Abstract

The accumulation of wealth by households is an essential contributor towards macroeconomic and financial stability and resilience, while also affecting social mobility. The aim of this paper is to analyze the relationship between household wealth and the receipt of inheritances and intergenerational transfers. We use detailed micro-level data from the 2017 vintage of the Household Finance and Consumption Survey (HFCS) for households across the Euro Area in order to explore this relationship in detail, analyzing various classes of assets and liabilities, together with inflows of inheritances and gifts between 2014 and 2017, as well as any associated wealth effects. The results show that inheritance flows are positively and significantly-associated with net overall household wealth, primarily via increases in the value of liquid assets like publicly-traded shares and the value of existing self-employment business, while reducing mortgage debt, particularly outstanding loans related to the household’s main residence. We find no evidence of any wealth effects from inheritances in terms of increased consumption expenditure, leisure spending or motor vehicle ownership. These findings collectively suggest that households anticipated the bequests received, with behavior in line with predictions emanating from standard rational expectations life cycle income hypothesis models.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The accumulation of wealth and capital by households has emerged as one of the key economic issues in the post-Great Recession era, assuming greater relevance than ever before (Piketty & Zucman, 2014). Household wealth is crucial for financial stability (e.g., Barrell et al., 2006), particularly given the sluggish nature of wage growth over the last decade across most developed countries (Bell & Blanchflower, 2018). In addition, wealth accumulation can lead to increased social mobility (Quadrini, 2000), particularly if the average returns from capital are high relative to growth in income. Household wealth is also an important contributor to macroeconomic resilience within a country, in terms of the ability to cope with negative income shocks and periods of unemployment, although the level of private indebtedness may exacerbate exposure to downturns if they result from (or are accompanied by) a financial crisis (Garcia-Macia, 2021). Within the context of a global economy that has only started to emerge from the ravages of the Great Recession, and that must now contend with the unique challenges posed by the COVID-19 pandemic, the importance of fostering macroeconomic resilience cannot be understated, a fact explicitly acknowledged by the European Commission in its proposed recovery plan Next Generation EU (EC, 2020). Therefore, wealth accumulation by households can play a critical role in expediting economic recovery in these circumstances (Emmons & Ricketts, 2015), provided that such wealth is not acquired through elevated levels of debt.

Key to the debate surrounding household wealth is the issue of inheritance and intergenerational asset transfers. Bequests have long been identified as an important source of wealth for households (Gale & Scholz, 1994; Mathä et al., 2017; Semyonov & Lewin-Epstein, 2013), with recent evidence suggesting that such transfers are even more important than income in determining wealth accumulation (Humer et al., 2016). The conversation on bequest transfers invariably includes the somewhat controversial debate on inheritance taxes and the potential efficiency-equity trade-off. On the one hand, some (e.g., Piketty & Saez, 2013) found that the optimal level of inheritance taxation is positive and, in some cases, potentially as high as 50–60%, due to its redistributive benefits. On the other hand, others (e.g. Elinder et al., 2018) found that inheritance taxes may actually increase relative wealth inequality, given that inheritances actually reduce wealth inequality in the first place due to their larger relative impact on less wealthy heirs (pre-inheritance), although redistributive transfers may mitigate this effect. In addition, bequests have also been studied in terms of their size and impact across different demographic groups. For example, Deere and León (2003) found that men are more likely to receive inheritances than their female siblings or relatives, which in turn perpetuates existing gender inequalities across Latin America. Similarly, Ashman and Neumuller (2020) found that, across the U.S., bequests and intergenerational transfers account for 28.6% and 25.8% of the total wealth gap between Black and White households, collectively exceeding the proportion due to differences in earnings.

This paper looks at the empirical relationship between intergenerational transfers and household wealth. We use micro-level data from the third wave of the European Central Bank (ECB)’s Household Finance and Consumption Survey (HFCS), conducted across Euro Area countries in 2017, thus enabling us to delve into detailed information regarding wealth and debt accumulation across a variety of asset classes, as well as data on recent gifts and transfers received, while controlling for several idiosyncratic household characteristics.

Literature Review

This paper fits in with the well-established literature on wealth accumulation and bequest motives. The canonical view in this regard follows directly from the seminal life-cycle hypothesis of consumption postulated by Modigliani (1966), whereby wealth accumulation occurs as a result of an individual desire for consumption smoothing over their lifetime. Thus, under this view individuals accumulate wealth for the sole purpose of using these resources to fund consumption spending when incomes are low—namely at a young age and after retirement. Since then, a lively debate has ensued regarding the key determinants of wealth accumulation, including earnings (Turner & Luea, 2009), health shocks and credit market imperfections (Jappelli & Pistaferri, 2000) and precautionary savings (Cagetti, 2003) due to uncertainties regarding income or future earnings. These determinants also include a variety of bequest motives, related to factors like altruism or concern for future generations (Laitner, 2002; Wilhelm, 1996), as well as strategic or exchange bequests whereby inheritance is seen as effective payment for services rendered by beneficiaries, like for example old-age care (Bernheim et al., 1986).

In this paper, we argue that bequests and inheritance received by beneficiaries are a key determinant of their ability to accumulate wealth in the first place, both directly in terms of providing assets like property, cash, etc., but also by enabling beneficiaries to utilise such assets to generate further earnings via investment, interest and collateral, while also potentially reducing debt obligations. In this regard, the literature on the impact of bequests on beneficiary behaviour is somewhat mixed. Authors like Holtz-Eakin et al. (1994) and Blanchflower and Oswald (1998) found that bequests stimulate entrepreneurship, and also increase the likelihood that a business continues to operate, with improved overall performance. More specifically, Hurst and Lusardi (2004) argued that the channels through which inheritances impact entrepreneurial activity go beyond liquidity constraints, encompassing several factors like household human capital, entrepreneurial spirit, past success and preferences, particularly since wealthier households are more likely to receive inheritances. One issue that must be addressed is the extent to which such inheritances are expected or not by the recipient, since this can have a significant impact on the ways in which households utilize these windfalls in terms of either investing or consumption expenditure (Browning et al., 2013). For example, Druedahl and Martinello (2020) found that recipients of unexpected inheritances reduce their saving tendencies over the subsequent decade following the windfall gain, with net wealth reverting back to its previous path prior to the windfall as inheritances are depleted. Similarly, Cagetti and De Nardi (2006) found that while voluntary or planned bequests are key to lifting borrowing constraints, facilitating entrepreneurial behaviour, accidental bequests lead to less wealth concentration and aggregate capital. This tallies with Cox (2014), who found that while planned inheritances lead to lower liquidity constraints and may boost labour supply, unanticipated bequests increase the chance of retirement, even among those who are in the prime of their working life, as the unexpected windfall acts as a disincentive to work. Therefore, this paper fits in with this literature by directly considering the extent to which inheritances are related to wealth accumulation. The structure of the HFCS data also allowed us to capture credit constraints separately from inheritances, thus enabling us to focus on the impact of other factors related to inheritances on wealth accumulation, as mentioned by Hurst and Lusardi (2004). In addition, we also considered different types of wealth (e.g., real estate, financial assets, business assets), since inheritances can affect wealth accumulation differently according to the type of asset under consideration. Thirdly, we also accounted for the issue of expected and unexpected bequests by utilizing inheritance flows between two waves of the HFCS (as described below) in order to minimize any timing issues, while also controlling for the number of household inhabitants aged 65 and over as a proxy for anticipated bequests.

Although the bulk of the bequest literature is concerned with the impact of inheritance on factors like capital accumulation, inequality, entrepreneurship and labour market choices, this paper considered a broader set of potential outcomes by also analysing potential wealth effects emanating from bequests, and their impact on consumption behaviour. The literature on wealth effects is varied, with different types of wealth exerting different levels of influence on consumption patterns. For example, across a panel of 14 countries and U.S. states, Case et al. (2005) found that while increases in the value of stock market assets has limited impact on consumption, higher property prices have significant wealth effects in terms of stimulating consumption, with the latter also reported in Cheng and Fung (2008) for Hong Kong. By contrast, Sousa (2009) reported significant and large wealth effects for financial assets like currency and deposits, shares and mutual funds, and negligible wealth effects for housing, within the Euro Area. Given that bequests can come in a variety of forms, namely financial or non-financial, and anticipated or unanticipated, the likely impact of such inheritance on consumption and thus any potential wealth effects are a priori ambiguous at best. For example, using survey data in the US, Zagorsky (2013) found that almost half of all wealth inherited is saved, with the rest either spent on consumption expenditure or lost through investments. Similar results are reported by Chambers et al. (2017), who found that people spend a higher proportion of inheritances than money received from bonuses, tax refunds, suggesting that windfall gains are spent more readily in line with the so-called house money effect (Thaler & Johnson, 1990). Our paper contributes to the literature on wealth effects from inheritance directly, by also considering which types of assets are related to increased inheritances, thereby isolating individual channels through which wealth effects may exist or not, while also attempting to control for anticipated and unanticipated bequests. We also looked at different types of consumption behavior across various spending classes in order to tease out more specific potential wealth effects.

Method

Econometric Models

We now specify the empirical models which shall be used in this paper, in order to capture the relationship between individual bequests and various outcomes of interest, in particular wealth accumulation. In broad terms, the regression equations estimated in this paper can be specified as follows:

where \({Y}_{i}\) = Dependent variable of choice, namely Net Wealth; Net Housing Wealth; Net Liquid Assets; Expenditure on Consumption Goods and Services; Debt-to-Assets Ratio; Value of Main Residence; Value of Real Assets; Value of Financial Assets; Value of Business Assets; Outstanding Home Loan Balance, \({Inherit}_{i}\) = Value of inheritance received by respondent i, denoted as the difference in total accumulated inheritance in the 2017 HFCS wave relative to the 2014 wave, \({PriorWealth}_{i}\) = Net wealth reported by household i in the 2014 HFCS wave, \({Income}_{i}\) = Household annual income, \({Credit}_{i}\) = Dummy variable denoting whether the household is credit constrained or not, \({65Plus}_{i}\) = Number of individuals aged 65 and over living within household i in the 2014 HFCS wave, \({Composition}_{i}\) = Change in number of inhabitants within household i in the 2017 HFCS wave relative to 2014, \({EconActive}_{i}\) = Number of economically-active household members in household i, \({Kids}_{i}\) = Number of children residing in household i, \({Educ}_{i}\) = Educational background of head of household i, \({Age}_{i}\) = Age of head of household i, \({Male}_{i}\) = Dummy variable denoting whether head of household i is male or not, \({\alpha }_{i}\) = Country-specific fixed effects related to each household i, \({\varepsilon }_{i}\) = Residual term.

Description of Data and Estimation Techniques

We estimated Eq. (1) across several different dependent variables using data from the 2017 wave of the Household Finance and Consumption Survey (HFCS). The HFCS is a wide-ranging survey designed by the European Central Bank (ECB) in 2010 and conducted across all 18 Euro Area countries plus Poland and Hungary, and seeks to understand the economic and financial behavior of households across Europe, including asset and liability accumulation, income as well as consumption expenditure (HFCN, 2020). In total approximately 84,000 interviews were conducted as part of the 2017 wave, making it one of the most comprehensive and largest surveys on household finances in the world, both in terms of size and scope of coverage. Apart from the results pertaining to each specific survey wave, the HFCS also contains a panel of households across select countries in order to gauge movements in household wealth, finances and expenditure over time, across different waves of the survey. Nonetheless, a key shortcoming of the HFCS is that, like most surveys of its kind, it relies on self-reported wealth, income and consumption by individuals representing their households. The validity of self-reported measures of financial variables like income have long been questioned (e.g., Rodgers et al., 1993), with such problems exacerbated when it comes to the reporting of illegal earnings (Anglin et al., 1993) which may be more prevalent in certain countries or territories, although more recent literature has expressed greater confidence in the overall validity and reliability of self-reported income for both legal and illegal channels (Angrist & Krueger, 1999; Nguyen & Loughran, 2017).

In this paper, we considered a number of different dependent variables in order to obtain a more comprehensive picture of the relationship between inheritance and household wealth. We first considered net wealth in its totality, representing total assets less liabilities, to assess the overall state of households’ financial position. We then broke it down into a number of key components across both assets and liabilities, including real estate, financial and liquid assets, business assets, personal debt and outstanding mortgages for property owners, as depicted in Fig. 1. The aim was to understand how inheritances related to each of these classes of assets and liabilities, and the extent to which such bequests affected the composition and structure of household wealth, thus enabling us to analyse specific findings from the literature discussed earlier. We also considered whether inheritances lead to higher consumption expenditure among recipient households, in order to understand how such inflows affected material standards of living and any wealth effects emanating from such transfers.

Our explanatory variable of interest is the value of inheritances received by households between the 2014 and 2017 waves of the HFCS. Each wave of the HFCS contains a specific set of questions on the total value of gifts or inheritances ever received by each respondent household, with further questions related to the type of gift or inheritance. Figure 2 below shows the composition of total inheritances received by our sample of respondents. As shown below, the vast majority of inheritances received as at the 2017 HFCS wave were in the form of money (41%), followed by dwellings (26%) and land (14%).

(Source: HFCS, 2020)

Total inheritances received by type

Although the aggregate value of inheritance or gifts received over the course of a lifetime is an interesting metric, the overwhelming evidence from the inequality literature suggests that wealthier individuals and households receive higher levels of intergenerational transfers and inheritances over their lifetime, exacerbating wealth inequality further (e.g., Piketty & Zucman, 2015). In practical terms, this relationship creates an endogeneity issue since reverse causality would have been present between several of our dependent variables and our key explanatory variable, which would have biased our results and called into question the reliability of any inferences. Therefore, in this paper we exploited the panel nature of the HFCS data to calculate the change in the value of inheritances across the 2014 and 2017 survey waves for each household:

The rationale behind using this variable is to capture any recent movements in inheritances or intergenerational gifts received by households, and thus how such movements influenced asset and wealth accumulation and consumption, with the timing of such receipts being relatively random since they would have largely depended on family deaths or arbitrary transfers, independent from the recipient’s level of initial wealth. This, together with the various control variables employed (including prior wealth and household income), enabled us to mitigate the effects of endogeneity in order to focus on the relationship between inheritances and wealth. It also allowed us to analyze the recipients’ relatively immediate reaction to a recent windfall gain in terms of their spending and saving patterns, as opposed to how the accumulation of inheritances over their lifetime contributed towards household wealth.

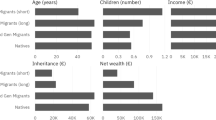

In addition to inheritances, we also included a large number of control variables in order to further assess the determinants of household wealth accumulation and probe various potential channels through which bequests may have operated as promulgated by the literature. We included net wealth in the previous (2014) wave of the HFCS and household annual income in order to control for the possibility that wealthier and/or high-income households were more likely to receive higher-valued inheritances between 2014 and 2017. We included a dummy variable denoting whether the household is credit constrained or not, to specifically control for the possibility that bequests may have alleviated credit and income constraints and lead to higher wealth accumulation, as discussed by Cagetti and De Nardi (2006). We also included two household-specific demographic characteristics related to the number of economically-active members of the household, the number of children and the change in household composition between 2014 and 2017, which may have affected both the receipt of bequests and the households’ ability to accumulate wealth, as well as a number of respondent-specific characteristics, namely gender, age and educational background. Furthermore, we included the number of inhabitants aged 65 and over residing within each household (excluding the respondent) during the 2014 wave of the HFCS as an additional control. This was done in order to further address the issue related to the timing of inheritances, since households with older inhabitants were more likely to expect to receive an inheritance within the short to medium term due to deaths, thus further enabling us to control for expected bequests. Detailed descriptions of each variable are provided in Table 1, with summary statistics shown in Table 2.

All econometric models in this paper were estimated using Ordinary Least Squares (OLS), with White robust standard errors employed to account for heteroskedasticity across households. We also included country fixed effects in all of our regressions, to account for country-specific idiosyncrasies and factors that may have influenced both household wealth as well as the extent of inheritance transfers, like for example inheritance tax systems. Accounting for missing data and other omissions, our final dataset included 19,069 observations across ten (10) Euro Area countries, namely Belgium, Cyprus, Germany, Estonia, Finland, France, Italy, Latvia, Malta and Slovakia. A breakdown of the number of respondents by country is provided in Fig. 3.

(Source: HFCS, 2020)

Number of HFCS Respondents by Country

Analysis

Net Wealth

We begin by looking at the relationship between inheritance flows and net wealth. The regression results are shown in Table 3, where column (1) shows the coefficients obtained when using household net wealth as the dependent variable, and column (2) shows the results when utilizing the respondents’ relative wealth position within the country. As seen in column (1), the key explanatory variables for net wealth were inheritance flows and prior net wealth. The coefficient obtained for inheritance indicated that on average, every additional Euro inherited or received as a gift between 2014 and 2017 boosted household net wealth of the recipient by around 0.56 Euro. Therefore, it is clear that inheritances and gifts contributed towards higher levels of net wealth in the Euro Area, either through increased asset holdings of some kind or else via reduced liabilities. It is worth bearing in mind that this finding has been obtained while controlling both for country-specific fixed effects as well as a proxy for expected inheritances, meaning that even when such bequests were unanticipated (at least from a timing perspective), this still translated into a rise in net wealth, at least in the short run. We also found that net wealth in 2017 is positively and significantly-related to net wealth in 2014, suggesting some level of persistence in household wealth, as expected.

It is also worth delving into the oft-discussed issue of wealth inequality, and more specifically how inheritances contributed towards exacerbating or reducing such disparities across households by facilitating upward mobility along the wealth distribution. To this end, we compared net wealth of each household to the average net wealth within the household’s country of residence in both 2014 and 2017, and noted whether each household was above or below their country mean. We then assessed whether each household had moved above the country average net wealth in 2017 compared to 2014 (1), moved below the mean (− 1), or remained unchanged (0), and constructed a new variable on this basis, which we utilized as our dependent variable in column (2). As seen below, inheritance flows had no impact on relative household wealth, indicating that such transfers were not sufficient to raise households above the average net wealth within their country, mainly since such receipts boosted net wealth across the entire distribution, thereby also raising the average. Thus, bequests only served to perpetuate existing inequalities across the Euro Area, in line with other findings in the literature (e.g., Piketty & Saez, 2013). We also found that households with higher levels of net wealth in 2014 were marginally less-likely to record an improvement in relative wealth position, which was wholly understandable given that they would already have been above the country mean wealth. Higher incomes were in turn associated with relative wealth improvements, although this relationship was quantitatively very weak as observed by the coefficient obtained. By contrast, age was negatively-correlated with relative wealth improvements, indicating that younger respondents were more likely to move above their country-specific net wealth while older people were more likely to dip below it, reflecting life cycle consumption and savings patterns.

Household Assets

Given that inheritance transfers had a significant impact on net wealth accumulation, we now considered the channels through which this effect existed. We looked at different classes of household assets as determined within the HFCS, namely real estate, financial assets and business assets. Real estate mainly includes the value of the household’s main residence (provided that the household actually owns or partially-owns the property), together with the value of other real estate holdings as reported (excluding real estate used in business). Financial assets include the sum of all household deposits, mutual funds, bonds, shares and equity (excluding shares in self-employment businesses), life insurance and other financial assets. Finally, business assets incorporate the value of self-employment businesses together with the value of real estate used in business activities. Each class of assets was used as a dependent variable and analyzed separately, as shown in Table 4.

We start with real estate holdings (column 1). Inheritance flows were not significantly-related to the value of real estate held by households in the Euro Area; indeed, inheritance was also unrelated to the likelihood of owning real estate assets or not (these latter results have been omitted due to space constraints). This was perhaps somewhat surprising given that dwellings were the second most popular type of inheritance or gift received in our sample as depicted in Fig. 2, although it is important to note that Fig. 2 refers to total accumulated inheritances by households, whereas our coefficient estimate in Table 4 column (1) refers to the flow of inheritances between 2014 and 2017. Therefore, the results suggested that over the time period under consideration inheritances of property were either of comparatively-low value or were overshadowed by other asset classes (e.g., money). In addition, it is also possible that many respondents who inherited property simply sold it off and utilized the proceeds for alternative purposes other than real estate investment. As expected, both net wealth in 2014 and household income were positively and significantly correlated with real estate holdings, indicating that wealthier households held higher-value real estate assets. In addition, the value of real estate assets was also positively-related to educational background, age and having a male head of household. The finding for education further underscores its importance in terms of yielding higher household wealth, in this case via property, while the positive coefficient for age reflects broad trends across Europe and other countries around the world regarding higher levels of homeownership among older individuals, coupled with typical property valuation trends over time, which naturally would favour older respondents due to property price inflation (e.g., Andrews & Sánchez, 2011). Finally, the positive coefficient for our male dummy variable indicates that there was a gender property gap in the Euro Area, whereby male heads of household on average owned real estate valued at over 73,569 Euro more than their female counterparts, even after controlling for inheritances, income and wealth, consistent with other findings regarding homeownership and gender (e.g., Garcia & Figueira, 2020).

We now turn to household financial assets (column 2). As seen below, inheritance flows were positively and significantly correlated with the value of financial assets held by households in our Euro Area sample, with each additional Euro of inheritance associated with an increase in financial assets of around 0.47 Euro. In the HFCS, household financial assets comprise nine main categories, namely deposits, mutual funds, bonds, non-self-employment private business ownership, publicly-traded shares, managed accounts, money owed to households, voluntary pensions and whole life insurance schemes and other assets. A deeper dive into these results showed that the positive association observed between inheritances and financial assets was primarily driven by increased holdings of publicly-traded shares, excluding any shares in self-employed businesses, with each additional Euro inherited related to a 0.51 Euro increase in the value of shares. Given that money was the single largest source of inheritance among our sample in the 2017 HFCS, while securities or shares only constituted a small fraction of total inheritances (Fig. 2), it is unlikely that these results merely reflected a windfall of inherited equity that is retained, but rather a more conscious decision to invest in shares. These findings are broadly consistent with those by Andersen and Nielsen (2011) in Denmark, who found that unexpected windfall inheritance results in higher stock market participation by households on average, with particularly strong effects observed among the top inheritance decile, although it is important to note that overall most households did not react by participating in the stock market, and indeed most equity inherited was sold off. We also found that inheritances are positively and significantly-related with the value of voluntary pensions and life insurance schemes, with every Euro inherited associated with a 0.17 Euro increase in such holdings. Once again, as seen from Fig. 2 inheritances from life insurance policies made up a small fraction of total inheritances among our sample (4%), implying that the decision to increase pensions and life insurance holdings following inheritances was likely a deliberate choice by recipients. This finding suggests that households that received a bequest in our sample, at least partially, adopted a long-term approach to managing these gains, motivated either by life-cycle income planning in the case of voluntary pensions, or potentially altruistic bequest motives in the case of life insurance policies. It is interesting to note that none of the other coefficients obtained were statistically-significant, which relates both to the difficulty in pinning-down the determinants of household saving (e.g., Grigoli et al., 2014) as well as potential issues related to disclosure of financial assets within our sample coupled with multicollinearity issues that may be particularly pertinent in this instance.

Finally, we focus on household business assets related to self-employment (i.e. entrepreneurship) and real estate holdings in other business activities. Given that many respondents in our sample omitted to reply to these questions, a relatively small final sample was used to estimate the regression in column (3), meaning that results must be treated with caution due to limited power. Nonetheless, we observed that inheritance flows were positively and significantly related to the value of business assets held by households, with each additional Euro of inheritance linked with an increase in business assets of over 0.64 Euro. A closer inspection of these results showed that this relationship was entirely underpinned by the value of self-employment businesses rather than real estate business holdings, across both those who already owned their own business and those who did not, thus encouraging new entrepreneurial endeavors. Therefore, our findings are consistent with the idea that inheritance flows increase both entrepreneurship as well as the likelihood that existing businesses continue to operate and flourish as discussed by the likes of Blanchflower and Oswald (1998) and Hurst and Lusardi (2004). Prior net wealth was also positively and significantly-correlated with business assets, indicating that wealthier households also tended to have more valuable businesses, although the direction of causality is unclear. We also find that credit constrained households had lower-value business assets, which is unsurprising since such entrepreneurs would struggle to find the necessary financing in order to conduct the necessary investments and expand their business.

Household Liabilities

The next set of dependent variables to consider are related to the value of household liabilities. Once again, given that several categories of liabilities exist, we broke these down into two specific types, namely mortgages and personal debt. Mortgages include any outstanding debt accrued in relation to ownership of the main household residence as well as any other properties, while personal debt includes other non-mortgage debt like credit lines, overdrafts, credit card debt, personal loans and other non-collateralized debt. The results for each specific class of liability are shown in Table 5.

As seen from column (1), inheritance flows were negatively and significantly-related to the value of household mortgage debt. The coefficient obtained implies that an additional Euro of inheritance was associated with a 0.09 Euro decline in outstanding mortgage debt, with the vast majority of this effect driven by reductions in debt related to the main household residence. Therefore, it appears that on the liabilities side, households utilized at least part of their inheritance receipts to pay-off existing mortgages on their home of residence, thus reducing or eliminating a large proportion of their debt and associated interest payments. In addition, we found that household income and the number of economically-active household members were both positively and significantly-related with mortgage debt, reflecting the fact that higher income households are typically able to take out higher home loans when purchasing their main residence. We also found that the number of children within the household was positively and significantly-correlated with mortgage debt, which makes sense given that larger households would typically require larger residences. Furthermore, the head of household’s level of education was also positively-related to mortgage debt, in line with other findings in the literature related to education and an individual’s willingness to take on debt (e.g., Almenberg et al., 2020).

We now turn to personal debt in column (2). As seen below, inheritance was not significantly-related to levels of personal debt; indeed, inheritance was not associated with any of the sub-components of personal debt like credit card debt, overdrafts and personal loans. Thus, it appears that inheritance receipts were not used to reduce any form of non-mortgage personal debt, at least in our sample of Euro Area respondents. On the other hand, we found that income was positively-correlated with the value of personal debt, mirroring broader macroeconomic trends on rising debt and income levels in other Western countries (e.g., Debelle, 2004). In addition, male respondents on average reported lower levels of personal debt relative to females, although this result was only marginally-significant at the 10% level. None of the other explanatory variables yielded statistically-significant results, once again reflecting the relatively-small sample used in the regression due to data omissions.

Wealth Effects

We conclude by looking at any wealth effects emanating from these inheritance receipts as promulgated in other domains by the likes of Cheng and Fung (2008) and Sousa (2009). We considered three dependent variables—overall annual household expenditure on consumer goods and services, annual expenditure on trips and holidays, in order to capture spending on luxuries and leisure activities, and the total value of the household’s vehicles, to capture expenditure on conspicuous durable goods.

When it comes to general consumption expenditure, as seen in column (1) we found no evidence of any wealth effects, with the coefficient on inheritance flows not statistically-significant. Therefore, it does not appear as though transfers of gifts or inheritance led to higher consumption spending in our Euro Area sample overall, in contrast with Zagorsky (2013) who reported higher levels of consumption in response to inheritances. As expected, consumption was positively-related to both household wealth and income, as well as the number of inhabitants aged 65+ in 2014, the number of economically-active household members and the number of children within the household. Furthermore, individual factors like education, age and the male dummy were all positively and significantly-related to consumption spending.

Turning to annual spending on holidays and trips (column 2), once again we found no statistically-significant coefficient on inheritance flows, which further points towards the absence of any inheritance wealth effects. As before, net wealth, income and educational background were all positively-related to holiday spending, while credit-constrained households and those with older heads of household spent less on annual trips and holidays on average. Finally, we also found no indication of any wealth effects when it comes to household expenditure of motor vehicles, as seen from column (3), with the coefficient on inheritance not statistically-significant. Wealthier households tended to have more valuable motor vehicles, as did those with male heads of household.

Therefore, our econometric results provided no evidence of any wealth effects from inheritance flows in our sample, both in terms of overall consumption and in terms of more specific types of spending like leisure and durable goods. This is particularly relevant since as seen from Fig. 2, the bulk of inheritances received in our sample were monetary. As mentioned earlier, Sousa (2009) found large wealth effects for financial assets like currency and deposits, shares and mutual funds within the Euro Area, in contrast to our results, although in the former case the focus was on the appreciation in value of financial assets as opposed to the inheritance/gifting of additional assets. Furthermore, our findings pertain to the short-run, while in Sousa (2009) the highest wealth effects were reported in the long-run, which were often substantially-larger than in the short-run.

Discussion

The findings from this paper raise several points of discussion within the scope of the literature. More specifically, the results showed that households that received an inheritance did not treat it as a typical ‘windfall gain’ as described in Chambers et al. (2017) in terms of simply increasing their consumption expenditure or reducing their level of saving (Druedahl & Martinello, 2020). Rather, we found that recipient households used the inheritances to invest in publicly-trades shares, voluntary pensions and life insurance policies, as well as existing self-employment businesses, while also paying off part of their outstanding debt on residential properties, with no significant increase in consumption expenditure. Thus, household behavior was very much consistent with the standard rational expectations lifecycle income hypothesis predictions whereby households were forward-looking and, in line with Browning et al. (2013), current inheritances had already been incorporated as part of the households’ lifetime income, implying that such bequests were in fact already anticipated to some extent.

When discussing the issue of unexpected versus expected inheritances, there are two broad dimensions to consider, namely timing and magnitude of receipts. This is because while an inheritance may be unexpected in terms of its timing, due to for example a sudden death of a relative, it is entirely plausible that the magnitude or incidence of an inheritance is expected by the recipient, and that this forms part of his/her long-run wealth and thus lifetime consumption, particularly given that as discussed earlier inheritances are typically received and passed on within wealthy households (Elinder et al., 2018). Most of the literature (e.g., Andersen & Nielsen, 2011; Druedahl & Martinello, 2020) have largely focused on the timing aspect; however, this ignores the second dimension of inheritances, namely the extent to which recipients expected to receive an inheritance sometime in the future. Our paper broadly follows in this general trend within the literature by capturing unexpected inheritances from a timing perspective, since it is focused on receipts within a specific point in time, which are largely random in nature, and controlling for the presence of inhabitants aged 65 and over within the household. However, like the rest of the literature, we are unable to distinguish between those who expected to receive an inheritance over their lifetime and those who did not. To attempt to account for this potential issue, we controlled for net household wealth in the previous wave of the HFCS within the regression itself, since wealthier households are more likely to receive a bequest, and are thus potentially more likely to expect a windfall. However, given that wealthier households are also more likely to receive an inheritance, this variable may prove to be rather weak in terms of actually controlling for inheritance expectations, especially since most bequest recipients in our sample were indeed wealthy (inheritance flows and household wealth in 2014 are significantly correlated with each other). Therefore, it is plausible that within our sample, households largely expected to receive an inheritance at some point in time and, within the context of a rational expectations lifecycle framework, had already accounted for such inflows when considering their lifetime income streams and wealth, thus resulting in higher levels of investment once the bequests were realized, and no significant increase in consumption expenditure.

The results that emerge from this paper also have clear implications for wealth accumulation and related fiscal policies. In particular, our results contribute towards the ongoing debate surrounding the introduction of some sort of wealth or inheritance tax across several countries. On the one hand, we found no evidence that inheritances help to reduce wealth inequality or promote social mobility across households, meaning that taxation on such receipts may help to redress any inequities through active redistribution policies and public expenditure programs, particularly if these are directed towards mobility-enhancing areas like education, which as seen from our results was a key driver of mobility. However, our results also indicated that inheritances were important in promoting greater stock market participation and, crucially, investment in entrepreneurial activities, which assist in boosting employment and economic growth, given that such businesses are the lifeblood of the EU’s economy, accounting for 99.8% of all non-financial businesses within the EU and 66.6% of employment (European Commission, 2019). Furthermore, inheritances also helped to alleviate household debt related to property mortgages, which would allow them to redirect resources towards other forms of expenditure and additional investment, helping to augment wealth further.

Therefore, the argument in favour or against the introduction of an inheritance tax largely hinges on whether the existence of such a tax would actively discourage wealth generation and in particular investment in business activities which are so crucial to EU economic growth. We can investigate this issue further by looking at the countries within our sample in terms of those that already do levy some sort of inheritance or gift tax, and which do not, and re-examining the key statistically-significant relationships derived earlier along these lines. In our sample, Germany, France, Italy, Belgium and Finland all have some form of inheritance or gift tax in place currently (albeit with differing conditions and systems), while Cyprus, Estonia, Latvia, Malta and Slovakia currently do not have any inheritance taxes in place. We therefore generated a new dummy variable that assumes a value of 1 if the respondent in question resided within a country that currently has some form of inheritance tax, and 0 otherwise, and interacted this dummy with our key variable of interest, namely inheritance flows. We then included this interaction term as an additional explanatory variable in our regression model specified in Eq. (1), and re-ran the regressions that were shown across Tables 3, 4, 5 and 6 above. We focused solely on those regressions that yielded statistically-significant coefficients for our inheritance flows variable. The results are shown below in Table 7, where for the sake of conciseness we only show the coefficients obtained for our key variables of interest, although each regression contains the entire suite of controls as specified in Eq. (1).

As shown below, living in a country that has an inheritance tax system in place resulted in a stronger relationship between inheritance flows and net wealth (column 1), with the slope coefficient obtained on our interaction term being both positive and statistically-significant. Subsequent analysis revealed that although there were no significant differences in terms of asset accumulation across both sets of countries, there was a stronger effect of inheritances on household property loan reductions among these taxed countries than there was among the non-tax countries (column 4). Clearly these results must be prefaced by the fact that our sample contains significantly more respondents from inheritance tax countries than non-tax countries, which limits the scope of comparison. Nonetheless, our results suggest that there is little evidence to support the assertion that inheritance taxes limited the scope of wealth generation (via asset accumulation or liability reduction) among recipient households.

Concluding Remarks

In this paper we sought to understand the impact of bequests and inheritances on household wealth. We used detailed survey data from the 2017 wave of the ECB’s HFCS in order to empirically-estimate the relationship between inheritances and household net wealth, as well as a wide variety of assets and liabilities. We exploited the panel nature of the HFCS in order to derive flows of inheritance and gifts across two different waves of the survey, in order to mitigate against potential endogeneity issues and isolate the flow of inheritance as opposed to stocks. We also assessed whether receiving inheritances led to any wealth effects among respondents, both in terms of overall consumption as well as expenditure on leisure and durable goods.

At this point, it is worth pointing out a number of important shortcomings related to this paper. Firstly, no attempt has been made to tease out causal relationships between inheritances and the various classes of household assets, liabilities and consumption expenditures, as was done in other similar papers like Andersen and Nielsen (2011) or Druedahl and Martinello (2020). Rather, we relied on the panel nature of the dataset in order to estimate inheritances and assess their relationship to asset, liability and consumption patterns in the latest wave of the HFCS, controlling for a wide variety of important factors in order to reduce the likelihood of endogeneity. Secondly, the relative proximity of the two waves of the HFCS (2014 and 2017) means that our results must be considered as essentially short-term in nature, with no indication of how wealth trajectories and wealth effects may alter in the long run, which may differ substantially from what we find (e.g., Sousa, 2009). Thirdly, the issue of anticipated and unanticipated inheritances from a timing perspective is an important consideration, and one that in this paper was dealt with via the construction of the inheritance flows variable of interest itself, together with an additional control variable for number of inhabitants aged 65 and over in the prior (2014) wave of the HFCS. Nonetheless, it is still entirely possible that the timing of these inheritances was still anticipated, since not all bequests are made by elderly household members, and moreover we were not able to control for the age of the respondents’ parents since such data was not collected as part of the HFCS. Finally, the study is based on the HFCS dataset which, while very detailed, contains a number of key issues like the presence of missing data, limited panel availability across countries and a somewhat scant focus on the role of inheritances, particularly (and crucially) the extent to which inheritances are expected or not by respondents, and the flow of inheritances across different categories of assets within each wave of the survey.

Nonetheless, the results indicate that inheritance flows were positively and significantly-associated with net overall household wealth. A deeper look at the findings showed that inheritances primarily increased the value of financial asset holdings, in particular liquid assets like publicly-traded shares, as well as the value of self-employment business and entrepreneurial undertakings. Inheritances also helped to reduce mortgage debt, particularly outstanding loans related to the household’s main residence. Finally, we found no evidence of any wealth effects from inheritances in terms of increased consumption expenditure and spending on durable goods like motor vehicles. Thus, the behavior of households within our sample was largely in line with prediction from the rational expectations lifecycle income hypothesis, whereby households exhibited forward-looking behavior and had already accounted for such inheritances in their lifetime income streams, furthering the notion that such receipts were anticipated by the households, since they did not result in higher levels of consumer spending. We also discussed the results in light of the ongoing debate regarding the potential introduction of inheritance taxes in several countries, and in particular the potential impact of such taxes on wealth accumulation. By splitting our sample into those countries that already have an inheritance tax in place and those that do not, we found no evidence that the presence of an inheritance tax limited the ability of recipient households to utilize their inheritances for the purposes of wealth creation.

Data Availability

All data was obtained from the Household Finance and Consumption Survey (HFCS), with permission from the European Central Bank (ECB). This data can be obtained by third parties, subject to obtaining the relevant clearance from the ECB.

Code Availability

Not applicable.

References

Almenberg, J., Lusardi, A., Säve-Söderbergh, J., & Vestman, R. (2020). Attitudes toward debt and debt behavior. The Scandinavian Journal of Economics, 123(3), 780–809. https://doi.org/10.1111/sjoe.12419

Andersen, S., & Nielsen, K. M. (2011). Participation constraints in the stock market: Evidence from unexpected inheritance due to sudden death. The Review of Financial Studies, 24(5), 1667–1697. https://doi.org/10.1093/rfs/hhq146

Andrews, D., & Sánchez, A. C. (2011). The evolution of homeownership rates in selected OECD countries: Demographic and public policy influences. OECD Journal: Economic Studies, 2011(1), 1–37. https://doi.org/10.1787/19952856

Anglin, M. D., Hser, Y. I., & Chou, C. P. (1993). Reliability and validity of retrospective behavioral self-report by narcotics addicts. Evaluation Review, 17(1), 91–108. https://doi.org/10.1177/0193841X9301700107

Angrist, J. D., & Krueger, A. B. (1999). Empirical strategies in labor economics. In Handbook of labor economics (Vol. 3, pp. 1277–1366). Elsevier.

Ashman, H., & Neumuller, S. (2020). Can income differences explain the racial wealth gap? A quantitative analysis. Review of Economic Dynamics, 35, 220–239. https://doi.org/10.1016/j.red.2019.06.004

Barrell, R., Davis, E. P., & Pomerantz, O. (2006). Costs of financial instability, household-sector balance sheets and consumption. Journal of Financial Stability, 2(2), 194–216. https://doi.org/10.1016/j.jfs.2006.05.001

Bell, D. N., & Blanchflower, D. G. (2018). The lack of wage growth and the falling NAIRU. National Institute Economic Review, 245(1), R40–R55. https://doi.org/10.1177/002795011824500114

Bernheim, B. D., Shleifer, A., & Summers, L. H. (1986). The strategic bequest motive. Journal of Labor Economics, 4(3, Part 2), S151–S182.

Blanchflower, D. G., & Oswald, A. J. (1998). What makes an entrepreneur? Journal of Labor Economics, 16(1), 26–60. https://doi.org/10.1086/209881

Browning, M., Gørtz, M., & Leth-Petersen, S. (2013). Housing wealth and consumption: A micro panel study. The Economic Journal, 123(568), 401–428. https://doi.org/10.1111/ecoj.12017

Cagetti, M. (2003). Wealth accumulation over the life cycle and precautionary savings. Journal of Business & Economic Statistics, 21(3), 339–353. https://doi.org/10.1198/073500103288619007

Cagetti, M., & De Nardi, M. (2006). Entrepreneurship, frictions, and wealth. Journal of Political Economy, 114(5), 835–870. https://doi.org/10.1086/508032

Case, K. E., Quigley, J. M., & Shiller, R. J. (2005). Comparing wealth effects: The stock market versus the housing market. The BE Journal of Macroeconomics. https://doi.org/10.2202/1534-6013.1235

Chambers, V., Bland, E., & Spencer, M. (2017). Does the source of a cash flow affect spending versus saving? Financial Services Review, 26(3), 291–313.

Cheng, A. C., & Fung, M. K. (2008). Financial market and housing wealth effects on consumption: A permanent income approach. Applied Economics, 40(23), 3029–3038. https://doi.org/10.1080/00036840600994021

Cox, D. (2014). Inheritance, bequests, and labor supply. IZA World of Labor. https://doi.org/10.15185/izawol.69

Debelle, G. (2004). Household debt and the macroeconomy. BIS Quarterly Review. Retrieved from https://ssrn.com/abstract=1968418.

Deere, C. D., & León, M. (2003). The gender asset gap: Land in Latin America. World Development, 31(6), 925–947. https://doi.org/10.1016/S0305-750X(03)00046-9

Druedahl, J., & Martinello, A. (2020). Long-run saving dynamics: Evidence from unexpected inheritances. The Review of Economics and Statistics. https://doi.org/10.1162/rest_a_01004

Elinder, M., Erixson, O., & Waldenström, D. (2018). Inheritance and wealth inequality: Evidence from population registers. Journal of Public Economics, 165, 17–30. https://doi.org/10.1016/j.jpubeco.2018.06.012

Emmons, W. R., & Ricketts, L. R. (2015). The importance of wealth is growing. The Balance, (13), Federal Reserve Bank of St. Louis. Retrieved from https://www.stlouisfed.org/publications/in-the-balance/2015/the-importance-of-wealth-is-growing.

European Commission. (2019). Annual report on European SMEs 2018/2019. SME performance review 2018/2019, Directorate-General for Internal Market, Industry, Entrepreneurship and SMEs.

European Commission. (2020). Europe's moment: Repair and prepare for the next generation. COM/2020/456 final.

Gale, W. G., & Scholz, J. K. (1994). Intergenerational transfers and the accumulation of wealth. Journal of Economic Perspectives, 8(4), 145–160. https://doi.org/10.1257/jep.8.4.145

Garcia-Macia, D. (2021). Household wealth and resilience to financial shocks in Italy. International Journal of Central Banking, 17(3), 241–272.

Garcia, M. T. M., & Figueira, R. (2020). Determinants of homeownership in Europe–an empirical analysis based on SHARE. International Journal of Housing Markets and Analysis. https://doi.org/10.1108/IJHMA-12-2019-0120

Grigoli, F., Herman, A., & Schmidt-Hebbel, K. (2014). World saving (No. 14–204). International Monetary Fund.

Holtz-Eakin, D., Joulfaian, D., & Rosen, H. S. (1994). Sticking it out: Entrepreneurial survival and liquidity constraints. Journal of Political Economy, 102(1), 53–75. https://doi.org/10.1086/261921

HFCS. (2016). The Household Finance and Consumption Survey: Results from the 2014 wave. ECB statistics paper series no. 18/December 2016.

HFCS. (2020). The Household Finance and Consumption Survey: Results from the 2017 wave. ECB statistics paper series no. 36/March 2020.

Humer, S., Moser, M., & Schnetzer, M. (2016). Bequests and the accumulation of wealth in the Eurozone. INEQ working paper series, 1. WU Vienna University of Economics and Business, Vienna. Retrieved from https://epub.wu.ac.at/4841/.

Hurst, E., & Lusardi, A. (2004). Liquidity constraints, household wealth, and entrepreneurship. Journal of Political Economy, 112(2), 319–347. https://doi.org/10.2139/ssrn.414780

Jappelli, T., & Pistaferri, L. (2000). The dynamics of household wealth accumulation in Italy. Fiscal Studies, 21(2), 269–295. https://doi.org/10.1111/j.1475-5890.2000.tb00025.x

Laitner, J. (2002). Wealth inequality and altruistic bequests. American Economic Review, 92(2), 270–273. https://doi.org/10.1257/000282802320189384

Mathä, T. Y., Porpiglia, A., & Ziegelmeyer, M. (2017). Household wealth in the euro area: The importance of intergenerational transfers, homeownership and house price dynamics. Journal of Housing Economics, 35, 1–12. https://doi.org/10.1016/j.jhe.2016.12.001

Modigliani, F. (1966). The life cycle hypothesis of saving, the demand for wealth and the supply of capital. Social Research, 33, 160–217.

Nguyen, H., & Loughran, T. A. (2017). On the reliability and validity of self-reported illegal earnings: Implications for the study of criminal achievement. Criminology, 55(3), 575–602. https://doi.org/10.1111/1745-9125.12144

Piketty, T., & Saez, E. (2013). A theory of optimal inheritance taxation. Econometrica, 81(5), 1851–1886. https://doi.org/10.3982/ECTA10712

Piketty, T., & Zucman, G. (2014). Capital is back: Wealth-income ratios in rich countries 1700–2010. The Quarterly Journal of Economics, 129(3), 1255–1310. https://doi.org/10.1093/qje/qju018

Piketty, T., & Zucman, G. (2015). Wealth and inheritance in the long run. In Handbook of income distribution (Vol. 2, pp. 1303–1368). Elsevier.

Quadrini, V. (2000). Entrepreneurship, saving, and social mobility. Review of Economic Dynamics, 3(1), 1–40. https://doi.org/10.1006/redy.1999.0077

Rodgers, W. L., Brown, C., & Duncan, G. J. (1993). Errors in survey reports of earnings, hours worked, and hourly wages. Journal of the American Statistical Association, 88(424), 1208–1218. https://doi.org/10.1080/01621459.1993.10476400

Semyonov, M., & Lewin-Epstein, N. (2013). Ways to richness: Determination of household wealth in 16 countries. European Sociological Review, 29(6), 1134–1148. https://doi.org/10.1093/esr/jct001

Sousa, R. M., (2009). Wealth effects on consumption—evidence from the Euro Area. ECB working paper no. 1050. Retrieved from http://hdl.handle.net/10419/153484.

Thaler, R. H., & Johnson, E. J. (1990). Gambling with the house money and trying to break even: The effects of prior outcomes on risky choice. Management Science, 36(6), 643–660. https://doi.org/10.1287/mnsc.36.6.643

Turner, T. M., & Luea, H. (2009). Homeownership, wealth accumulation and income status. Journal of Housing Economics, 18(2), 104–114. https://doi.org/10.1016/j.jhe.2009.04.005

Wilhelm, M. O. (1996). Bequest behavior and the effect of heirs’ earnings: Testing the altruistic model of bequests. The American Economic Review, 86, 874–892.

Zagorsky, J. L. (2013). Do people save or spend their inheritances? Understanding what happens to inherited wealth. Journal of Family and Economic Issues, 34(1), 64–76. https://doi.org/10.1007/s10834-012-9299-y

Funding

Not applicable.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no conflicts of interest.

Ethical Approval

This paper has been granted ethical approval by the University of Malta’s Research Ethics Committee.

Consent to Participate

Not applicable.

Consent for Publication

Not applicable.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Spiteri, J., von Brockdorff, P. Household Wealth and Inheritance Transfers: Evidence from the Euro Area. J Fam Econ Iss 44, 619–633 (2023). https://doi.org/10.1007/s10834-022-09861-0

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10834-022-09861-0