleberg, A. L. (2020). Labor market uncertainties and youth labor force experiences: Lessons learned. The Annals of the American Academy of Political and Social Science, 688(1), 258–270. https://doi.org/10.1177/0002716220913861

Kim, E. S., Cao, C., Wang, Y., & Nguyen, D. T. (2017). Measurement invariance testing with many groups: A comparison of five approaches. Structural Equation Modeling: A Multidisciplinary Journal, 24(4), 524–544. https://doi.org/10.1080/10705511.2017.1304822

Klassen, R. M., Usher, E. L., & Bong, M. (2010). Teachers’ collective efficacy, job satisfaction, and job stress in cross-cultural context. The Journal of Experimental Education, 78(4), 464–486. https://doi.org/10.1080/00220970903292975

Knabe, A., & Rätzel, S. (2011). Scarring or scaring? The psychological impact of past unemployment and future unemployment risk. Economica, 78(310), 283–293. https://doi.org/10.1111/j.1468-0335.2009.00816.x

Kortum, E., Leka, S., & Cox, T. (2010). Psychosocial risks and work-related stress in developing countries: Health impact, priorities, barriers and solutions. International Journal of Occupational Medicine and Environmental Health, 23(3), 225–238. https://doi.org/10.2478/v10001-010-0024-5

Krahn, H. J., Howard, A. L., & Galambos, N. L. (2015). Exploring or floundering? The meaning of employment and educational fluctuations in emerging adulthood. Youth & Society, 47(2), 245–266. https://doi.org/10.1177/0044118X12459061

Kujawa, A., Green, H., Compas, B. E., Dickey, L., & Pegg, S. (2020). Exposure to COVID-19 pandemic stress: Associations with depression and anxiety in emerging adults in the United States. Depression and Anxiety, 37(12), 1280–1288. https://doi.org/10.1002/da.23109

Lanz, M., Sorgente, A., & Danes, S. M. (2020). Implicit family financial socialization and emerging adults’ financial wellbeing: A multi-informant approach. Emerging Adulthood, 8(6), 443–452. https://doi.org/10.1177/2167696819876752

Lanz, M., Sorgente, A., Vosylis, R., Fonseca, G., Lep, Ž, Li, L., Zupančič, M., Crespo, C., Relvas, A. P., & Serido, J. (2021). A cross-national study of covid-19 impact and future possibilities among emerging adults: The mediating role of intolerance of uncertainty. Emerging Adulthood. https://doi.org/10.1177/21676968211046071

Lazarus, R. S. (1966). Psychological stress and the coping process. McGraw-Hill.

Lazarus, R. S. (1999). Stress and emotion: A new synthesis. Springer.

Lazarus, R. S., & Folkman, S. (1984). Stress, appraisal, and coping. Springer.

Leininger, J. L., & Kalil, A. (2014). Economic strain and children’s behavior in the aftermath of the Great Recession. Journal of Marriage and Family, 76(5), 998–1010. https://doi.org/10.1111/jomf.12140

Little, R. J. A. (1988). A test of missing completely at random for multivariate data with missing values. Journal of the American Statistical Association, 83(404), 1198–1202. https://doi.org/10.1080/01621459.1988.10478722

McKee-Ryan, F. M. (2016). Looking to unemployment and underemployment research for insights on including financial variables in occupational health research: A commentary on Sinclair and Cheung (2016). Stress and Health, 32(3), 196–198. https://doi.org/10.1002/smi.2682

Moen, P., Pedtke, J. H., & Flood, S. (2020). Disparate disruptions: Intersectional COVID-19 employment effects by age, gender, education, and race/ethnicity. Work, Aging and Retirement, 6(4), 207–228. https://doi.org/10.1093/workar/waaa013

Mortimer, J. T., Kim, M., Staff, J., & Vuolo, M. (2016). Unemployment, parental help, and self-efficacy during the transition to adulthood. Work and Occupations, 43(4), 434–465. https://doi.org/10.1177/0730888416656904

Muthén, B., & Asparouhov, T. (2014). IRT studies of many groups: The alignment method. Frontiers in Psychology, 5, 978–978. https://doi.org/10.3389/fpsyg.2014.00978

Nielsen, M., Haun, D., Kärtner, J., & Legare, C. H. (2017). The persistent sampling bias in developmental psychology: A call to action. Journal of Experimental Child Psychology, 162, 31–38. https://doi.org/10.1016/j.jecp.2017.04.017

Parkinson, C. (2021). Are temporary layoffs becoming permanent during COVID-19? U.S. Bureau of Labor Statistics [Web log message]. Retrieved from: https://www.bls.gov/opub/mlr/2021/beyond-bls/are-temporary-layoffs-becoming-permanent-during-covic-19.htm

Peterson, R. A., & Merunka, D. R. (2014). Convenience samples of college students and research reproducibility. Journal of Business Research, 67(5), 1035–1041. https://doi.org/10.1016/j.jbusres.2013.08.010

Pohlan, L. (2019). Unemployment and social exclusion. Journal of Economic Behavior & Organization, 164, 273–299. https://doi.org/10.1016/j.jebo.2019.06.006

Qiu, J., Shen, B., Zhao, M., Wang, Z., Xie, B., & Xu, Y. (2020). A nationwide survey of psychological distress among Chinese people in the COVID-19 epidemic: Implications and policy recommendations. General Psychiatry, 33(2), 66. https://doi.org/10.1136/gpsych-2020-100213

Rhemtulla, M., Brosseau-Liard, P. É., & Savalei, V. (2012). When can categorical variables be treated as continuous? A comparison of robust continuous and categorical SEM estimation methods under suboptimal conditions. Psychological Methods, 17(3), 354–373. https://doi.org/10.1037/a0029315

Ringen, S., & Ngok, K. (2017) What kind of welfare state is emerging in China? In I. Yi (Ed.), Towards universal health care in emerging economies. Social Policy in a Development Context. Palgrave Macmillan. https://doi.org/10.1057/978-1-137-53377-7_8

Romm, T. (2020). Americans have filed more than 40 million jobless claims in past 10 weeks, as another 2.1 million filed for benefits last week. The Washington Post. Retrieved from https://www.washingtonpost.com/business/2020/05/28/unemployment-claims-coronavirus/

Ruengorn, C., Awiphan, R., Wongpakaran, N., Wongpakaran, T., Nochaiwong, S., & Health Outcomes and Mental Health Care Evaluation Survey Research Group (HOME-Survey). (2021). Association of job loss, income loss, and financial burden with adverse mental health outcomes during coronavirus disease 2019 pandemic in Thailand: A nationwide cross-sectional study. Depression and Anxiety, 38(6), 648–660. https://doi.org/10.1002/da.23155

Satorra, A., & Bentler, P. M. (2001). A scaled difference chi-square test statistic for moment structure analysis. Psychometrika, 66(4), 507–514. https://doi.org/10.1007/BF02296192

Savickas, M. L. (1999). The transition from school to work: A developmental perspective. The Career Development Quarterly, 47(4), 326–336. https://doi.org/10.1002/j.2161-0045.1999.tb00741.x

Scherer, K. R., & Moors, A. (2019). The emotion process: Event appraisal and component differentiation. Annual Review of Psychology, 70, 719–745. https://doi.org/10.1146/annurev-psych-122216-011854

Schwandt, H., & Von Wachter, T. (2019). Unlucky cohorts: Estimating the long-term effects of entering the labor market in a recession in large cross-sectional data sets. Journal of Labor Economics, 37(S1), S161–S198. https://doi.org/10.1086/701046

Shen, J., & Kogan, I. (2020). Job loss or income loss: How the detrimental effect of unemployment on men’s life satisfaction differs by immigration status. Frontiers in Sociology, 5, 10. https://doi.org/10.3389/fsoc.2020.00010

Sirgy, M. J., Efraty, D., Siegel, P., & Lee, D. J. (2001). A new measure of quality of work life (QWL) based on need satisfaction and spillover theories. Social Indicators Research, 55(3), 241–302. https://doi.org/10.1023/A:1010986923468

Sorgente, A., & Lanz, M. (2019). The multidimensional subjective financial wellbeing scale for emerging adults: Development and validation studies. International Journal of Behavioral Development, 43(5), 466–478. https://doi.org/10.1177/0165025419851859

Sorgente, A., Tagliabue, S., Andrade, C., Oliveira, J. E., Duan, W., & Lanz, M. (2021). Gender, age, and cross-cultural invariance of brief inventory of thriving among emerging adults. Measurement and Evaluation in Counseling and Development, 54(4), 251–266. https://doi.org/10.1080/07481756.2020.1827434

Sorgente, A., Tagliabue, S., & Lanz, M. (2019). Brief inventory of thriving: Testing Italian version's reliability using SEM. PSICOLOGIA DELLA SALUTE.

Stupar-Rutenfrans, S., Verdouw, P. C., van Boven, J., Ryzhkina, O. A., Batkhina, A., Aksoz-Efe, I., Hamzallari, O., Papageorgopoulou, P., Uka, F., Petrović, N., & Statovci, A. (2021). Ethnic outgroup aggression: A pilot study on the importance of emotion regulation, nationalism and susceptibility to persuasion. International Journal of Intercultural Relations, 84, 79–85. https://doi.org/10.1016/j.ijintrel.2021.07.004

Su, R., Tay, L., & Diener, E. (2014). The development and validation of the Comprehensive Inventory of Thriving (CIT) and the Brief Inventory of Thriving (BIT). Applied Psychology: Health and Wellbeing, 6(3), 251–279. https://doi.org/10.1111/aphw.12027

Tang, M., Hofreiter, S., Reiter-Palmon, R., Bai, X., & Murugavel, V. (2021). Creativity as a means to well-being in times of COVID-19 Pandemic: Results of a cross-cultural study. Frontiers in Psychology, 12, 66. https://doi.org/10.3389/fpsyg.2021.601389

The State Council Information Office of the People's Republic of China. (2020). Fighting Covid-19: China in action. Retrieved from: http://www.scio.gov.cn/zfbps/32832/Document/1681809/1681809.htm

Vosylis, R., & Klimstra, T. (2022). How does financial life shape emerging adulthood? Short-term longitudinal associations between perceived features of emerging adulthood, financial behaviors, and financial well-being. Emerging Adulthood, 10(1), 90–108. https://doi.org/10.1177/2167696820908970

World Health Organization (WHO). (2020). Impact of Covid-19 on people’s livelihoods, their health and our food systems. [Statement]. Retrieved from: https://www.who.int/news/item/13-10-2020-impact-of-covid-19-on-people%27s-livelihoods-their-health-and-our-food-systems

Yao, R., & Wu, W. (2021). Mental disorders associated with COVID-19 related unemployment. Applied Research in Quality of Life. https://doi.org/10.1007/s11482-021-09950-6

Zacher, H., & Rudolph, C. W. (2021). Individual differences and changes in subjective wellbeing during the early stages of the COVID-19 pandemic. American Psychologist, 76(1), 50–62. https://doi.org/10.1037/amp0000702

Zupančič, M., & Sirsch, U. (2018). Različni vidiki prehoda v odraslost [Different perspectives of becoming an adult]. In M. Zupančič, & M. Puklek Levpušček, (Eds.), Prehod v odraslost: Sodobni trendi in raziskave [Emerging adulthood: Current trends and research] (pp. 11–43). Znanstvena založba Filozofske fakultete.

Funding

Partial funding for the study was provided by the Department of Family Social Science at the University of Minnesota (Grant recipients: Lijun Li and Joyce Serido) and the Slovenian Research Agency, Award # P5-0062 (Grant recipients: Zan Lep and Maja Zupančič).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have no relevant financial or non-financial interests to disclose.

Ethics Approval

All research detailed in the manuscript was conducted in accordance with the standards of American Psychological Association. Ethics oversight approval was obtained at each participating institution.

Consent to Participate

All participants provided online consent.

Consent for Publication

The manuscript has been seen and reviewed by all authors, and all authors have contributed to it in a meaningful way. All authors consent to its publication.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Li, L., Serido, J., Vosylis, R. et al. Employment Disruption and Wellbeing Among Young Adults: A Cross-National Study of Perceived Impact of the COVID-19 Lockdown. J Happiness Stud 24, 991–1012 (2023). https://doi.org/10.1007/s10902-023-00629-3

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10902-023-00629-3